Top Stories of the Week - 11/10

This week in the newsletter, we write about Kraken’s planned launch of its own L2, the ongoing competition between marketplaces for NFT volumes, and Lido’s new effort to utilize distributed validator technology.

Subscribe here and receive Galaxy's Weekly Top Stories, and more, directly to your inbox.

CEX competition heats up on-chain with potential Kraken L2

Kraken considers creating its own L2 network. Kraken, the second largest US crypto exchange behind Coinbase, is reportedly seeking a partner to help with launching its own L2 network. This follows the move by its rival Coinbase, which launched the Base L2 network earlier this year (first introduced in February this year before launching to the public in August).

According to CoinDesk, Kraken is considering partnering with Polygon (Polygon PoS, Polygon zkEVM), Matter Labs (zkSync Era) and Nil Foundation (=nil;), among other teams, to use their technology to power their network. Other teams and tech stacks may still be considered as conversations are still fluid, according to the sources who asked not to be named.

Kraken did not confirm or deny the plans to launch its own L2 network, but a Kraken spokesperson told CoinDesk that the company is "always looking to identify and solve for new industry challenges and opportunities," declining to share further details. Kraken recently added a job posting for a Senior Cryptography Engineer who could be tasked with the "design and implementation of layer-2 solutions" and has qualifications including "experience working with modern cryptography (ZKP, MPC, FHE)".

OUR TAKE:

Competition among crypto exchanges heats up on-chain. Aside from Coinbase's Base, other networks launched by exchanges include Crypto.com's Cronos and Binance's BNB Chain – both of which are EVM networks that launched several years ago in 2020-21.

Kraken is now having a bake off for the best technical solution to power its own network. All three of the teams specified in the CoinDesk article are working on zk-based solutions - Polygon and Matter Labs launched the first zkEVMs in March this year while Nil Foundation just announced its own L2 this week called =nil; that is a sharded zk-rollup. The potential Kraken L2 could stand out among rival exchange chains as the only zk-based L2 network if Kraken chooses to work with one of these providers – Cronos and BNB Chain were built as L1s using the Cosmos SDK while Coinbase opted to leverage Optimism's OP Stack to power Base as a rollup (Binance released its own L2 built on top of BNB Chain called opBNB which also leverages the OP Stack).

It makes sense for centralized exchanges to meet its users on-chain with their own solutions. Centralized providers serve as the primary on-ramp for users getting into crypto. But as some of these users look to access on-chain applications including DeFi, NFTs, social/gaming, they typically have to take custody of their crypto assets, resulting in outflows from the exchange. So, to increase touchpoints with users and promote greater engagement, exchanges can offer products including their own sponsored network infrastructure or self-custodial wallets for users to interface with the network. Coinbase already offers both a wallet and a network while Binance just released its own wallet this week to complement BNB Chain. Cronos and BNB Chain are among the top 10 chains ranked by TVL while Base is already #11 after just launching three months ago, reflecting the potential effectiveness of CEXes having their own chains. – Charles Yu

Yuga Labs Applying Pressure on NFT Royalty Debate

Yuga Labs, the largest NFT studio in the world, partnered with Magic Eden to launch a royalty enforcing marketplace for Ethereum NFTs. This collaboration follows Yuga Labs' decision to sever ties with OpenSea back in August 2023 after OpenSea shifted to an optional creator royalty model. Yuga Labs views the upcoming marketplace as "the first major ETH marketplace contractually obligated to honor creator royalties." According to Yuga Labs, Magic Eden's new royalty enforcing marketplace is set to launch at the end of 2023. The new marketplace will force collectors selling NFTs in the secondary market to pay the specified creator royalty percentage.

Notably, Magic Eden's new framework to enforce royalties appears to be at the smart contract level, though more details on this innovation will be released before the marketplace launch. Since Yuga's initiative to launch a royalty enforcing marketplace, BAYC, Cryptopunks, and MAYC's floor prices are up 17%, 15%, and 14% respectively.

OUR TAKE:

NFT royalties witnessed a notable decline in 2023, posing a financial setback for NFT creators. OpenSea's adoption of an optional royalty model in August 2023 dealt a significant blow to the royalty supporting community, signaling a shift away from mandatory royalties. Consequently, prominent NFT studios such as Yuga Labs experienced declines in revenue from secondary sales.

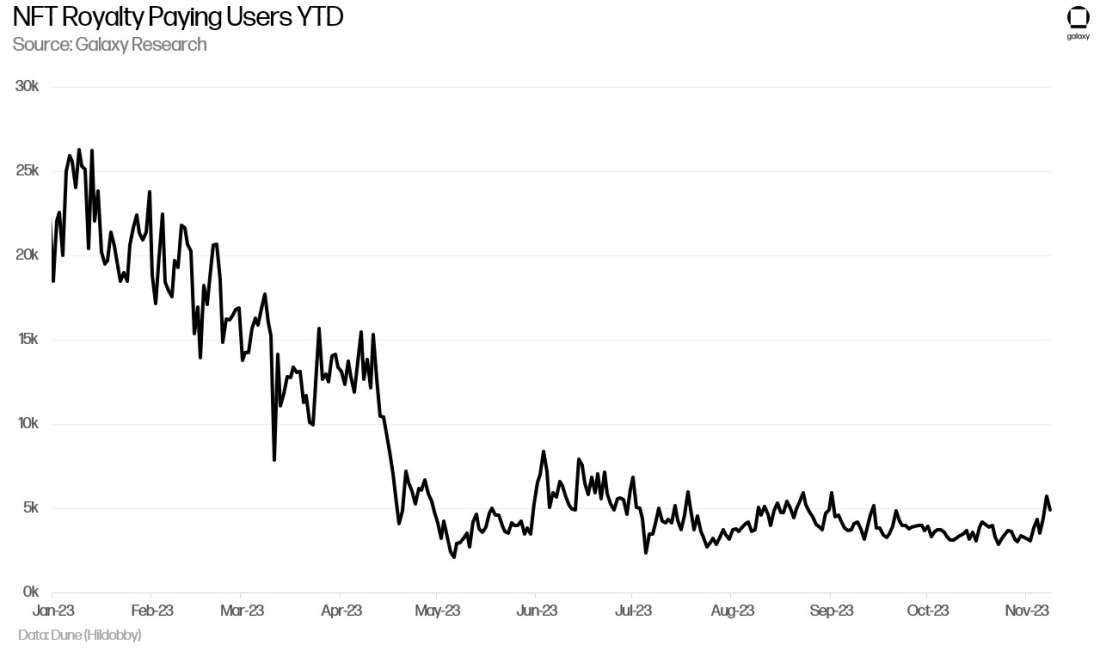

Yuga’s stance on creator royalties is pivotal in the ongoing royalty debate, given that their collections represent approximately 40% of the entire NFT market. This positions Yuga Labs with substantial influence as they strive to reshape the prevailing anti-royalty narrative. Nevertheless, with a 73% YTD decrease in royalty-paying users, rejuvenating the NFT royalty discourse will be a challenge. Despite this obstacle, the NFT sector recognizes the potential financial strain on creators if royalties are permanently eliminated. Our report on NFT royalties underscores that creators have historically earned over $1.8bn in royalties from secondary sales. This highlights the economic significance of sustaining a fair royalty system within the NFT realm.

Magic Eden's introduction of a royalty-enforcing marketplace marks a positive stride for the Web3 creator economy. The partnership with Yuga Labs stands as a significant victory for Magic Eden, strategically positioning the platform to compete for market share against industry giants like Blur and OpenSea. If Magic Eden's smart-contract-level royalty enforcement framework sets a new industry standard, it holds the potential to shape a promising future for NFT creator royalties. - Gabe Parker

Lido to Launch New Staking Module to Utilize Distributed Validator Technology

On Thursday, November 2, LDO governance token holders approved a proposal to onboard new validators through the Obol and SSV networks. These two protocols built on Ethereum are focused on developing and promoting distributed validator technology (DVT). DVT is a promising area of innovation for validator node operators that will enable the operations of a single validator to be split up between multiple node operators. In doing so, validator node operators can increase the resiliency of their staking operations by spreading out risk of a technical failure or unexpected downtime between multiple nodes, as opposed to one single node.

Since 2022, Lido developers have made efforts to pilot various implementations of DVT designed by prominent DVT projects such as Obol and SSV. This year, both DVT projects have made significant progress and headway in creating a robust, production-ready DVT solution for validator node operators. Obol announced in April 2023 the deployment of multiple distributed validators (DVs) on Ethereum mainnet. SSV announced in September 2023 the launch of their mainnet DVT network with whitelisted partners including Ankr, Claystack, StakeTogether, and Coindelta, among others.

The approval of Thursday’s snapshot vote does not mean that DVs will be included directly in the Lido validator node operator set. The proposal suggests creating a “staking module” that will operate independently from Lido’s existing validator set. Staking modules are a feature of Lido that was recently enabled through the Lido V2 upgrade. Alongside the activation of staked ETH withdrawals, the Lido V2 upgrade, which went live in May 2023, introduced the “staking router,” which is a new architecture for onboarding different types of validators such as DVs and organizing them into validator pools, each with customizable pool parameters for onboarding node operators, storing validator keys, and allocating staking rewards.

As written in the proposal, the staking module for DVT validators, called the Simple DVT Module, will be rolled out in several phases over the next six months. Lido DVs will first be activated on a testnet, before operating on Ethereum mainnet in a limited capacity. Only after at least three months of strong performance on mainnet will LDO governance token holders vote to expand the capacity of the Simple DVT Module to onboard more DVs.

OUR TAKE:

The Lido community is making progress in their efforts to adopt new staking technologies that enhance the resiliency and decentralization of the Lido validator set. While the snapshot vote on Thursday approving the proposal to launch the Simple DVT Module is a positive development for Lido, it will still be a while, likely six months, if not longer, before DVs are actually onboarded to Lido through the staking router. As seen by Lido’s slow roll out of staked ETH withdrawals through their V2 upgrade earlier this year, Lido developers are incredibly cautious about implementing new technologies that may introduce unexpected risks and bugs to the protocol. This is understandable given the massive amount of stake under management by the protocol. As of Thursday, November 9, nearly 32% of all ETH staked on Ethereum is staked through Lido.

In many ways, Lido is to alternative Ethereum staking protocols, what Ethereum is to alternative Layer-1 blockchains. Having the first-mover advantage as the first protocol to offer users a scalable liquid staking solution, Lido is set to accumulate more stake as more users are drawn to the high liquidity, resiliency, and adoption of the protocol over others. More users simply reinforce these three characteristics about Lido that then continues to attract more users in a positive feedback loop. However, the high profile of Lido is a double-edged sword that prevents Lido from adopting new technologies quickly and as seen in recent weeks, also contributes to increased scrutiny of the protocol and its design. Through the introduction of staking modules like the Simple DVT Module, Lido developers are clearly looking to increase the protocol’s dominance without also increasing the centralization risks of ETH staked to a single staking pool. It will be important to closely follow the development and rollout of staking modules on Lido over the next six to 12 months due to their importance to Lido’s long-term success and growth as a staking protocol. - Christine Kim

Charts of the Week

Bitcoin inscription count notched its second highest daily figure all time on November 4 of 433,471 inscriptions. More than 432k (99.75%) of which were text-based inscriptions.

The rise in inscription activity on-chain coincided with a rise in fees generated by inscriptions. They have generated more than 162 BTC in fees over the 7-day period ending November 9 and reached a 6-month daily high of 55 BTC on November 9.

Other News

Nasdaq files for BlackRock's proposed iShares Ethereum Trust ETF

Polygon Village launches $90 million fund for ecosystem development

HSBC to launch tokenized securities custody service with Ripple-owned Metaco

Binance announces self-custody crypto wallet during conference

Coatue Management marks down stake in OpenSea by 90%

The Graph set to roll out new blockchain data services, including AI-assisted querying

Bitcoin Ordinals trading volume hits 6-month peak as $ORDI surges on Binance listing

Arbitrum community approves initial vote on proposal to activate token staking

Polygon Labs and NEAR Foundation collaborate to build a zkWasm L2 Prover

Legal Disclosure:

This document, and the information contained herein, has been provided to you by Galaxy Digital Holdings LP and its affiliates (“Galaxy Digital”) solely for informational purposes. This document may not be reproduced or redistributed in whole or in part, in any format, without the express written approval of Galaxy Digital. Neither the information, nor any opinion contained in this document, constitutes an offer to buy or sell, or a solicitation of an offer to buy or sell, any advisory services, securities, futures, options or other financial instruments or to participate in any advisory services or trading strategy. Nothing contained in this document constitutes investment, legal or tax advice or is an endorsementof any of the digital assets or companies mentioned herein. You should make your own investigations and evaluations of the information herein. Any decisions based on information contained in this document are the sole responsibility of the reader. Certain statements in this document reflect Galaxy Digital’s views, estimates, opinions or predictions (which may be based on proprietary models and assumptions, including, in particular, Galaxy Digital’s views on the current and future market for certain digital assets), and there is no guarantee that these views, estimates, opinions or predictions are currently accurate or that they will be ultimately realized. To the extent these assumptions or models are not correct or circumstances change, the actual performance may vary substantially from, and be less than, the estimates included herein. None of Galaxy Digital nor any of its affiliates, shareholders, partners, members, directors, officers, management, employees or representatives makes any representation or warranty, express or implied, as to the accuracy or completeness of any of the information or any other information (whether communicated in written or oral form) transmitted or made available to you. Each of the aforementioned parties expressly disclaims any and all liability relating to or resulting from the use of this information. Certain information contained herein (including financial information) has been obtained from published and non-published sources. Such information has not been independently verified by Galaxy Digital and, Galaxy Digital, does not assume responsibility for the accuracy of such information. Affiliates of Galaxy Digital may have owned or may own investments in some of the digital assets and protocols discussed in this document. Except where otherwise indicated, the information in this document is based on matters as they exist as of the date of preparation and not as of any future date, and will not be updated or otherwise revised to reflect information that subsequently becomes available, or circumstances existing or changes occurring after the date hereof. This document provides links to other Websites that we think might be of interest to you. Please note that when you click on one of these links, you may be moving to a provider’s website that is not associated with Galaxy Digital. These linked sites and their providers are not controlled by us, and we are not responsible for the contents or the proper operation of any linked site. The inclusion of any link does not imply our endorsement or our adoption of the statements therein. We encourage you to read the terms of use and privacy statements of these linked sites as their policies may differ from ours. The foregoing does not constitute a “research report” as defined by FINRA Rule 2241 or a “debt research report” as defined by FINRA Rule 2242 and was not prepared by Galaxy Digital Partners LLC. For all inquiries, please email [email protected]. ©Copyright Galaxy Digital Holdings LP 2023. All rights reserved.