2023: Crypto VC Seeks a Bottom

Introduction

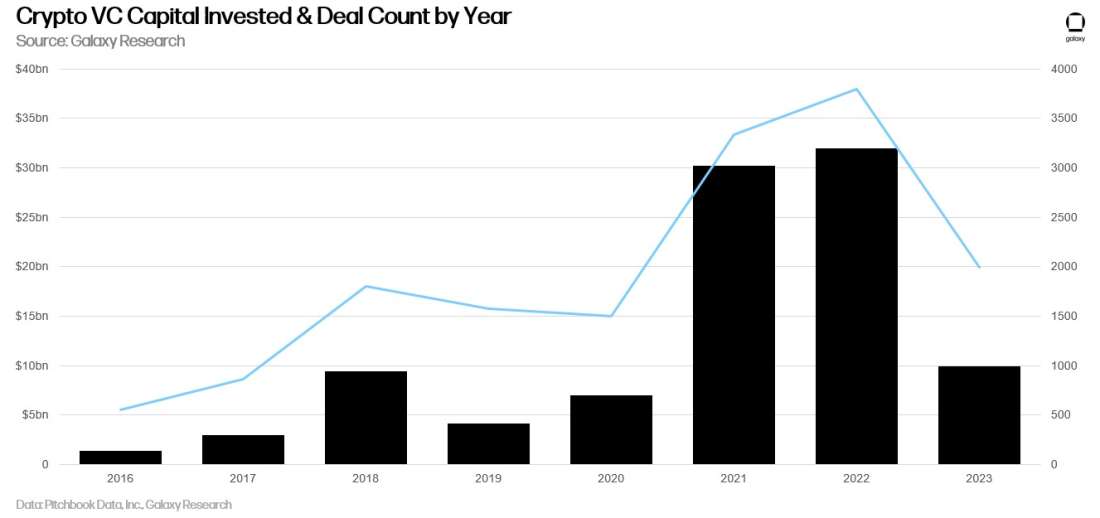

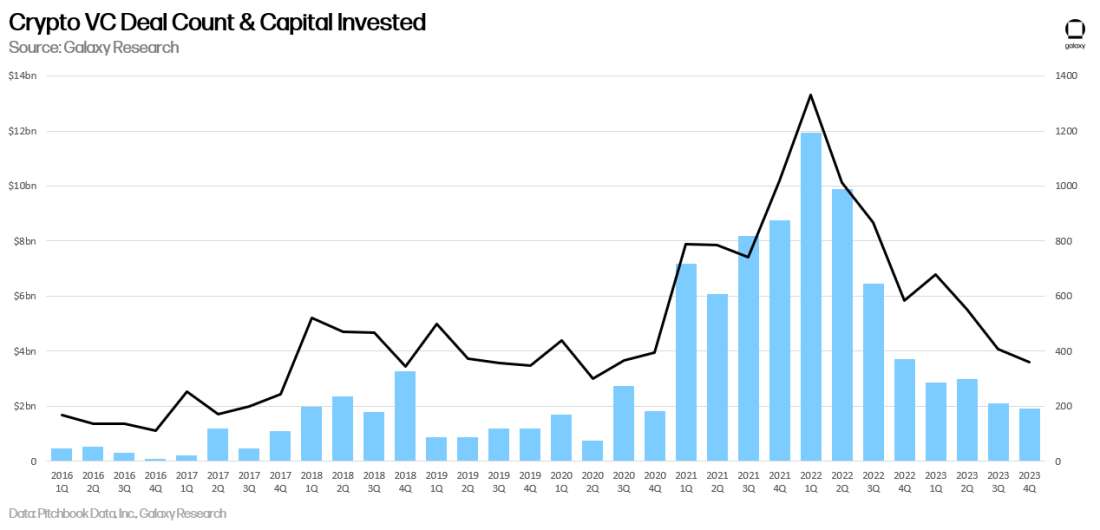

2023 was a monumental year for cryptocurrency, with BTC rising more than 160% and ETH rising 90%, but crypto venture capital investment nonetheless declined significantly from 2022’s banner year. Tightening monetary policy increased the cost of capital and reduced venture allocations across the board and several prominent blowups of venture-backed cryptocurrency industry startups further reduced allocator appetite for exposure. Ultimately, 2023 finished the year with only 1/3 of the crypto VC investment than each of the prior two years across just a little more than half of the deals. However, the crypto industry appears set to surge in 2024 and central banks are poised to ease, the combination of which could lead to renewed interest in crypto venture capital this year.

VC Investing

Deal Count & Capital Invested

2023 was the third largest year for crypto VC by both deal count and capital invested, although both metrics dropped significantly from 2022.

On a quarterly basis, deal count and capital investment continue to put in new lows. Q4 2023 saw $1.98bn invested across 359 deals, down slightly from Q3 2023.

Deal count hit its lowest point since Q2 2020 and capital invested was the lowest since Q4 2020.

VC Money Invested & Bitcoin Price

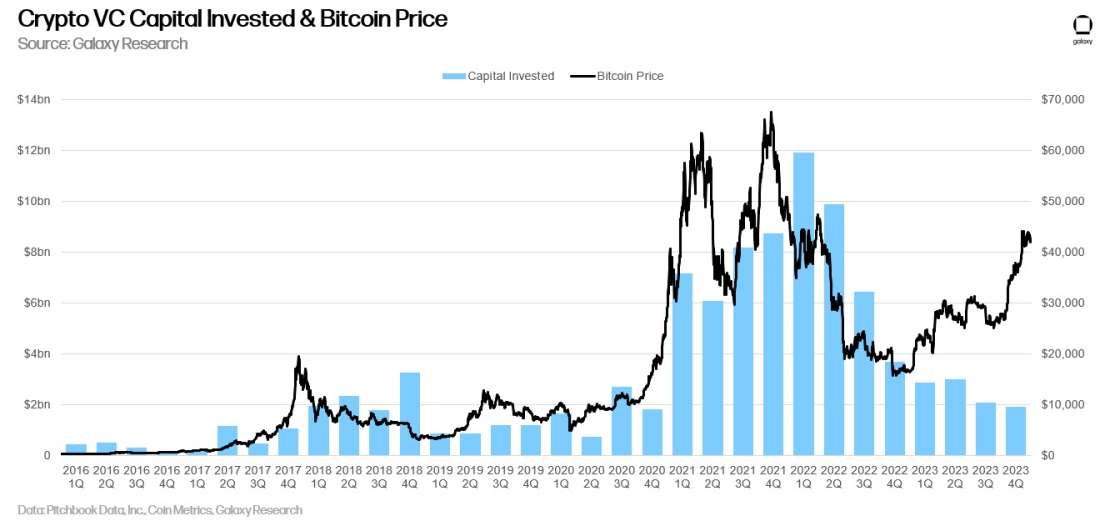

While VC investment has typically correlated to Bitcoin price, that correlation broke down significantly in 2023, with Bitcoin rising 160% while crypto VC capital invested continuously making new lows.

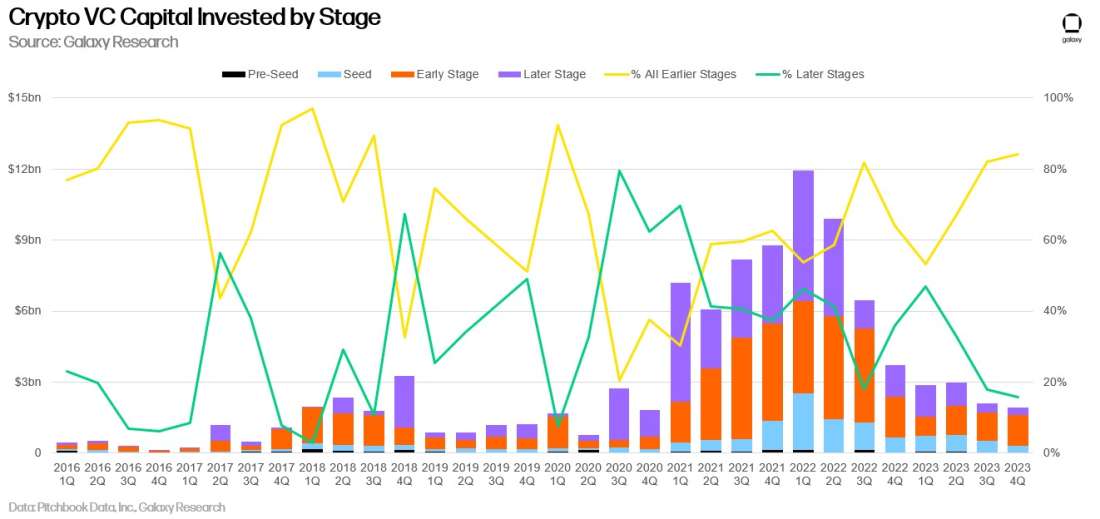

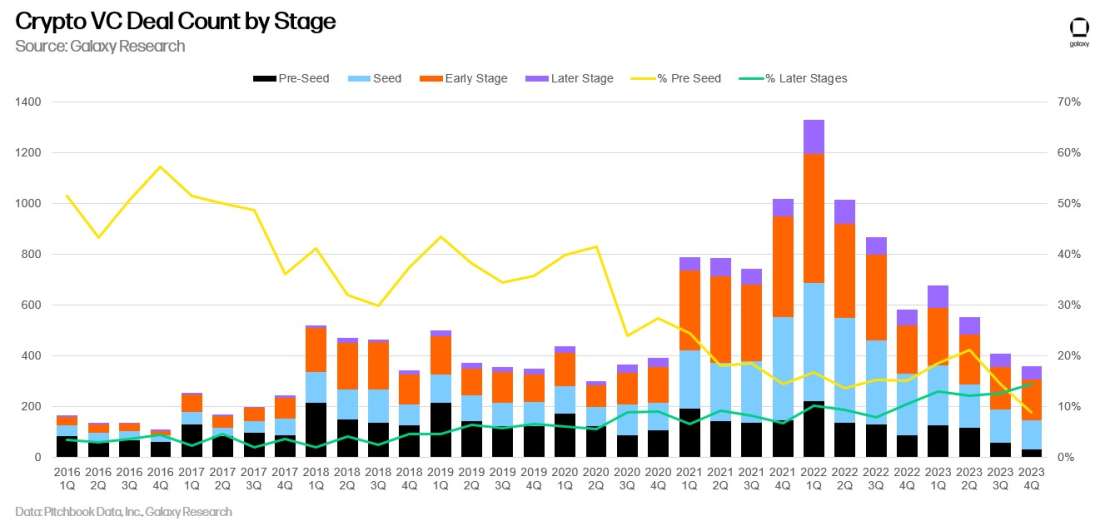

VC Investment by Stage

Throughout 2023, earlier stage companies accounted for the majority of VC deals, a trend that accelerated throughout the year. Less than 20% of deals in Q3 and Q4 2020 were completed by later stage companies.

While pre-seed deal share grew from the middle of 2022 through the middle of 2023, the earliest stage deal share declined precipitously in the second half of 2023.

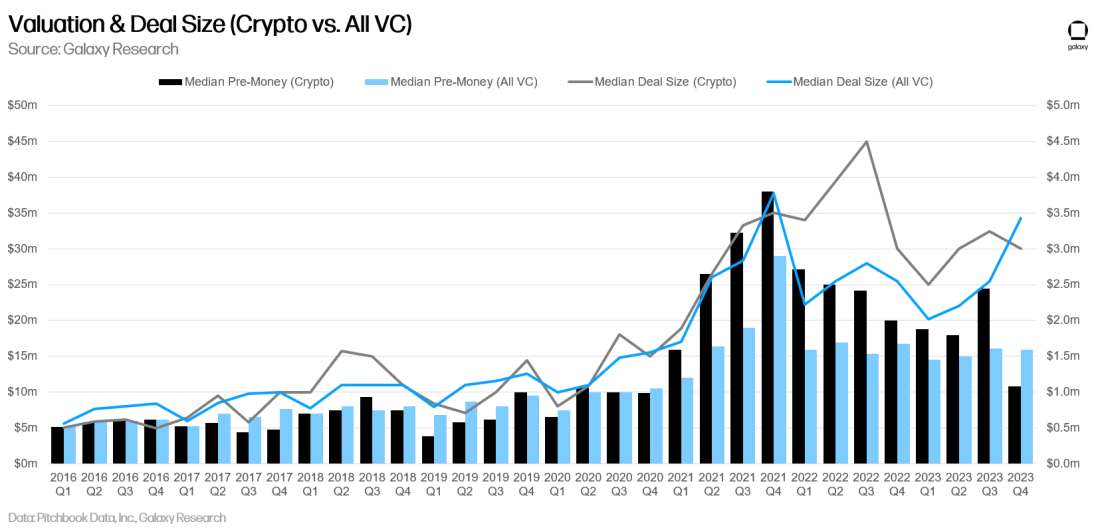

Valuation & Deal Size

VC-backed crypto company valuations declined significantly in 2023, with Q4 reaching the lowest median pre-money valuation since Q4 2020, while pre-money valuations across all venture capital held relatively steady after initially declining at the beginning of 2022. Median deal size in Q4 was down 33% from its all time high of $4.5m in Q3 2022.

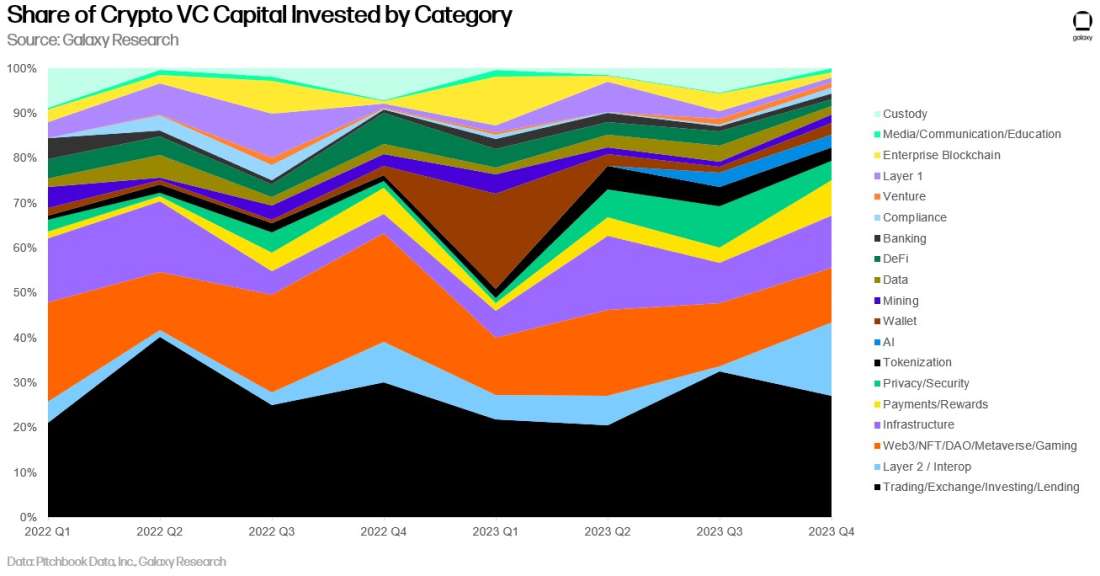

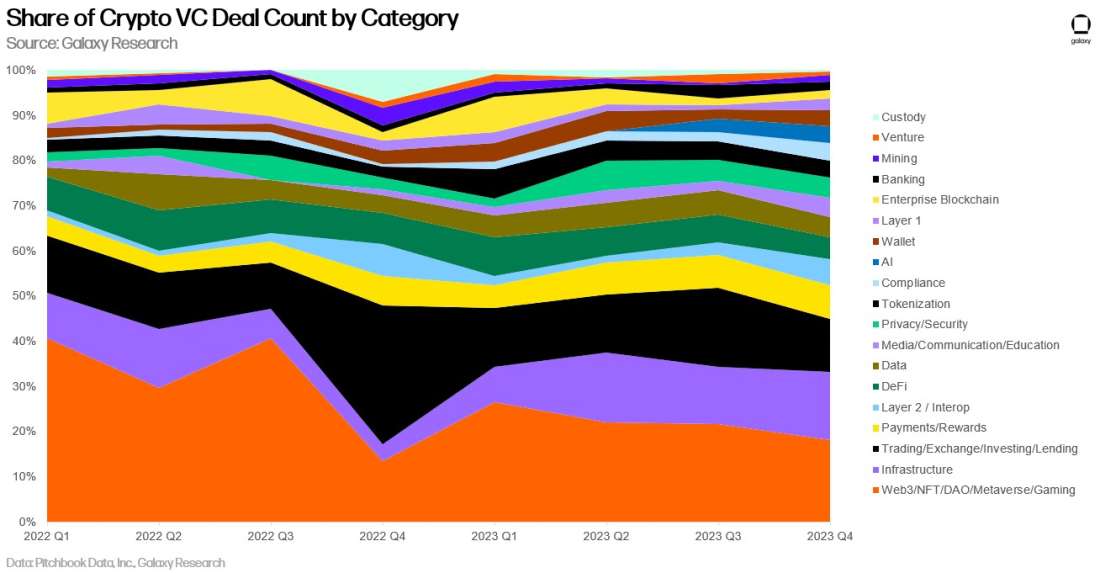

Investment by Sector

For the fourth consecutive quarter, startups building Trading, Exchange, Investing, and Lending companies raised the most venture capital money (27% of the total). For the first time, our Layer 2 & Interoperability category raised the 2nd most capital (16%), led by Wormhole’s $225m fundraise. Web3 came in third with 12% of the capital raised. Our new AI category held steady at about 3% of all raised capital.

By deal count, Web3 continued to lead, a broad category that includes gaming, NFTs, DAOs, and metaverse-related companies, followed by Infrastructure companies, which gained the second spot over Trading, Exchange, Investing & Lending companies.

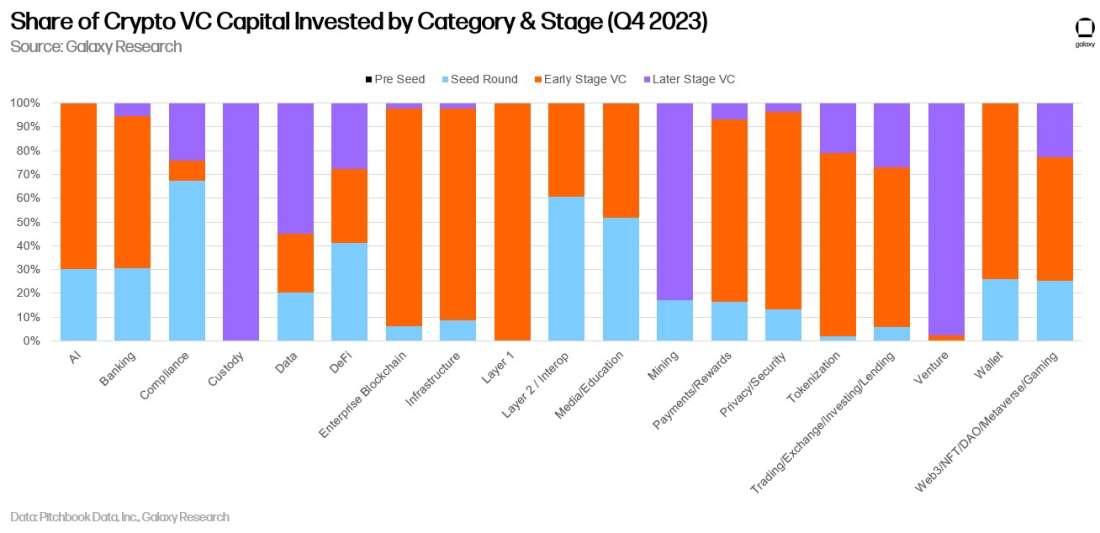

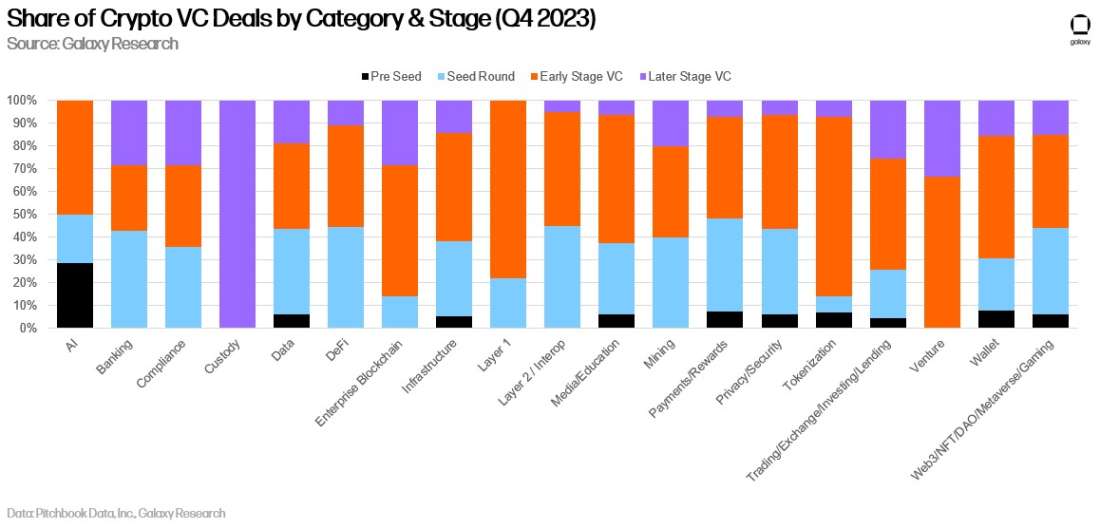

Investment by Stage & Category

Looking by stage, startups in our Compliance category skewed towards seed while capital in our Venture and Custody categories skewed heavily towards later stage. Companies are categorized as “Venture” if they are platforms for fundraising or capital deployment. Note, one company raised late stage funding in the Custody category but no deal size was disclosed, so its column in this chart is based on extremely limited data.

On deal count, it’s important to note that 50% of AI startup deals were seed or pre-seed, showing significant entrepreneurial interest in this emerging category.

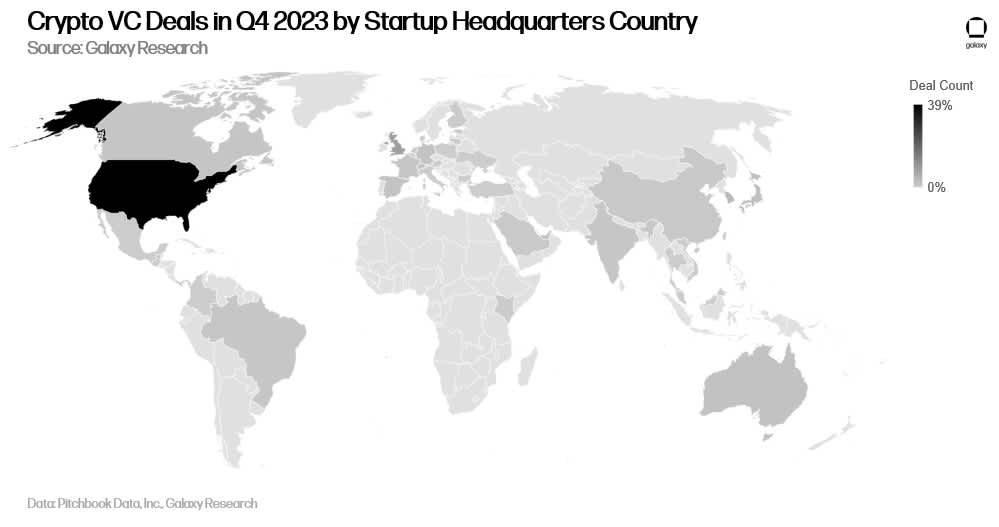

Investment by Geographic Location

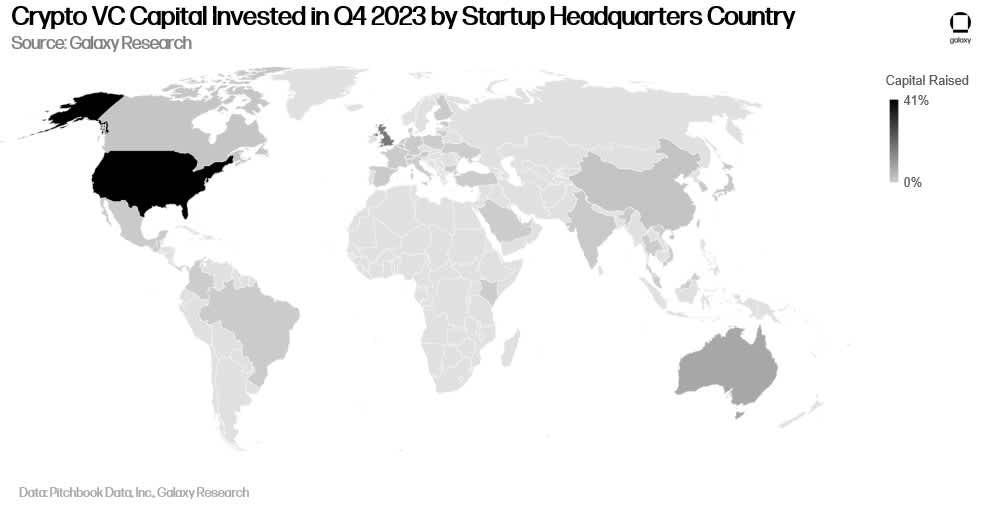

The US continued to dominate by deal count and capital invested throughout 2023. Nearly 40% of deals in Q4 involved a US-headquartered startup.

When looking at capital invested, the story was similar. US dominance continues despite regulatory headwinds.

Investment by Cohort

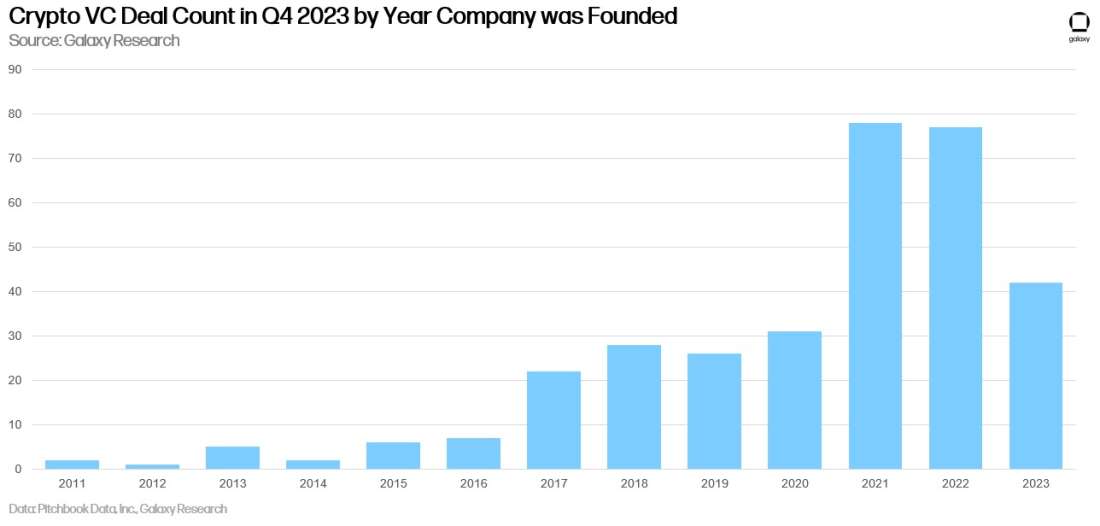

In Q4 2023, companies founded in 2021 accounted for the most deals (78), followed by 2022 (77) and 2023 (42).

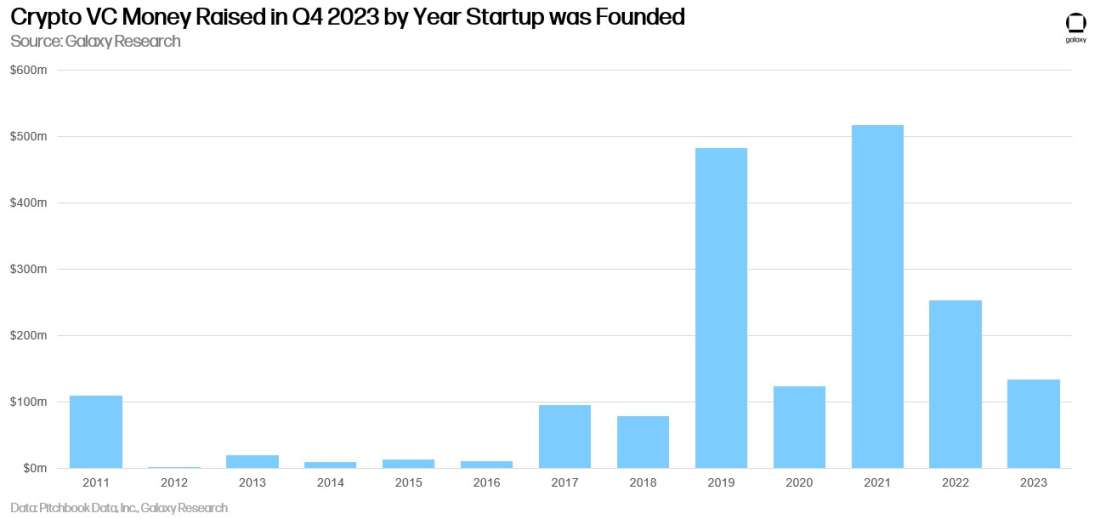

While companies founded in 2021 also raised the most capital ($516m), 2019 era startups were second with ($482m).

Crypto VC Fundraising

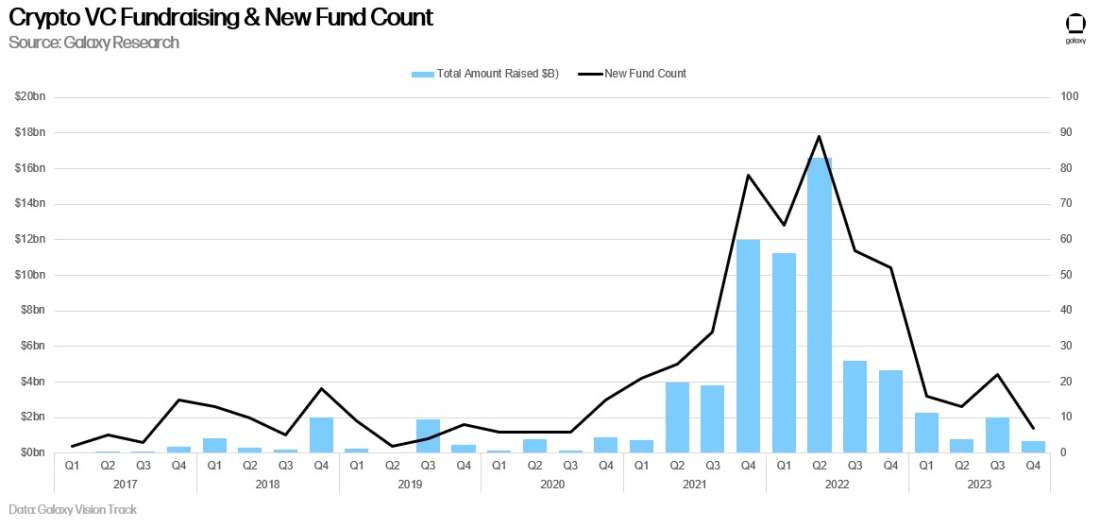

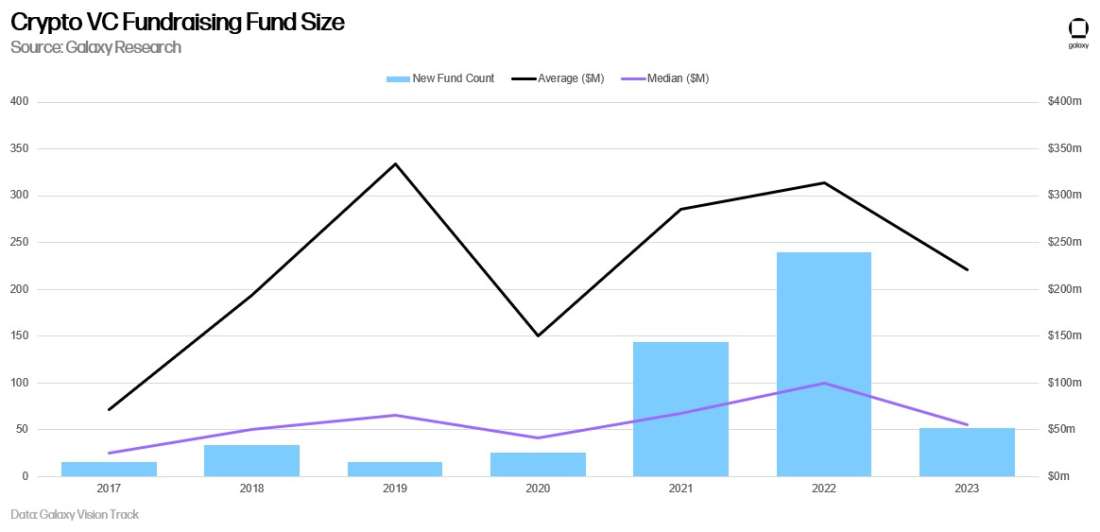

Fundraising for crypto venture funds continues to be extremely challenging. The macro environment and turmoil in the crypto market infrastructure startup world combined to dissuade allocators from making the same level of commitments to crypto that they did in 2021 and 2022. Q4 2023 saw the fewest number of new crypto venture capital funds and the smallest amount allocated to them since Q3 2020.

On an annual basis, 2023 saw the fewest number of new crypto venture capital fund launches since 2020. Average fund size declined 30% year over year, while median fund size declined 45%.

Key Takeaways

2023 was a tough year for crypto VC and the ecosystem has yet to firmly reach a bottom. Despite resurgent liquid crypto prices, venture capital activity consistently made new lows each quarter. Founders and investors each continue to face a tough fundraising environment.

Bitcoin ETFs will pressure crypto VC and hedge funds. The ability for allocators to gain exposure to crypto through regulated spot-based Bitcoin ETFs with low fees will pose an additional challenge to asset managers seeking to launch new active funds. While several managers already do so, managers who don’t currently benchmark against BTC will face pressure to do so either overtly or implicitly.

Pre-seed deals continue to decline both in real terms and on a relative basis. Only 32 pre-seed deals were completed in Q4 2023 and comprised only 8.9% of deals completed and 0.26% of capital invested, down from a Q1 2019 deal count high of 217 (43%) and a Q1 2016 capital investment high of 19%.

Trading and Web3 companies continue to dominate, but AI is showing growth. Companies providing ways to investors to buy and sell cryptocurrencies continued to dominate capital raises, but Layer 2 and Interoperability investment increased in Q4, with the Wormhole bridge raising a significant amount of capital. AI is becoming a more interesting category, with several startups entering the arena.

The United States continues to dominate the crypto startup ecosystem. While the US is maintaining clear leads in deals and capital, regulatory challenges in the US could force more companies abroad. Policymakers should be conscious how their actions or inaction might impact this ecosystem, if the US is to remain the center of technological innovation.

Legal Disclosure:

This document, and the information contained herein, has been provided to you by Galaxy Digital Holdings LP and its affiliates (“Galaxy Digital”) solely for informational purposes. This document may not be reproduced or redistributed in whole or in part, in any format, without the express written approval of Galaxy Digital. Neither the information, nor any opinion contained in this document, constitutes an offer to buy or sell, or a solicitation of an offer to buy or sell, any advisory services, securities, futures, options or other financial instruments or to participate in any advisory services or trading strategy. Nothing contained in this document constitutes investment, legal or tax advice or is an endorsementof any of the digital assets or companies mentioned herein. You should make your own investigations and evaluations of the information herein. Any decisions based on information contained in this document are the sole responsibility of the reader. Certain statements in this document reflect Galaxy Digital’s views, estimates, opinions or predictions (which may be based on proprietary models and assumptions, including, in particular, Galaxy Digital’s views on the current and future market for certain digital assets), and there is no guarantee that these views, estimates, opinions or predictions are currently accurate or that they will be ultimately realized. To the extent these assumptions or models are not correct or circumstances change, the actual performance may vary substantially from, and be less than, the estimates included herein. None of Galaxy Digital nor any of its affiliates, shareholders, partners, members, directors, officers, management, employees or representatives makes any representation or warranty, express or implied, as to the accuracy or completeness of any of the information or any other information (whether communicated in written or oral form) transmitted or made available to you. Each of the aforementioned parties expressly disclaims any and all liability relating to or resulting from the use of this information. Certain information contained herein (including financial information) has been obtained from published and non-published sources. Such information has not been independently verified by Galaxy Digital and, Galaxy Digital, does not assume responsibility for the accuracy of such information. Affiliates of Galaxy Digital may have owned or may own investments in some of the digital assets and protocols discussed in this document. Except where otherwise indicated, the information in this document is based on matters as they exist as of the date of preparation and not as of any future date, and will not be updated or otherwise revised to reflect information that subsequently becomes available, or circumstances existing or changes occurring after the date hereof. This document provides links to other Websites that we think might be of interest to you. Please note that when you click on one of these links, you may be moving to a provider’s website that is not associated with Galaxy Digital. These linked sites and their providers are not controlled by us, and we are not responsible for the contents or the proper operation of any linked site. The inclusion of any link does not imply our endorsement or our adoption of the statements therein. We encourage you to read the terms of use and privacy statements of these linked sites as their policies may differ from ours. The foregoing does not constitute a “research report” as defined by FINRA Rule 2241 or a “debt research report” as defined by FINRA Rule 2242 and was not prepared by Galaxy Digital Partners LLC. For all inquiries, please email [email protected]. ©Copyright Galaxy Digital Holdings LP 2023. All rights reserved.