Can Binance Smart Chain Sustain Its Roaring Comeback?

Executive Summary

Decentralized exchange (DEX) volumes on Binance Smart Chain (BSC) surged to outpace DEX activity on Solana in May and June, driven by the success of Binance Alpha, a product incentivizing onchain activity via airdrops and trading incentives. However, questions remain about the sustainability of this growth due to high levels of incentivized trading and the shifting competitive landscape across L1 ecosystems.

Background

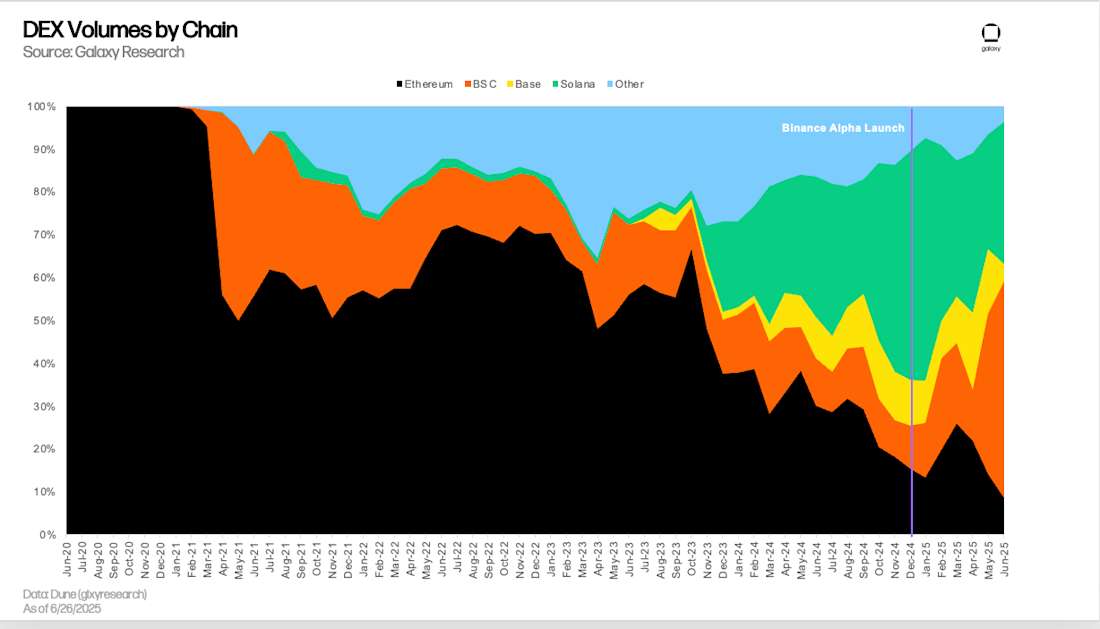

Binance has long held a dominant position among centralized exchanges (CEXs), with market share peaking at 63% in 2023 and maintaining 30%+ monthly since. Its layer-1 blockchain, Binance Smart Chain (BSC), is also a major component of the exchange’s offering. It routinely ranked second behind Ethereum in DEX volume during the 2021 cycle. However, over the past two years, BSC steadily lost market share as Solana emerged as the leading ecosystem for onchain retail flows. Beginning in December 2023, Solana consistently held the top spot—or a close second—in onchain volumes.

That trend reversed sharply in May of this year as BSC staged a comeback, surpassing Solana by 44% in DEX volumes and accounting for over 37% of total DEX activity. As June came to a close, BSC was on pace to log more than double Solana’s volume for the month. The reversal can primarily be attributed to the growing traction of Binance Alpha, an onchain product introduced in December that offers Binance users early access to tokens unavailable on Binance’s spot or futures markets. Since its debut, Binance Alpha has steadily expanded its offerings and tweaked its incentive structure, culminating in the recent surge in activity.

Binance Alpha

Binance Alpha’s initial success boils down to a few factors:

Eliminating Friction: In its initial form, Binance Alpha required users to download the Binance onchain wallet and transfer funds. In March, the offering was integrated directly with the Binance exchange interface. This enabled any Binance customer, not just Binance wallet users, to trade Binance Alpha tokens directly from their CEX account using previously deposited funds. The team also added a pro-style Binance Alpha trading terminal directly to the Binance website to create a better trading experience.

Points System: To qualify for the points program, users need to already hold eligible tokens or buy them (Selling these tokens earns them no points). Depending on the number of points a user has accumulated, they gain access to a tiered system for airdrops and exclusive token generation events (TGEs). As with airline frequent flier miles, points are subtracted from users’ balances every time they claim rewards. In May, the points system was modified to require users to redeem points within 15 days or lose them. This incentivizes users to actively engage on Binance Alpha and think strategically about how they deploy and maintain their balances. Binance has raised the minimum number of points to be eligible to claim rewards multiple times. While this has drawn some criticism for boxing out smaller users in favor of whales, it has been highly effective in driving activity. Finally, Binance has specifically encouraged trading of tokens on the BSC network, offering extra points on BSC tokens or for liquidity provider tokens on BSC-native DEX PancakeSwap.

Trading Fee Reductions: Binance continues to reduce trading fees for users of Binance Alpha. In March, it rolled out a zero-trading-fee promotion for all Binance Wallet exchange trading pairs. In June, Binance reduced fees on all Binance Alpha trades that use limit orders by 14 basis points, to 0.01%. While these sweeteners have not been a major driver of volume for Binance Alpha tokens, they contribute to Binance’s efforts to drive activity by reducing costs and friction.

Outlook

Binance is implementing a familiar playbook, leveraging its access to highly sought out airdrops and TGEs to incentivize activity. This is a similar strategy to the exchange’s Launchpool product introduced in 2020, which requires users to stake tokens to get access to new TGEs. Instead of targeting token supply sinks, this time Binance is focused on driving onchain activity. This is particularly effective in the current market environment where users are increasingly seeking opportunities to gain access to tokens prior to their CEX listing.

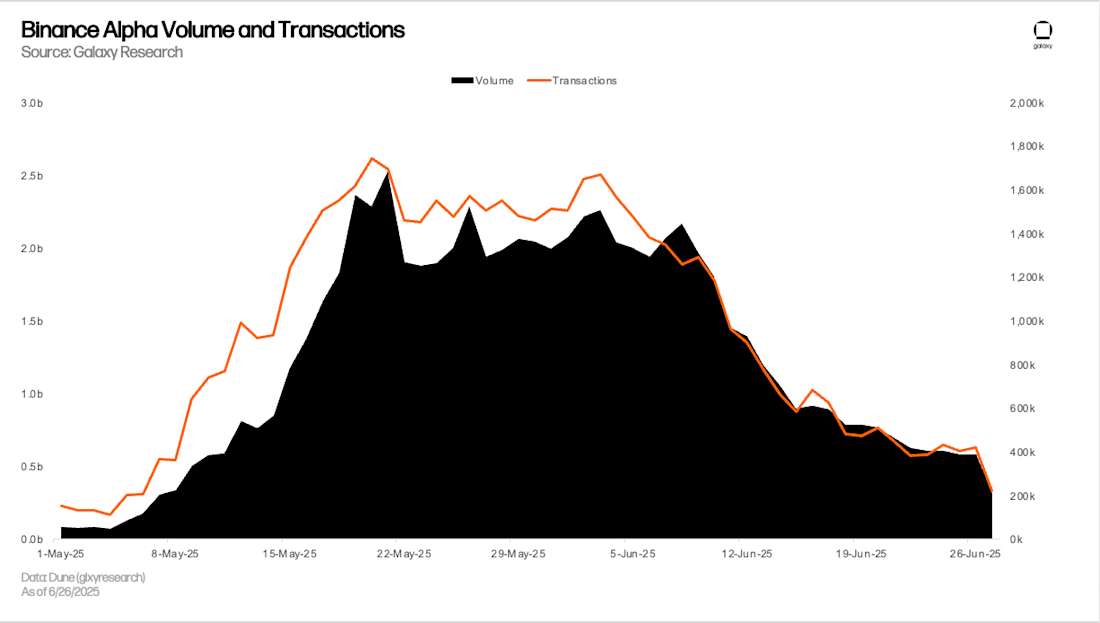

So far, the program has been a resounding win, as evidenced by Binance Smart Chain overtaking Solana in daily DEX volumes. However, it’s unclear how sustainable this success is, because the incentives are mostly driving farming activity rather than organic trading volume. Specifically, the inclusion of a user’s trading volume as a key determinant of their Alpha points appears to have incentivized wash trading, crowding out smaller individual traders in favor of apparent bot-driven activity by whales. A simple search of “Binance Alpha” mentions on X (formerly Twitter) reveals numerous posts describing how to game the program.

Additionally, Binance has continued to raise the base Alpha point tier levels required to access airdrops and new TGEs, compounding the problem and making it increasingly difficult for new or casual entrants to gain access. To address the issue, on June 17 Binance removed volume as a key determinant of Alpha points. While this may create a more even playing field, an immediate result has been a drastic drop in volumes to less than half their peak in May and early June.

Moreover, BSC faces steep competition from Solana, which remains the go-to chain for retail meme activity and the main incubator for onchain “metas” (animal-themed coins from fall 2023 to spring 2024, AI tokens in late 2024 and early 2025, and most recently “internet capital markets” tokens). Binance’s main advantage, for now, is its ability to offer early access to highly sought token listings that are otherwise unavailable to the average user. With the emergence of platforms that provide users similar access (Echo, Legion, etc.), the allure of these offerings may erode over time.

As previously covered in Galaxy Research’s newsletter, CEX expansion onchain is expected to accelerate in the coming years. Binance has largely been ahead of the trend as one of the first major CEXs to launch its own L1, but onchain users are getting smarter and farming programs like Binance Alpha encourage inorganic and extractive activity rather than sustainable growth. Binance will need to double down on designing onchain use cases that attract sticky capital and real users. Coinbase’s integration with Morpho to allow CEX users to borrow against their BTC onchain, for example, has generated over $430 million in loan originations since June without suffering the pitfalls of wash trading and inorganic activity.

Ultimately, the most promising future for Binance Alpha lies not just in its ability to drive engagement or volume, but in its potential as a tool for asset curation. If Binance took additional steps to filter out low-effort or spammy trading activity, while continuing to incentivize deeper user interaction with novel onchain projects, it could use Alpha to identify high-quality tokens worthy of a full exchange listing. This would help address a longstanding problem in crypto — the lack of reliable, market-tested curation mechanisms — while reinforcing Binance’s leadership in listing the most compelling digital assets.

Legal Disclosure:

This document, and the information contained herein, has been provided to you by Galaxy Digital Inc. and its affiliates (“Galaxy Digital”) solely for informational purposes. This document may not be reproduced or redistributed in whole or in part, in any format, without the express written approval of Galaxy Digital. Neither the information, nor any opinion contained in this document, constitutes an offer to buy or sell, or a solicitation of an offer to buy or sell, any advisory services, securities, futures, options or other financial instruments or to participate in any advisory services or trading strategy. Nothing contained in this document constitutes investment, legal or tax advice or is an endorsement of any of the stablecoins mentioned herein. You should make your own investigations and evaluations of the information herein. Any decisions based on information contained in this document are the sole responsibility of the reader. Readers should consult with their own advisors and rely on their independent judgement when making financial or investment decisions.

Participants, along with Galaxy Digital, may hold financial interests in certain assets referenced in this content. Galaxy Digital regularly engages in buying and selling financial instruments, including through hedging transactions, for its own proprietary accounts and on behalf of its counterparties. Galaxy Digital also provides services to vehicles that invest in various asset classes. If the value of such assets increases, those vehicles may benefit, and Galaxy Digital’s service fees may increase accordingly. The information and analysis in this communication are based on technical, fundamental, and market considerations and do not represent a formal valuation. For more information, please refer to Galaxy’s public filings and statements. Certain asset classes discussed, including digital assets, may be volatile and involve risk, and actual market outcomes may differ materially from perspectives expressed here.

For additional risks related to digital assets, please refer to the risk factors contained in filings Galaxy Digital Inc. makes with the Securities and Exchange Commission (the “SEC”) from time to time, including in its Quarterly Report on Form 10-Q for the quarter ended September 30, 2025, filed with the SEC on November 10, 2025, available at www.sec.gov.

Certain statements in this document reflect Galaxy Digital’s views, estimates, opinions or predictions (which may be based on proprietary models and assumptions, including, in particular, Galaxy Digital’s views on the current and future market for certain digital assets), and there is no guarantee that these views, estimates, opinions or predictions are currently accurate or that they will be ultimately realized. To the extent these assumptions or models are not correct or circumstances change, the actual performance may vary substantially from, and be less than, the estimates included herein. None of Galaxy Digital nor any of its affiliates, shareholders, partners, members, directors, officers, management, employees or representatives makes any representation or warranty, express or implied, as to the accuracy or completeness of any of the information or any other information (whether communicated in written or oral form) transmitted or made available to you. Each of the aforementioned parties expressly disclaims any and all liability relating to or resulting from the use of this information. Certain information contained herein (including financial information) has been obtained from published and non-published sources. Such information has not been independently verified by Galaxy Digital and, Galaxy Digital, does not assume responsibility for the accuracy of such information. Affiliates of Galaxy Digital may have owned, hedged and sold or may own, hedge and sell investments in some of the digital assets, protocols, equities, or other financial instruments discussed in this document. Affiliates of Galaxy Digital may also lend to some of the protocols discussed in this document, the underlying collateral of which could be the native token subject to liquidation in the event of a margin call or closeout. The economic result of closing out the protocol loan could directly conflict with other Galaxy affiliates that hold investments in, and support, such token. Except where otherwise indicated, the information in this document is based on matters as they exist as of the date of preparation and not as of any future date, and will not be updated or otherwise revised to reflect information that subsequently becomes available, or circumstances existing or changes occurring after the date hereof. This document provides links to other Websites that we think might be of interest to you. Please note that when you click on one of these links, you may be moving to a provider’s website that is not associated with Galaxy Digital. These linked sites and their providers are not controlled by us, and we are not responsible for the contents or the proper operation of any linked site. The inclusion of any link does not imply our endorsement or our adoption of the statements therein. We encourage you to read the terms of use and privacy statements of these linked sites as their policies may differ from ours. The foregoing does not constitute a “research report” as defined by FINRA Rule 2241 or a “debt research report” as defined by FINRA Rule 2242 and was not prepared by Galaxy Digital Partners LLC. Similarly, the foregoing does not constitute a “research report” as defined by CFTC Regulation 23.605(a)(9) and was not prepared by Galaxy Derivatives LLC. For all inquiries, please email [email protected].

©Copyright Galaxy Digital Inc. 2026. All rights reserved.