Introduction

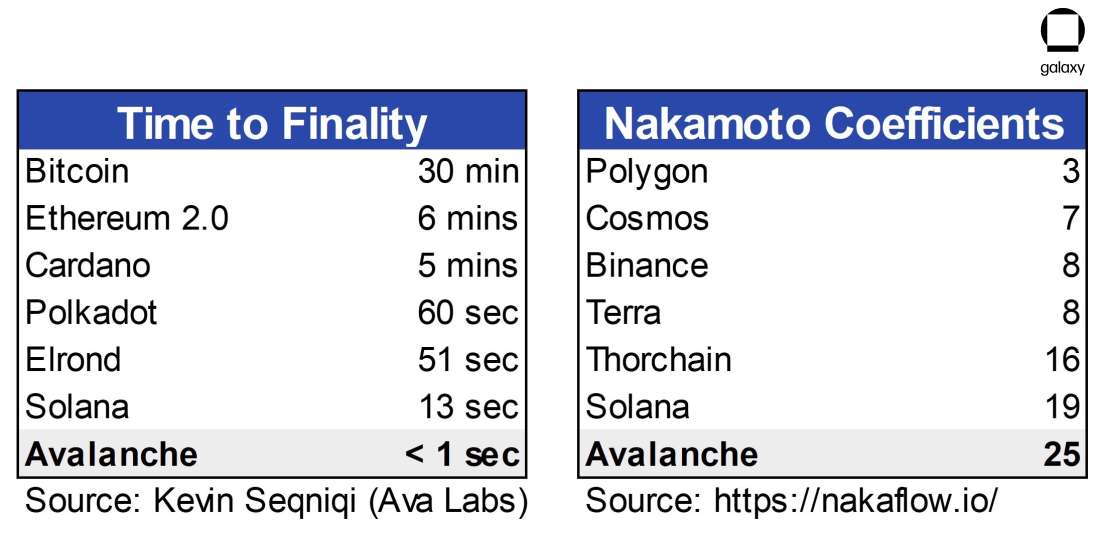

Whether you ski or snowboard, it’s important to be prepared this winter because Avalanche season is here. Avalanche is the fastest blockchain as measured by time-to-finality (often sub-second). Powered by its innovative consensus mechanism (also called “Avalanche”), Avalanche provides high throughput, scalability, and strong safety guarantees—all while still preserving competitive levels of decentralization—a unique attribute that many of its competitors have been unable to match.

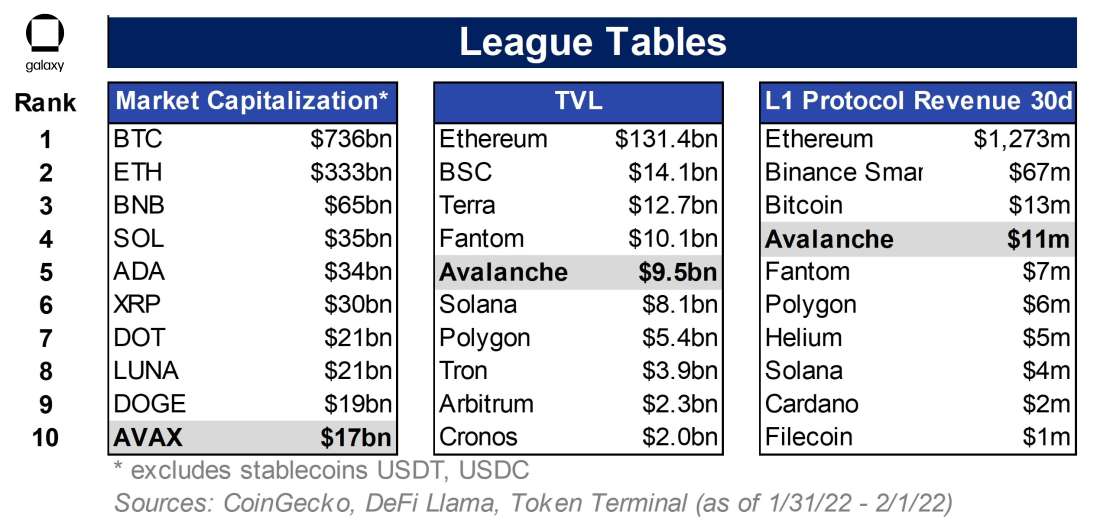

With a strong leadership team, thoughtful design in its platform architecture, backing from top-tier investors, a passionate community (the most dedicated members showing their affiliation with a red triangle 🔺 on their Twitter profiles), and, of course, a massive stockpile of financial resources for users and developers, Avalanche has grown into a vibrant ecosystem with over 500 projects building on top of it and over 800k monthly active users. It’s currently the #5 platform ranked by DeFi TVL with the AVAX token ranked #10 in market cap among non-stablecoin cryptocurrencies – an extraordinary feat considering it’s only been 15 months since launching on mainnet.

The team developing Avalanche envisions it becoming a platform of interoperable blockchains and hopes to digitize all assets in the world, allowing Avalanche to serve as the foundational network of interoperable finance. The key to unlocking this goal is subnets: short for subnetworks, subnets are secondary networks built on the Avalanche platform that run in parallel with the Primary Network, providing developers seeking to deploy in the Avalanche ecosystem with a high level of design customization to support a wide range of use cases.

To date, subnets have largely been in the R&D phase, leaving just Avalanche’s EVM chain available to users for DeFi and NFT activities. This has led many to group Avalanche into a crowded pool of Ethereum challengers that offered temporary usability improvements and financial incentives but lacked a feasible technical solution to the network’s outstanding scaling problems. Avalanche could break away from this grouping as its distinctive offerings become more apparent with the launch of the first live subnets expected in coming weeks. However, the merits of subnets are still far from proven and how the technology will be adopted into the greater crypto ecosystem has yet to be uncovered. For better or for worse, 2022 will be a transformative year for Avalanche and its identity.

Avalanche Background

Ava Labs, the team responsible for developing and implementing the software behind Avalanche, was co-founded in 2018 by Emin Gün Sirer, a computer scientist and professor at Cornell University, alongside Ted Yin and Kevin Sekniqi, two doctoral students at Cornell. The founding group specialized in distributed systems consensus protocols. Ted Yin also notably designed HotStuff, a scalable classical consensus algorithm that was chosen to power Facebook’s Diem (then Libra) project. As with many other blockchain projects at the time, Ava Labs set out to solve the scaling challenges faced by Ethereum.

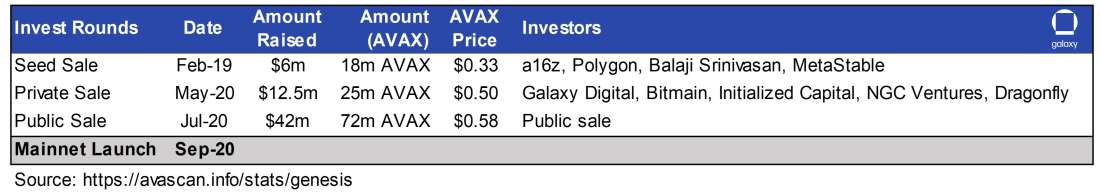

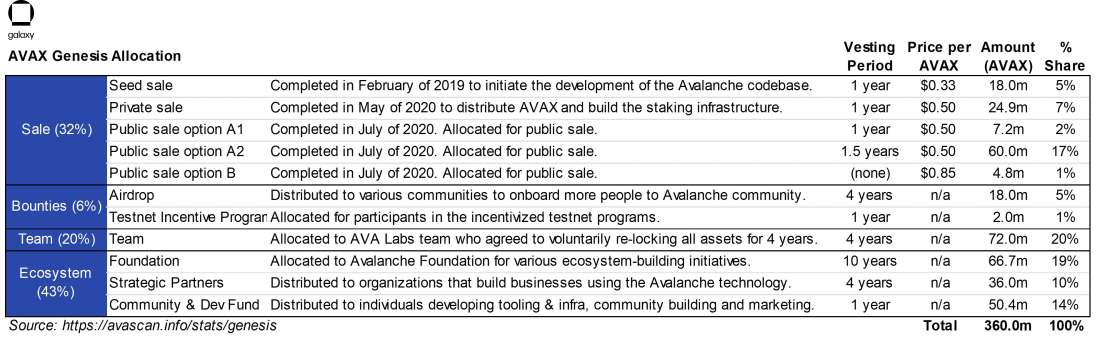

To fund the project, Ava Labs conducted a series of private and public token pre-sales. Its seed sale in February 2019 raised $6m (=18m AVAX @ $0.33/token) to initially fund the development of the Avalanche codebase. Participants in the seed round included a16z, Polychain, and Balaji Srinivasan among others. Just 3 months later, Ava Labs came out of stealth and launched a private testnet powered by Avalanche Consensus Protocol.

Ava Labs then closed a $12.5m private sale of its token (=25m AVAX @ $0.50/token) in May 2020 that included Galaxy Digital, Initialized Capital, BitMain, NGC Ventures, Dragonfly Capital, and IOSG Ventures as investors. Avalanche had its first public sale in July 2020, raising $42m in under five hours, before its mainnet launch on September 20th, 2020.

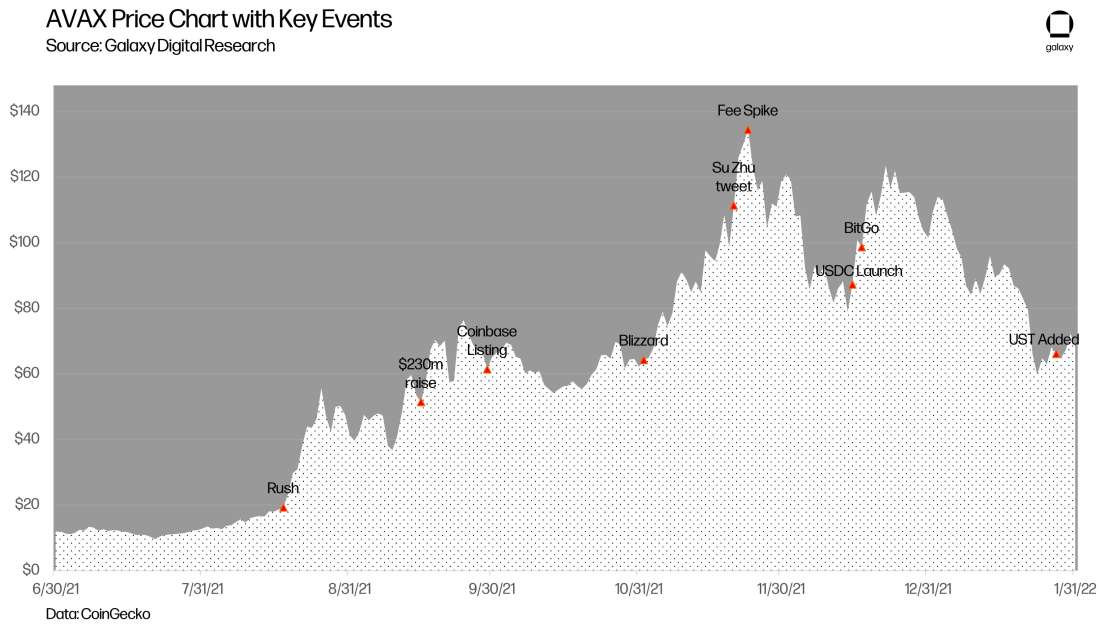

More recently, Polychain and Three Arrows Capital led a $230m investment in Avalanche completed in June 2021 that included participation from R/Crypto Fund, Dragonfly, CMS Holdings, Lvna Capital, and others. Part of this investment was directed to large ecosystem growth initiatives, including incentivization and grant programs Avalanche Rush, a $180m liquidity mining program, and Blizzard , a $200m+ fund for ecosystem development (both later discussed in further detail).

Profile / Identity

Avalanche’s key value propositions include:

Low costs and speed. These sound like generic offerings, but Avalanche is one of the fastest blockchains as measured by finality, which refers to the point that a transaction is irreversible. Avalanche employs a lightweight network sampling mechanism to quickly reach consensus and achieve low latency, typically with finality in 1-2 seconds. Avalanche Consensus relies on probabilistic finality with parameters that can be tuned so that once a transaction is confirmed, it is accepted and final – it does not permit re-orgs unlike the Nakamoto Consensus employed by Bitcoin and Ethereum. Per Ava Lab’s COO Kevin Seqniqi, the time it takes for a transaction to be considered final:

Note: Solana is often quoted as the fastest blockchain due to its block times of ~400ms, but it usually requires several blocks and confirmations before a transaction becomes irreversible.

High throughput AND scalable. According to the Avalanche Platform white paper, Avalanche Consensus has recorded over 5,000 transactions per second (TPS) at the base layer in a real implemented study. However, we note TPS is not a particularly intuitive metric for comparisons across blockchains since: (i) one transaction doesn’t necessarily correspond to a single payment or deposit, and (ii) any blockchain can easily enable high throughput trading off decentralization and implementing larger blocks or provisioning higher bandwidth for each node. That brings us to our next point…

Competitive decentralization without sacrificing on performance. From its inception, Avalanche was intended to responsibly manage scaling tradeoffs while maintaining a decentralized network. The reported 5,000+ TPS in the white paper was from a scenario with 2,000 nodes on AWS using low-end machines. As noted in our Ready Layer One report, Avalanche already has one of the highest active validator counts (>1,200) and Nakamoto Coefficients (25) out of the 10 major Proof-of-Stake networks we reviewed, and its consensus mechanism enables the validator set to potentially grow unbounded, meaning the network could achieve higher levels of credible neutrality. Please refer to our Ready Layer One report for further details comparing validating costs and levels of decentralization across Layer 1 blockchains.

Flexible and configurable. Avalanche is meant to serve as a universal and flexible platform to support other blockchains to be built on top. Avalanche’s architecture is designed to support different virtual machines and multiple scripting languages. Subnets offer a high level of customization over their implementation to support a wide range of use cases. For example, a subnet creator could specify a closed-off group of permissioned participants in its validator set for regulated institutional clients, specify advanced computing requirements for high performance gaming, or make myriad other design choices that remain interoperable with the rest of the Avalanche ecosystem.

All these characteristics inherently derive from Avalanche’s unique and innovative consensus mechanism and platform architecture.

Consensus

Avalanche Consensus is a probabilistic model that quickly comes to a decision by using a lightweight network sampling mechanism called repeated random sub-sampled voting. Instead of requiring input from every validator on the network, Avalanche polls just a sample of the validator set, which nearly always achieves the same outcome as pinging the entire network but at much quicker speed.

At a high level, a validator makes an initial decision to accept or reject a transaction then looks for assurances from other members of the network. These other members may then perform the same process of asking others to build confidence around their decision about the transaction. After each round of polling, agreement builds for a decision to approve or reject the transaction and each subsequent round builds on the momentum of the preferred side (“snowball building momentum as it goes down the hill”). Transactions go through repeated rounds of polling until there is a high probability of agreement across the network. The decision is finalized when everyone settles on one side and the system comes to a resting state.

Repeated random sub-sampled voting process:

Users submit transactions that go to one or more validators that decide which transactions to accept. A validator makes its initial preference to accept or reject the transaction with help from the virtual machine (“VM”), which defines the rules for transaction processing and helps to inform the client which transactions are acceptable. Invalid transactions are ignored, while valid transactions are added to a list of pending transactions.

After making its initial preference, the validator then initiates a voting process by polling a group of other nodes in the network’s validator set on their preferences to accept or reject select transactions (probability of being polled is weighted by stake amount). This helps build a confidence score for validation.

Each polled node then independently issues a response to the query. If the supermajority (>50%) of the polled sample agrees with the initial decision, it adds to the confidence score for acceptance. If the supermajority supports a different value, then the initial proposal is updated appropriately.

To build up the confidence score for acceptance, queried nodes will subsequently engage in their own sub-sampling rounds by querying other random nodes and updating their decisions correspondingly.

The sub-sampling process will continue until a specified number of sampling rounds are completed or until the confidence threshold is met. Transactions that meet the required level of acceptance after enough polling rounds are then finalized.

This same process is applied in the event of conflicting transactions, such as if a malicious actor tries to double spend on the network. The conflicting transactions are moved into a conflict set where the voting process resumes until either (i) one transaction receives sufficient votes of confidence to be accepted thereby rejecting the non-accepted conflicting transactions, or (ii)the specified number of sampling rounds are reached without meeting the confidence threshold resulting in the dropping of the transactions in the conflict set, whichever comes first.

The big breakthrough of the Avalanche Consensus is that it is both permissionless and scalable – the network is equipped to handle a meaningful increase in the number of full block–producing validators while still maintaining the quick time to finality. Bitcoin’s PoW design is also permissionless and scalable in its “validator set” (i.e., miners) but it lacks low latency. Most other PoS systems require either specialized computing hardware or a limited validator set to maintain quick finality – both of which come at the expense of decentralization.

Specifically, other proof-of-stake chains are forced to make tradeoffs to get what Avalanche achieves:

Achieve faster consensus by limiting the validator set. Classical consensus protocols (e.g. PBFT, Tendermint/Cosmos) are based on all-to-all voting where the communication overhead typically increases quadratically [O(n2) where n=# validators so 10 nodes:100 messages | 1,000 nodes:1,000,000 messages]. They typically cannot maintain high throughput and fast settlement with an increase in nodes and often require all validators to be known and approved (not permissionless). To achieve faster performance and lower messaging overhead, networks often limit their validators on the network (e,g, BSC relies on 21 validators; Cosmos has 125 validators), thereby sacrificing on decentralization.

For Avalanche, the number of messages each node handles stays mostly constant as the validator set grows. Ava Labs’ Gün Sirer has recently noted in an interview that consensus is reached after 17 sub-sampling rounds – all which occurs in under one second. He noted that the set of full block-producing nodes could grow ten-fold before the required number of rounds goes from 17 to 18.

High, expensive computing hardware requirements. For Solana, validation costs are updated of thousands of dollars as validators need equipment with 12 core CPU, at least 128 GB of RAM, and an enormous amount of storage (some estimates suggest ~500 GB a day). BSC validators generally require 48 GB of RAM and 12 cores of CPU. Polkadot validators require 64 GB of RAM and CPU > 4.20 GHz.

For Avalanche, the technical requirements for each node are relatively minimal (2 cores, 4 GB memory). The financial requirement of staking a minimum of 2,000 AVAX tokens are a bit more restrictive – although this could be lowered through governance so that Avalanche Consensus can be even more inclusive.

Avalanche Consensus is leaderless and quiescent, meaning all nodes can produce a block and that nodes don’t do work unless there is work to do—there is no mining or target number of blocks to produce over any interval. There are no reorgs on Avalanche, so transactions have finality once they are decided (known as 0-conf”). Nodes accept finalized TXs as permanent on Avalanche, while Nakamoto Consensus requires that nodes follow the longest chain (with the most work), which gives an opportunity for an attacker to mine in secret and force nodes to flip to their chain upon broadcast.

Note: Avalanche consensus refers to a family of consensus protocols that are used by different components of the Avalanche Primary Network (detailed next section):

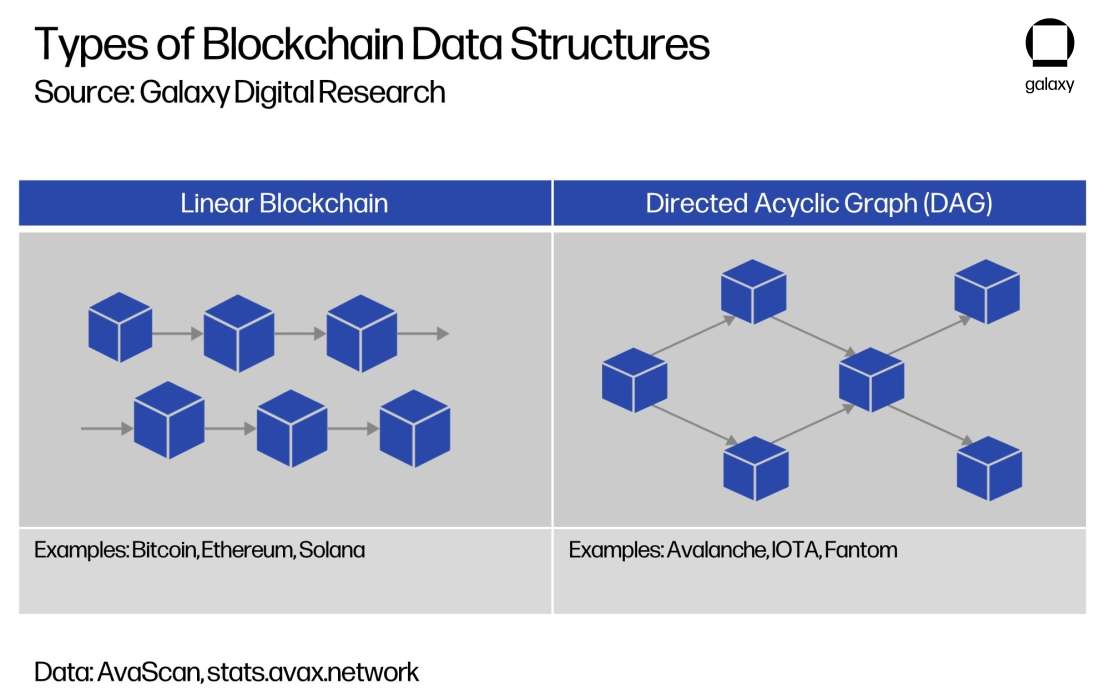

The Avalanche Consensus mechanism described here is used by the default asset chain, a UTXO-based chain that is structured as a DAG (Directed Acyclic Graph)—an alternative distributed ledger technology used for data storage that contrasts with the traditional linear blockchain structure. DAGs have tree-like structures and give partial ordering of decisions by linking transactions together, which allows for multiple transactions to be validated simultaneously rather than having to wait for transactions to be bundled together in a block. Each vote on a DAG is implicitly a vote for prior linked transactions. The DAG structure eliminates the need for mining, so transaction speeds are unencumbered by block creation.

Snowman Consensus is the linearized version of the Avalanche protocol and is used by the EVM-compatible chain. More widely used by blockchains including Bitcoin and Ethereum, linear chains follow the longest chain rule where blocks are added to the latest block of the longest validated chain (e.g. each child block has only one parent block). Snowman Consensus is for account-based systems, which are relied on by most existing applications with smart contracts. A recent upgrade introduced Snowman++ congestion control, which elected a soft leader for block production to reduce MEV and network contention.

Prioritizing Security over Liveness

For its security, Avalanche relies on Proof-of-Stake for Sybil protection. For stakers, there is no slashing or loss of funds with validator downtime or misbehavior. Instead, the stake is only used for spam prevention (deter fake validators from entering the network) and Sybil protection (deter malicious actors from pretending to be more than one validator) by requiring that funds be locked for some duration. A common point of confusion is whether PoS is for both Sybil deterrence and a consensus mechanism. The confusion arises when comparing proof-of-stake systems to proof-of-work or Pure PoS (a specific variant of proof-of-stake), which each serve as both consensus and Sybil deterrence mechanisms.

Avalanche is a probabilistic protocol that is Byzantine tolerance configurable. Because it is probabilistic, it is possible that sub-sampled nodes could come to the wrong conclusion. However, the protocol’s liveness and safety parameters (i.e. sample size, quorum size, decision threshold) are configurable to make the probability of such an occurrence happening near-zero. Liveness refers to conflict resolution, or the ability for the nodes on a network to reach agreement in a timely manner so that the system can continue running, security means that accepted transactions are valid and identical at all nodes, and fault tolerance is the distributed system’s ability to continue operating with the failure of one node at any point. Changing the parameters for fault tolerance to a higher Byzantine node ratio threshold requires more rounds to reach consensus, so the network degrades (i.e. time for finality approaches ∞) if one-third of nodes go offline. Similarly, lowering the node ratio threshold would tradeoff safety for liveness since fewer rounds would be required for agreement.

Avalanche Consensus has been configured to prioritize safety over liveness. Compared to the 51% vulnerability levels on many PoW chains and above the >33% levels of many other PoS chains, Avalanche Consensus has a higher security threshold that can tolerate between 60–80% of nodes being malicious without halting or compromising the network. These strong safety guarantees come at the tradeoff of liveness or finality. Other chains that prioritize liveness will have nodes always come to a result for conflicting transactions but with Avalanche Consensus, transactions in a conflict set may never reach resolution, which impacts only parties in the conflict set while the rest of the network resumes operating. Due to the DAG structure, this only impacts malicious spenders as their transactions may get stuck and never reach finality while consensus continues to progress for the rest of the network (virtuous transactions retain the liveness and strong security assurances).

Platform Architecture

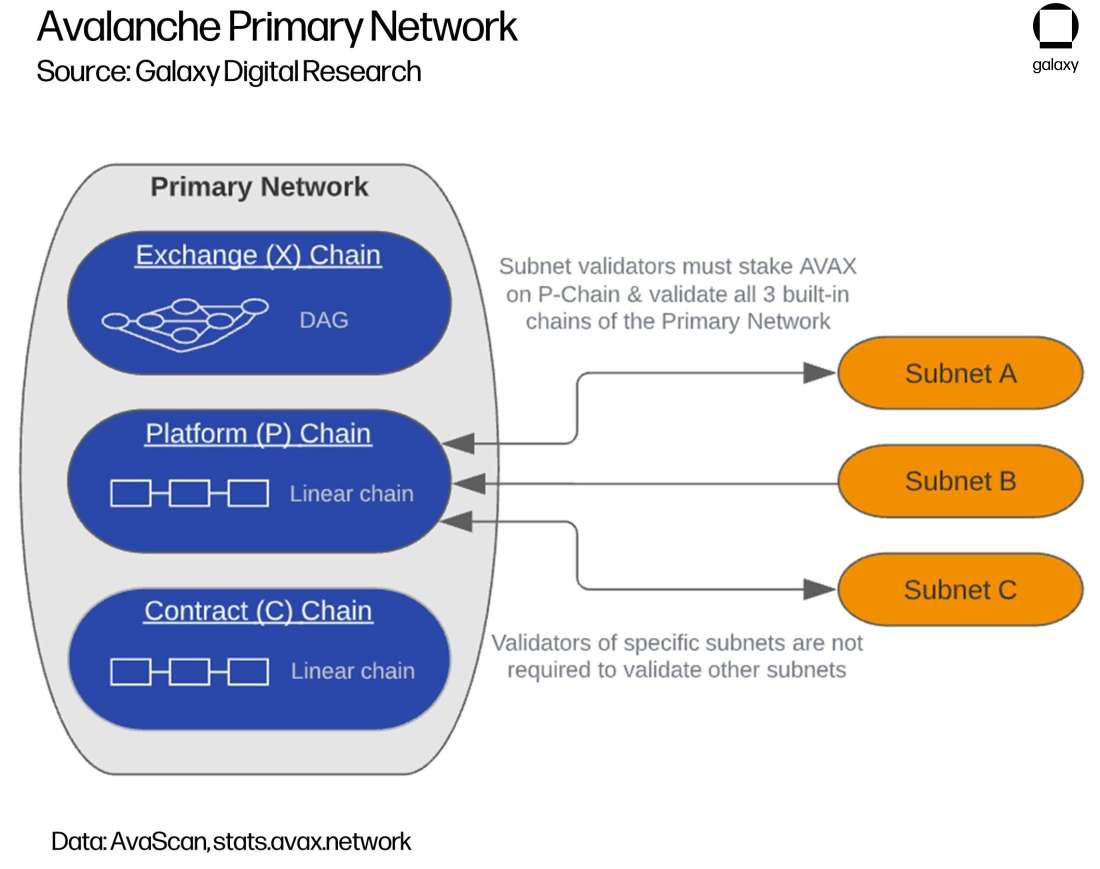

The Avalanche Primary Network follows a modular architecture and comprises three built-in blockchains that each perform a different core function:

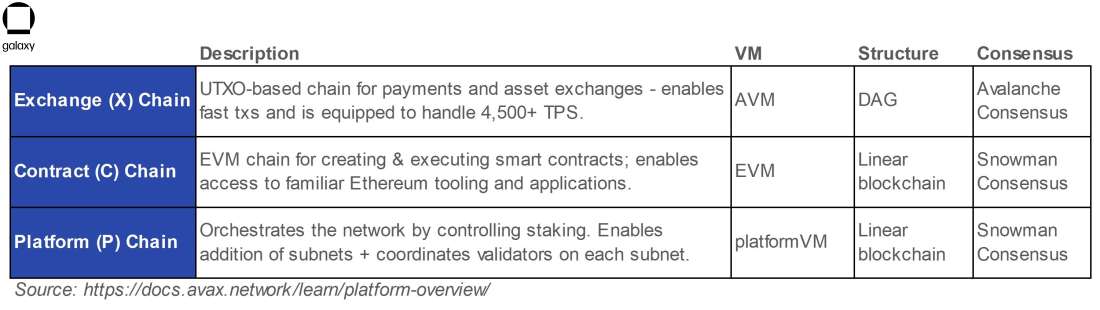

Exchange Chain (X-Chain). The X-Chain is a UTXO-based chain that is structured as a DAG that implements the core Avalanche Consensus engine. It is the default asset chain that carries Avalanche’s native AVAX token and enables new assets to be created and traded such as utility tokens, NFTs, or smart contract platforms. The X-Chain is an instance of the Avalanche Virtual Machine (AVM).

Contract Chain (C-Chain). The C-Chain hosts smart contracts and is the primary chain that Avalanche users interact with for DeFi and NFT activity. It is a linear chain that employs the Ethereum Virtual Machine (EVM), using the same tooling that most developers are familiar with on Ethereum, but it also comes with the added benefits of speed and low costs from implementing Avalanche’s Snowman Consensus.

Platform Chain (P-Chain). The P-Chain is used for staking, platform governance, and coordination of validators. Validators stake AVAX on the P-Chain. It enables the creation of custom subnets and holds metadata about the network including the active subnets and each subnet’s respective node list. Like the C-Chain, the P-Chain is constructed as a linear chain that implements the Snowman Consensus so that it can effectively add/remove a node from the validator set at a given time (i.e. at a specified block height).

All three built-in chains are validated by the Avalanche Primary Network, which is a special type of subnet. The platform supports the creation of many subnets (described further in following section). Each subnet must be a member of the Primary Network which requires staking of the native token AVAX – effectively meaning that each validator on a subnet must also validate all three built-in chains. However, validators of an individual subnet are not required to validate other subnets (each subnet has control over its own validator set).

Most attention to-date has been on the C-Chain, the EVM chain that most users directly interact with for DeFi and NFTs, with less attention devoted to the X-Chain and P-Chain. Interoperability is still a work-in-progress as the fragmented structure across the three primary chains has made communication a challenge. But all these decisions around the Avalanche platform design, including the 3 built-in chains and use of DAGs and subnets, were thoughtfully implemented to help Avalanche achieve its ultimate vision of becoming an interoperable platform of blockchains.

Network upgrades on Avalanche have focused on adding more functionality for token types and atomic transactions (i.e. imports/exports from/to other chains). AVAX is the only token that could move across all three built-in chains as the only Avalanche Native Token (ANT). In December, the network implemented a upgrade, Apricot Phase Five, that improved the cross-chain transfer UX by adding ANT<>C-Chain support, which allowed for native AVAX to be deposited into ERC-20 wrapper contracts when invoked on the C-Chain, as well as for direct transfers between the P- and C-Chains and atomic transaction batching (initially limited to 10 atomic transactions per block block).

Subnets

A subnetwork, or subnet, is a secondary network built on the Avalanche platform. Avalanche supports the creation of many subnets. All three built-in chains are validated by the Primary Network, which is a special subnet. Each subnet must be a member of the Primary Network which requires staking AVAX – so by extension, each node on a subnet must also validate the three built-in chains.

Overall, Avalanche’s subnets provide builders with a high level of customization over its implementation to support a wide range of use cases. While other platforms are designed as a unified network operating with a single VM, Avalanche’s architecture can support different VMs (e.g. Ava-VM, EVM, WASM and more) and multiple scripting languages. To create a new subnet, builders must specify: (i) the virtual machine which defines the rules for transaction processing, and (ii) the validator set which defines who can process transactions.

Subnets offer several key advantages:

Manageable for regulatory compliance. Subnets also have full control over the validator set, which determines the visibility and accessibility of the subnet. Compliance-conscious subnets could include certain criteria, such as validators must reside in a certain country, must pass KYC checks, etc. Alternatively, private subnets could be created and opened to just a known set of trusted validators. Subnets can also each implement their own uptime requirements or slashing mechanisms for validators.

Reduces burden on validators. Unlike most blockchains that require validators to validate every single transaction on a network, subnets enable a separation of concerns. Validators don’t have to validate other subnets that they have no interest in; they only must validate the Primary Network.

Customizable for application-specific requirements. Aside from subnets for institutionalized DeFi which may require permissioned validator sets, there could also be dedicated gaming subnet may require validators to have advanced computing hardware to avoid network latency. NFTs could also find a more optimal platform for trading that is customized for decentralized data storage. Platform-specific subnets could also be created for use as a testnet. With support of multiple VMs and scripting languages, a subnet replicating the designs of blockchains such as Bitcoin or Solana could theoretically be created.

Permits use of own token. Applications can also launch their own gas token and specify its own transaction fee structure, potentially covering the gas costs on behalf of their users as a marketing tactic or to offer a better UX. Each subnet can also offer rewards to validators in other tokens. To create a subnet or to join a subnet still requires a payment denominated in AVAX.

Scales horizontally. Compared to vertical scaling, where network growth is bottlenecked by a blockchain’s processing capacity, horizontal scaling enables hundreds of transactions to be executed in parallel. Avalanche already achieves vertical scaling through its consensus mechanism. By supporting multiple subnets, Avalanche could theoretically increase its scalability by multiples of what it offers today on the C-Chain.

But even if developers are already creating a new VM, they might still choose to create a subnet rather than launch a separate L1. Avalanche handles the most difficult aspects of launching a new blockchain, providing the consensus engine, security, and network effects (“plug and play consensus”). Subnet creators could benefit from Avalanche’s quick finality and gain instant access to liquidity (vs. users having to bridge funds over from another network, which entails myriad risks and challenges) and the cross-chain communication between subnets. With Avalanche handling all the heavy lifting, builders can then direct their focus to creating new value through their subnet or applications.

Current state of subnets

The case for customizable subnets built for specialized applications has been more compelling especially over this past year with the proliferation of NFTs, whose outsized demand for block space on Ethereum had led to a surge in transaction fees and contract deployment costs to uneconomical and restrictive levels across the network.

Subnets, up until recently, have largely been in the R&D phase with no meaningful subnets in production (the Fuji Testnet is home to 177 subnets at the time of writing). But since December 2021, Ava Labs has showcased several subnets on testnet starting with Subnet-EVM – a custom VM that makes it easy for anyone to create their own EVM-compatible blockchain on Avalanche. It is one of the first “real” custom VMs on Avalanche and showcased how configurable subnets were and how they could easily be spun up. EVM-as-a-Service is a powerful addition to the Avalanche ecosystem that could drive more adoption given the primacy of the EVM, as we discussed at length in Ready Layer One. Ava Labs also introduced WAGMI subnet, a EVM-based subnet demo with supercharged parameters (6.67x the gas target and 4% of the minimum fees of the C-Chain), as well as Spaces VM, an experimental subnet with IPFS-like storage for key values.

Over the next few months, we expect to see builders start deploying some of Avalanche’s first subnets, including incentivized subnets managed by the P-Chain. Ava Labs is also looking into potential ZK-based and rollup-based subnets. For the time being, Avalanche still has several limitations in place around the functionality of subnets (e.g. validator sets must be added manually and assets cannot natively be transferred from the subnet to the X-Chain) but planned upgrades this year will ease some of those barriers to growth. The creation of permissionless subnets and native cross-subnet transfers will make subnet development more flexible and increase interoperability. Then, as more subnets are deployed, cross-subnet transfers will be a more integral feature to unlocking the potential of the Avalanche platform.

AVAX Tokenomics

AVAX is the native token of the Avalanche platform and is used to secure the network through staking and paying for transaction fees. The genesis block date of AVAX was September 20th, 2020.

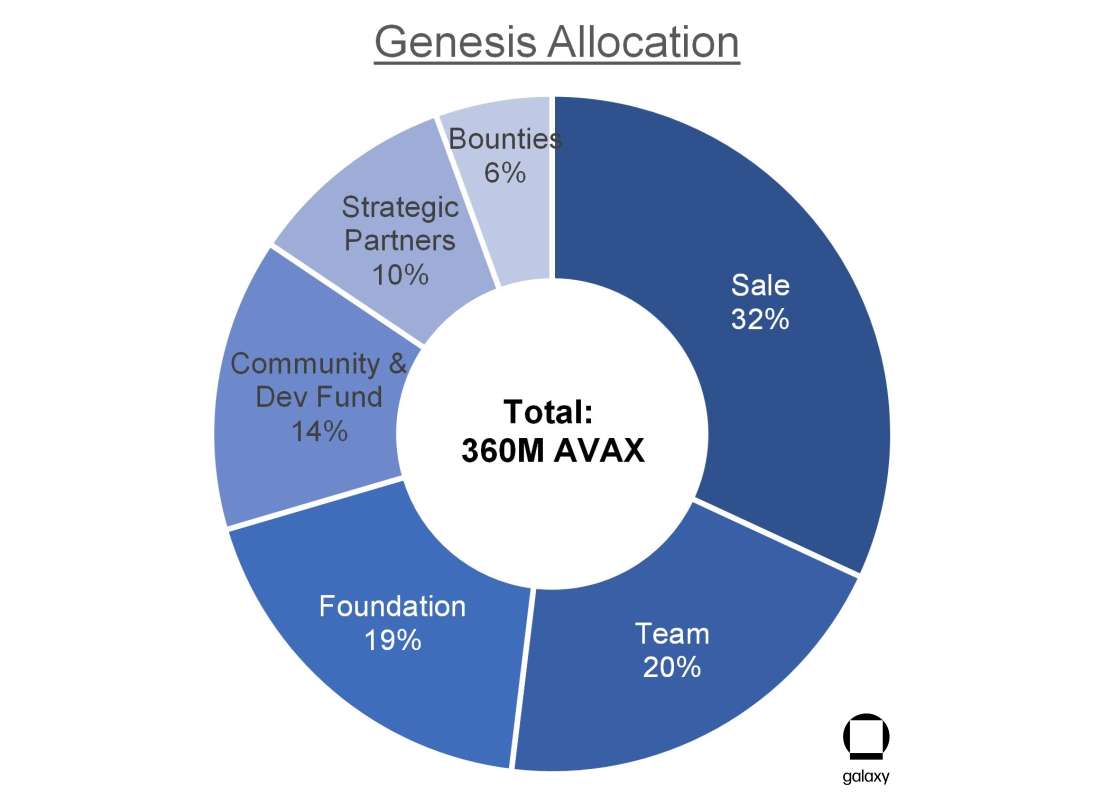

Avalanche has a supply cap of 720m AVAX tokens. 50% was pre-mined with the Ava Labs team and the Avalanche Foundation receiving the largest shares of the Genesis allocation at 20% and 19%, respectively. Of note, however, Ava Labs members with pre-mined tokens have voluntarily agreed to lock up their assets for four years, unlocking in December 2024.

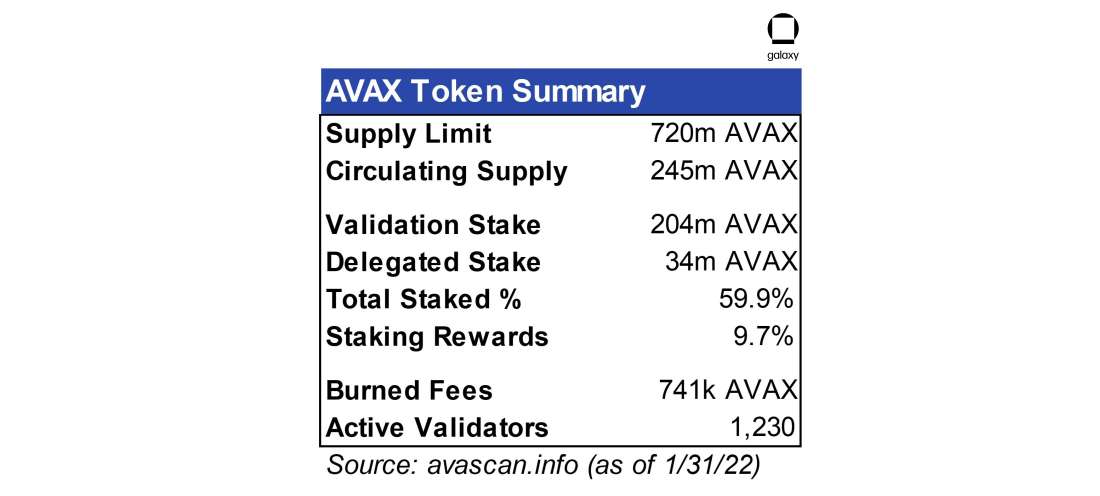

The remaining 50% of the total supply is allocated to validators as staking rewards and will be released over several decades. The default staking requirements require a minimum of 2,000 AVAX tokens (~$140k USD as of writing) with a minimum staking period of 2 weeks and a maximum of 52 weeks. The staking requirements and the emission rate at which the supply cap is reached is subject to governance, meaning they can be changed by community vote. Staking rewards can be increased to promote more staking or decreased to support lower fees and encourage more engagement on the network.

Transaction fees on the C-Chain are set by a verifiable fee function based on Ethereum’s EIP-1559’s dynamic fee structure consisting of a base fee, gas tip, and gas fee cap. But unlike Ethereum which splits burns only a portion of transaction fees (baseFee is burned while priority fee is kept by miners), Avalanche burns the entirety of transaction fees—inclusive of any priority fee. This provides a more encompassing benefit to the greater ecosystem rather than going to just one set of participants (i.e. the miners).

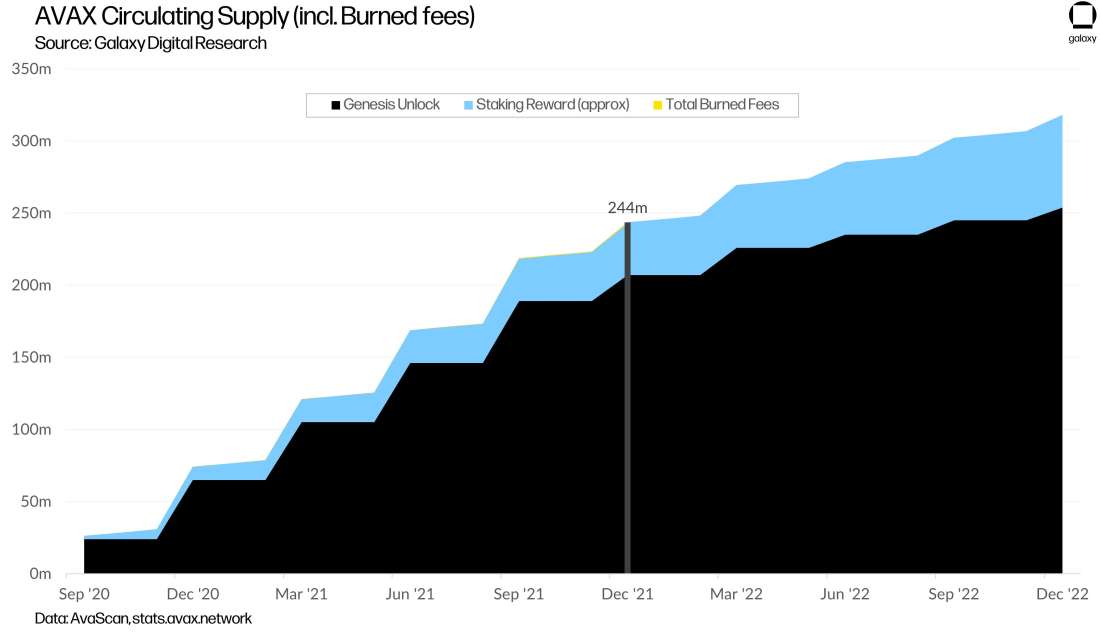

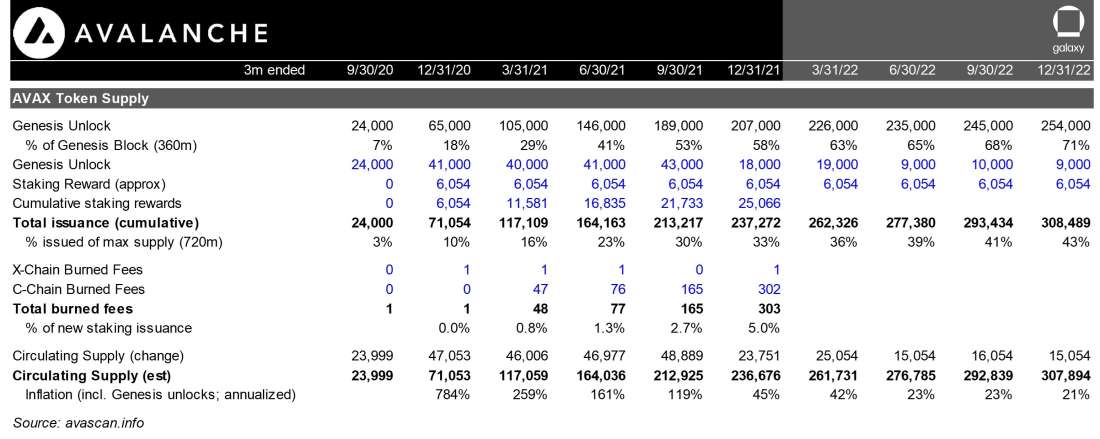

As of 1/31/22, the circulating supply of AVAX was 245m. The unlocked Genesis circulating supply totaled 208m (~58% of the total Genesis Block) with an additional 152m tokens from the Genesis block still time-locked—47m of which are scheduled to be unlocked over the course of 2022 to the Ava Labs team, the Foundation, and strategic partners. Since genesis, new issuance from staking rewards has averaged approximately 2.3m tokens per month (~11% annual inflation without including the effect of the genesis unlocks or burned fees). Including the Genesis unlock and assuming the same rate of issuance from staking rewards, AVAX circulating supply is estimated to hit ~318m by 2022 year-end (+31% y/y; ~44% of max supply).

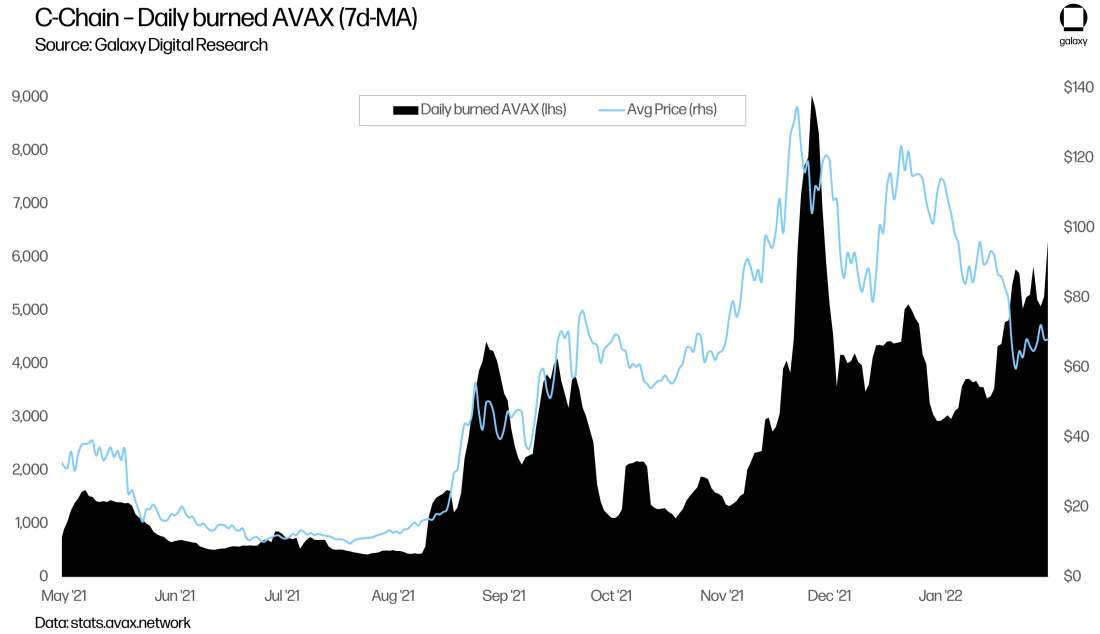

Burned fees in Q4 2021 totaled over 300k AVAX, up 83% QoQ. Over the month of December, burned AVAX from transaction fees totaled ~124k AVAX, offsetting the new issuance from staking rewards (~+2.3m AVAX) by 5.4%, implying AVAX still has a long way to go before it is deflationary.

Fee Structure

C-Chain Fees

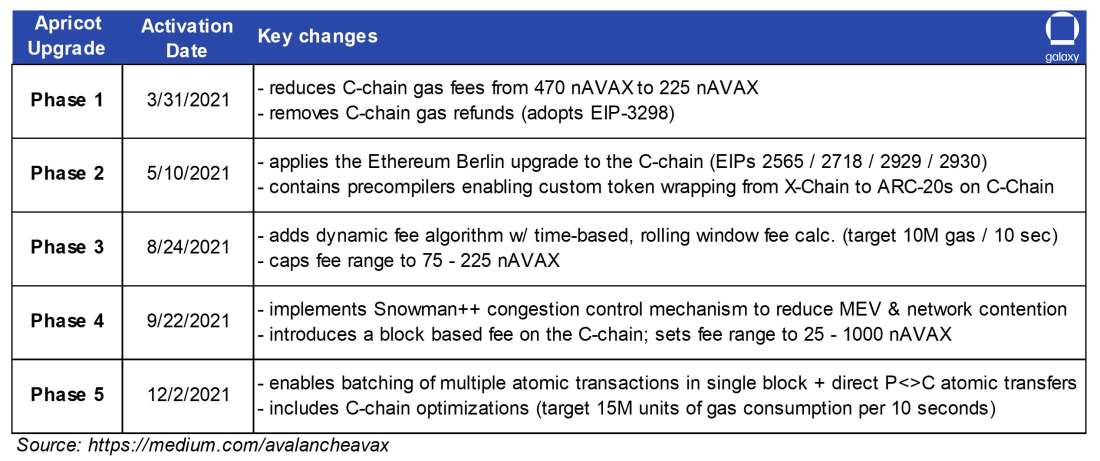

Avalanche underwent a series of upgrades (“Apricot”) this year that changed how transaction fees on the C-Chain are structured. After Apricot Phase 3 “AP3” implemented early August, transaction fees on the C-Chain are based on Ethereum’s EIP-1559’s dynamic fee structure consisting of a base fee, gas tip, and gas fee cap (where the base fee increases when network utilization > target utilization and decreases when network utilization < target utilization).

Transaction fees on Avalanche are denominated in nAVAX (nanoAVAX = 10-9 AVAX), similar to gwei on Ethereum. Key differences with Avalanche’s fee structure are that the entirety of transaction fees are burned inclusive of any priority fee. Avalanche gas fees also have a floor or minimum level that is often reset with Apricot upgrades.

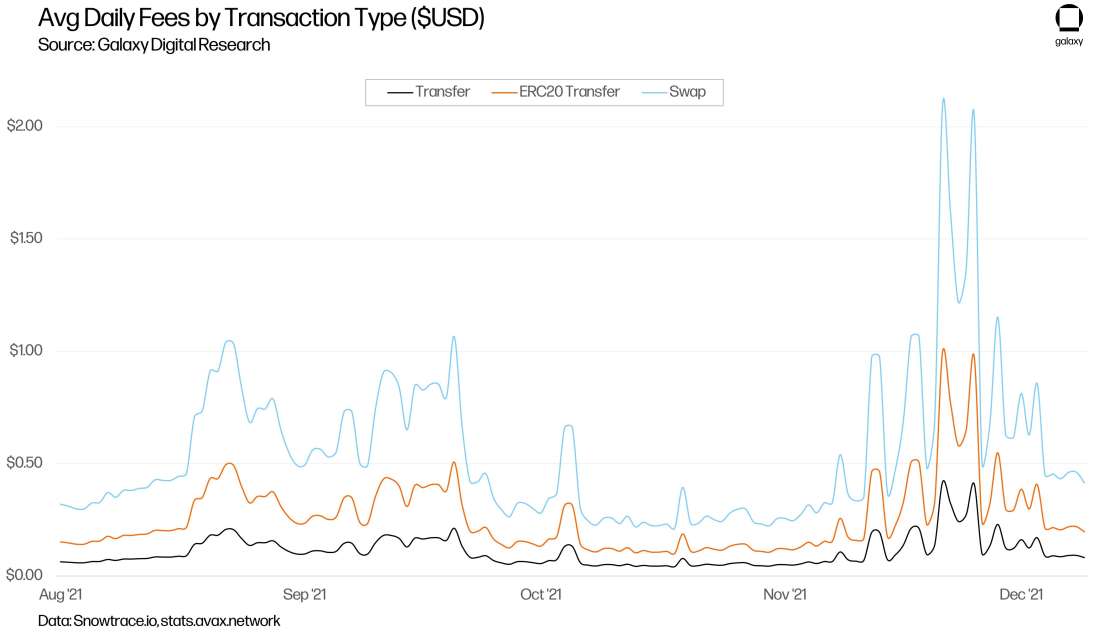

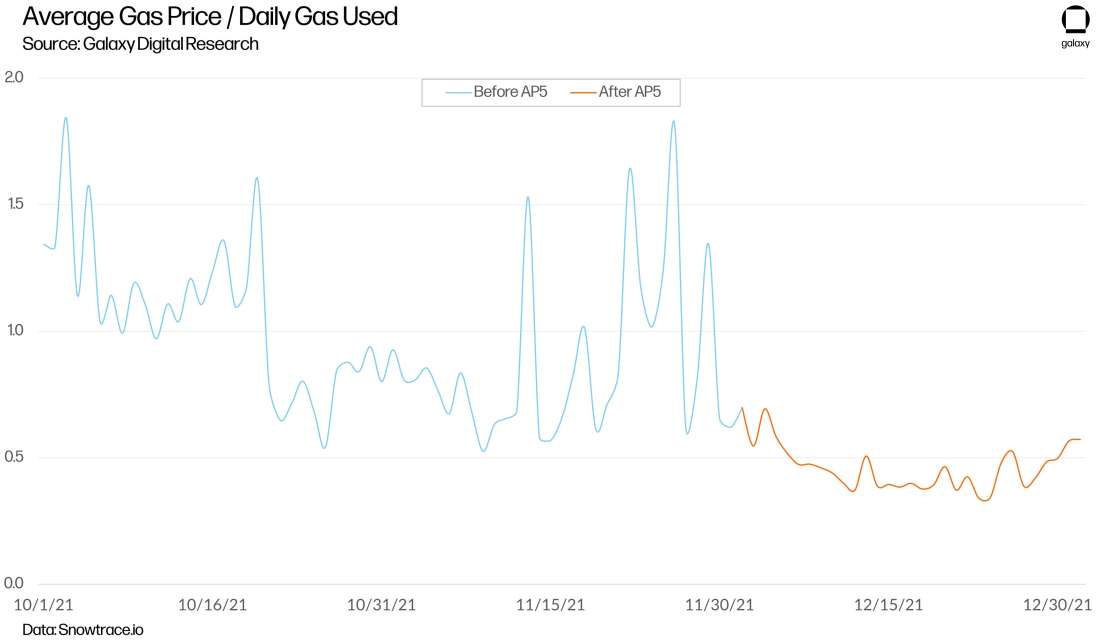

In December, Apricot Phase 5 (AP5) had brought a significant improvement to fee function, resulting in lower gas fees for transactions. Prior to AP5, AP3 had set the target gas to 10m per 10 seconds. The purpose of the capped gas level was to reduce spam and limit state growth. This level, however, proved to be a very restrictive on Avalanche as transaction fees have oscillated meaningfully since activity on Avalanche ramped up starting in August. Towards the end of November, average daily fees for swaps had spiked with some swaps costing users over $20, raising concerns that Avalanche was not scalable and that it would run into the same state growth problems as Ethereum.

Ava Labs quickly responded to ease the network congestion. As it turns out, the prior gas target of 10m gas / 10 seconds from AP3 was artificially low, representing block utilization of 25% (calculated as average gas used over the gas limit; compares to EIP-1559’s gas target of ~50% on Ethereum). AP5 had increased the target level by 50% to 15M gas / 10 sec. If we look at the average gas price in combination with daily gas used on the C-chain, we can clearly see the benefits of AP5: volatility has been smoothed and gas prices have gone down as gas consumption has increased.

The Ava Labs team has several other ongoing initiatives to optimize fee costs including:

C-Chain Fast Sync, which speeds up the time needed for validators to ramp and reducing the load on each validator. It results in cheaper fees on lower disk space for validators, but the full optimizations have yet to roll out as part of the Apricot upgrades.

Super pruning to further manage state bloat and keep the option of running a node from becoming more difficult and restrictive. More specific details have yet to be shared by Ava Labs, but we will see the first iteration of super pruning on the recently-launched WAGMI subnet demo.

Growth Strategy

Grant & Incentives Programs

Avalanche-X was announced in 2Q20 as an accelerator program to incentivize developers to build DeFi applications on the network. This grant program helped kickstart development of the initial ecosystem on Avalanche prior to its mainnet launch in September last year.

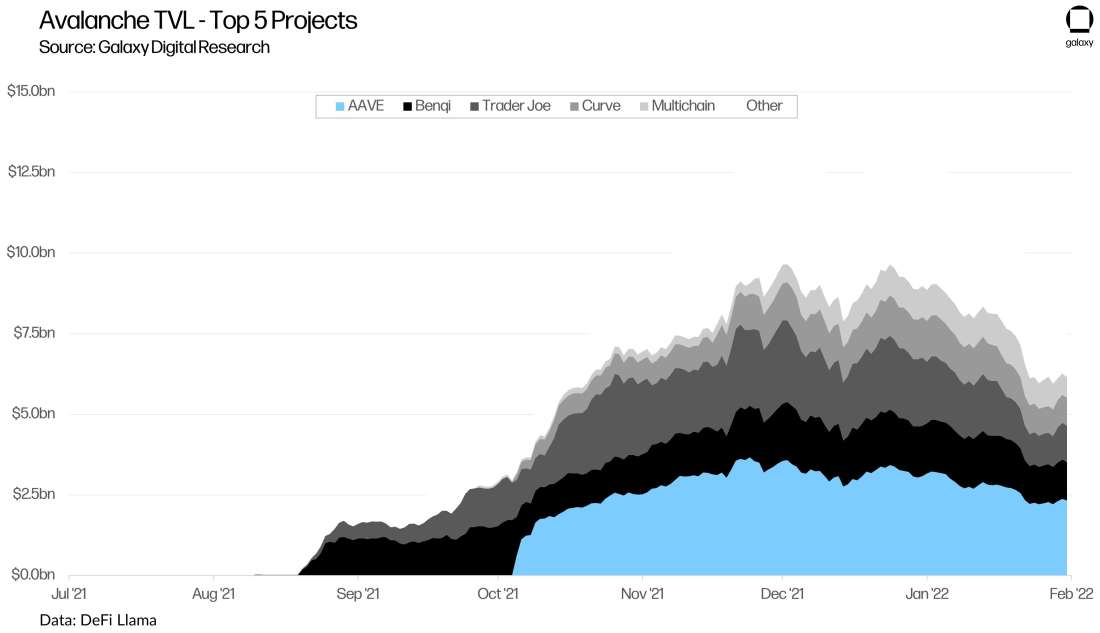

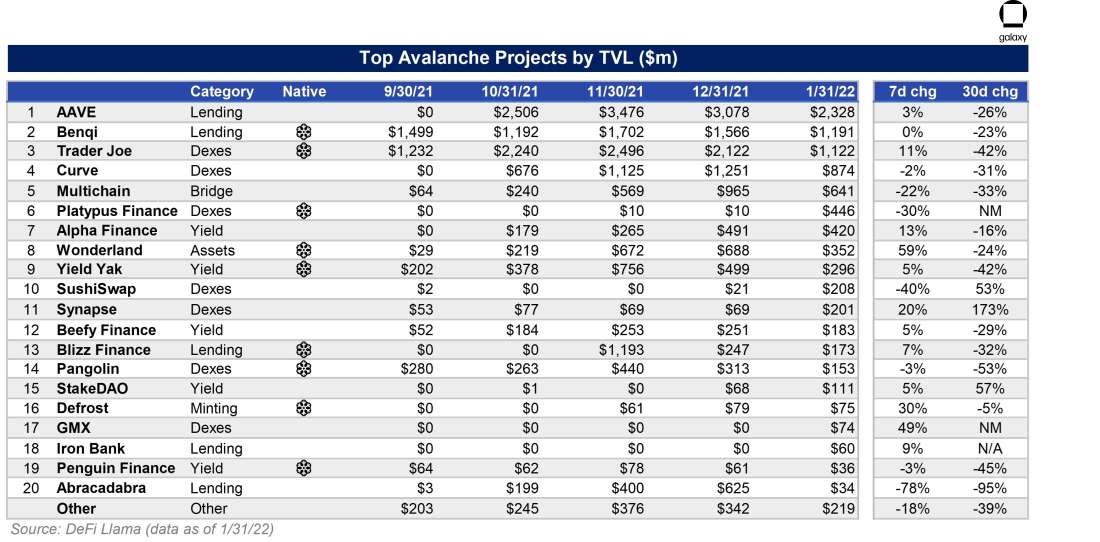

Despite a successful mainnet launch, usage on Avalanche had been relatively muted until August this year with the announcement of Avalanche Rush which, at the time, was one of the largest liquidity mining incentive programs valued at $180m (~10m AVAX tokens which would be worth north of $700m at today’s prices). Whereas Avalanche-X funded development of more organic upstarts, Rush was targeted at more polished project teams to incentivize user growth, including Ethereum-native DeFi blue-chips like Aave, Curve, and Sushi, as well as established Avalanche-native projects like Trader Joe, Benqi, and Yield Yak—all of which are among the most popular projects today as ranked by TVL.

In November, the Avalanche Foundation launched Blizzard, a $200m+ fund to support ecosystem development, which already saw over 320 projects building on the platform. Rush onboarded the users and Blizzard was meant to build on that momentum by keeping users engaged through supporting more application development on the chain. It was a more organic form of investment compared to the Foundation’s liquidity mining program as supported project teams involved in the Blizzard program could direct how to spend the tokens. Having these persistent and ongoing incentives programs has been important for Avalanche to promote loyalty & stickiness of users who are constantly looking for more rewarding and novel projects.

Other ecosystem accelerator programs like DeFi Alliance and Colony Lab should help bootstrap another wave of projects on Avalanche.

Institutional & Enterprise Adoption

Avalanche’s DeFi ecosystem has gained meaningful traction so far, but Ava Labs has larger aspirations for Avalanche than just DeFi—it also aims to bring public blockchain to more areas, including the much larger addressable market of traditional finance. As examples, ReTok Finance has chosen to build on Avalanche to offer fractional property ownership and Ryval has offered Initial Litigation Offerings (“ILOs”), a litigation financing product for individuals to litigate or arbitrate civil claims. Many other token use cases, including security tokens, have yet to materialize.

In recent months, Avalanche made significant strides in both institutional acceptance and enterprise adoption. Key events and partnerships include:

11/16: Deloitte announced strategic alliance with Ava Labs

12/1: Fireblocks launches support for AVAX

12/16: VanEck created AVAX ETN

12/9: Ava Labs selected for Mastercard Start Path Program

12/14: Circle launched USDC on Avalanche

12/16: BitGo launched support for AVAX

12/31: AVAX added to Bitwise 10 Large Cap Crypto Index

In November, Deloitte partnered with Ava Labs to use Avalanche’s technology to help improve the process of getting relief aid for natural disasters and public health emergencies. FEMA grants can take months or up to half a year for state and local governments to distribute to victims in disaster zones. Deloitte estimates that working with Avalanche will help governments save 50-80% of the all-in costs. Avalanche was required to meet high standards set by Deloitte and its end customers (FEMA, state & local governments) for this partnership to have happened, and Deloitte’s approval serves as validation for Avalanche’s technology and security.

Avalanche continued to see increased institutional access points with Fireblocks and BitGo adding support for AVAX, along with new investment products with VanEck and Bitwise. It should also see more connections with the global fintech ecosystem following Ava Lab’s selection into Mastercard’s accelerator program. Circle launching native USDC on Avalanche creates another tool for engagement.

What’s particularly impressive about these partnerships is that they all occurred prior to subnets taking off. Avalanche has been pitching subnets as the ideal product for institutions and enterprises that require complete control over their implementation and data for compliance or privacy concerns. The full effect of all these investments and partnerships have yet to hit, but they provide enhanced visibility to Avalanche, serving as a catalyst for further technological adoption.

Break into new verticals with subnets

Other target areas for subnets moving forward include NFTs and gaming, which have yet to find the ideal product-market fit across most blockchains. NFT projects that are powered by Avalanche include Topps NFTs and Particle, while notable play-to-earn games that are live or about to launch on include Cradaba, Imperium Empires, and DeFi Kingdoms, which recently expanded cross-chain from Harmony. These applications will operate on the C-Chain but could find even more performance optimizations when moving over to customized subnets.

Then, with more and more subnets in production, each with their own specifications to fit various application types, there becomes even more demand from builders to develop their projects on top of Avalanche.

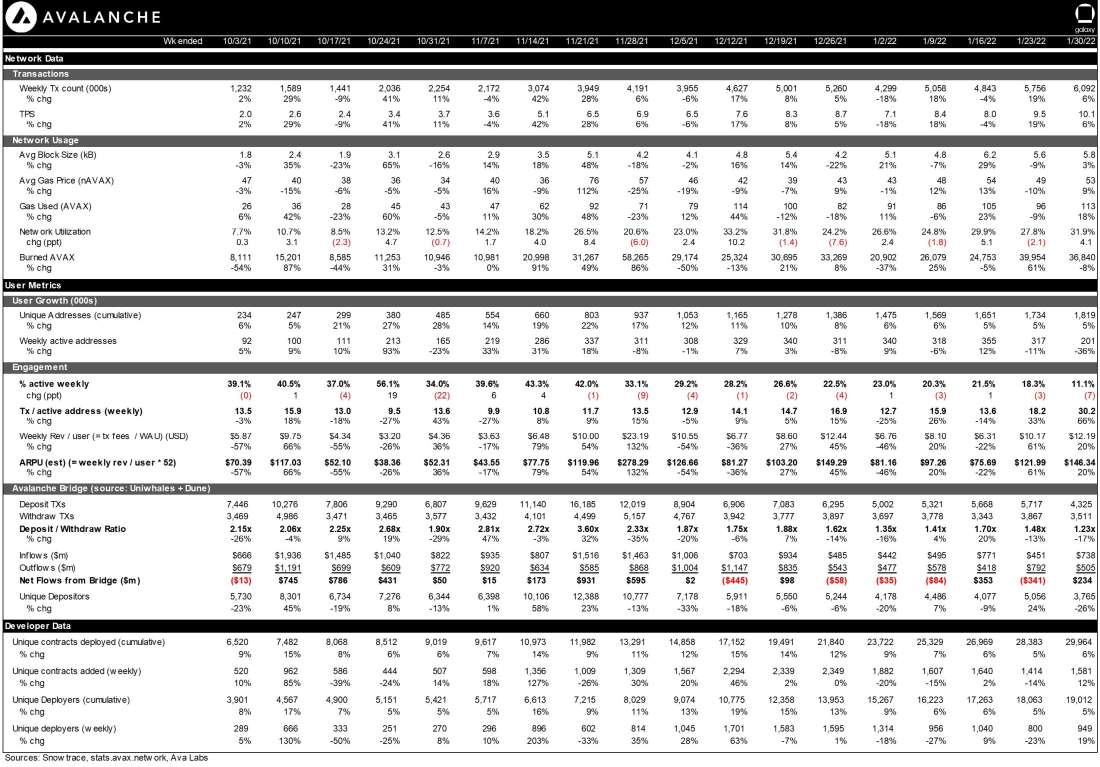

AVAX Usage (C-Chain)

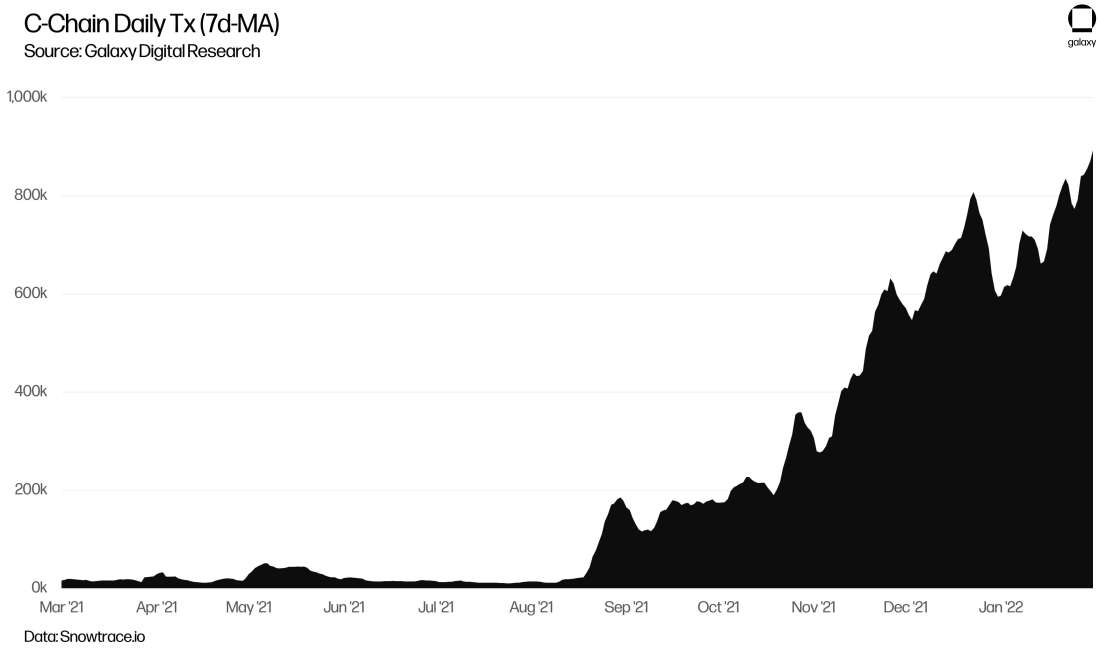

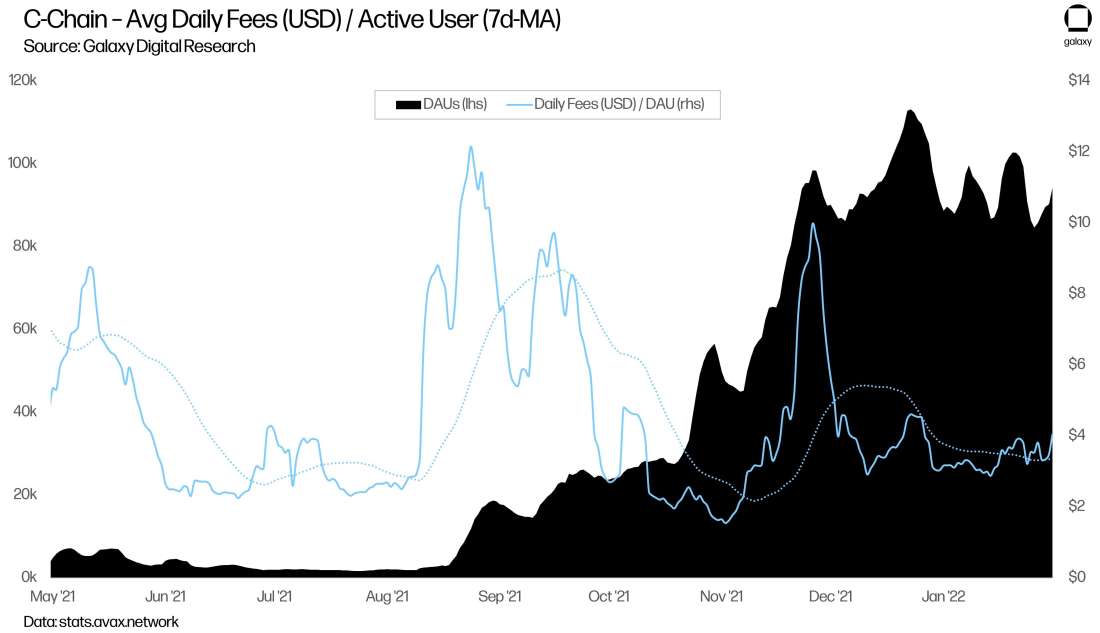

Transactions. Daily transactions on the C-Chain have steadily and consistently ramped up since the announcement of Avalanche Rush, reaching a previous high of over 800k on December 23rd (7-day moving average) before activity slowed over the final week of 2021. Since then, transactions have picked up again since to hit new highs, exiting January at over 900k (7d-MA) with over 1 million transactions recorded on the January 17th and the 27th.

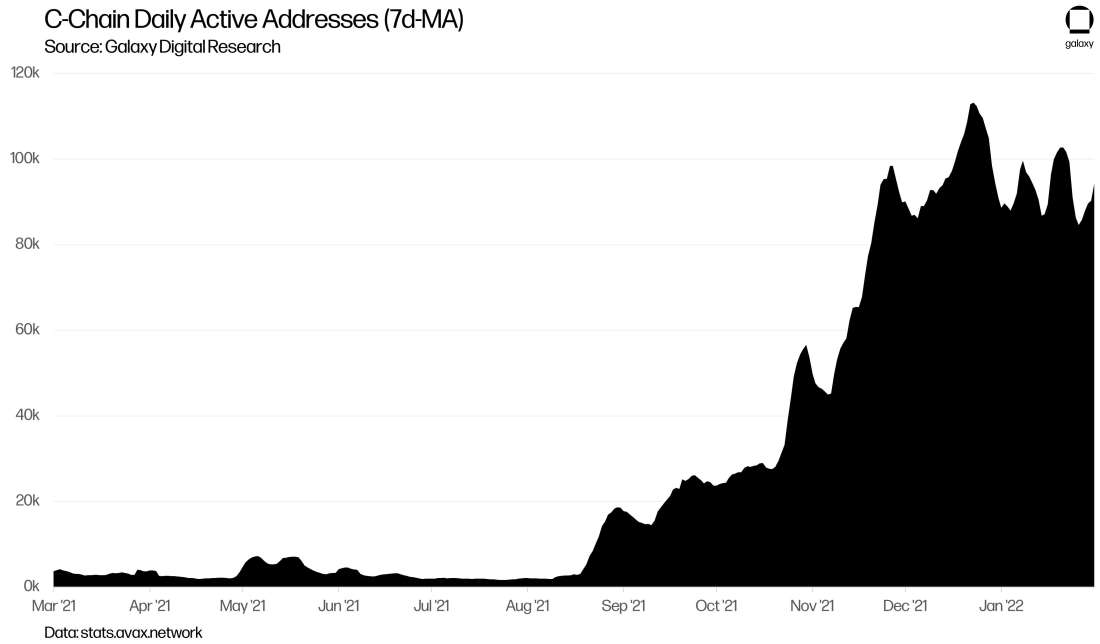

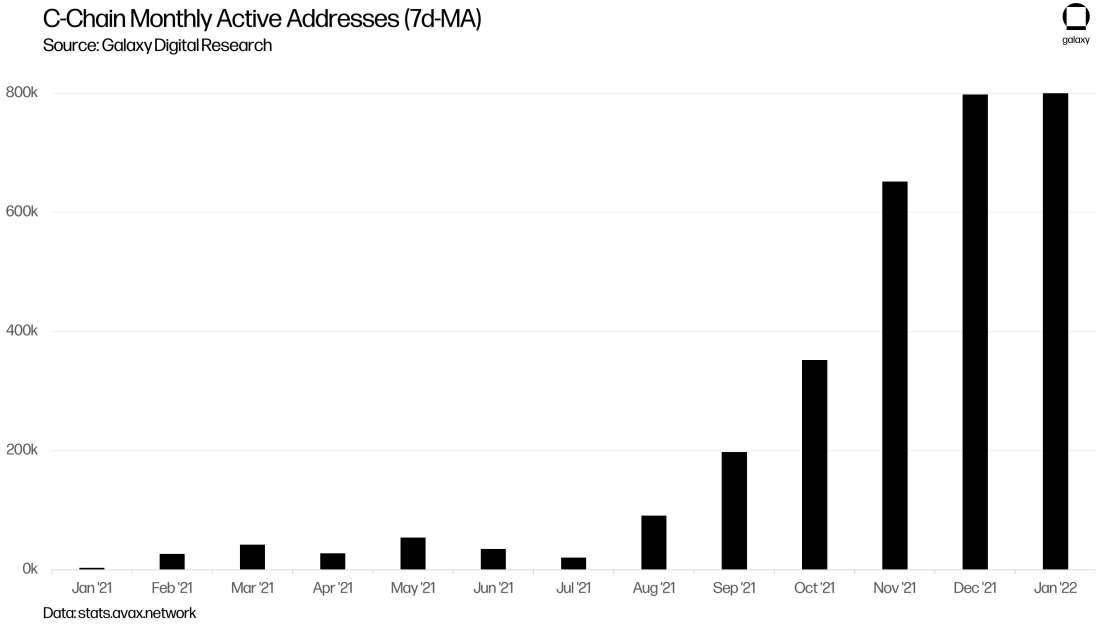

Active addresses. Daily active addresses had also grown in a similar fashion, averaging over 100k (7-day moving average) for the second half of December. Monthly active addresses totaled 798k in December, up 22% over the prior month, and up 4x compared to the month of September. Growth had slowed to start the year as January active addresses were roughly flat month-over-month but still surpassing the 800k milestone.

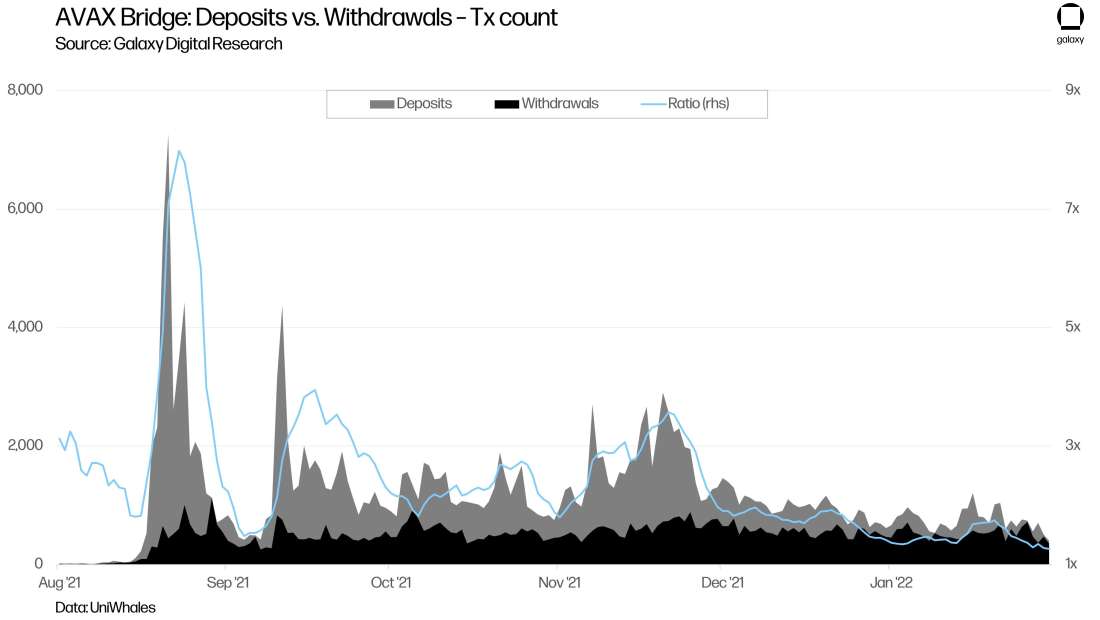

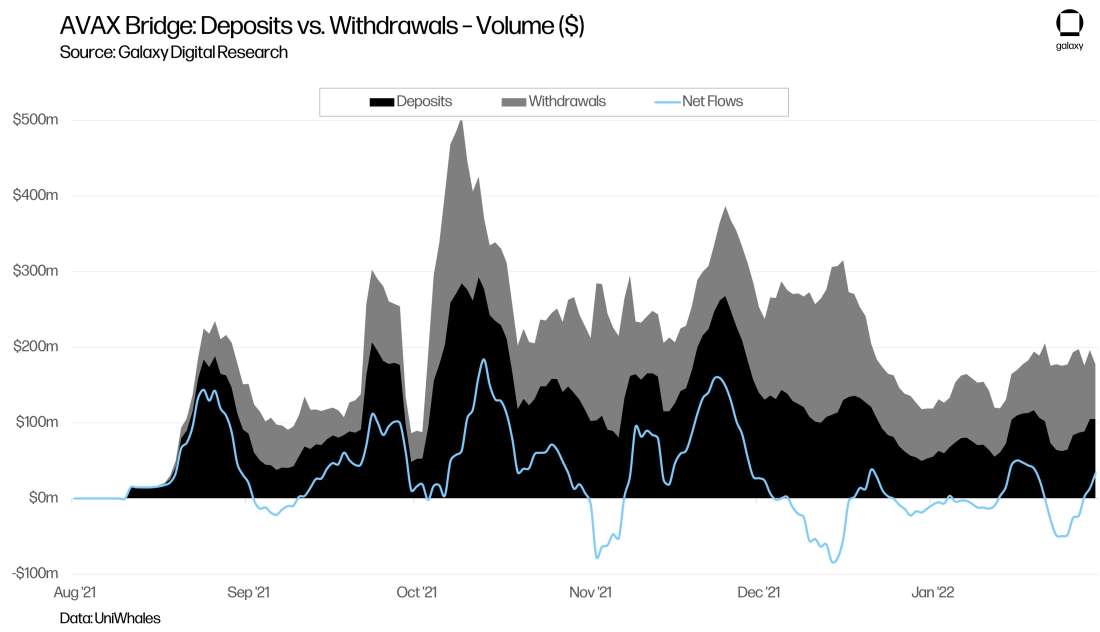

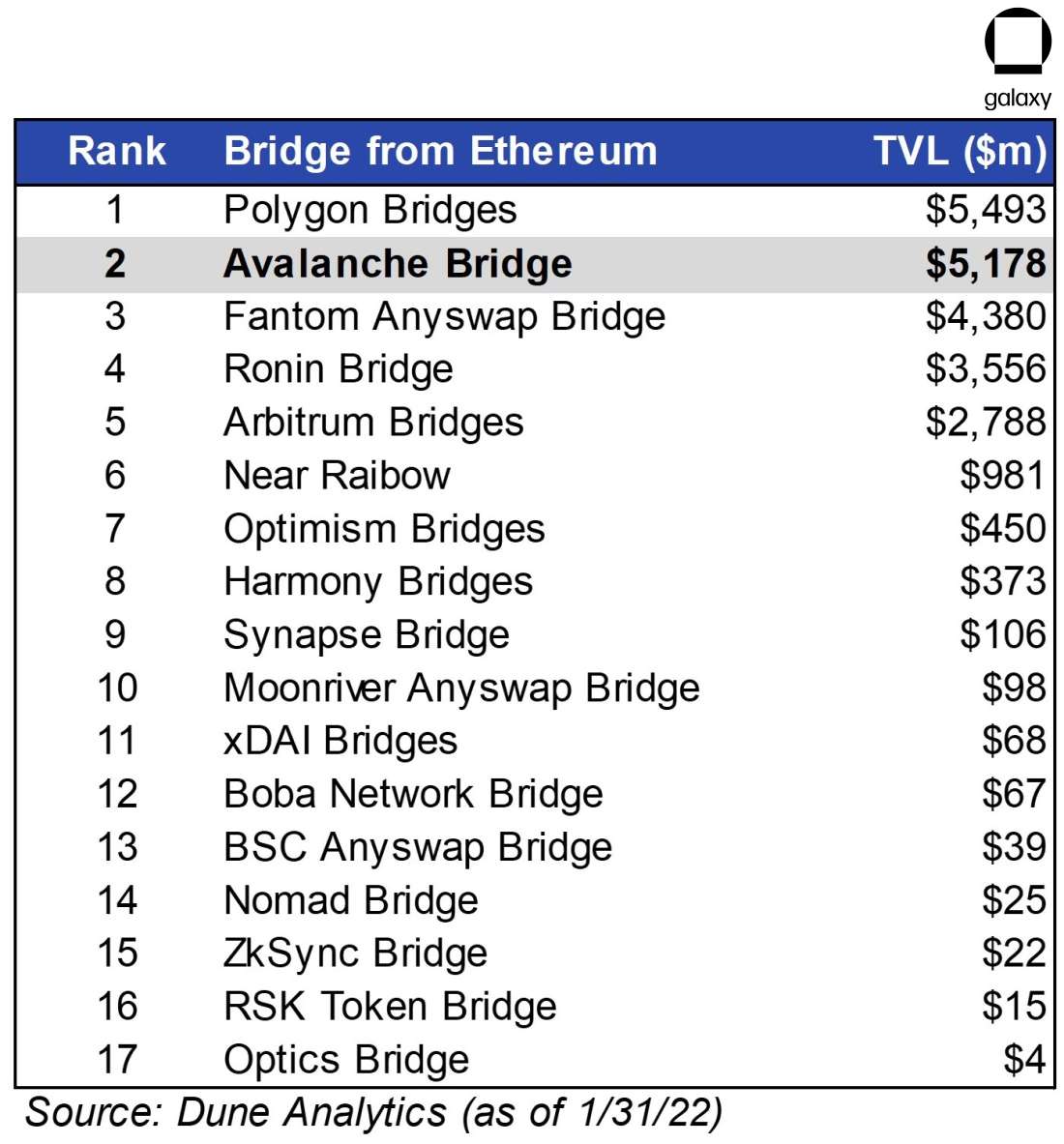

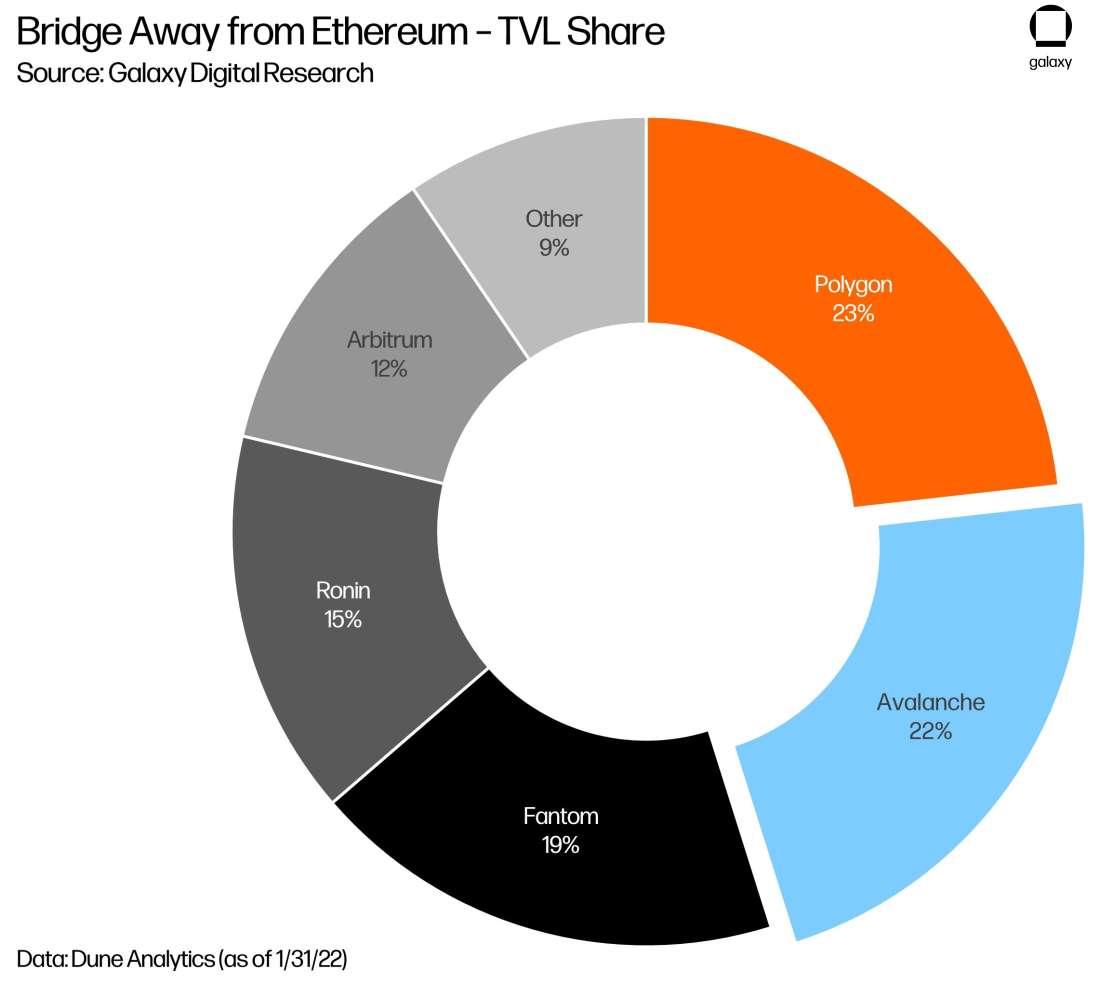

Avalanche Bridge. According to Uniwhale’s Avalanche Bridge tracker, the ratio of deposits to withdrawals has consistently remained above 1 with no single day seeing more deposits than withdrawals. This suggests more users are keeping their funds on Avalanche than exiting back to Ethereum, although this ratio has steadily decreased since late November to 1.3x as of late. TVL on the Avalanche Bridge totaled $5.2bn as of 1/31/21 – meaning $5.2bn in net flows have been bridged from Ethereum to Avalanche. The Avalanche Bridge has seen several days of net outflows since early December, but have started to pick back up exiting January, with TVL growing 36% compared to the prior week.

Profitability. Over the month of December, which includes the quiet period of the holidays, addresses collectively spent ~126k AVAX in transaction fees on the C-Chain (the X-Chain burned 202 AVAX tokens). At an average price of ~$104 and 798k MAUs on the C-Chain, this translates to ~$16 of monthly revenue / MAU or at a run-rate of ~$197 on an annualized basis.

January saw 144k AVAX spent on transaction fees on the C-Chain (+15% m/m) across 800k MAUs. At an average price of ~$82, this averages out to ~$15 of revenue / active user for the month of January or a run-rate of ~$178. Macro conditions were partly to blame for the decrease in fees generated per user, leading to lower usage across most blockchains, as well as new fee optimizations, which, if continued, can decrease the amount of AVAX burned per transaction that could be offset by more usage on the network.

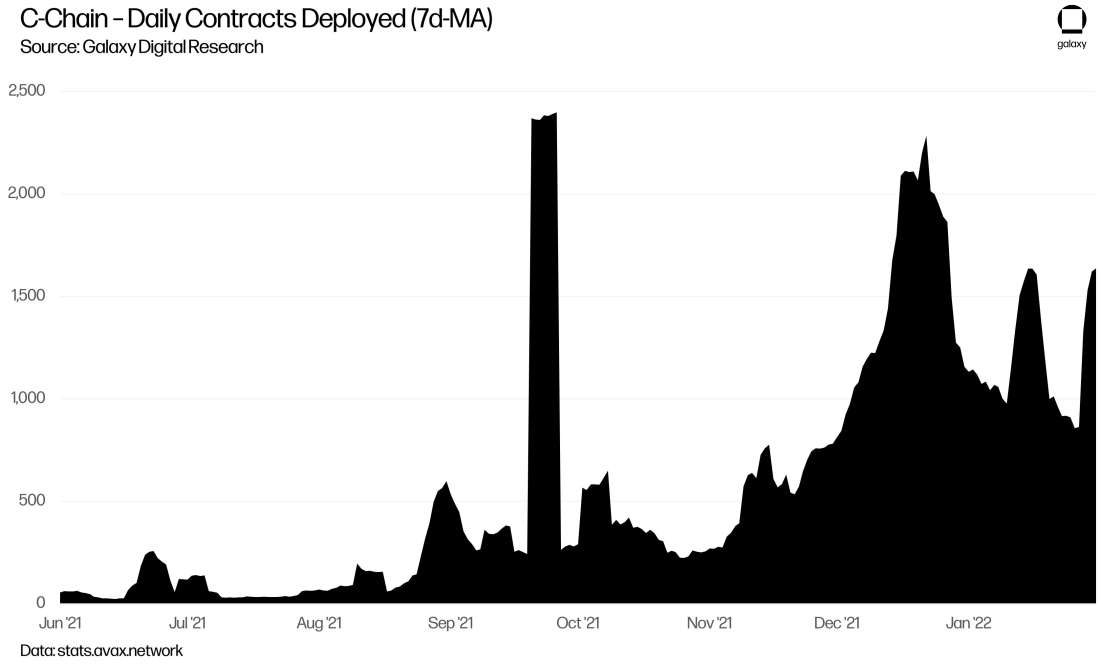

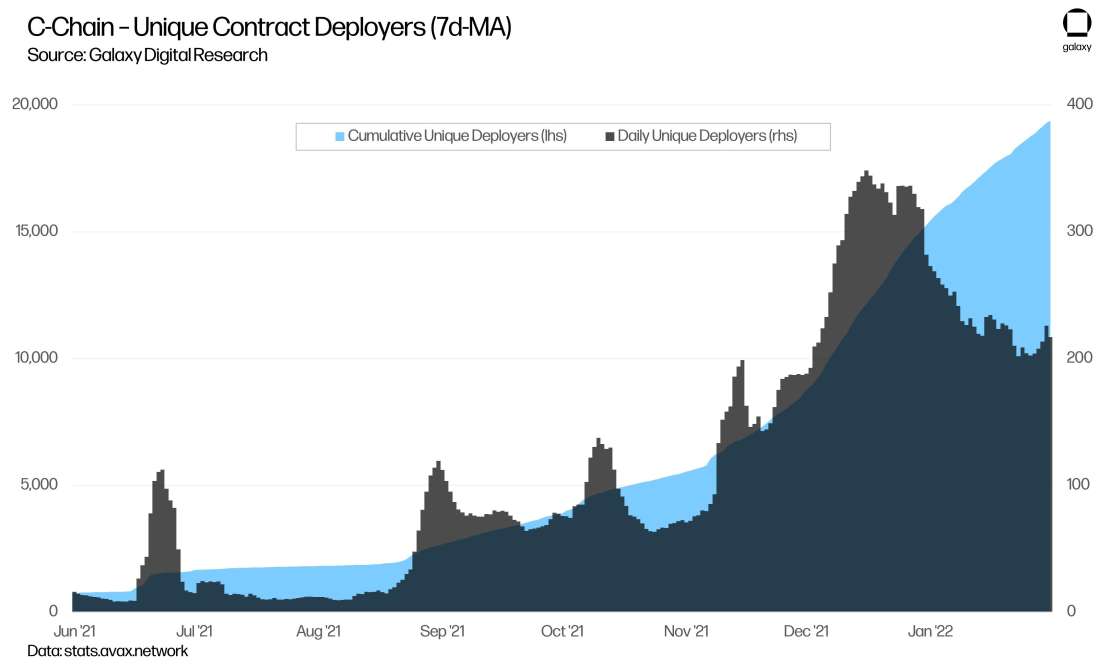

Developer activity. Development activity on C-Chain has grown meaningfully since the end of October with December recording particularly high growth. As of January 31,, 2022, the C-Chain has seen over 19.1k unique deployers, up from 14.9k at year-end (+28% m/m), and more than double the level at November-end of 8,275 unique deployers. Cumulative contracts have grown in a similar fashion, totaling 115k as of January 31, 2022, up from 88k at year-end (+31% m/m) and 54k at November-end.

Competitive Positioning

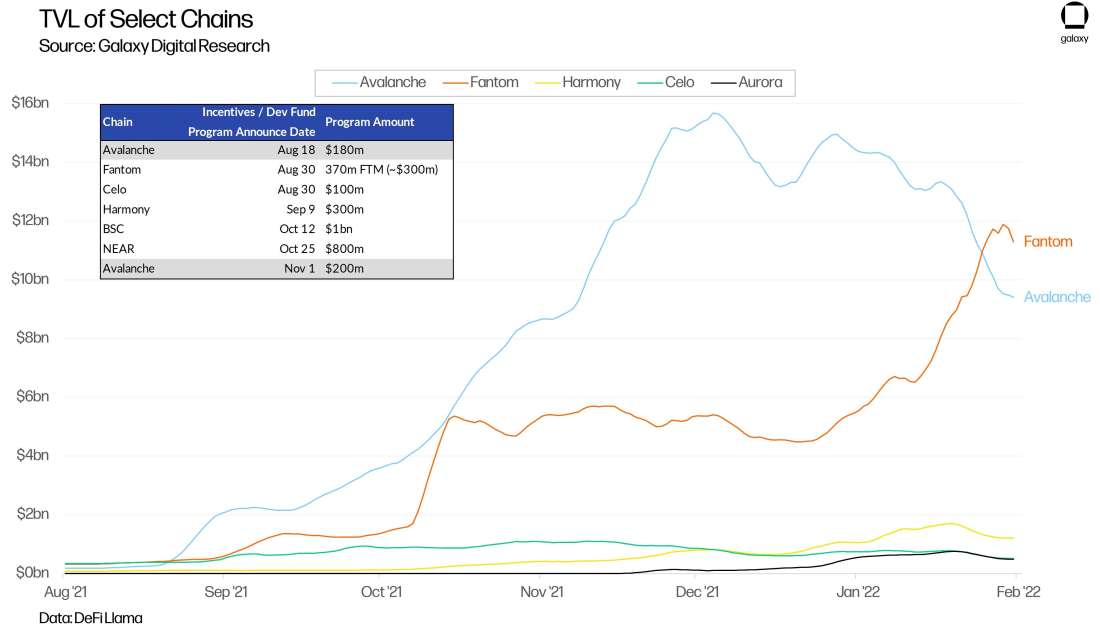

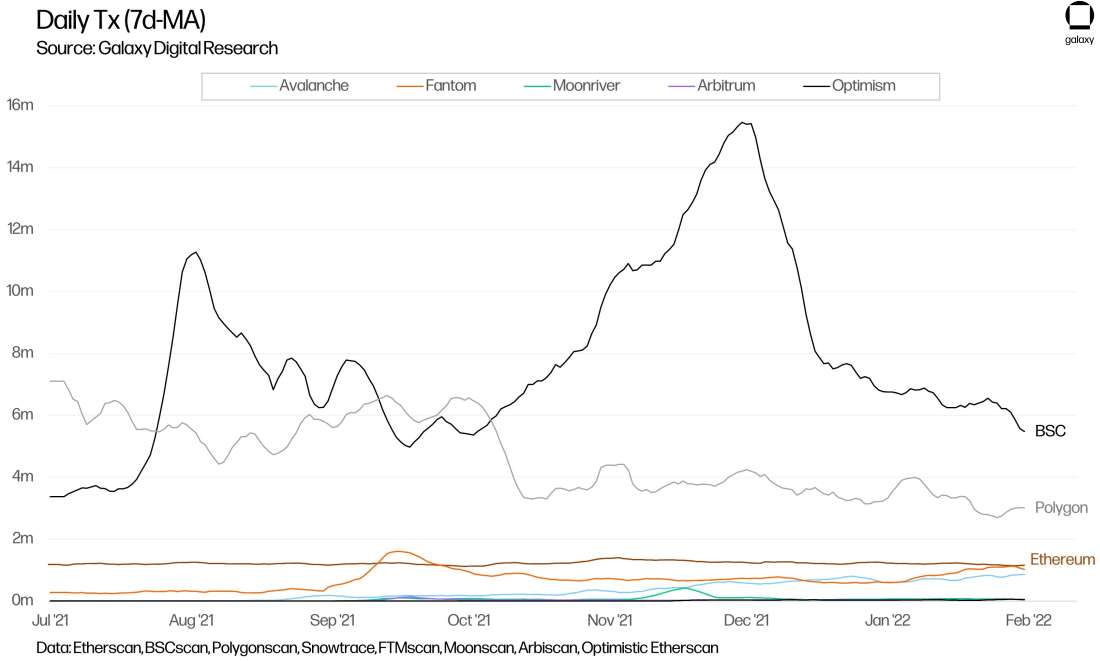

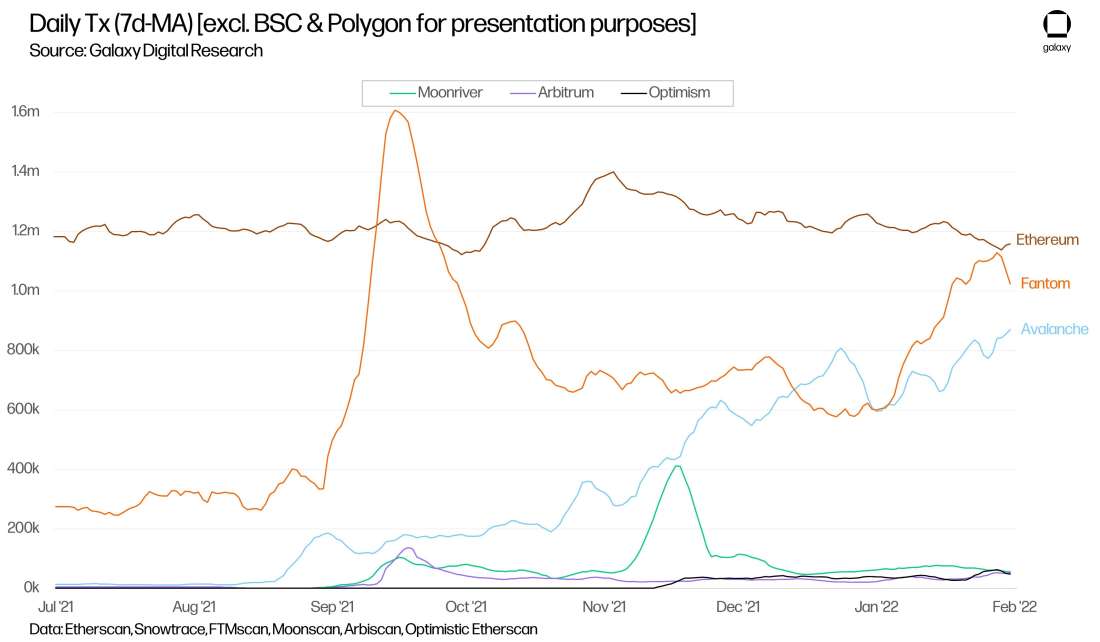

The announcement of Avalanche Rush came during a competitive time when multiple L1s, including Binance Smart Chain, Fantom, Harmony and Celo were all following the same playbook: (i) create an EVM chain that can bridge from Ethereum, (ii) launch liquidity mining incentives, and (iii) port over users and applications. Each chain offered the highly valued (albeit similar) benefits of cheaper fees and UX improvements. With high gas fees persisting on Ethereum, the benefits of moving to an alternative chain became even more attractive to users.

The incentive programs and development funds launched by these chains were quite substantial – several had even topped the value of Rush at the time of announcement including Fantom, Harmony, and NEAR. However, many of these chains mentioned have been unable to sustain high levels of growth after the initial surges in interest unlike Avalanche. What has sustained Avalanche’s use over time?

The UX on Avalanche was a meaningful advantage over other L1s starting with the bridging experience. Avalanche Bridge v2 was implemented just days prior to the announcement of Rush. Powered with SGX technology, the upgraded bridge offered quick finality and saved users fees by limiting the costs paid on Ethereum mainnet. Users who bridged over at least $75 worth of assets were airdropped AVAX tokens for free which could be used to pay the initial gas fees on Avalanche, significantly simplifying the user experience. As of 1/31/22, $5.2bn has been bridged from Ethereum over to Avalanche, making the Avalanche Bridge the #2 most popular bridge from ETH just behind Polygon’s (according to Eliasimos’ Bridge Away from Ethereum Dune dashboard).

Avalanche having a full DeFi ecosystem in place was integral to keeping users engaged on the platform, aided by its initial Avalanche-X grant program. Incentive programs on some of the other alt-L1s (e.g. Fantom, Harmony, and Moonriver) were geared more towards developers rather than users because the network didn’t have a robust DeFi ecosystem built out to the same extent, reducing the usefulness for users of bridging to the network. With Rush, Avalanche had struck a solid balance of having both Avalanche-native projects and DeFi blue-chips that users were already familiar with—much of the credit should go towards the Ava Labs team and the Foundation for their work in allocating funds to the right project teams and building out the platform.

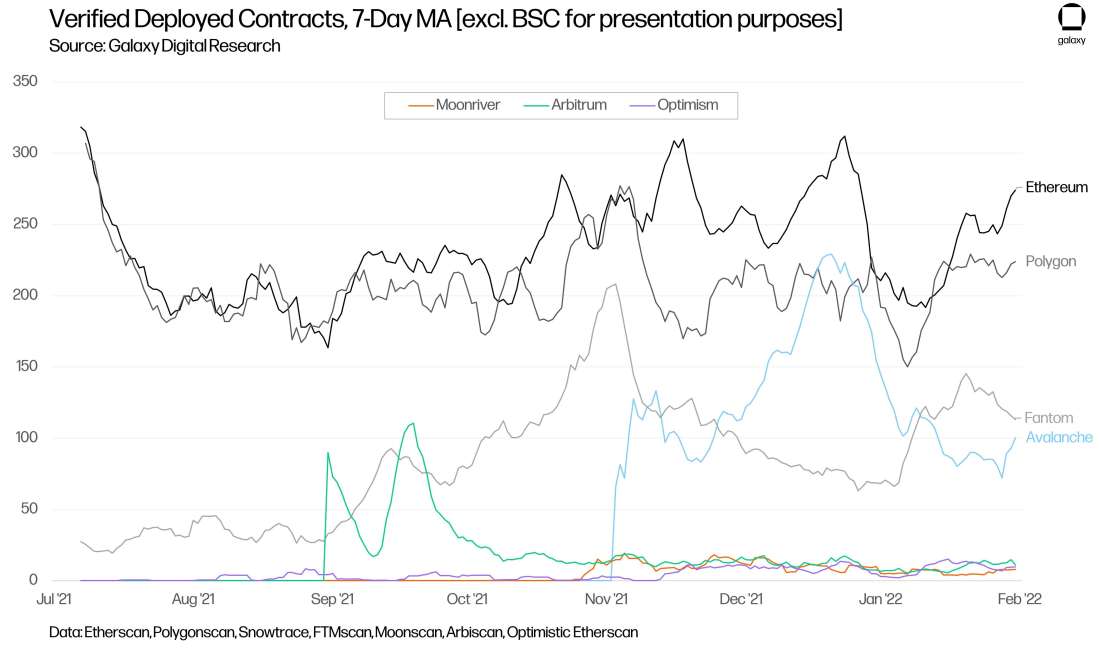

Looking at daily verified contracts across select EVM chains as a proxy for ecosystem strength (as reported by Etherscan and its affiliated block explorers for other networks), Avalanche, during its peak in mid-to-late December, had overtaken Polygon and neared the daily levels on Ethereum. Daily verified contracts on Avalanche had slowed since then, falling in line with Ethereum and Polygon while Fantom activity picked back up and surpassed Avalanche, which has largely slowed but started to break the downtrend towards the end of January. Despite the deceleration in verified contracts as of late, the activity levels on Avalanche are still well ahead of those on L2s like Arbitrum and Optimism, which have been at relatively muted levels throughout this year. (Note: Avalanche data N/A before November; BSC was excluded from this chart as an outlier with >1000 daily verified contracts)

Other comparative metrics

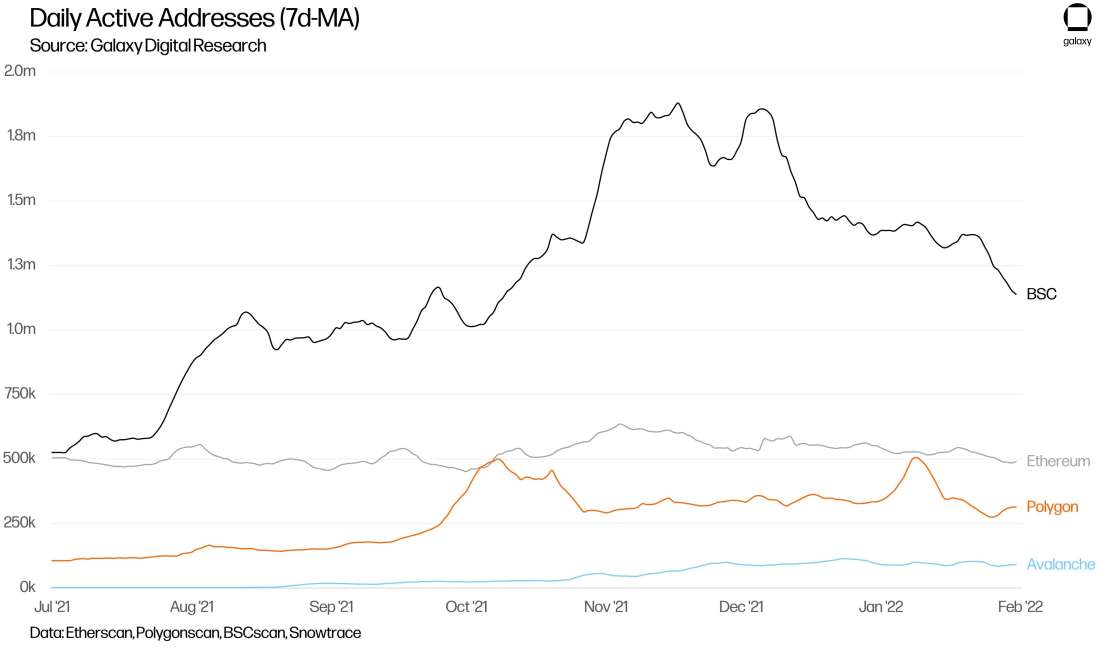

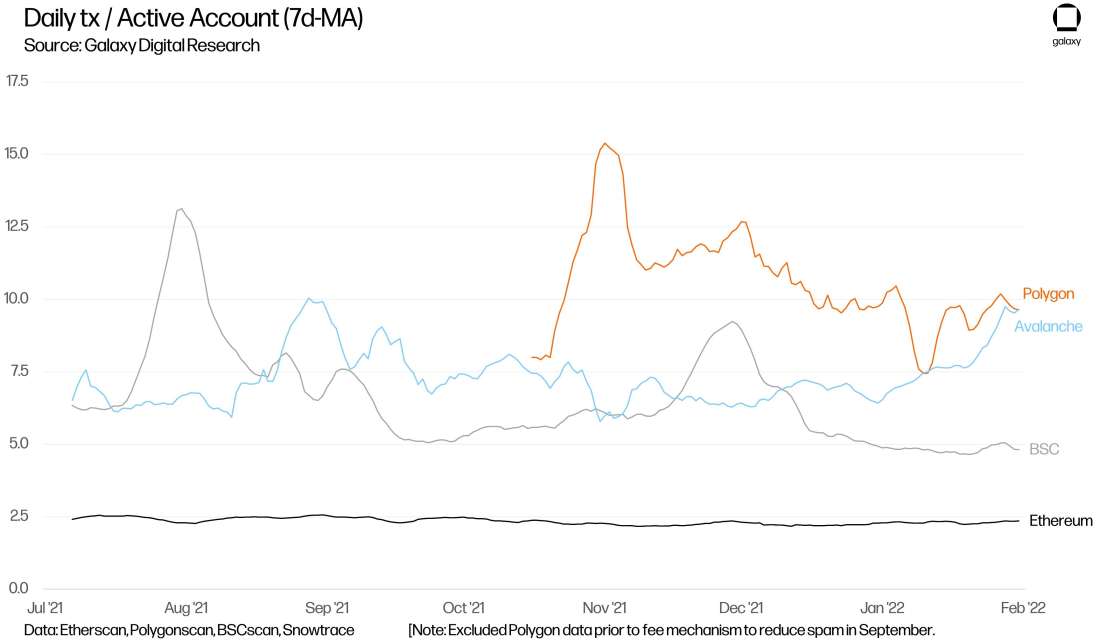

Active addresses and engagement. Compared to Ethereum, Polygon or BSC, daily active addresses on Avalanche are still relatively low averaging ~94k in January (about one-fifth of daily actives on Ethereum and about 7% of BSC’s levels). However, the daily active users on Avalanche are showing more engagement compared to other networks, transacting more frequently at an average of 8.2 transactions per day throughout January and approaching 10 daily transactions towards the end of the month—approximately 2x and 4x more frequent than daily active users on BSC and Ethereum, respectively, and recently surpassing the levels on Polygon. This is particularly notable considering Polygon and BSC’s average transaction fees are typically in the low single-digit cent range, which is magnitudes lower than on Avalanche.

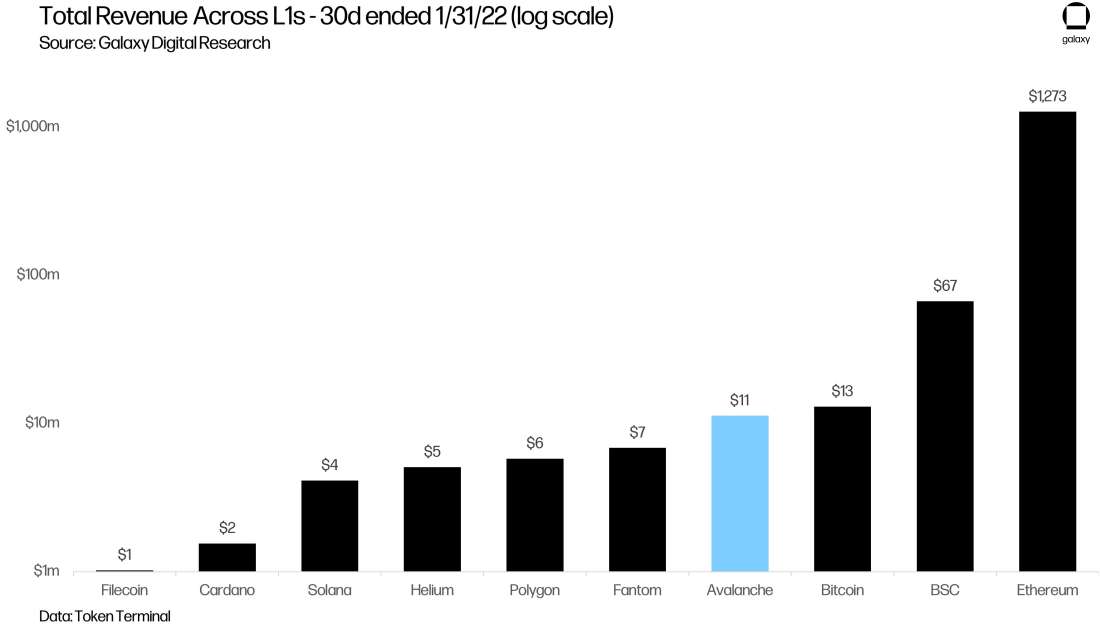

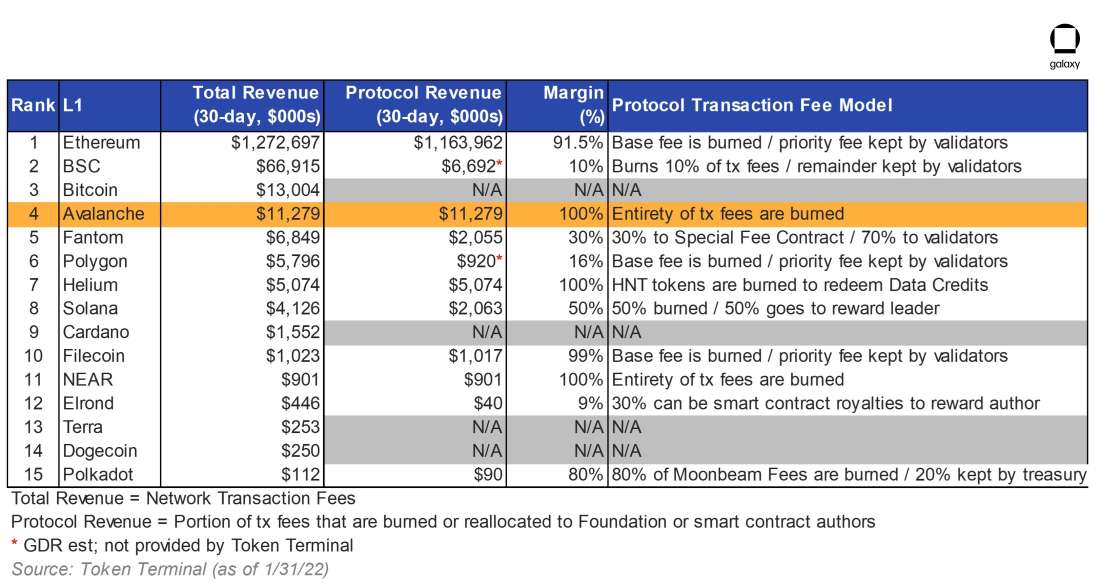

Transaction Fees and Protocol Revenue. Transaction fees show how much users are paying to use a blockchain. Per Token Terminal, Avalanche ranks 4th among L1s in total protocol revenue (total transaction fees) over the 30 days ended 1/31/22, generating $11m in transaction fees and sitting just behind Ethereum, BSC, and Bitcoin—the three most valuable tokens by market cap. Ethereum leads all protocols by a wide margin for total transaction fees, coming in at nearly 20x that of the next closest competitor.

These transaction fees on Avalanche also translate directly to protocol revenues given the entirety is burned which solely benefits token holders rather than block producers/validators or stakers. In the total transaction fee chart above, only Bitcoin and Cardano do not burn any tokens. Polygon recently implemented EIP-1559 burning mechanism on 1/17/22 and BSC activated real-time burning mechanism with BEP-95 on 12/1/21, setting the burn ratio at 10%. Out of this group, Avalanche and Helium are the only protocols to burn 100% of transaction fees—all other protocols either direct the entirety or at least a portion of transaction fees towards rewarding validators or miners (e.g. Ethereum & Polygon transaction fees may include a priority fee that goes to miners, Fantom sends 30% of transaction fees to a Special Fee Contract (SFC) that maintains a list of validators and distributes the rewards, Solana burns 50% of transaction fees).

Over the 30-day period ended 1/31/22, 8.5% of transaction fees on Ethereum went directly to miners as a priority fee. While this is only a small proportion of transaction fees and is mostly needed during times of congestion, these priority fees would have benefitted the greater community instead of just the miners if on Avalanche. Said differently, all else equal, AVAX token holders have accrued 9.3% more value from network transaction fees compared to ETH token holders (without accounting for the circulating token supply or any new token issuance).

Competitive Outlook

Many of the Alt L1s have reproduced have benefited from the strong network effects of Ethereum’s EVM. Common arguments from the Ethereum community against some of these Alt-L1 EVM chains are that they are not decentralized or that they are not actually scaling solutions and are expected to run into the same state bloat issues and high transaction fees with further usage—they only serve as temporary outlets to offload congestion on Ethereum.

Many had believed Avalanche hit its scaling limits and were turned off from the platform after the high transaction fees experienced at the end of November 2021. But as previously mentioned, those high fees were only temporary given the target gas limits on the C-Chain back then were artificially low and still have more flexibility to be increased at present levels (similarly to how rollups today have artifically have capped usage and have relatively high fees among scaling solutions).

In addition, rather than relying on Ethereum’s roadmap or solutions to scaling through sharding or rollups, Ava Labs has its own plans for state management through pruning or C-Chain fast sync to deliver cheaper fees with lower disk space. Even without these initiatives, Avalanche could see more activity migrating to its chain as Ethereum goes through significant network upgrades that are all but guaranteed. The longer history of Ethereum has certainly been an advantage for decentralization thus far, but Avalanche is a technical step ahead of Ethereum, not having to merge from PoW to PoS.

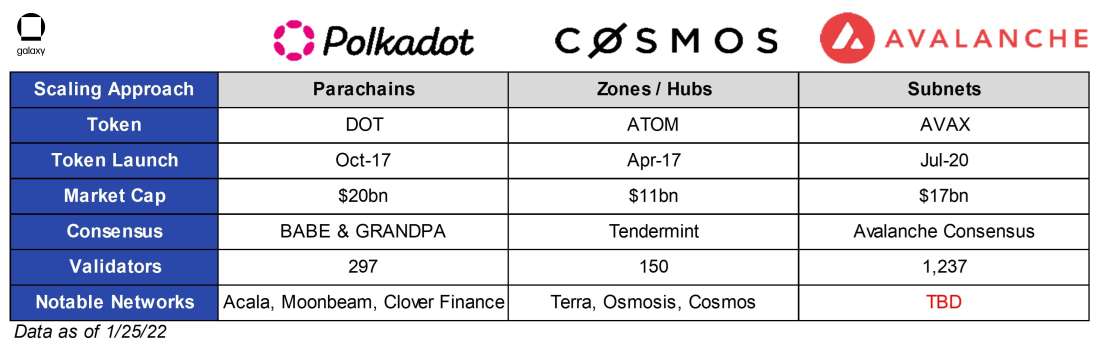

Regardless, these scaling criticisms may also become less of a focal point when considering subnets for horizontal scaling. As subnets gain more traction over time, Avalanche should be viewed less as an “Alt L1 EVM chain” and should be drawing more comparisons to interoperability protocols (sometimes called “L0s”) like Polkadot and Cosmos. These platforms provide similar benefits as subnets in supporting multiple ecosystems that can each have their own set of rules with separate resources – all connected over a single communication network. The similarities largely stop there as they each employ their own very different approaches to scaling and connectivity:

Polkadot is built on Substrate and uses a sharding infrastructure with chains running in parallel (“parachains”), each connecting to the central Relay Chain. Parachains benefit from shared security with the Relay Chain. Parachains auction off a limited number of slots to validators where the winners may lease the slot for up to 24 months. The first parachain auctions only occurred recently in December 2021.

Cosmos aims to become the “Internet of Blockchains.” It is built on Tendermint, a classical BFT consensus algorithm, and uses inter-blockchain communications (IBC protocol) built on the Cosmos Hub to connect exterior chains and applications (called “hubs” & “zones”). Several notable projects have leveraged the Cosmos SDK including THORChain and Terra. At this time, Cosmos does not offer shared security but is researching how to integrate interchain security between chains to make development of new chains easier. See our note discussing Cosmos upgrades for further details.

Together, each approach comes with its own set of trade-offs along robustness, flexibility, and decentralization, and performance (we plan to dive into these points deeper in the future). The merits and flaws behind each methodology have yet to be proven, although they will become more apparent as usage grows over time. Polkadot and Cosmos already have some notable projects that are part of their ecosystems—we have yet to see what subnets will be built on top of Avalanche.

Until we do see viable subnets launched, Avalanche continues to be viewed as an “Alt L1”, leading many users to assess it against other smart contract platforms: first and foremost, along usability—where its competitive advantages may be less apparent to users given offerings of transaction speed and cost have basically become customary across all chains—while other metrics along security, decentralization, and future scalability remain largely overlooked by users. These factors, along with ease of development and infrastructure robustness, form Avalanche’s main value proposition and will gradually become more appreciated especially as the interoperability theme takes hold in our increasingly multi-chain world.

Conclusion

Like many projects, Avalanche was created to address the difficulties in scaling blockchains. Avalanche’s unique, innovative consensus mechanism powers Avalanche to be one of the fastest blockchain often with sub-second finality, high throughput, and strong safety guarantees–all while still preserving competitive levels of decentralization. The validator set can potentially grow unbounded without driving up the latency times—a unique attribute that other platforms have been unable to match. Ultimately, Avalanche hopes to digitize all assets in the world, integrate them onto its network, and serve as a new foundational platform of interoperable finance.

The key to achieving its grand vision is subnets. Avalanche already delivered impressive results without subnets; with subnets, Avalanche’s lofty goal looks to be more realizable. Subnets can be fitted for institutions and enterprises to have greater control over their operations and data so they can meet the compliance requirements of regulators. They can also be customized for application-specific requirements such as gaming or NFTs and can support multiple VMs and scripting languages. Leveraging Avalanche’s powerful consensus and robust infrastructure, builders on the platform can then focus solely on providing the best projects for their users. The near future of Avalanche will likely see a greater number of new verticals taking advantage of the network’s performance and low transaction fees.

However, subnets have only just started to see the tooling fall into place and have yet to be proven from both a technological and adoption standpoint. It’s important to remember that Avalanche’s consensus mechanism, its platform architecture, and the practicality of subnets are relatively new and not fully battle tested. Avalanche’s approach is just one of many to solving the scaling and interoperability challenges facing blockchains. That said, Avalanche has built up a passionate community, attracted the mindshare of builders, and formed major partnerships with new forms of enterprise adoption that should go a long way in validating its technology.

Whether it is the optimal platform to tokenize all of finance and onboard the billions of users into the crypto economy from a technical standpoint remains to be seen…but these winter conditions in place should put us all on Avalanche watch.

Legal Disclosure:

This document, and the information contained herein, has been provided to you by Galaxy Digital Holdings LP and its affiliates (“Galaxy Digital”) solely for informational purposes. This document may not be reproduced or redistributed in whole or in part, in any format, without the express written approval of Galaxy Digital. Neither the information, nor any opinion contained in this document, constitutes an offer to buy or sell, or a solicitation of an offer to buy or sell, any advisory services, securities, futures, options or other financial instruments or to participate in any advisory services or trading strategy. Nothing contained in this document constitutes investment, legal or tax advice or is an endorsement of any of the stablecoins mentioned herein. You should make your own investigations and evaluations of the information herein. Any decisions based on information contained in this document are the sole responsibility of the reader. Certain statements in this document reflect Galaxy Digital’s views, estimates, opinions or predictions (which may be based on proprietary models and assumptions, including, in particular, Galaxy Digital’s views on the current and future market for certain digital assets), and there is no guarantee that these views, estimates, opinions or predictions are currently accurate or that they will be ultimately realized. To the extent these assumptions or models are not correct or circumstances change, the actual performance may vary substantially from, and be less than, the estimates included herein. None of Galaxy Digital nor any of its affiliates, shareholders, partners, members, directors, officers, management, employees or representatives makes any representation or warranty, express or implied, as to the accuracy or completeness of any of the information or any other information (whether communicated in written or oral form) transmitted or made available to you. Each of the aforementioned parties expressly disclaims any and all liability relating to or resulting from the use of this information. Certain information contained herein (including financial information) has been obtained from published and non-published sources. Such information has not been independently verified by Galaxy Digital and, Galaxy Digital, does not assume responsibility for the accuracy of such information. Affiliates of Galaxy Digital may have owned or may own investments in some of the digital assets and protocols discussed in this document. Except where otherwise indicated, the information in this document is based on matters as they exist as of the date of preparation and not as of any future date, and will not be updated or otherwise revised to reflect information that subsequently becomes available, or circumstances existing or changes occurring after the date hereof. This document provides links to other Websites that we think might be of interest to you. Please note that when you click on one of these links, you may be moving to a provider’s website that is not associated with Galaxy Digital. These linked sites and their providers are not controlled by us, and we are not responsible for the contents or the proper operation of any linked site. The inclusion of any link does not imply our endorsement or our adoption of the statements therein. We encourage you to read the terms of use and privacy statements of these linked sites as their policies may differ from ours. The foregoing does not constitute a “research report” as defined by FINRA Rule 2241 or a “debt research report” as defined by FINRA Rule 2242 and was not prepared by Galaxy Digital Partners LLC. For all inquiries, please email [email protected]. ©Copyright Galaxy Digital Holdings LP 2022. All rights reserved.