How Could Shanghai Unlocks Affect the Price of ETH?

Ethereum’s next upgrade, named Shanghai, is expected to enact sometime in early April 2023. The upgrade will enable full staked ETH withdrawals on the Ethereum network and unlock consensus layer rewards earned by validators on the Beacon Chain to-date. A major question facing investors is the amount of ether supply that will unlock and what its impact could be on the market. This note focuses on projecting and predicting the likelihood of ETH sell pressure because of the Shanghai event.

Some facts that are key to understand this question include:

Just over 1 million in ETH rewards will become liquid at the Shanghai upgrade over a 4-7 day time period. This amounts to approximately 0.82% of total Ether supply.

Approximately 1,138 validators have already exited the validator set (0.2% of Ether validators), amounting to approx. 36,416 of principally staked ETH waiting to unlock in Shanghai. 20% of the exited validators were slashed and kicked off the network, so this number represents a significant number of validators that were forced to exit. These validators are currently not validating and they aren’t earning any rewards.

We expect the number of exiting and exited validators to rise nearer to when the date for Shanghai is finalized, that is when Ethereum core developers decide on an epoch number for the upgrade. Even if a validator wants to exit, it makes no sense to enter the queue now because it is unclear when withdrawals will be enabled. Until there is clarity and more certainty around the exact date and time, validators will likely keep operations running and earning rewards, instead of forgoing rewards for an indefinite period.

Broadly, our expectation is that most validators on Ethereum will not unstake at Shanghai, for several reasons:

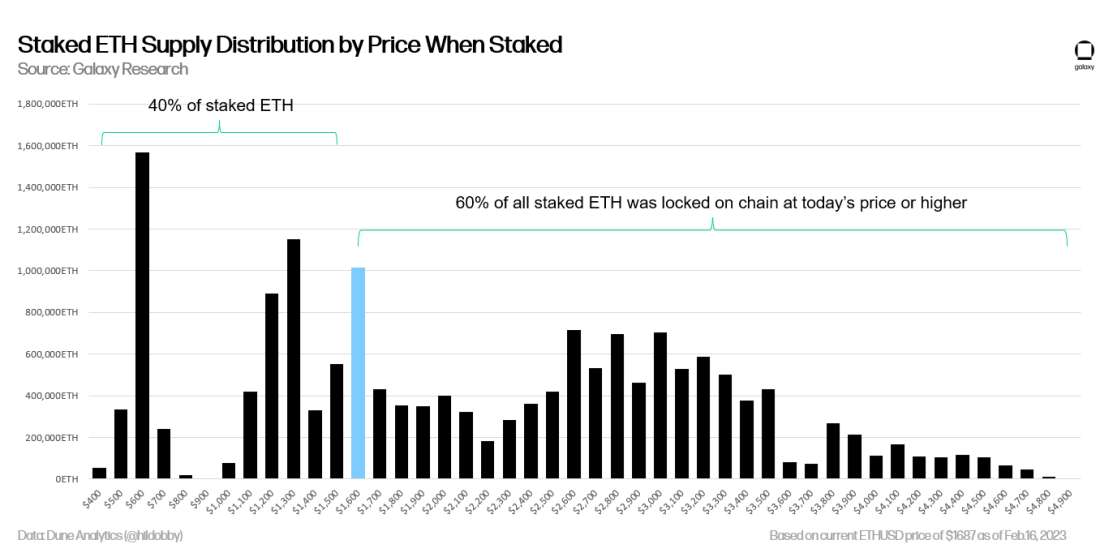

The cost basis for most Ether validators – i.e., the ETHUSD price at the time they staked on the Beacon Chain – is above the current exchange rate. Thus, most validators have no profits to realize by exiting the validator set.

The community of users that have committed Ether to stake on the network even before withdrawals are enabled skews to long-term Ethereum bulls.

The presence of liquid staking derivatives, like Lido’s stETH, has given those users who do want to exit the validator set a functional way to do so in a relatively liquid manner.

The yields from staking are higher at present than yields in decentralized finance applications. They are also comparable to yields in traditional fixed income markets.

Even though most validators will likely not unstake at Shanghai, we expect many to take some profit from the rewards they have accrued from the Beacon Chain. On average, validators have earned roughly 2 ETH from consensus layer rewards on their 32 ETH principle. We conservatively estimate that validators will sell up to 50% of these rewards, but project amount of ETH sold in the market at various assumptions below.

For the validators that have already exited, these entities may re-stake through a different staking provider or choose to sell their ETH completely. Given that it is unclear who the entities are behind these exited validators, we err on the side of caution and assume 100% of staked ETH from exited validators will be sold off shortly after the activation of Shanghai. The following analysis does not include assumptions about validators that will enter the exit queue at Shanghai, namely validators operated by Kraken, which recently announced they will be shuttering their US staking operations. However, for U.S. customers that were staking through Kraken, there is no strong reason to believe these users would immediately sell their staked ETH once they are deposited back into their Kraken accounts.

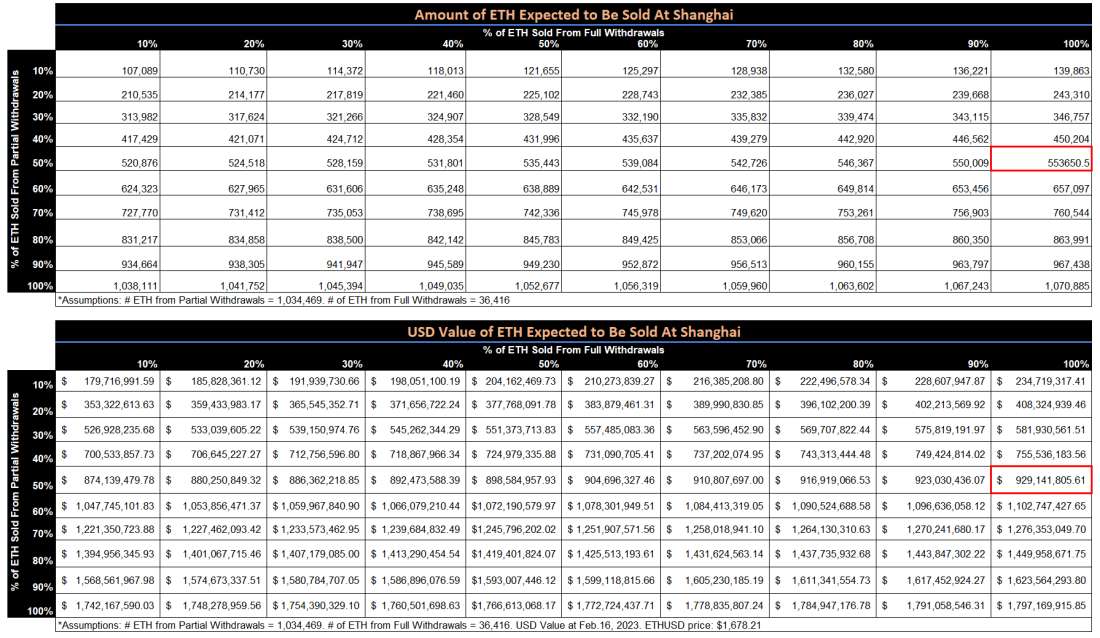

Below, we calculate the amount of spot ETH and its USD value to be sold under variable conditions, assuming the fixed amount of ETH that will be unlocked immediately following the activation of Shanghai from partial withdrawals is 1,034,469 ETH and from full withdrawals is 36,416 ETH:

If we assume that validators will sell 50% of their staked ETH rewards (not their principally staked ETH), we expect 553,650 ETH will be sold. Amortized over 7 days, this amounts to approximately 1% of daily ETH volume (including spot and perpetual futures volume) of selling per day for a week. Depending on the risk environment broadly and overall liquidity in Ether during the Shanghai upgrade, expected in early April, we view this amount as ranging from inconsequential to slightly bearish ETHUSD. Another view is that the Shanghai upgrade going smoothly is broadly bullish for Ethereum as a technology, and thus bullish for ETHUSD.

Addendum: Shanghai unstaking mechanics:

2 queues run side by side: withdrawal queue and exit queue:

Full withdrawals are withdrawals of the full balance of staked ETH including rewards and the base amount of 32 ETH. Full withdrawals require a validator to pass through the exit queue first, then the withdrawal queue.

Partial withdrawals are withdrawals of only the consensus layer rewards issued from the Beacon Chain. Partial withdrawals only pass through the withdrawal queue, not the exit queue.

Exits (full withdrawals) need to be initiated by the validator, partial withdrawals do not require initiation and will happen automatically (for all validators that have updated their withdrawal credential and have > 32E from rewards to date, this excess ETH will automatically get processed as a partial withdrawal to their validator address if they do not request to exit. It's then up to the validator what they do with this newly "freed" ETH).

The blockchain will process a maximum of 16 withdrawals (partial or full) per block following the upgrade. Based on a 12 second block time, that amounts to 115,200 withdrawals (partial or full)/day. A total of ~1100 exit requests will take approximately 4.5 days to process. Some validators will need to update their credentials from 0x00 to 0x01, which may lengthen the withdrawal process for partial and full withdrawals, and thus we project the window to take 4-7 days in total.

Additional resources:

Projections of partial withdrawals at Shanghai here: https://dataalways.substack.com/p/partial-withdrawals-after-the-shanghai

Exit queue can be monitored here:https://beaconcha.in/validators#exiting

More information on the withdrawals process:https://www.galaxy.com/research/insights/100-days-after-the-merge/

Example of real-time monitoring of withdrawals activity here: https://zhejiang.beaconcha.in/validators/withdrawals

Legal Disclosure:

This document, and the information contained herein, has been provided to you by Galaxy Digital Holdings LP and its affiliates (“Galaxy Digital”) solely for informational purposes. This document may not be reproduced or redistributed in whole or in part, in any format, without the express written approval of Galaxy Digital. Neither the information, nor any opinion contained in this document, constitutes an offer to buy or sell, or a solicitation of an offer to buy or sell, any advisory services, securities, futures, options or other financial instruments or to participate in any advisory services or trading strategy. Nothing contained in this document constitutes investment, legal or tax advice or is an endorsementof any of the digital assets or companies mentioned herein. You should make your own investigations and evaluations of the information herein. Any decisions based on information contained in this document are the sole responsibility of the reader. Certain statements in this document reflect Galaxy Digital’s views, estimates, opinions or predictions (which may be based on proprietary models and assumptions, including, in particular, Galaxy Digital’s views on the current and future market for certain digital assets), and there is no guarantee that these views, estimates, opinions or predictions are currently accurate or that they will be ultimately realized. To the extent these assumptions or models are not correct or circumstances change, the actual performance may vary substantially from, and be less than, the estimates included herein. None of Galaxy Digital nor any of its affiliates, shareholders, partners, members, directors, officers, management, employees or representatives makes any representation or warranty, express or implied, as to the accuracy or completeness of any of the information or any other information (whether communicated in written or oral form) transmitted or made available to you. Each of the aforementioned parties expressly disclaims any and all liability relating to or resulting from the use of this information. Certain information contained herein (including financial information) has been obtained from published and non-published sources. Such information has not been independently verified by Galaxy Digital and, Galaxy Digital, does not assume responsibility for the accuracy of such information. Affiliates of Galaxy Digital may have owned or may own investments in some of the digital assets and protocols discussed in this document. Except where otherwise indicated, the information in this document is based on matters as they exist as of the date of preparation and not as of any future date, and will not be updated or otherwise revised to reflect information that subsequently becomes available, or circumstances existing or changes occurring after the date hereof. This document provides links to other Websites that we think might be of interest to you. Please note that when you click on one of these links, you may be moving to a provider’s website that is not associated with Galaxy Digital. These linked sites and their providers are not controlled by us, and we are not responsible for the contents or the proper operation of any linked site. The inclusion of any link does not imply our endorsement or our adoption of the statements therein. We encourage you to read the terms of use and privacy statements of these linked sites as their policies may differ from ours. The foregoing does not constitute a “research report” as defined by FINRA Rule 2241 or a “debt research report” as defined by FINRA Rule 2242 and was not prepared by Galaxy Digital Partners LLC. For all inquiries, please email [email protected]. ©Copyright Galaxy Digital Holdings LP 2022. All rights reserved.