How to Watch Shanghai: The Completion of Ethereum’s Merge Upgrade

On April 12, 2023, at 22:27 (UTC), the Ethereum execution layer (EL) will undergo its 15th hard fork upgrade known as Shanghai. At the same time, the Ethereum consensus layer (CL), also known as the Beacon Chain, will undergo its 3rd hard fork upgrade known as Capella. The Shanghai and Capella upgrades, sometimes collectively called Shapella, will primarily activate staked ETH withdrawals. While there are a handful of other minor code changes that will be included in Shapella, these Ethereum Improvement Proposals (EIPs) are not expected to significantly impact or enhance the user experience.

The major code change in Shapella is EIP 4895, which adds a new system-level operation to support validator withdrawals. The addition of withdrawal functionality to the Ethereum codebase represents the final step in completing the network’s multi-year transition to a proof-of-stake (PoS) consensus protocol. Once Shapella is completed, validators will be able to withdraw their issuance rewards from the Beacon Chain, as well as unstake their principal balance of 32 ETH. Already, there are over 1,500 validators that have stopped validating on the Beacon Chain and await the activation of withdrawals to fully complete the exiting process. Some of these validators have been waiting to withdraw their staked ETH balance for over two years.

Once Shanghai is activated, the number of validators exiting the Beacon Chain is likely to grow for a variety of reasons, including but not limited to:

At-home stakers wanting to retire operations and re-stake through a staking provider.

Distressed crypto businesses like Celsius selling off staked assets to other businesses.

Stakers relying on service providers like Kraken that is no longer operating staking services in the US looking to re-stake through a different provider.

While some validators unstake for a variety of reasons following the activation of Shanghai, greater confidence among ETH holders in the liquidity of staked ETH positions after withdrawal functionality is enabled will likely drive an influx of new validators. (For a detailed breakdown of how Shanghai could impact ETH price considering increased staking and unstaking activity, read this Galaxy report. For a comprehensive technical overview of how staked ETH withdrawals will work, read this Galaxy report.)

In this report, we will discuss how to observe the Shanghai upgrade, which key metrics during and shortly after the upgrade will provide insight into its success and network activity, and which websites and data dashboards will be available at Shanghai to understand the activity and health of the network.

Timing

Unlike the prior Ethereum upgrade (“The Merge”), Shanghai will activate on a specific day at a specific time that has been pre-determined by Ethereum core developers well in advance. The reason that developers can set the timing of Shanghai down to the millisecond, rather than estimating block times or setting a network difficulty threshold for activating the upgrades, is because of how Ethereum’s new consensus layer (CL) works. The Beacon Chain is progressed by slots and epochs, rather than blocks. Blocks are not produced through a variable amount of computational energy. Validators who expend more energy are not more likely to “find” a block than other validators who spend less. Instead, validators are selected at random to propose a block every 12 seconds. This set cadence for progressing the Ethereum blockchain has made scheduling upgrades extremely predictable. Developers now choose a slot number instead of a block number, and the timing of these slots is highly predictable.

The slot number for the Shanghai upgrade is 6209536. This slot will hit at 22:27:35 UTC on April 12, 2023. There are a few resources that count down to this exact time.

One popular resource used for the Merge, which has now been repurposed for Shanghai, is known as wenmerge.com. The website features estimations on how much ETH rewards will become liquid at Shanghai, as well as the length of both the exit and entry queues for validators.

Similarly, there are Dune data dashboards that count down to the Merge. This one by 21Shares Research gives a comprehensive overview of how much ETH is staked and by what entity.

Finally, CoinDataFlow has a countdown timer for Shanghai that is coupled with more information about the upgrade and an ETH price chart.

Network Health

Once Shanghai activates, the metrics to watch to evaluate network health are identical to the ones highlighted in a prior Galaxy report for the Merge. Namely, it will be important to watch for network finalization. Network finality on the Beacon Chain is reached once 2 epochs are confirmed by at least 2/3 of active validators. An epoch is a period lasting 6.4 minutes where up to 32 blocks spread across 12 slots, which are 12 second intervals, can be proposed. Missed slots suggest validators are not proposing blocks, which can be for a host of reasons, the most common of which is due to a client misconfiguration or the use of outdated client versions.

During the activation of Shanghai on the Goerli testnet in March, the network had a difficult time reaching finalization because several validators on Goerli had not upgraded their software. Chair of the All Core Developers Execution Call Tim Beiko said at the time that the issue of non-upgraded nodes should not be a problem for the activation of Shanghai on mainnet as the assets at stake on Ethereum have real financial value while the assets on Goerli are practically worthless. Still, it is worth monitoring the readiness of the network for Shanghai by tracking node client versions. There are two websites that track node readiness.

Ethernodes: To check the readiness of Ethereum nodes for Shanghai, click on the “Clients” tab of the website. Then click into the individual client types, such as “geth.” Then, a full breakdown of which software versions are being run on Ethereum will appear. The following screenshot illustrates that among nodes running the Geth client, roughly 25% of operators have successfully upgraded to the Shanghai-ready version, version 1.11.5.

Metrika: To check the readiness of Ethereum nodes for Shanghai, click on the “Network Upgrade” tab. Navigate to the “Network Readiness” dashboard which will illustrate how many nodes are running software compatible with the current version of Ethereum and how many nodes are running software compatible with the current version of Ethereum and the Shanghai upgrade. The former is called “Compatible Client Version.” The latter is called “Next Fork Version. The following screenshot illustrates that roughly 40% of nodes on Ethereum are ready for Shanghai as of April 4, 2023.

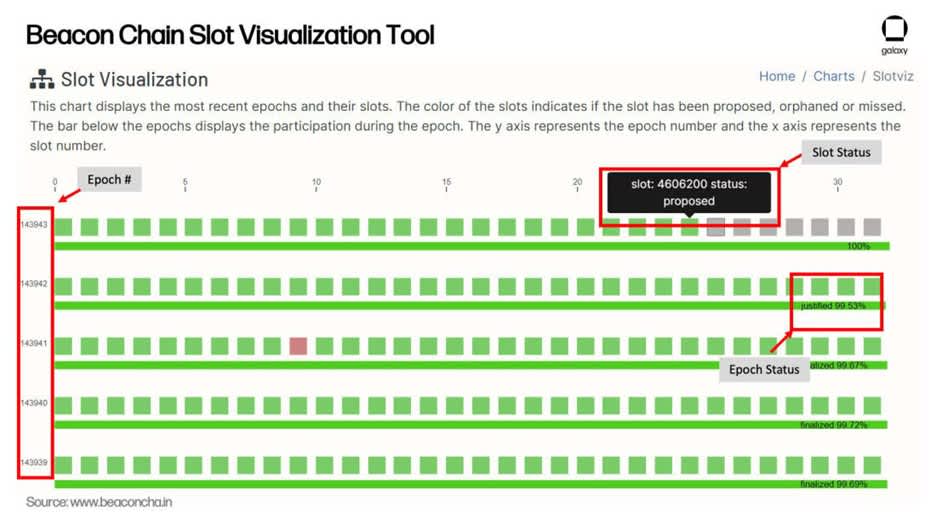

Network finalization is a key milestone for the network to reach after Shanghai is activated because it gives confidence to users, exchanges, dapps, and other network stakeholders that the upgrade and the blocks processed since the upgrade are here to stay permanently and not likely to be reverted. A real-time view of epochs and slots processed on the Beacon Chain can be seen on block explorers such as beaconcha.in and beaconscan.com. The following is a snapshot of the slot visualization page on the beaconcha.in website. On this page, you can see the epoch number, epoch status, and slot status.

Withdrawal Activity

Aside from tracking network health, the type of network activity that will be most interesting to watch post-Shanghai are staked ETH withdrawal activity. Noteworthy metrics around staked ETH withdrawals include:

Total amount of ETH withdrawn: Illustrates how much ETH has become liquid, available for validators to move around.

Number of withdrawal credential changes: The number of validators that have successfully updated their withdrawal credentials and therefore are eligible for partial withdrawals (withdrawals of Beacon Chain issuance rewards, as opposed to principle staked ETH).

Number of validators in the entry and exit queue: This is based on the churn limit, which is currently set at 8 validators per epoch, meaning a maximum of 8 validators can enter and 8 validators can exit every 6.4 minutes.

Number of active and exited validators: Following the entry queue, validators will start to earn rewards from the Beacon Chain and following the exit queue, validators will be able to unstake their full principal balance of 32 ETH. Tracking how quickly the number of active and exited validators increases post-Shanghai is a good proxy for tracking changes in the security and issuance dynamics of Ethereum.

Number of full versus partial withdrawals: Another important metric to track post-Shanghai is the type of withdrawal activity happening. Over time, the number of full withdrawals should decrease as the number of partial withdrawals stays relatively constant.

There are a few different websites where the above metrics can be tracked in real-time.

Market Impact

In addition to network health and withdrawals activity, there are a handful of market metrics to also keep an eye out for both before and after the hard fork:

1. ETH Price: As with the Merge, and particularly considering Shapella’s focus on staked ETH withdrawals, all eyes will be on ETHUSD. As stated above, we examined potential sell pressure as a result of the upgrade in this Galaxy report by exploring various scenarios of % ETH sold vs. total consensus layer rewards. If we conservatively estimate that validators will sell 50% of their staked ETH rewards (not their principally staked ETH, but those newly-minted ETH they’ve earned from validating), we expect 553,650 ETH will be sold. Amortized over 7 days, this amounts to approximately 1% of daily ETH volume (including spot and perpetual futures volume) of selling per day for a week. Depending on the risk environment broadly and overall liquidity in Ether during the Shanghai upgrade, expected on Wednesday, April 12, we view this amount as ranging from inconsequential to slightly bearish ETHUSD. Another view is that the Shanghai upgrade going smoothly is broadly bullish for Ethereum as a technology, and thus bullish for ETHUSD.

a. ETH/BTC: Much focus has been paid to BTC’s outperformance to ETH year to date, despite ETH’s upcoming upgrade. We wrote about BTC’s strong performance in this Galaxy report, where we showed that BTC has benefitted year to date from a safe-haven narrative, with a banking crisis enveloping the globe and Bitcoin and gold rallying. The ETH/BTC cross has traded lower over the course of 2023 and ultimately bottomed late March at 0.06274, just below 0.063, widely viewed as an important technical level. In recent weeks, as the market’s attention to the regional banking crisis eased, ETH/BTC has jumped from this 0.63 support area, trading above 0.067 at time of writing. This stands in contrast to the 3 month time frame leading up to The Merge, where ETH/BTC rallied by 60% from mid-June to mid-September 2022 (and subsequently traded lower following the strong rally into the upgrade). We will be watching to see if ETH/BTC can sustain signs of recent strength heading into and following the upgrade.

i. Volatility: As result of BTC dominating the market’s attention for most of the past month, the implied volatility of ETH relative to BTC is trading around all-time low levels (Chart). As ETH price has started to outperform vs BTC, so too has ETH’s volatility relative to BTC. We note that this spread has exhibited sharp moves around catalysts historically, as illustrated below, and will continue to watch if the spread continues to recover into the event, which would be driven by demand for options on ETH.

2. Liquid Staking Protocols: Governance tokens of liquid staking protocols, such as Lido (LDO) and Rocketpool (RPL), have strongly outperformed year-to-date given the direct impact of the Shanghai upgrade on these protocols. Lido’s LDO token is +165% year-to-date while Rocketpool’s RPL is up 132%. This reflects a similar pattern of liquid staking outperformance witnessed into the Merge, where LDO and was +81% (vs ETH +28%) in the period 3 months leading into the Merge (July 1 to Sep 6).

3. Funding rates: Given that Shanghai will provide liquidity of rewards and staked ETH to validators, the event could impact the market rates to borrow and lend ETH and liquid staked ETH tokens, such as Lido’s stETH. Once withdrawals from Lido and other liquid staking protocols are enabled following the hard fork, the divergence in the borrow rates between ETH (currently 4.2% on Aave V3) and liquid staked ETH tokens (stETH currently 0.44% on Aave V3) can be expected to converge. This dynamic can be monitored on Aave V3 here.

Event Commentary

Finally, no Ethereum upgrade would be complete without commentary from core developers, users, infrastructure providers, dapp developers, and other enthusiasts. To this end, there is a scheduled YouTube livestream for viewing the upgrade virtually alongside other Ethereans organized by the EthStaker community. There are also a several Ethereum Reddit communities with an active following that will likely be discussing the upgrade. They are:

The following is a Twitter list compiling the accounts of several Ethereum core developers who are also likely to tweet about the upgrade as it happens.

Ethereum Devs (made by @christine_dkim)

The official Discord channel in which Ethereum core developers communicate and coordinate upgrades is here. Core developers will give a full post-mortem of Shanghai a day after the upgrade on April 13 during their bi-weekly All Core Developers Execution call. Livestream link for this call will be shared on this YouTube channel.

Beyond short-term analysis, there will also be several commentators discussing the medium to long-term impact of staked ETH withdrawals on validators and the broader Ethereum ecosystem in the months and years following the activation of Shanghai. Commentators include many of the companies that have already been named in this report but also:

Conclusion

As the Ethereum community prepares for yet another upgrade that will introduce a new network functionality, this time staked ETH withdrawals, it is worth noting the immense amount of preparation and care needed to upgrade Ethereum. Upgrades are only expected to become heavier lifts for core developers as the protocol grows in value, code complexity, and ideally, decentralization. There are several different lenses through which to evaluate the forthcoming Shanghai upgrade and its success. At a minimum, it is worth watching Shanghai’s impact on network health, withdrawal activity, ETH price, and crypto market dynamics through the metrics and resources highlighted in this report. Over the medium to long-term, Galaxy Research and others, many of which have been named in this report, will present more nuanced analysis and research around the impacts of Shanghai on Ethereum’s diverse ecosystem of stakeholders.

Legal Disclosure:

This document, and the information contained herein, has been provided to you by Galaxy Digital Holdings LP and its affiliates (“Galaxy Digital”) solely for informational purposes. This document may not be reproduced or redistributed in whole or in part, in any format, without the express written approval of Galaxy Digital. Neither the information, nor any opinion contained in this document, constitutes an offer to buy or sell, or a solicitation of an offer to buy or sell, any advisory services, securities, futures, options or other financial instruments or to participate in any advisory services or trading strategy. Nothing contained in this document constitutes investment, legal or tax advice or is an endorsementof any of the digital assets or companies mentioned herein. You should make your own investigations and evaluations of the information herein. Any decisions based on information contained in this document are the sole responsibility of the reader. Certain statements in this document reflect Galaxy Digital’s views, estimates, opinions or predictions (which may be based on proprietary models and assumptions, including, in particular, Galaxy Digital’s views on the current and future market for certain digital assets), and there is no guarantee that these views, estimates, opinions or predictions are currently accurate or that they will be ultimately realized. To the extent these assumptions or models are not correct or circumstances change, the actual performance may vary substantially from, and be less than, the estimates included herein. None of Galaxy Digital nor any of its affiliates, shareholders, partners, members, directors, officers, management, employees or representatives makes any representation or warranty, express or implied, as to the accuracy or completeness of any of the information or any other information (whether communicated in written or oral form) transmitted or made available to you. Each of the aforementioned parties expressly disclaims any and all liability relating to or resulting from the use of this information. Certain information contained herein (including financial information) has been obtained from published and non-published sources. Such information has not been independently verified by Galaxy Digital and, Galaxy Digital, does not assume responsibility for the accuracy of such information. Affiliates of Galaxy Digital may have owned or may own investments in some of the digital assets and protocols discussed in this document. Except where otherwise indicated, the information in this document is based on matters as they exist as of the date of preparation and not as of any future date, and will not be updated or otherwise revised to reflect information that subsequently becomes available, or circumstances existing or changes occurring after the date hereof. This document provides links to other Websites that we think might be of interest to you. Please note that when you click on one of these links, you may be moving to a provider’s website that is not associated with Galaxy Digital. These linked sites and their providers are not controlled by us, and we are not responsible for the contents or the proper operation of any linked site. The inclusion of any link does not imply our endorsement or our adoption of the statements therein. We encourage you to read the terms of use and privacy statements of these linked sites as their policies may differ from ours. The foregoing does not constitute a “research report” as defined by FINRA Rule 2241 or a “debt research report” as defined by FINRA Rule 2242 and was not prepared by Galaxy Digital Partners LLC. For all inquiries, please email [email protected]. ©Copyright Galaxy Digital Holdings LP 2023. All rights reserved.