Weekly Top Stories - 6/13

This week in the newsletter, we break down recent and upcoming changes to Bitcoin’s software; the U.S. SEC chairman’s olive branch to crypto and DeFi; and the wildly successful deposit drive from Plasma, a yet-to-be-launched blockchain for stablecoins.

Bitcoin Dev Drama and Opportunity

After weeks of contentious debate, Bitcoin Core developers merged the OP_RETURN adjustment as a community push began for the network’s next soft fork. In an unusual step, 31 open-source developers who work on Core, Bitcoin’s primary software client, signed a letter explaining the reasoning behind removing a size limit on a key transaction field for arbitrary data. The pull request merge makes the change a part of the upcoming Bitcoin Core v30 release.

Almost concurrently, 66 prominent developers from across the Bitcoin world signed a separate letter calling for two new opcodes (functions in Bitcoin) to be added to the protocol: OP_CHECKTEMPLATEVERIFY (“CTV,” from Bitcoin Improvement Proposal 119) and OP_CHECKSIGFROMSTACK (“CSFS,” in BIP-348).

We described the OP_RETURN debate in the May 2 edition of this newsletter. The removal of limits on the amount of arbitrary data that can be placed in OP_RETURN reflects a recognition that using Bitcoin for non-monetary transactions (such as NFTs, data-anchoring, or other arbitrary uses) is an inevitable byproduct of the protocol’s permissionless nature. Rather than enact censorship at the client level, which would be largely futile, developers instead hope to coax data posters to utilize the OP_RETURN field. This is perhaps the least damaging way to store data on the network, rather than more troublesome methods like creating unspendable UTXOs.

Separately, momentum continues to build for the combination of CTV and CSFS for bitcoin’s next major upgrade. We wrote at length about the benefits of CTV in a March research report. Broadly, CTV allows for new, more expressive transaction types that could enhance bridging, scaling, custody, and more, while CSFS is a benign opcode that improves delegation, oracles, and other functions.

OUR TAKE:

Bitcoin Core developers rarely issue a public explanation as a group, but this was a reaction to harassment and brigading of their channels (such as GitHub) by non-developer critics. The debate over relaxing the OP_RETURN limits was much less important than the loud but small group of critics alleges. They floated wild accusations of the “death of Bitcoin,” which we think were untrue and needlessly hyperbolic. It’s also amusing to hear angry debaters call arbitrary data “spam,” when Satoshi Nakamoto himself included arbitrary data (the famous “chancellor on brink of second bailout” line) in the Genesis Block. If non-arbitrary data were truly overwhelming the transaction queue (“mempool”) and pricing out normal monetary transactions, the argument might make sense, but the mempool is currently at historically low levels. It’s almost empty.

Much more interesting is an apparent growing coalescence around CTV and CSFS as the next Bitcoin network upgrade. I’ve been a public supporter of CTV (BIP-119) since December 2021, and we continue to believe this is a conservative but powerful opcode that would greatly enhance the ability to build better, safer methods of custody, create new forms of layer-2 bridges, and much more. Already, about 20% of hashrate has signed a letter to signal support for the upgrade. CTV has had a BIP for more than five years and has been widely reviewed, while CSFS has been live on Blockstream’s Elements sidechain for at least eight years.

Bitcoin is notoriously difficult to upgrade because it operates completely in an open-source manner. Making major changes takes a lot of time and consensus-building. That’s a good thing, as the cryptocurrency is designed to be a long-term store of value and a high-fidelity system and network that is resistant to short-term pressures and incentives. But that doesn’t mean Bitcoin should never be upgraded. There is still more to do if bitcoiners want the world to continue to adopt the world’s oldest cryptocurrency, and the combination of CTV and CSFS would be a welcome step toward greater scalability and security. – Alex Thorn

SEC’s Atkins Embraces DeFi in Watershed Speech

U.S. Securities and Exchange Commission Chair Paul Atkins has put to rest any doubts that the regulatory agency has changed its tune on crypto, including DeFi. In a speech Monday opening the SEC’s latest crypto roundtable, this one focused on decentralized finance, Atkins codified a remarkable shift in tone from a once-hostile agency. He declared that “the American values of economic liberty, private property rights, and innovation are in the DNA of ... DeFi.” He described the right to self-custody as “a foundational American value” and said the SEC is “in favor of affording greater flexibility to market participants to self-custody crypto assets.” And he said he had asked the SEC staff to “explore whether further guidance or rulemaking may help enable registrants to transact” on DeFi protocols.

OUR TAKE:

Atkins’ call for potential “further guidance” signals that DeFi connectivity may become available to traditional broker-dealers, registered investment advisors (RIAs), or securities exchanges. The sentiment also bodes well for the likelihood that the SEC will allow meaningful tokenization of equity securities.

The “further” part is important, too. It suggests that the SEC may even take the view that registrants are already cleared to interact with DeFi protocols. His comment exhibits both a flexible view on the status quo and a willingness to liberalize further. DeFi protocols – those with truly “self-executing software code,” in Atkins’ words – could be about to get a lot more usage.

More is coming than simple guidance. Atkins also said that while he was happy the SEC staff had clarified that miners and validators fall outside the scope of securities laws, “it is not a duly promulgated rule with the force of law, so we cannot stop there.” Rather, the SEC “must adopt a regulation based on the authority that Congress has given us.” Expect formal rulemaking processes on validators and other issues.

Atkins’ statement about self-custody was one of the most important parts of his speech. Broadly, it’s bullish for self-custody and could influence how other U.S. agencies (such as FinCEN) reckon with digital bearer assets. It’s bullish for the prospect of RIAs custodying crypto assets on behalf of clients, rather than having to use traditional qualified custodians (an arrangement that can hamstring RIAs from putting those assets to work, e.g., through staking). It’s also bullish in the near term for tokenization, because ambiguity about how broker-dealers can interact with tokens means many such schemas will be designed, at least initially, with participants utilizing self-custody. In the long term, Atkins’ statement may augur a rethink of TEFRA, a 1982 tax law, and UCC Article 8, which had the combined effect of disadvantaging bearer securities legally and economically.

The SEC Chair further criticized the previous administration for undermining innovation by “asserting through regulatory actions that the developers of [wallet] software may be conducting brokerage activity.” His comment dovetails with the Blockchain Regulatory Clarity Act (BRCA), which would exempt developers of non-custodial software wallets from having to register as money service businesses under the Bank Secrecy Act. The BRCA was recently added to a pending, comprehensive crypto market structure bill (the “CLARITY Act”).

Atkins’ coinage (no pun intended) of the term “self-executing software code” underscores the SEC’s openness and interest in advancing automated and transparent financial markets. Indeed, he said he’d asked the staff to consider an “innovation exemption” to SEC rules that would allow market participants, even firms not registered with the SEC, to bring on-chain products to market faster. The availability of such an exemption could allow new products, types of tokens, or system designs to launch (and interact with TradFi) long before the SEC formalizes the rules related to them, thereby accelerating timelines for onchain tokenization.

All in all, a far cry from the Gary Gensler era. – Alex Thorn & Marc Hochstein

Plasma Attracts $1B of Deposits Ahead of Stablecoin Chain’s Launch

Plasma, a forthcoming “purpose-built blockchain for stablecoins,” garnered $1 billion of deposits in two stretches totaling less than an hour. Plasma hit its initial limit of $500 million just five minutes after opening the window for deposits on June 9; two days later, it doubled the cap, which was hit in 30 minutes. The deposits of various stablecoins will earn “units” entitling users to allocations of Plasma’s sale of its native XPL token, from which it is seeking $50 million in proceeds (for a fully diluted valuation of $500 million). After a lockup period of at least 40 days, users will be able to withdraw their deposits as USDT on the newly launched chain.

Plasma uses the Ethereum Virtual Machine (EVM) for execution, PlasmaBFT (a protocol derived from Fast-HotStuff) for consensus, and Bitcoin for settlement. Notably, the chain boasts zero-fee transfers for USDT, compatibility with USDT0 (Tether’s omni-chain variant of USDT), and a trust-minimized BTC bridge.

The initial drive on June 9 was competitive, with a single user paying a 39.15 ETH fee, worth $99,758 at the time of execution, to guarantee a $10.17 million contribution. In total, roughly 2,930 individual users participated in the deposit process across both rounds at an average deposit amount of about $341,309. The top participant in the process contributed just under $50 million, equal to 5% of the deposit cap. The top 100 participants contributed just over $700 million, claiming 70% of the total.

OUR TAKE:

While Plasma has no direct ties to Tether (they share common investors), its apparent raison d'etreis to offer a one-stop shop for most anything you’d want to do with USDT. This helps explain why the blockchain is so popular before even launching. (It gathered all those deposits without yet releasing a white paper.)

Right now, the best user experiences for USDT are fragmented between different blockchains, depending on the use case. Picture a barbell distribution, with the Tron blockchain at one extreme, Ethereum and a couple of other networks at the other end, and very little in between.

For payments, the market’s view is that Tron is the place to be. The network 1) consistently owns 65%+ of all monthly onchain peer-to-peer USDT volume (i.e., volume of USDT transferred solely between externally owned accounts onchain), which has cleared $748 billion every month since November 2024 and 2) boasts the second-largest stablecoin supply of any chain at $79.04 billion (99% of which is USDT). Launched in June 2018, well before DeFi bloomed, Tron had a seven-year head start on adoption. Integration with point-of-sale infrastructure and wallet adoption by individuals entrenched its payments pole position. These factors, juxtaposed against relatively low decentralized exchange (DEX) volumes and small amounts of stablecoins deposited onto lending apps on Tron, underscore its status as a one-trick pony.

On the DeFi side of the stablecoin utility barbell sit cash loans against crypto and synthetic token issuance (e.g., collateral debt position, or CDP, stablecoins), with BTC being a major collateral source in both cases. Ethereum’s Layer 1 (L1) is the incumbent network, and Aave and Sky are the incumbents on the application layer for these use cases. Dex liquidity provision also falls under the DeFi utility category. However, that activity is typically done by a smaller group of users.

Plasma is stepping into an increasingly crowded field in the next chapter of DeFi stablecoin history: Bitcoin L2s are racing to launch comparable lending and CDP rails, even if their branding isn’t explicitly “stablecoin utility,” and Noble is moving to launch its AppLayer. Meanwhile, BTC-backed lending and CDPs on Ethereum L1 are already a multi-ten-billion-dollar market. Users in that segment have shown little sensitivity to network fees (Aave continues to grow on the expensive Ethereum base layer). What matters to them are things like loan terms (e.g., interest rates) and liquidity. For this stablecoin use case, low network fees are not the primary edge, and there is no technological moat, two of Plasma’s headline benefits. A chain simply must house applications with attractive financial terms and liquid markets, which is a difficult feat. Another consideration around borrowing activity is that it’s typically low-velocity and sticky. For example, borrowers post BTC on Ethereum L1, borrow stablecoins, and redeploy that capital across DeFi and CeFi for long stretches, sometimes bound by legal agreements. As a result, migrating activity to Plasma may prove to be a slow and obstacle-laden process.

Realistically, Plasma (and those same Bitcoin L2s and stablecoin utility L1s) will be competing to capture new demand rather than uproot entrenched positions. On the CDP-stable side, demand remains well below prior cycle highs as flows have pivoted toward centralized stablecoins like USDT and USDC and yield-bearing options such as Ethena. CDP issuers enjoy theoretically unlimited scale, but only if they can pay to bootstrap liquidity across the rest of DeFi, which is an expensive proposition. Sky (formerly Maker) is already pushing its DAI and USDS CDPs cross-chain, adding yet another competitive front Plasma will need to navigate, should it choose to incorporate CDP stablecoins. In the stablecoin utility arms race, Plasma sits between Tron (payments) and Ethereum L1 (DeFi), while facing pressure from Bitcoin L2s that pursue a similar product vision under the “Bitcoin-aligned” banner, and from other L1s with a pure stablecoin utility mandate. Nonetheless, the barbell of stablecoin utility is getting heavier at both ends, so Plasma doesn’t necessarily have to dislodge the incumbents (e.g., Tron on the payments side or Aave, Sky, or Ethereum L1 for BTC-backed lending and CDP stablecoins). What really matters is the fight to win the next wave of users and demand for stablecoin utility: Bitcoin L2s and other new entrants are all chasing the same greenfield market, turning it into a go-to-market and partnership race among Plasma, Bitcoin L2s, and similar platforms rather than a zero-sum battle that knocks out the likes of Tron or Aave.

For incumbents, partnering with Plasma or other similar products coming online could be an attractive way to capture that fresh demand while extending their stablecoin utility footprints. This is especially so on the DeFi end of the barbell. – Zack Pokorny

Charts of the Week

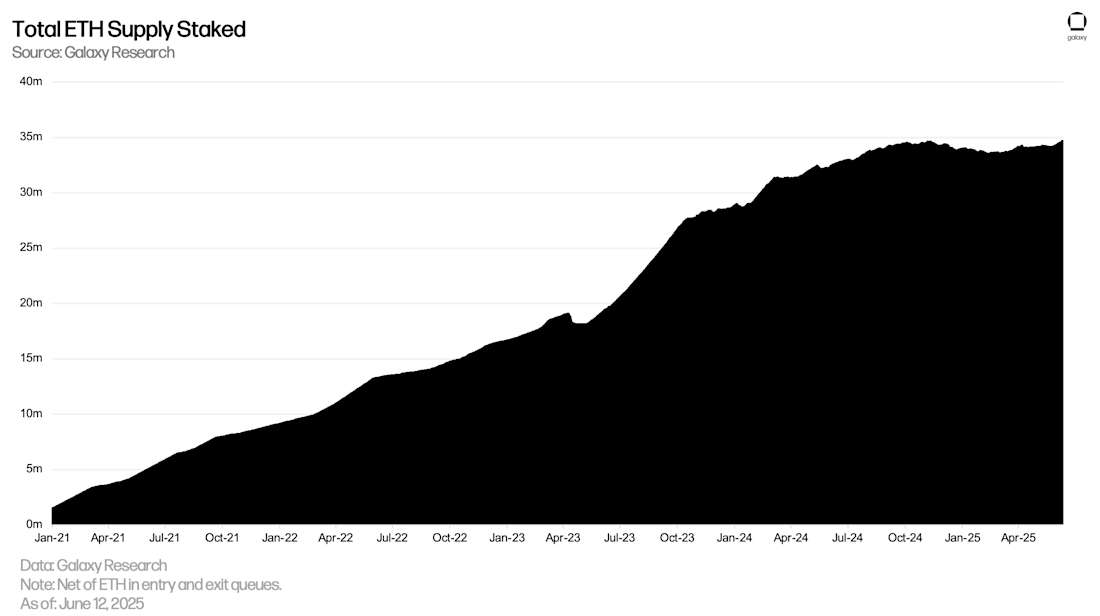

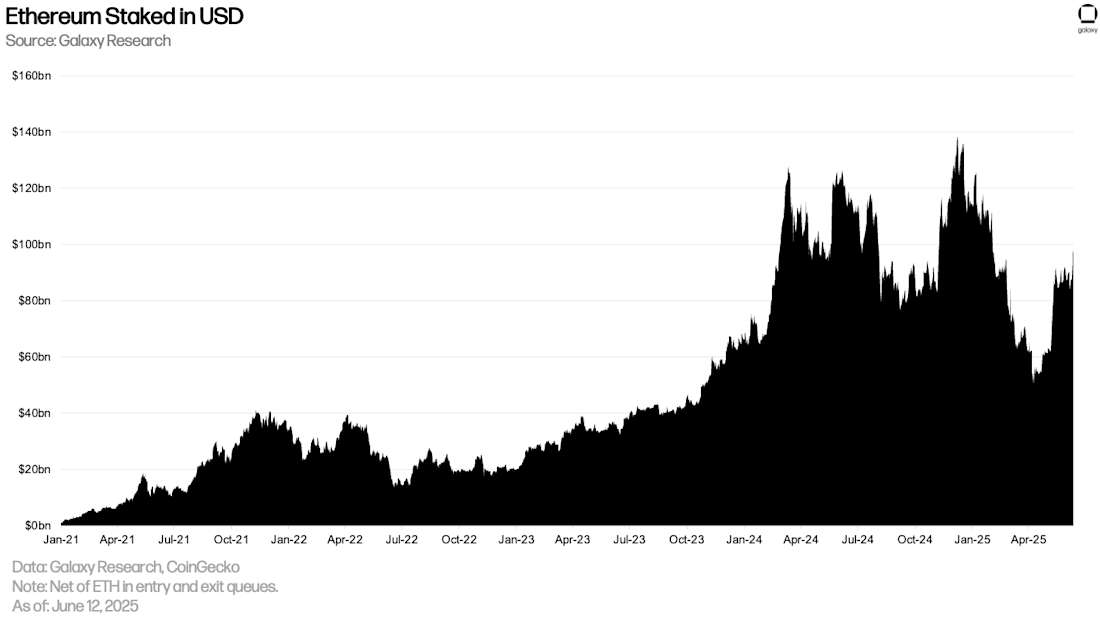

The amount of ETH staked set a fresh record on June 10, with 34,817,353 ETH locked in the network’s consensus layer. However, the share of circulating ETH staked is still below its November 7, 2024, high of 28.87%. On the day of the new all-time high, 28.82% of circulating ETH was staked. As of June 12, the share staked was down slightly to 28.79%.

The increase in ETH deposited onto Ethereum’s Beacon Chain, paired with strength in the price of ETH, has lifted the value of the network’s slashable collateral back toward the $100 billion mark. As of June 12, the value of ETH staked stood at $96.6 billion. This is 30.2% below the all-time high value of $138.3 billion set on December 7, 2024, and is 91.9% above the low set on April 9, 2025, of $50.3 billion.

Other News

🤝 Stripe to acquire crypto wallet provider Privy (price undisclosed)

📉 Paul Tudor Jones predicts dollar slump, says every portfolio should include BTC

💳 Coinbase unveils bitcoin rewards Amex card ... and U.S. perps trading

🏛️Crypto exchange Bullish confidentially files for IPO, FT reports

💵 Franklin Templeton pays “intraday yield” for assets tokenized on its Benji platform

🚫 Connecticut bans any state or municipal crypto investments

🇰🇷 Korea’s central bank to discuss won-based stablecoin with country’s top banks

🌱 DeFi protocol Aave expands to Sony's Ethereum L2 Soneium

🚨 Nearly 1/3 of Bitcoin ATMs are in major drug trafficking areas, Inca Digital finds

Legal Disclosure:

This document, and the information contained herein, has been provided to you by Galaxy Digital Inc. and its affiliates (“Galaxy Digital”) solely for informational purposes. This document may not be reproduced or redistributed in whole or in part, in any format, without the express written approval of Galaxy Digital. Neither the information, nor any opinion contained in this document, constitutes an offer to buy or sell, or a solicitation of an offer to buy or sell, any advisory services, securities, futures, options or other financial instruments or to participate in any advisory services or trading strategy. Nothing contained in this document constitutes investment, legal or tax advice or is an endorsement of any of the stablecoins mentioned herein. You should make your own investigations and evaluations of the information herein. Any decisions based on information contained in this document are the sole responsibility of the reader. Readers should consult with their own advisors and rely on their independent judgement when making financial or investment decisions.

Participants, along with Galaxy Digital, may hold financial interests in certain assets referenced in this content. Galaxy Digital regularly engages in buying and selling financial instruments, including through hedging transactions, for its own proprietary accounts and on behalf of its counterparties. Galaxy Digital also provides services to vehicles that invest in various asset classes. If the value of such assets increases, those vehicles may benefit, and Galaxy Digital’s service fees may increase accordingly. The information and analysis in this communication are based on technical, fundamental, and market considerations and do not represent a formal valuation. For more information, please refer to Galaxy’s public filings and statements. Certain asset classes discussed, including digital assets, may be volatile and involve risk, and actual market outcomes may differ materially from perspectives expressed here.

For additional risks related to digital assets, please refer to the risk factors contained in filings Galaxy Digital Inc. makes with the Securities and Exchange Commission (the “SEC”) from time to time, including in its Quarterly Report on Form 10-Q for the quarter ended September 30, 2025, filed with the SEC on November 10, 2025, available at www.sec.gov.

Certain statements in this document reflect Galaxy Digital’s views, estimates, opinions or predictions (which may be based on proprietary models and assumptions, including, in particular, Galaxy Digital’s views on the current and future market for certain digital assets), and there is no guarantee that these views, estimates, opinions or predictions are currently accurate or that they will be ultimately realized. To the extent these assumptions or models are not correct or circumstances change, the actual performance may vary substantially from, and be less than, the estimates included herein. None of Galaxy Digital nor any of its affiliates, shareholders, partners, members, directors, officers, management, employees or representatives makes any representation or warranty, express or implied, as to the accuracy or completeness of any of the information or any other information (whether communicated in written or oral form) transmitted or made available to you. Each of the aforementioned parties expressly disclaims any and all liability relating to or resulting from the use of this information. Certain information contained herein (including financial information) has been obtained from published and non-published sources. Such information has not been independently verified by Galaxy Digital and, Galaxy Digital, does not assume responsibility for the accuracy of such information. Affiliates of Galaxy Digital may have owned, hedged and sold or may own, hedge and sell investments in some of the digital assets, protocols, equities, or other financial instruments discussed in this document. Affiliates of Galaxy Digital may also lend to some of the protocols discussed in this document, the underlying collateral of which could be the native token subject to liquidation in the event of a margin call or closeout. The economic result of closing out the protocol loan could directly conflict with other Galaxy affiliates that hold investments in, and support, such token. Except where otherwise indicated, the information in this document is based on matters as they exist as of the date of preparation and not as of any future date, and will not be updated or otherwise revised to reflect information that subsequently becomes available, or circumstances existing or changes occurring after the date hereof. This document provides links to other Websites that we think might be of interest to you. Please note that when you click on one of these links, you may be moving to a provider’s website that is not associated with Galaxy Digital. These linked sites and their providers are not controlled by us, and we are not responsible for the contents or the proper operation of any linked site. The inclusion of any link does not imply our endorsement or our adoption of the statements therein. We encourage you to read the terms of use and privacy statements of these linked sites as their policies may differ from ours. The foregoing does not constitute a “research report” as defined by FINRA Rule 2241 or a “debt research report” as defined by FINRA Rule 2242 and was not prepared by Galaxy Digital Partners LLC. Similarly, the foregoing does not constitute a “research report” as defined by CFTC Regulation 23.605(a)(9) and was not prepared by Galaxy Derivatives LLC. For all inquiries, please email [email protected].

©Copyright Galaxy Digital Inc. 2026. All rights reserved.