Top Stories of the Week - 10/6

This week the newsletter, we write about Kevin McCarthy’s ouster from Speaker of the House, the start of Sam Bandman-Fried’s criminal trial in lower Manhattan, and Optimism moving closer to enabling fraud proofs.

Subscribe here and receive Galaxy's Weekly Top Stories, and more, directly to your inbox.

McCarthy Ousted as Speaker of the House

On Wednesday, Speaker of the House Kevin McCarthy (R-CA) faced a discharge petition filed by Representative Matt Gaetz (R-FL).McCarthy was ousted by a vote of 216 to 210 after 8 Republicans voted with House Democrats to fire McCarthy.

Speaker Pro Tempore Patrick McHenry (R-NC)—also Chair of the House Committee on Financial Services (HFSC)—will serve as the “acting” speaker until the House Republican Conference (HRC) selects a new candidate for Speaker. House Republicans are expected to hold a candidate forum next week. McCarthy’s ouster, in the short term, will not affect the macro funding debates as the government is funded through November 17, 2023. The medium-term implications related to government funding and legislating are much tougher to handicap and are partially—if not entirely—dependent on how House Republicans proceed in their selection process for a new Speaker.

OUR TAKE:

It’s not worth getting bogged down in speculation over who will become the next Speaker, but whomever is chosen will have an impact on crypto policymaking—and more broadly policymaking in any regard during the balance of this year. Additionally, speculating on who will be the next Speaker is futile given the myriad of factors involved, i.e., who, if anyone, will former President Trump endorse (will Trump be nominated and/or run?); who will former Speaker McCarthy endorse; will the HRC back a consensus candidate; will the HRC select a hard-liner; does the HRC elect to undergo further rules changes—such as raising the motion to vacate threshold that McCarthy agreed to; etc…

The implications for crypto are still uncertain. The political discourse in Washington is so fraught that accomplishing anything appears difficult. Just earlier this year it took Speaker McCarthy a dozen-plus votes to become the Speaker—so anyone wanting the job is in an eerily similar situation as when former Speaker Paul Ryan (R-WI) accepted the post when then Speaker Boehner (R-OH) stepped down in 2015.

On a policy basis, the Congress just cut, narrowly, a deal to avert a government shutdown but is confronted with perhaps a worse dynamic than they were this past weekend. The United States has $33+ trillion in debt and the deficit for FY2023 will be $2 trillion. These are macro issues of great significance, but Congress is unable to address them—so how will they get to a position of addressing more nuanced and technical policy matters like crypto?

To accompany this logic, the political/partisan divide—especially in the House—makes it tough to identify how these spending packages will come together and how individual policy riders (i.e., tax extenders, crypto legislation, etc.) will materialize. This suggests that we’ll see a government shutdown in Q42023 and further paralysis in Washington, with little if anything happening on the policy-making front.

An alternative, more optimistic, view of things is that the HRC returns to Washington with a newfound unity. This newfound unity is one that rejects the fringes of their party and chooses to legislate by party and chamber consensus (i.e., with Democratic support as well). This optimistic view is one that suggests that policy priorities (i.e., crypto policy) like those of HFSC Chair (current Speaker Pro Tempore) McHenry will be considered. Further, it suggests that the House and Senate will be able to constructively worth together to support the advancement of the crypto economy in the US. This an optimistic view, and might not materialize, but it’s not outside the realm of possibilities and may be closer than people realize. - Lucas Tcheyan

Optimism moves closer to enabling Fraud Proofs

OP Stack's first fraud proof system launches on testnet. OP Labs, the primary developer behind OP Mainnet (fka Optimism), launched an alpha release for the proof system built for the OP Stack on the OP Goerli testnet, moving one step closer to having fraud proofs in production. According to the announcement blog post, the fraud proof (FP) system is comprised of three main components: (i) a FP program that defines the synchronous L2 state-transition, (ii) a FP VM called Cannon that runs the program, and (iii) a dispute game protocol to identify where the fault may have occurred.

The separation between the FP program and the FPVM are intended to enable other contributors to work on separate, yet interoperable modules so eventually developers on the OP Stack can custom-build their own proof systems with different system components (including ZK proofs in the future). The multi-client, multi-proving approach is expected to deliver greater redundancies to the OP Stack for greater security and resilience. (For more information on the fraud proof system, see this technical walkthrough and posts from the OP Labs team on the FPVM and dispute game.)

Before the fraud proof system moves into production, OP Labs is asking for contributors to test the system and is offering a generous bug bounty program through Immunefi. The team is also welcoming external contributions to work on proof system components for the OP Stack.

OUR TAKE:

OP Lab's alpha release of Cannon is the culmination of nearly two year's worth of work - in November 2021, the team disabled Optimism's existing fraud proof system to work on a newer implementation suited for a more modular, Ethereum-aligned strategic vision. Despite not having working fraud proofs all this time, OP Labs has put considerable thought into their proving system which aims to lay the foundation for a multi-client, multi-proof future. Aside from the OP Stack's first proof system on the Goerli testnet, the Optimism Collective has already enlisted the help of external contributors to working on various components of the proof system including: (i) a RISC-V FPVM written in Go called Asterisc, (ii) a Rust-version of Cannon, and (iii) ZK proofs worked on by O(1) Labs & RISC Zero. ZK proofs are critical for unlocking Superchain composability with low latency bridging between OP Stack chains.

As we have written in our report that tracks decentralization progress between Optimism and Arbitrum, the fraud proof system is a meaningful milestone in the journey for optimistic rollups to decentralize. Having a fraud proof system paves the way for rollups to open up their operator setups for validating / sequencing. According to Vitalik & L2Beat’s Stages framework to assess rollup maturity & decentralization along a 0 – 2 grading system, Arbitrum qualifies as a 'Stage 1' rollup, one level ahead of Optimism, which remains at 'Stage 0'. But once the fraud proof system is live in production, Optimism can graduate to a 'Stage 1' rollup after forming a Security Council to oversee core protocol functions and provisioning for user exits without operator coordination.

It's surprising that the OP Stack has drawn so much adoption from other rollup teams (e.g., Base, opBNB, Mantle, etc.) without having functioning fraud proofs, but the beauty of having a shared technical standard is that all OP Stack chains can realize the security benefits of fraud proofs once they are live in production. There is still significant progress needed to fully decentralize and to realize the Superchain vision, but the Optimism Collective can make quick progress on its goals with core contributions coming from a number of teams within the Ethereum community. - Charles Yu

Crypto’s Most Infamous Criminal Goes to Trial

On Tuesday, October 3, the criminal trial of Sam Bankman Fried (SBF) officially started. The trial is being held at the Manhattan Federal Court in New York City. The judge presiding over SBF’s trial is US District Judge Lewis A. Kaplan, who has presided over several high-stakes cases in his 30-years on the bench including criminal cases against as Adidas executive, the Gambino crime family, and former U.S. president Donald Trump. Trump is also coincidentally on trial in Manhattan at the same time as SBF for civil fraud.

In the first few days of SBF’s trial, the jury was finalized, the prosecution and defense gave their opening statements, and the first four witnesses introduced by the prosecution took the stand.

The jury consists of 12 jurors from a wide range of backgrounds. They include:

33- year-old female nurse,

39-year-old female physician assistant,

40-year-old female social worker,

43-year-old female who does IT at Bloomberg,

47-year-old female high school librarian,

50-year-old female Metro North train conductor,

53-year-old female Duke University graduate,

55-year-old female special education teacher,

65-year-old female retired corrections officer,

59-year-old male banker,

61-year-old male U.S. Postal Service employee,

69-year-old male retired investment banker.

The opening statements of the prosecution was delivered by Assistant U.S. Attorney Thane Rehn. Rehn made strong allegations that SBF intentionally stole customer funds. “He was committing a massive fraud, taking billions of dollars from thousands of victims. He had started FTX. He told customers it was safe. But he was taking it and spending it,” Rehn said. Rehn emphasized that SBF spent the stolen money not only on lavish personal expenses but also to buy “power and influence” by making large-sized political donations in D.C.

The opening statements of the defense was delivered by Mark Cohen of Cohen & Gresser, the lead defense attorney for SBF. He emphasized repeatedly that from FTX’s founding to its collapse, SBF “acted in good faith.” Cohen painted the downfall of FTX as caused by a myriad of factors outside of SBF’s direct control including crypto market volatility, lack of organizational structure and oversight, and negligence by Caroline Ellison, the former CEO of Alameda Research, the trading firm affiliated with FTX.

On the second day of trial, the first witness presented by the prosecution gave their testimony before the court. The first witness was a London-based cocoa broker named Marc-Antoine Julliard, who said that he lost around $100,000 worth of cryptocurrency when FTX went under. The second witness was former FTX software engineer Adam B. Yedidia, who testified that he resigned from the company after discovering that FTX deposits were being used to pay back loans to Alameda creditors. Yedidia said that when he discovered alarming discrepancies in FTX’s balance sheet, he shared his findings directly with SBF through the messaging app Signal.

Matt Huang, cofounder of crypto VC firm Paradigm, testified on Thursday, October 5. Huang testified that his company was considering investing in FTX for the exchange’s Series B funding round. Huang had allegedly expressed concerns to SBF through emails about “value leakage to Alameda.” Huang said his firm invested $278m in FTX equity and has marked that position to zero.

The final and most notable witness brought by the DOJ so far in SBF’s trial has been co-founder of FTX Gary Wang. Wang testified that he, along with SBF, Caroline Ellison, and other FTX executives knowingly committed wire fraud, securities fraud, and commodities fraud. “We gave special privileges to Alameda Research to allow it to withdraw unlimited funds … and lied about it,” Wang said. Wang’s testimony will continue Friday, October 6. After Wang, the DOJ has indicated that they will bring Zac Prince, CEO of BlockFi, to the stand.

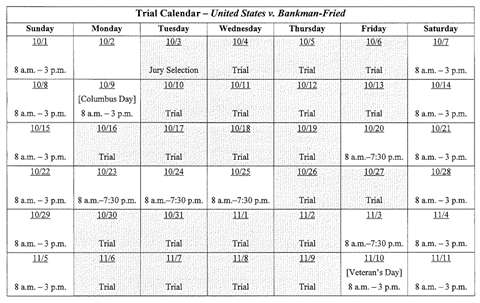

The trial is expected to last six weeks. The following is a calendar of scheduled trial dates:

SBF faces seven counts of fraud and conspiracy that together carry a maximum sentence of 110 years in prison. He will face five additional counts of fraud in another criminal trial scheduled for March 2024.

OUR TAKE:

The market impact from the collapse of FTX in early November 2022 has been wide-reaching and industry-shaking. Since FTX’s downfall, the crypto industry has evolved in major ways as the market share of FTX competitors like Binance has grown and scrutiny from regulators, particularly in the U.S., has increased. Though there are some outstanding developments from FTX’s insolvency that may continue to impact markets, the criminal trial of SBF is likely not one of them.

The significance and importance of the criminal trial of SBF almost a year after FTX’s collapse is primarily driven by emotion. The sheer number of individuals and companies alike in the crypto industry that were negatively impacted by the actions of SBF and those involved in the misuse of FTX customer funds is unparalleled in the 13-year history of this industry. It is reported that due to SBF and his colleague’s schemes, some $8.9 bn in customer funds was lost. While the damage to the markets and the reputation of the crypto industry from the collapse of FTX was significant, it seems to have largely run its course. However, through the criminal trial of SBF, many people in the crypto industry are holding out hope that the person responsible in large part for the damage will be brought to justice and receive due retribution.

It is unclear from the first few days of trial whether the DOJ will be able to successfully convict SBF for intentionally defrauding FTX customers. So far, the lineup of witnesses by the DOJ have been strong and diverse. These witnesses have helped illustrate the events of FTX’s collapse from the perspective of a user, a developer, an investor, and finally, the co-founder of the exchange itself. CoinDesk reporter Nikhilesh De who is covering the SBF trial told Galaxy, “We're seeing the DOJ really try to ease the jury into the case. Even though the case centers around a crypto trading firm/hedge fund allegedly stealing customer funds from a crypto trading platforms/exchange, the DOJ is only getting into that at a very high level with its initial slate of witnesses.”

There are many potential high-profile witnesses that have yet to take the stand. The defense will likely not begin presenting their witnesses until the end of October. For the next six weeks, the entirety of the crypto industry will be watching this trial, scrutinizing every detail of it. A big question remains unknown: will Sam take the stand? -Christine Kim

Charts of the Week

Crypto Venture Capital Landscape Update

Crypto VC deal count and capital invested continued its downward trajectory through the third quarter. The quarter saw just $1.98b in capital invested across 376 deals. This marks –34% change in capital invested and –28% in deal count from the previous quarter; and a –68% change in capital invested and –55% in deal count from the same quarter last year. The slump in deal count is 71% below the all-time reached in 2Q 2022 and is level with that of Q4 2020.

Stars Arena and Impact on Avalanche Network

Stars Arena, a new SocialFi platform on Avalanche, passed $10m in cumulative volume on October 5. It took 16 days for the platform to reach this milestone.

Despite the strong growth in volume, Stars Arena transaction count is lagging behind the point Friend.Tech was at through its first 2 weeks post launch by 44%. In the 16 days following launch, Stars Arena has amassed a total transaction count of 1.269m transactions compared to Friend.Tech’s 2.269m transactions at the same time.

The traction gained by Stars Arena has left a noticeable mark on the Avalanche network. The network’s daily transaction count came within 1,000 transactions of its yearly high on October 4 after nearly 5.5 months of steady decline. Stars Arena reached 393k and 389k on October 3 and October 4 respectively. On these days, Stars Arena transactions accounted for 70% and 68% of all transactions on Avalanche.

See additional charts created by the team on the Galaxy Research Twitter/X account.

Other News

Crypto-friendly Rep. Patrick McHenry becomes speaker pro temp following House

speaker oust

Ethereum Layer 2 StarkWare delays first token unlocks to April 2024

Vitalik Buterin contemplates Ethereum staking changes in blog post

FriendTech adds option to swap from phone to email after user reports of SIM swap attacks

FriendTech rival Stars Arena fuels Avalanche transaction surge

Legal Disclosure:

This document, and the information contained herein, has been provided to you by Galaxy Digital Holdings LP and its affiliates (“Galaxy Digital”) solely for informational purposes. This document may not be reproduced or redistributed in whole or in part, in any format, without the express written approval of Galaxy Digital. Neither the information, nor any opinion contained in this document, constitutes an offer to buy or sell, or a solicitation of an offer to buy or sell, any advisory services, securities, futures, options or other financial instruments or to participate in any advisory services or trading strategy. Nothing contained in this document constitutes investment, legal or tax advice or is an endorsementof any of the digital assets or companies mentioned herein. You should make your own investigations and evaluations of the information herein. Any decisions based on information contained in this document are the sole responsibility of the reader. Certain statements in this document reflect Galaxy Digital’s views, estimates, opinions or predictions (which may be based on proprietary models and assumptions, including, in particular, Galaxy Digital’s views on the current and future market for certain digital assets), and there is no guarantee that these views, estimates, opinions or predictions are currently accurate or that they will be ultimately realized. To the extent these assumptions or models are not correct or circumstances change, the actual performance may vary substantially from, and be less than, the estimates included herein. None of Galaxy Digital nor any of its affiliates, shareholders, partners, members, directors, officers, management, employees or representatives makes any representation or warranty, express or implied, as to the accuracy or completeness of any of the information or any other information (whether communicated in written or oral form) transmitted or made available to you. Each of the aforementioned parties expressly disclaims any and all liability relating to or resulting from the use of this information. Certain information contained herein (including financial information) has been obtained from published and non-published sources. Such information has not been independently verified by Galaxy Digital and, Galaxy Digital, does not assume responsibility for the accuracy of such information. Affiliates of Galaxy Digital may have owned or may own investments in some of the digital assets and protocols discussed in this document. Except where otherwise indicated, the information in this document is based on matters as they exist as of the date of preparation and not as of any future date, and will not be updated or otherwise revised to reflect information that subsequently becomes available, or circumstances existing or changes occurring after the date hereof. This document provides links to other Websites that we think might be of interest to you. Please note that when you click on one of these links, you may be moving to a provider’s website that is not associated with Galaxy Digital. These linked sites and their providers are not controlled by us, and we are not responsible for the contents or the proper operation of any linked site. The inclusion of any link does not imply our endorsement or our adoption of the statements therein. We encourage you to read the terms of use and privacy statements of these linked sites as their policies may differ from ours. The foregoing does not constitute a “research report” as defined by FINRA Rule 2241 or a “debt research report” as defined by FINRA Rule 2242 and was not prepared by Galaxy Digital Partners LLC. For all inquiries, please email [email protected]. ©Copyright Galaxy Digital Holdings LP 2023. All rights reserved.