Top Stories of the Week - 3/22

This week in the newsletter, we write about the SEC reportedly investigating the Ethereum Foundation, Blackrock building tokenization offerings, and one of the world’s largest pension funds considering allocating to BTC.

Subscribe here and receive Galaxy's Weekly Top Stories, and more, directly to your inbox.

SEC Investigates the Ethereum Foundation?

The US Securities & Exchange Commission has reportedly sent subpoenas to crypto firms regarding relationship with Ethereum Foundation. In what appears to be a separate incident of legal service, the Ethereum Foundation removed the “warrant canary” from its GitHub on Feb. 26 and disclosed that it had “received a voluntary enquiry from a state authority that included a requirement for confidentiality.” It’s unclear from which authority the Ethereum Foundation itself has received service -- the EF is a Swiss-domiciled entity -- or if the “enquiry” it has received is related to the subpoenas sent by the S.E.C.

The substance of the legal service reportedly sent to crypto firms and the EF is also unknown at this time. Fortune characterized the SEC subpoenas as being part of an “energetic campaign to classify Ethereum... as a security.” The SEC has long held that Bitcoin was a commodity, but across various opportunities in recent years has refused to say the same about Ether, the native currency of the Ethereum network, despite the fact that former SEC Head of the Div. of Corp. Finance Bill Hinman said in a June 2018 speech that “putting aside the fundraising that accompanied the creation of Ether, based on my understanding of the present state of Ether, the Ethereum network and its decentralized structure, current offers and sales of Ether are not securities transactions.”

The reporting of the legal service appears at a time when several prominent ETF issuers are vying to list spot-based ETH ETFs. The first final 19b-4 deadline for the SEC on the pending applications is May 23, on which the Commission must approve or reject VanEck’s application to list its spot-based ETH ETF. Market observers have mostly assigned a low probability to approvals in May, with Bloomberg ETF Analyst saying Mar. 20 that “we now believe these will ultimately be denied May 23rd for this round.”

OUR TAKE:

SEC Chairman Gary Gensler has repeatedly refused to say whether or not the Commission believes Ether is a security, despite the fact that the Commodity Futures Trading Commission (CFTC), which regulates commodities and futures trading, has definitively stated that Ether is a commodity and has allowed its regulated futures exchanges to list Ether futures. These ongoing refusals to acknowledge the Commission’s views on Ether have led to theories that the SEC intends to perform some kind of crackdown on the world’s second most valuable blockchain network, theories that gained steam this week following reporting from Fortune and CoinDesk. They also threaten to create an irregular schism between the two primary American markets regulators, the SEC and the CFTC.

Regarding the reported subpoenas and legal service to the EF, though, it is impossible to know the substance of these legal services of process. If, as Fortune reports, the Commission is seeking information about crypto firms’ interactions with the Ethereum Foundation, it’s possible the SEC is considering whether the original Ethereum ICO was an unregistered securities offering rather than engaging in an exercise to classify the secondary trading of Ether today as securities trading. Were the SEC to bring charges against the Ethereum Foundation regarding the initial offering of Ether but allow its ongoing secondary trading as non-securities, this would actually be somewhat in-line with Hinman’s 2018 speech as well as some of the distinctions between primary and secondary sales in various court cases. (We should note, though, that the Ethereum ICO ran from July to September 2014, nearly 10 years ago, so bringing an enforcement action against the EF at this point would be extremely irregular).

The Fortune piece also quoted an unnamed subpoena recipient who said that the SEC viewed Ethereum’s Fall 2022 “Merge” upgrade as enhancing the likelihood that Ether is a security due to the network’s transition from Proof-of-Work to Proof-of-Stake. It would be particularly perplexing if the SEC views Proof-of-Stake as making Ether a security given that the Commission allowed the launch of several futures-based ETH ETFs in Fall 2023, a full year after Ethereum transitioned to PoS. Not only would alleging that PoS alone makes an asset a security likely require the SEC to somehow rollback or unwind their approval of the futures ETFs, such a position would have sweeping implications across crypto markets given that the vast majority of Layer 1 blockchains operate on a PoS model. (It’s worth noting that the New York Attorney General alleged in a civil suit against KuCoin in March 2023 that Ether was a security partially due to its reliance on Proof-of-Stake, though we haven’t located an instance of the SEC yet making a similar case in legal documents. KuCoin settled that case in December 2023).

All this to say, if the reporting is accurate and if it indicates the Commission is indeed gearing up to make securities-laws allegations against Ether or the Ethereum Foundation, the SEC is treading on tricky ground in terms of law, regulatory precedent, and impact on over a decade old industry. Should the SEC attempt to take action on Ether or even on the Ethereum Foundation for the original presale from 10 years ago, it would represent a dramatic escalation in an enforcement-driven war waged by a Commission that appears to be increasingly facing headwinds and scrutiny in court and on Capitol Hill. It’s hard to know the direct impact on ETH ETF approval of whatever the SEC is cooking with this reported investigation, but when coupled with Bloomberg’s ETF Analyst James Seyffart saying that the SEC has not been actively engaging with issuers just two months before the first deadline, May approval now appears extremely unlikely. - Alex Thorn

BlackRock Begins to BUIDL its Tokenization Offerings

BlackRock revealed its first tokenized fund issued on a public blockchain this week. The BlackRock USD Institutional Digital Liquidity fund (BUIDL) provides qualified investors with access to tokenized U.S. dollar yields on the Ethereum blockchain.

BUIDL invests 100% of its total assets in cash, U.S. Treasury bills, and repurchase agreements and aims to keep a stable value of $1 per token. Holders of BUIDL receive accrued dividends directly to their wallets monthly as new tokens. The fund also enables holders to transfer their tokens “24/7/365 to other pre-approved investors” and have flexibility in how they choose to custody their BUIDL tokens (shares). Other advantages include instantaneous and transparent settlement.

BlackRock filed a Form D, a notice indicating their intention to launch an exempt token securities offering, alerting onlookers to the funds launch. Securitize will act as the tokenization platform, and it has previously tokenized assets for major corporations like KKR. BNY Mellon, Coinbase, Anchorage, BitGo, and Fireblocks will serve various infrastructure provider roles.

OUR TAKE:

BlackRock’s entrance into the digital asset space is just beginning and it’s a boon for the crypto industry as a whole. Just as BlackRock’s Bitcoin ETF filing signaled to many the inevitability of ETF approval, BUIDL may foreshadow the beginning of a much larger shift toward tokenization. BlackRock CEO Larry Fink said in January on Bloomberg that “tokenization is the next step.”

While certain types of tokenization efforts such as stablecoins and tokenized gold have existed for several years, others like tokenized Treasuries have recently emerged against the backdrop of a rising interest rate environment. Borrow-lend protocols like Maker and Frax have devised new ways to capture offchain yields, usually setting up offchain entities that invest protocol assets into Treasuries and other money market offerings and return those revenues back to token holders. In December, Galaxy announced a partnership with DWS to issue a fully collateralized EUR-denominated stablecoin in the future.

There has also been interest from companies like Franklin Templeton and Wisdom Tree, traditional finance companies whose primary business is unrelated to cryptocurrencies and blockchain technology. Of the nearly $800 million in onchain tokenized Treasury offerings existing today, 50% are offered through Franklin Templeton’s Benji platform. This represents a small percentage of global assets, however, with recent estimates putting the money-market funds industry alone at $6 trillion. BlackRock’s entrance can help change that. The world’s largest asset manager has been vocal that tokenization is inevitable, with CEO Larry Fink saying that tokenization represents the “next generation for markets” and that he envisions “the tokenization of every financial asset.” It is clear that their foray into the space is part of a larger long-term strategy, not just a small-scale experiment.

BlackRock’s use of a public blockchain, Ethereum, also highlights an important design choice. The exact specifics aren’t public, but it is clear that actual distribution and transfer of the tokens will incorporate a trusted/permissioned element. BUIDL should open the door for a new class of ulta-high net worth investors (minimum investment size for BUIDL is $5 million) to start feeling more comfortable with onchain offerings. This may better incentivize teams to start building institutional products in line with BlackRock’s regulatory positioning while demonstrating the advantages of tokenized products issued on public blockchains. - Lucas Tcheyan

Japan’s State Pension Fund Requests Information About Bitcoin

On Tuesday, the Government Pension Investment Fund Japan (GPIF) announced that it is seeking information for research-purposes on a range of “illiquidity assets” including but not limited to farmland, gold, forests, and cryptoassets such as bitcoin. The request for information (RFI) by the GPIF states that their research into these assets is in accordance with their “annual plan.”

Respondents to the RFI have until April 19 to make submissions outlining how GPIF could add these assets to its investment portfolio. The GPIF is the world’s largest pension fund by assets under management, with holdings worth approximately $1.54tn as of December 2023, according to Reuters. The fund currently invests in domestic and foreign bonds, stocks, real estate, infrastructure, and private equity. The GPIF’s RFI comes days after bitcoin hit a new all-time high of $73,797, and weeks following the news that Japan’s cabinet approved a bill to allow venture capital and investment firms to hold crypto assets. This bill is presently under review by the Japanese Parliament, the Diet. Last year, Japan’s cabinet also approved a bill to exclude corporations from paying tax on unrealized gains from long-term crypto holdings. This bill is also under review by the Diet.

OUR TAKE:

To be clear, the RFI does not mean that the GPIF will invest in cryptoassets or even conduct the research to evaluate cryptoassets as investments. The RFI suggests that the GPIF is open to receiving “basic information” to then evaluate whether research into cryptoassets, or any other asset class that they are not currently invested in or already considering for investment, is worth pursuing. It is an early step indicating a general openness to exploring new investment strategies for the fund that given changing trends in global economics, politics, and markets is a prudent step for any serious financial institution to take. However, we believe it is only a matter of time before the GPIF recognizes the core role that cryptoassets should take in a diversified investment portfolio.

Major institutions around the world are waking up to the investment potential of cryptoassets. Last year, South Korea’s National Pension Service announced the purchase of over 280,000 shares in cryptocurrency exchange Coinbase. Also in 2022, the Houston Firefighters Pension fund became the first public pension plan in the U.S. to invest in cryptoassets, BTC and ETH. This year, the U.S. SEC approved the first cohort of spot Bitcoin ETFs. As of March 21, these 10 funds collectively hold over 4% of total BTC supply and their AUM is only projected to increase as more registered investment advisors, broker-dealers, and banks open up access to these investment vehicles.

Though still early, interest from GPIF and other institutions seeking enhanced returns in their portfolios will continue to drive demand for cryptoassets and other investment vehicles offering exposure to these assets in major ways. As the adoption of cryptoassets and blockchain technology grows, it is becoming increasingly difficult for institutions that represent and protect the interest of retail investors to ignore the powerful role that cryptoassets can have in an investment portfolio. For more information about the role of Bitcoin in a portfolio, read this Galaxy Research report. For more information on the projected market for a spot Bitcoin ETF, read this Galaxy Research report. - Christine Kim

Charts of the Week

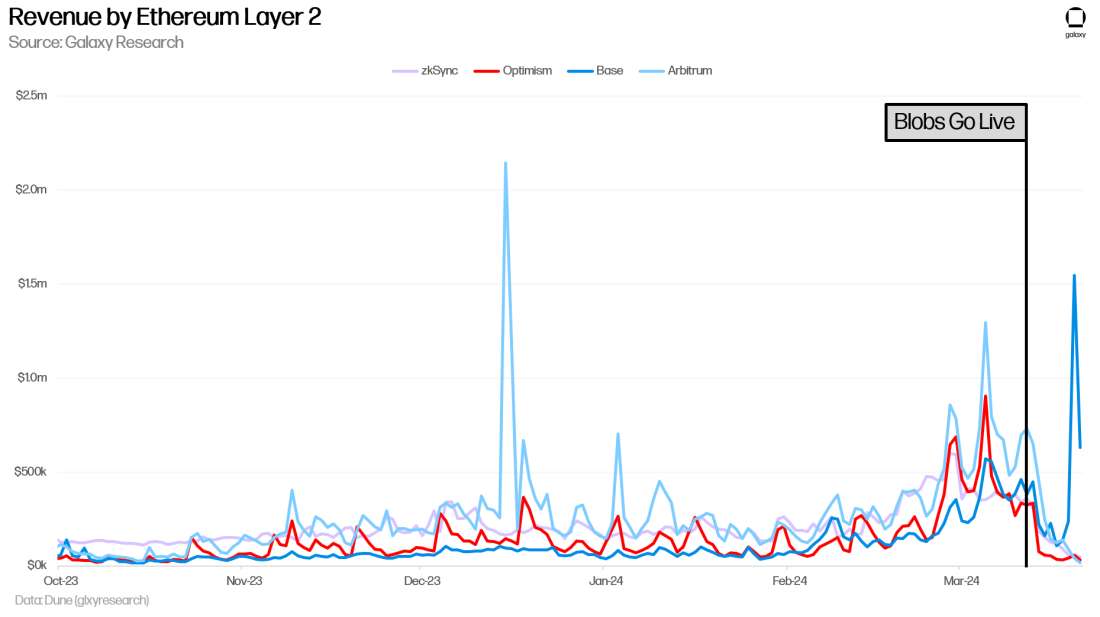

Ethereum Layer 2s (L2s) are seeing economic improvement in the first week since blobs went live (to learn more about blobs see our newsletter from March 15, 2024). Most notably, sequencer profit margins have increased and transaction costs have come down considerably.

The average profit margin of zkSync, Optimism, Base, and Arbitrum was 24.2% in the three-month period leading to the introduction of blobs. Since blobs went live, they have averaged a combined profit margin of 80.4%.

These same L2s also experienced a combined 55% reduction in their median transaction costs. Optimism saw the greatest reduction at more than 71%.

Base experienced elevated transaction fees through March 20, 2024 and March 21, 2024 as users flooded the network. Increased activity on the chain pushed fees higher as users competed to get their transactions executed. This event highlights a key point that, while EIP-4844 has reduced Ethereum Layer 1 (L1) costs for these L2s and brought their transaction fees down, it does not insulate them the upwards pressure put on fees as on-chain activity grows.

The tradeoff of lower transaction costs has been lower revenues, with the exception of Base which notched its most profitable day since it launched in July 2023. On March 20, 2024 Base recorded $1.55m in revenue at a profit margin of 99.9%. Despite the reduction in revenues for Optimism, Arbitrum, and zkSync, they have maintained consistent bottom line margins. So, while lower fees have hurt their topline revenues, the chains have not yet shown sustained signs taking home less net income than they did in the pre-blob era.

See Galaxy Research’s EIP-4844 Dune Analytics dashboard for more detail on the economic evolution of Ethereum L2s and EIP-4844.

Other News

Daily volume on Base network sees 51% surge to $356 million

Second-most expensive CryptoPunk ever sells — for the second time

SEC delays decision on VanEck spot Ethereum ETF, asks for public comments

Citrea releases open-source BitVM based two-way peg program

Starknet's 2024 roadmap includes parallel transaction execution coming in Q2

Grayscale Ethereum Trust discount has widened to -20%, its lowest level since November 2023 as hope dwindles for spot ETF in May

Following Fidelity's lead, Grayscale looks to add staking for its proposed Ethereum ETF

OP Mainnet tests 'fault proofs' in bid to strengthen network security

Genesis agrees to pay $21m penalty to settle SEC charges

Legal Disclosure:

This document, and the information contained herein, has been provided to you by Galaxy Digital Holdings LP and its affiliates (“Galaxy Digital”) solely for informational purposes. This document may not be reproduced or redistributed in whole or in part, in any format, without the express written approval of Galaxy Digital. Neither the information, nor any opinion contained in this document, constitutes an offer to buy or sell, or a solicitation of an offer to buy or sell, any advisory services, securities, futures, options or other financial instruments or to participate in any advisory services or trading strategy. Nothing contained in this document constitutes investment, legal or tax advice or is an endorsementof any of the digital assets or companies mentioned herein. You should make your own investigations and evaluations of the information herein. Any decisions based on information contained in this document are the sole responsibility of the reader. Certain statements in this document reflect Galaxy Digital’s views, estimates, opinions or predictions (which may be based on proprietary models and assumptions, including, in particular, Galaxy Digital’s views on the current and future market for certain digital assets), and there is no guarantee that these views, estimates, opinions or predictions are currently accurate or that they will be ultimately realized. To the extent these assumptions or models are not correct or circumstances change, the actual performance may vary substantially from, and be less than, the estimates included herein. None of Galaxy Digital nor any of its affiliates, shareholders, partners, members, directors, officers, management, employees or representatives makes any representation or warranty, express or implied, as to the accuracy or completeness of any of the information or any other information (whether communicated in written or oral form) transmitted or made available to you. Each of the aforementioned parties expressly disclaims any and all liability relating to or resulting from the use of this information. Certain information contained herein (including financial information) has been obtained from published and non-published sources. Such information has not been independently verified by Galaxy Digital and, Galaxy Digital, does not assume responsibility for the accuracy of such information. Affiliates of Galaxy Digital may have owned or may own investments in some of the digital assets and protocols discussed in this document. Except where otherwise indicated, the information in this document is based on matters as they exist as of the date of preparation and not as of any future date, and will not be updated or otherwise revised to reflect information that subsequently becomes available, or circumstances existing or changes occurring after the date hereof. This document provides links to other Websites that we think might be of interest to you. Please note that when you click on one of these links, you may be moving to a provider’s website that is not associated with Galaxy Digital. These linked sites and their providers are not controlled by us, and we are not responsible for the contents or the proper operation of any linked site. The inclusion of any link does not imply our endorsement or our adoption of the statements therein. We encourage you to read the terms of use and privacy statements of these linked sites as their policies may differ from ours. The foregoing does not constitute a “research report” as defined by FINRA Rule 2241 or a “debt research report” as defined by FINRA Rule 2242 and was not prepared by Galaxy Digital Partners LLC. For all inquiries, please email [email protected]. ©Copyright Galaxy Digital Holdings LP 2024. All rights reserved.