Top Stories of the Week - 2/16

This week in the newsletter, we write about the explosive inflows into BTC ETFs, opposition to the SEC’s restrictive rules on banks working with crypto, and the long-awaited announcement of StarkNet’s airdrop.

Subscribe here and receive Galaxy's Weekly Top Stories, and more, directly to your inbox.

Bitcoin ETFs Heat Up

Bitcoin Spot ETF flows are gaining momentum this week as Bitcoin tops $50k for the first time since December 2021. On February 13, Bitcoin ETFs had their strongest day since launch, recording $631m in positive net inflows across all ETFs (+12,736 BTC). BlackRock’s spot BTC ETF saw $493m of net inflows on February 13, representing 70% of the total spot BTC ETF flows that day. On the same day, Fidelity's spot BTC ETF recorded $163.6m in net inflows, approximately 23% of the total spot BTC ETF flows that day. BlackRock’s spot BTC ETF now holds over $5.6bn assets under management, placing it in the top 7% of all ETFs by size in just 24 days.

While spot BTC ETFs recorded their highest day of net inflows on February 13, Grayscale saw their second lowest day of net outflows at $72.8m. Since January 11, 2024, BTC spot ETFs have amassed over $4bn in positive net flow.

OUR TAKE:

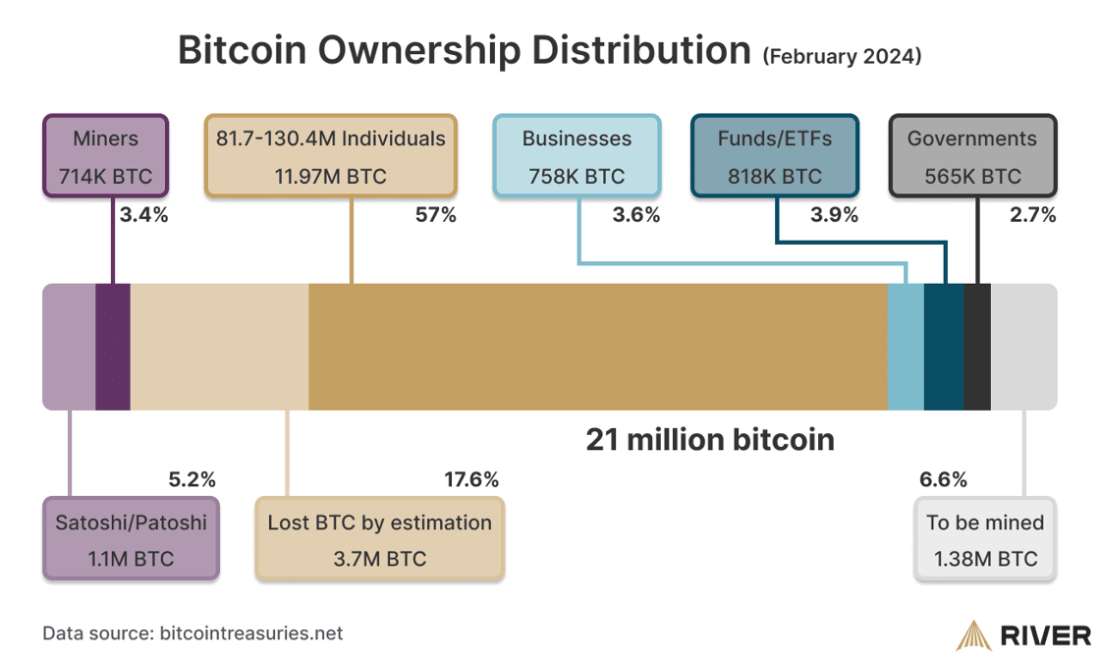

The rising net inflows into BTC spot ETFs suggest increasing confidence and familiarity among U.S.-based investors regarding the structure of these ETF products. As reported by River Financial, Bitcoin ETF providers and funds now hold 3.9% of BTC's circulating supply, surpassing the holdings of publicly traded miners (3.4%) and businesses (3.6%). With the Bitcoin Halving just 64 days away, it is anticipated that the spread between Bitcoin ETFs/funds and public miners in terms of ownership of circulating BTC supply will continue to expand.

The increase in BTC spot ETF inflows is significant as we approach Bitcoin’s fourth halving. When taking the average net inflows in BTC terms over the past six trading days, Bitcoin ETFs are taking approximately 10x more bitcoin off the market than BTC issued daily from the block reward, which is about 868 BTC. If the current Bitcoin ETF inflows hold through the halving, then Bitcoin ETFs will be taking 20x more off the market than the daily issuance.

The spike in inflows surprised many observers given that wealth management platforms, widely seen as the primary net-new accessible market opened by these ETFs, has largely not yet allowed Bitcoin ETF trading for their end-clients. The impressive flows are largely happening through brokerage platforms and, although high net worth investors and institutional traders like hedge funds can and do use those platforms, that there is significant retail demand for Bitcoin exposure.

As the market becomes more aware of the effect the halving will have in relation to increasing relative share of BTC spot volume driven by the ETFs, and as wealth management platforms turn on access, it is possible that the net inflows for Bitcoin ETFs to increase over the next 64 days. Additionally, BTC reclaiming the critical $50k mark will also entice sidelined investors to re-consider their BTC positioning leading up to the halving. - Gabe Parker, Alex Thorn

Banks Call on SEC to Reverse Crypto Guidance

A coalition of bank trade groups called for the SEC to overturn S.A.B. 121, a March 2022 guidance that effectively prohibits banks from holding crypto assets. Staff Accounting Bulletin 121 is SEC interpretive guidance that requires companies safeguarding cryptoassets for customers to account for those customer assets as balance sheet liabilities, which effectively removes the typical bankruptcy-remoteness enjoyed by clients who safeguard their assets with a custodian.

For banks, which are major custodians of assets in our financial system, the rule was particularly prohibitive due to the fact that bank balance sheet practices are highly regulated. Specifically, banks have regulatory capital requirements, and requiring banks to hold client assets as on-balance sheet liabilities increases the amount of regulatory capital they must hold. In practical terms, SAB 121 made it economically impossible for banks to offer cryptoasset custody services because of the increase in regulatory capital they’d be required to hold to do so.

Two weeks ago, Senator Cynthia Lummis (R-WY) joined Reps. Wiley Nickel (D-NC) and Mike Flood (R-NE) to introduce Congressional Review Act (CRA) resolutions in the Senate and House to overturn SAB 121. The CRA was enacted as part o the Small Business Regulatory Enforcement Fairness Act in 1996 and requires federal agencies to report the issuances of “rules” to Congress and allows Congress to pass legislation to overturn rules.

OUR TAKE:

The SEC staff justified SAB 121 by arguing that safeguarding cryptoassets enatiled significant and unique risks not present with traditional assets. While it’s true that cryptoasset custody is different from custodying assets like stocks, the reality is that modern cryptoasset custody is extremely advanced, with redundancies like multisig or MPC and the ability to cryptographically prove and disclose ownership through proofs of reserves.

SAB 121 is terrible for individual investors. Banks are historically the safest third-parties with whom individuals can custody their assets, but the combination of SAB 121 and bank capital requirements has made it impossible for banks to service this industry. Even on the non-bank public company side, by forcing companies like Coinbase to carry client assets as balance sheet liabilities, the SEC turns all depositors into unsecured creditors in the event of a bankruptcy. So, SAB 121 effectively weakens the guarantees of existing custodians and prevents the entrance of new types of custodians.

Under former OCC leader Brian Brooks, during the Trump administration, the restrictions on bank interactions with crypto assets were eased materially with several guidances, but those have been rescinded by the OCC. Similarly restrictive guidances have come from the Federal Reserve and the FDIC. SAB 121 notably also prevents banks from being custodians for the Bitcoin ETFs. And the inability of broker dealers to touch bitcoin – the result of SEC rules and guidance – is part of the reason that the SEC did not allow Bitcoin ETF issuers to support in-kind creations and redemptions (because the broker dealers and banks wouldn’t be able to participate). Broadly, the restrictions on banks interactions with blockchains, whether on custody, stablecoin issuance, network transactions, or even more “vanilla” blockchain use cases like tokenization or records management, have been a setback for the advancement and institutionalization of crypto in America. Congress has noticed and, now, finally, so have the banks themselves. - Alex Thorn

Starknet’s STRK Token to Launch Next Week

StarkWare announces Starknet Provisions Program (STRK Airdrop). Starknet Foundation announced the Starknet Provisions Program that will distribute the first allocation of Starknet Tokens (STRK) to the community – starting on February 20, over 700m STRK may be claimed across ~1.3m eligible addresses. Eligible STRK recipients include Starknet users, developers, community contributors, StarkEx users (users of projects including dYdX, Immutable X, Sorare, and RhinoFi prior to cut-off date of 6/1/22), Ethereum protocol contributors and stakers, and developers of select non-crypto open-source projects.

For background, Starknet is an L2 ZK-rollup secured by STARK validity proofs. Starknet's native programming language is Cairo, a specialized but relatively flexible coding language compared to the rest of Ethereum ecosystem. Starknet offers Account Abstraction natively for frictionless transaction signing.

The STRK token will be used for (i) paying network fees - currently Starknet fees are paid in ETH but end users will have choice of payment in STRK or ETH post token launch, (ii) participation in governance, and (iii) staking within PoS model with decentralized network of sequencers (expected at a later date). StarkWare published its token-minting proposal for Starknet on 2/7/24, which details how they plan to transition the operation of the Starknet sequencer and prover to a PoS protocol to enable an expanded operator set of operators / validators.

The first round of Provisions will distribute 700m (out of 900m STRK total in the Provisions program and out of 1.8bn STRK total allocated to the community). Any unclaimed tokens after 4 months from the token launch event will be reclaimed to the pool and used for future distribution programs. Read the Tokenomics documentation for further details on STRK distribution details.

OUR TAKE:

StarkWare set off on an ambitious path 6 years ago to build out a specialized non-EVM rollup based around the Cairo programming language using STARK proofs. This can be an important differentiator for StarkNet as the L2 landscape becomes increasingly congested with EVM-based generalized rollups – not only is there a new ZK rollups from established teams as zk-tech matures (incl. Linea, Scroll, zkSync, Polygon - each of which have not (yet) launched tokens except for MATIC (soon to be POL)), there’s also another wave of L2 competitors or ‘Alt L2s’ (e.g., Manta Pacific, Mantle, Blast) that have already generated significant interest and network activity.

Starknet’s token design brings several innovations: while StarkNet operators have been paying fees in ETH, end users can opt to pay transaction fees in either ETH or the STRK token (thanks to Starknet’s native account abstraction). The team has also introduced a new PoS system for STRK to be staked to achieve its decentralization goals (scheduled for late 2024 or 2025). These new concepts will be important for other rollup teams to monitor going forward as they work to improve on their own token designs.

This is one of the widest airdrop distributions ever with 1.3m eligible addresses. The airdrop will also reward early pre-Merge Ethereum stakers including greater allocations for solo stakers, which could set precedent for future airdrops to award more ‘Ethereum-aligned’ contributors. Interestingly, the Foundation is also rewarding non-crypto open-source project contributors to attract more builders to the ecosystem.

However, one point of criticism around the STRK token design is the unlock schedule for insiders – in just two months on 4/15/24, 13.1% of the total supply is scheduled to unlock for Investors and Early Contributors, which would effectively triple the circulating token supply after the Provision Program launch. This sets a poor precedent for token designs and unlock schedules as insiders (investors & core contributors) would have little incentive to continue contributing after the first major unlock. We are hopeful that the team will either delay the vesting periods for insiders to a later date or provide greater assurances of their long-term commitment to the project. - Charles Yu

Charts of the Week

Solana users have been paying an elevated amount of priority fees since the start of 2024. They have paid a total of $18.2m so far in 2023, compared to just $6.6m in the last four months of 2023. Increased use of the network has made transaction inclusion more competitive, prompting users to add priority incentives to validators.

Priority fees have been occupying a growing share of non-vote transaction fees paid on the network. More than 90% of the 274.1k SOL worth of fees paid over the last three months have come in the form of priority fees. In January 2024 they outpaced base fees by more than 12 times. Note, Solana has a fixed base fee of 5,000 lamports (the smallest denomination of SOL) which equates to 0.00005 SOL per transaction – or $0.0056 at current prices around $111 / SOL.

Other News

Coinbase beats Q4 estimates as transaction revenue rises to $529 million

MicroStrategy's bitcoin is worth more than $10 billion as cryptocurrency nears $53,000

Court rules Genesis can sell over $1.3 billion worth of GBTC shares

ENS community mulls $300,000 settlement with Manifold in eth.link domain dispute

Ripple plans to acquire digital asset platform Standard Custody

Ether options open interest on CME on track to hit fresh all-time high

Puffer Finance hits $850m in TVL, now second-largest liquid restaking platform

Legal Disclosure:

This document, and the information contained herein, has been provided to you by Galaxy Digital Holdings LP and its affiliates (“Galaxy Digital”) solely for informational purposes. This document may not be reproduced or redistributed in whole or in part, in any format, without the express written approval of Galaxy Digital. Neither the information, nor any opinion contained in this document, constitutes an offer to buy or sell, or a solicitation of an offer to buy or sell, any advisory services, securities, futures, options or other financial instruments or to participate in any advisory services or trading strategy. Nothing contained in this document constitutes investment, legal or tax advice or is an endorsementof any of the digital assets or companies mentioned herein. You should make your own investigations and evaluations of the information herein. Any decisions based on information contained in this document are the sole responsibility of the reader. Certain statements in this document reflect Galaxy Digital’s views, estimates, opinions or predictions (which may be based on proprietary models and assumptions, including, in particular, Galaxy Digital’s views on the current and future market for certain digital assets), and there is no guarantee that these views, estimates, opinions or predictions are currently accurate or that they will be ultimately realized. To the extent these assumptions or models are not correct or circumstances change, the actual performance may vary substantially from, and be less than, the estimates included herein. None of Galaxy Digital nor any of its affiliates, shareholders, partners, members, directors, officers, management, employees or representatives makes any representation or warranty, express or implied, as to the accuracy or completeness of any of the information or any other information (whether communicated in written or oral form) transmitted or made available to you. Each of the aforementioned parties expressly disclaims any and all liability relating to or resulting from the use of this information. Certain information contained herein (including financial information) has been obtained from published and non-published sources. Such information has not been independently verified by Galaxy Digital and, Galaxy Digital, does not assume responsibility for the accuracy of such information. Affiliates of Galaxy Digital may have owned or may own investments in some of the digital assets and protocols discussed in this document. Except where otherwise indicated, the information in this document is based on matters as they exist as of the date of preparation and not as of any future date, and will not be updated or otherwise revised to reflect information that subsequently becomes available, or circumstances existing or changes occurring after the date hereof. This document provides links to other Websites that we think might be of interest to you. Please note that when you click on one of these links, you may be moving to a provider’s website that is not associated with Galaxy Digital. These linked sites and their providers are not controlled by us, and we are not responsible for the contents or the proper operation of any linked site. The inclusion of any link does not imply our endorsement or our adoption of the statements therein. We encourage you to read the terms of use and privacy statements of these linked sites as their policies may differ from ours. The foregoing does not constitute a “research report” as defined by FINRA Rule 2241 or a “debt research report” as defined by FINRA Rule 2242 and was not prepared by Galaxy Digital Partners LLC. For all inquiries, please email [email protected]. ©Copyright Galaxy Digital Holdings LP 2024. All rights reserved.