Top Stories of the Week - 9/22

This week in the newsletter, we discuss the launch of a Solana VM-based rollup, CitiBank’s new blockchain project, and the delay of Mt. Gox creditor payouts

Subscribe here and receive Galaxy's Weekly Top Stories, and more, directly to your inbox.

Eclipse Announces Launch of Ethereum Solana Virtual Machine L2

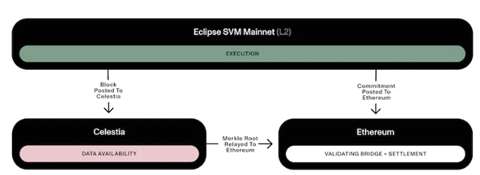

Eclipse, a customizable rollup provider, is launching an Ethereum Layer 2 solution using Solana Virtual Machine (SVM). Eclipse Mainnet executes transactions on SVM, ensures data availability through Celestia, uses RISC Zero for fraud proofs, and settles on Ethereum. Eclipse claims this approach offers the best features currently available for Layer 2s.

Eclipse chose SVM for its superior execution features, including parallel processing and state management. They settle on Ethereum because it's the preferred decentralized currency. Celestia is used for data availability due to Ethereum's bandwidth limits, and RISC Zero provides customizable fraud proofs. Eclipse will use ETH as its gas token and currently has no plans to release its own token.

Eclipse Mainet will launch before the end of this year (no specific date has been confirmed) and the devnet is already active. While this is the first Ethereum L2 SVM, over the past year Eclipse has also partnered with projects like Injective to launch the first SVM-compatible chain on Cosmos.

OUR TAKE:

Eclipse’s launch announcement is notable for challenging the current L2 landscape, arguing, “The main use case for a million chains today often appears to be launching a million more tokens.” This comes at the expense of users who have to deal with fragmented liquidity and different UXs. Eclipse resolves this by providing a roll up with multi-threaded processing capabilities (enabled due to the SVM’s parallel processing and local fee markets) rather than the single-threaded approach common amongst today’s most popular L2s. In this way, Eclipse challenges the dominant visions articulated by single-threaded rollups like Optimism, Arbitrum, and zkSYnc, offering a more performant composable network at the cost of incremental trust assumptions (due to Celestia DA).

As with everything involving the fiercely tribalistic crypto community, the Eclipse announcement quickly spiraled into a highly contentious topic on X. Proponents from each contributing chain were quick to claim it a victory for themselves, when in reality it benefits all:

Solana gains a foothold in the Ethereum ecosystem. Coupled with the introduction of MetaMask Snaps (discussed in my newsletter post last week), this significantly reduces the friction for onboarding new users to the SVM as well as porting Solana applications into the Ethereum ecosystem. It also expands the pool of developers and collective mindshare willing to build SVM compatible products.

Ethereum adds a highly performant chain to its growing array of L2s, providing users and developers with even more optionality and customizability.

Celestia and RISC Zero get an opportunity to demonstrate the practical benefits of using a modular architecture over the existing dominant L2 designs which rely on Ethereum for everything besides execution.

This is the beauty of permissionless open-source software. Anyone can adapt it to their own preferences based on their views of what works best. The market will then determine which ones are best suited relative to the use cases needed. - Lucas Tcheyan

Mt. Gox Distributions Delayed (again)

Mt. Gox trustees extend deadline for BTC repayments by one year to October 31, 2024. According to the announcement on the Mt Gox website, the trustee would not be able to complete repayments by the original repayment deadline set for October-end this year due to additional time required to collect and verify creditor information with relevant parties for distribution. Specifically, the trustee cites "the time required for rehabilitation creditors to provide the necessary information, and for the Rehabilitation Trustee to confirm such information and engage in discussions and share information with banks, fund transfer service providers, and Designated Cryptocurrency Exchanges etc., involved in the repayments, which are required before the repayments can be made".

The Tokyo District Court has approved the new proposed repayment deadline of October 31, 2024. Creditors that have not yet provided the trustee with the necessary information are encouraged to do so for repayments to commence. However, the announcement also states that some repayments could be made as early as the end of this year for creditors that have provided the necessary information (schedule subject to change and specific timing of repayments to each creditor has not yet been determined).

BTC briefly rallied above $27,000 on the news before declining to ~$26,500 as of Thursday afternoon, roughly flat on the week.

OUR TAKE:

Mt. Gox distributions are delayed again, seemingly little surprise to the market given the muted price volatility around the announcement. Even though the deadline to provide repayment information closed in April this year (nearly 7 months before the distribution deadline), the Trustee and the courts clearly underestimated the coordination effort required before distributions could be made. The process requires creditors to specify an exchange to receive their claims and go through onboarding; the trustee and relevant exchanges/custodians then must coordinate with ~20k creditors in over 100 countries with different languages and local bank requirements. Extending the deadline by an additional 12 months reflects the administrative challenges in verifying all the submitted creditor information.

Repayments are to be made in a mix of mostly crypto and some fiat – the Trustee holds 142k BTC (~$3.8bn at current prices), 69bn JPY (~467m), 143k BCH (~$30m) and potentially other related forks such as BSV – though final distributions are still to be determined given ongoing bankruptcy processes and several other legal proceedings.

The timing of Gox repayments continues to be an overhang for BTC and the broader crypto market. Many believe creditors will opt to sell their distributions immediately upon receipt (at current prices, BTC is up nearly 65-70x from the ~$400 level at the time Gox was hacked so a ~20% partial recovery of lost funds still represents a significant financial gain for most creditors). However, some of the expected sell pressure may be partially offset as the majority of creditors have already sold their claim interests to investor groups for early payments while the remaining creditors have held off from selling their claims for 5+ years now. No one likes having to wait to be repaid, but what’s one more year to these diamond-handed HODLers? - Charles Yu

Unveiling ‘Citi Token Services’

On Monday, September 18, American financial services company Citigroup unveiled the creation of Citi Token Services. Citi Token Services (CTS) is a new product being piloted by Citi Treasury and Trade Solutions for servicing institutional clients with their cash management and trade finance needs. “Institutional clients have a need for ‘always-on’, programmable financial services and Citi Token Services will provide cross-border payments, liquidity, and automated trade finance solutions on a 24/7 basis,” the company wrote in their announcement.

CTS relies on a permissioned blockchain owned and managed by Citi. The blockchain has already been used in two separate pilot programs. The first pilot involved Citi clients using CTS to transfer liquid assets between Citi branches round-the-clock. The second pilot was completed in partnership with Maersk, a Danish international container shipping company, and involved the use of smart contracts and tokenization to provide instant settlement of transactions with the same guarantees as letters of credit for service providers.

CTS is a product that is complemented by Citi’s ongoing work on the Regulated Liability Network (RLN), a separate initiative to use blockchain technology for wholesale payments, that is payments between large entities, such as banks, multinational corporations, and governments. Citi’s experimentation with blockchain has spanned years and involved partnerships with several other major financial institutions such as HSBC, Goldman Sachs, and Inter-American Development Bank (IDB). In April, JPMorgan Chase, the largest U.S. bank by assets under management, also shared plans to tokenize traditional financial assets such as money market funds on their permissioned blockchain, Onyx.

OUR TAKE:

Bitcoin, the world’s first and most valuable cryptocurrency in the world, popularized the use of blockchains for record-keeping of financial transactions. The creator of Bitcoin did not invent blockchains. The idea of storing data on a cryptographically secure chain of blocks was first described in a dissertation by cryptographer David Chaum in 1982. It is only because of the rise of Bitcoin and other public blockchains like Ethereum in more recent years that financial institutions and large enterprises have started to dig deeper into blockchains as a technology for record-keeping and ledger management.

One of the earliest and most infamous examples of a permissioned blockchain project is the startup R3. R3 was founded in 2014 to create a consortium of financial institutions, involving the world’s largest banks, and major fintech companies to develop a permissioned blockchain for cross-border transactions and payments. The startup has since pivoted to building a regulatory-friendly decentralized finance network. Aside from R3, other notable permissioned blockchain projects include Hedera Hashgraph,Hyperledger Fabric, and Consensys Quorum.

While the adoption and value of public blockchains has soared since the creation of Bitcoin, there has yet to be a permissioned blockchain to rival, or even come close to rivaling, the same level of traction as that of public blockchains. One of the key reasons for this is because blockchains are not an efficient way to record and maintain a ledger of financial transactions unless the goal is to maintain a ledger that anyone in the world can view, validate, and submit updates to.

Blockchains are a simple way to record data in a strictly linear fashion. Financial transactions are added to a blockchain by referencing transactions recorded in a prior block. To edit data in a block that has already been built upon requires the consensus of all users that have stored a copy of the canonical ledger on their computer. The more participants running software verifying the contents of a blockchain, the harder it is to tamper with blockchain data records. Therefore, the immutability of a blockchain as it is adopted by a higher number of users is one of the key reasons for why this technology is so powerful when applied to decentralized and permissionless protocols like Bitcoin and Ethereum.

For permissioned blockchains like CTS and Onyx, the risks of data being tampered are already mitigated by the fact that its participants are vetted and the guarantees of data immutability are only as strong as the reliability and trustworthiness of the participants involved. Therefore, the value of storing data between permissioned participants through a data structure like blockchains is unclear and may not be be more efficient than simply relying on a centralized database that select participants can update 24/7. -Christine Kim

Charts of the Week

Bitcoin’s hash rate climbed to a new all-time high this week using the 14-day SMA. Now at 406.3 ExaHashes per second, hash has risen 6% so far in September and 67% YTD. The new high comes on the heels of a positive difficulty adjustment of 5.5%, the sixth largest positive change in 2023.

The recent expansion in hash rate, and subsequent rise in network difficulty, has pushed Hash Price within 4% of its 4-year low of $0.061. Hash price is the expected value of a unit of hashing power, 1 TeraHash (TH) of power in the case of this chart, per day. It is a proxy for the per unit revenue miners are earning in aggregate across the entire Bitcoin network. As it currently stands, miners are earning $0.063 per TH of mining power, or $6.30 per 100 TH/s, per day.

Other News

Tether increased stablecoin loans to $5.5 billion after saying it planned to stop

Grayscale Investments files for new ether futures ETF

Polygon Labs proposes facilitating Celo's migration to Ethereum Layer 2 with CDK

Base introduces security monitoring system named Pessimism

Nomura's crypto arm launches 'long-only' bitcoin exposure fund

Judge makes no ruling in SEC-Binance document dispute

ApeCoin DAO votes in favor of sister DAO to acquire influential NFTs

Legal Disclosure:

This document, and the information contained herein, has been provided to you by Galaxy Digital Holdings LP and its affiliates (“Galaxy Digital”) solely for informational purposes. This document may not be reproduced or redistributed in whole or in part, in any format, without the express written approval of Galaxy Digital. Neither the information, nor any opinion contained in this document, constitutes an offer to buy or sell, or a solicitation of an offer to buy or sell, any advisory services, securities, futures, options or other financial instruments or to participate in any advisory services or trading strategy. Nothing contained in this document constitutes investment, legal or tax advice or is an endorsementof any of the digital assets or companies mentioned herein. You should make your own investigations and evaluations of the information herein. Any decisions based on information contained in this document are the sole responsibility of the reader. Certain statements in this document reflect Galaxy Digital’s views, estimates, opinions or predictions (which may be based on proprietary models and assumptions, including, in particular, Galaxy Digital’s views on the current and future market for certain digital assets), and there is no guarantee that these views, estimates, opinions or predictions are currently accurate or that they will be ultimately realized. To the extent these assumptions or models are not correct or circumstances change, the actual performance may vary substantially from, and be less than, the estimates included herein. None of Galaxy Digital nor any of its affiliates, shareholders, partners, members, directors, officers, management, employees or representatives makes any representation or warranty, express or implied, as to the accuracy or completeness of any of the information or any other information (whether communicated in written or oral form) transmitted or made available to you. Each of the aforementioned parties expressly disclaims any and all liability relating to or resulting from the use of this information. Certain information contained herein (including financial information) has been obtained from published and non-published sources. Such information has not been independently verified by Galaxy Digital and, Galaxy Digital, does not assume responsibility for the accuracy of such information. Affiliates of Galaxy Digital may have owned or may own investments in some of the digital assets and protocols discussed in this document. Except where otherwise indicated, the information in this document is based on matters as they exist as of the date of preparation and not as of any future date, and will not be updated or otherwise revised to reflect information that subsequently becomes available, or circumstances existing or changes occurring after the date hereof. This document provides links to other Websites that we think might be of interest to you. Please note that when you click on one of these links, you may be moving to a provider’s website that is not associated with Galaxy Digital. These linked sites and their providers are not controlled by us, and we are not responsible for the contents or the proper operation of any linked site. The inclusion of any link does not imply our endorsement or our adoption of the statements therein. We encourage you to read the terms of use and privacy statements of these linked sites as their policies may differ from ours. The foregoing does not constitute a “research report” as defined by FINRA Rule 2241 or a “debt research report” as defined by FINRA Rule 2242 and was not prepared by Galaxy Digital Partners LLC. For all inquiries, please email [email protected]. ©Copyright Galaxy Digital Holdings LP 2023. All rights reserved.