Top Stories of the Week - 4/21

In the newsletter, we write about congressional hearings, flashbots, and lightspark, the new bitcoin payments firm founded by former paypal executive david marcus. Subscribe here and receive Galaxy's Weekly Top Stories, and more, directly to your inbox.

Congressional Hearings make Progress to Regulate Crypto in the US

Lawmakers hold hearings on SEC oversight and stablecoin legislation. On Tuesday 4/18, the US House Committee on Financial Services (HFSC) held an oversight hearing of the SEC, featuring testimony from Chairman Gary Gensler. During the 4+ hour session, Gensler fielded questions on a range of topics, but most of the discussion was on the SEC's approach to regulating the crypto market. Committee Chairman Patrick McHenry (R-NC) said during his opening statement: "Congress must provide clear rules of the road to the digital asset ecosystem because the regulators cannot agree… regulation by enforcement is not sufficient nor sustainable. Your approach is driving innovation overseas and endangering American competitiveness."

One of the most notable exchanges occurred when Gensler refused to provide a definitive answer when McHenry explicitly asked the SEC Chair whether he thought ETH was a security, and declined to provide details into the SEC's investigation into the FTX collapse and its Wells Notice to Coinbase last month. Gensler defended his agency's actions when asked about the SEC's approach to regulating crypto companies including its prioritization of enforcement over providing regulatory clarity. Some members argued that the existing/proposed regulatory framework and disclosure rules designed for traditional markets are incompatible with the crypto industry (specifically criticizing the SEC's recent proposal to modify the definition of “exchange” to include “communication protocol systems,” potentially expanding the SEC’s authority over DEXes). Most of the overreach criticism came from the Republican side (Majority Whip Tom Emmer (R-MN) had a notable strongly-worded argument), while many Democrats praised Gensler for his tough stance and forceful actions against the crypto industry (including Ranking Member Maxine Waters (D-CA)).

On Wednesday 4/19, the HFSC’s subcommittee on digital assets held a hearing to discuss stablecoins and the need for legislation after publishing a draft stablecoin bill earlier in the week. Key highlights from the draft bill include:

insured depository stablecoin issuers would be regulated by existing federal banking agencies (e.g., the OCC, Fed, FDIC, and the NCUA), while non-bank institutions would be subject to oversight by the Fed.

Stablecoin issuers would be subject to reserve standards and oversight requirements that include the collateralization, collateral types, custodial arrangement, and redeemability of the stablecoin, and would prohibit issuers from certain activities like lending and rehypothecation.

Algorithmic stablecoins would be subjected to a 2-year ban, while the Treasury conducts a study on “endogenously collateralized stablecoins".

The Fed would be ordered to carry out a study on the impact of a CBDC.

The hearing featured testimony from five witnesses including NYDFS Superintendent Adrienne Harris, Circle's Dante Disparte, Columbia adjunct professor and former Paxos portfolio manager Austin Campbell, Blockchain Association's Jake Chervinsky, and Consumer Reports’ Delicia Hand. Members asked about the importance of stablecoins, the practical benefits for consumers and for financial inclusion, why the bill was needed, the urgency to act, and the risks/limitations of the technology including around its potential for criminal usage and the potential for contagion across the broader US banking system. Campbell and Chervinsky emphasized that the bill is needed to reinforce the dollar's supremacy as global reserve currency, preserve the nation's strategic position in financial technology against potential adversaries, and to preserve innovation in the US. The panel largely agreed with committee members' stance on the need for substantive consumer protections, proper disclosures, surveillance tools and ability to freeze/seize funds, and limitations on certain activities (e.g., commingling, self-dealing).

Another issue that was repeatedly brought up was the role of state legislators in a potential dual regulatory framework (federal & state) with some lawmakers concerned over the potential for states to undermine federal authority. The NYDFS' Harris argued to preserve the right for separate regimes for states for stablecoins (as it is already applied to banking), noting that the existing regime in NY is one of the most rigorous in the world with already established requirements for stablecoin issuers to be properly backed, meet certain capital requirements, and provide frequent attestations. She added no NY-licensed crypto entity has gone bankrupt (NY did not license FTX, Celsius, or Voyager).

Our take

Both hearings highlighted the lack of clarity for crypto participants to operate and emphasized the growing need for proper regulatory guidance.

For the SEC hearing, the line of questioning and Gensler's testimony illustrated the harmful effects of the SEC’s stance towards crypto regulation. Gensler's credibility had already been in question after FTX's collapse that raised concerns of selective enforcement, new lawsuits and legal threats issued by the SEC to cooperative companies, and a questionable history of promoting specific projects only to later deem the related token a security in new lawsuit (i.e., Algorand's ALGO token). Although we would have liked to see even more bipartisan support challenging the SEC's current approach to crypto regulation, it was encouraging to see alignment as Ranking Member Waters followed up her counterpart in interrogating Gensler on whether ETH is a security after his non-answer. The SEC will likely face added pressure to change its current approach of regulation-by-enforcement to actually providing fair regulatory clarity/guidance amid new proposed legislation to remove the remove current SEC Chair and potential rulings in ongoing SEC crypto cases (and there are a lot, not including Coinbase, which is prepared with substantial resources to go to court against the SEC). What remains unclear is whether there will be authorizing legislation or judicial action to remove the cloud of uncertainty that exists in the marketplace for Chair Gensler’s current posture—that most of the tokens are securities and that most crypto firms are operating in non-compliance with the securities laws.

The stablecoin hearing saw a phenomenal set of panelists making strong arguments for stablecoin technology and discussing the need for proper regulation. While many Democrats still criticized stablecoin technology and the bill itself (e.g., facilitating money laundering, potential for banking contagion), both sides of the aisle engaged in mostly constructive questioning to find some common ground. We are pleased that the draft bill has a path for non-banks to compete, although the Fed would regulate them, which makes us wonder how viable that path will really be.. During the hearing, Chervinsky outlined why neither the SEC/CFTC would be a good fit for oversight and Harris made convincing arguments for states to maintain/establish their own stablecoin regulatory frameworks ahead of federal guidelines (the NYDFS also announced clearer guidance for its Bitlicense). The draft bill calls for a CBDC impact study, which may be worthwhile since we still struggle to understand the problem the CBDC means to solve and whether the Fed knows how to solve it despite years of thinking about it. Fortunately, legislators did not appear committed to the idea of a CBDC during the hearing. The big question that we have now is how secondary transfers of stablecoins will be treated and whether issuers / intermediaries would be required perform KYC on all intermediate token holder addresses (Campbell made solid arguments that existing regulated stablecoin issuers have sufficient freeze/seize capabilities in suspected criminal activity).

Despite the HFSC’s renewed legislative and oversight efforts, passing legislation to regulate digital assets and stablecoins faces steep challenges with a divided Congress, competing legislative priorities, and of course the more pressing debt ceiling debates and geopolitical concerns. Still, the call to action has never been louder: the US is losing its lead in crypto developers, more companies are moving offshore (including Coinbase's plans to launch offshore derivatives exchange after obtaining a Bermuda-license and its considerations for relocating outside the US), growing preference for USDT over onshore stablecoins like USDC, competitive jurisdictions moving forward with more crypto-friendly regulations like the EU, which just became the first major jurisdiction to introduce comprehensive crypto law after Parliament voted on Thursday to approve MiCA. US lawmakers have the potential to preserve the nation's strategic lead in financial technologies if they can reach agreement on a thoughtful, reasonable approach to regulate digital assets and stablecoins. With so much at risk, amending the current regulatory structure in the US is direly needed. - CY

Introducing the Flashbots Matchmaker

Flashbots has launched a new service known as MEV-Share that provides kickbacks to users on the MEV created from their transactions. It is an optional feature that users of Flashbots’ existing MEV protection services, called Flashbots Protect, can configure to earn back up to 80% of the MEV extracted by searchers on their transactions. Flashbots Protect is an RPC endpoint that users add to their wallets so that their transactions bypass the mempool and are sent directly to the Flashbots builder for inclusion in a block. Through MEV-Share, Flashbots Protect users can choose to reveal parts of their transactions to searchers to improve the chances of having their transaction included more quickly in a block and to receive MEV kickbacks.

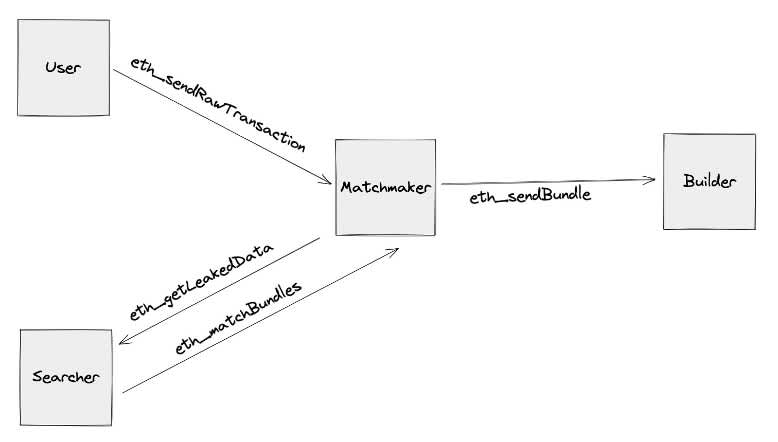

The pivotal actor in MEV-Share is the matchmaker. The Flashbots Matchmaker listens to the privacy preferences expressed by users and matches their transactions to appropriate searchers and their transaction bundles. At present, MEV-Share is in beta mode and only supports backrunning on user transactions. Once a searcher bundle is matched with a user’s transactions, the matchmaker forwards the bundle to a block builder with a requirement that a portion of MEV proceeds made from the bundle are siphoned back to the user. If the bundle is included in a block that is successfully proposed on-chain, the user is then paid a percentage of backrunning profits on their transactions.

Caption: MEV-Share transaction flow. Source: Flashbots

The idea for MEV-Share was outlined in a post by the Flashbots team back in February. The post discussed ways to prevent denial of service attacks on the matchmaker, the implementation of MEV-Share on blockchains outside of Ethereum, and early ideas for decentralizing the matchmaker role. The beta version of MEV-Share that is live through Flashbots Protect relies on the Flashbots Matchmaker, which is operated by a trusted and permissioned intermediary, that is Flashbots. However, as stressed by the Flashbots team, MEV-Share as a technology is fully open-sourced for any operator to use alongside their builder. Earlier this month, a consortium of 30 Ethereum projects announced the launch of MEV Blocker which like MEV-Share is an RPC tool designed to connect with user wallets and protect user transactions from negative types of MEV whilst also returning MEV profits back to users.

For background on MEV, read this two-part Galaxy Research report.

Our take

One of the key concepts underpinning the design and implementation of MEV-Share is the concept of programmable privacy. The ability for users to decide how much of their order flow is exposed to searchers and what kind of searchers (I.e. backrunning searchers only) effectively empowers users to become active participants in the MEV supply chain, rather than passive victims. Users who can dictate to whom their transaction flow is shared and what components of their transactions have the bargaining power to auction off the value of their transactions to searchers and thereby earn back a portion of MEV proceeds. Flashbots’ Shea Ketsdever tweeted on Thursday: “Users should decide how, when and by who their transactions are executed ... This lets them internalize their MEV and be included faster on chain.”

MEV-Share relies on a trusted intermediary, the matchmaker, to protect the privacy of user transactions but also intentionally leak varying components of user transactions depending on individual user preferences to searchers. Ideally, the implementation of programmable privacy over user transactions can be achieved through cryptography and trustless blockchain protocols. To this end, the broader vision for MEV-Share is likely to be realized through Flashbots SUAVE chain project. Read this Galaxy Research report for a detailed overview of SUAVE. Essentially, MEV-Share is a prototype of SUAVE, a decentralized network where users have full control over the level of privacy of their transactions and the matchmakers in charge of including transactions in searcher bundles are incentivized through an open and permissionless marketplace.

There is a long way to go before trustless protocols can take over the trusted roles and responsibilities of the Flashbots matchmaker. Similarly, there is a long way to go before MEV-Boost, which relies on trusted relays, can be replaced by enshrined proposer-builder separation (PBS), which replaces the role of relays with the Ethereum protocol itself. Based on the latest MEV research, the intermediary step to advance away from trusted, centralized entities and before full reliance on permissionless protocol and cryptography could be reliance on trusted hardware in the form of trusted execution environments and SGX enclaves. Whatever the solution becomes, it is important that progress is spearheaded by a diverse group of Ethereum stakeholders and participants. To this end, the diversification of participants in the MEV supply chain since the open-sourcing of MEV-Boost software and the launch of new MEV protection products like MEV Blocker are both welcome signs of decentralized coordination on the MEV problem that will hopefully lead to a decentralized solution in the long-run. - CK

New Enterprise Grade Bitcoin Payment Product on Lightning

Lightspark launches their enterprise bitcoin payments platform that uses the Lightning Network, Bitcoin's top layer 2 scaling solution for payments. The platform aims to onboard businesses and is viewed as the first "enterprise-grade entry point" to the Lightning Network. Lightspark offers a Lightning wallet interface coupled with API keys and SDKs for developers to seamlessly integrate the Lightning Network to their business applications without dealing with the overhead that comes with using the Lightning Network. Specifically, Lightspark takes the responsibility of routing payments, managing channel liquidity, and converting bitcoin to fiat. This is significant as these strenuous overheads are key reasons deterring businesses to integrate the Lightning Network.

Notably, the company is led by David Marcus, former president of PayPal and co-creator of Facebook's Diem cryptocurrency project. Marcus believes that the Lightning Network can become the standard protocol for online payments, stating that "money should move online like emails or text messages, and the Lightning Network has the best chance of becoming the standard protocol that enables that and much more for everyone around the world." Lightspark's bullish outlook on the Lightning Network is further backed by A16z and Paradigm, who contributed $175mn in the most recent funding round; Lightspark is now valued at $875mn, making it one of the most valuable Lightning Network startups in the space.

Our take

The Lightning Network will play a vital role in scaling Bitcoin payments, but its complexity and steep learning curve hinder its widespread adoption. Lightspark's new platform aims to simplify the onboarding process for enterprises and make Lightning more accessible. However, Lightspark is not the only company focused on bringing the benefits of Lightning to a wider audience; OpenNode, who has a five-year head start, offers similar products to enterprises and merchants and runs the 13th largest routing node in the network. Additionally, Jack Dorsey's new research group Spiral, is developing a Lightning developer kit with a new client called LDK and Square’s Cash App is well-positioned to lead in this space. In light of the active development on lightning, Square, OpenNode and other prominent Lightning focused companies will inevitably apply pressure on Lightspark as all of these products seek to find product market fit in a highly competitive emerging ecosystem.

The Lightning Network's liquidity (channel capacity) is up 70% YoY. The significant growth in network capacity over the past year is largely due to institutions and exchanges adopting Lightning though building routing nodes for the network. Coinbase and Kraken are the latest exchanges to integrate Lightning into their services. These entities use their routing nodes to provide liquidity for the network and in return, receive a small yield on their bitcoin from routing fees. The yield on fee routing and demand for Lightning is poised to increase from a higher transaction fee environment due to Ordinal adoption. The emerging business opportunities on Lightning points to our view that the Lightning Network increases the investable landscape for Bitcoin. As the Lightning Network onboards more client-facing products, Bitcoin’s top layer 2 protocol is positioned to become the go-to payments product for the largest digital asset in crypto. - GP

Other News

Lido deposits surpass $12 billion as Ethereum's Shapella boosts liquid staking

Bitcoin-focused Unchained Capital raises $60m

Societe Generale's crypto subsidiary Forge launches euro stablecoin on Ethereum

Flashbots launches MEV-Share to distribute profits with Ethereum users

Bankrupt crypto lender voyager seals fed deal for $1bn Binance.US acquisition

Helium completes migration from own blockchain to Solana

Apple launches new savings account with Goldman offering 4.15% yield

A16z announces Magi, a new rollup client on Optimism

Dutch Court releases Tornado Cash dev on bail pending trial

Emerging Layer 1 Berachain raises $42m at $420m valuation

Sui Network announces May 3 Mainnet launch date

Legal Disclosure:

This document, and the information contained herein, has been provided to you by Galaxy Digital Holdings LP and its affiliates (“Galaxy Digital”) solely for informational purposes. This document may not be reproduced or redistributed in whole or in part, in any format, without the express written approval of Galaxy Digital. Neither the information, nor any opinion contained in this document, constitutes an offer to buy or sell, or a solicitation of an offer to buy or sell, any advisory services, securities, futures, options or other financial instruments or to participate in any advisory services or trading strategy. Nothing contained in this document constitutes investment, legal or tax advice or is an endorsementof any of the digital assets or companies mentioned herein. You should make your own investigations and evaluations of the information herein. Any decisions based on information contained in this document are the sole responsibility of the reader. Certain statements in this document reflect Galaxy Digital’s views, estimates, opinions or predictions (which may be based on proprietary models and assumptions, including, in particular, Galaxy Digital’s views on the current and future market for certain digital assets), and there is no guarantee that these views, estimates, opinions or predictions are currently accurate or that they will be ultimately realized. To the extent these assumptions or models are not correct or circumstances change, the actual performance may vary substantially from, and be less than, the estimates included herein. None of Galaxy Digital nor any of its affiliates, shareholders, partners, members, directors, officers, management, employees or representatives makes any representation or warranty, express or implied, as to the accuracy or completeness of any of the information or any other information (whether communicated in written or oral form) transmitted or made available to you. Each of the aforementioned parties expressly disclaims any and all liability relating to or resulting from the use of this information. Certain information contained herein (including financial information) has been obtained from published and non-published sources. Such information has not been independently verified by Galaxy Digital and, Galaxy Digital, does not assume responsibility for the accuracy of such information. Affiliates of Galaxy Digital may have owned or may own investments in some of the digital assets and protocols discussed in this document. Except where otherwise indicated, the information in this document is based on matters as they exist as of the date of preparation and not as of any future date, and will not be updated or otherwise revised to reflect information that subsequently becomes available, or circumstances existing or changes occurring after the date hereof. This document provides links to other Websites that we think might be of interest to you. Please note that when you click on one of these links, you may be moving to a provider’s website that is not associated with Galaxy Digital. These linked sites and their providers are not controlled by us, and we are not responsible for the contents or the proper operation of any linked site. The inclusion of any link does not imply our endorsement or our adoption of the statements therein. We encourage you to read the terms of use and privacy statements of these linked sites as their policies may differ from ours. The foregoing does not constitute a “research report” as defined by FINRA Rule 2241 or a “debt research report” as defined by FINRA Rule 2242 and was not prepared by Galaxy Digital Partners LLC. For all inquiries, please email [email protected]. ©Copyright Galaxy Digital Holdings LP 2023. All rights reserved.