Top Stories of the Week - 2/3

Federal Reserve Puts the Hammer Down

Last week, the Federal Reserve released a policy statement further limiting the cryptoasset activities of member banks. As we wrote in the Jan. 13 edition of this newsletter, at the beginning of 2023, the Federal Reserve, Office of the Comptroller of the Currency (OCC), and Federal Depository Insurance Corporation (FDIC)—together, the federal prudential regulators for banks—issued a joint statement questioning the “safety and soundness” of cryptoasset activities and discouraging banks’ involvement with the sector. That letter called for banks to limit the portion of their business comprised of cryptoasset-related activities and essentially prohibited national banks from “issuing or holding as principle crypto-assets” stored on public blockchains.

Then, on Friday Jan. 27, the Federal Reserve said in a policy statement that such restrictions will apply to all member banks, including state-chartered banks, arguing that Section 9(13) of the Federal Reserve Act provides them such authority. Concurrently, the Federal Reserve rejected Custodia Bank’s application for membership in the Fed system anddenied it access to a master account at the Fed. Custodia is a fully-reserved [TW1] Wyoming-chartered special purpose depository institution (SPDI) that custodies cryptoassets and intends to build payments infrastructure utilizing public blockchains. In denying membership to its system, the Federal Reserve broadly argued that Custodia’s “novel business model and proposed focus on crypto-assets presented significant safety and soundness risks” and also that the firm’s “risk management framework was insufficient to address concerns regarding the heightened risks associated with its proposed crypto activities.”

Our take

The Fed’s new policy statement confirms a concerted effort to crack down on the cryptoasset industry in the United States. In general, the policy statement also requires banks to get specific permission from their regulators before engaging in any crypto-related activities. More specifically, the memo pulls forward to state banks several restrictions and guidances from the Fed/OCC/FDIC joint statement from Jan. 3, 2023. [TW2] Essentially banning regulated banks from principally holding any crypto directly is significant and will impact the operations of any bank that chooses to operate in the space, such as by providing custody services. For example, a bank providing crypto custody services would be challenged o keep some BTC and ETH on-hand to pay transaction fees and facilitate on-chain transactions (whether withdrawals to clients or simple for internal account management. This adds complexity for banks, but it’s not fatal. The “safety and soundness” viewpoint will make it difficult if not impossible for significant portions of bank business to be comprised of crypto-related activities, which appears to favor large incumbent banks over smaller ones. If smaller banks are effectively prohibited from servicing crypto-related businesses, and if larger banks don’t step in to service them, US-based crypto businesses could find it difficult to maintain banking relationships and therefore, in an extreme case, even operate their businesses at all.

Given the tenor of the policy statement, the joint statement, and the Fed’s rejection of Custodia’s applications, it’s not abundantly clear that there are any compliance regimes or “safety and soundness” measures that will satisfy bank regulators at this time. These types of policies, which are reminiscent of the beginning of a second Operation Chokepoint (though decidedly different), are often slow to entrench because the top-level directives takes time to filter down to examiners and supervisory staffs around the country, but it also means they are difficult to unwind once they’ve seeped-in. Legislative intervention, whether in the form of oversight or new legislation, could impact or mitigate these events—but similarly it’s difficult to get legislation agreed on and presented to the president. One note is that the emergence of a regulated stablecoin could mitigate bank restrictions by giving cryptoasset companies a durable avenue to bring fiat currency in and out of the system. We don’t expect immediate impact from these bank regulator notices, but we do expect the impact to ripple out in the near and medium future. US firms operating in the crypto industry should pay close attention. -AT

You Can Now Mint NFTs on Bitcoin and it’s a Big Deal

Bitcoin Core contributor and head of SF Bitcoin Devs, Casey Rodarmor, launched his open-source project called Ordinal that enable NFT-like features on Bitcoin. Ordinals allow arbitrary data inscriptions such as texts, images and videos to individual satoshis (“sats”, the smallest unit of a bitcoin), which essentially makes the inscribed satoshi non-fungible. Typically, sats are fungible, however, inscribing a single satoshi promotes non-fungible qualities (similar to an NFT token) without tainting the fungibility of non-inscribed sats.

To inscribe an Ordinal, users add arbitrary information into the witness data of a bitcoin transaction through the Ord application, which also requires users to run Bitcoin Core. The Ordinal is then signaled to the network as a pending transaction and can be stored on-chain after the block containing the transaction is mined. According to the “Ordinal Theory”, the supply limit for Ordinals on Bitcoin is capped at 2.1 quadrillion. The current market for Ordinals is exclusively peer-to-peer on Bitcoin forums due to the lack of marketplace infrastructure. As a result, Ordinals are difficult to construct and acquire for the average Bitcoin user.

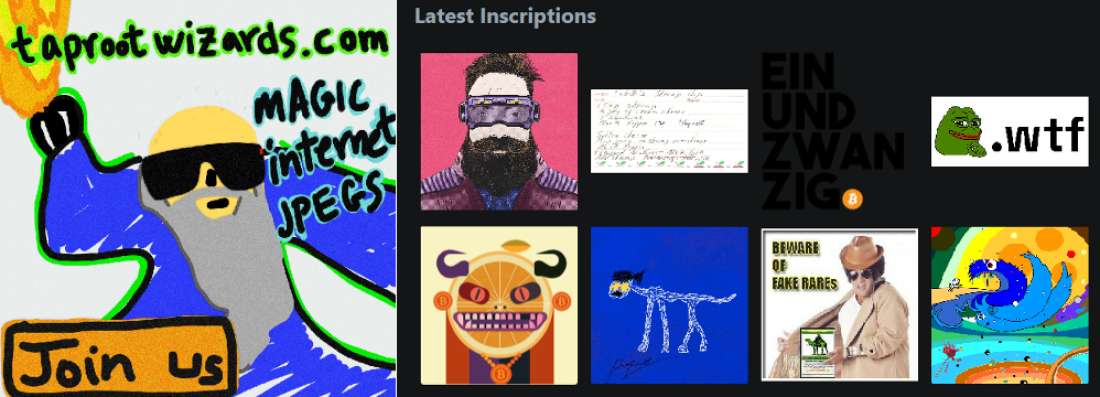

Some examples of Ordinals created so far include repurposed popular NFT projects such as Bored Apes, CryptoPunks, memes and random images. One Ordinal notably took up almost the entire blockspace, leading to a record setting 3.96MB block (#774628) mined on Tuesday (Inscription 642 included below). Despite the singular transaction filling up the entire blockspace, the Bitcoin network had no issues reaching consensus and mining the block.

(Record-setting Inscription 642 and other examples of Ordinals. Source: Ordinals.com)

Our take

The ability to “inscribe” arbitrary data to bitcoin is not new, but not until this new Ordinals project (made possible by the Taproot upgrade) had users been able to post data of this size to the Bitcoin blockchain. And the use of ordinal theory to then tie those inscriptions to individual units of bitcoin (satoshis) is also innovative. The two features combined effectively create the ability to launch 1-of-1 NFTs on bitcoin mainnet, something not previously possible. There are several ways to look at this development.

First, this is bullish for bitcoin. Outside of monetary uses, the primary drivers of cryptoasset adoption to-date have been decentralized finance and non-fungible tokens. While DeFi isn’t really possible on Bitcoin directly due to the lack of a virtual machine or persistently stateful applications, there have been many proposals and uses tokenization on bitcoin in the past. Most of these utilized the OP_RETURN field to encode additional arbitrary data, but for years the protocol has capped the volume of data that can be stored in that field, limiting the amount of information that can be stored. These ordinal-based inscriptions can now store significant amounts of data – up to almost 4mb – allowing the storage and transfer of images, mp3s, PDFs, or other documents. If wallets build out features like “sat selection” (the ability to specifically transfer individual, inscribed satoshis), which is probably imminent, then it is likely a robust NFT ecosystem, in which the content itself is immutably stored on-chain, will form on Bitcoin in the coming months. Given the broad interest in NFTs generally, that could drive significant interest in Bitcoin for a variety of use-cases previously relegated to other blockchain ecosystems.

If the use of Ordinals increases, that can help Bitcoin drive fee revenue to miners, a topic of great interest both to miners and long-term users of Bitcoin. Bitcoin’s quadrennial halvings are the mechanism that ultimately results in Bitcoin’s fixed terminal supply at 21m, but as those halvings occur, miner revenue declines, which some argue could harm Bitcoin’s overall security in the future. Without wading too much into that debate here, one obvious way to mitigate potential negative outcomes is for transaction fees to increase, and Ordinals can help here.

Criticisms of this development have mostly relied on subjective interpretations of the “proper use” of Bitcoin—i.e., many believe that bitcoin should not be used in this way, but instead should be reserved solely for monetary uses. Regardless of whether that’s true, the fact is that it can be used in this way, and Bitcoin is an open and permissionless system. One core complaint, which has some merit, is that Ordinals use of witness data means that it’s 75% cheaper to post this data than it is to send a standard bitcoin transaction, which is a result of the Segregated Witness update. While that does indeed seem contrary to the goals of Bitcoin (should posting arbitrary data to this peer-to-peer electronic cash system really cost less than actually using it for peer-to-peer electronic cash transfers?), the reality is there’s no good way to change that without significant protocol disruption. Another complain is that Ordinals can increase the cost of operating a full node due to the possibility that they increase the mean size of blocks, a fear that we believe is misplaced. Ordinals cannot increase the maximum block size beyond 4mb, which is the theoretical upper bound—whether filled with cash transactions or ordinal data, if demand to transact on Bitcoin is to grow in the future, full nodes already need to be prepared to download and relay 4mb blocks.

There’s a lot more to say about Ordinals. For more information, make sure you listen to this week’s episode of Galaxy Brains, in which we interview the project’s creator, Casey Rodarmor. And we’ll write more in the future. But one final point to advance here. The fact that Rodarmor’s project—and even that it was technically possible at all—appears to have caught the Bitcoin community completely by surprise is extremely problematic. The Taproot upgrade enabled this capability, but there was essentially no discussion of this outcome during that upgrade’s public debate in 2021. Did developers miss this entirely? Had Taproot been publicly known to create the ability to dramatically increase the size of arbitrary data storage on Bitcoin, it’s very likely that the upgrade would not have received the level of support required to reach activation. That should be concerning to all Bitcoiners and is, frankly, bearish for the prospects of future bitcoin improvement proposals (BIPs). -AT/GP

NFT Marketplace Wars: Blur Strikes Back

Blur finds a way. A couple weeks ago, we wrote about OpenSea’s move to block trades on marketplaces like Blur and Sudoswap in order to enforce creator royalties. The timing of this move coincided with Yuga Labs debut of its Sewer Pass NFTs for the Dookey Dash minigame (meaning that only whitelisted marketplaces that support creator royalties could facilitate trades for Sewer Passes). Now, NFT traders can buy and sell Sewer Pass NFTs on Blur. What gives?

Panda Jackson’s tweet thread breaks down how Blur escaped OpenSea’s blocklist in detail. Ultimately, Blur’s loophole centers on the underlying smart contracts used to facilitate NFT trades. As a refresher, OpenSea launched Seaport in May 2022 as an open-source protocol for developers to safely build marketplace functionality. OpenSea then switched away from Wyvern to Seaport at the time of their announcement. Why does this matter? OpenSea’s block list doesn’t apply to marketplaces that are powered by Seaport. This makes sense as OpenSea wouldn’t want to block themselves from trading, and that’s precisely what Blur realized. In the two weeks since the launch of Sewer Pass (which put OpenSea’s royalty enforcement mechanism front-and-center), the Blur team internally developed a secondary NFT exchange system that is built entirely on Seaport. Whenever a Blur end-user chooses to trade an NFT on OpenSea’s blocklist (like Sewer Passes), Blur will switch over to their Seaport contracts on the backend. This is what enables users to now trade NFTs that were previously banned on platforms like Blur.

NFT royalties have been a contentious issue since the Summer/Fall of 2022 (and we wrote about this broader issue in our reportNFT Royalties: The $1.8bn Question). The rise of Blur late last year coincided with the rise of royalty-free marketplaces because they touted cheaper transaction costs as a key benefit for power traders. Blur, has stood out from a litnay of OpenSea challengers, currently holding strong at 40% market share of ETH NFT volume compared to 36% for OpenSea.

Our take

Blur deftly counterpunches OpenSea. The irony is that Blur used OpenSea’s own protocol against them, and it potentially has far-reaching consequences for NFT royalties. The main take-away is that this situation is a win-win for both traders and creators. Blur has now effectively shifted away from its anti-royalty stance to a more hybrid approach. This is because the Blur platform still enforces royalties on any Seaport contract trade. Blur even signaled this change in a recent Tweet, meaning that royalties will probably have an enduring future now that marketplaces #1 and #2 support them at some level. Though OpenSea will probably cede some market share to Blur in the short-term, they will also emerge stronger in the long-term as adoption of their Seaport protocol grows. OpenSea is the biggest stakeholder and contributor to Seaport, and It’s possible OpenSea doesn't mind cannibalizing some of their trading business in order to push Seaport onto more developers (look no further than Apple as an example of why self-cannibalization is often a winning strategy).

So long as creators choose to implement OpenSea’s blocklist, they will now earn full royalties on both OpenSea and Blur. We imagine most new NFT collections will now choose this route since it will lead to increased earnings from secondary sales. What’s less clear is if a blocklist managed by a central party like OpenSea is truly the long-term solution to enabling royalty enforcement for NFTs. Metaplex (responsible for minting >99% of Solana NFTs), is currently working on a solution to royalty enforcement at the token standard level which could entice creators to embrace Solana NFTs long-term. Regardless, this latest installment of the ongoing NFT royalty saga indicates that royalties are far from dead. -SQ

Other News

UK Treasury publishes new consultation for crypto regulation

Examiner's report on Celsius Network released

Aave V3 deployed on Ethereum Mainnet

Federal judge dismisses class-action securities suit against Coinbase

Intain launches tokenized structure finance marketplace on Avalanche Subnet

Hamilton Lane tokenizes $2.1bn flagship equity fund on Securitize

Social token project Rally shuts down its Ethereum sidechain

Cross-chain messaging protocol Connext completes Amarok upgrade

Bonq lending protocol exploited in oracle hack

Legal Disclosure:

This document, and the information contained herein, has been provided to you by Galaxy Digital Holdings LP and its affiliates (“Galaxy Digital”) solely for informational purposes. This document may not be reproduced or redistributed in whole or in part, in any format, without the express written approval of Galaxy Digital. Neither the information, nor any opinion contained in this document, constitutes an offer to buy or sell, or a solicitation of an offer to buy or sell, any advisory services, securities, futures, options or other financial instruments or to participate in any advisory services or trading strategy. Nothing contained in this document constitutes investment, legal or tax advice or is an endorsementof any of the digital assets or companies mentioned herein. You should make your own investigations and evaluations of the information herein. Any decisions based on information contained in this document are the sole responsibility of the reader. Certain statements in this document reflect Galaxy Digital’s views, estimates, opinions or predictions (which may be based on proprietary models and assumptions, including, in particular, Galaxy Digital’s views on the current and future market for certain digital assets), and there is no guarantee that these views, estimates, opinions or predictions are currently accurate or that they will be ultimately realized. To the extent these assumptions or models are not correct or circumstances change, the actual performance may vary substantially from, and be less than, the estimates included herein. None of Galaxy Digital nor any of its affiliates, shareholders, partners, members, directors, officers, management, employees or representatives makes any representation or warranty, express or implied, as to the accuracy or completeness of any of the information or any other information (whether communicated in written or oral form) transmitted or made available to you. Each of the aforementioned parties expressly disclaims any and all liability relating to or resulting from the use of this information. Certain information contained herein (including financial information) has been obtained from published and non-published sources. Such information has not been independently verified by Galaxy Digital and, Galaxy Digital, does not assume responsibility for the accuracy of such information. Affiliates of Galaxy Digital may have owned or may own investments in some of the digital assets and protocols discussed in this document. Except where otherwise indicated, the information in this document is based on matters as they exist as of the date of preparation and not as of any future date, and will not be updated or otherwise revised to reflect information that subsequently becomes available, or circumstances existing or changes occurring after the date hereof. This document provides links to other Websites that we think might be of interest to you. Please note that when you click on one of these links, you may be moving to a provider’s website that is not associated with Galaxy Digital. These linked sites and their providers are not controlled by us, and we are not responsible for the contents or the proper operation of any linked site. The inclusion of any link does not imply our endorsement or our adoption of the statements therein. We encourage you to read the terms of use and privacy statements of these linked sites as their policies may differ from ours. The foregoing does not constitute a “research report” as defined by FINRA Rule 2241 or a “debt research report” as defined by FINRA Rule 2242 and was not prepared by Galaxy Digital Partners LLC. For all inquiries, please email [email protected]. ©Copyright Galaxy Digital Holdings LP 2022. All rights reserved.