This is the third part of a 3 part series originally published in 2019. Read part 1, On Sound Money, here. Read part 2, On Free Markets for Money, here.

Abstract

Tepid developed market growth projections, the proliferation of negative yielding debt, and political motivations create a moral hazard and incentivize the continued monetary and fiscal stimulus that has underpinned much of post-global financial crisis economic expansion. As signs of macroeconomic uncertainty begin to emerge and many of the traditional strategies employed by policymakers are no longer effective, the probability of a global system breakdown rises with already weakened economies and the overextension of sovereign debt and easy money policies. While traditional safe haven assets benefit from increased demand during periods of market instability, they do not offer true scarcity as their relatively elastic supply responds to increases in price. In contrast, bitcoin provides a fixed-quantity, supply-inelastic alternative to today’s safe haven assets and could potentially serve as a better instrument during periods of macroeconomic turmoil.

Incentives

Today’s macroeconomic landscape is littered with uncertainty and conflict. Central banks have become less effective at the tail end of a long-term debt cycle with limited ability to stimulate growth and are contemplating so-called “makeup” strategies to combat low real economy inflation. Non-debt pension obligations continue to soar and outstrip the assets required to sustain them, threatening key sources of income for current and future generations. Wealth gaps are widening, and political polarity across ideological, political, and economic factions are producing increased levels of domestic conflicts. Externally, the continued rise of China threatens the US’ incumbent position as the premier global superpower and issuer of the world’s reserve currency, and points toward a potential change in the world order. This backdrop provides fertile ground for the continuation of debt monetization and emergence of deeply consequential externalities, as the incentives to monetize debt driven by low growth outlooks, negative yielding debt, and political motives remain all too alluring for policymakers. The consequences of prolonged debt monetization set up a “house of cards” scenario in which too much capital chases too few NPV-positive endeavors, confidence in our global financial systems falters, and the probability of a global system failure catalyzed by some unknown contagion increases.

Growth & Negative Yielding Debt

Growth rebounded sharply post-global financial crisis on the back of quantitative easing and increased fiscal stimulus but has slowed in recent years across both developed and emerging economies. Growth forecasts paint a bland future: growth in key global economies such as the US, China, and the Euro area is expected to decline over the next five years. Inflation remains low and below most central bank targets, and while unemployment rates have likely reached their nadir and there is seemingly little slack in labor markets, lukewarm wage gains persist. Many domestic governments have attempted to combat the slowing growth and low inflation with continued fiscal stimulus, monetizing debt at a historic pace and increasing sovereign debt to previously unimaginable levels.

Fig. 1: Real GDP historical growth & forecast, IMF. (1)

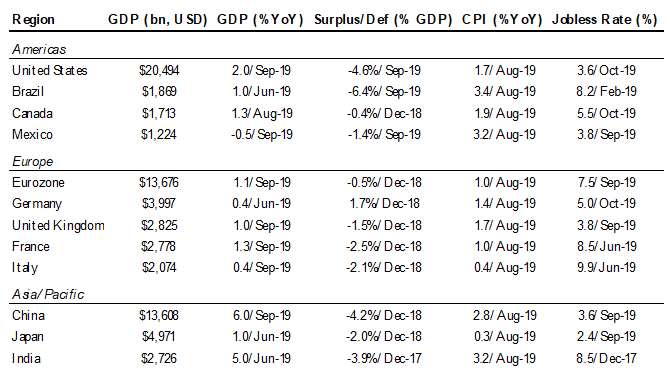

Table 1: Global economy watch, selected countries & regions. (2)

Meanwhile, central banks continue to ease, cutting interest rates, buying up sovereign debt, and pushing more stimulus into the global financial system. The increased printing and monetary stimulus has not manifested itself in real economy prices or inflation; rather, asset inflation has manifested amidst cheap debt, particularly as the trail of breadcrumbs shows rising corporate debt levels, increased corporate expenditures on dividends and share buybacks, and higher proportions of overall equity demand stemming from corporate buybacks. (3) Macroeconomic uncertainty and global tensions have increased the demand for developed market sovereign bonds driven by a flight to (relative) safety, and alongside the continued decline in interest rates have resulted in trillions of dollars of negative yielding debt.

Fig. 2: Market capitalization, outstanding negative yielding debt, trillions of dollars. (4)

Historically, institutions and investors have flocked to sovereign bonds for safety and income, but negative yielding debt creates a mechanism where institutions are buying under the hope of capital gains rather than yield and not holding the bonds to maturity. Much of the world’s developed market sovereign rates are now negative across the curve, with an estimated $12t of negative yielding debt outstanding. The ramifications of negative yielding debt are plenty: the specter of a bond bubble looms, pension funds lose critical sources of income while their asset-liability imbalances grow, and investors may be incentivized to make riskier investments that they may not be compensated for in search of positive returns. The benefits of negative yielding debt lie solely with the issuers, who effectively have a zero dollar cost to print and carry their debt, while the holders of the debt shoulder significant risks.

Trade Imbalances, MMT, and Political Motivations

Waning growth, trade imbalances, and political motivations from both sides of the aisle further point toward fiscal expansion. Economic growth, stability, and prosperity are unquestionably among the goals of the global policymakers, but perhaps becomes more relevant during key political elections. Particularly if the incumbent candidate has presided over a period of economic expansion, he or she has a clear incentive to maintain that growth in the year leading into an election year. In the US, President Trump has laid many claims to the successes of the economic expansion and stock market and has become a key point for his 2020 campaign.

Much of President Trump’s economic policy has focused on perceived trade imbalances, as the US continues to expand its current account deficit. Less expensive imports have hurt domestic exporters, and President Trump has engaged in multiple trade negotiations (or wars) with China, Japan, and the US’ NAFTA counterparts. The US’ current account deficit has grown 18% from $787b in 2014 to over $926b in 2018, as a strengthening dollar and cheap imports from improvements in global productivity increased the domestic consumption of foreign goods. Roughly half of the current account deficit growth has come from increased Chinese imports. The global balance of trade and US dollar strength has made it difficult for domestic exporters, adding an additional incentive to engage in strategies to weaken the dollar and make US exports more competitive on a global scale, a desire that President Trump has verbalized on multiple occasions.

Fig. 3: US net exports across major trading partners, millions of dollars. (5)

Challengers to President Trump’s seat in the White House have pointed to continued debt monetization: many leading US progressives, some of who are vying for the Democratic presidential nomination, have presented ambitious, expensive policy proposals including the Green New Deal and Medicare for All. These potential nominees advocate running a deeper deficit to fund extensive new social programs, particularly with current low inflation and interest rates, and a relatively unorthodox strain of economics called modern monetary theory (MMT) has worked its way into the mainstream political debate.

In a nutshell, MMT argues that a country borrowing in its own fiat currency can finance fiscal stimulus by issuing debt and printing money to purchase its own debt. It is a theory of full employment and price stability that argues that the government is the monopoly supplier of money, and because it issues its own money, it can always afford to spend in nominal terms. It rejects the traditional idea that the government needs money before it spends, and therefore the government’s spending is not limited to its tax revenues. MMT proposes to resolve unemployment through a job guarantee program that would provide full employment to everyone willing to work. The job guarantee portion is essential to the school of thought because it supposedly solves the problem of full employment and price stability. MMT doesn’t say deficits don’t matter or that the government’s spending is unconstrained; in reality the government does have a real budget constraint (inflation).

According to MMT, when inflation is low there’s room for bigger government deficits. By extension, MMT would allow the government to control inflation through tax policy. Instead of asking the Fed to stabilize prices through monetary policy, the government could raise taxes when prices get too high and cut taxes when prices get too low. The idea that traditional fiscal-policy needs to be rethought in eras of low real interest rates has validity to it, but the idea has been warped into claims that massive spending on job guarantees can be financed by central banks without any burden on the economy. During the current era of economic and political frustration, some are jumping on the possibility of politically attractive ways out of economic difficulty.

MMT has several potential issues. First, it is false that governments can create new money to pay all due liabilities and avoid default. MMT argues that the government can pay for as much as it wants with an endless supply of money that it creates to boost employment and promote price stability. However, there is a limitation of real resources. Eventually, if the government and an artificially buoyed workforce keeps paying for more things, the economy inevitably runs up against real supply constraints, whether it’s offices and factories, natural resources, or production capacity, thereby causing rapid inflation. Naturally, inflation arises when money is created in excess of the capacity of the supply side of the economy to produce additional goods and more money ends up chasing a limited supply of goods. As evidenced by several emerging markets, this strategy and its practiced variants inevitably leads to hyperinflation. MMT also leads to the collapsing of an exchange rate, causing increased inflation, capital fleeing the country, and lower real wages as exchange rate collapses and the price of imports rises.

It is also important to note that not all debt and spending are created equal. Debt that creates enough economic benefit to pay for itself is a good thing. Too little debt growth can create as bad or worse economic problems as having too much, particularly with the cost of foregone opportunities. Whether more debt is necessary depends on whether the debt is used productively enough to generate enough economic benefit to service the overall cost of the debt. If that is the case, the resources will have been well-allocated, the capital was appropriately used toward positive NPV projects, and both the lender and the borrower will benefit economically. Sometimes these trade-offs are hard to see (such as when monetary income does not cover the cost of debt but the project leads to an overall positive economic benefit). If lending standards are too tight that they require a near certainty of being paid back, it may lead to fewer debt problems but too little development. If the lending standards are too loose, that could lead to more development but could also create serious debt problems down the road that erase the benefits. While MMT has a small faction of supporters, it is unlikely that MMT will gain full traction in the United States. However, the broad social, healthcare, and environmental programs proposed by Democratic candidates do not have requisite revenue or budgetary sources, which suggests continued fiscal expansion and debt monetization regardless of which party controls the White House or Congress.

Deficits & Debt Maintenance

Negative yielding sovereign debt and a desire for stimulus set up an open invitation to run deeper deficits and monetize debt: when growth slows and turns negative, there is an incentive for federal government to spend more to combat a flagging economy and negative yielding debt creates an infinite incentive to print money because the cost to issue and carry is $0. Over the past twenty years, the cumulative federal budget deficit has ballooned to roughly $11.4t; notably, the rate at which the deficit (and by extension the federal government’s total debt outstanding) grew at a faster pace following the GFC as policymakers stimulated the economy through increased government expenditures.

Fig. 4: Cumulative US federal budget deficit summary since September 1999, dollars. (6)

Servicing the growing federal government outstanding debt has become increasingly expensive as deficits and debt loads grew: federal net interest expense has risen to 10% of its total revenue and is expected to increase to nearly 15% over the next decade according to CBO projections. Market demand for these Treasuries is also effectively limitless: the Federal Reserve can print money and purchase this debt in open market operations, thereby monetizing federal debt. While there is no concept of interest coverage ratios or margins for governments, in comparison the S&P 500’s aggregate interest expense margin as a percent of sales was just 2.1% in 2018. (7)

Fig. 5: US federal net interest expense as % of revenues, historical and projected estimates. (8)

House of Cards

Growth projections, negative yielding debt, and political motivations incentivize debt monetization and create a house of cards situation that misprices risk and assets. The unwind of this inflated risky asset bubble would be a broad system failure with some trigger spreading a global contagion into interconnected economies and financial markets. It could lower negative real return breakpoint that cause sovereign debt holders to finally capitulate, a trade imbalance that causes a deeper trade war and catalyzes inflation amidst a retrenchment from globalization, or the addition of capital controls that restrict the creation, flow, and ownership of capital. It is unclear what or when this trigger will be, or how the house of cards will unwind, but we can see from posterior economic and financial crises that the probability that it does occur is heightened significantly.

Scarcity

A global risky asset unwind predictably has outlets, much like the breaking of a dam forces water into old and new tributaries. As a crisis of confidence in our financial and economic system spreads, value will flow out of liquid, non-sovereign financial assets such as equities or corporate bonds as well as relatively riskier currencies and sovereign bonds and push capital into safe haven assets. Though its apparent that even the “safest” global reserve currency and sovereign bonds, the dollar and Treasuries, have clear systemic risks in an absolute sense, on a relative basis the dollar and Treasuries are faring far better than other developed market sovereign assets. Paradoxically, value that flows out of non-sovereign financial assets will likely partially flow into US sovereign assets, thereby sustaining the untenable house of cards situation. However, the systemic risks that continue to grow behind these sovereign assets remain, and other real assets will likely serve as better safe haven assets.

The traditional stores of value outside of Treasuries and the dollar are gold, real estate, art, and the yen. While on the surface these assets may seem like attractive stores of value, in reality they all have elastic supply functions that modulate price increases and limit the benefit it can have on one’s portfolio during periods of uncertainty or crisis. If gold prices increase, existing miners with excess capacity and miners who were not profitable at prior prices may find themselves suddenly profitable at current prices will turn on production; the supply of gold will rise from the new mining production and naturally dampen price. Similarly, if the supply of current homes is constrained and home prices were to rise, homebuilders will start building more houses; the increase in home supply will lead to a decrease the price of the homes in aggregate. From a scarcity and “hardness” perspective, art is comparatively better, but art has an inherent subjectivity in its value interpretation, non-fungibility, illiquidity, and limited capacity to hold value. The yen carries similar systematic risks as other sovereign financial assets (particularly as Japan’s debt-to-GDP is among the highest in the world) and has a similar value modulation: a stronger yen makes exports comparatively more expensive, hurting domestic producers of global goods and incentivizing the subsequent weakening of the yen to restore trade imbalances.

Bitcoin offers the only verifiably scarce, immutable, and capped supply asset in the world. Importantly, bitcoin has a price-inelastic supply, where bitcoin’s value cannot change its supply issuance: bitcoin’s supply issuance is strictly bound and algorithmically hard-coded as the transaction validation difficulty of the Bitcoin network modulates supply creation. If bitcoin’s price rises, more miners will deploy resources to mining bitcoin, speeding up the block times to under the targeted ten minutes per block and temporarily increasing the supply issuance. However, an algorithmic regulation occurs every 2016 blocks (approximately every two weeks) that dynamically adjusts the complexity of the mining algorithm, re-targeting the block time and periodic issuance back to ten minutes despite the new resources vying to mint new bitcoin at higher prices. A similar process occurs if the price of bitcoin falls and resources are taken off the network, thereby increasing the block time and slowing issuance: the difficulty is lowered and block times are decreased back to roughly ten minutes. This dynamic process, alongside the issuance halving every four years and capped supply, creates the only transparent and trustless stock-to-flow schedule for any asset. (9) Due to the design of bitcoin, its stock-to-flow ratio rises over time, as the annual issuance of bitcoin decreases relative to the outstanding supply. Bitcoin already has a higher stock-to-flow ratio than US notes & bonds and silver, and is expected to surpass that of the yen by 2021 and that of gold by 2025.

Fig. 6: Bitcoin stock-to-flow schedule and selected assets. (10)

Contrary to popular belief, the value proposition of a safe haven asset is not about its low volatility; rather, it’s about its stock and flow assurances, or predictable and high stock-to-flow ratios through time. Stock-to-flow assurances are what gives things staying value but not necessarily constant value. Bitcoin’s volatility is a function of its 1) high marginal buyers and sellers relative to existing liquidity (the incentive and high propensity to hold bitcoin makes its liquidity low by design), and 2) the current holder base is mostly retail and more susceptible to behavioral biases. Over time, as the value of bitcoin grows alongside its stock-to-flow ratio, liquidity should follow with a higher market capitalization and more institutional, liquidity venues. The market should naturally be able to absorb the impact of marginal trading better, but it’s important to note that assets with high stock-to-flow ratios and deflationary issuance will have high volatility by design due to high incentive and propensity to hold, ceteris paribus.

Final Remarks

The premise that somehow a government can always print enough money to cover its debts is plainly imprudent. It is foolish to assume that current conditions will last, or to ignore the real risks faced by countries with high and rising debt burdens. The federal government’s ability to print money is a privilege, but a printing press is not a panacea for its problems. Particularly with the backdrop of low global growth, cheap debt, and political motives that point to continued stimulus and debt monetization, it seems that the status quo will continue for as long as the market can stomach the gluttony of debt and money printing. With less effective tools at the disposal of central banks and federal governments to stimulate, influence prices, and maintain employment in a potential downturn, real assets will become necessary for investor portfolios amidst a broader slide in risky assets. Existing safe haven assets may provide marginal portfolio diversification during these periods of uncertainty and crisis, but their elastic supply responses limit the benefits these assets can provide. In contrast, bitcoin’s design provides supply-elasticity resistance that could potentially provide better diversification for an investor’s portfolio.

Citations

(1) IMF, World Economic Outlook, DataMapper, as of April 2019.

(2) Bloomberg, November 13 2019.

(3) For further reading, see Galaxy Digital Research’s On Free Markets for Money.

(4) Bloomberg, BNYDMVU Index, weekly, November 13 2019.

(5) Bloomberg, November 13 2019.

(6) Bloomberg, November 13 2019.

(7) Facset, FY 2018, Retrieved November 2019.

(8) Congressional Budget Office, historical and projected estimates, Retrieved October 2019.

(9) Stock-to-flow is a measure of an asset’s scarcity. It is defined as the ratio between the current stock supply and new production over some time period). Assets with high stock-to-flow ratios have low issuance or creation relative to the existing supply.

(10) Galaxy Digital Research, Bitcoin, various sources.

This document, and the information contained herein, has been provided to you by Galaxy Digital Holdings LP and its affiliates (“Galaxy Digital”) solely for informational purposes. This document may not be reproduced or redistributed in whole or in part, in any format, without the express written approval of Galaxy Digital. Neither the information, nor any opinion contained in this document, constitutes an offer to buy or sell, or a solicitation of an offer to buy or sell, any advisory services, securities, futures, options or other financial instruments or to participate in any advisory services or trading strategy. Nothing contained in this document constitutes investment, legal or tax advice or is an endorsementof any of the digital assets or companies mentioned herein. You should make your own investigations and evaluations of the information herein. Any decisions based on information contained in this document are the sole responsibility of the reader. Certain statements in this document reflect Galaxy Digital’s views, estimates, opinions or predictions (which may be based on proprietary models and assumptions, including, in particular, Galaxy Digital’s views on the current and future market for certain digital assets), and there is no guarantee that these views, estimates, opinions or predictions are currently accurate or that they will be ultimately realized. To the extent these assumptions or models are not correct or circumstances change, the actual performance may vary substantially from, and be less than, the estimates included herein. None of Galaxy Digital nor any of its affiliates, shareholders, partners, members, directors, officers, management, employees or representatives makes any representation or warranty, express or implied, as to the accuracy or completeness of any of the information or any other information (whether communicated in written or oral form) transmitted or made available to you. Each of the aforementioned parties expressly disclaims any and all liability relating to or resulting from the use of this information. Certain information contained herein (including financial information) has been obtained from published and non-published sources. Such information has not been independently verified by Galaxy Digital and, Galaxy Digital, does not assume responsibility for the accuracy of such information. Affiliates of Galaxy Digital may have owned or may own investments in some of the digital assets and protocols discussed in this document. Except where otherwise indicated, the information in this document is based on matters as they exist as of the date of preparation and not as of any future date, and will not be updated or otherwise revised to reflect information that subsequently becomes available, or circumstances existing or changes occurring after the date hereof. This document provides links to other Websites that we think might be of interest to you. Please note that when you click on one of these links, you may be moving to a provider’s website that is not associated with Galaxy Digital. These linked sites and their providers are not controlled by us, and we are not responsible for the contents or the proper operation of any linked site. The inclusion of any link does not imply our endorsement or our adoption of the statements therein. We encourage you to read the terms of use and privacy statements of these linked sites as their policies may differ from ours. The foregoing does not constitute a “research report” as defined by FINRA Rule 2241 or a “debt research report” as defined by FINRA Rule 2242 and was not prepared by Galaxy Digital Partners LLC. For all inquiries, please email [email protected]. ©Copyright Galaxy Digital Holdings LP 2019. All rights reserved.