Introduction

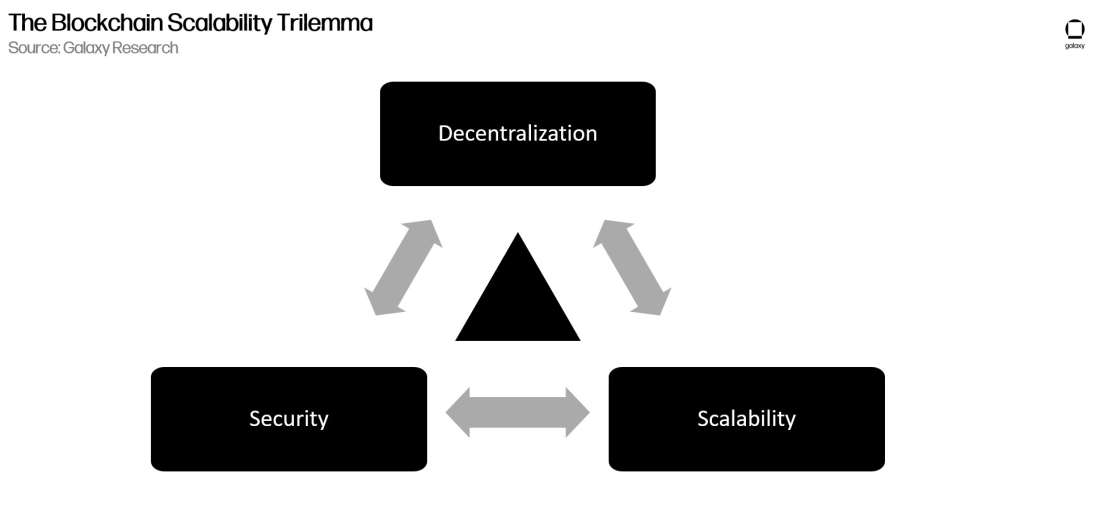

Throughout the 14-year history of cryptocurrencies, observers and builders have developed a wide variety of theses, theories, and technologies to address the blockchain scaling trilemma, the idea that no public blockchain can simultaneously achieve maximum decentralization, security, and scalability. And while different projects have proposed and built several types of solutions with various tradeoffs, demand still exists for a cleaner and more comprehensive solution to this tricky design conundrum. None thus far have proven successful.

In recent years, a new thesis called blockchain modularity has emerged and, this year, crypto industry stakeholders will be able to see this thesis applied with the launch of the Celestia blockchain. Celestia is a Layer-1 blockchain optimized to support Layer-2 rollups, which themselves perform general purpose blockchain computation. Because Celestia does not itself support general purpose blockchain computation natively, but rather offloads the responsibility of smart contract execution to other Layer-2 networks, the theory is that Celestia can become the backbone for a highly scalable and interoperable network of rollups and, most importantly, achieve this modular vision without sacrificing decentralization or security.

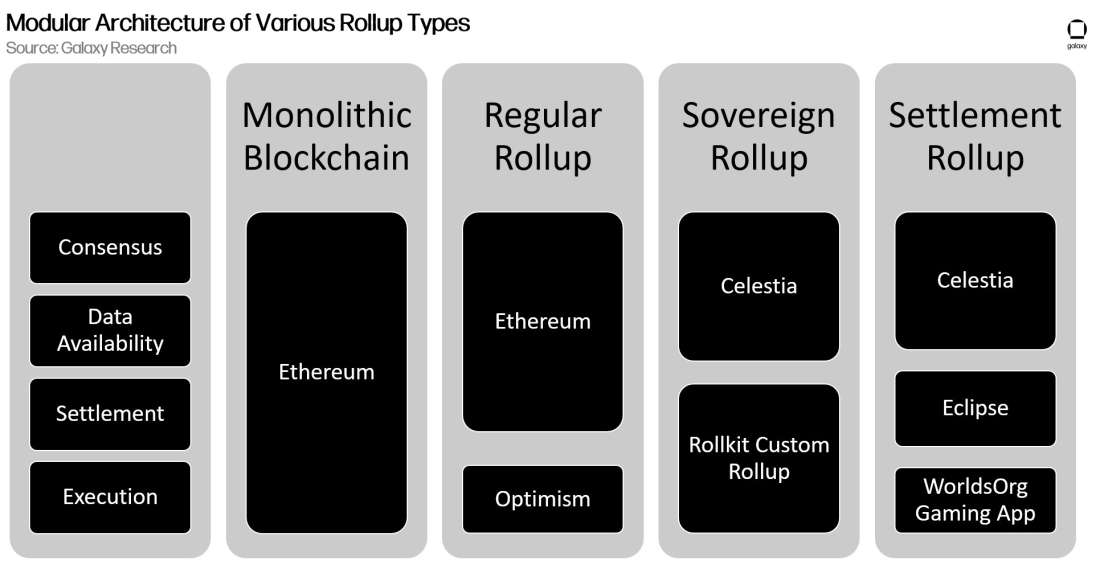

At its core, the blockchain modularity theory proposes that the core functions of modern blockchains—execution, settlement, data availability, and consensus—should themselves be disaggregated and broken into different layers or networks, allowing for tweaks and maximizations that increase the efficiency of each while sacrificing the fidelity of none. This report will explore the blockchain modularity thesis and present a comprehensive overview of different components of the modular blockchain stack.

Background

There are three distinct properties of blockchains that technologists have struggled to maximize simultaneously.

Decentralization: The level of distributed and public participation from users reinforcing the rules of the network. Traditionally, measured by the number of independent node operators on a blockchain. A node operator is an individual or entity that runs software verifying the blocks and transactions finalized on the network. This is not to be confused with a miner or validator, which are individuals or entities that run software to produce and append new blocks to the blockchain. Oftentimes, miners and validators must also run full nodes in addition to their own software for producing blocks to have access to an updated view of the network state. There are other secondary metrics by which to measure a blockchain’s decentralization such as client diversity and supply distribution. For a deeper understanding of the ways decentralization as a property is measured on blockchains, read this blog post by Ethereum founder Vitalik Buterin.

Security: The second key property of a blockchain is security, which refers to the level of resilience a blockchain has against a coordinated attack. Examples of ways in which a malicious actor could compromise the security of a blockchain include an attacker halting or disrupting block production, re-writing transaction history, and/or censoring certain types of activities on the network from executing. The extent to which a blockchain can resist these forms of attack relies on the collective amount of value stakeholders have expended on or locked into the network. For example, on Bitcoin, the collective amount of hashpower (computation) expended every second by stakeholders makes it extremely (i.e., prohibitively) expensive for attackers to disrupt the network. Miners are responsible for progressing the Bitcoin blockchain and most network attack types would require amassing more than 51% miner computation at any given period. On Ethereum, the collective amount of ether (ETH) staked secures the network against reorg attacks, which are attacks that attempt to rewrite chain history. Validators, which today are deposits of 32 ETH (although this threshold may change in the near future, see our recent report), are responsible for progressing the Ethereum blockchain and attacks on the network would require manipulating at least two-thirds of staked ETH at any given period. Manipulating one-third of staked ETH would prevent Ethereum from reaching chain finality, but it would not prevent block production or disrupt chain liveness. For more information about Ethereum’s proof-of-stake (PoS) consensus mechanism, see our recent report.

Scalability: The third and final property of a blockchain in the blockchain trilemma is scalability, perhaps the primary trait that technologists have focused on improving over the last decade. Bitcoin launched in 2009 with a maximum block size of 1MB. A small, fixed block size limits the amount of data that can be included during each interval, effectively limiting the network’s transaction throughput. While 2017’s Segregated Witness (SegWit) upgrade essentially raised the block size limit to 4mb, the property of limiting the maximum size of blocks puts an upper bound on the network’s transaction throughput.

As of 2023, Bitcoin is processing approximately 7 transactions per second (TPS), which is a far cry away from the TPS of centralized payment rails such as Visa, which is 24,000 TPS. To boost Bitcoin’s scalability without sacrificing the network’s properties of decentralization, the bitcoin community has focused on Layer 2 technologies like the Lightning Network. Bitcoin’s Lightning Network was launched in 2018 and can theoretically can reach up to 1m TPS. However, while significant strides have been made, the Lightning Network is difficult to operate in a non-custodial manner and is still in its early stages.

Ethereum has also struggled to improve network scalability over the years. Ethereum launched in 2015 with a maximum block capacity of 3.1m gas. Gas is a measure of the computational energy needed to execute an operation on the network. (True to its genesis as primarily a general computation network, Ethereum calculates the maximum block size in computational units rather than formatted file capacity). Unlike Bitcoin developers’ resistance to block size increases for the sake of preserving decentralization, Ethereum developers have liberally implemented increases to block gas limits over the past several years. Since the launch of Ethereum in 2015, the maximum block gas capacity has been incrementally increased from 3.1m gas to now 30m gas. However, despite increases in available blockspace, user activity continues to stretch the network to its limits and cause network fees to skyrocket under times of high on-chain activity.

The concept of the blockchain trilemma suggests that meaningfully increasing the scalability of a blockchain necessarily results in the degradation of either decentralization or security. This concept has proven itself to be true despite the advent of recent technologies and blockchain designs over the past few years. In the next section of this report, we will give a brief overview of popular approaches to blockchain scaling leading up to the ideation of the modular blockchain thesis.

Monolithic Blockchains

The two most valuable monolithic blockchains are Bitcoin and Ethereum. However, the limitations of each of these networks have inspired scaling solutions that offload transaction activity to separate layers (i.e., protocols) with varying degrees of functionality and interoperability. Before discussing the various layered scaling solutions that Bitcoin and Ethereum with which developers (and those of other Layer-1 blockchains) have experimented in prior years, it’s worth highlighting Solana as an example of a notable and high-value blockchain that continues to pursue scaling without layers.

Solana is a general purpose blockchain that debuted in March 2020. Notably, Solana’s approach to achieving long-term scalability does not rely on moving parts of on-chain computation off-chain or to alternative blockchain layers. Instead, Solana developers are laser focused on utilizing and stretching node capacity to its limits such that they can tune and optimize all available computational resources for validating the blockchain. Developers argue that advancements and breakthroughs in hardware technology over time will inevitably enable further improvements to network capacity and decentralization. In theory, Solana can achieve 50,000 TPS. To sustain such elevated levels of on-chain activity, the network must rely on users operating advanced computers to operate nodes and validators. The requirements to operate a node on Solana are significantly more costly than most other public blockchains and therefore, usually operated by a business or institution, rather than an individual. In practice, even with advanced machinery supporting the network, the Solana blockchain is notorious for frequently experiencing outages during times of high transaction activity. It is worth noting that recent upgrades have reduced node requirements and increased uptime, though they are still significant issues. Therefore, two tradeoffs for Solana’s elevated level of transaction throughput have historically been network decentralization and uptime, or security. Whether Solana can expand beyond these tradeoffs and overcome the scalability trilemma long-term remains to be seen.

For more information about the Solana blockchain and its approach to scalability, read this Galaxy Research report.

Layered Scaling Solutions

As discussed, Bitcoin developers have experimented with layered scaling solutions through the development of the Lightning Network, which enables users to create bi-directional payment channels atop Bitcoin that function independently from Bitcoin except when opening or closing a channel. Aside from Lightning, other layered scaling projects on Bitcoin include the Liquid sidechain created by blockchain infrastructure company Blockstream and Rootstock, a smart contract protocol that is secured by the Bitcoin blockchain through a technique known as merge mining. More recently, two teams Kasar Labs and Chainway have begun working on new sovereign zero-knowledge rollups that settle to Bitcoin’s Layer 1 blockchain, though these have not yet launched.

On Ethereum, developers have experimented with different approaches to layered scaling including state channels and sidechains like the ones seen on Bitcoin through Liquid and Rootstock, but also through other techniques such as Plasma, sharding, and rollups. (We will discuss rollups in detail later in this report.) The proliferation of layered scaling projects on Ethereum has grown significantly larger in value, adoption, and diversity than the layered scaling projects on Bitcoin. One of the most valuable sidechains built atop Ethereum is Polygon.

Polygon PoS is a sidechain of Ethereum that launched in May 2020. Polygon relies on a modified proof-of-stake (PoS) consensus model that relies on both its own set of independent validators staking the MATIC token in addition to the existing validator set operating on Ethereum staking ETH. Due to the fast 2 second block times on Polygon and the way validators propose multiple blocks at a time in a sprint, there is a high probability of chain reorgs and increased latency when it comes to withdrawing funds from the network back to Ethereum. To address these issues with the Polygon sidechain design, the development team behind Polygon is actively researching and building other technologies, most notably a zkEVM rollup.

To learn more about zkEVMs as a scalability solution on Ethereum, read this Galaxy Research report.

Other Notable Blockchain Scaling Solutions

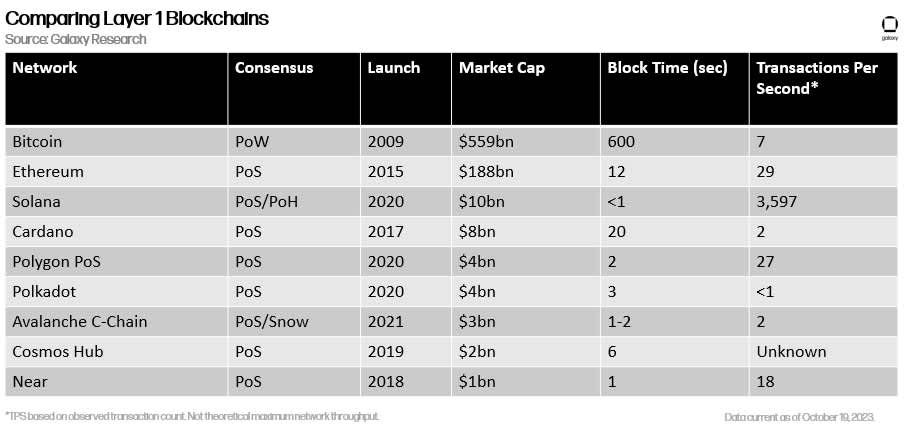

Aside from the layered scaling solutions experimented on Bitcoin and Ethereum, there are a handful of other innovative approaches to layered scaling featured on other Layer-1 blockchains. The following is a table comparing the value and speed of Layer-1 blockchains from the Galaxy Research Report, ‘Ready Layer One’:

For the purposes of illustrating a few examples of other notable blockchain scaling solutions outside of Bitcoin and Ethereum that focus on layered approaches to scaling, we will highlight the design of Avalanche and Cosmos.

Avalanche is a public blockchain that debuted in September 2021 comprised of three blockchain layers: the X-Chain, C-Chain, and P-Chain. Avalanche developers designed each of these layers to support different blockchain activities. For example, on the X-Chain users can create and trade new cryptocurrencies. On the C-Chain, users can deploy smart contracts, and finally on the P-Chain, users can spin-up their own custom mini-blockchains, also called subnets. The primary advantage of Avalanche over other Layer-1 blockchains like Ethereum and Solana is the network’s fast block times, typically between 1-2 seconds. Avalanche can achieve fast finality due to the network’s reliance on an innovative set of consensus models known as Avalanche Consensus and Snowman Consensus.

Despite faster block times, the scalability of subnets and the C-Chain of Avalanche is still limited by bandwidth constraints of nodes. Solana validators need equipment with 12 core CPU and at least 128 GB of RAM. Avalanche validators by comparison require 8 core CPU and 16 GB of RAM. As the use of the C-Chain increases, Avalanche developers will have to either increase node requirements to increase block size or consider other solutions for achieving long-term scalability. Additionally, the node requirements increase with the creation of new subnets, which again presents a bottleneck to scalability. (For more information about the Avalanche blockchain and its consensus model, read this Galaxy Research report.)

Cosmos launched in 2019 as the “internet of blockchains,” offering users a modular software stack comprised of a plug and play consensus model, called CometBFT, and a flexible software development kit (SDK) for enabling smart contract functionality on these blockchains. Within the Cosmos ecosystem, transaction throughput is split between independent networks known as “zones” that can connect with each other via an interoperability protocol called the Inter-Blockchain Communication Protocol (IBC). IBC defines a standard for zones to communicate with each other and exchange data, messages, and tokens in a permissionless and trustless manner. Even though Cosmos software is modular by design, the modular components of Cosmos (i.e., its consensus protocol and SDK) still present bottlenecks to network scalability.

One of the key bottlenecks to scalability for blockchains, be it Cosmos zones or Avalanche subnets, is the bandwidth constraints of nodes to verify on-chain data through a central blockchain, even despite novel consensus mechanisms, data compression techniques through cryptographic proof generation, and multiple validator sets. Over the years, blockchain developers have researched ways to address the bandwidth constraints of nodes such that they can verify large amounts of data without increasing block size. This issue is at the core of why most general-purpose blockchains that achieve scalability through layering or off-chain computation are unable to meaningfully scale without sacrificing decentralization. The next section of this report will dive into the key innovations of forthcoming blockchain projects like Celestia that address the blockchain trilemma in new ways and through new paradigms.

The Modular Blockchain Thesis

As discussed in the prior section, many approaches to scaling blockchains have emerged over the years. However, designing scalable blockchains by removing core functionalities as opposed to replicating them across layers, hubs, shards, parachains, subnets, etc. is a relatively new concept. The concept was first laid out by British computer security researcher and co-founder of Celestia Mustafa Al-Bassam in 2019 in an academic paper titled, “LazyLedger: A Distributed Data Availability Ledger with Client-Side Smart Contracts.” In this paper, Al-Bassam proposes a blockchain design where the functions of network consensus and data availability are decoupled from transaction settlement and execution. In other words, the LazyLedger chain only ensures that block data is available and ordered, while a separate application-layer queries this data and then executes valid transactions on a different chain.

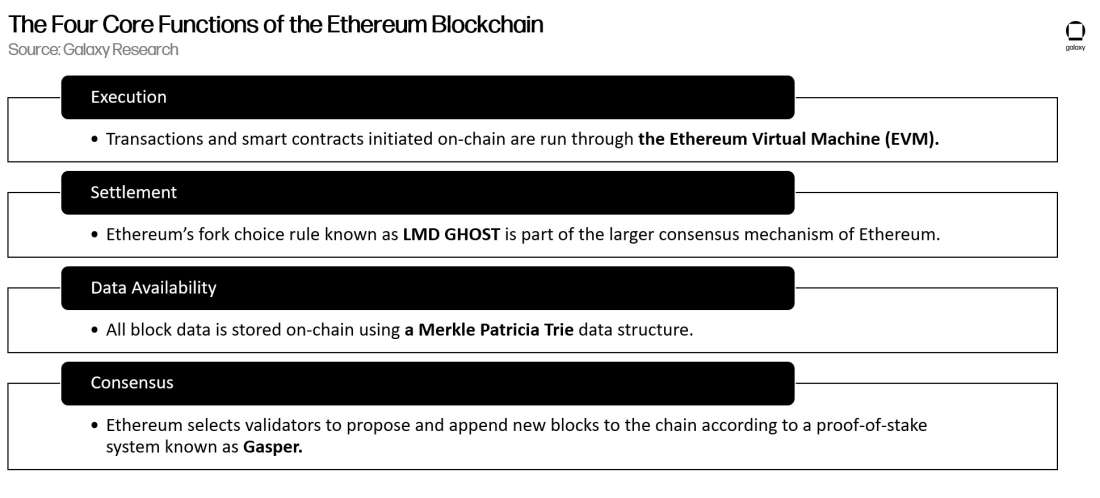

Taking a step back, the four core functions of a blockchain are:

Execution refers to the state transition function of a blockchain, meaning the process through which user transactions and smart contracts get defined and then deployed.

Settlement is the functionality of a blockchain that verifies the validity of a transaction and determines whether certain transactions were erroneously recorded (i.e., should not be part of the canonical chain).

Data availability (“DA”) refers to the record keeping function of a blockchain. Once nodes propagate a transaction, they should store a copy of the transaction and ensure that other nodes can retrieve this data for a period.

Consensus is the activity through which nodes order transactions in a specific block and determine collectively how to append new blocks to the chain.

Ethereum as a monolithic blockchain fulfills all four functions on the same network. All transactions and smart contracts are processed through an execution environment known as the Ethereum Virtual Machine (“EVM”). Data about finalized transactions are stored in Merkle Patricia Trie data structures. An LMD GHOST fork choice rule dictates settlement of competing blocks or opposing views of blockchain state. Finally, a proof-of-stake consensus mechanism known as Gasper enforces rules around how new blocks are proposed and which network stakeholders have the rights to participate in the process of creating network consensus.

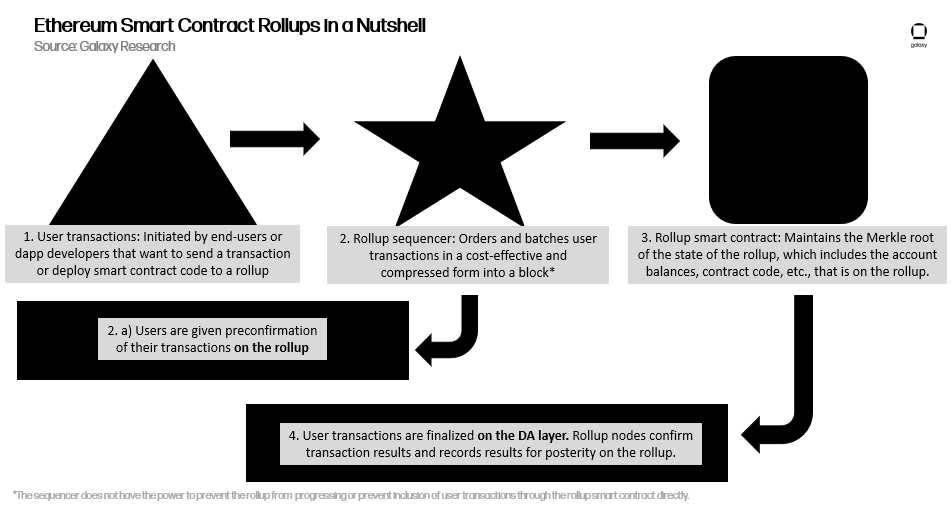

A modular blockchain differs from a monolithic chain in that one or more of these four functions are offloaded to a separate layer. Celestia (formerly LazyLedger) is an example of a blockchain that specializes in fulfilling the function of data availability (“DA”) and consensus by offloading the responsibility of transaction execution and settlement to a different network. Celestia has no native smart contract functionality and, as a result, is more like a decentralized data platform with distributed consensus than a full-featured blockchain like Ethereum. Layer-2 rollups are also examples of modular blockchains. Rollups specialize in fast and low-cost transaction execution for end-users and decentralized application (dapp) developers, while offloading the function of DA and consensus to another layer. By posting transaction data to a separate DA layer, Layer-2 rollup sequencers can specialize in cheap and fast transaction execution without the additional computational burden of performing DA.

Rollups in the modular stack

One of the earliest examples of a crypto project that specialized for transaction execution and offloaded the function of DA to another chain was Mastercoin. Launched in 2013, Mastercoin was the first crypto project funded through an initial coin offering (ICO). Mastercoin developers later renamed the project to Omni and Omni became the bedrock for the creation of Tether (USDT). The Mastercoin protocol sought to introduce programmability to the Bitcoin blockchain by creating a separate network that would execute transactions according to a different, more flexible set of rules than Bitcoin. While the Mastercoin protocol defines the execution of transactions, transaction data is committed down to Bitcoin and thus inherit the strong guarantees of DA from the Bitcoin blockchain.

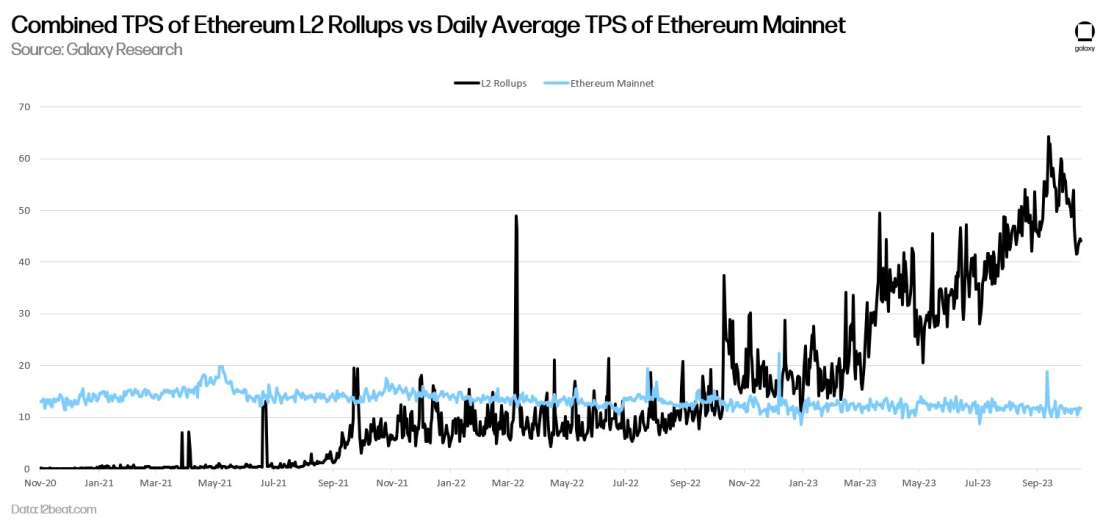

Since Mastercoin, there have been other rollup projects on Bitcoin and Ethereum that similarly have no DA capabilities of their own. Instead of introducing more flexibility to transaction execution like Mastercoin, the latest rollup projects on Ethereum seek to introduce cost savings for transaction execution through data compression. Most rollups on Ethereum mimic the same execution environment of Ethereum (the EVM) to which users and dapp developers are already accustomed and for which tooling has been built. Layer-2 rollups on Ethereum are smart-contract based, meaning transactions on Layer-2 rollups are finalized through interactions with a smart contract on Ethereum. Users can directly submit transactions to the rollup smart contract and have their transactions included in a block on the Layer-2 or can rely on rollup sequencers. Relying on a sequencer is more cost-effective for users because sequencers batch and compress user transactions. However, today rollup sequencers are generally centralized entities operated by a single company. (Read our recent report on the state of decentralization for two of the most widely used rollups, Arbitrum and Optimism).

Fraud and validity proofs are the mechanisms through which users can withdraw funds from a Layer-2 rollup to Ethereum, or bridge assets to other blockchains. For a detailed explanation of the Layer 2 ecosystem on Ethereum, read this Galaxy Research report.

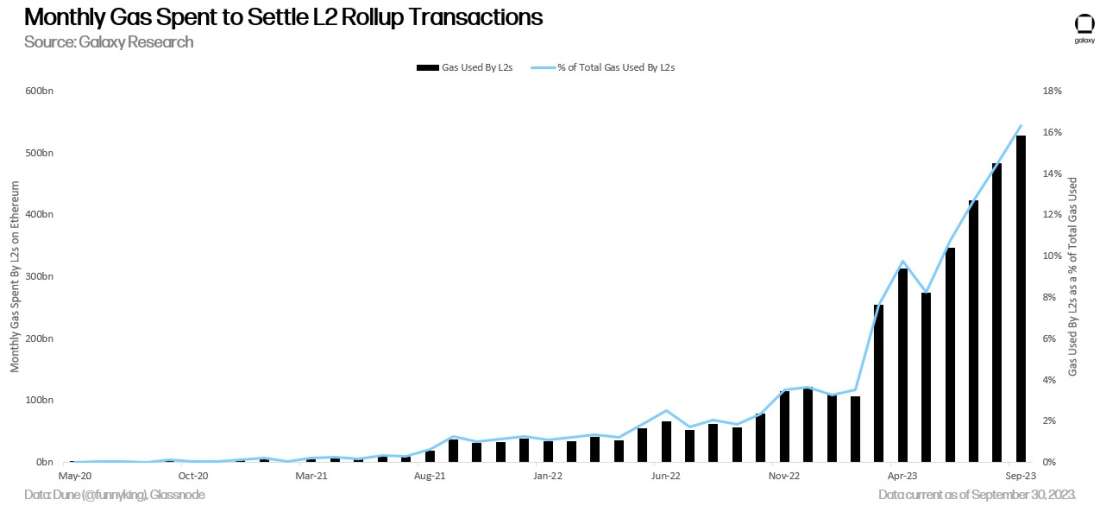

Despite the innovations in rollup technologies and the diverse ways to optimize a blockchain for execution, as opposed to other functions, there has been little focus on optimizations for the underlying DA layer. However, as rollup technology advances and their use specifically for scalability proliferates, the bottleneck in unlocking the full scaling potential for rollups falls on the DA layer. Both Bitcoin and Ethereum, as monolithic blockchains, can and do behave as DA layers but they are not optimized for this function. To post data to these chains, rollup sequencers are subject to the same fee market, block size constraints, and block times as regular transactions.

DA layers in the modular stack

Optimizing blockchains for DA is a relatively new area of research in the crypto space that has reinvigorated excitement in modular blockchain design and potentially unlocked new levels of scalability through rollups. A key technique that major blockchain projects like Ethereum and Celestia are pursuing to enhance DA functionality is known as data availability sampling (“DAS”). DAS was formalized in a paper by Celestia co-founder Mustafa Al-Bassam in 2018, a year before the Lazy Ledger publication.

The role of a DA layer in the blockchain modular stack is to guarantee that transaction data from rollups have been ordered and published on-chain. A DA layer does not necessarily need to guarantee that transactions are valid according to a rollup’s state transition machine, but the DA layer does need to ensure that the block proposers have accurately recorded all block content data and made this data available for anyone to retrieve. Due to the resource constraints of nodes operating on a DA layer, the amount of data that can be recorded in one block from execution layers is limited, even despite sophisticated ways to compress data from Layer-2 rollups in batches. In other words, the standard way blockchain developers have been ensuring data availability is to require that nodes download and verify the full data contents of a block, which means that the larger the block size, the greater the burden on nodes in terms of both latency and storage, which can lead to centralization.

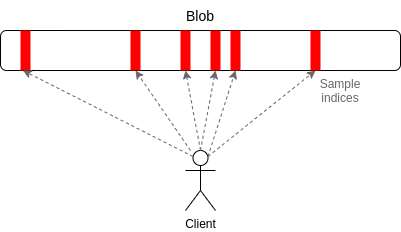

One of the unique techniques used by DA layers to increase the scalability of the blockchain by orders of magnitude without increasing node capacity is data availability sampling (“DAS"). DAS relies on sampling random pieces of data within a block, rather than the entirety of the block itself.

Caption: A diagram showing a node sampling data in a block.

Source: Vitalik Buterin

With each successful sample of data, the probability that the block is complete (meaning the full set of transactions has been communicated by a block proposer) increases. Nick White, COO of Celestia Labs, explains in a tweet thread, “If you have a 4MB block and you need 20 samples of 1kB each, then you only need to download ~0.5% of the total block to be 99.9999% sure [the data] is available.” This method of DAS only becomes more efficient the bigger block sizes become. By downloading only a fraction of the contents of a block, a node operator can verify the DA for the entire block.

DAS introduces a novel way to scale DA on blockchains. Rather than breaking up transaction load across different mini-blockchains, called shards, to process transactions in parallel, which creates a significant amount of network complexity and coordination overhead, and rather than moving transaction load off-chain, relying only on the base layer for settlement purposes, which reduces security, DA layers optimized through DAS can scale by relying on relatively simple assumptions of mathematical probability and statistical certainty. When coupled with other cryptographic primitives such as erasure encoding, DAS reinforces the availability of data without increasing the resource requirements of a node.

Caption: Erasure coding process

Source: TechTarget

DAS is one of the key innovations underpinning the blockchain modularity thesis and the resurgence of interest in modular blockchain design. In theory, an optimized DA layer should unlock new levels of scalability for rollups that were not possible before without sacrificing decentralization. However, it is difficult to evaluate this thesis in practice because there is not yet an example of a public and permissionless modular blockchain in production that functions exclusively as a DA layer. There are examples of monolithic blockchains that are currently being re-engineered and optimized to support a modular blockchain design but none that natively specialize in a layered scaling approach.

The next section of this report will give an overview of the projects and protocols involved in implementing various aspects of the modular blockchain thesis.

Data Availability Layer Landscape

There are high-profile projects aiming to build robust DA layers that can support permissionless rollup innovation. It is worth noting that the DA layer projects discussed below mostly couple the functions of consensus with DA, unless otherwise stated.

Ethereum: Danksharding

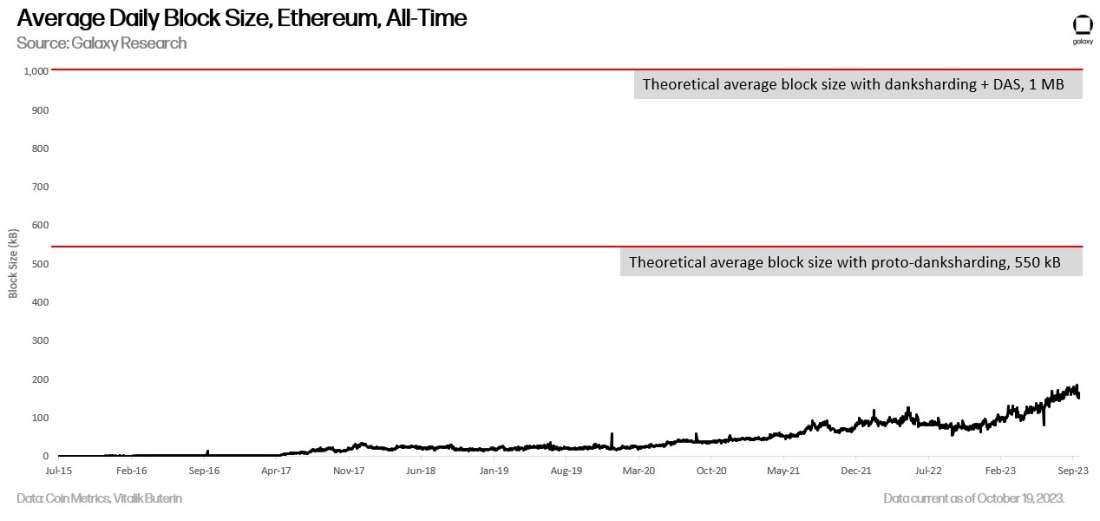

As the world’s largest general purpose blockchain, Ethereum itself is evolving to become more optimized and efficient as a DA layer through upgrades like proto-danksharding and danksharding. Danksharding refers to creating dedicated block space, transaction types, fee markets, and new data verification rules for execution layers. It requires the implementation of technologies like DAS so that validators on Ethereum can verify transaction data from Layer-2s efficiently and treat this data differently from regular transactions executed directly on Ethereum. Proto-danksharding refers to the early iteration of danksharding on Ethereum where validators will be able to verify up to 1 MB of additional data from execution layers. (Read our report for a more detailed explanation of proto-danksharding).

In the future, the full vision of danksharding increases the limit for posting batched transaction data on Ethereum to 32 MB. The assumption is that the majority of user and dapp activity will migrate to Layer-2 rollups at that point and Ethereum as a base layer will be used almost exclusively for DA and consensus purposes. In addition, because Ethereum today is a monolithic blockchain that fulfills all four core blockchain functions, it is also possible that rollups built on top of Ethereum continue to rely on Ethereum as the settlement layer for inter-rollup communication and for bridging assets from one Ethereum-based rollup to another.

One of the main concerns about Ethereum’s future as a performant DA layer is the extent to which the network can pivot to another radically different technological design than the one it was first launched with. It took developers more than 7 years to complete Ethereum transition from proof-of-work (PoW) to proof-of-stake (PoS), despite the change being planned by Ethereum core developers since the inception of the network in 2015. To optimize Ethereum away from being a monolithic blockchain to a modular one will likely take years to complete and, even if it succeeds, it is unclear to what extent Ethereum will be able to excel as a DA layer given the overhead of also supporting other legacy functions such as that of transaction execution and settlement while in competition with other execution layers and settlement layers that are built on top of Ethereum.

Celestia: Mainnet Launch

Celestia is arguably the world’s first truly modular blockchain as the functions of Celestia are exclusively that of DA and consensus. The stripped-down and bare bones design of Celestia is what makes this blockchain so unique and most likely to fully realize the theoretical benefits and gains outlined in the modularity thesis. Mustafa Al-Bassam, Ismail Khoffi, and John Adler co-founded the project in 2019 under the name LazyLedger. It was rebranded to Celestia in 2021, which is also when the team released an MVP of the network and closed a $1.5mn seed round led by the Interchain Foundation with participation from Binance Labs, Maven 11, Divergence Ventures, P2P Capital, Dokia Capital, Cryptium Labs, Tokonomy, Signature Ventures and others. The graphic below provides details on Celestia’s known venture financing to date.

This year, the team has launched its first incentivized testnet where a select group of 1,000 whitelisted users will complete respective tasks for operating validators, bridge nodes, storage nodes, and light nodes on the network in exchange for points, that may translate into tokens on mainnet. In September, the Celestia Foundation announced details about the distribution of the blockchain’s native token, TIA. The Celestia team plans to launch the protocol on mainnet later this year.

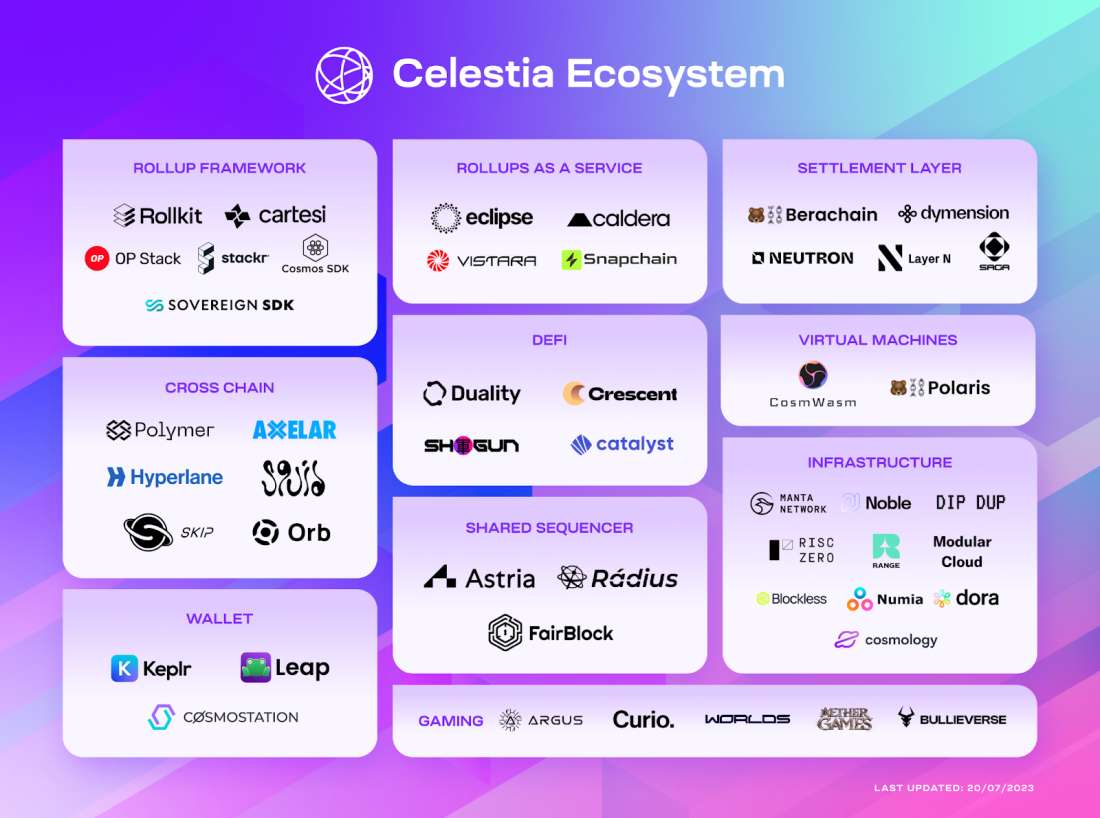

Caption: A diagram illustrating the projects building atop Celestia.

Source: Celestia Foundation

Due to the leanness of the Celestia protocol and its limited functionality as a blockchain, a large part of Celestia’s long-term success will depend on the adoption of the applications and protocols that rely on Celestia as a DA layer. More than the launch of Celestia, the concurrent launch of execution layers like Eclipse and Argus and settlement layers like Neutron and Dymension are what will attract end-users and capital. Celestia has no native capabilities for smart contract deployment or transaction execution. It also has no native capabilities for cross rollup bridging or dispute resolution. Therefore, Celestia adoption relies on the adoption of execution and settlement layers built on top of it. In the next section of this report, we will discuss the array of execution layer projects that are being built for the modular blockchain future. Celestia’s main strength as a blockchain will be its optimization over existing blockchains like Ethereum to perform DA functions at lower costs and greater speeds.

Data Availability Committees

Rather than posting batches of transaction data on-chain to a separate DA layer or monolithic blockchain like Ethereum, execution layers may choose to post their data to a permissioned network of computers, also called nodes. Node operators have the responsibility of holding copies of posted data and making them available to execution layer nodes upon request. Compared to the DA solutions described above, these data availability committees (“DAC”) are easier to implement as they only require the coordination between a few permissioned entities. However, DACs are smaller in size and therefore vulnerable to censorship or centralized points of failure. They are often associated with validiums, which are types of rollups in which data is posted off-chain to a DAC rather than to a dedicated DA layer. This setup weakens the guarantees of DA but may present the cheapest and most customizable option for launching a rollup without relying on public blockchain infrastructure. Given that solutions like danksharding on Ethereum and Celestia are not yet live as of September 2023, low-cost transaction execution on rollups remains elusive. In some respects, DACs are a temporary solution to low-cost rollup transactions in lieu of a robust on-chain DA layer.

The following is a list of major DACs that are live as of September 2023:

StarkEx DAC. StarkEx is a permissioned zero-knowledge rollup technology built by Starkware. StarkEx is designed to post data down to Ethereum as a DA layer or to a dedicated DAC for lower transaction costs. StarkEx’s default DAC members consist of ConsenSys, Infura, Nethermind, Cephalopod, Iqlusion, and the StarkWare team itself. One of the primary benefits of designing a StarkEx rollup to rely on a DAC is added confidentiality of posted data. With a volition-type design, developers can obfuscate transaction data and make the data only accessible by DAC members.

zkPorter. zkSync is a zero-knowledge rollup built on Ethereum. Due to the prohibitive costs associated with executing transaction even through a Layer-2 rollup on Ethereum, users have the optionality with zkSync 2.0, which went live October 2022, to post data to an off-chain DAC. The DAC is secured by users staking their zkSync tokens. This network of zkSync staking entities is known as zkPorter and, unlike most DAC solutions, zkPorter is a network that any zkSync token holder can join and earn rewards for participating in increasing the security and decentralization of the network.

Arbitrum Nova. Arbitrum is an optimistic rollup built on Ethereum. Under a similar rationale as zkPorter, OffChain Labs built Arbitrum Nova to enable lower cost rollup transactions by relying on a DAC, which is comprised of the following members: ConsenSys, FTX, GoogleCloud, OffChain Labs, P2P validator, Quicknode and Reddit. For added security for DA, Arbitrum Nova employs a fall-back mechanism in the event committee members crash or refuse to cooperate to the regular operations of the Arbitrum rollup which posts data directly to Ethereum for DA. Arbitrum Nova is presumably the first of several of its kind, also called AnyTrust Chains, which can be spun-up alongside Arbitrum, to provide lower-cost rollup transactions with group of 20 trusted committee members.

Execution Layer Landscape

Alongside projects focused on improving DA functionality on blockchains, there are projects focused on innovations for blockchain transaction execution. As discussed, a rollup is a technology that specializes in transaction and smart contract execution and minimizes state growth by relying on a separate DA layer for transaction inputs and ordering. A rollup also specializes in data compression to minimize the costs of paying a DA layer to host their transaction data through specialized block producers known as sequencers. The design space for rollups has traditionally been dominated by general purpose execution layers, such as Arbitrum and Optimism, which mimic a similar execution environment and virtual machine as Ethereum. Ethereum being the largest general purpose blockchain, the goal for most rollup projects has been to make it as easy as possible for decentralized application developers to migrate away from Ethereum to their rollup.

However, relying on Ethereum as a DA is costly because rollup sequencers must compete for block space in the same fee market as all other transactions and smart contract deployment. There are teams of developers designing execution layers for more optimized DA layers like Celestia where rollup sequencers can post batches of transaction data for lower costs. In addition, there are projects working on frameworks and software development kits to make it easier to deploy rollups on top of multiple DA layers. In addition, there are execution layers optimizing to simply connect rollups to other rollups and function as a separate settlement layer for bridging assets between rollups.

The following is an overview of the three main types of rollups based on their settlement strategies:

Smart contract rollups

The most common type of rollups are smart contract rollups that rely on Ethereum not only as a DA layer but also a settlement layer. Rollup sequencers post data to Ethereum and update rollup state through interactions with a dedicated smart contract. Withdrawals from the rollup back to the Layer-1 blockchain are made possible through proof systems, such as fraud or validity proofs that can be interpreted by smart contracts on Ethereum to verify a rollup’s finalized state such as the state of account balances. In other words, withdrawals from a rollup to Ethereum or any other blockchain should be thought of as a bridging contract that is secured through a proof system such as an optimistic proof system or a zero-knowledge proof system.

The main weaknesses of smart contract rollups, and more broadly rollups in general, are censorship resistance and decentralization. Rollup developers relegate the activity of batching and compressing user transactions into a block for posting to a DA layer to a single entity, that is the sequencer. Sequencer decentralization is a notoriously challenging task that requires the implementation of a consensus protocol to organizer participants and most likely a token to reward them. However, rollup projects are exploring possibilities of using existing validator sets and re-staking protocols to reduce overhead costs. Another weakness associated with rollups is their upgradeability. Due to their experimental nature and high technical risk, developers usually design rollups with emergency measures to override code in case of unexpected bugs or hacks.

Most rollups in 2023 are built with training wheels as reflected by their level of centralization and upgradeability. However, as the technology becomes battle-tested, these rollups will likely mature and ossify over time through reducing reliance on single sequencers and removing update mechanisms. A few examples of smart contract rollups on Ethereum include Arbitrum, Optimism, Base, zkSync, Polygon zkEVM, and Scroll zkEVM.

Sovereign rollups

Rather than rely on smart contracts to update rollup state, sovereign rollups rely on their own peer-to-peer network of computers, also called nodes, to verify updates to account balances and blockchain state. One of the main benefits of operating as a sovereign rollup is the ability to execute upgrades and change the rules of state transitions independently from a DA layer. As an aside, rollups that settle through DA layers that can natively validate batched transactions without the need to deploy dedicated smart contract code are sometimes referred to as enshrined rollups. While these do not yet exist on Ethereum, they are another example of how disputes around blockchain state for a rollup can be settled by nodes on the DA layer.

Nodes operating on a sovereign rollup can change the rules of what is considered a valid or invalid transaction through a hard fork, which is a backwards-incompatible upgrade, without impacting or changing the DA layer to which user transactions are posted. Another benefit of sovereign rollups is that compared to smart contract rollups and enshrined rollups, sovereign rollups can be a more cost-effective way to settle transactions. Rather than verifying proofs on Ethereum or Celestia directly, they are verified locally through execution layer nodes. Sovereign rollups also have the benefit of greater flexibility to deploy transactions of a type that are not natively verifiable by a Layer-1 blockchain. Sovereign rollups in theory will rely on their own settlement mechanisms such that they only rely on the Layer-1 blockchain to retrieve data. In theory, data availability blockchains would be able to support a multitude of rollups each designed with their own unique virtual machines and smart contract languages.

App-specific rollups are best suited for a sovereign rollup design as greater control over the network would be placed in the hands of users of the rollup, as opposed to the node operators of the DA layer. The main drawback of sovereign rollups is the fragmentation of asset liquidity. Smart contract rollups built atop Ethereum share a common settlement layer through which assets from Ethereum are locked and unlocked, which concentrates liquidity to a shared layer. Settlement through a diversity of sovereign rollups on the other hand silos asset liquidity according to each rollup’s unique proof system for state transitions. Projects working on rollup interoperability protocols to solve the issue around liquidity fragmentation include Polymer Labs and Catalyst.

Settlement rollups

Settlement rollups are rollups optimized for settling transactions and blocks from rollups and posting data to a desired DA layer. Instead of bundling execution with settlement like sovereign rollups or relegating settlement to a DA layer, which may be costly, like smart contract L2-rollups on Ethereum, settlement rollups function as the intermediary network that can interface between multiple app-specific rollups and DA layers. The app-specific execution layers built atop settlement layers, also called Layer 3’s (L3s), naturally compete with the dapps launched directly on smart contract, general-purpose rollups.

The advantages to deploying an L3 rollup vs a dapp on an L2 include:

L3s have greater flexibility when it comes to designing an execution environment for deploying smart contract code.

L3s do not need to expend resources building their own consensus model or pay fees to a costly DA layer for achieving rollup settlement.

L3s may achieve higher levels of scalability than other types of rollups as rollup developers can dedicate network resources exclusively to smart contract code execution.

In theory, the more modularized the functions of a blockchain are, the more blockchain developers can optimize the efficiency and scalability of specific core functions such as transaction execution or settlement. However, the extent to which separating out settlement from execution will result in significant gains to the developer and end-user experience remains unclear. In addition, while settlement layers make customizing an execution environment for a specific use case be it gaming or application development easier for developers, they like sovereign rollups must rely on their own consensus mechanism for transaction settlement. Therefore, the decentralization of settlement rollups and the extent to which they can work across multiple DA layers in a trust-minimized way is a determining factor to the security guarantees of L3s built atop settlement rollups. Examples of notable settlement layers being built include Eclipse, Caldera, and Dymension.

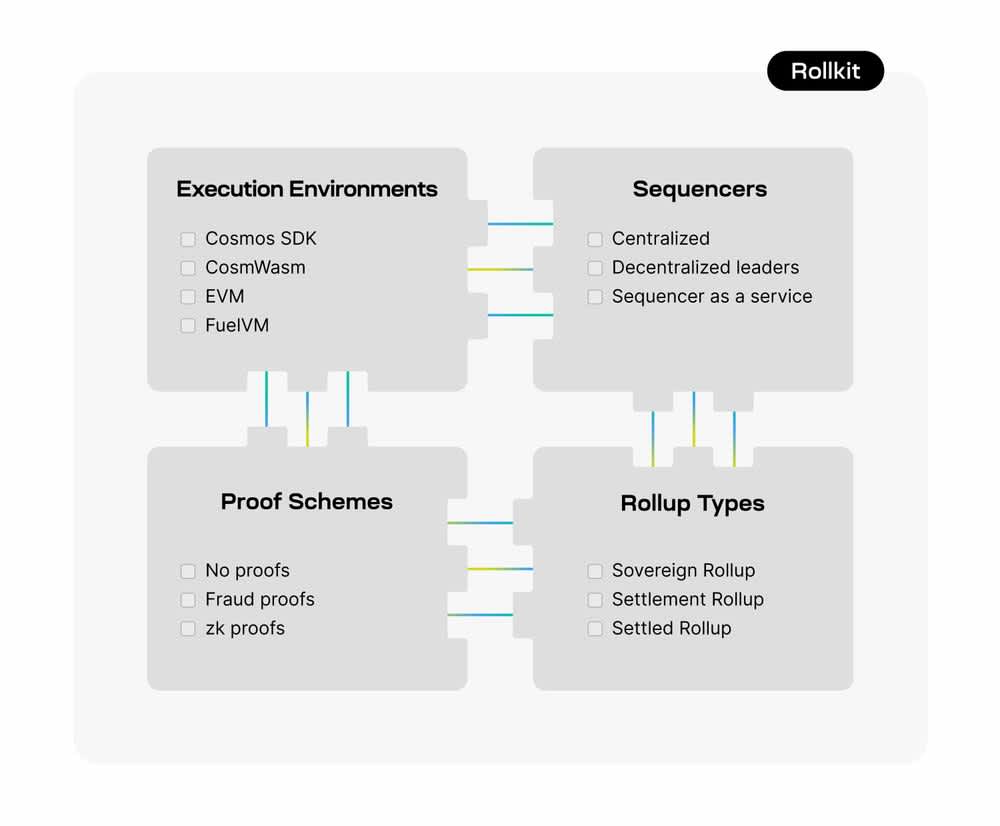

Rollup SDKs

There are projects focused on out of the box solutions for spinning up customizable rollups. Rollup software development kit (SDKs) projects seek to make rollups more customizable by letting developers choose their own settlement frameworks, between validity and fraud proofs, sequencer types, and bridging functionalities. Different rollup SDKs will present users with different toolkits for mixing and matching rollups designs. However, it is likely that rollup SDK projects also contribute a significant amount of consulting work for its users along with their toolkits to assist in the creation of customizable rollups. These projects likely need to dedicate a significant amount of blockchain engineering for each user and client. Therefore, it is unclear to what extent these types of rollup SDK projects will be able to scale overall. Notable examples of rollup SDKs are Rollkit and Sovereign Labs.

Caption: A diagram illustrating the customizable tech stack that Rollkit can offer developers who are looking to deploy their own rollup.

Source: Celestia Foundation

Despite the adoption of modularity as a guiding principle for blockchain design, most projects working on the modular blockchain tech stack remain in a highly experimental and research driven phase of development as of March 2023. The next section of this report will dive into a handful of key research questions related to blockchain modularity and the competitive dynamics between and amongst modular layers.

Outlook

The blockchain modularity thesis rests on innovations like DAS that optimize layers of a blockchain tech stack for specific core functions. By splitting DA and consensus from execution and settlement, in some cases even splitting the functions of execution and settlement, the argument of the modularity thesis is that the sum of these layers will be able to achieve vastly higher levels of efficiency, scalability, and decentralization. However, there remain questions around the costs associated with a modular blockchain tech stack such as latency and cross-chain communication. In addition, it is unclear to what extent bottlenecks for scalability still exist on execution and settlement layers despite techniques to alleviate throughput constraints on the DA layer.

Scaling execution

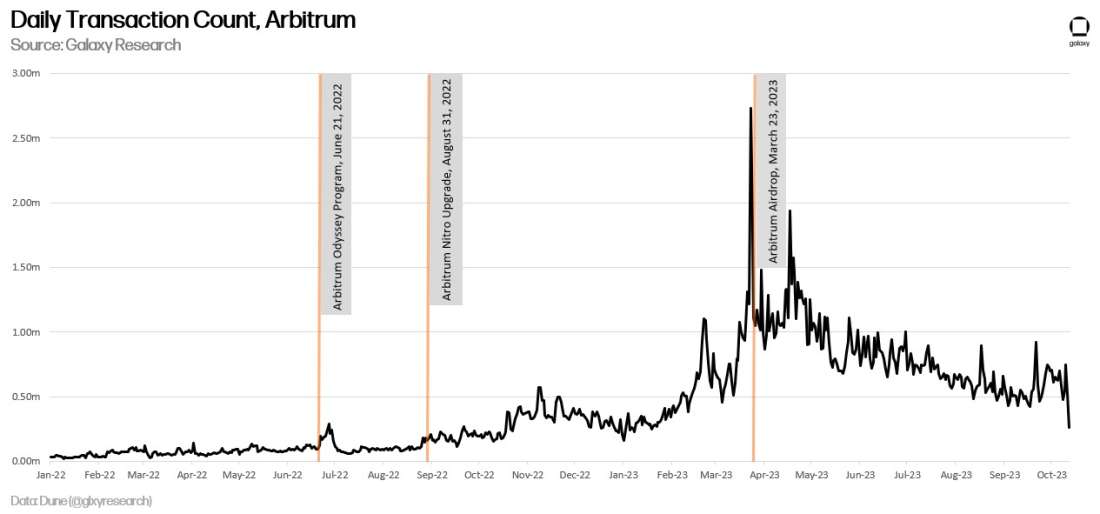

Through DAS, relatively lightweight nodes on a DA layer can theoretically support multitudes of independent execution layers, each with the same transaction execution capacity as that of a monolithic blockchain like Ethereum. However, there remains questions around how to best scale the function of transaction execution and manage state growth over time. Rollups like Arbitrum have experienced bouts of extremely high fees, impacting the user experience, due to surges in on-chain activity. One notable example occurred back in June 2022 when the Arbitrum core development team launched its NFT incentive program, Odyssey, but quickly had to shut down the program due to overwhelming demand.

Arbitrum has since deployed upgrades that have significantly improved rollup capacity, as illustrated by the chart below:

The lack of scalability on rollups is not a pressing concern as an optimized DA layer would theoretically have the capacity to support multiple Layer-2 networks without increasing the resource burden of DA layer nodes. If a single execution layer is burdened with too much user activity, it would take minimal costs and time to spin up another execution layer with the same level of decentralization and security backed by the underlying DA layer. The downside of spinning up multiple execution layers is the fragmentation of liquidity and the introduction of bridging risks. Applications launched on one execution layer lose transaction atomicity if user transactions are fragmented across multiple rollups. In addition, the transfers of assets from one execution layer to another would require additional steps such as the generation of proofs on the DA layer and the burning and minting of assets from one chain to another, which introduces latency and the greater potential for technical bugs and failures.

Therefore, it is important for modular blockchain developers to research and develop technologies for optimizing execution layers such that greater transaction activity does not overwhelm rollups and create heavy resource burdens on rollup node operators. Some of the solutions developers are actively pursuing for optimizing the execution layer include state expiry, light clients, and zero knowledge virtual machines.

MEV in a Modular World

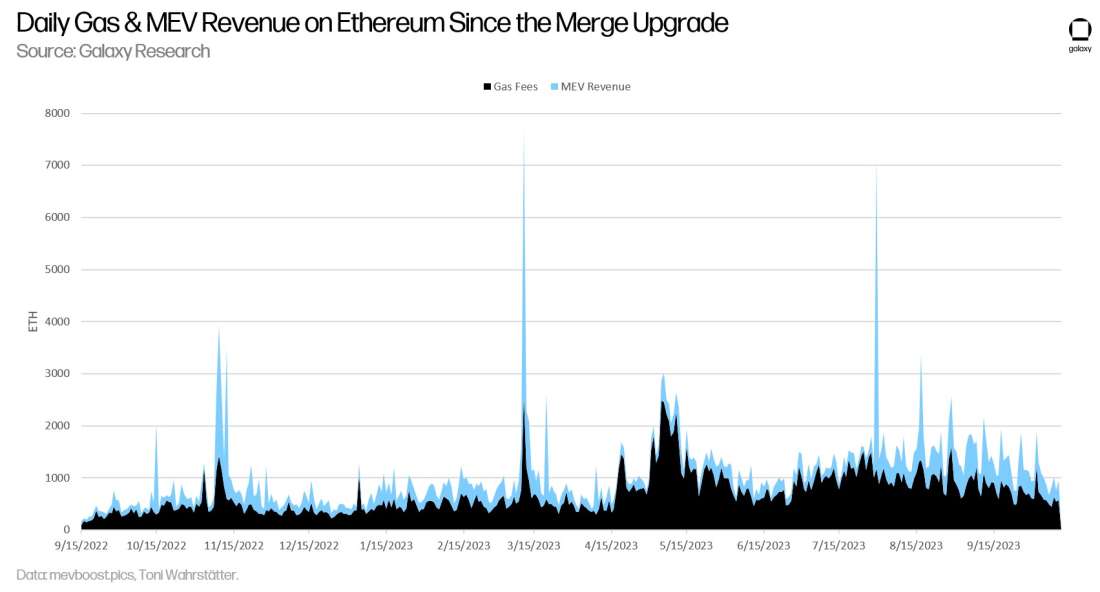

Another outstanding question around the blockchain modularity thesis is where exactly in this modular tech stack the highest amount of maximal extractable value (MEV) will accrue. As background, MEV refers to the value created from ordering user transactions in a specific way. (Read this Galaxy Research report to learn more about MEV). MEV differs from transaction fees and issuance rewards which is value created by the user in the form of a payment and value generated by the network through supply growth, respectively. Specialized actors called searchers create MEV by identifying opportunities for value extraction through strategies such as frontrunning, backrunning, and sandwiching user transactions. On a monolithic blockchain like Bitcoin or Ethereum, this value primarily accrues to the block proposer, as the proposer has the final say over the order of transactions. On a modular blockchain, MEV will likely accrue to the layer where transaction ordering and block building occur, that is the settlement layer.

The following is a chart of the amount of MEV earned daily, in addition to regular transaction fees, on Ethereum since the Merge upgrade:

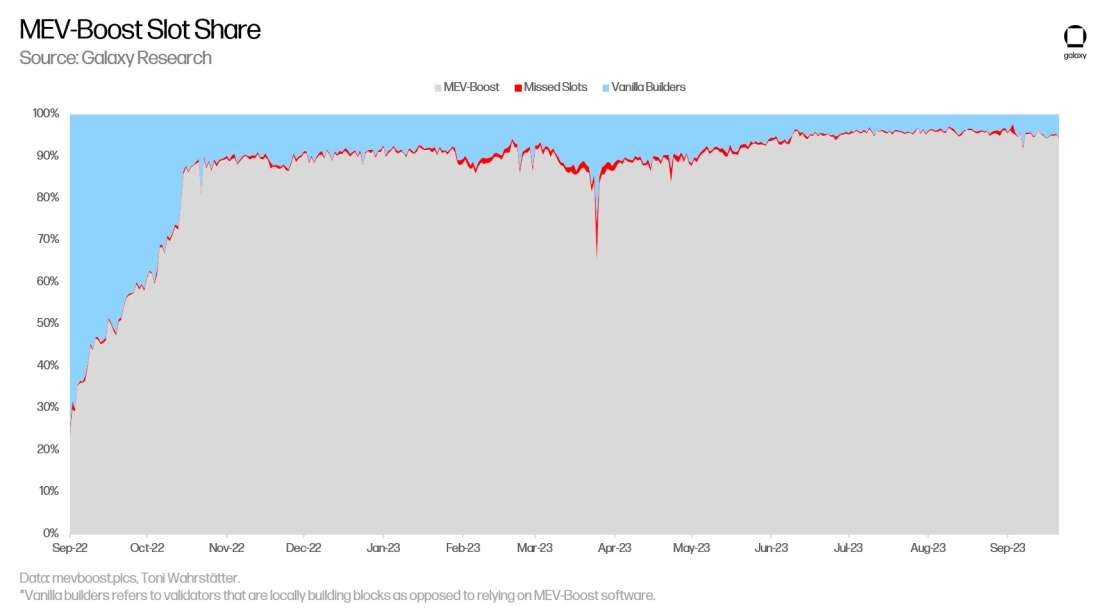

Rollups that control transaction settlement, that is sovereign rollups, have the highest amount of flexibility and autonomy when it comes to designing MEV marketplaces and incentives. On a rollup, the block proposer, that is the entity that batches user transactions and submits them for finalization to a DA layer, is the sequencer. As discussed, the sequencer is generally operated by a centralized entity because many rollups in 2023 are in a nascent stage of development. However, over time, the sequencer is expected to decentralize and therefore, so will the activity of block production. To prevent specialization among a decentralized network of sequencers, the activity of block building is likely to be abstracted away to a separate layer like how dedicated off-chain MEV marketplaces were created through MEV-Boost on Ethereum.

The following chart illustrates the percentage of Ethereum blocks submitted by validators through the use of MEV-Boost software since the Merge upgrade:

However, through the introduction of third-party block builders to the MEV supply chain on Ethereum, and it would appear in the future on rollups, there is the risk of centralization among block builders. Therefore, efforts to decentralize block building through privacy technologies such as secure enclaves, trusted execution environments, fully homomorphic encryption, threshold encryption, and multi-party computation are important to the future of MEV in a modular blockchain tech stack.

Alongside shared block building, there are ongoing efforts to decentralize rollup sequencers through shared sequencer networks. One of the projects building a shared sequencer network is Astria. The idea of a shared sequencer network is similar to the idea of re-staking in that both are motivated by the understanding that creating a decentralized network of participants is difficult to replicate and takes a long time to cultivate. Instead of sharing validators for the purposes of securing multiple DA layers, shared sequencers would enable shared security and censorship resistance across multiple rollups. Aside from a shared sequencer network, there is the possibility of sequencing, that is the ordering of transactions on a rollup, to be relegated down to the node operators of a DA layer directly. This is the idea behind based rollups. In this scenario, validators of an L1 blockchain such as Ethereum or Bitcoin would still be the primary recipient earnings MEV. Where the ordering of user transactions occurs is important to understanding where MEV will accrue in the modular blockchain tech stack. Projects like Skip and Anoma re building configurable MEV auction marketplaces designed for sovereign rollups where the role of the sequencer is not shared or relegated to the DA layer.

Latency and interoperability in a modular world

Breaking apart the core functions of a blockchain across layers introduces latency to transaction finality. Finality in this context refers to when a transaction on a rollup is considered irreversible. On Ethereum, transaction finality is determined through a supermajority vote of active validators over two epochs, that is roughly 12 minutes. On Bitcoin, transaction finality is more subjective and determined probabilistically based on the number of blocks appended on-chain after a transaction is first included in a block. In the context of a modular blockchain, there are differing levels of transaction finalization as transaction data moves from the execution layer down to the DA layer. Ultimately, transaction finality will depend on the underlying DA layer and its consensus mechanism, as well as block times. Once the rollup sequencer bundles transactions into blocks and submits them to the DA layer, the finalization of these transactions depends on how quickly the DA node operators processes the rollup bundle on-chain.

Once transaction data is posted to a DA layer, the transactions are considered final and only reversible if the security of the underlying DA layer becomes compromised and the DA layer becomes vulnerable to block reorganizations. To reduce latency created from having to commit rollup blocks to a separate DA layer, blockchain developers are researching techniques for supporting pre-confirmations of rollups blocks even before the block is successfully committed down to a DA layer.

These techniques include but are not limited to:

For rollups where transaction settlement occurs on a separate layer from the DA layer, there is the possibility of guaranteeing soft finality over rollup transactions before they are posted to a DA layer that is based on consensus between node operators on a shared settlement layer or sovereign rollup.

Another solution around pre-confirmations involves requiring sequencers to post collateral that the rollup can penalize if sequencer does not successfully post the block to a DA layer after a period. Settlement rollup projects in specific are focused on these solutions in addition to rollup interoperability.

One of the main benefits to rollups sharing the same settlement layer and DA layer is interoperability through shared block times and therefore, shared times to transaction finality. The benefits of composability between rollups in a modular blockchain tech stack is the strongest argument for why competition between DA layers and settlement layers becomes a winner take all dynamic, similar to the competitive landscape between monolithic general purpose blockchains. As the first general purpose blockchain, Ethereum has continued to dominate in terms of market share and value despite the emergence of alternative L1 competitors. Ethereum retains market share because it is difficult for application developers on Ethereum to move their projects and end-users to different chains whilst still maintaining the same level of interoperability and composability with the broader Ethereum dapp ecosystem. This will be true for settlement rollups and especially DA blockchains.

Competition among DA layers

In a future where there may exist more than one independent DA layer and DACs, it is an ongoing debate whether user activity becomes concentrated to a single DA layer or multiple. Not all applications or rollups will need the same level of security, which is why multiple DA layers with varying degrees of decentralization may persist over time. Naturally, it will be more expensive to launch an execution layer on top of a DA layer with a high level of security than launching the same technology on top of a DA layer with lower security guarantees. It remains unclear how wide the disparity in costs will be between DA layers. Costs between DA layers will depend heavily on the consensus model and monetary policies enforced on these chains.

One of the simplest ways to protect and reduce the likelihood of spam or denial of service attacks on a permissionless blockchain is the use of transaction fees. Fees create a way for block proposers to prioritize and order transactions within a block. All DA layers will need a fee mechanism to disincentivize execution layers from dumping copious amounts of junk transactions on-chain. Despite being highly optimized to download substantial amounts of data through techniques like DAS, DA layers will still be constrained to a block size that will dictate fees for posting transaction data on-chain. A fee mechanism will also most often be coupled with a consensus mechanism which will determine the order of transactions within a finalized block and a fork choice rule to determine what blocks were or were not included in the canonical chain.

Depending on the DA layer, the fee mechanisms and consensus protocols may differ. Regardless of the exact monetary policies and consensus models dictating the operations of a DA layer, the goal of a DA layer is to be resilient against chain reorgs and centralized points of failure. The greater the network of value built on top of a DA layer, the greater the level of security should be always guaranteeing the availability of transaction data for verification and execution purposes. Therefore, the level of decentralization and performance of a DA layer will be important to evaluate that network’s long-term potential for user adoption and value accrual in competition with other blockchains that also offer DA services. Among blockchains optimized for DA, the layer that is the most decentralized and therefore secure is likely to support the greatest amount of innovation and value. It remains unclear how the fee structures between different DA layers will evolve, especially considering restaking protocols such as EigenLayer that may create ways to rehypothecate staked assets, and therefore extend security, from one blockchain protocol to another.

Governance in a modular world

Finally, it is worth noting that governance and coordination of protocol upgrades across a modular blockchain tech stack become more complex due to the existence of independent execution layers relying on data posted to a single DA layer. Assuming execution layers do not rely on DA layers for transaction settlement, each execution layer will retain its sovereignty to interpret transaction data posted to the DA layer according to its own consensus mechanism. This gives a high degree of freedom to execution layers to dictate protocol-level changes impacting the validity of transactions separately from the governance of a DA layer. However, the extent to which a DA layer can roll back transactions posted to its network for any reason is not as easy. Like how changes to the Ethereum protocol have become more cumbersome in terms of governance because of the number of decentralized applications deployed on the network, popular DA layers are likely to face the same challenges when considering protocol-level upgrades impacting execution layers and decentralized applications built on top of those execution layers.

Conclusion

The ecosystem of new blockchains that are modular by design is set to explode in 2023 and beyond. These blockchains offload at least one of four core functions of settlement consensus DA and execution to another blockchain. Due to innovations around DAS that increases the ability of a blockchain to scale for DA, there is also an innovative design space for highly scalable application focused execution layers. There are several assumptions that will have to be evaluated however in this dynamic including revamped fee architecture for securing each of the layers against fraud and attacks, the level of scalability that can be achieved on execution layers, and models for decentralized governance, which is an issue as old as the blockchain trilemma.

Modularity is an exciting road forward for blockchain scalability that seeks to solve decentralization and security to which blockchain projects are already betting and building. However, key to realizing this modular vision is the continued innovation of blockchain developers implementing each layer of the modular blockchain tech stack, not just DA but also that of execution and settlement. The Celestia team will launch their DA layer this year. However, it is really the innovations and projects built on top of the Celestia DA layer that will prove the modular blockchain thesis correct. To that end, the adoption of execution layers and settlement layers connecting to Celestia will be most important to watch and evaluate in the years ahead.

Ongoing research topics include the impacts of MEV and re-staking on a modular blockchain tech stack. In addition, increased latency to transaction finalization and reduced composability between dapps built on app-specific rollups are third-order consequences from separating out the functions of a blockchain that settlement rollups in specific are trying to mitigate. Due to the nascency of modular blockchain projects, it is difficult to predict the competitive dynamics between rollups and emerging DA layers. However, early analysis does suggest concentration of dapp activity to a single settlement and DA layer is likely. The evolution of the blockchain modularity thesis has resulted in a paradigm shift in how many general purpose blockchains including Ethereum are approaching the blockchain trilemma and solving for long-term scalability. There is still much to be built before the benefits of modularity can be fully realized and rigorously evaluated, but the growing consensus between blockchain developers in the crypto space around the blockchain modularity thesis affirms the strong potential of these ideas to revolutionize blockchain tech in the years forthcoming.

Legal Disclosure:

This document, and the information contained herein, has been provided to you by Galaxy Digital Holdings LP and its affiliates (“Galaxy Digital”) solely for informational purposes. This document may not be reproduced or redistributed in whole or in part, in any format, without the express written approval of Galaxy Digital. Neither the information, nor any opinion contained in this document, constitutes an offer to buy or sell, or a solicitation of an offer to buy or sell, any advisory services, securities, futures, options or other financial instruments or to participate in any advisory services or trading strategy. Nothing contained in this document constitutes investment, legal or tax advice or is an endorsementof any of the digital assets or companies mentioned herein. You should make your own investigations and evaluations of the information herein. Any decisions based on information contained in this document are the sole responsibility of the reader. Certain statements in this document reflect Galaxy Digital’s views, estimates, opinions or predictions (which may be based on proprietary models and assumptions, including, in particular, Galaxy Digital’s views on the current and future market for certain digital assets), and there is no guarantee that these views, estimates, opinions or predictions are currently accurate or that they will be ultimately realized. To the extent these assumptions or models are not correct or circumstances change, the actual performance may vary substantially from, and be less than, the estimates included herein. None of Galaxy Digital nor any of its affiliates, shareholders, partners, members, directors, officers, management, employees or representatives makes any representation or warranty, express or implied, as to the accuracy or completeness of any of the information or any other information (whether communicated in written or oral form) transmitted or made available to you. Each of the aforementioned parties expressly disclaims any and all liability relating to or resulting from the use of this information. Certain information contained herein (including financial information) has been obtained from published and non-published sources. Such information has not been independently verified by Galaxy Digital and, Galaxy Digital, does not assume responsibility for the accuracy of such information. Affiliates of Galaxy Digital may have owned or may own investments in some of the digital assets and protocols discussed in this document. Except where otherwise indicated, the information in this document is based on matters as they exist as of the date of preparation and not as of any future date, and will not be updated or otherwise revised to reflect information that subsequently becomes available, or circumstances existing or changes occurring after the date hereof. This document provides links to other Websites that we think might be of interest to you. Please note that when you click on one of these links, you may be moving to a provider’s website that is not associated with Galaxy Digital. These linked sites and their providers are not controlled by us, and we are not responsible for the contents or the proper operation of any linked site. The inclusion of any link does not imply our endorsement or our adoption of the statements therein. We encourage you to read the terms of use and privacy statements of these linked sites as their policies may differ from ours. The foregoing does not constitute a “research report” as defined by FINRA Rule 2241 or a “debt research report” as defined by FINRA Rule 2242 and was not prepared by Galaxy Digital Partners LLC. For all inquiries, please email [email protected]. ©Copyright Galaxy Digital Holdings LP 2023. All rights reserved.