Top Stories of the Week - 11/3

This week in the newsletter, we write about SBF’s guilty verdict, a new executive order from the White House on AI, and the launch of Celestia, a new blockchain at the core of the “modularity” thesis.

Subscribe here and receive Galaxy's Weekly Top Stories, and more, directly to your inbox.

SBF Found Guilty on All Counts

Sam Bankman-Fried, the former CEO of now defunct cryptocurrency exchange FTX, was declared guilty on all seven federal charges of fraud, conspiracy, and money laundering on Thursday, November 2. The unanimous verdict was reached by a New York jury after less than five hours of deliberation on Thursday evening. SBF faces up to 115 years in jail for his crimes. A tentative sentencing date was set for March 28, 2024.

SBF’s lawyers will likely appeal the decision. In a statement, lead defense attorney Mark Cohen said, “We respect the jury’s decision. But we are very disappointed with the result. Mr. Bankman Fried maintains his innocence and will continue to vigorously fight the charges against him.” Laura Shin, a long-time crypto industry reporter and author, who has been an eye witness to the trial since it started on October 3, said SBF appeared emotionless and stoic when the verdict was announced at roughly 7:45pm (ET) on Thursday. Shin reported that SBF’s parents who were also present at the New York courtroom were visibly distraught, with “their head in their hands.”

OUR TAKE:

After weeks of testimony from a wide range of individuals including FTX customers, investors, executives, and SBF himself, the crypto industry’s biggest fraudster has finally been brought to justice and declared guilty. The industry can now let out the breath that it has been holding in since the trial began in early October when it was still unclear whether the Department of Justice (DOJ) would be able to successfully convict SBF for intentionally defrauding FTX customers. (Read our prior newsletter to recall the early outlook on SBF’s trial.)

Ironically, the most damning testimony in the monthlong trial that likely sealed SBF’s conviction by the jury was from SBF himself. Eye witnesses at the trial have reported that during SBF’s testimony, particularly the cross-examination by the DOJ, the jury was visibly perturbed by SBF’s statements and failures to remember any material detail about the events that caused FTX’s collapse.

Now that SBF has been convicted, the consequences of his actions are sobering. SBF faces up to 115 years in jail. “The cryptocurrency industry might be new; players like Sam Bankman-Fried might be new. But this kind of fraud, this kind of corruption, is as old as time, and we have no patience for it,” Manhattan U.S. Attorney Damian Williams said in a news briefing following Thursday’s verdict. Though the final sentencing has yet to be happen, the verdict alone is a positive development for the crypto industry showcasing that bad actors in this industry can and will be brought to justice in the U.S. court of law. - Christine Kim

New US Executive Order looks to address AI risks

President Biden signs AI Executive Order (EO). On Monday, President Biden issued an EO that aims to manage the potential risks of AI systems. The EO aims to establish new standards for AI safety and security and calls for developers "of the most powerful AI systems" that pose "serious risk to national security, national economic security, or national public health and safety" to notify the federal government when training the model and to share safety test results and other critical information with the US government before they are deployed publicly. The EO also calls for the National Institute of Standards and Technology to set safety and testing standards which will be applied by other agencies including the Departments of Energy and Homeland Security. Some of the specified risks in the 111-page document that the Biden Administration is looking to address include threats to critical infrastructure, AI's potential to engineer biological weapons, cybersecurity risks, AI-enabled fraud and deception, and data privacy.

Biden's EO on AI follows other recent global efforts to regulate the technology including the EU AI Act draft legislation issued in June and the UN's newly formed advisory board, which includes 39 people from across government, academia and industry to explore the international governance of AI.

While some industry groups praised the Administration for its efforts in regulating AI, which builds on top of the White House's blueprint for an AI Bill of Rights released last October, others have concerns around the question of AI fairness, reporting requirements, or "overhyped risks (such as human extinction) lets tech lobbyists get enacted stifling regulations that suppress open-source and crush innovation" as stated by Andrew Ng.

OUR TAKE:

Biden's latest EO on AI doesn't make any specific mention to blockchain or crypto but it closely resembles the EO on digital assets issued last March. The document starts out by briefly touching upon the promise and potential benefits of the emerging tech, followed by a much longer discussion on the hypothetical risks that the tech may pose to national security to emphasize the pressing need for US regulation. The Administration is also looking to regulate code and computation, which can have broader, potentially harmful implications for software and software devs (as we argued in our report on Tornado Cash sanctions).

Policymakers have much at stake when it comes to regulating disruptive technologies – a restrictive or overreaching regime can harm competition, delay tech progress, and possibly drive AI innovation out of the US into friendlier jurisdictions that understand the promise of the technology (as we have already seen with some crypto participants). We are hopeful that industry advocates will engage with policymakers to educate them on the myriad complexities of this growing industry. Ideally, the US can strike the right balance between establishing the necessary safeguards and still allowing room for startups to compete so they can remain the leading hub for innovation. – Charles Yu

Celestia Launches on Mainnet

Celestia, the first self-proclaimed “modular” blockchain, launched on mainnet on October 31. “What was once considered a wild moonshot is now a reality four years after the LazyLedger whitepaper was published,” said Ekram Ahmed, spokesperson at the Celestia Foundation. According to the Foundation, “Celestia is the first modular blockchain network that securely scales with the number of users, making it easy for anyone to spin up their own blockchain.”

The consensus protocol of Celestia is proof-of-stake (PoS). The validator node operators securing Celestia are primarily professional staking providers such as Bitcoin Suisse, Coinbase Cloud, and Chorus One. There is a total of 156 unique validators on Celestia. Since the network’s launch, over 300,000 transactions have been finalized on-chain. Validators are reportedly earning an annual percentage return of close to 25% on their stake.

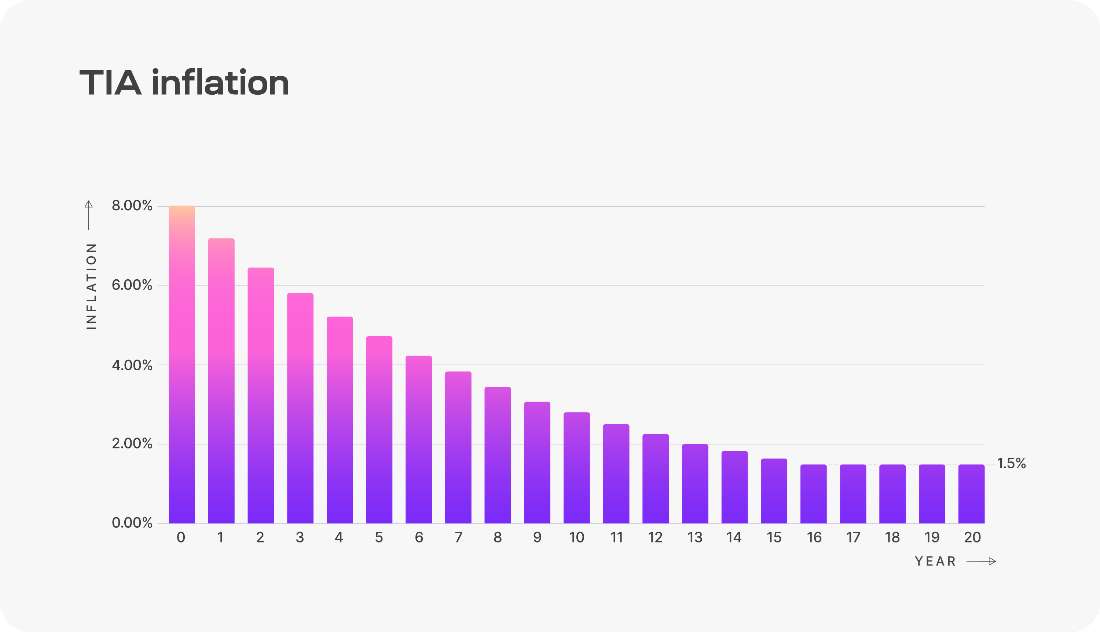

As stated in the Celestia docs, the initial inflation rate of TIA at network genesis will start at 8% of the total supply and decrease by 10% every year thereafter until the inflation rate reaches the long-term issuance rate of 1.5%.

As expected, 1bn TIA tokens was created at Celestia’s genesis and allocated according to the airdrop details explained in this prior Galaxy Research newsletter. TIA is trading on most major cryptocurrency exchanges including Binance, Bybit, OKX, Coinbase, and Kraken. TIA price peaked at $2.83 less than 48 hours after Celestia’s launch. At time of writing, TIA is trending at $2.43.

OUR TAKE:

Celestia is the most highly anticipated Layer-1 blockchain launch since Cosmos. Cosmos was marketed as the “internet of blockchains” in 2019 and its genesis was widely celebrated by developers of other major cryptocurrencies including Bitcoin and Ethereum. Similarly, the launch of Celestia this week has garnered excitement from developers of almost all the Layer-1 blockchains including Bitcoin, Ethereum, and Cosmos, as well as Layer-1 protocols such as Arbitrum, Optimism, and Polygon.

When Cosmos launched, the protocol’s novel “hub and spoke” architecture was highly regarded by its developers as the key to solving the blockchain scalability trilemma. The anticipation for Celestia’s launch has also largely been fueled by the innovative design of Celestia that offers a new solution to the blockchain scalability trilemma, modularity. Celestia is a data availability network optimized for Layer-2 rollups. As explained in this Galaxy Research report about the blockchain modularity thesis, Celestia has no native smart contract functionality or native SDK for rollups. The core protocol was built using the Cosmos-SDK and a Tendermint-based PoS consensus model.

Celestia purely offers block space for rollup sequencers to commit proofs of batches of user transactions to their protocol for data availability. Such a narrow use case for a blockchain enables Celestia developers to deploy unique scalability strategies such as data availability sampling to reduce the computational overhead for node operators having to verify large amounts of data. Now that Celestia has launched, the true value of the protocol will come from the rollup ecosystem that is created over the next few months and years on top of Celestia. The adoption of the rollups built on top of Celestia will dictate the revenue and long-term success of the protocol, and ultimately, prove (or disprove) the blockchain modularity thesis. - Christine Kim

Charts of the Week

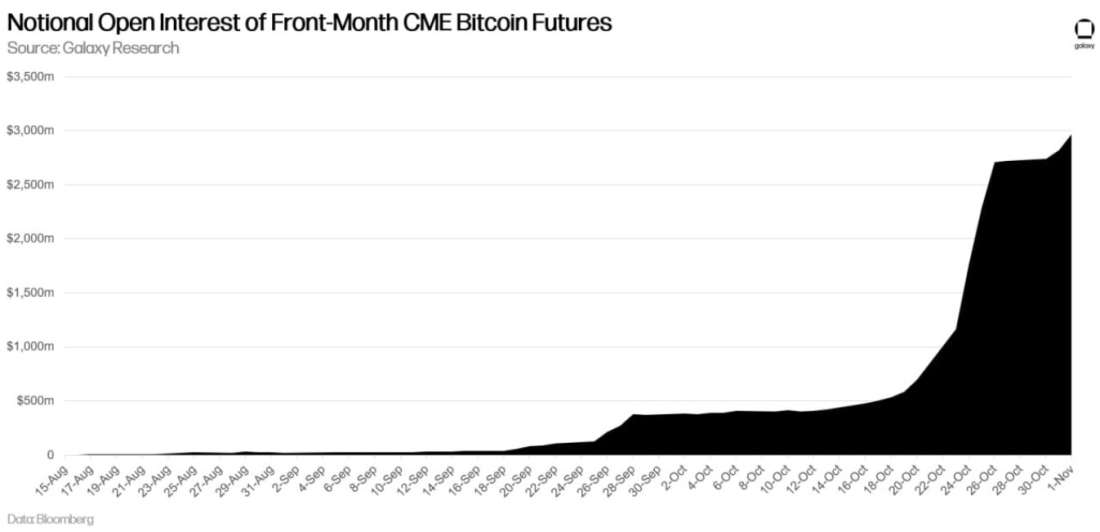

The notional open interest in current month Bitcoin futures on CME hit nearly $3bn this week, tripling week-over-week, signalling growing interest from traditional investors.

Optimism and Arbitrum have maintained the highest amount of net deposits (rolling sum of deposits less withdraws) year-to-date (YTD). Arbitrum has seen $1.67b in net inflows and Optimism has seen $631m in net inflows. Polygon and zkSync Era have seen the most value flight, with net outflows of $393m and $171m respectively.

Bucketing the chains observed below by technology, it is observable that optimistic rollups were the only type that had positive net cumulate bridge flows YTD. Optimistic rollups saw $2.2b in net inflows, while zk-rollups and other technologies saw outflows of $101m and $393m respectively.

Other News

GAO says SEC messed up with SAB 121

Aragon Association to dissolve itself, provide liquidity for ANT redemption

PayPal hit with SEC subpoena over its PYUSD stablecoin

Coinbase crypto futures for retail US traders goes live

Tether touts highest ever percentage of cash and cash equivalents in reserves

Unibot confirms exploit and promises compensation as token price plunges

Starknet to hand out 50 million STRK tokens to early ecosystem contributors

Billionaire Druckenmiller calls Bitcoin a 'brand' he should probably own

From the Desk of Galaxy Digital Research

Legal Disclosure:

This document, and the information contained herein, has been provided to you by Galaxy Digital Holdings LP and its affiliates (“Galaxy Digital”) solely for informational purposes. This document may not be reproduced or redistributed in whole or in part, in any format, without the express written approval of Galaxy Digital. Neither the information, nor any opinion contained in this document, constitutes an offer to buy or sell, or a solicitation of an offer to buy or sell, any advisory services, securities, futures, options or other financial instruments or to participate in any advisory services or trading strategy. Nothing contained in this document constitutes investment, legal or tax advice or is an endorsementof any of the digital assets or companies mentioned herein. You should make your own investigations and evaluations of the information herein. Any decisions based on information contained in this document are the sole responsibility of the reader. Certain statements in this document reflect Galaxy Digital’s views, estimates, opinions or predictions (which may be based on proprietary models and assumptions, including, in particular, Galaxy Digital’s views on the current and future market for certain digital assets), and there is no guarantee that these views, estimates, opinions or predictions are currently accurate or that they will be ultimately realized. To the extent these assumptions or models are not correct or circumstances change, the actual performance may vary substantially from, and be less than, the estimates included herein. None of Galaxy Digital nor any of its affiliates, shareholders, partners, members, directors, officers, management, employees or representatives makes any representation or warranty, express or implied, as to the accuracy or completeness of any of the information or any other information (whether communicated in written or oral form) transmitted or made available to you. Each of the aforementioned parties expressly disclaims any and all liability relating to or resulting from the use of this information. Certain information contained herein (including financial information) has been obtained from published and non-published sources. Such information has not been independently verified by Galaxy Digital and, Galaxy Digital, does not assume responsibility for the accuracy of such information. Affiliates of Galaxy Digital may have owned or may own investments in some of the digital assets and protocols discussed in this document. Except where otherwise indicated, the information in this document is based on matters as they exist as of the date of preparation and not as of any future date, and will not be updated or otherwise revised to reflect information that subsequently becomes available, or circumstances existing or changes occurring after the date hereof. This document provides links to other Websites that we think might be of interest to you. Please note that when you click on one of these links, you may be moving to a provider’s website that is not associated with Galaxy Digital. These linked sites and their providers are not controlled by us, and we are not responsible for the contents or the proper operation of any linked site. The inclusion of any link does not imply our endorsement or our adoption of the statements therein. We encourage you to read the terms of use and privacy statements of these linked sites as their policies may differ from ours. The foregoing does not constitute a “research report” as defined by FINRA Rule 2241 or a “debt research report” as defined by FINRA Rule 2242 and was not prepared by Galaxy Digital Partners LLC. For all inquiries, please email [email protected]. ©Copyright Galaxy Digital Holdings LP 2023. All rights reserved.