Key Takeaways

Roughly 34% of crypto-dedicated hedge funds have a 3+ year track record; 56.2% have a fund inception date between 1-3 years. Less than 7.2% of crypto hedge funds have a 4+ year track record.

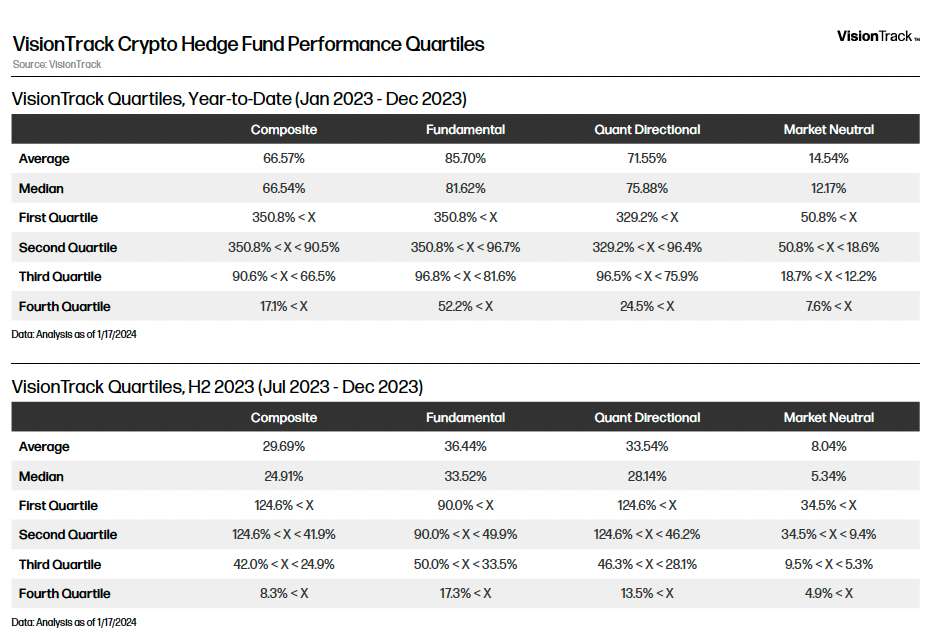

The top two quartiles of crypto fundamental and quant directional funds outperformed Bitcoin in the second half of 2023.

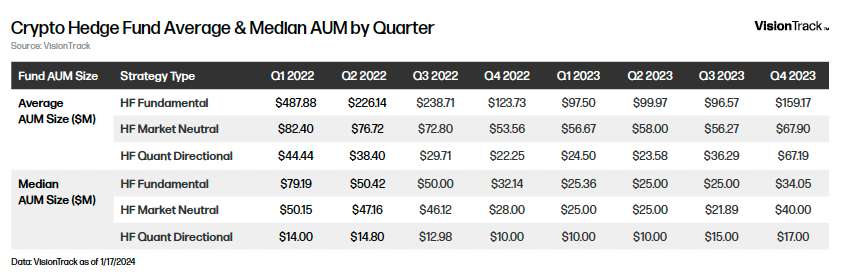

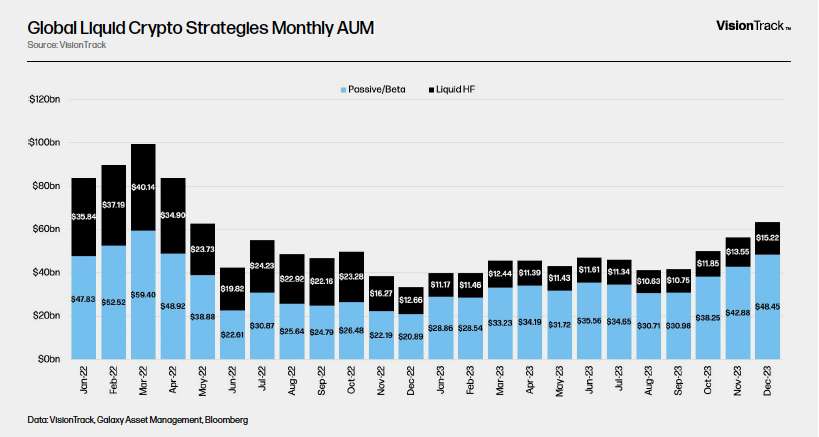

Crypto hedge fund AUM jumped in Q4 2023 to ~$15.2b. Fundamental strategies held $11.4b, Quant Directional Funds held $1.8b, and Market Neutral Funds held $1.9b.

The median fund size grew modestly through the year for all crypto hedge funds largely attributed to cryptocurrency price appreciation, though subscriptions increased in Q4 2023.

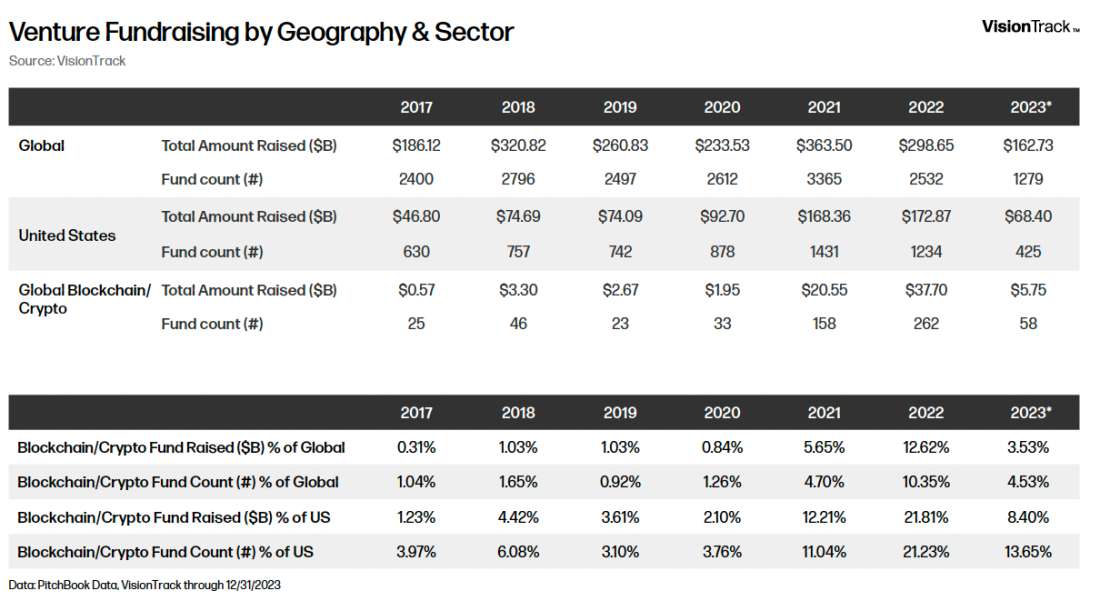

Annually, global venture capital firms in crypto/blockchain raised $5.75b in 2023 across 58 funds, down from 2022’s record year of $37.7b across 262 funds. When comparing crypto venture firm’s share of global venture capital fundraising, crypto funds tallied roughly 3.53% of global funding down from 2022’s high of 12.62%.

Crypto-native firms tallied 72% of funds closed in 2023 as traditional investors supported fundraising for the industry. On average annually, crypto-native firms close 81% of funds dedicated to crypto venture investing.

Executive Summary & Market Context

Cryptocurrency total market capitalization ended 2022 with $840b in liquid token value. In 2023, the total market capitalization grew to $1.77t, a healthy one-year climb. Bitcoin at year-end 2022 held around 38.43% market dominance as compared to other cryptocurrencies ranked in the top ten. By year-end 2023, Bitcoin held around 47.8% market dominance. Its highest percentage of top ten liquid crypto tokens was achieved on December 6 when it comprised 51.5% as tracked by CoinGecko.

Bitcoin’s dominant run began as sentiment towards the US Bitcoin Spot ETF approval process gained momentum at the end of Q2 2023. BlackRock’s decision to file for a spot BTC ETF in June – their first such filing – reignited the horse race, leading prior issuers Invesco/Galaxy, ArkInvest, Fidelity, VanEck, WisdomTree, Bitwise and others to reapply driving a surge in market interest. Bitcoin returned to yearly highs previously reached in March 2023. By mid-summer 2023, many crypto fund managers had spent most of the early part of the year onboarding new service providers notably for banking relationships, digital asset custodians, institutional staking partners, and centralized crypto exchanges. With the implosions of 2022 still fresh on the mind of many fund managers, enhancing operational controls was a priority for firms last year. Fundraising to fund strategies had not resumed and many firms faced a market with lower volume and volatility for much of the year compared to historical standings.

Based on data from VisionTrack, we estimate that 250 of 715 crypto-dedicated hedge funds closed from May 2022 through December 2023, nearly 35% of the market. Of fund managers that didn’t lose their entire fund value to the 2022 bankruptcies, many were faced with an uncertain macro environment and the risk-appetite among allocators was reduced. While many arguments may be made to help institutions “get off zero,” the messaging for active strategies did not translate well and top hedge funds saw redemptions.

For funds that survived the 2022 downturn and redemptions in early 2023, our data suggests 34.01% of crypto-dedicated hedge funds have a 3+ year track record. 56.2% have a 1–3-year track record and less than 7.2% of crypto-dedicated hedge funds have a 4+ year track record. For an industry that grew with significant enthusiasm around fund growth in prior years, by year-end 2023, the top 20 hedge funds held roughly 71.6% of total hedge fund AUM, based on data from VisionTrack. At the end of 2022, this figure was roughly 75%. Consolidation of fund value by the top fund managers is unsurprising as many LPs will stay with a crypto-hedge fund for years at a time. While downturns are difficult and crypto hedge funds commonly have monthly subscription/redemptions, more often than not the LP base treats crypto hedge funds with a multi-year investment thesis.

For industry fund managers and their investors, a downturn such as the one witnessed in 2022, is truly confidence-shaking and sometimes existential. Constantly managing both criticism and skepticism, all positive news events are latched onto to help rebound and revive the asset class. The darkest days never appear too far removed, and a rebounding year is not always met with thrill or exuberance, rather validation and relief. The final months of the year were treated as such.

Though criticism and skepticism remain leading into 2024, crypto, most notably Bitcoin, has proved in both spirit and performance, for over a decade, to be a credible alternative to fiat currencies maintaining its store of value trade and offering a revolutionary digitally fixed-supply monetary system. In 2023, this narrative solidified, with geopolitical uncertainty and turmoil in the banking system further highlighting bitcoin’s unique value proposition.

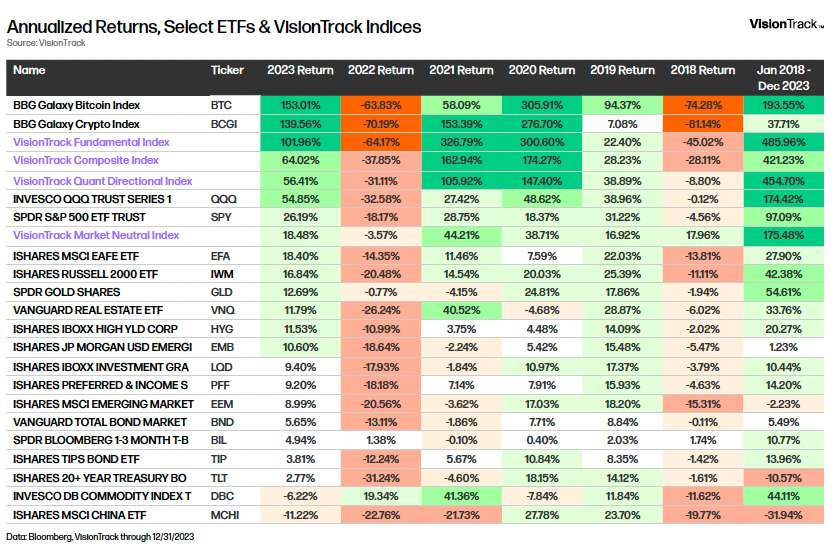

While it’s unreasonable to predict with certainty what will happen to crypto assets in 2024, we can look to the past to prepare for a range of outcomes. What we do know is there are deep, structural issues with global monetary policy exacerbated by a high interest rate environment and pressing year-over-year inflation. For public markets, investors entered 2023 with great anticipation, though with concerns, for a soft/hard landing. The SPDR S&P 500 ETF gained +16.79% on the year, but a look behind the curtain shows much may be attributed to the magnificent seven as the S&P 500 has never in history been this top heavy. Semiconductors, the debut of practical artificial intelligence, calls for the revitalization of infrastructure and defense, and changes to global trade policy drove markets for much of the year.

Savvy investors debated the timing of the looming US recession as short-term treasuries and money market funds climbed in attractiveness month-over-month. The lush days of private market liquidity felt all but over as private equity fundraising fell to 6-year lows. Looming in the backdrop, US corporate bankruptcies climbed to 642 filings, the highest count since 2011 and investors continued to question unrealized HTM losses from top financial institutions given the illiquidity crisis of March 2023.

For much of the first half of the year, crypto fund managers faced enormous operational risks, continued regulatory uncertainty, and a difficult fundraising environment. Enthusiasm from 2021 and 2022 dissipated and it felt as if allocators and the financial media desired time away from crypto and a structural change to the adults in the room.

Hedge Funds

Performance

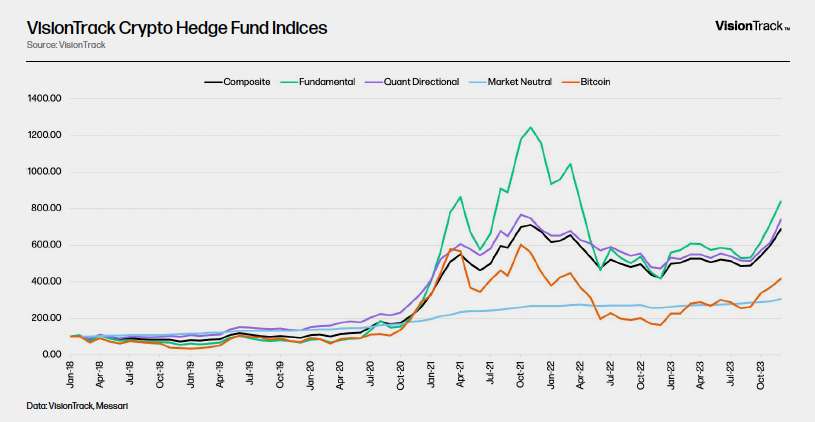

In 2023, VisionTrack’s crypto hedge fund indices underperformed Bitcoin through year end. The Bloomberg Galaxy Bitcoin Index gained +153.01% and the Bloomberg Galaxy Crypto Index (BGCI) 1[1] added +139.56% through Q4. The VisionTrack Composite Index returned +64.02%, the VisionTrack Fundamental Index gained +101.96%, the VisionTrack Quant Directional Index climbed +56.41%, and the VisionTrack Market Neutral Index reported +18.48% through December.

As indicated in our Q2 Institutional Hedge Fund and Venture report, 2023 started the year resembling 2019, with rebounded gains following a major down year. In 2019, Bitcoin outperformed compared to select ETFs and benchmarks gaining +94.37%. Over the same period, the VisionTrack Fundamental Index grew +22.4%, the VisionTrack Quant Directional Index added +38.89%, and the VisionTrack Market Neutral Index recorded +16.92%.

In 2019, Bitcoin struggled in the second half of the year with downward monthly performance in five of six months. October was the only month Bitcoin rallied (+10.19%) in H2 2019. From the end of July to the end of December that year, BTC dropped -28.83% and the VisionTrack Composite Index was down -14.92%. In the same time-frame, the VisionTrack Fundamental Index lost -24.71%, the VisionTrack Quant Directional Index dropped -10.45%, but the VisionTrack Market Neutral Index gained +1.60%.

The second half of 2023 was a much different story than the second half of 2019 for Bitcoin. In 2023, Bitcoin rallied though the Fall and early Winter beginning with impressive performance in October. Known in the industry as “Uptober,” Bitcoin gained +28.34% largely from ETF anticipation, compounded by a gamma squeeze rally in the Bitcoin options market. In October, reports by Bloomberg, Reuters, and others indicated genuine positive momentum in discussion between the Securities & Exchange Commission and ETF Issue-applicants. Though not guaranteed and met with suspicion, in October, Bloomberg Analysts James Seyffart and Eric Balchunas called for a 90% approval probability for US BTC Spot ETFs by January 2024 further adding to industry excitement.

Considering VisionTrack’s liquid crypto hedge fund constituent set with performance reported net of fees in USD, only ~3.9% of managers outperformed Bitcoin in 2023. In 2019, this figure was 5.9%. As indicated time and time again, the largest beta assets will outperform at the start of a cycle and allocators were prepared in 2023. In the anticipation for a year driven by Bitcoin’s dominance, US-based Asset Managers reduced allocations to crypto hedge funds. Hedge funds struggled to raise capital as they failed to beat both BTC and the BCGI month-over-month, two unofficial benchmarks for many funds. Bitcoin’s continued impressive performance through the first three quarters of the year increased competition for net new subscriptions to all active strategies in Q4. To address the challenging fundraising environment, a few actively managed fund strategies began to offer BTC-denominated share classes to attract investors in H2 2023.

Historically, BTC-denominated share classes have served primarily as a method for treasury management and assessment management solutions. The investor base is typically tailored to Bitcoin Miners, HNWIs, Family Offices, crypto companies, and foundations managing existing cryptocurrency exposure. Often justified by convenience and more familiar custodial solutions, actively managed teams offer bespoke funds for many interested investors eager to maintain or scale their Bitcoin holdings. However, in Q4 many fund managers saw these strategies as a means to compete with single-asset Bitcoin offerings, notably the highly anticipated US BTC ETFs, by targeting annual returns BTC +10-15%. According to VisionTrack, this cohort of funds returned, as denominated in BTC, +7.59% in 2023, an exciting start for the categorization, though small in its cohort.

Considering crypto fund strategies that fulfill the requirements for VisionTrack Index inclusion, in Q4 2023, the VisionTrack Fundamental Index recorded its best performing quarter of +57.85% since Q1 2021 (+186.15%) just shy of Bitcoin in Q4 2023 (+58.12%) including early reported estimates. Important to note, the fundamental index saw three-consecutive monthly double-digit gains, a first since Q1 2021 and an occurrence which has only happened twice since January 2018. Though quarterly performance almost surpassed Bitcoin’s rally, there has only been one time where the Fundamental Index had two consecutive quarters of positive outperformance to the upside, Q3 2021 and Q4 2021, a potential indicator to consider as crypto prices continue to climb in January 2024 and as the VisionTrack Fundamental Index achieves final fixings.

Quant Directional Strategies included in the VisionTrack Quant Index had their best performing quarter since Q1 2021 as well, gaining +43.75% on average to end the year, smashing through previous quarters. Several firms saw an increase in fund subscriptions through the final months of the year, suggesting liquid quant strategies may be gearing up for more fundraising in 2024.

Positive outperformance in Q4, especially November and December, was largely driven by alternative cryptocurrencies and excitement for the US BTC Spot Approval. To end the quarter and considering crypto assets with roughly $1b market capitalization or more, Solana jumped +401.9%, Sei jumped +377.1%, Injective gained +373.3%, Avalanche gained +321.1%, Near added +227.1% and Celestia debuted their liquid token gaining +301% in just two months. Quant directional and market neutral approaches were well positioned for price increases across top crypto assets as well as alternative cryptos as volume and volatility returned to liquid assets. As sentiment continued to improve and top-level narratives drove Bitcoin to yearly highs, new narratives and excitement across the market drove prices even higher, showcasing successful trading opportunities for many tested managers.

Hedge Fund Performance Quartiles

VisionTrack does not produce granular performance rankings of the crypto hedge fund constituent set. Below are performance quartiles which may inform managers and allocators to the risk and return profiles relative to VisionTrack’s fund categorizations. The categorizations below describe four segmentations replicating the underlying methodology used in the VisionTrack Indices: Composite, Fundamental, Quant Directional, and Market Neutral. Modifications to the constituent set have been made to be most inclusive of historical fund performance including select SMAs. For inclusion in the quartile analysis, funds must report net of fees and have full monthly performance detail within the given timeframe. Crypto fund strategies with incomplete performance detail on a month-over-month basis are excluded from the analysis.

Including early estimates, in 2023, Crypto Fundamental strategies averaged +85.70% through December. Quant Directional funds averaged +71.55%, and Market Neutral funds averaged 14.54%. For funds performing in the top two quartiles, hedge fund fundamental strategies and quantitative strategies were near similar in performance on the year. However, considering the second half of the year, quantitative strategies showed strong outperformance in the top quartiles. Though many funds were chasing Bitcoin for most of the year, both of the top two quartiles for Fundamental and Quant Directional categories beat Bitcoin (+38.75%) in the second half of 2023.

AUM/Fund Flows

Despite the difficulty for fund managers to outcompete passive/beta products in the first three quarters of 2023, fund managers in the top two quartiles year-over-year did see AUM growth to end 2023. While VisionTrack does not collect subscription/redemption detail at this time, we do collect monthly AUM by fund strategy. Should growth in AUM by strategy exceed the total performance reported, it’s assumed managers are seeing an increase in subscriptions.

Data collected by VisionTrack suggests crypto hedge fund sizing trended flat from February 2023 to September 2023 for many fund managers. However, from September to December crypto hedge funds grew their total AUM by +41.62% from $10.75b to $15.22b. Fundamental strategies saw the largest increase, jumping from $7.82b in total AUM to $11.46b in AUM in the same time. Quant Directional strategies ended the year with roughly $1.81b and Market Neutral funds grew to $1.97b.

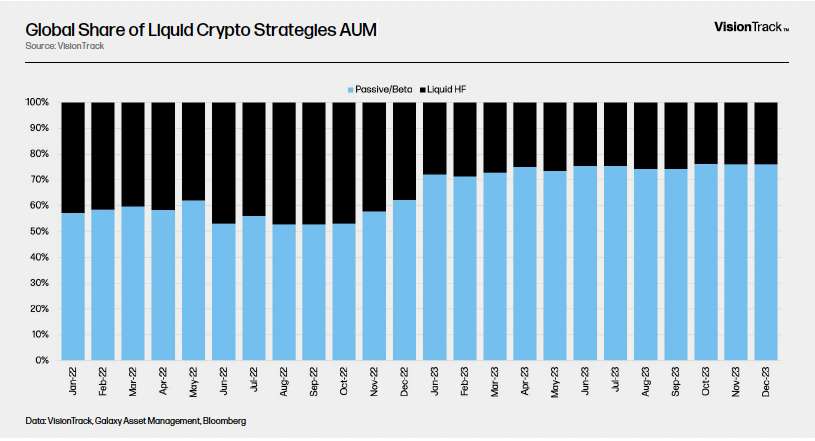

Passive/beta offerings including single-asset vehicles and multi-asset index products maintain crypto fund market dominance. From month-end in September to year-end in December, all liquid fund strategies grew from $41.73b to $63.67b. At year-end passive/beta offerings held roughly 76% of institutional liquid fund value, the highest share percentage since VisionTrack’s AUM tracking began in November 2021. Of the $63.67b, roughly $32.8b was held in Grayscale’s BTC and ETH Trusts. The top ten passive/beta offerings collectively held $37.7b in total AUM at the end of December.

For fundamental funds, the median fund size grew modestly throughout the year to $34.05m, the highest value on the year, though small in comparison to early 2021. Quant directional funds recorded a sizable gain to end the year, recording a median fund size of $40.0m. Market Neutral funds achieved their highest recorded median fund size to end the year of $17.0m, a notable achievement for the cohort.

Though crypto-dedicated liquid hedge fund AUM picked up pace in Q4 2023, the top 20 liquid hedge funds still maintain roughly 71.6% of total hedge fund AUM. At year-end in 2022, this figure was 75%, a marginally positive sign to see net new funds growing the crypto hedge fund market. However, for top crypto fund managers competing with a difficult 2022 and a wave of new hedge funds from the previous cycle, fundraising for liquid strategies was met with many challenges.

Venture

Fundraising

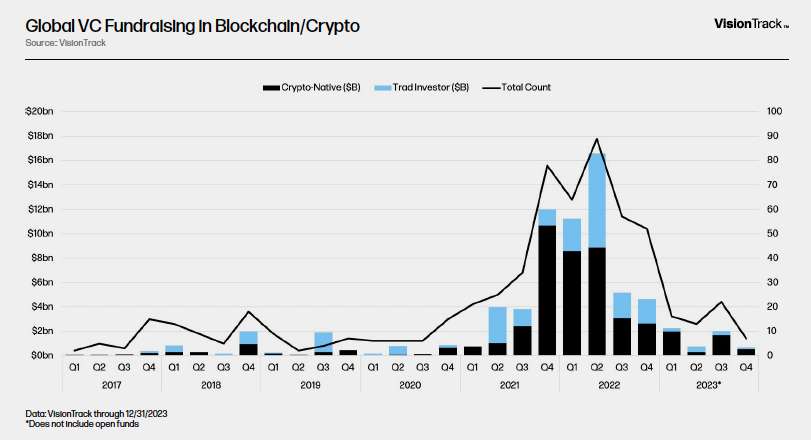

Venture strategies often raise funds as demand for crypto reaches its height when valuations are more expensive and top cryptocurrencies perform well. As valuations cool, institutional allocation and interest declines and fundraising for crypto venture strategies becomes challenging. This was largely the case for crypto venture fundraising since Q3 2022 as passive/beta products took center stage in 2023.

Annually, global venture capital firms in crypto/blockchain raised $5.75b in 2023 across 58 funds, down from 2022’s record year of $37.7b across 262 funds. Considering the global venture capital landscape, the total amount raised from VC funds in all sectors dropped -45.51% from $298.65b in 2022 to $162.73b in 2023 with data sourced from PitchBook. When comparing crypto venture firm’s share of global venture capital fundraising, crypto funds tallied roughly 3.53% of global funding down from 2022’s high of 12.62%. Venture fundraising fell short of 2021’s share (5.65%) as well, though it improved from all prior years.

As outlined in several VisionTrack research reports over the last several quarters, venture fundraising in crypto was not a major fund vehicle until 2021. Despite dismal fundraising figures in 2023, the strategy type has made further strides since pre-2021 levels. As the market spent much of 2023 focused on passive/beta single-asset and multi-asset index offerings, crypto venture capital will likely return should crypto-native allocators aim to rotate to venture fund products later in 2024. Venture funds are critical for the development of the blockchain/crypto ecosystem as they not only provide protection to the downside through quarterly marks in private market valuations, but they also are the primary source of capital for new companies. Though historically there has only been one true downturn where crypto venture funds rose funding en masse, we anticipated that larger crypto venture firms will return in 2024 with new funds.

In Q4 2023, $689m was raised across 7 funds, the lowest level since Q3 2020. Even through Q4 2023, more capital was raised in Q2 2022 than all following quarters combined ($15.58b). The fallout of several major venture-backed startups in 2022, including those backed by some of the most prominent traditional venture firms, continues to be a contributing factor inhibiting allocator investment to the sector. When considering the investor mix of venture firms raising for the blockchain/crypto industry, crypto-native firms tallied roughly 72% of funds closed in 2023 as traditional investors supported fundraising for the industry. On average annually, crypto-native firms close 81% of funds dedicated to crypto venture investing. Traditional investors scored their largest share in 2022 when crypto natives raised only 71% of funds.

The expectation for venture funds given the cyclical rotation of allocators in the previous five years is that crypto natives and traditional investors will return to the market by mid-year 2024 with new funds. Considering the runway of crypto venture companies, this fundraising cycle will be critical for the industry. To date, few funds are mandated for later stage deals, many funds focusing attention on early-stage activity. For funds that have deployed since 2022 and through 2023, many venture-backed businesses will be further along their company lifecycle, indicating later stage rounds should be on the horizon. To best facilitate portfolio companies entering this next stage, it would be unsurprising to see later stage funds raised to support these companies.

For crypto venture capital funds, this would be a major step for the types of venture funds that are raised. Historically, it’s rare to see mandated later stage crypto venture funds raise since the blockchain/crypto market is not as robust as traditional venture. Data collected from VisionTrack finds that 90 of the 785 crypto-dedicated venture funds that raised in the previous 10 years are named Fund II, Fund III, or greater. This suggests that almost 90% of crypto-dedicated venture funds are a first-time fund for crypto exposure from crypto-native firms and traditional investors alike.

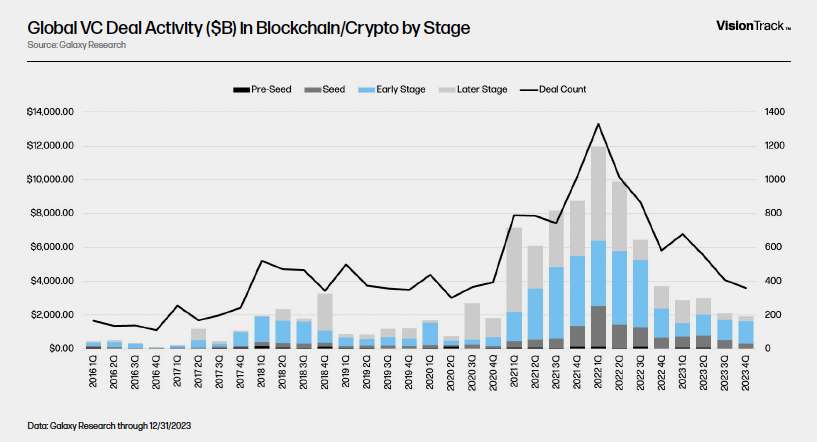

Deals

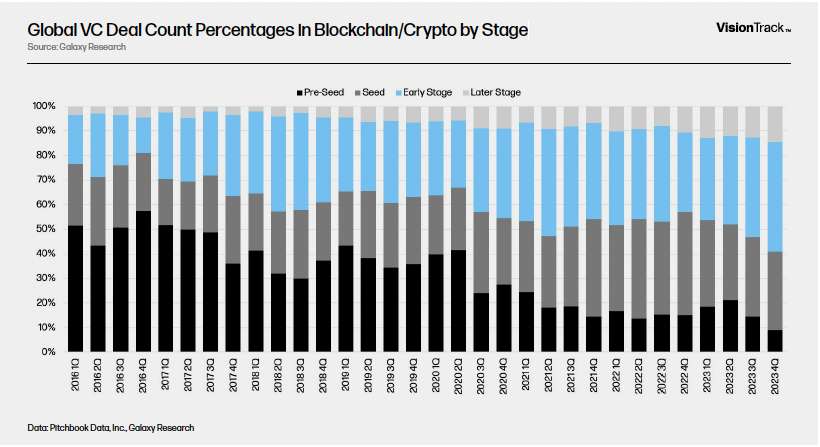

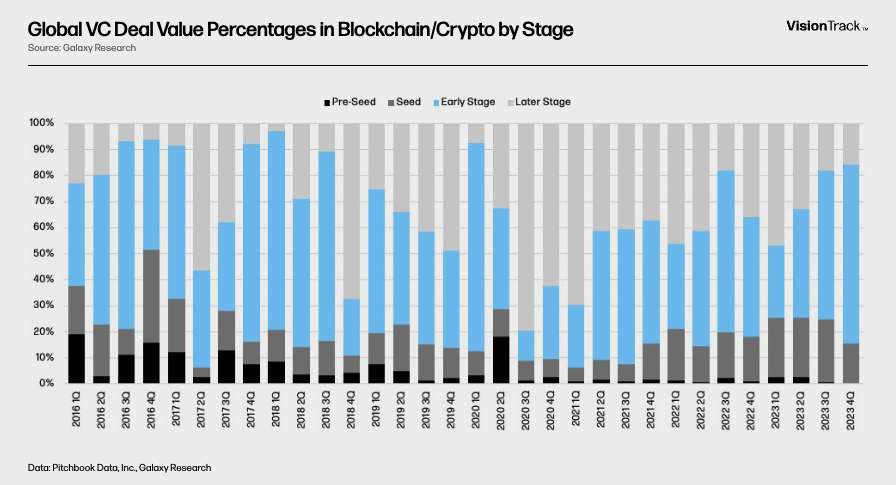

In 2023, crypto venture deal activity accounted for $9.8b in deal value across 1,998 deals according to data collected by Galaxy Research. The annual total is down from $31.9b in deal value across 3,795 deals. In Q4, dismal venture deal activity continued as 359 deals accounted for $1.92b in deal value. Considering early reported details, Q4 2023 saw the lowest deal count since Q2 2020’s 301 deals as deal counts on a quarterly basis have progressively slowed since their peak of 1,331 deals in Q1 2022. As capital in the sector is continually constrained, funds are reaching capacity on deployment and later-stage winners are capturing the remaining fund value.

In Q4 2023, later-stage venture deals captured 14.48% of deal counts and 15.83% of deal value. Historically, this is the highest percentage of later-stage deals recorded on a quarterly basis considering deals by stage. Conversely, pre-seed stage deals dropped off significantly in Q4 2023 recording just 32 of 359 total deals. Pre-seed stage deal count made up just 8.91%, the lowest level since Q1 2016. Pre-seed deals made up 15.43% of deal value in Q4 2023, below the quarterly average of 19.14% with data since Q1 2016.

As noted in our 2023 midyear report, venture capitalists were taking advantage of later-stage deal valuations and supporting prized portfolio companies. This trend did not change through the end of the year as deal activity dwindled and valuations remained flat considering all deal stages. Because the crypto venture capital fundraising market has struggled in the previous six quarters, it is unsurprising to see more consolidation to top portfolio companies. Top deals on the year included Wormhole ($225m), Line Next ($140m), Blockstream ($125m), LayerZero ($120m), and Worldcoin ($115m) generally all later stage deals. Considering the top deals of 2023, only eight exceeded a value of $100m+ in deal value. No deal from 2023 recorded a record deal value in the top 50 from the previous ten years of crypto venture deals. In short, venture deal activity has not come close to reaching historic levels.

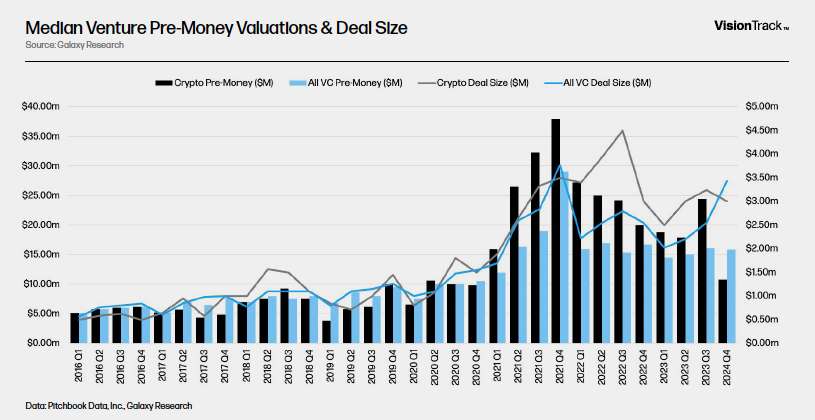

The median deal size for crypto venture deals dropped to $3m in Q4 from $3.25m in Q3. For all deals, the historical median since 2016 is $1.4m in deal value. On a positive note, the previous twelve quarters have all exceeded this median deal value. Since 2016 there have only been three quarters with a median deal size exceeding $3m in deal value, suggesting early-stage deals are more expensive despite the drop off in deal count and value. Put differently, crypto venture investors are not only increasing their minimum check size since 2016, but also becoming more strategic in their deployment year after year. Additionally, for first time in several quarters, the median deal size for all VC surpassed crypto venture, a signifier that valuations have came down for crypto companies.

In terms of valuations, median pre-money dropped to $10.8m in Q4 from $21.13m in Q3, largely attributed to less deal counts. Median post-money valuations also dropped to $14m in Q4 from $28m in Q3. The significant drop in both median pre-money and post-money valuations paired with the lack of fundraising suggests more conservative valuations for less vc-backed companies and consolidation to top-portfolio companies at lower than historical valuations. This does not attribute to a step-down for existing portfolio companies, rather, net new firms in later stages seeing lower historical valuations.

For crypto venture investors, this is a positive sign. For crypto-backed vc-companies, it’s a bit of a different picture. In general, for both crypto venture investors and vc-backed companies the industry has made progress in terms of deal sizing and valuations when considering the market prior to 2020. Despite the challenges faced for crypto venture investors, deal counts on a quarterly basis remain at or near the quarterly average since 2016 with valuations rising since 2020, a positive sign for the growing venture market.

Venture Deal Data

Accurate venture deal data for a market-wide view remains a challenge for the blockchain/crypto markets notably due to the smaller sizing in comparison to traditional venture markets. For example, through year-end 2023, for deals with a known pre-money and post-money valuation, crypto tallied 1,632 total deals utilizing PitchBook Data and Galaxy’s methodology. Considering all venture deals in traditional venture markets, this figure is 34,471. Additionally, information as it pertains to proper deal taxonomies, sectors, tokenized assets, vesting schedules, deal values, deal counts, and secondary transactions are often opaque and arbitrary datasets for crypto venture investors. This ultimately leads to discrepancies in valuations and a fragmented marketplace for venture dealers, especially on the secondary market.

When considering venture deal datasets working to improve market coverage, differences in deal value and counts are a great example of this market challenge. Galaxy’s Research’s methodology with PitchBook Data cites $9.8b across 1,998 deals in 2023. DeFiLlama’s year-end total deal value summed to $6.2b across 720 deals. Crypto Valley’s annual blockchain venture report cites $9.8b across 1,031 deals. The Block recorded $10.7b across 1,819 deals. And Messari records $19.6b with the inclusion of Stripe’s $6.5b raise as a crypto-adjacent deal. With the exclusion of Stripe, Messari’s total deal value is $13.1b across 1,698 deals.

While a handful of venture deal datasets share resemblance in deal value and count, deal categorizations and taxonomies make assessment of the venture market difficult on an asset level. Should a fintech firm that facilitates crypto integrations with companies such as Metamask, Magic Eden, and Audius be included in venture deal activity? As more FinTech and traditional financial service firms integrate blockchain/crypto infrastructure and web3 business models, excluding these firms should be disclosed in reported figures. And, while Stripe might not be a crypto-native company with crypto-native backing, the firm is integrating infrastructure and technology to capture significant market share. That’s an important consideration for venture-backed crypto businesses.

Because there is no standardization on data collection, venture deal data may have inaccuracies. Third-party data companies, fund administrators, and valuation specialists all work diligently on this issue. However, the fragmentation calls into question the ultimate performance of crypto venture funds. Further, the lack of quality information limits the investor base inhibiting more crypto venture capital deal making. Additionally, the quality of information related to deal terms, cap tables, and time between rounds is still not as transparent in crypto venture capital as is in traditional venture capital creating challenging pipelines or paths to exit opportunities for venture-backed crypto businesses.

For a venture market in “desperate need of an IPO comeback”, VC exits are especially challenging for crypto-backed companies. Should crypto-venture capital funds not raise well through 2024, we either will see a continuation of dismal deal activity similar to the previous six quarters or companies will seek public markets for liquidity should they not close altogether. Should distributions pick up from recently raised venture funds, notably with 2022 vintages, this will certainly help with the fundraising cycle and be a net benefit for deal activity and valuations ending 2024. Additionally, outperformance in earlier vintages with data through 2023 will certainly help argue for more institutional allocation to venture funds. VisionTrack aims to have 2023 year-end performance of crypto venture strategies by mid-year 2024.

On-Chain Funds

For institutional crypto investors, 2023 was certainly a rebuilding year focused on restoring confidence in the market and testing new products. While not new, tokenized fund offerings and real-world assets carried investor interest through a period of low volume and volatility. Institutional staking products alongside the growth in popularity of tokenized money market funds and short-term tokenized treasuries served as a convenient operational product for investors to mitigate stablecoin risk. March of 2023’s banking illiquidity crisis drove investors to consider alternatives to stablecoins for cash-equivalent solutions bringing interested active fund managers to these financial services.

Crypto Hedge funds have tokenized investment strategies in years past, however, many challenges still face this model, and the use-case is not common. Despite many firms’ attempts to bring such a product to market, it’s anticipated that more alterative fund vehicles will come to chain the coming years. Reports from Bain at year-end 2023 suggest the tokenization of alternative investment vehicles might lead to a $400b opportunity. An exciting figure, though, we’ve yet to see this materialize with any consistency. Firms such as Superstate and Securitize are crypto-native firms working on this exact issue and are largely paving the way for investors. Of the current identifiable universe of tokenized fund products, most often funds raised are categorized as private credit. However, we are seeing more alternative funds such as KKR’s Health Care Growth II fund and commodities funds gain industry interest.

A major announcement in the development of tokenized fund products also came from Apollo and JP Morgan in Q4 2023 after several quarters of industry excitement to RWAs. The two investment giants partnered with infrastructure providers Oasis Pro and Provenance Blockchain on Project Guardian to utilize private blockchains for the management of tokenized assets and fund products. Whether the crypto hedge fund and venture industry moves in similar operational direction, we will have to wait and see.

Conclusion & Outlook

Actively managed strategies are crucial for the development of institutional crypto. Hedge funds and venture funds alike serve as a support system for the development and adoption of more widespread crypto use-cases. While performance is important, the investment vehicles provide liquidity and opportunity to an industry riddle with complications in 2022. Much of 2023 might be summarized as a challenging time for many crypto hedge funds and venture firms as passive/beta products dominated the market. As seen in previous cycles, managers focused on diligent institutional quality fund offerings often with the support of crypto-native LPs will survive and reap the benefits in rebounding markets.

From an allocator’s perspective, timing the market with a proper fund vehicle is often difficult for institutional allocators when compared to crypto-native investors as immediate market forces position an allocator in the “current trend.” Getting off zero is important and often the first step for allocators. However, the attractiveness of these fund strategies becomes much clearer in market downturns. For instance, this past summer was an excellent time to consider small and mid-cap fundamental and quant directional exposure. Should single asset spot products perform well to start 2024, it would be unsurprising to see interest and excitement build a rotation towards market-neutral and venture fund offerings later in the year.

The VisionTrack Data Dashboard and the VisionTrack Database are provided for informational purposes only and should not be relied upon for the basis of any investment decisions.

This document provides links to other websites that we think might be of interest to you. Please note that when you click on one of these links, you may be moving to a provider’s website that is not associated with Galaxy. These linked sites and their providers are not controlled by us, and we are not responsible for the contents or the proper operation of any linked site. The inclusion of any link does not imply our endorsement or our adoption of the statements therein. We encourage you to read the terms of use and privacy statements of these linked sites as their policies may differ from ours.

This document, and the information contained herein, has been provided to you by Galaxy Digital Holdings LP and its affiliates (“Galaxy”) solely for informational purposes. This document may not be reproduced or redistributed in whole or in part, in any format, without the express written approval of Galaxy. Neither the information, nor any opinion contained in this document, constitutes an offer to buy or sell, or a solicitation of an offer to buy or sell, any advisory services, securities, futures, options or other financial instruments or to participate in any advisory services or trading strategy. Nothing contained in this document constitutes investment, legal or tax advice. You should make your own investigations and evaluations of the information herein. Any decisions based on information contained in this document are the sole responsibility of the reader. Certain statements in this document reflect Galaxy’s views, estimates, opinions or predictions (which may be based on proprietary models and assumptions, including, in particular, Galaxy’s views on the current and future market for certain digital assets), and there is no guarantee that these views, estimates, opinions or predictions are currently accurate or that they will be ultimately realized. To the extent these assumptions or models are not correct or circumstances change, the actual performance may vary substantially from, and be less than, the estimates included herein. None of Galaxy nor any of its affiliates, shareholders, partners, members, directors, officers, management, employees or representatives makes any representation or warranty, express or implied, as to the accuracy or completeness of any of the information or any other information (whether communicated in written or oral form) transmitted or made available to you. Each of the aforementioned parties expressly disclaims any and all liability relating to or resulting from the use of this information. Certain information contained herein (including financial information) has been obtained from published and non-published sources. Such information has not been independently verified by Galaxy and Galaxy does not assume responsibility for the accuracy of such information. Affiliates of Galaxy’s own investments in some of the digital assets and protocols discussed in this document. Except where otherwise indicated, the information in this document is based on matters as they exist as of the date of preparation and not as of any future date, and will not be updated or otherwise revised to reflect information that subsequently becomes available, or circumstances existing or changes occurring after the date hereof. The foregoing does not constitute a “research report” as defined by FINRA Rule 2241 or a “debt research report” as defined by FINRA Rule 2242 and was not prepared by GalaxyDigital Partners LLC. For all inquiries, please email [email protected]. ©Copyright Galaxy Digital Holdings LP 2024. All rights reserved.