Weekly Top Stories - 6/20

This week in the newsletter, we break down the U.S. Senate’s passage of the GENIUS Act and JPMorgan’s “tokenized deposits,” centralized exchanges’ continued expansion into onchain markets, and Polymarket’s controversial, but in our view valuable, bets on geopolitical conflicts.

Stablecoin Bill Advances to House

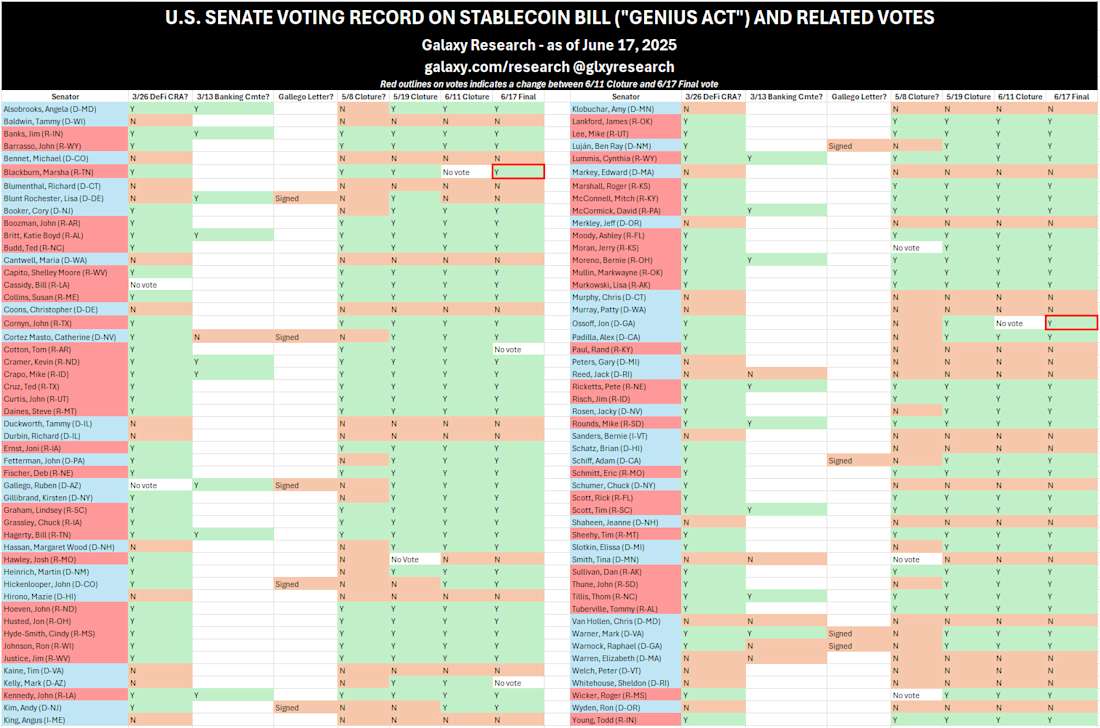

U.S. Senate passes GENIUS Act 68-30. The U.S. Senate passed the landmark stablecoin legislation GENIUS Act on Tuesday with 18 Democrats joining most Republicans. The passage marks the culmination of more than a month of procedural votes and political hurdles, including a dramatic cloture vote on May 8 that failed due to a last-minute dispute.

The GENIUS Act now goes to the House, where Financial Services Committee Chair Rep. French Hill (R-AR) has suggested he intends to combine GENIUS with the CLARITY Act, a comprehensive crypto market structure reform bill. This hasn’t happened yet, and it’s unclear if it will; President Trump has publicly opposed combining the bills. If GENIUS passes the House, a reconciled version could be on his desk to sign by August.

Meanwhile, Bloomberg reported that J.P. Morgan, the world’s largest bank, was planning to pilot a “tokenized deposit” token called JPMD on Coinbase’s Ethereum L2, Base. “The token issuance and transfer will happen on Coinbase-affiliated public blockchain Base, and will be denominated in dollars," the article said. "[G]oing forward, Coinbase’s institutional clients will be able to use the deposit tokens for transactions.” JPM intends to expand to other users and currencies “pending approval from regulators,” said Naveen Mallela, global co-head of Kinexys, JPM’s blockchain division.

OUR TAKE:

The passage of GENIUS marks a major milestone in upgrading the U.S. financial system for the 21st century. As we’ve written about extensively, the GENIUS Act would meaningfully upgrade dollar payment rails in ways that speed settlement times, improve transparency, promote dollar dominance, and juice U.S. debt demand. The bill would add substantial consumer protections, collateral requirements, and regulatory oversight, while creating a pathway for innovators and incumbents to use public blockchains to move dollars worldwide. Getting traditional finance onto public blockchains through stablecoins could also open the door for wider adoption of bitcoin, crypto, and DeFi generally. Notably, the average age of U.S. Senators who voted in favor of GENIUS was 62, while the average age of those who opposed was 68.

We oppose efforts to combine the GENIUS and CLARITY Acts in the House. I argued in March that combining the two bills could jeopardize both. That risk has only increased in recent months as Democrats have agitated against the Trump family’s crypto ventures. Democrats have indicated that they intend to add an amendment prohibiting such activities to the market structure bill, and the White House reportedly balked at the idea. The reality is that market structure legislation like CLARITY is significantly more complicated than GENIUS. With or without controversial amendments and whether or not the bills are combined, CLARITY likely has a bumpy ride ahead as stakeholders across the political spectrum and business landscape pick apart its myriad provisions. The House should pass a clean GENIUS Act now and then turn to the task of crypto market structure.

JPM’s announcement of a “tokenized deposit” pilot was surprising in light of the Senate’s passage of legislation that would authorize a different form of dollar tokens, “permitted payment stablecoins.” A tokenized deposit is effectively an IOU for a bank deposit in token form and presumably can only be transferred among the bank’s accountholders, while GENIUS stablecoins can be transferred to any non-blacklisted address. A notable difference is that banks can pay interest on deposits (even though, in practice, they pay little of it; deposits are banks’ cheapest sources of funding) while GENIUS stablecoins are prohibited from paying interest to token holders. Also, bank deposits are arguably riskier than 1:1 collateralized stablecoins because deposits at different banks are not fungible with one another. One bank’s risk of default is not the same as another’s (though JPM is probably one of the least likely banks of all to default – “too big to fail” and all that). Indeed, a future in which each bank issued deposit tokens would be much closer to the 1830s “wildcat banking” era endlessly trotted out by stablecoin critics. In reality, GENIUS stablecoins will adhere to a single, rigid federal standard, making them highly fungible among issuers.

Lastly, as my friend Austin Campbell said on this week’s episode of Galaxy Brains, it’s very possible that in a post-GENIUS world, regulators could look at a “tokenized deposit” and simply determine it is a stablecoin that must be registered like all the others. Regardless, if JPM is allowed to expand its tokenized deposit program significantly, and if the megabank chooses to pay meaningful interest, it could challenge the adoption of permitted payment stablecoins. Thus, if GENIUS becomes law and JPMD ends up competing with regulated stablecoins, we expect the Treasury Department and executive branch banking agencies to thwart its rise. They are not going to let JPM subvert the revolutionary project they just built.

It probably won’t come to that, though, because while tokenized deposits and bringing “commercial bank deposits” onchain might sound plausible and reasonable, they are unlikely to be widely adopted in the permissionless market of public blockchains. For all we know, JPM may even know this, and is simply timing an innovation announcement to capitalize on stablecoins’ big moment. – Alex Thorn

CEXs’ Onchain Expansion Accelerates

Kraken and Bybit announced major updates to their onchain initiatives this week, continuing the trend of centralized exchanges expanding deeper into the crypto stack. Bybit revealed the launch of Byreal, a Solana-based decentralized exchange incubated by, but developed by a team independently from, the exchange. Byreal is positioned as an onchain extension of Bybit’s CEX, offering a DEX architecture that combines concentrated liquidity market making with request-for-quote (RFQ) routing. It will also feature what Bybit bills as a fair launchpad with customizable launch options and curated yield vaults. Bybit CEO Ben Zhou described Byreal as a platform that combines “CEX-grade liquidity with DeFi-native transparency,” calling it “what real hybrid finance looks like.” Bybit previously incubated Mantle, an Ethereum layer-2 network, in 2023, but it remains unclear what, if any connection, Byreal will have with Mantle.

Kraken, meanwhile, announced the upcoming release of the INK token for its Ethereum L2 network of the same name. INK will have a permanently fixed supply of 1 billion tokens and will not be used for governance. The initial utility centers around a liquidity protocol powered by Aave, though further integrations are expected. No formal launch date was given, but the Ink team said early users of the protocol will be eligible for an airdrop, with details forthcoming.

Kraken unveiled Ink in October 2024. Built on the Optimism OP Stack, Ink aims to provide a “seamless bridge to DeFi” with Ethereum-grade security and full compatibility with the broader Superchain ecosystem.

OUR TAKE:

Leading centralized exchanges continue to dive deeper into the onchain seas, each with its own approach. Binance, Coinbase, OKX, Bybit, and Kraken now all have distinct offerings, ranging from general-purpose L1s and L2s (Binance, Coinbase, Kraken) to more targeted product launches (Bybit, OKX).

While Kraken’s new L2 shares many similarities with Coinbase’s Base (both launched on the OP stack), traction has been lackluster. Ink boasts just over $8 million in TVL, compared to Base’s more than $3.8 billion. Beyond DeFi, Base has aggressively pushed into consumer applications and managed to build out a large community of developers and users, while Ink still features only a few DeFi applications. However, Kraken’s willingness to introduce a token and airdrops for early users may help shift momentum, especially if the team can meaningfully differentiate INK's utility and make it a “no fluff” token as claimed. Coinbase has consistently reiterated that it has no plans to launch a Base token.

Bybit’s new product comes just months after the exchange announced a “strategic shift” in which it would shut down several onchain products, including its cloud and keyless wallets, DEX and NFT offerings, and niche products like an inscriptions marketplace. We’re now starting to see what that shift entails. By launching on Solana’s L1 rather than a controlled environment like an L2, Bybit is taking a fundamentally different approach from Kraken, Binance, and Coinbase. While Bybit may forfeit some control this way, the team appears to be betting it can offer existing customers frictionless access to one of the most active onchain ecosystems while picking up new ones from among Solana users.

Centralized exchanges aren’t just places to trade anymore. They’re building full onchain ecosystems that accelerate direct use of the underlying blockchains. This isn’t just about growth; it’s about survival. The ratio of DEX to CEX spot trading volumes is at an all-time high, and CEXs risk missing out on volume if they don’t get ahead of the shift to onchain markets. For this reason, integrating with onchain rails is both an opportunity and a defensive move, aimed at keeping users, liquidity, and fees inside exchanges' own ecosystems. – Lucas Tcheyan

Polymarket Returns to the Geopolitical Stage

Polymarket is back in the spotlight as geopolitical tension mounts over fears of U.S. involvement in the Middle East conflict. A whirlwind of events this week led to widespread speculation about potential U.S. military action in the Israel-Iran war. All eyes were on the onchain prediction markets, specifically Polymarket’s “Iran ballistic missile strike on Israel by Friday?” contract (which has been resolved) and its pending “US military action against Iran before July?” contract.

As of Thursday evening, Eastern time, the latter market had seen $18.15 million worth of volume across 25,819 bets and 7,640 bettors and was the second-largest politics-related market on the platform by total volume. “Yes” shares were trading at 39 cents, meaning traders assigned a 39% probability that U.S. military action will be taken before next month. (Each share pays out $1 worth of USDC if the prediction comes true, and zero if it does not.) On the other hand, the missile strike market garnered only $211,795 in volume across 491 bets and 276 betters. Despite being significantly smaller, this market generated a fast-moving and increasingly correct signal ahead of the event.

OUR TAKE:

Polymarket’s bets on the Middle East conflict’s outcome have rekindled debates about the informational value of prediction markets and the potential for "insider trading."

Amid uncertainty about a massively consequential event, both bettors and bystanders flocked to Polymarket. The general public turns to Polymarket for live, crowdsourced signals that cut through headline noise; profit opportunities incentivize true experts to efficiently disseminate their information. Every order is recorded onchain and reflected in real time, making the market a global, open-source barometer whose needle anyone can move. Capital shifts instantly with new data (or its absence), producing forecasts traditional media can’t (or won’t) match. Each informed bet drags the price toward ground truth while noise traders effectively subsidize that clarity, yielding a probability that is economically disciplined and transparently verifiable. As a result, prediction markets offer the cleanest signal available in situations like the Israel-Iran conflict, when official narratives diverge and information is sparse and can be interpreted subjectively.

This idea is broadly applicable to all prediction markets but is particularly relevant to the ongoing crisis and to Polymarket because 1) so much of the publicly available information on the conflict is ambiguous, filtered, or outright propaganda, and mainstream outlets have little incentive (or ability) to state unequivocally what is happening or what is likely to happen, and 2) the conflict transcends geographic borders and Polymarket is open to the world, allowing for a broader pool of bettors who can have accurate and diversified information on the event (only blockchains make this possible).

Many question what amount of economic activity constitutes a “meaningfully” accurate market. One of the most common critiques of Polymarket’s efficacy is that most of its markets are low stakes, economically speaking, holding little volume and open interest. The resolved missile strike market shows that what matters most is not the magnitude of volume or open interest, but rather the quality of the participants and their information.

As for the insider trading question, the reality is that all information flows like a waterfall, beginning with the few at the top who may or may not let some or all of their knowledge cascade down to the broader public. It is impossible to change this. However, we have mechanisms that more effectively move information from the top of the waterfall to the pool below, especially when it matters most (e.g., geopolitical conflict), a beneficial arrangement to all, perhaps except those who want the information kept secret. That tension will surely rear its head if prediction markets continue to grow. The permissionless nature of onchain prediction markets lets people anywhere in the world express their unfiltered knowledge; combined with the economic incentive built into the markets, this puts onchain prediction markets among the most effective ways of quickly and accurately moving information down the waterfall. While the pseudonymity of blockchain participants makes it difficult to assess individual qualifications to opine on any given topic, it leaves the door wide open for high-quality forecasters to participate.

In Polymarket’s “Iran ballistic missile strike on Israel by Friday?” market, little value was at stake, the number of market participants was low, and a single trader significantly altered the shape of the market and made $134,000. In the end, however, the market turned out to be highly accurate and provided a definitive signal on the matter to the world faster than traditional financial markets did, let alone traditional media outlets. As noted above, the market only had $211,795 in volume and 276 traders. One trader who had never used Polymarket before (at least, not with the same wallet) significantly altered the odds. Traders are identified by onchain addresses, but a single person can control thousands of individual addresses. Matching clusters of addresses to single individuals is difficult and a probabilistic exercise. While this particular address only used Polymarket once, it is possible that the person behind it used Polymarket in the past and is active on blockchains under other addresses. He or she could have simply spun up a new address to protect his or her identity before signaling to the market that a missile strike was imminent. This characteristic of the trader left many on X crying foul. Some speculated that the trader was profiting on leaked intelligence, despite the claim being unprovable by nature of the anonymity of onchain addresses.

Even assuming that this was an intel leak by an insider who profited, what critics miss is that paying insiders to reveal information is a feature, not a bug, of prediction markets. If someone truly knows an event is imminent, the most compelling way to share that knowledge is by moving the price and making money; everyone else sees the shift and can update their priors instantly. Theoretically, well-funded actors could try to spread misinformation through prediction markets by purchasing the opposite side of the correct bet. But this comes at a financial cost to the propagandists and only provides more incentive for those with solid information to trade against them. There’s no doubt that this radical information transparency incentivization, caused by prediction markets, creates an inherent tension with the principles of confidentiality and the policy principles behind insider trading prohibitions. These are new types of markets, and they will inevitably create conflicts with global regulators.

Essentially, in prediction markets, one person’s misinformation is another person’s financial incentive. That is what makes them powerful disseminators of timely and accurate knowledge. – Zack Pokorny

Charts of the Week

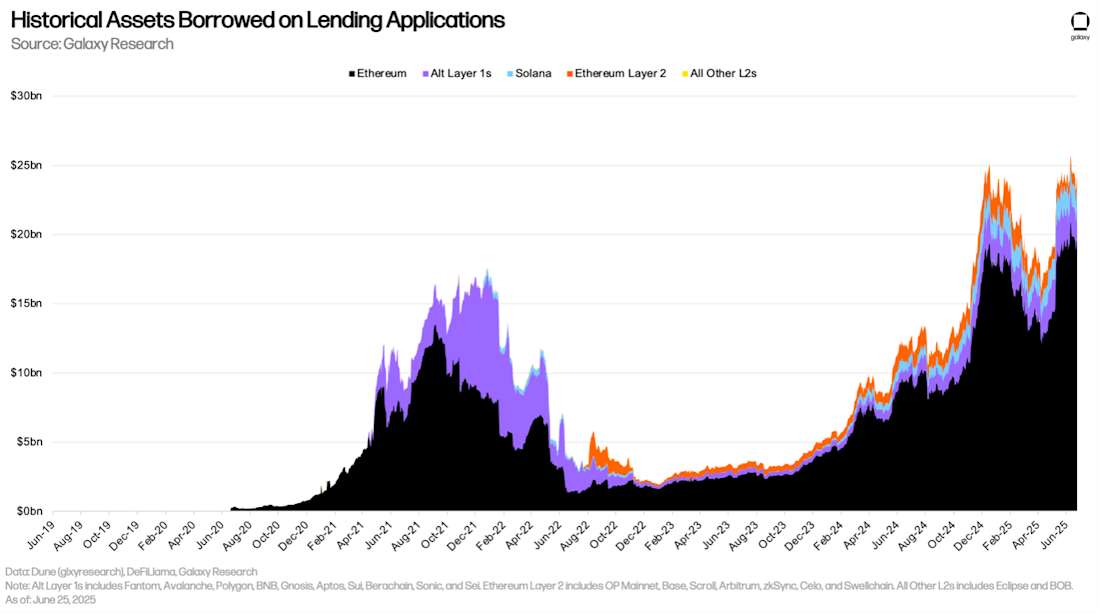

The total value of assets supplied to onchain lending applications continues to climb to all-time highs after a 36% compression between December 2024 and April 2025. Sitting at $55.5 billion as of June 18, and reaching an all-time high of $59.9 billion on June 11, the value supplied to lending applications is now 50% higher than the April 9, 2025, low. The strong surge off the April lows is partially attributable to the strong performance in crypto asset prices, but new collateral types (e.g., Pendle tokens) have added to the momentum. For additional context on the crypto lending markets, check out our recently published State of Crypto Leverage report.

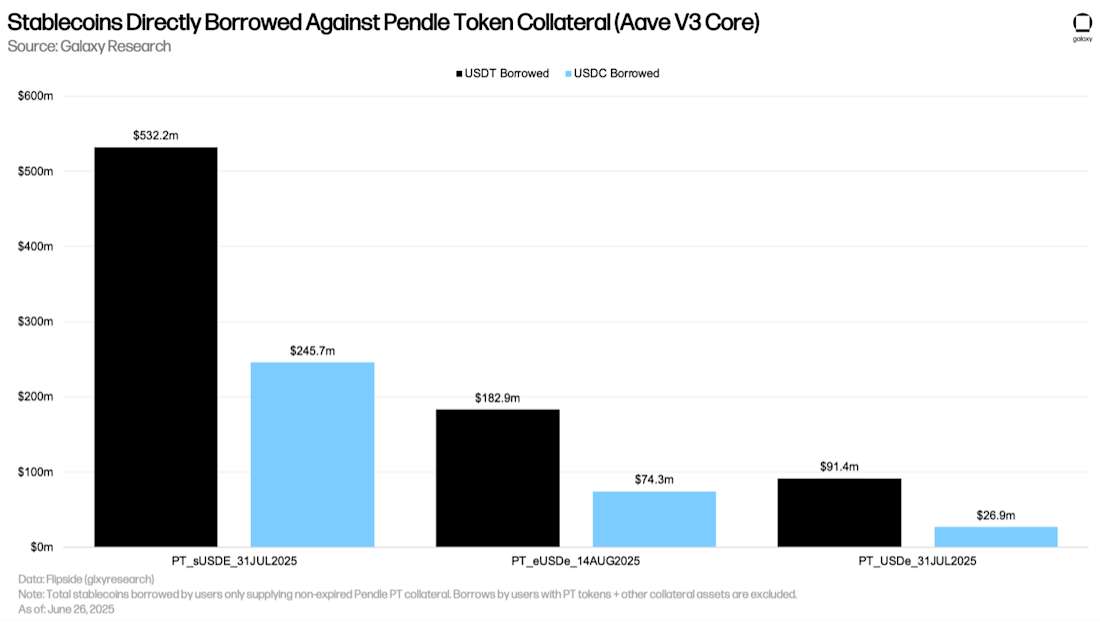

Over the last 90 days, $3.9 billion worth of USDT, USDC, and Pendle tokens have been supplied to Aave V3 Core on Ethereum mainnet alone. Pendle tokens create a flywheel for depositors that allows them to use yield-bearing, stablecoin-adjacent collateral to back leveraged looping strategies. This has put the collateral type in high demand, with Pendle tokens consistently hitting or nearing their deposit limits on the application. In turn, this collateral type has fueled demand for additional stablecoin deposits, resulting in $2.02 billion of new USDT and USDC being deposited onto the application. Together, they have added tailwinds to the value of assets deposited onto lending applications onchain.

Other News

Even Tron has a listed treasury company now ...

Eric Trump denies involvement in ‘Tron Inc.’

Iranian exchange hacked; pro-Israel group claims responsibility

Peter Thiel invests in (Galaxy-led) seed round for stablecoin clearer

Haun Ventures leads seed round for a different stablecoin infra builder

Coinbase seeks SEC approval to offer tokenized stocks

Pump.Fun’s X account suspended over violation of terms

ZKJ token plummets 80% amid liquidation crisis

a16z bets big on EigenLayer again with $70M token buy

HyperLiquid trader (not Wynn) turns $10M profit into $2.5M loss

Stablecoin activity was 99% legit in 2024, TRM Labs says

Privacy-focused L1 Namada completes mainnet rollout

Legal Disclosure:

This document, and the information contained herein, has been provided to you by Galaxy Digital Inc. and its affiliates (“Galaxy Digital”) solely for informational purposes. This document may not be reproduced or redistributed in whole or in part, in any format, without the express written approval of Galaxy Digital. Neither the information, nor any opinion contained in this document, constitutes an offer to buy or sell, or a solicitation of an offer to buy or sell, any advisory services, securities, futures, options or other financial instruments or to participate in any advisory services or trading strategy. Nothing contained in this document constitutes investment, legal or tax advice or is an endorsement of any of the stablecoins mentioned herein. You should make your own investigations and evaluations of the information herein. Any decisions based on information contained in this document are the sole responsibility of the reader. Readers should consult with their own advisors and rely on their independent judgement when making financial or investment decisions.

Participants, along with Galaxy Digital, may hold financial interests in certain assets referenced in this content. Galaxy Digital regularly engages in buying and selling financial instruments, including through hedging transactions, for its own proprietary accounts and on behalf of its counterparties. Galaxy Digital also provides services to vehicles that invest in various asset classes. If the value of such assets increases, those vehicles may benefit, and Galaxy Digital’s service fees may increase accordingly. The information and analysis in this communication are based on technical, fundamental, and market considerations and do not represent a formal valuation. For more information, please refer to Galaxy’s public filings and statements. Certain asset classes discussed, including digital assets, may be volatile and involve risk, and actual market outcomes may differ materially from perspectives expressed here.

For additional risks related to digital assets, please refer to the risk factors contained in filings Galaxy Digital Inc. makes with the Securities and Exchange Commission (the “SEC”) from time to time, including in its Quarterly Report on Form 10-Q for the quarter ended September 30, 2025, filed with the SEC on November 10, 2025, available at www.sec.gov.

Certain statements in this document reflect Galaxy Digital’s views, estimates, opinions or predictions (which may be based on proprietary models and assumptions, including, in particular, Galaxy Digital’s views on the current and future market for certain digital assets), and there is no guarantee that these views, estimates, opinions or predictions are currently accurate or that they will be ultimately realized. To the extent these assumptions or models are not correct or circumstances change, the actual performance may vary substantially from, and be less than, the estimates included herein. None of Galaxy Digital nor any of its affiliates, shareholders, partners, members, directors, officers, management, employees or representatives makes any representation or warranty, express or implied, as to the accuracy or completeness of any of the information or any other information (whether communicated in written or oral form) transmitted or made available to you. Each of the aforementioned parties expressly disclaims any and all liability relating to or resulting from the use of this information. Certain information contained herein (including financial information) has been obtained from published and non-published sources. Such information has not been independently verified by Galaxy Digital and, Galaxy Digital, does not assume responsibility for the accuracy of such information. Affiliates of Galaxy Digital may have owned, hedged and sold or may own, hedge and sell investments in some of the digital assets, protocols, equities, or other financial instruments discussed in this document. Affiliates of Galaxy Digital may also lend to some of the protocols discussed in this document, the underlying collateral of which could be the native token subject to liquidation in the event of a margin call or closeout. The economic result of closing out the protocol loan could directly conflict with other Galaxy affiliates that hold investments in, and support, such token. Except where otherwise indicated, the information in this document is based on matters as they exist as of the date of preparation and not as of any future date, and will not be updated or otherwise revised to reflect information that subsequently becomes available, or circumstances existing or changes occurring after the date hereof. This document provides links to other Websites that we think might be of interest to you. Please note that when you click on one of these links, you may be moving to a provider’s website that is not associated with Galaxy Digital. These linked sites and their providers are not controlled by us, and we are not responsible for the contents or the proper operation of any linked site. The inclusion of any link does not imply our endorsement or our adoption of the statements therein. We encourage you to read the terms of use and privacy statements of these linked sites as their policies may differ from ours. The foregoing does not constitute a “research report” as defined by FINRA Rule 2241 or a “debt research report” as defined by FINRA Rule 2242 and was not prepared by Galaxy Digital Partners LLC. Similarly, the foregoing does not constitute a “research report” as defined by CFTC Regulation 23.605(a)(9) and was not prepared by Galaxy Derivatives LLC. For all inquiries, please email [email protected].

©Copyright Galaxy Digital Inc. 2026. All rights reserved.