Crypto & Blockchain Venture Capital - Q3 2022

Introduction

Key Takeaways

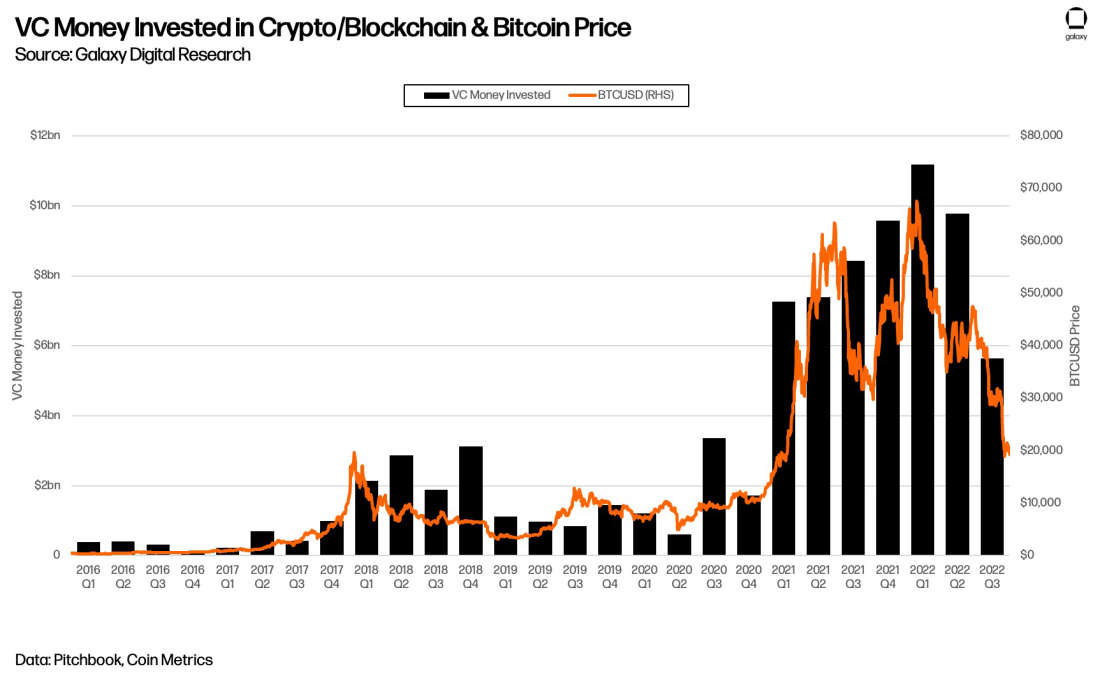

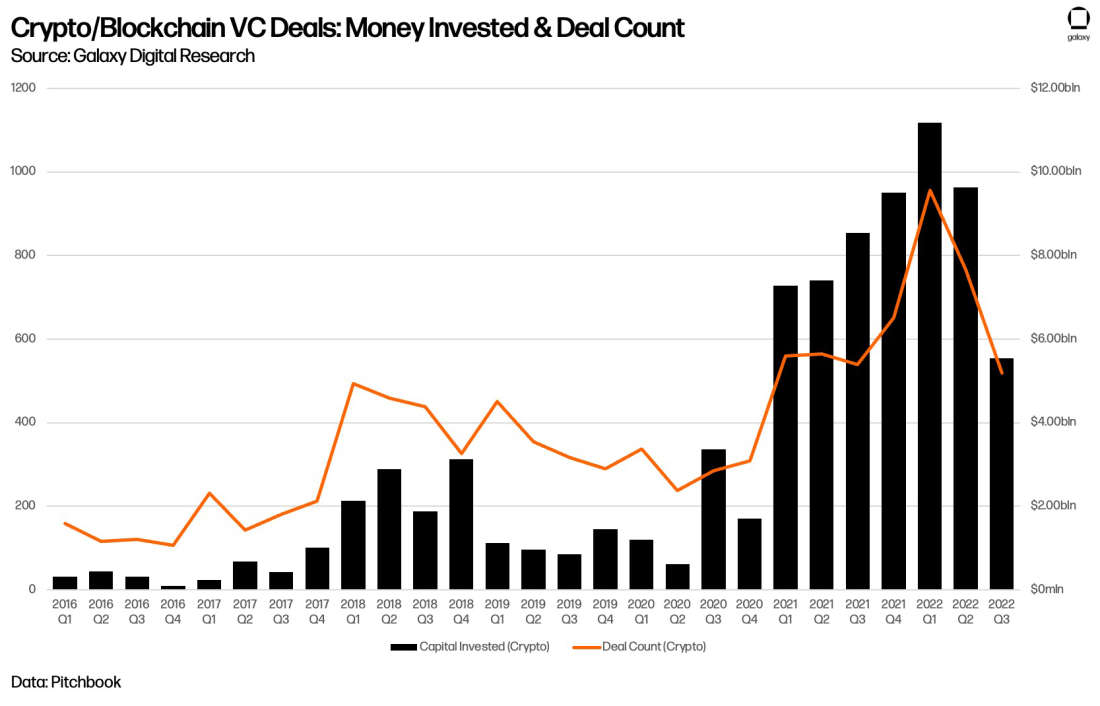

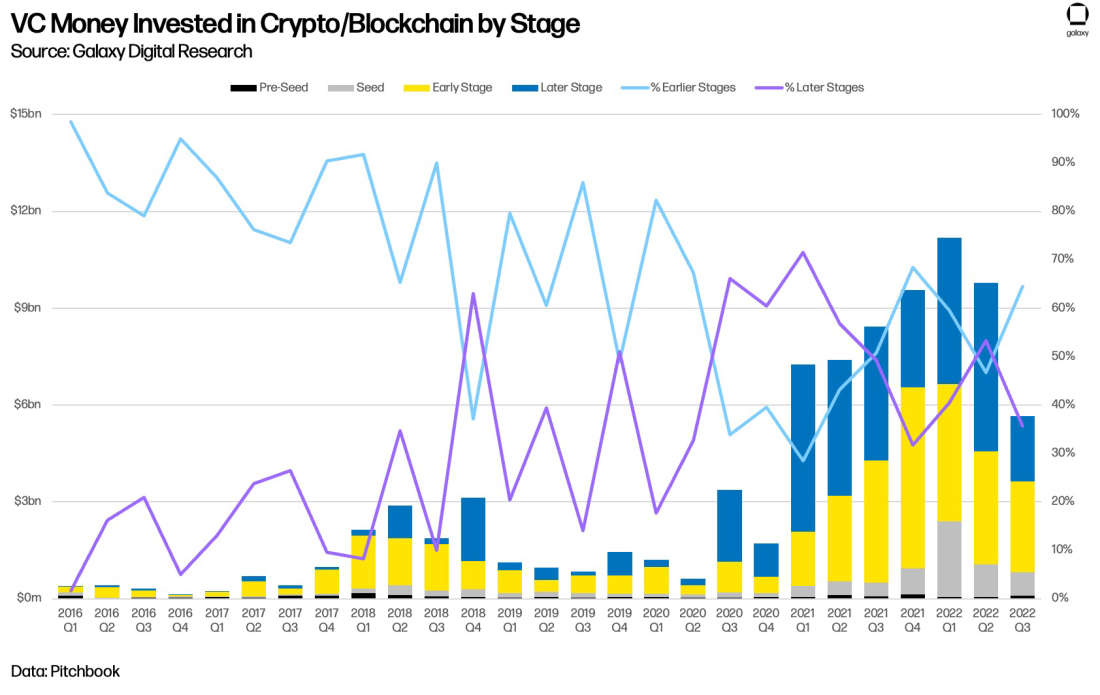

In Q3 2022, venture capitalists invested more than $5.5 billion in crypto startups, marking a new low for 2022, but still $2 billion greater than the 7-year average of $3.1 billion and more than $2 billion higher than the 2020 peak.

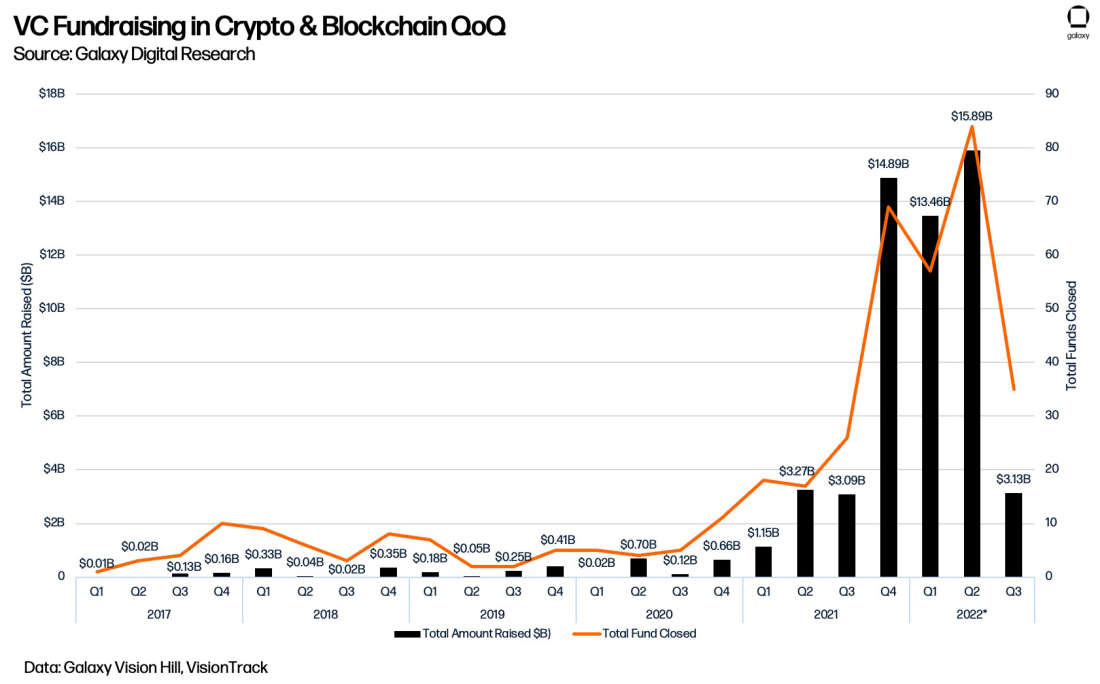

Year to date, VC fundraising is at record levels at more than $32bn. When analyzing fundraising on a QoQ basis, a significant drawdown is visible in Q3 due to liquid asset drawdowns causing an imbalance in allocator portfolios and the lag in VC fund mark reporting.

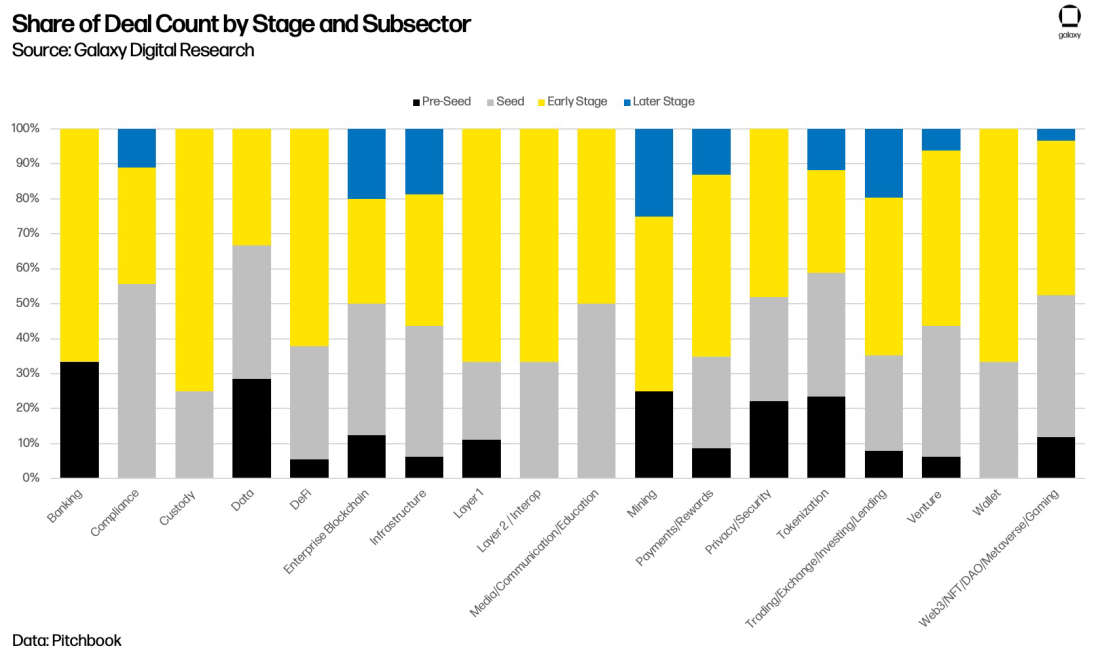

Despite the drawdown in broader VC investing, early-stage investing remains competitive and robust. On the other hand, late-stage investing showed notable weakness potentially due to the sustained bloated valuations.

Companies founded in 2021 attracted a significant amount of VC attention in Q3 2022. The cohort led in deal count and came a close second in money invested.

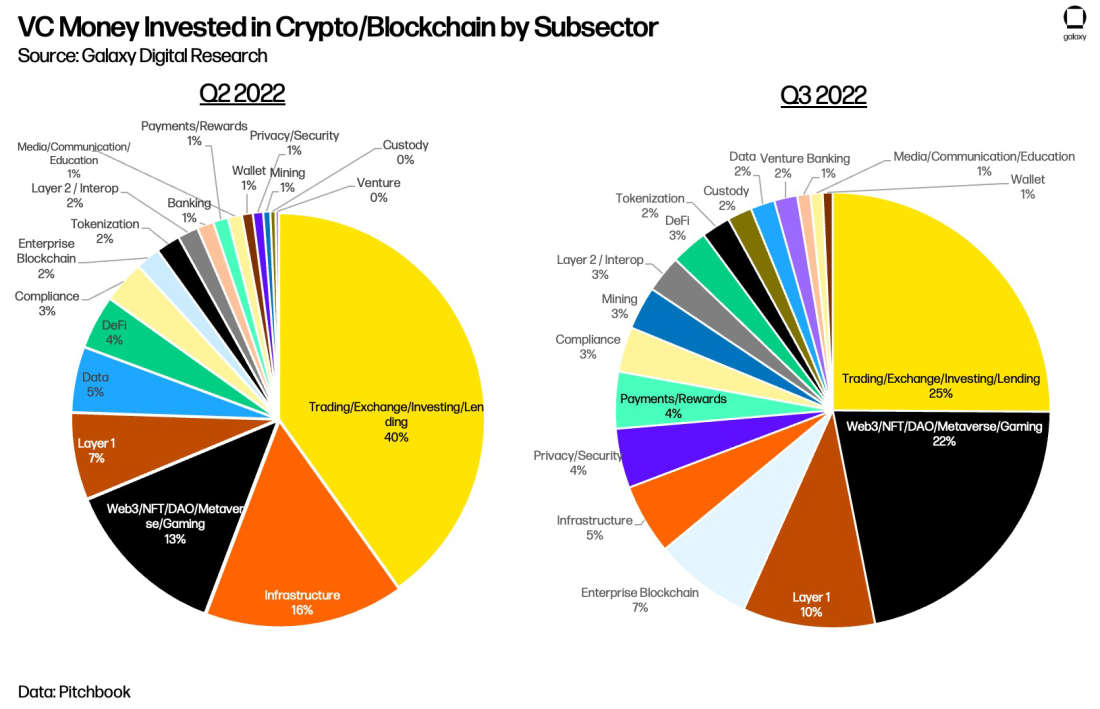

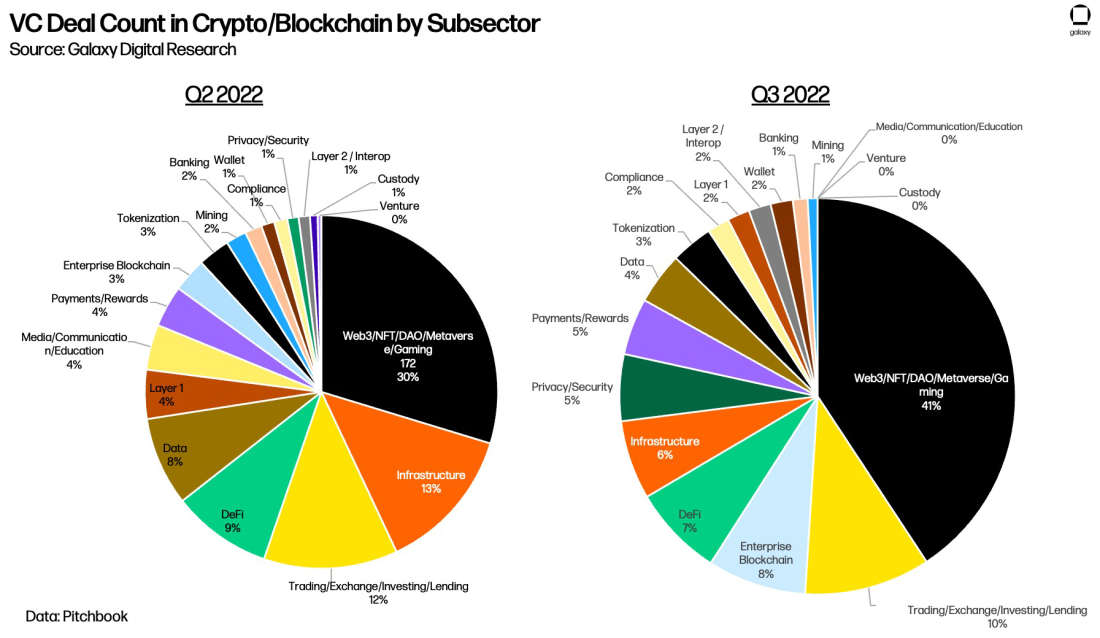

The “Trading, exchange, investing, and lending” category led all subsectors in total capital invested, but “Web3, NFT, DAO, Metaverse, and Gaming” dominated in the share of deal count by a large margin.

VC Fundraising

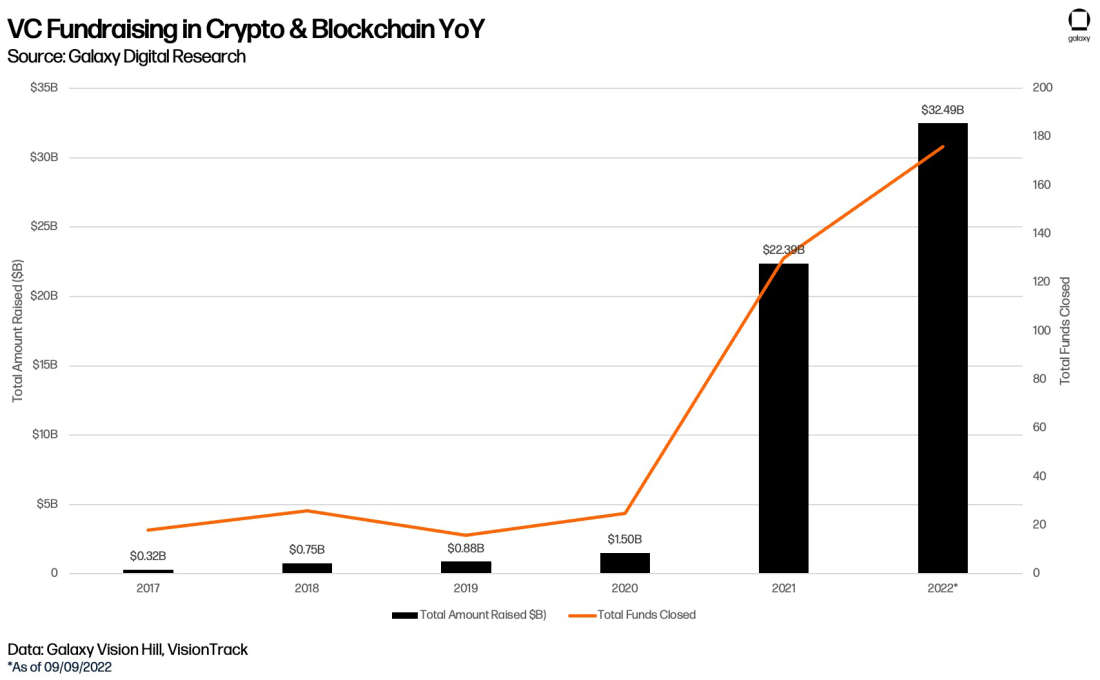

We worked with Galaxy Asset Management’s multi-manager team to analyze the venture fund landscape. Venture capital fundraising is on pace for a record year; fundraising in 2022 is already outpacing that of the fiscal year 2021.

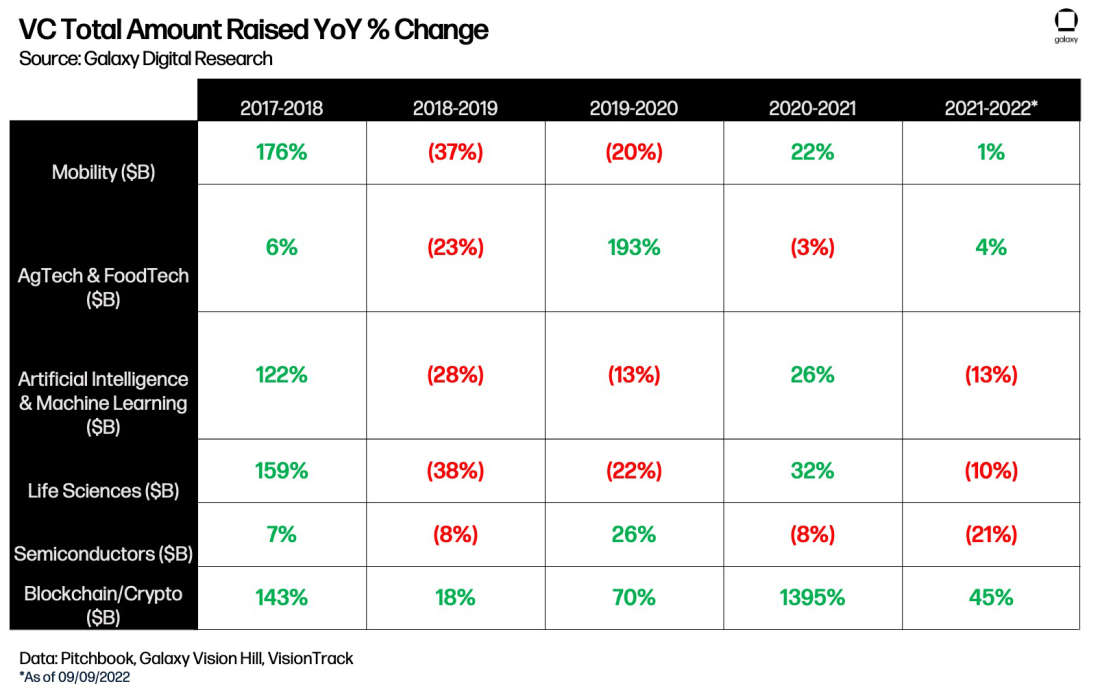

Crypto and Blockchain fundraising stands out compared to other high-growth sectors, being the only sector with continuous YoY growth.[1]

VC fundraising saw a sharp decline in Q3, with the amount of capital fundraised dropping by 80%. Due to tumultuous crypto market conditions in May and June, funds are likely pushing their fall fundraising to Q4 to allow markets to recalibrate.

VC Investing

VC Money & Deal Count

The Crypto and Blockchain sector saw $5.5 billion of venture capital invested in Q3 2022 through 518 deals. Despite the QoQ decrease, the $5.5 billion invested in Q3 is $2 billion greater than the 7-year average of $3.1 billion and more than $2 billion higher than the 2020 peak.

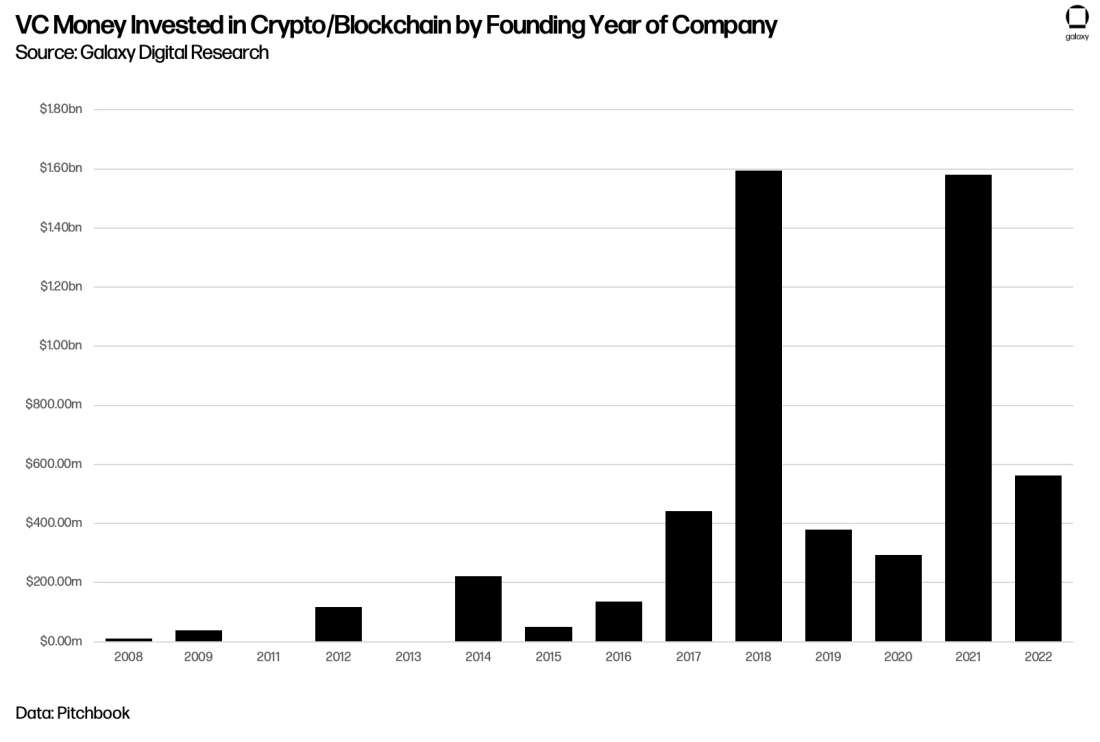

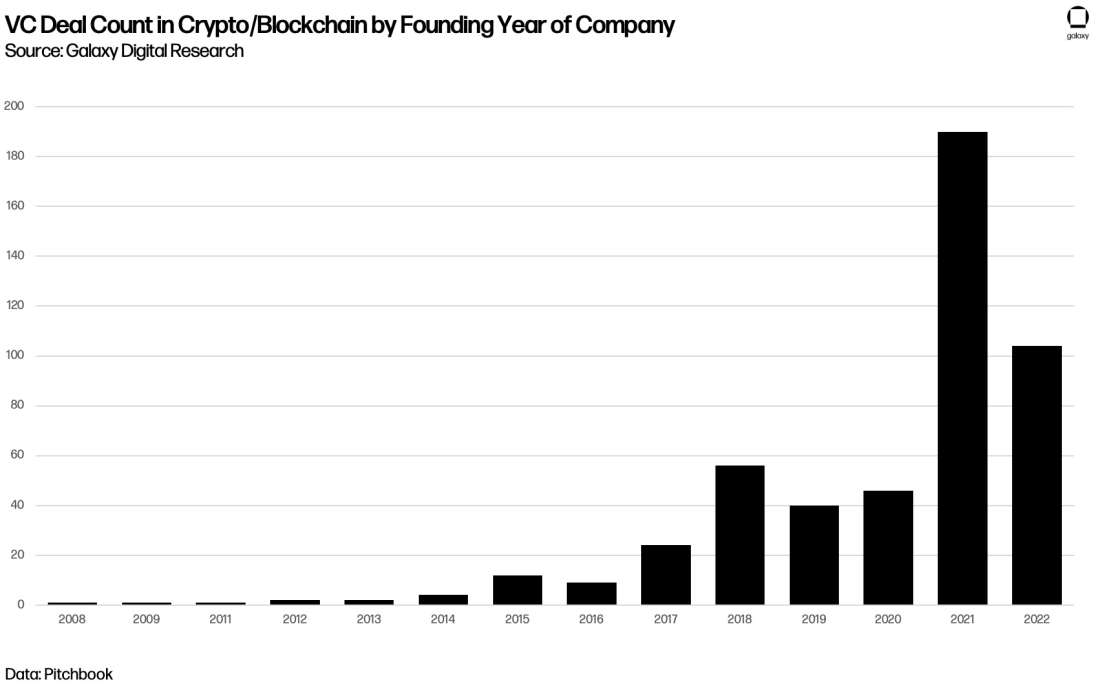

VC Money Invested and Deal Count by Company Vintage

Companies founded in 2018 and 2021 attracted the most VC money in Q3 of 2022, with $1.5 billion invested in each cohort. This is a stark difference from Q2 2022, when companies founded in 2018 were the sole leader.

Companies founded in 2021 attracted the most deals in Q3 of 2022, with over 190 deals done.

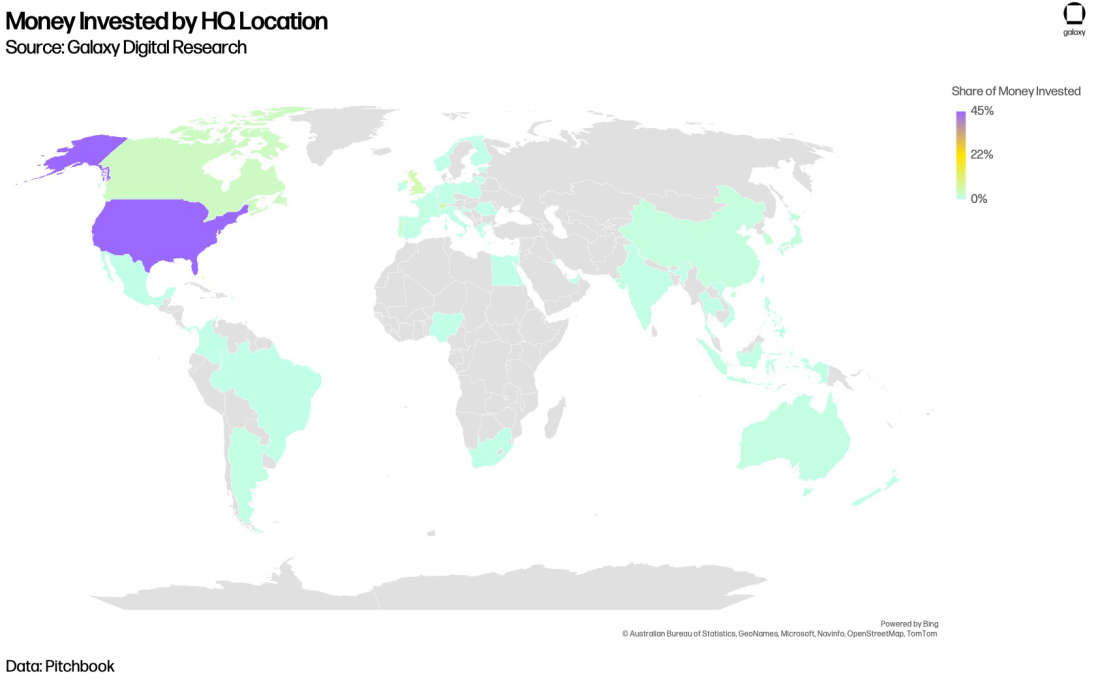

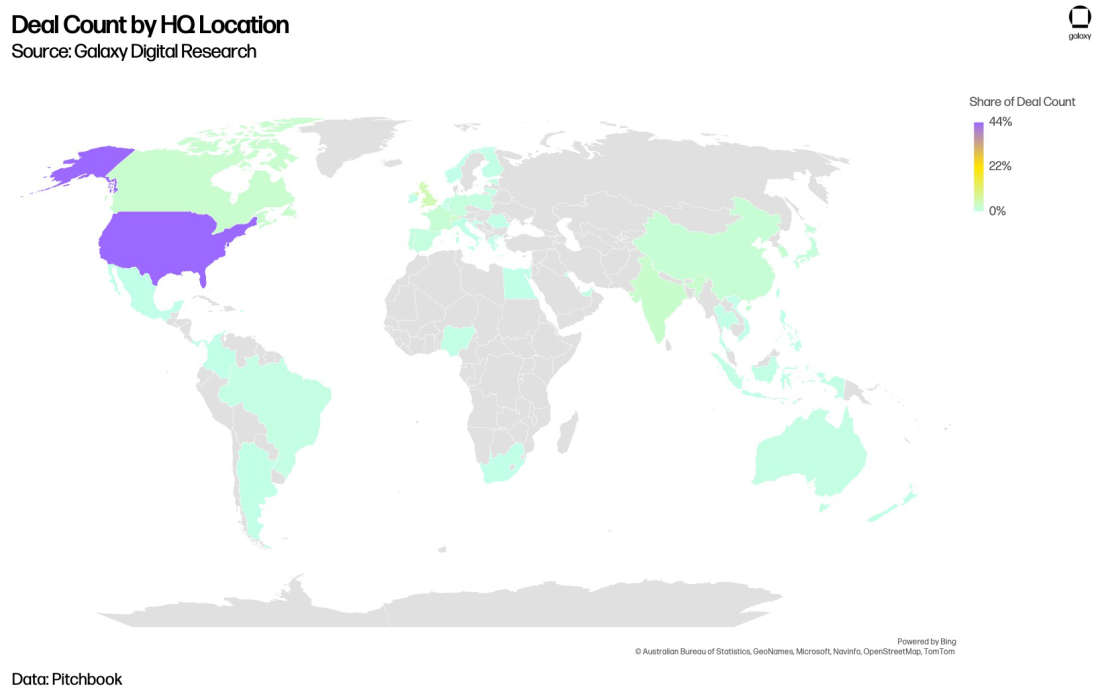

VC Money Invested and Deal Count by Company Headquarters

Companies based in the United States absorbed more than 45% of VC money invested in Q3 2022. The Bahamas and Singapore came in second and third, accounting for 18% and 11%, respectively. Combining all EU nations brings their total share of invested money to 14%.

The United States again dominates in the share of deals done, accounting for 44% of all deals in Q3 2022. In distant second and third are Singapore and the United Kingdom, accounting for 12% and 5%, respectively.

Investments by Stage

Reversing a trend from the last three quarters, the share of capital allocated to later-stage companies fell sharply to 36%. Early-stage companies dominated the landscape, absorbing more than $3.6 billion of all money invested in Q3 2022.

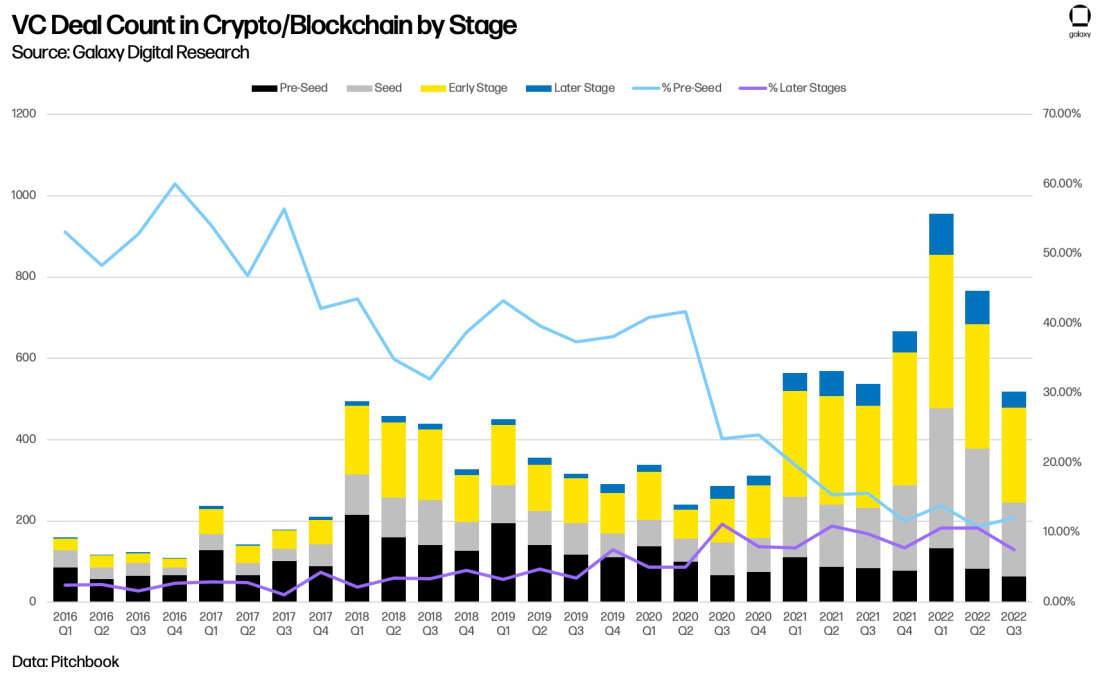

Deal Count by Stage

Another reversal in trend is visible in the number of deals done by stage, where the later stage saw its first decline in 2022. The number of deals done in the later stage dropped by more than 50% QoQ.

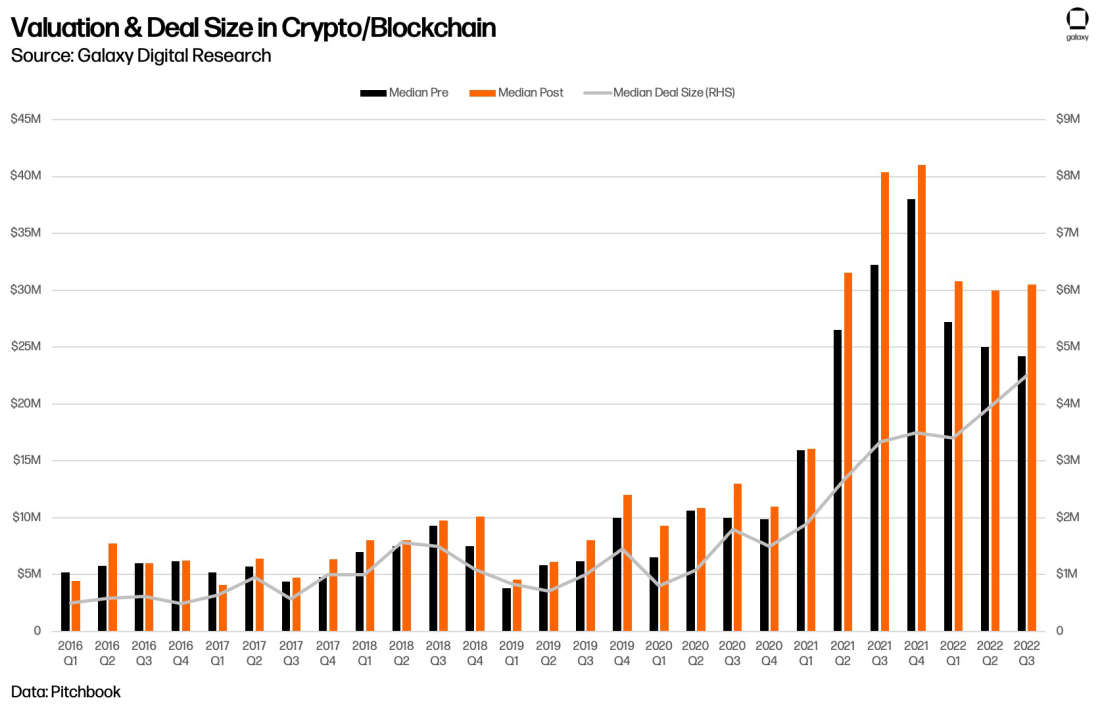

Valuation & Deal Size

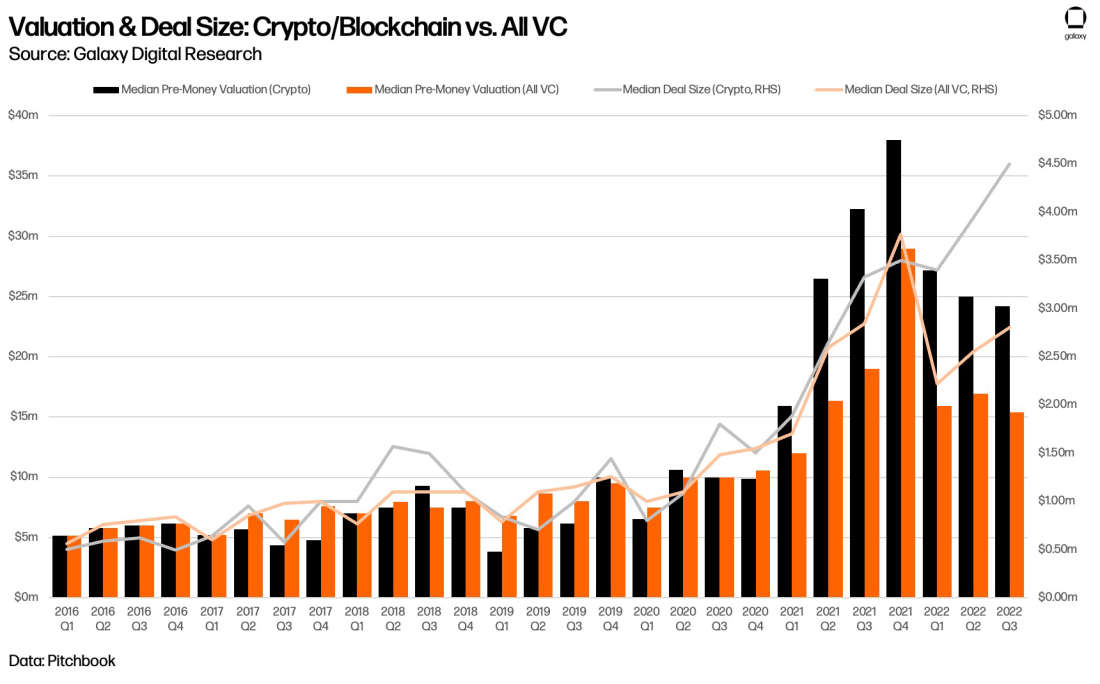

Despite the continued decline in Median Pre-money valuations, median deal size made another all-time high in Q3 2022.

Venture capital valuations and deal size in Crypto/Blockchain continue to dwarf the broader VC industry.

Investments by category

Trading, Exchanges, Investing, and Lending continues its QoQ lead with more than $1.3 billion invested. Web3, NFT, DAO, Metaverse, and Gaming reasserted itself as the number two category, pulling in $1.1 billion. Enterprise blockchain emerged as a new category of focus, with $400 million invested in Q3 2022.

VC deal count by subsector paints a different picture, with Web3, NFT, DAO, Metaverse, and Gaming sectors far outpacing that of any other subsector. However, Enterprise Blockchain also showed growth in deal count, with over 40 deals in Q3 2022.

The absence of later-stage deals is visible when analyzing deal count by subsector, where later stage accounted for less than 20% in all but one subsector.

Key Takeaways

Examining the data from Q3 2022 leads to several takeaways on trends in the crypto and blockchain startup investment landscape:

Venture Capital funds in crypto and blockchain are on track for a record year in fundraising, but QoQ data shows a sharp decline in fundraising.

With one quarter still to go in 2022, VC fundraising in Crypto and Blockchain has outpaced 2021 levels by more than 40%. Going back to 2017, the sector has never raised less than the year before, showing continued growth and interest in the space. Venture Capital in the industry is maturing rapidly.

Venture funds report their net asset value on a lag. In a more stable market, the lag does not impede the allocator’s ongoing investment, but in a highly volatile market, the lag can cause problems. Specifically, the portion of allocators’ portfolios invested in liquid assets, such as equities and fixed-income products, experienced significant declines over the last two quarters. To maintain their desired portfolio allocations, allocators must adjust their holdings of liquid and alternative assets by periodically re-balancing. Because their liquid portfolios declined in Q2, but they receive their Q2 VC fund reporting on a lag, Q2 fund reporting from their venture investments, allocators did not have an accurate view of their portfolio balances in Q3, making new investments in crypto VC problematic. If their VC fund investments came in up, flat, or down less than their liquid portfolios, allocators would have found themselves potentially over-allocated to VC and thus unable to write new checks. As markets have since stabilized somewhat, and with some funds eventually reporting significant markdowns in Q2, we expect that Q4 fundraising will be more robust than Q3.

Companies founded in 2021 attracted the most Venture Capital attention. In both money invested and deal count, companies founded in 2021 led their counterparts, gathering $1.5 billion and 190 deals. Companies founded in 2018 outpaced in money invested by a slight margin of only $10 million. This is a new development and a stark change from Q2 2022, where capital was more equally invested, and companies founded in 2015, 2017, and 2018 attracted more money than those founded in 2021. There is clearly a new segment of opportunity emerging in the crypto and blockchain space, where VC investors can no longer look to older firms for disruptive high-return opportunities. The theses driving pre-2021 companies have either panned out or run their course. Now three quarters into 2022, companies founded in 2021 have had ample time to fortify their mission and demonstrate product market fit. The companies founded in 2021 are the new cohort of disruptors and potential future unicorns, addressing new demands and use cases that will lay the groundwork for the next four years. In addition, a large portion of these companies are inWeb3/NFT/DAO/Metaverse/Gaming, a subsector that has only truly emerged in 2021.

Early-Stage companies shined in Q3, dominating later-stage companies and attracting the largest share of VC money. Venture capital investing in early-stage companies remains robust and competitive. The stage accounted for 64% of all money invested in Q3 and illustrated strength across respective crypto subsectors. The strength of the Web3/NFT/DAO/Metaverse/Gaming subsector in both deal count and money invested demonstrates investors’ attention toward early-stage companies. Due to the subsector’s infancy, there are very few mature companies to gain exposure to, thus directing capital to new early-stage companies. As the sun sets on the crypto markets bull cycle and prior investment theses have come to fruition, VC investors are now looking to place bets for a new dawn. Median pre-money valuations continue to fall, but median deal size continues to climb, showing VC investors are placing high-conviction bets.

Web3/NFT/DAO/Metaverse/Gaming continues to show strength compared to other subsectors, but money is beginning to disperse more evenly, reaching previously neglected subsectors.

Between Q1 and Q2 of 2022, the Web3, NFT, DAO, Metaverse, and Gaming subsector lost some of its momenta, with money invested and deal count declining QoQ. But in Q3, the subsector remerged as a leader, accounting for $1.1 Billion of money invested and a whopping 202 deals. As one of the newer subsectors, it is quickly evolving, and until the market can definitively define what Web3 and Metaverse truly mean in practice, this subsector appears to have no ceiling and is likely to continue to see outsized venture capital investment. This phenomenon of discovery through capital allocation is taking shape in the application of blockchain in gaming, accounting for more than 35% of all money invested; gaming was the leading component of this subsector. Founders are utilizing blockchain not only as a foundation for games but to better authenticate and identify users, acting as online identification and further strengthening online communities.

The crypto & blockchain sector continues to mature as its subsectors blossom into addressable segments. Illustrated by the more even distribution of VC money QoQ, in which not a single subsector was left without a capital injection. Founders and VC investors are beginning to discover new use cases for crypto and blockchain outside the historically dominant subsector of Trading, exchange, investing, and lending. Money invested in Privacy/Security, Payments/Rewards, and Enterprise Blockchain subsectors grew notably QoQ.

Enterprise Blockchain companies are garnering more attention from VC investors in Q3 2022. The subsector jumped into the top 5 by deal count and capital invested, accounting for 40 and $400 million, respectively. Many companies in this cohort are using blockchain to address supply chain issues stemming from COVID by increasing transparency, security, and efficiency. Healthcare and energy transition technology emerged as other addressable markets for enterprise blockchain companies in Q3 2022. Blockchain offers unique identity authentication and secure data transmission solutions that both healthcare and renewable energy systems can utilize. In healthcare, this can mean securely storing medical records and privately connecting patients to their healthcare providers.

Crypto and Blockchain companies continue to garner higher median pre-money valuations and deal sizes than the broader VC landscape. Despite the continued QoQ decline in pre-money valuations, the crypto and blockchain sector still dwarfs that of all VC. Median deal size in the crypto and blockchain sector recorded another all-time, reaching $4.5 million. Median deal size in broader VC investing has been unable to make a new high after dropping sharply in Q1 of 2022. From Q2 to Q3 of 2022, median pre-money valuations in all VC dropped by 9% but in crypto and blockchain, valuation lowered by just 3%.

Note: This report relies on external data and is subject to revision in the future as additional deal and fundraising information becomes available.

Legal Disclosure:

This document, and the information contained herein, has been provided to you by Galaxy Digital Holdings LP and its affiliates (“Galaxy Digital”) solely for informational purposes. This document may not be reproduced or redistributed in whole or in part, in any format, without the express written approval of Galaxy Digital. Neither the information, nor any opinion contained in this document, constitutes an offer to buy or sell, or a solicitation of an offer to buy or sell, any advisory services, securities, futures, options or other financial instruments or to participate in any advisory services or trading strategy. Nothing contained in this document constitutes investment, legal or tax advice or is an endorsementof any of the digital assets or companies mentioned herein. You should make your own investigations and evaluations of the information herein. Any decisions based on information contained in this document are the sole responsibility of the reader. Certain statements in this document reflect Galaxy Digital’s views, estimates, opinions or predictions (which may be based on proprietary models and assumptions, including, in particular, Galaxy Digital’s views on the current and future market for certain digital assets), and there is no guarantee that these views, estimates, opinions or predictions are currently accurate or that they will be ultimately realized. To the extent these assumptions or models are not correct or circumstances change, the actual performance may vary substantially from, and be less than, the estimates included herein. None of Galaxy Digital nor any of its affiliates, shareholders, partners, members, directors, officers, management, employees or representatives makes any representation or warranty, express or implied, as to the accuracy or completeness of any of the information or any other information (whether communicated in written or oral form) transmitted or made available to you. Each of the aforementioned parties expressly disclaims any and all liability relating to or resulting from the use of this information. Certain information contained herein (including financial information) has been obtained from published and non-published sources. Such information has not been independently verified by Galaxy Digital and, Galaxy Digital, does not assume responsibility for the accuracy of such information. Affiliates of Galaxy Digital may have owned or may own investments in some of the digital assets and protocols discussed in this document. Except where otherwise indicated, the information in this document is based on matters as they exist as of the date of preparation and not as of any future date, and will not be updated or otherwise revised to reflect information that subsequently becomes available, or circumstances existing or changes occurring after the date hereof. This document provides links to other Websites that we think might be of interest to you. Please note that when you click on one of these links, you may be moving to a provider’s website that is not associated with Galaxy Digital. These linked sites and their providers are not controlled by us, and we are not responsible for the contents or the proper operation of any linked site. The inclusion of any link does not imply our endorsement or our adoption of the statements therein. We encourage you to read the terms of use and privacy statements of these linked sites as their policies may differ from ours. The foregoing does not constitute a “research report” as defined by FINRA Rule 2241 or a “debt research report” as defined by FINRA Rule 2242 and was not prepared by Galaxy Digital Partners LLC. For all inquiries, please email [email protected]. ©Copyright Galaxy Digital Holdings LP 2022. All rights reserved.