What is bitcoin?

Born in the wake of the 2008 global financial crisis, bitcoin leverages innovative blockchain technology to function as a transparent and decentralized digital asset. Evolving from a concept of peer-to-peer electronic cash to a resilient store of value upheld by open-source code[1] and mathematical principles, it ensures highly secure, trust-minimized transactions without a centralized intermediary. Bitcoin is the first natively digital asset and its advent heralded the beginning of digital finance.

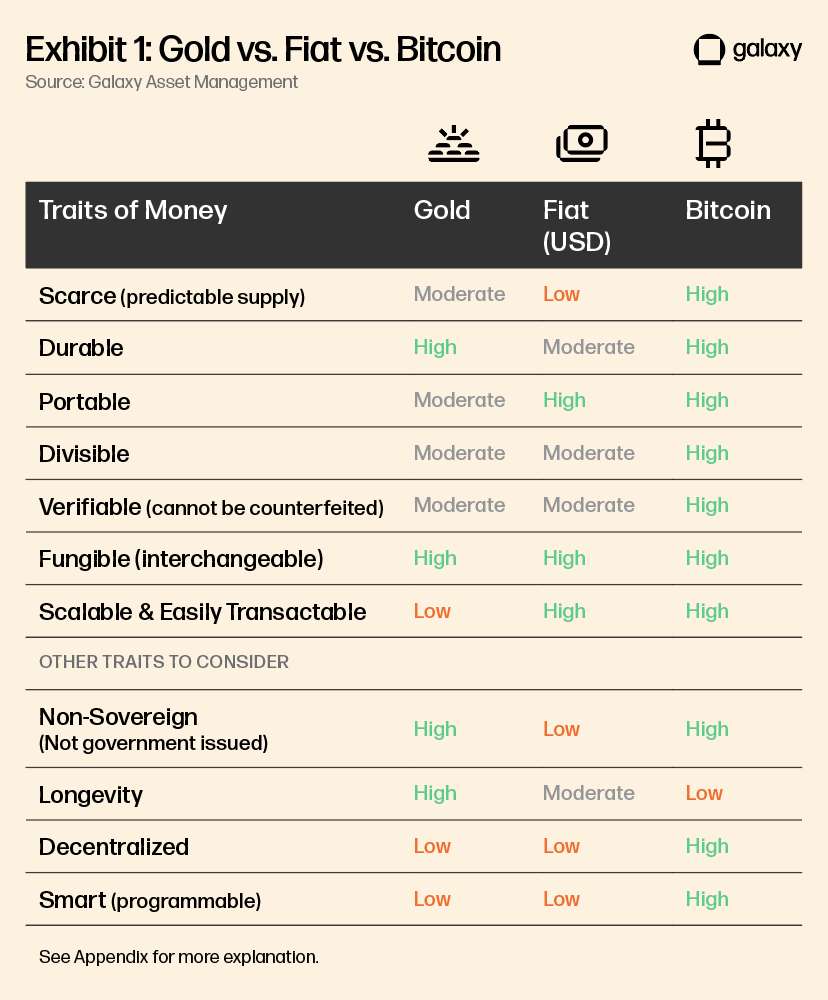

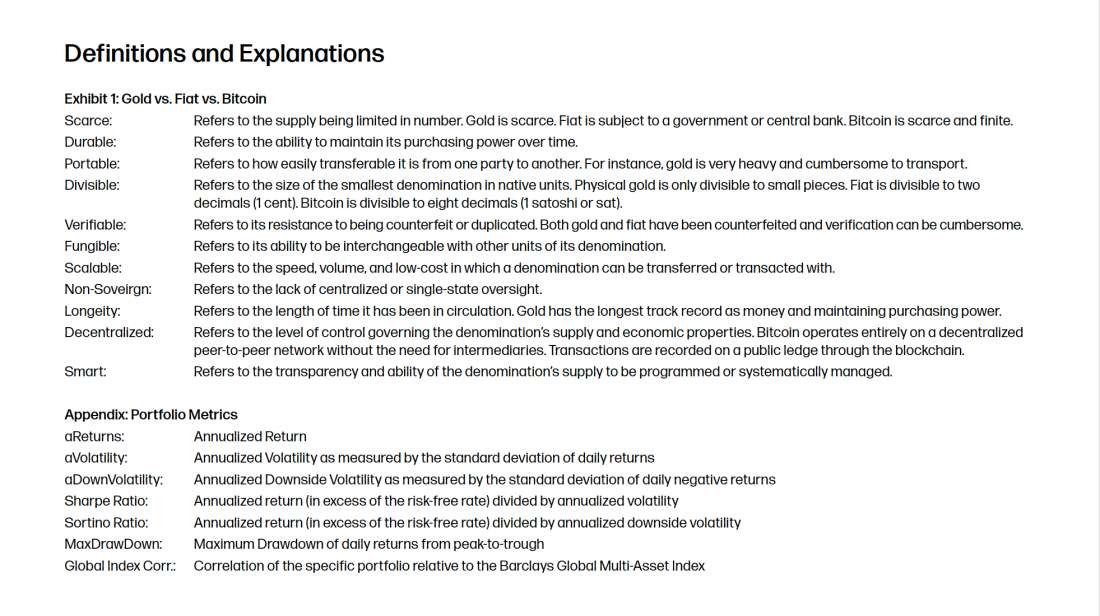

The Bitcoin blockchain is a distributed ledger that guarantees a transparent, predictable, and immutable monetary policy,[2] which has led many to refer to it as “digital gold.” Bitcoin shares gold's traditional attributes of being a non-sovereign store of value with a scarce supply, but it also surpasses gold in many ways. While Bitcoin’s gold-like properties have spurred its use as a hedge against central bank monetary policy or inflation, Bitcoin is also significantly more portable, verifiable, transferrable, and divisible than gold.

Why bitcoin belongs in a portfolio?

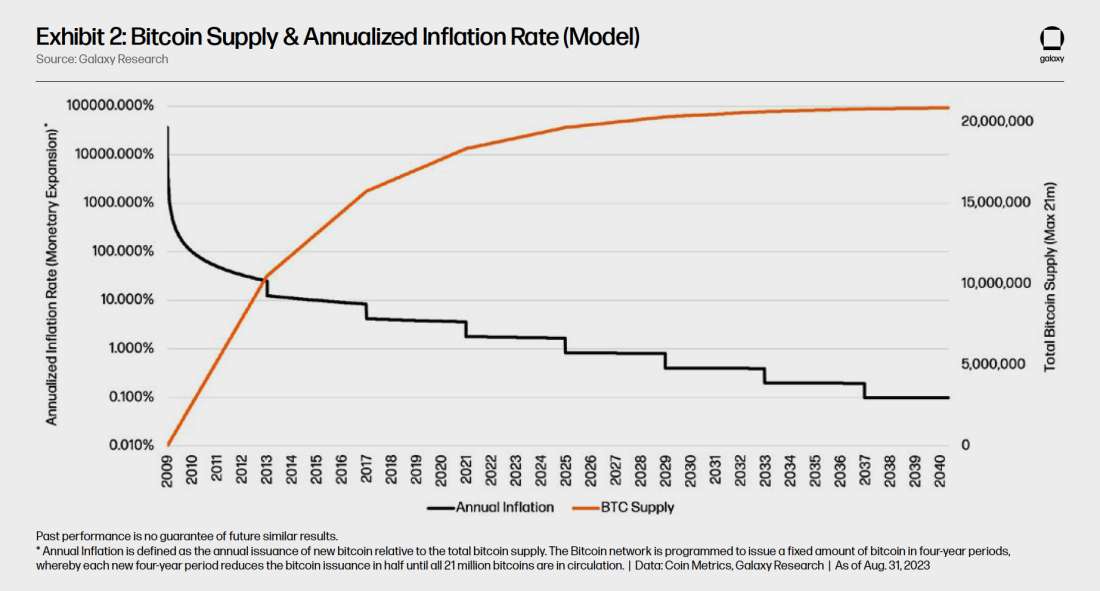

Bitcoin is the only verifiably scarce, fixed-supply asset in the world. Its underlying code controls how much new bitcoin is created and limits the maximum amount of bitcoin that will ever exist to 21 million, and that code is simultaneously enforced by a decentralized network of thousands of independent node[3] operators around the world. Bitcoin has a price-inelastic supply, meaning that a change in price does not change its supply issuance. Said differently, bitcoin’s supply is transparent and unchangeable; it is strictly bound, algorithmically coded, and governed by a community of global participants that believe in the long-term fundamental properties bitcoin offers to individuals.

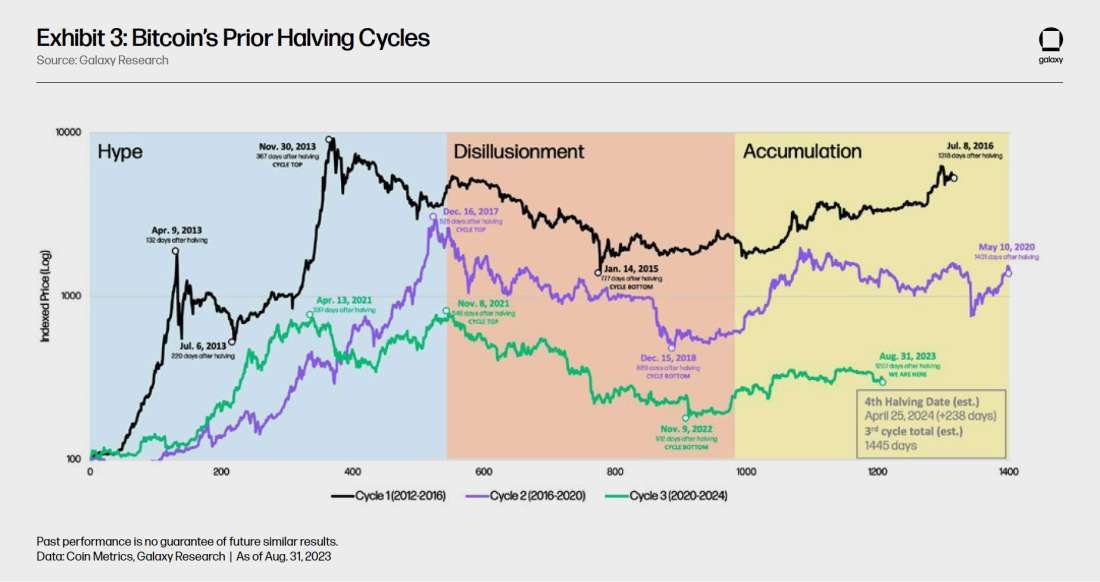

Bitcoin’s fixed terminal supply is enacted in code through quadrennial “halving” events. Approximately every four years, the rate of newly issued bitcoin reduces by half. These events will continue until roughly the year 2140 when the last piece of newly issued bitcoin is expected to be mined. A byproduct of these halving events has provided a seasonality effect in bitcoin’s price, as evidenced in exhibit 3.

In a world beset with stubborn inflation, monetary debasement, divergent and extreme fiscal policies, increasing multipolarity, and other macroeconomic challenges, bitcoin’s non-sovereign, transparent, and predictable nature stands out. Bitcoin’s fundamental properties may help it serve as a hedge against global uncertainties for investment portfolios in the long run.

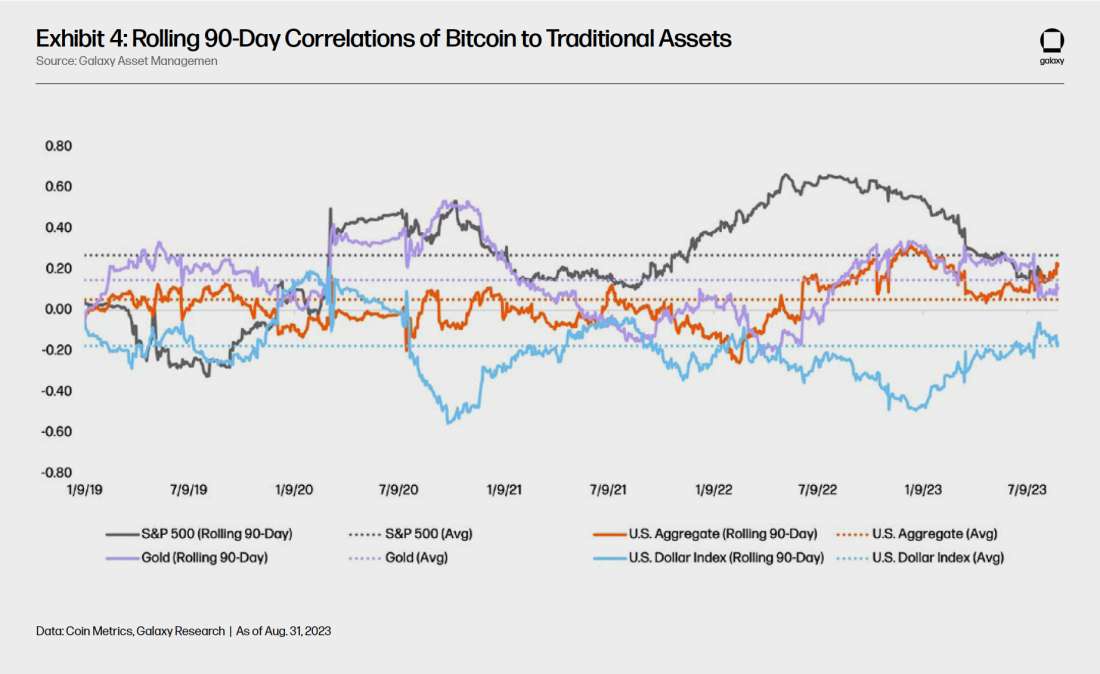

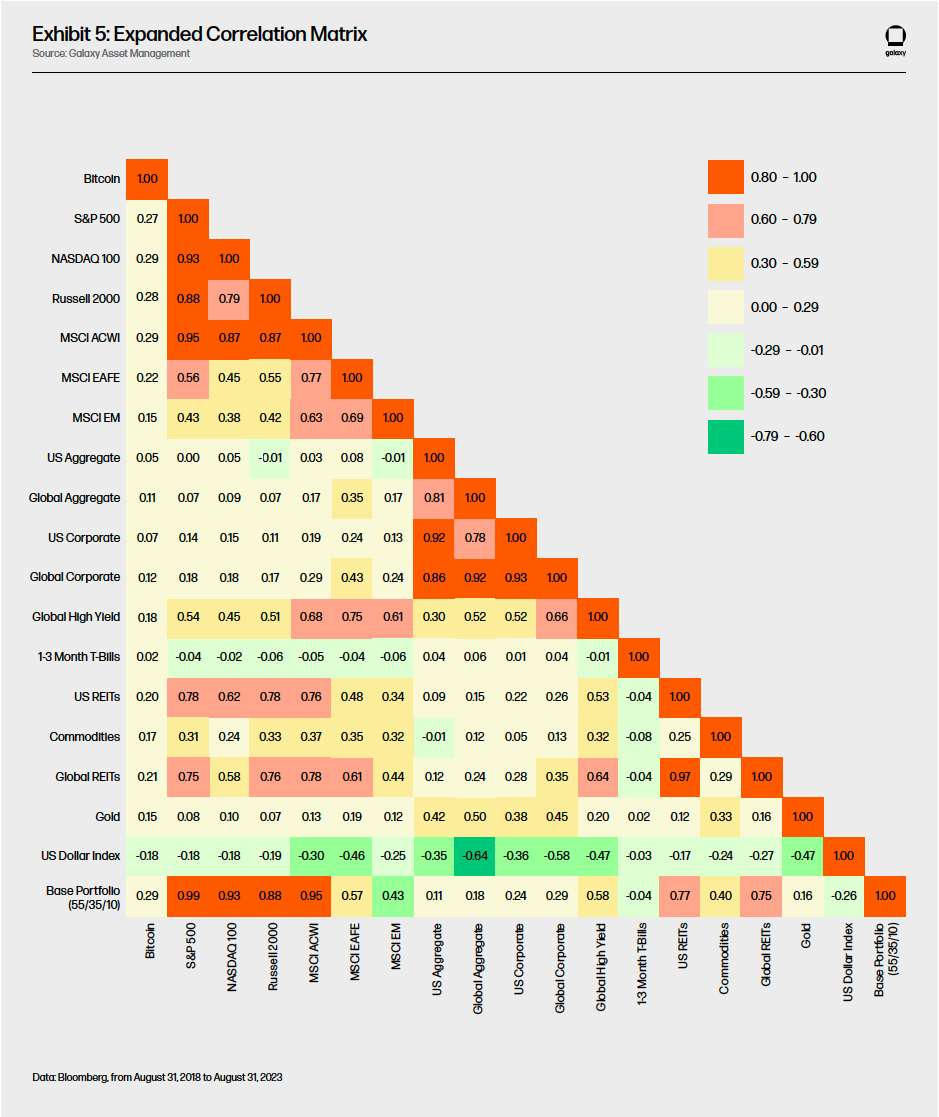

Historically, bitcoin’s correlation relative to established macro assets, on average, hovers within a +/- 0.30 range around zero. Over its 14-year history, bitcoin has demonstrated very low or even slightly negative correlation to most major global asset classes, including the S&P 500, Russell 2000, MSCI ACWI Index, US Agg Bond Index, Bloomberg Commodities, Gold, and the US Dollar index (see Exhibit 5). It is these typically low correlations to major asset classes paired with bitcoin’s asymmetric return profile that has enabled bitcoin to demonstrate return-enhancing outcomes when added to traditional portfolios. Although bitcoin is more volatile than traditional assets, its 30-day realized volatility continues to decline as adoption grows. While many view bitcoin as a risk asset and more closely correlated to equities, we anticipate bitcoin’s price behavior to resemble other non-fiat stores of value, like gold, in the long-term.

Bitcoin is still a novel asset, so there is no guarantee the current relationship between its returns and those of traditional asset classes will persist going forward, but our research suggests bitcoin may have an impactful role in a diversified portfolio. With its unique blend of scarcity, potential for significant returns, and role as a hedge against global macro uncertainties, bitcoin has carved a niche for itself as an indispensable asset in a diversified investment portfolio.

How to think about a bitcoin allocation?

Fundamentally, we now understand the role bitcoin can play in an investor’s portfolio – a hedge against global financial uncertainty; a scarce, secure, price-inelastic digital commodity, but which also possesses portability features that allow it to function as money. Quantitatively, we now also understand the role bitcoin can play as a diversifier in a portfolio. Next, we would like to further contextualize how bitcoin can enhance a portfolio and ways to think about an allocation.

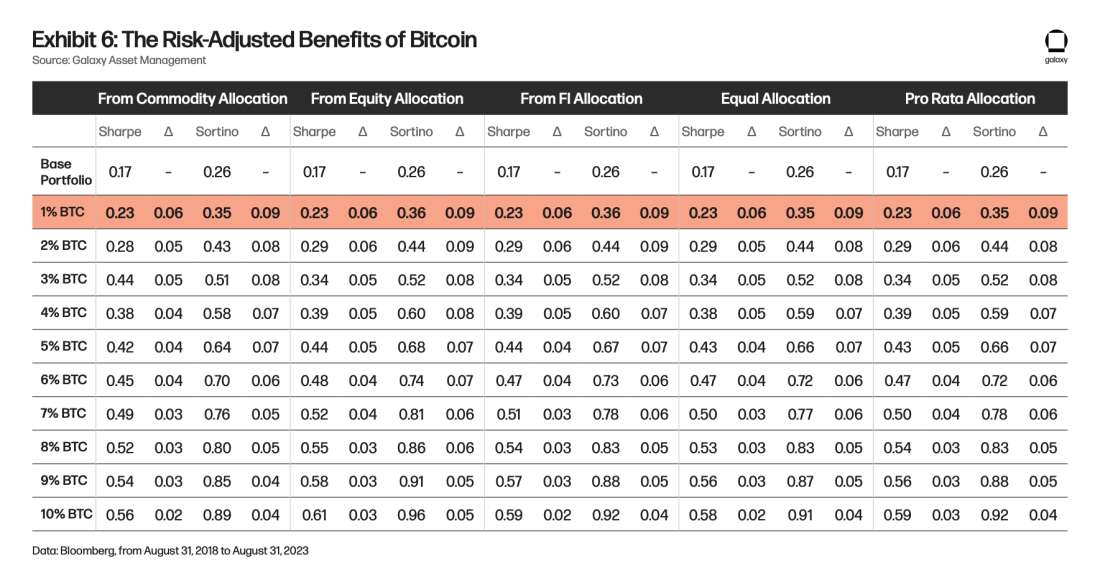

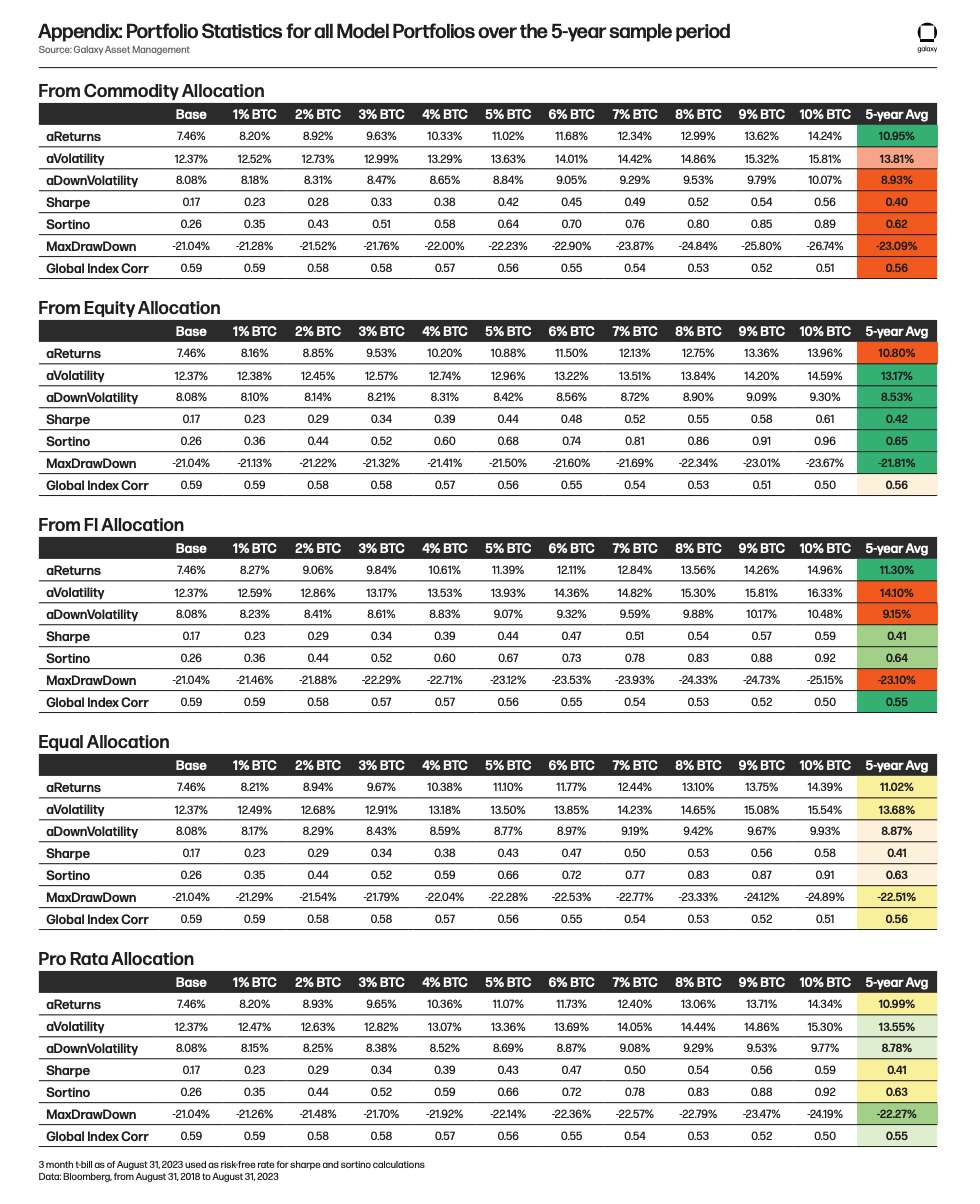

To perform our test, we started with a base portfolio of 55% equities (S&P 500 index), 35% fixed income (Bloomberg US Aggregate Bond Index), and 10% commodities (Bloomberg Commodities Index) (“Base portfolio”), rebalanced quarterly to these target weights. In our view, a five-year sample lookback period provides a comprehensive, yet conservative, window to assess the impact bitcoin may have on a diversified portfolio. This sample period excludes the bull-run in 2017, but includes two “crypto winters” and the all-time-highs reached in 2021. It was important to capture, in our view, a representative sample of bitcoin’s peaks, troughs, and volatility, while also excluding impacts of the base effect inherent with pre-2018 bitcoin price levels.

To conduct a thorough analysis, we created portfolios containing bitcoin allocations of 1% through 10%, reallocating entirely from the commodity sleeve, entirely from the equity sleeve, entirely from the fixed income sleeve, equally across all three sleeves, and pro rata from all three sleeves – creating fifty model portfolios in total.

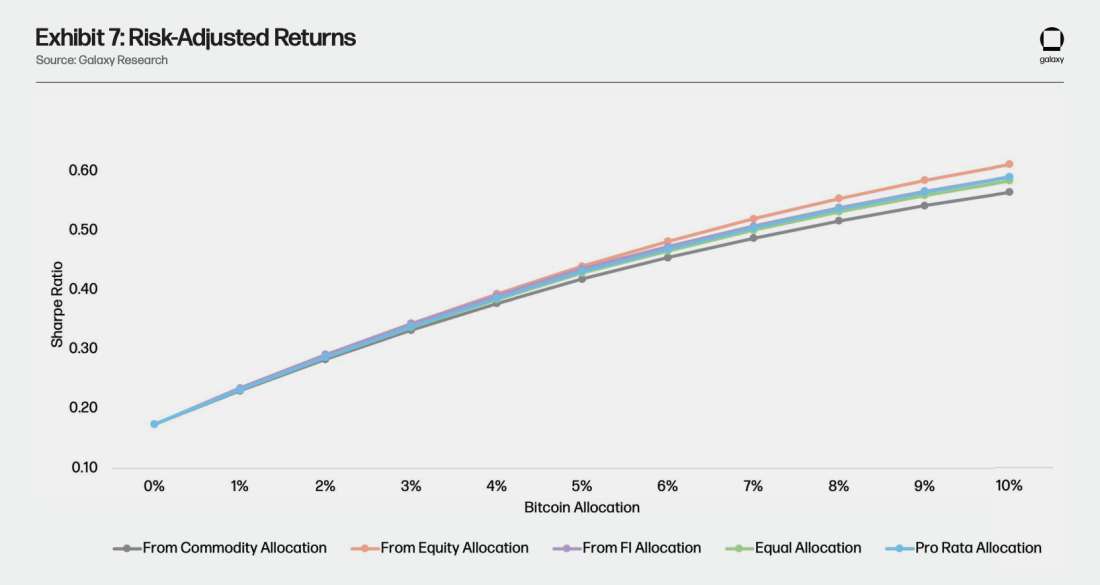

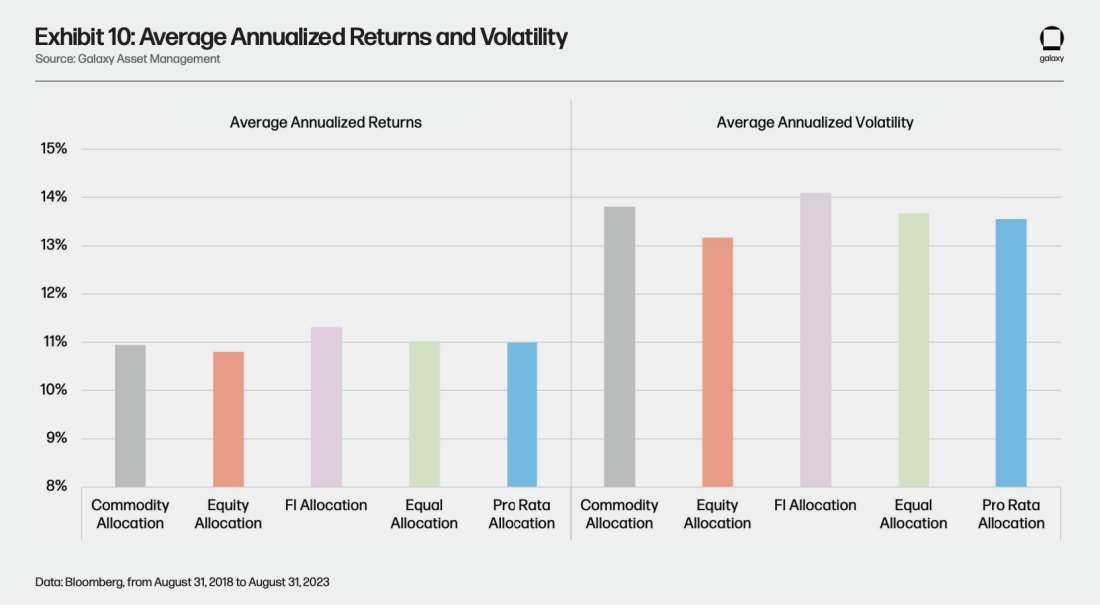

In all scenarios, our analysis indicates the best approach to portfolio construction is to “get off zero” when it comes to a bitcoin allocation. Regardless of where the reallocation is sourced, all portfolios we analyzed benefitted from an allocation to bitcoin over the observation period. In fact, the strongest marginal improvement to a portfolio’s risk-adjusted return, as measured by the Sharpe[4] and Sortino[5] ratios, occurred when moving from a 0% to a 1% allocation.

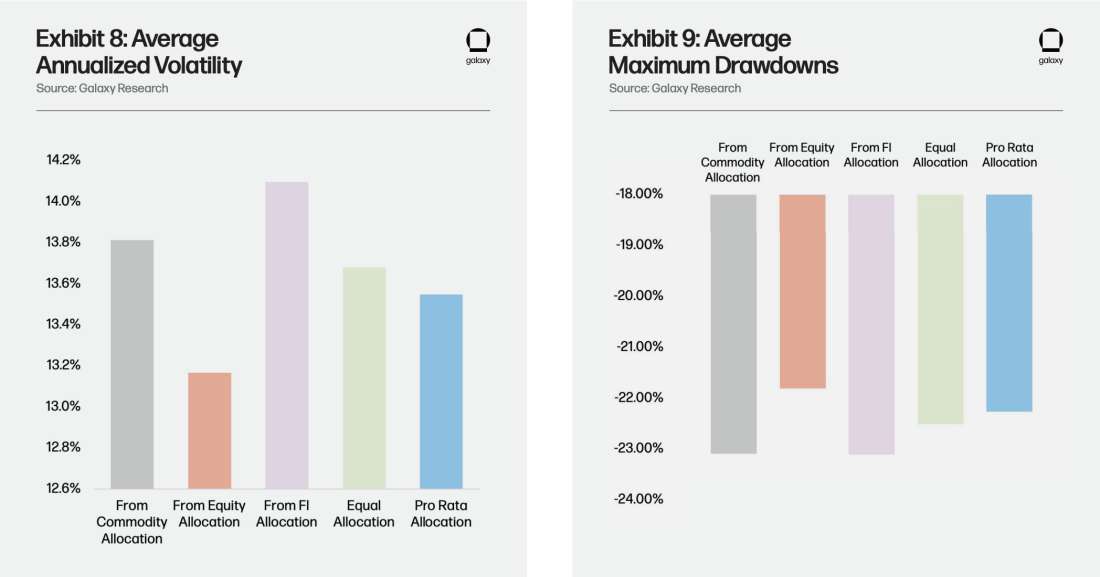

But, while “getting off zero” is clear, determining “how to get off zero” is just as important. Once an investor decides to allocate to bitcoin, from where in the portfolio should they draw capital for the allocation? Based on our analysis of the Base portfolio, funding a bitcoin allocation from the equity sleeve provided the most significant portfolio enhancement as measured by lower annualized volatility, higher risk-adjusted returns (Sharpe ratio), and lower maximum drawdowns. Intuitively, this makes sense given bitcoin’s elevated correlation with equities during the observed sample period relative to other asset classes.

Now, not all investor preferences are the same. An investor’s tolerance towards risk may dictate the size of a bitcoin allocation and where to reallocate from. Consequently, investors that tend to be more risk-averse may also benefit by reallocating from their equity sleeve.

Conversely, risk-seeking investors focusing on absolute returns may prefer allocating to bitcoin from their fixed-income sleeve. Our analysis suggests that funding a bitcoin allocation from fixed income may reward investors with higher annualized returns on average, but that comes at the expense of accepting the greatest risk, as measured by average annualized volatility.

An alternative approach to the reallocation question is to look at dynamic rebalancing methods. Since the five-year sample period for our analysis is brief relative to a long-term investment horizon, it may be prudent to initiate a bitcoin allocation pro-rata across the portfolio. Based on our analysis, this allocation framework, on average, resulted in some of the strongest all-around portfolio statistics. The appendix of this paper contains additional details.

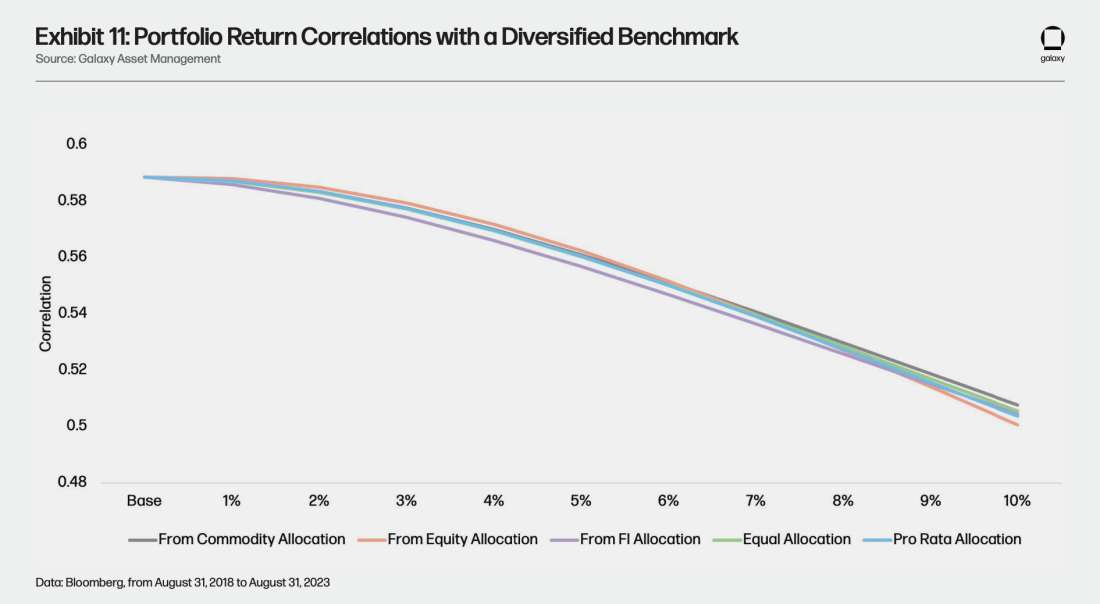

One final consideration to the allocation framework brings us back to bitcoin’s role as a diversifier. As a standalone asset, it’s evident that bitcoin has low correlations to most major asset classes. However, it’s important to demonstrate that bitcoin can maintain its ability to diversify in a portfolio context. To test this, we took our Base portfolio and calculated the correlation of its returns to that of a broad, global multi-asset benchmark – the Barclays Global Multi-Asset index. Next, we calculated the correlations of the returns of each of our model portfolios to the returns of this same benchmark to determine if the addition of bitcoin to our Base portfolio provided any portfolio diversification. The results suggest that bitcoin may not only help further diversify a portfolio, but as the bitcoin allocation increased, so did its ability to enhance portfolio diversification.

Regardless of an individual’s fundamental views of bitcoin, our analysis shows clearly that bitcoin improved the risk-adjusted returns and portfolio diversification of our Base portfolio. Applying a strategic asset allocation framework to bitcoin can result in several approaches. However, during our five-year sample period, allocating to bitcoin from the Base portfolio’s equity sleeve yielded the strongest risk-adjusted returns, lowest volatility, and lowest draw downs. More importantly, “getting off zero” is not just prudent, but imperative for investors seeking diversification and robust performance. In essence, integrating bitcoin into traditional investment portfolios is no longer a speculative bet, but a forward-looking approach to holistic financial planning and wealth preservation.

Legal Disclosure:

This document, and the information contained herein, has been provided to you by Galaxy Digital Holdings LP and its affiliates (“Galaxy Digital”) solely for informational purposes. This document may not be reproduced or redistributed in whole or in part, in any format, without the express written approval of Galaxy Digital. Neither the information, nor any opinion contained in this document, constitutes an offer to buy or sell, or a solicitation of an offer to buy or sell, any advisory services, securities, futures, options or other financial instruments or to participate in any advisory services or trading strategy. Nothing contained in this document constitutes investment, legal or tax advice or is an endorsementof any of the digital assets or companies mentioned herein. You should make your own investigations and evaluations of the information herein. Any decisions based on information contained in this document are the sole responsibility of the reader. Certain statements in this document reflect Galaxy Digital’s views, estimates, opinions or predictions (which may be based on proprietary models and assumptions, including, in particular, Galaxy Digital’s views on the current and future market for certain digital assets), and there is no guarantee that these views, estimates, opinions or predictions are currently accurate or that they will be ultimately realized. To the extent these assumptions or models are not correct or circumstances change, the actual performance may vary substantially from, and be less than, the estimates included herein. None of Galaxy Digital nor any of its affiliates, shareholders, partners, members, directors, officers, management, employees or representatives makes any representation or warranty, express or implied, as to the accuracy or completeness of any of the information or any other information (whether communicated in written or oral form) transmitted or made available to you. Each of the aforementioned parties expressly disclaims any and all liability relating to or resulting from the use of this information. Certain information contained herein (including financial information) has been obtained from published and non-published sources. Such information has not been independently verified by Galaxy Digital and, Galaxy Digital, does not assume responsibility for the accuracy of such information. Affiliates of Galaxy Digital may have owned or may own investments in some of the digital assets and protocols discussed in this document. Except where otherwise indicated, the information in this document is based on matters as they exist as of the date of preparation and not as of any future date, and will not be updated or otherwise revised to reflect information that subsequently becomes available, or circumstances existing or changes occurring after the date hereof. This document provides links to other Websites that we think might be of interest to you. Please note that when you click on one of these links, you may be moving to a provider’s website that is not associated with Galaxy Digital. These linked sites and their providers are not controlled by us, and we are not responsible for the contents or the proper operation of any linked site. The inclusion of any link does not imply our endorsement or our adoption of the statements therein. We encourage you to read the terms of use and privacy statements of these linked sites as their policies may differ from ours. The foregoing does not constitute a “research report” as defined by FINRA Rule 2241 or a “debt research report” as defined by FINRA Rule 2242 and was not prepared by Galaxy Digital Partners LLC. For all inquiries, please email [email protected]. ©Copyright Galaxy Digital Holdings LP 2023. All rights reserved.