Weekly Top Stories - 6/27

In this week's newsletter, we break down the big funding rounds by the two largest prediction market platforms, a breakthrough in zero-knowledge proofs on Ethereum, and the Jupiter dev team's controversial decision to pause DAO voting.

Prediction Markets Achieve Unicorn Status

This week brought further evidence that prediction markets, both onchain and off, are sustaining the breakout success they achieved during the run-up to the 2024 U.S. presidential election.

Polymarket, which runs on crypto rails and is the largest prediction market platform by far, is finalizing a $200 million raise at a $1B+ valuation, several news outlets reported, citing unnamed sources. Peter Thiel’s Founders Fund is leading the round, reprising its role from Polymarket’s last big raise, the reports said. Shortly afterward, Kalshi, Polymarket’s centralized, fiat-based arch-rival, announced a $185 million round led by Paradigm (a new investor in the cap table) at a $2 billion valuation.

The scale of these raises reaffirms investor conviction in information markets as a core financial primitive. Kalshi operates as a CFTC-regulated U.S. exchange for event contracts, enabling Americans to trade legally on real-world outcomes, such as elections and CPI. Last year, the firm won a landmark legal battle, granting it the right to list political contracts.

Polymarket takes a more crypto-native approach, using stablecoins and smart contracts to let users globally bet on news, politics, and geopolitics. (Under a CFTC settlement, it blocks U.S. IP addresses, although it has been widely reported that clever Americans have used VPNs to get around the geofencing.) The platform cemented its credibility during the 2024 U.S. elections and again this year during the Israel-Iran conflict, as its markets often reflected emerging consensus faster than traditional media. This week, both Polymarket and Kalshi demonstrated real-time responsiveness in the Democratic New York City mayoral primary, as Zohran Mamdani’s odds of victory surged before mainstream coverage recognized his stunning upset. Both platforms reacted dynamically to the reality on the ground, demonstrating the core thesis that these markets are often better aggregators of information than polls.

OUR TAKE:

Broadly, these funding rounds are the latest sign that prediction markets, once an academic hobbyhorse, aren’t fringe tools anymore. They’re being taken increasingly seriously by capital allocators and participants who use them as truth-pricing engines. The continued backing, now at unicorn valuations, from big-name VCs is a testament to the informational efficacy of prediction markets and how they are disrupting the business of information dissemination.

But there’s a divergence in business models worth noting. Kalshi represents the fully regulated U.S. model, while Polymarket is the crypto-native and permissionless model. Last year, during the waning days of the Biden administration, the FBI and Department of Justice reportedly investigated Polymarket for failing to keep Americans off its platform; the status of that probe under the Trump administration is unclear. Kalshi, meanwhile, boasts of its status as a fully licensed designated contract market (DCM) supervised by the CFTC, even if the company has clashed with its regulator at times. Simply put, Kalshi is a bet on regulatory clarity, and Polymarket is a bet on scale and faster information discovery.

Now, this divergence is quantifiable. Polymarket is currently seeing $590 million in active trading volume across all open markets, more than 5x Kalshi’s $113 million. Yet Kalshi commands a 2x higher valuation, reflecting how much weight investors are assigning to compliance and U.S. user access versus market traction alone.

At least for now, institutional appetite is prioritizing alignment with regulators over pure usage metrics. – Will Owens

Ethereum Gets Fast ZK Proving Machine That Runs on One GPU

GPU farms just got humbled. Matter Labs unveiled Airbender, an open-source prover that the firm claims can generate a validity proof for an entire Ethereum block in less than 35 seconds on a single consumer GPU. Benchmarks released with the launch show the system completing a block proof at least three times faster than the quickest public zkEVMs. It can accomplish this feat on a single gaming-grade graphics card while its slower predecessors require expensive multi-GPU clusters.

Airbender works as fast as it does by compiling every execution trace into the minimalist RISC-V (pronounced “risk five”) instruction set. That choice shrinks the arithmetic circuit that underlies the zero-knowledge proof and eliminates the extra translation layer that slows EVM-centric rollups. The design echoes Vitalik Buterin’s April proposal to shift Ethereum itself toward a RISC-V engine, an idea he argues could cut proving overhead by 50x to 100x and simplify the protocol without breaking existing contracts.

If these performance gains hold in production, inexpensive consumer GPUs could shoulder the heavy proving work for rollups, lowering barriers to participation and pushing transaction costs down to a fraction of a cent. This advance would further decentralize the settlement layer and revive the question of whether Ethereum should adopt a new virtual machine to keep pace with the latest proving technology.

OUR TAKE:

A processor is the computer’s brain. In a blockchain, that brain is recreated in software, called a virtual machine, so the same program can run on thousands of computers at once. Developers write smart contracts, turn them into machine-friendly bytecode, and every computer in the network runs that bytecode to reach the same result. The Ethereum Virtual Machine (EVM) works with very large, 256-bit numbers and more than 100 basic instructions, known as opcodes.

Think of a roll-up as an Ethereum contractor; it gathers thousands of transactions, runs the smart-contract code offchain, and hands the main chain a cryptographic receipt. That receipt is built by a prover, specialized software that converts the batch’s execution trace into a compact zero-knowledge proof showing every rule was followed. The roll-up posts this proof, plus a small “blob” of data, to Ethereum so any node can double-check later. Once most nodes confirm the proof, they reach consensus and lock the result in place without replaying all the steps. Until now, those proofs have run on processors built around Intel and AMD x86 designs or on chips that license Advanced RISC Machines’ (ARM) architecture. RISC-V, created at the University of California at Berkeley and free for anyone to use, is a simpler instruction set that fits zero-knowledge proofs much better.

Airbender, the new prover from Matter Labs, shows what this open architecture can do. It turns a full Ethereum block into RISC-V instructions and produces a proof in about 35 seconds on one RTX 4090 graphics card. That is at least three times faster than the best public zkEVM tests, and it needs only a single consumer GPU instead of a rack of them, pointing to a future where everyday hardware can handle the heavy proving and drive roll-up costs even lower.

The benchmark has reopened a strategic question. In April, Buterin suggested moving Ethereum itself from the current EVM bytecode to native RISC-V so that proofs would no longer need a translation step. He argued that a standard register machine could cut overhead by as much as 100x while existing contracts continued to run through an interpreter during a gradual transition.

Not everyone is convinced: developer Ben Adams cautions that “ZK-proving may get better, but block building and execution will deteriorate significantly” because 256-bit EVM arithmetic sits awkwardly on a 32/64-bit instruction set architecture (ISA). Adam Cochran questions whether a monumental RISC-V rewrite should leapfrog more pressing roadmap items like danksharding, given the rewrite’s heavy engineering cost.

Airbender’s single-GPU benchmark doesn’t just cheapen proofs; it widens the circle of who can generate them. A lean RISC-V circuit lowers the hardware bar so anyone with a gaming-grade GPU can help secure a rollup. That pushes individual proving costs down to fractions of a cent, while Ethereum’s revenue stays steady because each proof still posts the same data blob to layer one, and blob gas remains the network’s main fee source.

The real upside is network health: thousands of new, low-cost provers would deepen decentralization, enable horizontal scaling of roll-up throughput, and let users enjoy cheaper L2 transactions. This is exactly the dynamic Ethereum’s roll-up-centric roadmap was meant to unlock.

Pushing RISC-V into the L1 would be a steeper climb. It could lighten ZK proving, but critics warn of slower block building, enormous migration work, and uncertain tooling. The pragmatic path is letting RISC-V thrive inside roll-ups first, perhaps as an optional engine later, so Ethereum can harvest today’s proving gains without gambling its core execution layer. — Christopher Rosa

Jupiter Pauses DAO Voting, to Community's Chagrin

Jupiter, the largest decentralized exchange on Solana, halted all DAO voting on June 20 and says the suspension will run until at least early next year. Core contributors argued that fast-approaching product launches such as Jupiter Lend and a mobile wallet demand full attention, while the governance process has bogged down in arguments. Workstreams in progress and the planned 50 million JUP per quarter in staking rewards remain active, but no new community spending proposals will advance during the pause.

The Jupiter team’s worries about executing their road map led to the decision. COO Kash Dhanda argued that a rush of product launches (Jupiter Lend, a mobile app, etc.) requires “laser-focused” execution, while the DAO has spiraled into a “negative feedback loop” that slows decision-making. Exacerbating their tough-to-execute roadmap is the combative and less-than-productive state of Jupiter’s governance. The community has expressed distaste for the token distribution, decrying the outsized voting power of a handful of early wallets, including one that recently cast more than 4.5% of all votes, which control roughly one-fifth of the 10 billion JUP supply. Faced with the outcry and difficult roadmap, the team chose to freeze the ballot box while it drafts guardrails that it hopes will restore confidence before voting resumes.

OUR TAKE:

We are of two minds when it comes to the Jupiter move. On the one hand, it has parallels to traditional finance, where a corporate majority holder stalls a shareholder meeting to steamroll a resistant minority. Traditional equity markets give minority investors legal tools to fight back against the tyranny of the majority, such as fiduciary-duty claims and appraisal rights, but token holders in this case enjoy no comparable safety net. The only rights conferred to token holders is an arm’s length agreement in the protocol’s FAQ. There is no official charter of rights or whitepaper. If developers can shut down governance whenever it becomes inconvenient, governance is just theatre and not substance.

On the other hand, the move can be seen as an appropriate refocusing in a high-velocity market. Corporate governance structures, in which agents make decisions and only confer with investors on material changes in strategy, are vastly more efficient than anarchic DAOs that must deliberate every move. Solana DEXs fight for market share week by week; pausing slow, contentious voting cycles can clear the decks for critical feature deliveries. Corporate boards often delay referenda or bypass shareholder polls to execute a turnaround, and Jupiter is following that playbook. By comparison, a mature lending protocol such as Aave on Ethereum operates in a mature market with few upstarts; it can afford the formality and delay of constant on-chain proposals via DAO.

Either way you view the move by Jupiter, as a pragmatic focus on shipping features or as a raiding of minority rights, it is a sign of the crypto industry’s flexibility. While Jupiter isn’t a truly decentralized protocol run by its community, à la the cypherpunk ethos of many DeFi protocols on Ethereum, it is a well-run business that is looking to be profitable over the long term. Not every protocol must adhere to the tenets and ethos of decentralization and trustlessness from the start; a bootstrapping phase can be required before reaching a mature point where trustlessness is viable. Ethereum has gone through its growing pains and bootstrapping phase. Now it is the Solana ecosystem’s turn. Even then, not every protocol must be trustless to succeed. A well-run business can glean benefits from operating onchain without having to give up control. Just look at Polymarket’s success in the prediction markets.

Just make sure that the token you buy confers on you the rights you believe it does. – Thad Pinakiewicz

Charts of the Week

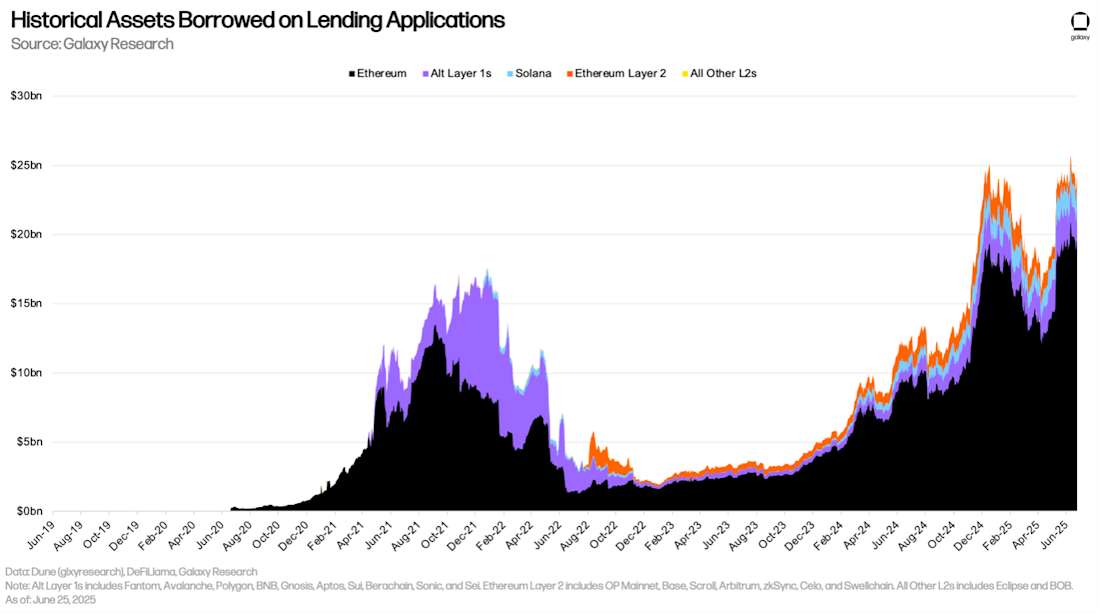

The amount of borrows outstanding on DeFi lending applications stood at $24.2 billion on June 25 after notching an all-time high of $25.8 billion on June 10. The sharp increase in borrows from April’s low can be attributed to the integration of new collateral types, the softening of lending market parameters (e.g., reductions in borrowing costs) to incentivize borrowing, and the risk-on shift in the market broadly.

Ethereum mainnet still holds the vast majority of lending application borrows. As of June 25, the network was home to 81.01% of onchain lending application borrows, and its share has only grown since the trough in total borrows that was reached on April 10. Since then, Ethereum mainnet has gained 4.98 percentage points of market share while Solana lost 0.2 points, Ethereum layer-2s (L2s) lost 3.18 points, alternative layer-1s (L1s) lost 1.86 points, and all other L2s combined lost 0.14 percentage point.

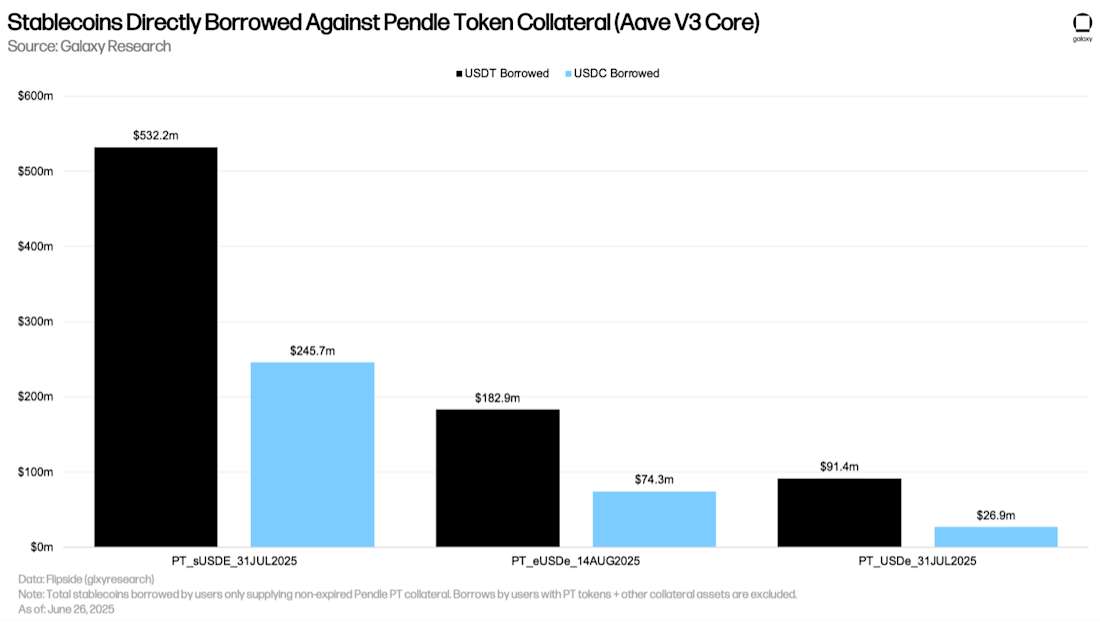

The integration of Pendle principal tokens (PT) as collateral on Aave V3 Core around mid-April has provided a significant boost to borrows on the application and on lending markets as a whole. Issued by Pendle Finance, PT tokens represent the principal portion of a yield-bearing asset (such as Ethena’s USDe, a stablecoin that pays interest). They can be thought of as DeFi-native zero-coupon bonds, where users buy the right, often at a discount, to receive the underlying asset (the principal) at a set future date. The tokens can be redeemed for the original asset at a 1:1 ratio upon expiry. The delta between the purchase price and the 1:1 redemption thus equals the yield received. (The tokens may remind old hands of the principal-only “strips” of mortgage-backed securities and U.S. Treasury bonds Wall Street pioneered in the 1980s.)

As of June 26, there were three non-expired PT tokens actively used as collateral on Aave V3 Core. These assets alone had $1.15 billion in direct borrows against them from 416 users who deposited them as their sole collateral assets. The same assets held a place in the collateral mix of an additional 115 users.

Notably, the borrowing users who solely supplied PT token collateral only borrow USDC and USDT stablecoins. They are “looping” – that is, pledging collateral to borrow assets that they then pledge to borrow other assets, and so on, to arbitrage borrowing rates and amplify the yield on the asset backing the PT token. This strategy is commonly seen with ETH and stETH (liquid staked ETH), where users acquire leveraged exposure to the Ethereum staking APY.

In total, there were $1.91 billion of non-expired Pendle PT tokens on Aave V3 Core as of June 26.

Other News

FHFA Chief orders Fannie and Freddie to prepare for Crypto in mortgage underwriting

Obscure Constitutional clause could help U.S. build BTC reserves

Dinari granted first broker-dealer registration to offer tokenized stocks

OKX explores U.S. IPO as crypto firms aim to emulate Circle's success

Coinbase secures EU-wide crypto services approval under MiCA

Texas joins two other U.S. states in creating a BTC reserve

Active XRP Ledger addresses down 80% since December

SEI's price skyrockets as Wyoming considers chain for upcoming stablecoin

U.S. government opposes release of 19-year-old involved in $245m BTC heist

Institutions get direct DeFi access as Anchorage integrates Uniswap API

Legal Disclosure:

This document, and the information contained herein, has been provided to you by Galaxy Digital Inc. and its affiliates (“Galaxy Digital”) solely for informational purposes. This document may not be reproduced or redistributed in whole or in part, in any format, without the express written approval of Galaxy Digital. Neither the information, nor any opinion contained in this document, constitutes an offer to buy or sell, or a solicitation of an offer to buy or sell, any advisory services, securities, futures, options or other financial instruments or to participate in any advisory services or trading strategy. Nothing contained in this document constitutes investment, legal or tax advice or is an endorsement of any of the stablecoins mentioned herein. You should make your own investigations and evaluations of the information herein. Any decisions based on information contained in this document are the sole responsibility of the reader. Readers should consult with their own advisors and rely on their independent judgement when making financial or investment decisions.

Participants, along with Galaxy Digital, may hold financial interests in certain assets referenced in this content. Galaxy Digital regularly engages in buying and selling financial instruments, including through hedging transactions, for its own proprietary accounts and on behalf of its counterparties. Galaxy Digital also provides services to vehicles that invest in various asset classes. If the value of such assets increases, those vehicles may benefit, and Galaxy Digital’s service fees may increase accordingly. The information and analysis in this communication are based on technical, fundamental, and market considerations and do not represent a formal valuation. For more information, please refer to Galaxy’s public filings and statements. Certain asset classes discussed, including digital assets, may be volatile and involve risk, and actual market outcomes may differ materially from perspectives expressed here.

For additional risks related to digital assets, please refer to the risk factors contained in filings Galaxy Digital Inc. makes with the Securities and Exchange Commission (the “SEC”) from time to time, including in its Quarterly Report on Form 10-Q for the quarter ended September 30, 2025, filed with the SEC on November 10, 2025, available at www.sec.gov.

Certain statements in this document reflect Galaxy Digital’s views, estimates, opinions or predictions (which may be based on proprietary models and assumptions, including, in particular, Galaxy Digital’s views on the current and future market for certain digital assets), and there is no guarantee that these views, estimates, opinions or predictions are currently accurate or that they will be ultimately realized. To the extent these assumptions or models are not correct or circumstances change, the actual performance may vary substantially from, and be less than, the estimates included herein. None of Galaxy Digital nor any of its affiliates, shareholders, partners, members, directors, officers, management, employees or representatives makes any representation or warranty, express or implied, as to the accuracy or completeness of any of the information or any other information (whether communicated in written or oral form) transmitted or made available to you. Each of the aforementioned parties expressly disclaims any and all liability relating to or resulting from the use of this information. Certain information contained herein (including financial information) has been obtained from published and non-published sources. Such information has not been independently verified by Galaxy Digital and, Galaxy Digital, does not assume responsibility for the accuracy of such information. Affiliates of Galaxy Digital may have owned, hedged and sold or may own, hedge and sell investments in some of the digital assets, protocols, equities, or other financial instruments discussed in this document. Affiliates of Galaxy Digital may also lend to some of the protocols discussed in this document, the underlying collateral of which could be the native token subject to liquidation in the event of a margin call or closeout. The economic result of closing out the protocol loan could directly conflict with other Galaxy affiliates that hold investments in, and support, such token. Except where otherwise indicated, the information in this document is based on matters as they exist as of the date of preparation and not as of any future date, and will not be updated or otherwise revised to reflect information that subsequently becomes available, or circumstances existing or changes occurring after the date hereof. This document provides links to other Websites that we think might be of interest to you. Please note that when you click on one of these links, you may be moving to a provider’s website that is not associated with Galaxy Digital. These linked sites and their providers are not controlled by us, and we are not responsible for the contents or the proper operation of any linked site. The inclusion of any link does not imply our endorsement or our adoption of the statements therein. We encourage you to read the terms of use and privacy statements of these linked sites as their policies may differ from ours. The foregoing does not constitute a “research report” as defined by FINRA Rule 2241 or a “debt research report” as defined by FINRA Rule 2242 and was not prepared by Galaxy Digital Partners LLC. Similarly, the foregoing does not constitute a “research report” as defined by CFTC Regulation 23.605(a)(9) and was not prepared by Galaxy Derivatives LLC. For all inquiries, please email [email protected].

©Copyright Galaxy Digital Inc. 2026. All rights reserved.