Top Stories of the Week - 1/26

This week in the newsletter, we share updates about the Crypto Open Patent Alliance’s (COPA) suit against Craig S. Wright, Solana expanding token functionality, and debates about Ethereum’s software client diversity.

Subscribe here and receive Galaxy's Weekly Top Stories, and more, directly to your inbox.

Will the real Satoshi please stand up?

COPA rejects settlement offer from self-proclaimed Satoshi over Bitcoin copyright lawsuit. Craig S. Wright, the individual who has for years claimed to be Bitcoin creator Satoshi Nakamoto, faced yet another setback in his lengthy legal battles over his claim to be the creator of Bitcoin. The Crypto Open Patent Alliance (COPA), the primary legal party in a UK suit against Wright, which is backed by Coinbase, Block Inc. (formerly Square) and other major cryptocurrency firms, quickly rejected Wright’s settlement offer Thursday a day after Wright proposed it.

Wright has sued individuals like Peter McCormack and @hodlnaut for alleging that he is a “fraud” as well as Bitcoin developers for using and developing software for which he claims to have a copyright. COPA’s suit against Wright attempts to prove that Wright is not, in fact, Satoshi Nakamoto. If COPA wins its suit, the organization hopes that other parties to Wright’s various litigations will be able to use the ruling to bolster their defenses.

Wright’s proposed terms of the settlement included: (i) waiving his database rights and copyrights over BTC, BCH, ABC & BSV databases, (ii) offering an irrevocable license to the parties who control / own those databases with all parties agreeing not to fork a new Bitcoin database; in return, Wright asked that (iii) the opposition agrees to cease any media campaigns against Wright. Wright claimed that the settlement offer preserves his “objective of maintaining the integrity of the Bitcoin system as it was initially developed, while“ limiting (for all parties) the needless expense of a lengthy High Court trial, which would take our collective focus away from supporting, adopting and advancing digital currency technologies,” according to the letter published to his blog. [Note: Wright’s Bitcoin Satoshi Vision (BSV) is a fork of Bitcoin Cash (BCH), which is a fork of Bitcoin.]

COPA cited in its rejection that the proposed settlement would “force us to accept that he is Satoshi,” adding that “the settlement comes with loopholes that would allow him to sue people all over again.” To further support their legal opposition, COPA published new forensic evidence of 20 forgeries in previously submitted documents that Wright considers crucial to his identity claims. The opening arguments in the COPA v. Wright trial in UK courts are scheduled to begin on February 5.

OUR TAKE:

While the BSV founder remains adamant that he is the creator of Bitcoin, his settlement offer suggests that he and his legal team are fearing that justice may be coming. Time and time again – in his suit against McCormack, against Hodlnaut, another suit in Florida federal court – large swaths of evidence submitted by Wright to back the assertion that he is Satoshi has been roundly debunked and rejected by judges One of the most humorous incidents occurred during the Kleiman v. Wright case when Wright submitted a list of Bitcoin addresses he claimed to own (as “Satoshi”), but the true owner of several of those addresses emerged and signed a cryptographic message with keys for those addresses calling Wright “a liar and a fraud” (that individual was also not Satoshi – they were just very old Bitcoin addresses). Legal pressure to settle appears to stem from evidence of forgeries presented by COPA regarding the mysterious, supposedly untouched disk drive from 2007 that Wright had suddenly come across in September 2023 (yet failed to disclose sooner) to support his claim of being Satoshi. Under forensic investigation, many documents that Wright asserts show that he worked on the Bitcoin white paper prior to its public release on Halloween 2008 were shown to be backdated and forged, using fonts or software not created until well after Satoshi published the white paper. Though all parties seemingly agree that Bitcoin should remain a public good that is free and accessible to all, COPA was quick in rejecting Wright’s proposed settlement terms especially as Wright had not offered to renounce his claim to being the creator of Bitcoin.

In the past, Wright and his legal team have gone to extreme lengths to silence any opposition to his identity claims – he has gone after individuals who have been outspoken of him including prominent Bitcoiners Peter McCormack and @hodlonaut, who have detailed Wright’s threatening and abusive behavior and the dramatic impact his actions have had on their lives. In addition to filing libel cases that appeared aimed to bankrupt these individuals, Wright allegedly hired Pis, promoted smear campaigns, and supported personal threats by his followers against his legal opposition. Wright suffered loses in these defamation cases in recent months as courts found insufficient evidence to support his claim to be Satoshi. In Peter McCormack’s case, the court ruling was finalized as Wright’s final appeal had reportedly been denied by the UK Supreme Court according to a tweet on Thursday.

As far as we can tell, Wright has never provided any conclusive evidence that he is Satoshi, and he has repeatedly provided proven forgeries or had his evidence powerfully debunked (sometimes cryptographically). At the same time, he has pursued a vindictive, opportunistic, litigious strategy to silence his critics and burden Bitcoin Core developers, who mostly work for free because they believe in the power of Bitcoin. The settlement offer is an interesting gambit by Wright, because he ostensibly gives COPA what they’re seeking – the right to work hassle-free on Bitcoin – but he does so by “granting” them unlimited license to the software by virtue of his supposed ownership of its copyright. However, as COPA rightly points out, accepting the settlement would give Wright what he really wants – admission that he owns a valid copyright to the Bitcoin source code. (It’s worth noting that Satoshi released Bitcoin’s source code on SourceForge in 2009 and explicitly did so under the MIT License, an extremely permissible open-source software license that already allows anyone to “use, copy, modify, merge, publish, distribute, sublicense, and/or sell copies… without restriction,” so even if Wright did own the copyright, Bitcoin developers wouldn’t need his new offered license to work on it.

Given Wright’s long history, it’s likely he’ll find some other way to harass Bitcoin developers even if he loses this case. But we hope COPA can prevail here and that their victory will help provide cover to Wright’s other victims – many of whom are just open-source software developers who believe in the Bitcoin project. Bitcoin has no foundation or company, so there’s no entity to step in and protect it in the courts, so big shout out to COPA and its financial backers for working to defend Bitcoin.-Charles Yu

Solana Launches Token Extensions

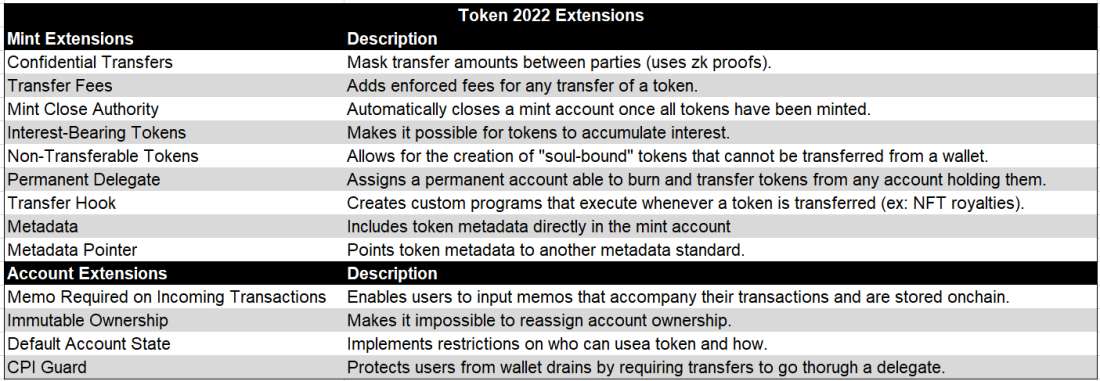

The Solana Foundation officially announced the launch of token extensions, a new Solana token program that expands token functionality for issuers. The new program, previously called Token-2022, is launching with thirteen extensions:

Extensions have been in development since 2021 (hence the original name Token 2022) and some initial functionality came online in Spring 2023 prior to all audits being completed. They were officially implemented with the latest update to the Solana Labs validator client, v1.17, but some further functionality, such as enabling anonymous transfers, will be released later this year with the v1.18. It is not possible to automatically convert tokens from the original standard to the Token 2022 standard. Doing so requires users to opt-in to do it and burns the previous token iteration. Extensions upgrade Solana’s original token program, Tokenkeg, which only enables a subset of transactions and requires complex smart contract programming or, in some cases, is not capable of implementing more advanced functionality. This limits interoperability and adds complexity for teams developing products that rely on multiple token types.

The announcement highlighted new possibilities unlocked by extensions for legitimate business use cases, such as payments and stablecoins. The introduction of transfer hooks enables token transfers to invoke programs requiring KYC/AML and confidential transfers are non-anonymous non-private transfers that can be used for use cases like payroll (but which hide the amounts of the transfers). Alongside the extensions launch, GMO Trust announced they would be launching a Japanese yen stablecoin and US dollar stablecoin on Solana. This followed Paxos’ launch of its USDP offering on Solana last week. Both companies pointed to extensions as partially enabling their launch.

OUR TAKE:

Solana’s resurgence has been partly driven by a narrative that its design choices and focus on scalability make it one of few public blockchains capable of hosting a product with mainstream adoption today. In other words, the Solana developer community can focus on developing applications, not infrastructure. In reality, infrastructure developments over the past year have also been instrumental to the network’s growth.

Validator client updates have resulted in Solana having its longest streak with no downtime (a year on February 25) and ensured the network could handle the incredible uptick in activity it experienced in recent months. State compression introduced a financially viable way to distribute digital assets at scale, opening the door for DePIN projects like Helium and Render to migrate to Solana and NFT collections to drop to millions of users. Token extensions even further expand the design space, bringing Solana’s token program up to par with functionality on Ethereum.

Not all members of the Solana community agreed with the approach, most notably the permanent delegate extension, which allows token creators to control token balances in other accounts and could be exploited by malicious actors. However, this is also a necessary functionality for use cases like issuing/reissuing soulbound credentials or enabling freeze and seize capability for asset recovery. It reflects the types of functionalities Solana Foundation believes will facilitate onboarding of businesses that want to use a public blockchain while maintaining the same privacy and protections afforded on traditional financial rails. The challenge remains, can Solana’s ecosystem demonstrate that beyond these new functionalities there are practical advantages over the alternatives? -Lucas Tcheyan

Lido and Coinbase Respond to Criticism Over Lack of Client Diversity

A bug in the Nethermind client that caused roughly 10% of Ethereum validators to lose connection to the network has reinvigorated efforts to improve Ethereum’s execution layer (EL) client diversity. On Friday, January 19, the Nethermind team released a new version of their software featuring major optimizations and improvements such as 40 to 50% faster block processing speeds. On Sunday, January 21, Ethereum validator node operators running the latest Nethermind release reported issues and failures related to block processing. Within a few hours, the Nethermind team was able to patch the bug and re-release an updated version of their client for node operators to download.

The incident with the Nethermind client over the weekend sparked renewed concerns about EL client diversity on Ethereum because if the bug causing validators to cease block processing had been identified in the Geth client, it would have impacted far more than 10% of Ethereum validators. A serious bug in the Geth client would have impacted close to 80% of validators and their rewards, and resulted in network-wide delays to block finality. Luckily, because Nethermind is a minority client, the brief outage of 10% of validators did not materially impact the user experience on Ethereum.

Though the incident was minor, the response from the Ethereum community was grave and far-reaching. Nixo Rokish, Executive Director of EthStaker, wrote in the Ethereum Discord the day of the incident, “If this had been a Geth bug, the network would stop finalizing and it would kickstart the inactivity leak and validators running Geth would start experiencing higher and higher penalties … In the case of an invalid block, the supermajority client could even build a forked version of the chain and start finalizing it. These validators can’t come back to the original chain even with a bugfix to Geth. Chaos.” Rokish wrote tweets encouraging users and major staking providers like Coinbase to diversify their operations away from Geth. Many other prominent individuals and core developers in Ethereum ecosystem amplified these sentiments further emphasizing the importance of EL client diversity.

In response to reinvigorated concerns over client diversity, Coinbase tweeted on Monday that they would re-evaluate their use of Geth as the only EL client for their Ethereum staking operations. They also noted: “When launching Ethereum staking and evaluating execution layer clients to maximize these traits, Geth was the only client that met our technical requirements. Although we’ve evaluated execution clients since 2020, none have met Coinbase Cloud’s requirements to date.” Lido, the largest staking pool on Ethereum, also responded to client diversity concerns. They tweeted on Tuesday that Geth usage across Lido node operators has dropped from 93% in Q4 2022 to 67% in Q4 2023 and that the Lido team would continue to actively work with their node operators “to help reduce supermajority client risk in Ethereum.” Allnodes, a staking infrastructure provider operating over 20,000 validators on Ethereum, announced on Thursday that they had switched all their validator clients to Besu and was no longer operating any clients with Geth software. P2P.org, another staking infra provider operating over 17,000 validators on Ethereum, also announced on Thursday that they had switched all their validator clients to Besu and was no longer operating any clients with Geth software.

OUR TAKE:

The response from the Ethereum community on client diversity though fierce on social media has historically resulted in little to no material change to EL client topography. For years, Geth has retained its dominance as the primary EL client of choice for node operators despite instances of bugs in its code and the code of other EL clients. There are several reasons for this:

Geth is the most long-running, battletested EL client.

Because it is the most widely used EL client, there is lots of documentation and tutorials for its use, making it easier to spin-up and troubleshoot in comparison to newer clients.

It is the only client fully supported and financed by the Ethereum Foundation, the primary non-profit that spearheads Ethereum protocol research and coordinates upgrades. Not only does this carry reputational weight, but it also makes the client less likely to be deprecated over the long-run like other popular EL clients (such as Parity/OpenEthereum) have been in the past.

There is safety in numbers. A bug impacting the Geth client would impact the vast majority of stakers and as seen over the past week, the Ethereum community is not aligned over whether stakers in this event should be reimbursed for their lost rewards. It is clear however that users running a minority client will not be reimbursed for lost rewards in the event of bug in a minority client.

Despite the strong rationale for node operators to individually choose Geth over other EL clients, there is a strong argument that collectively the Ethereum network as a whole would be more secure with higher levels of client diversity. Because Ethereum continues to upgrade large swaths of its core protocol, client teams are required to frequently release new versions of their software, which increases the odds of errors in code. A diversity of client implementations would protect the network from degradations in liveness and finality in the scenario of an unexpected bug impacting a single client if no one client on Ethereum controls more than 33% of active validators. The strongest rationale for client diversity on Ethereum is for the common good of the network. To some extent, this rationale has been influential in changing the behaviors of certain node operators such as Allnodes and P2P.org.

But it is difficult to see how the majority of node operators on Ethereum would be convinced to switch from Geth to a minority client for altruistic reasons alone, without incentives impacting operators individually (in some ways, this is a “tragedy of the commons” problem). To this end, Geth developer Marius van der Wijden has started a campaign on Twitter encouraging minority client teams to promote features and advantages that are exclusive to their client. In his tweets, Van der Wijden highlighted the fact that the Besu client has a unique state format called Bonsai that pairs nicely with the Teku consensus layer client and the Nimbus client is more optimized than other clients for superior performance on resource constrained devices. Indeed, the performance, usability, and security of minority clients is and should be the primary decision-making factor in node operators’ minds when considering whether to switch from Geth to another client. When the advantages of operating a minority client outweighs, or at least is competitive to, the benefits described above for operating Geth, it is in the best interest of node operators to choose to run a different client.

There are barriers to entry to build and maintain a performant Ethereum client. Client software is a public good so it comes as no surprise that there’s usually only one supporting most public blockchains. However, given the ambitious development roadmap of Ethereum, the Ethereum ecosystem would benefit from several and the most rational way to encourage client diversity is to encourage the development of competitive clients. – Christine Kim

Charts of the Week

MakerDAO’s exposure to U.S. Treasury Bills (T-Bills) has been reduced by $1.27 billion since the end of October 2023. This comes at a time when on-chain assets are being increasingly used to create new DAI. Maker’s T-Bill exposure comes from three collateral vaults: Monetalis Clydesdale, BlockTower Andromeda, and Coinbase Custody. In November 2023 these three vaults were drawn down a cumulative total of $337M. An additional $222m was removed from these pools in December, totaling more than $550m over the last two months of 2023. Maker has rolled more than $340m worth of T-Bills out of these vaults already year-to-date (YTD) 2024.

These vaults were tapped to bolster liquidity for Maker’s USDC peg stability module (PSM). This module ensures that DAI is redeemable for USDC at a 1:1 ratio, which helps maintain DAI’s peg to $1. The USDC PSM requires a minimum of $200m at any point in time and must be funded when this threshold is crossed. As shown below, the USDC PSM dipped below the $200m threshold at the end of October 2023, once in November 2023, and again in December 2023. In these cases, funds in Maker’s Monetalis Clydesdale, BlockTower Andromeda, and Coinbase Custody vaults were used to fund the PSM.

Other News

SEC delays decision timeline for BlackRock’s proposed spot Ethereum ETF to March

Bitwise publishes digital wallet addresses with bitcoin holdings for spot ETF

Polygon aims to launch ‘AggLayer’ focused on blockchain interoperability in February

Rari Foundation launches Rari Chain mainnet on Arbitrum to help protect NFT royalties

Etherfi launches eETH restaking token

Binance and SEC face off in court with detailed questioning from judge

EigenLayer plans ‘shared security’ model for dapps

Rollups are coming to Bitcoin through a ‘Superlayer’ Protocol from BitcoinOS

Legal Disclosure:

This document, and the information contained herein, has been provided to you by Galaxy Digital Holdings LP and its affiliates (“Galaxy Digital”) solely for informational purposes. This document may not be reproduced or redistributed in whole or in part, in any format, without the express written approval of Galaxy Digital. Neither the information, nor any opinion contained in this document, constitutes an offer to buy or sell, or a solicitation of an offer to buy or sell, any advisory services, securities, futures, options or other financial instruments or to participate in any advisory services or trading strategy. Nothing contained in this document constitutes investment, legal or tax advice or is an endorsementof any of the digital assets or companies mentioned herein. You should make your own investigations and evaluations of the information herein. Any decisions based on information contained in this document are the sole responsibility of the reader. Certain statements in this document reflect Galaxy Digital’s views, estimates, opinions or predictions (which may be based on proprietary models and assumptions, including, in particular, Galaxy Digital’s views on the current and future market for certain digital assets), and there is no guarantee that these views, estimates, opinions or predictions are currently accurate or that they will be ultimately realized. To the extent these assumptions or models are not correct or circumstances change, the actual performance may vary substantially from, and be less than, the estimates included herein. None of Galaxy Digital nor any of its affiliates, shareholders, partners, members, directors, officers, management, employees or representatives makes any representation or warranty, express or implied, as to the accuracy or completeness of any of the information or any other information (whether communicated in written or oral form) transmitted or made available to you. Each of the aforementioned parties expressly disclaims any and all liability relating to or resulting from the use of this information. Certain information contained herein (including financial information) has been obtained from published and non-published sources. Such information has not been independently verified by Galaxy Digital and, Galaxy Digital, does not assume responsibility for the accuracy of such information. Affiliates of Galaxy Digital may have owned or may own investments in some of the digital assets and protocols discussed in this document. Except where otherwise indicated, the information in this document is based on matters as they exist as of the date of preparation and not as of any future date, and will not be updated or otherwise revised to reflect information that subsequently becomes available, or circumstances existing or changes occurring after the date hereof. This document provides links to other Websites that we think might be of interest to you. Please note that when you click on one of these links, you may be moving to a provider’s website that is not associated with Galaxy Digital. These linked sites and their providers are not controlled by us, and we are not responsible for the contents or the proper operation of any linked site. The inclusion of any link does not imply our endorsement or our adoption of the statements therein. We encourage you to read the terms of use and privacy statements of these linked sites as their policies may differ from ours. The foregoing does not constitute a “research report” as defined by FINRA Rule 2241 or a “debt research report” as defined by FINRA Rule 2242 and was not prepared by Galaxy Digital Partners LLC. For all inquiries, please email [email protected]. ©Copyright Galaxy Digital Holdings LP 2024. All rights reserved.