Ethereum's EIP 1559 Upgrade: 100 Days Later

In this report, we break down the short-term impact of Ethereum’s EIP 1559 upgrade for users, miners, and investors. Though the code change has succeeded in helping users accurately estimate the most optimal fee for their transactions at the moment it is executed, the wider issues surrounding fee volatility across multiple blocks, cost-prohibitive fees, and uncertainty around the longevity of Ethereum’s fee market structure remain unchanged.

Key Takeaways

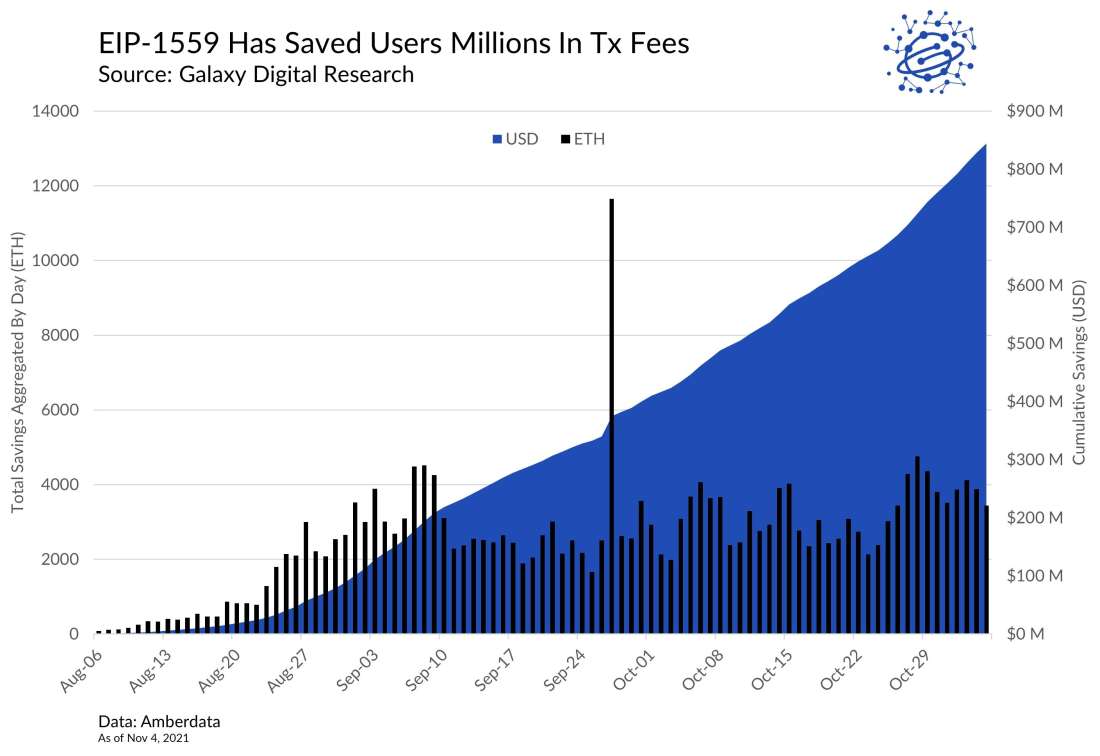

Since activation, EIP 1559 has saved users a total of $844 million in transaction fees through base fee refunds.

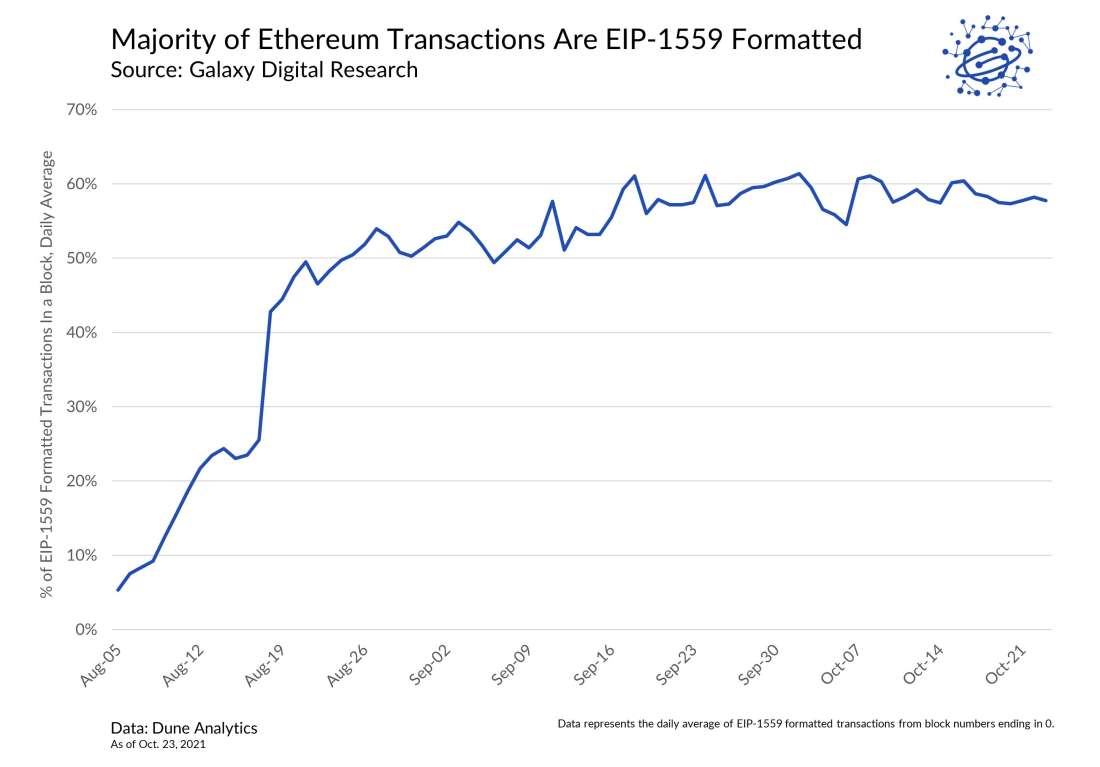

Since August 5, 2021, an average of 58% of transactions made use of the EIP 1559 upgrade.

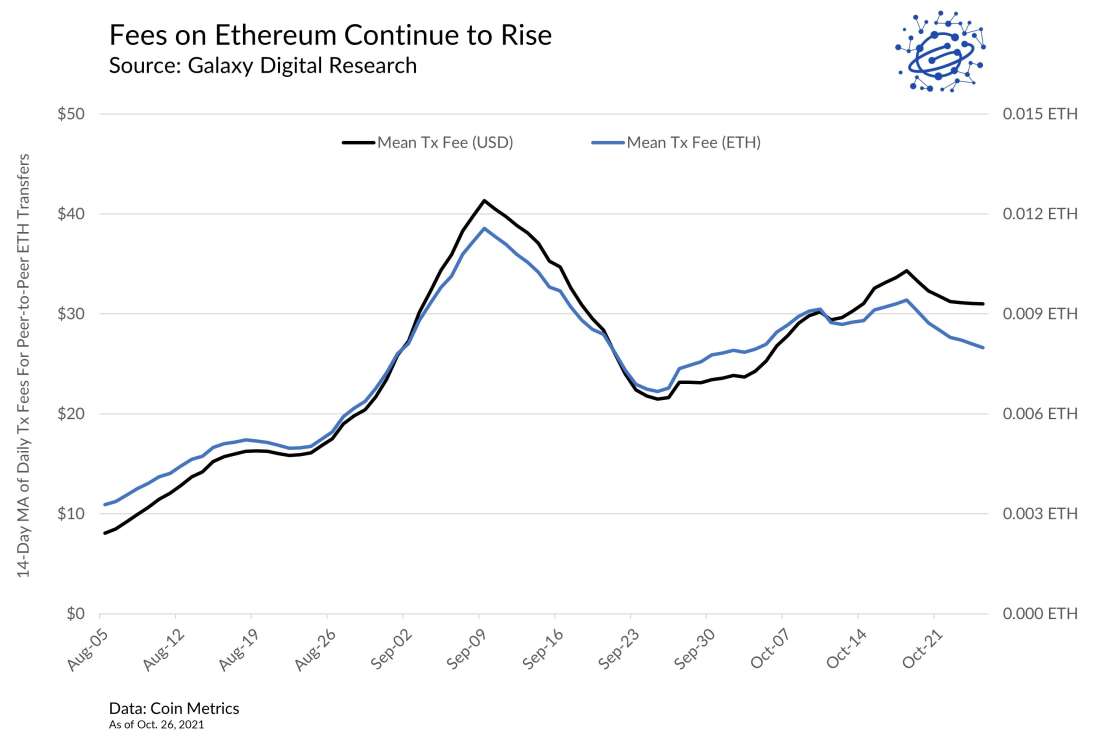

The average cost of sending a transaction on Ethereum has continued to climb, tripling in dollar terms, and doubling in native units since the activation of EIP 1559.

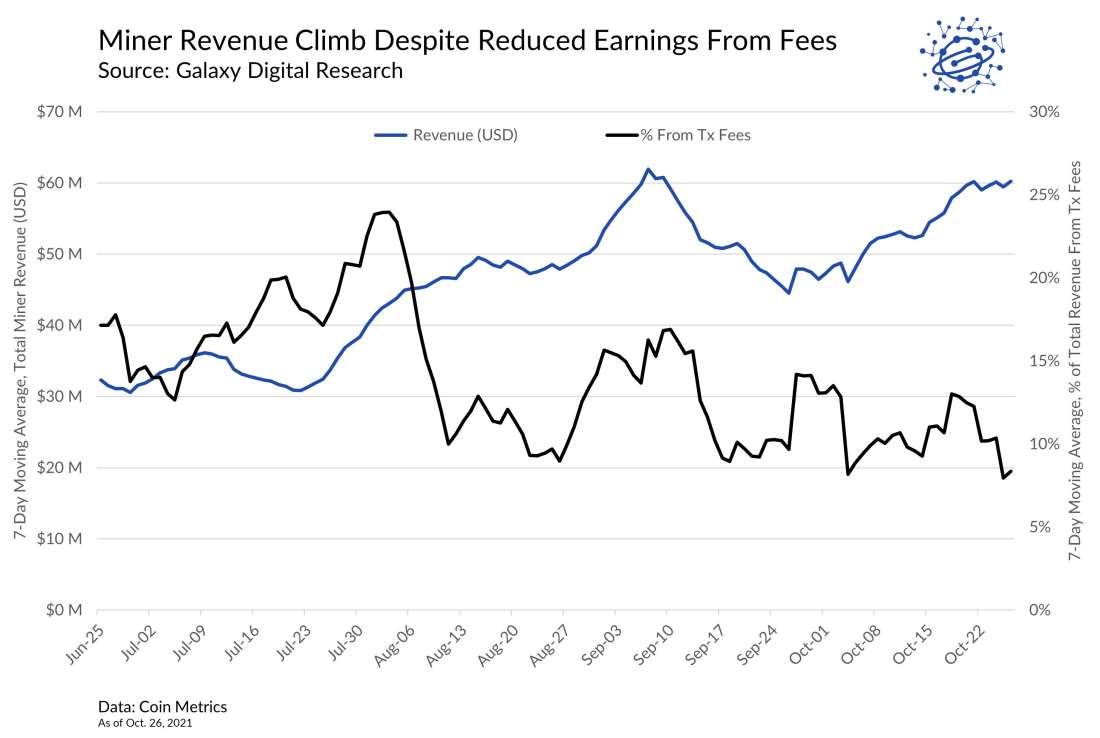

Despite lower earnings from transaction fees, total miner revenue in dollar terms has increased 33% since the activation of EIP-1559.

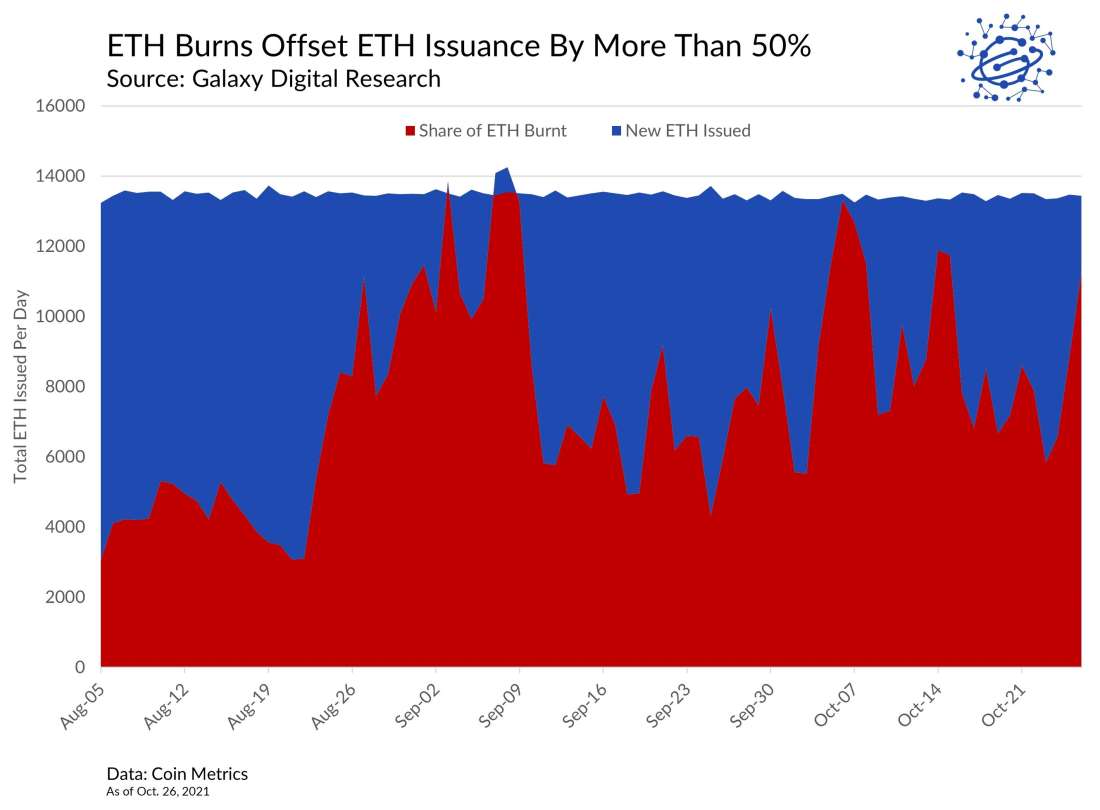

56% of new coins issued on the Ethereum blockchain since EIP 1559 activation has been offset by the amount of ETH being burned through base fees.

Introduction

It has been just over 100 days since the activation of Ethereum Improvement Proposal (EIP) 1559. For more background on EIP 1559, read our report from April.

For the most part, the code change impacting Ethereum’s lucrative fee market has worked as anticipated. It has created an algorithmically priced “base fee” for all transactions that dictates which transactions are eligible for inclusion in the next block and which are not. EIP 1559 has also introduced a fee burning mechanism to the Ethereum protocol that has proven effective in curbing ether (ETH) supply growth by over 50%.

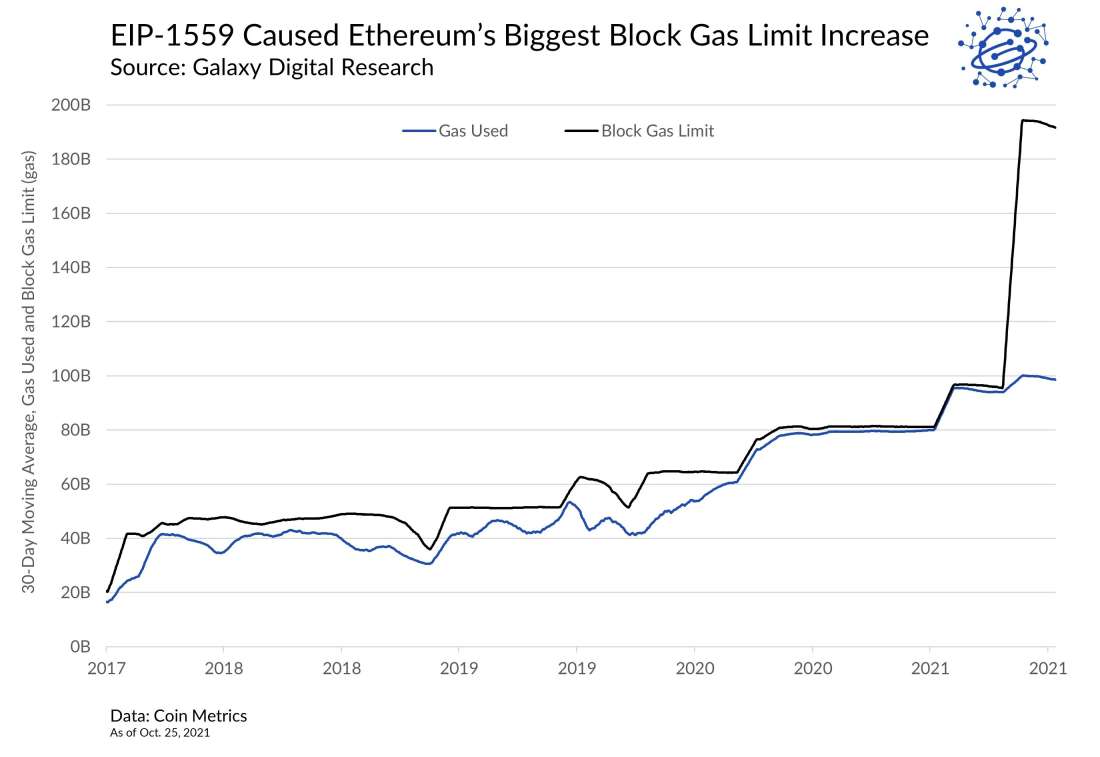

At the same time, EIP 1559 has also created severe block size volatility, which may pose third-order consequences to the network – such as block time irregularities and network centralization – especially if developers continue to rely on raising block gas limits as a temporary solution to the issue of high fees on Ethereum.

Though it will likely take several more months, if not years, for the full effects of EIP 1559 on Ethereum to play out, early analysis of network health and adoption of this upgrade suggest users are benefiting from more accurate fee estimations for their transactions. However, the benefits are strictly for users who are not trying to optimize their fee payments across multiple blocks. By design, EIP 1559 is not relevant for users who are disgruntled by rising fee levels on Ethereum.

As such, while EIP 1559 has succeeded in achieving its goals of accurate, real-time fee estimations, its limited scope has left much of the wider concerns around Ethereum’s fee market unaddressed and undeterred.

Impacts & Limitations

The main stakeholders of Ethereum can be broadly categorized into three main buckets: users, miners, and investors (a.k.a. ETH holders). The following section of this note breaks down the impacts and limitations of EIP 1559 on these interest groups.

Users - Impacts

Impact #1 - Since activation, EIP 1559 has saved users a cumulative total of $844 million in transaction fees through base fee refunds.

As background, EIP 1559 splits user transaction fees into two main components: the base fee and the priority fee. The latter is a tip that can be added by users to incentivize miners to prioritize their transactions but is not required. The base fee was introduced with EIP 1559 and is the minimum cost for sending a transaction on Ethereum. The base fee is dynamically set by the protocol and subject to change at every block.

The main benefit of EIP 1559 to users is accurate fee estimations. Instead of guessing the optimal fee for a transaction to be processed on Ethereum, users only need to specify their maximum willingness to pay. If a user overestimates what they think the base fee of the network is, the difference between their maximum willingness to pay and the base fee will be refunded back to their account. Users who do not specify a maximum willingness to pay forfeit any difference from their fee payment and the base fee to miners through the priority fee.

Impact #2 – On average, 58% of transactions in an Ethereum block are formatted to take advantage of EIP 1559 and its base fee refunds.

The effectiveness of the cost-savings from EIP 1559 have helped fuel broad support for updating user interfaces away from legacy transactions across a variety of Ethereum services including cryptocurrency exchanges, wallets, and decentralized applications (dapps).

Users – Limitations

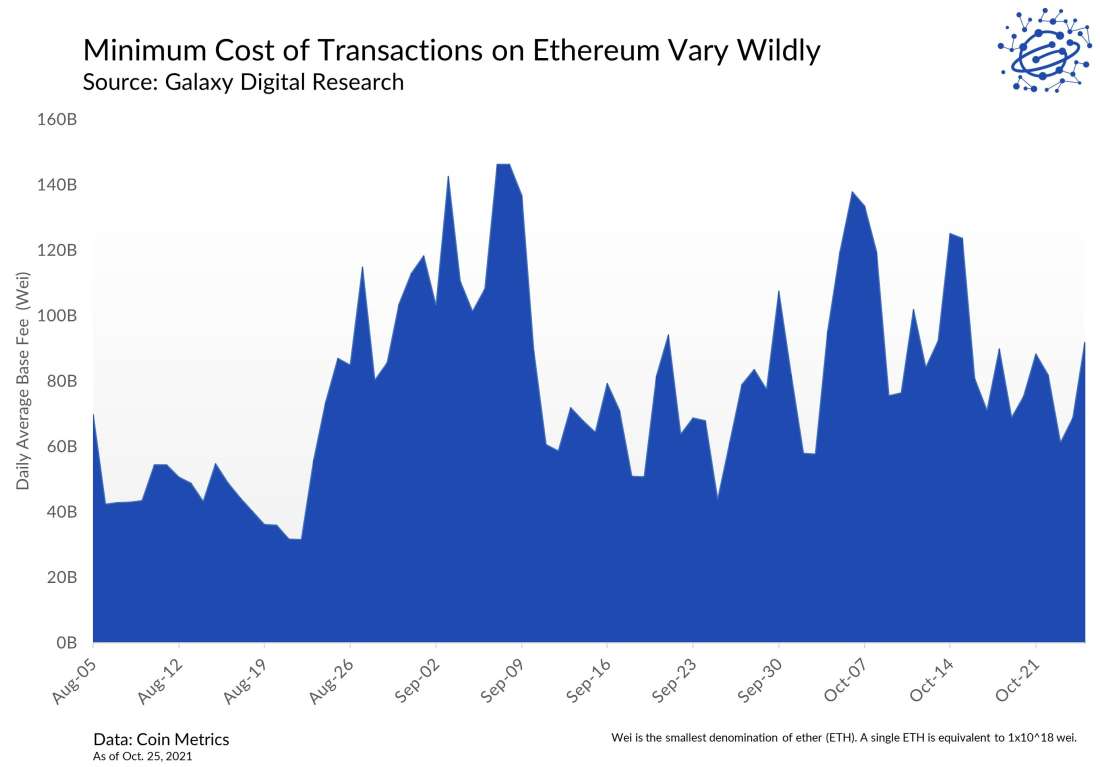

Limitation #1 - The average cost of sending a transaction on Ethereum has continued to climb, tripling in dollar terms, and doubling in native units since the activation of EIP 1559.

Even though EIP 1559 doubled block capacity so that Ethereum can process twice as many transactions per block, the network remains the most expensive blockchain to use, processing over $40 million in fees daily, which is 40 times that of Bitcoin, the world’s first and largest blockchain by market capitalization.

The following chart illustrates the average fee on Ethereum for simple peer-to-peer transfers of ETH. Given that the cost for executing the simplest type of transaction on Ethereum has risen since EIP 1559 activation, it can be assumed that the cost of more complex transactions such as executing DeFi trades or NFT mints have also increased. According to data from Dune Analytics, the average cost of a Uniswap trade is roughly $57.11, while a deposit into decentralized lending platform Compound costs on average $85.18 as of November 15, 2021.

Over the past year, applications enabling on decentralized finance and the creation of non-fungible tokens (NFTs) have taken off in popularity, attracting mainstream attention and adoption. As the epicenter for blockchain-based software development, hosting thousands of decentralized applications (dapps), Ethereum has been inundated with increasingly large transaction volumes of complex varieties. Due to a limited supply of block space, higher demand and user activity on the network has led to rising fees.

EIP 1559 is aimed at helping users’ better price their transactions, not lower those prices all together. To tackle the broader issue of network scalability, Ethereum protocol developers are working towards a long-term solution known as sharding, which is expected to be deployed some time in 2022 or 2023.

Limitation #2 – The base fee for transactions on Ethereum fluctuates sharply day to day making fee predictability and stability a lingering issue for users.

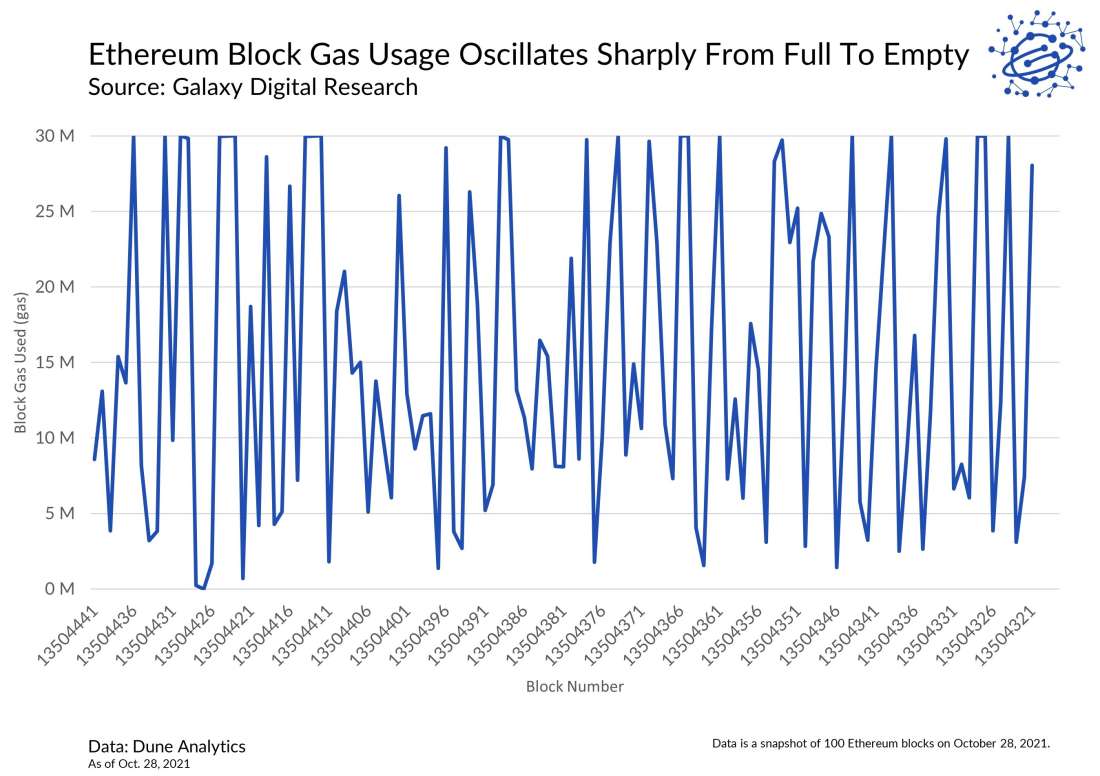

Under EIP 1559, the base fee is adjusted by up to 12.5% if the gas usage of a block exceeds the gas target. As a refresher, gas is a unit of measurement that quantifies the computational energy required to execute a transaction on Ethereum and helps limit the number of transactions that can be included in a block. The current gas target of a block is 15 million gas. This number used to be the maximum gas limit of a block before EIP 1559 doubled Ethereum’s block capacity.

In theory, a dynamic and constantly adjusting base fee is meant to encourage gas usage to trend towards the gas target over time. However, in practice, savvy users are taking advantage of the new rules of Ethereum’s fee market and anticipating changes to the base fee right before they happen.

Like Bitcoin, Ethereum has a waiting area of transactions that are not yet included in a block called the mempool. Savvy users can anticipate whether the minimum base fee will rise by considering the volume of eligible transaction in the mempool in line for inclusion in the next block. If the volume is high, savvy users will try to send as many transactions in the current block as opposed to the next block before the dynamic base fee adjusts upwards. Conversely, users that anticipate the minimum base fee will fall during the next block due to the low volume of transactions being included in the current block will choose to wait for the next block before sending their transactions through the network.

This behavior creates sharp variations in block gas usage and the volatility in turn impacts the base fee, which is fluctuating as a result by up to 12.5% every 13 seconds, rather than steadily trending towards a stable value as had been hoped. (13 second is the average time it takes for a block to be processed on Ethereum.)

Although users can price their transactions more efficiently in the moment because of EIP 1559, it is still difficult for users to predict and optimize for how fees fluctuate minute to minute.

Miners – Impacts

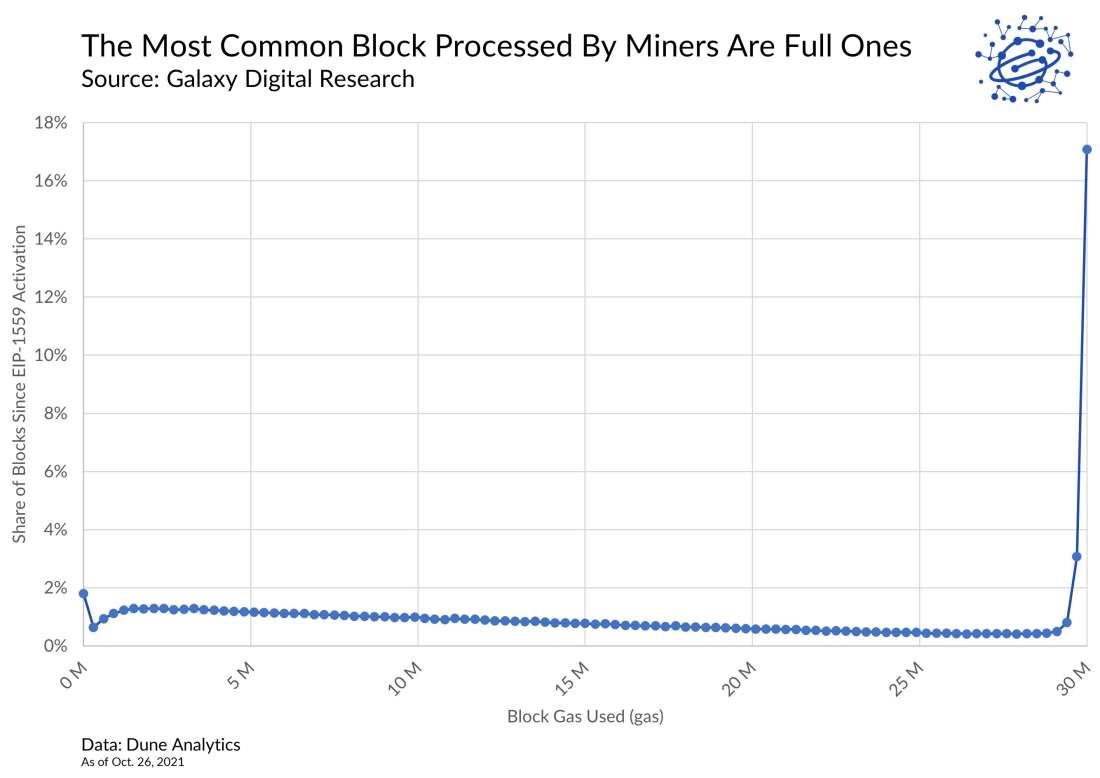

A deeper look at block gas usage reveals that one in almost every five blocks that miners process are large-sized blocks, meaning they contain 30 million gas.

In theory, EIP 1559 was expected to coax block gas usage consistently towards a target of 15 million gas. However, in practice, the code change has created an average gas usage near this target by oscillating sharply between extremely large blocks and small ones. Because of this, miners on Ethereum are producing fewer mid-sized blocks and more frequent blocks that require double the amount of computational energy to propagate/process as before the upgrade.

For most of Ethereum’s history, increases to block capacity have been modest in size and made sparingly to the network through a process of slow, deliberate consensus-building among miners.

This is because drastic increases to block capacity place a larger burden on miners and other network stakeholders running nodes to maintain a copy of Ethereum accounts and transaction history, also called state. As the technical requirements for maintaining Ethereum’s state increase, so does the risk of network centralization towards only those miners and node operators with the advanced hardware to keep up.

Miners – Limitations

Despite lower earnings from transaction fees, total miner revenue in dollar terms has increased 33% since the activation of EIP-1559.

Miners earn rewards on Ethereum through three main sources. First, there is the block subsidy, which is a fixed amount of ETH issued to a miner for every block they successfully append to the canonical chain. Second, there are transaction fees, which are a variable amount of ETH users can pay to miners as incentive to include their transactions in a block faster than others. Finally, there is miner extractable value (MEV) which encompass earnings from a miner’s ability to reorder transactions within a block.

Before EIP 1559, miners earned the full amount of fees paid by users for executing their transaction. After EIP 1559, transaction fees were divvyed up into two buckets: the base fee and the priority fee. Only the latter is awarded to miners, while the base fee is burned and removed from circulation.

The new fee dynamic has significantly reduced miner earnings from transaction fees. However, the dollar amount of total miner revenue from block subsidies and priority fees combined has increased since EIP-1559 activation. The increase suggests that the loss in revenue from fee burning has been overshadowed by a growth in on-chain activity from NFTs and decentralized finance dapps. Though miners are earning less income from transaction fees, they continue to benefit and profit from influxes of on-chain transaction activity just as before the upgrade.

The above chart does not include data about earnings from MEV. This is because it is difficult to estimate which transactions executed on-chain are motivated by opportunities for MEV. Instead, this data can be pulled from third-party providers such as Flashbots who host off-chain channels designed for miners to easily earn MEV.

Investors – Impacts

56% of new coins issued on the Ethereum blockchain since EIP 1559 activation has been offset by the amount of ETH being burned through base fees.

A common critique against holding ETH as a store of value is the currency’s unbounded supply growth. Unlike Bitcoin (BTC), there is no fixed cap on the amount of ETH in circulation. While this doesn’t disqualify the asset from being a good store of value, it does present investors with the risk of an ever-diluting value to their ETH holdings.

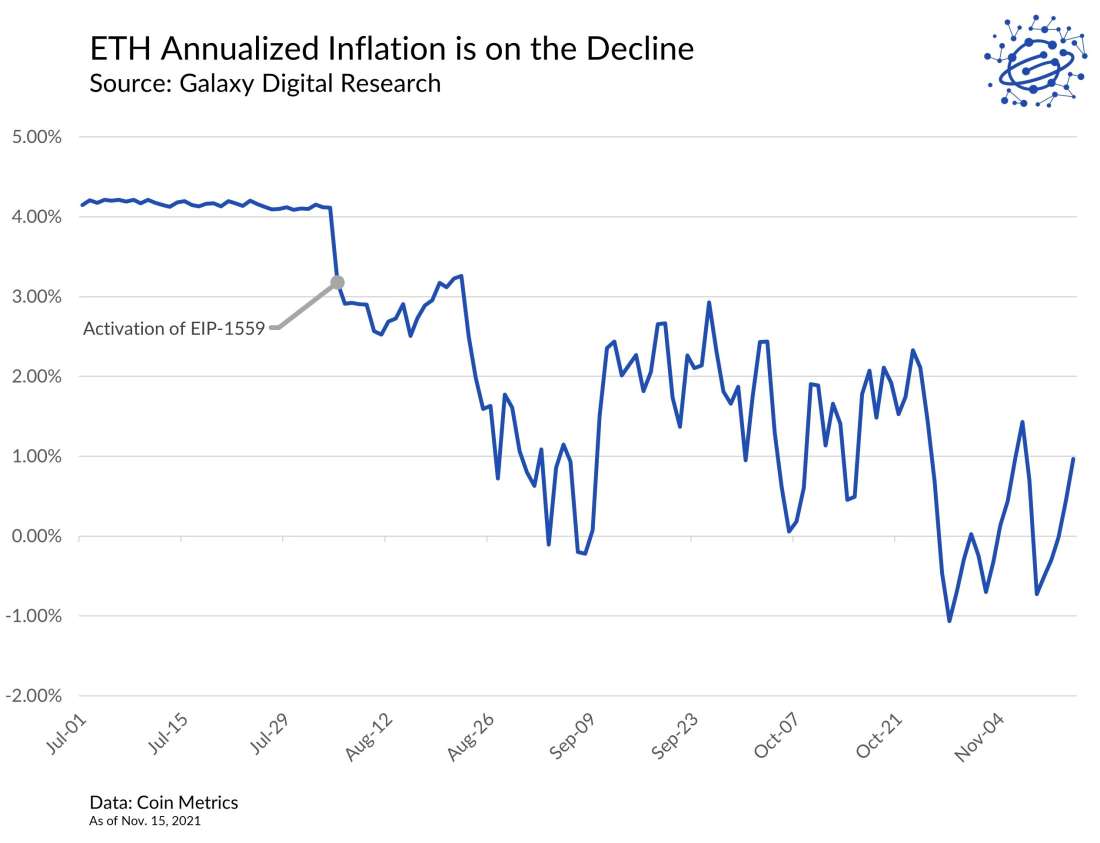

One of the impacts of EIP 1559 is that the code change creates a counterbalancing force to the supply growth of ether that is directly correlated to network usage. The more transaction activity on Ethereum there is, the more ETH is burned through transaction fees. So far, the amount burned has not been able to completely offset Ethereum’s infinite coin supply growth. However, it has come close, with annualized inflation on Ethereum trending at 1% as of November 15, 2021.

The rate at which ETH is being burnt over the last 100 days suggests it won’t be long until EIP 1559 leads to a consistently contracting, rather than expanding, coin supply. The reason why is because Ethereum is expected to undergo a radical overhaul of its consensus mechanism early next year. The upgrade, dubbed the Merge, will fundamentally change key aspects of Ethereum’s protocol such as: how blocks are produced, how transactions are validated, and most importantly, how stakeholders are rewarded for participating in network consensus.

After the Merge, validators will replace miners to produce blocks and validate transactions. Because the computational resources and hardware requirements for being a validator is much lower than for a miner, the rewards doled out to validators are also significantly lower. Miners currently earn 2 ETH, worth roughly $8,400, for each block they propose and append to Ethereum. Validators on the other hand operating on the Beacon Chain, which is the protocol that Ethereum will eventually transition to, earn around 0.005 ETH, worth roughly $21, for every block they propose.

As such, post-Merge, Ethereum’s burn rate is likely to overtake supply growth. This has positive implications on the investment narrative around ETH, which is so often compared to BTC, because investors may start viewing ETH as a deflationary, rather than inflationary, currency.

Investors – Limitations

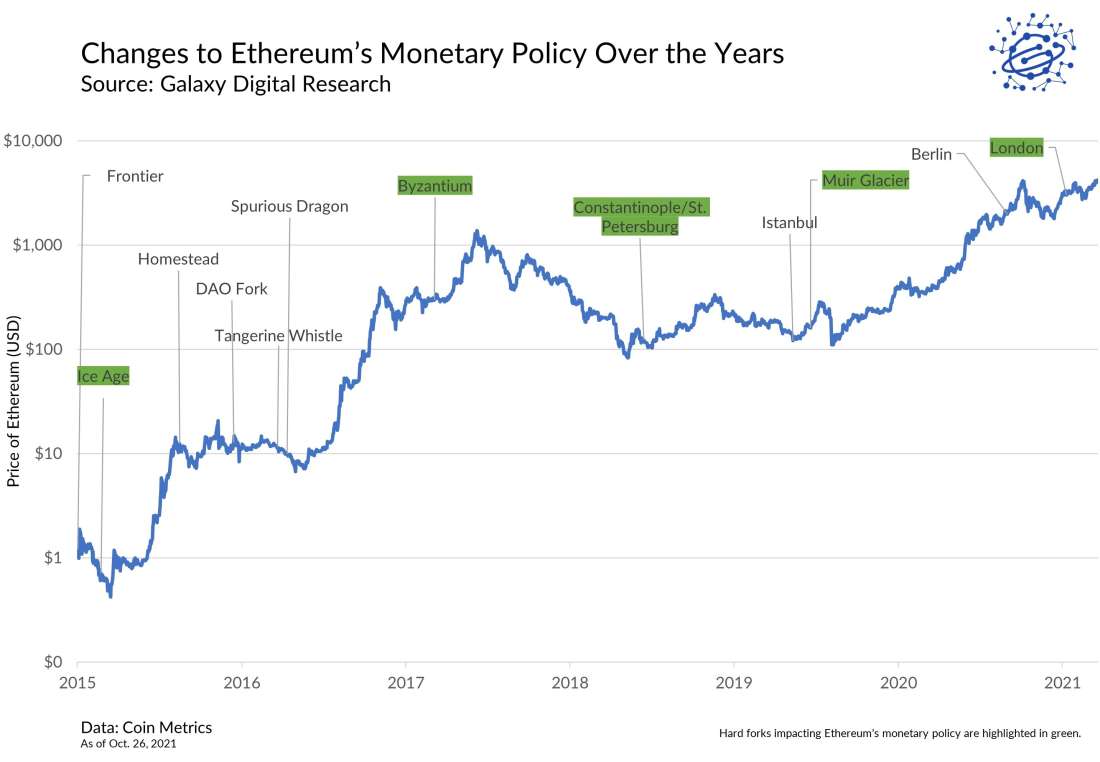

EIP 1559 is one of several code changes that will introduce equally, if not more ambitious, updates to Ethereum’s monetary policy.

Before EIP 1559, the issuance of ETH was changed by protocol developers from 5 ETH to 3 ETH to 2 ETH over the course of six years. In addition, the difficulty levels according to which miners earn these rewards have also undergone tweaks through four mandatory hard forks activated ad hoc since 2015. Still yet, Ethereum is expected to make further changes impacting its monetary policy through the Merge and in the years following.

As highly anticipated as EIP 1559 was to investors for its impact on the investment narrative of ETH, the code change has not created confidence among investors that Ethereum is nearing the end of its experimentation with protocol-level upgrades or beginning to stabilize core network functions. Rather, EIP 1559 like many of the EIPs that were introduced before it represents one steppingstone in a still long journey towards making Ethereum production-ready and feature-complete.

Conclusion

The activation of EIP 1559 on August 5, 2021, brought about sweeping changes to Ethereum’s fee market impacting the users, miners, and investors of the world’s second largest blockchain by market capitalization.

In its first 100 days of activation, over 50% of all on-chain transactions have leveraged EIP 1559’s updated transaction format. Collectively, these transactions have saved end-users $844 million in fees. In addition, more than half of all ETH issued into circulation over the past 100 days has been offset through EIP 1559’s fee burning mechanism.

At the same time, one of the unexpected impacts of the code change has been the frequency by which miners are processing blocks with extremely high gas usage, double that of what was considered the block gas limit before EIP 1559. One of the concerns of blocks containing a higher number of transactions is the increasing risk of centralization to a smaller number of miners and node operators who have the bandwidth and hardware to keep up with Ethereum’s growing state size.

The impacts of EIP 1559 have been limited and have left much of the wider issues to do with Ethereum’s lack of scalability and protocol stability undeterred. Since August 5, average transaction fees have climbed 224%% and as a result, miners are earning more of their total revenue from fees than ever before.

Looking ahead, the impacts of EIP 1559 are expected to shift as Ethereum upgrades to a new consensus model. Post-Merge, the rate at which base fees are burned is anticipated to outpace the rate at which new coins are issued effectively flipping ETH supply from being ever-expanding to contracting. This in addition to other changes to the protocol such as sharding farther down the road will alter the long-term effects of EIP 1559 on Ethereum stakeholders and interest groups.

For now, the repercussions of EIP 1559 have been limited in scope but these effects are likely to magnify and potentially change direction as EIP 1559 collides with other EIPs on Ethereum’s ambitious development roadmap.

Legal Disclosure:

This document, and the information contained herein, has been provided to you by Galaxy Digital Holdings LP and its affiliates (“Galaxy Digital”) solely for informational purposes. This document may not be reproduced or redistributed in whole or in part, in any format, without the express written approval of Galaxy Digital. Neither the information, nor any opinion contained in this document, constitutes an offer to buy or sell, or a solicitation of an offer to buy or sell, any advisory services, securities, futures, options or other financial instruments or to participate in any advisory services or trading strategy. Nothing contained in this document constitutes investment, legal or tax advice or is an endorsement of any of the stablecoins mentioned herein. You should make your own investigations and evaluations of the information herein. Any decisions based on information contained in this document are the sole responsibility of the reader. Certain statements in this document reflect Galaxy Digital’s views, estimates, opinions or predictions (which may be based on proprietary models and assumptions, including, in particular, Galaxy Digital’s views on the current and future market for certain digital assets), and there is no guarantee that these views, estimates, opinions or predictions are currently accurate or that they will be ultimately realized. To the extent these assumptions or models are not correct or circumstances change, the actual performance may vary substantially from, and be less than, the estimates included herein. None of Galaxy Digital nor any of its affiliates, shareholders, partners, members, directors, officers, management, employees or representatives makes any representation or warranty, express or implied, as to the accuracy or completeness of any of the information or any other information (whether communicated in written or oral form) transmitted or made available to you. Each of the aforementioned parties expressly disclaims any and all liability relating to or resulting from the use of this information. Certain information contained herein (including financial information) has been obtained from published and non-published sources. Such information has not been independently verified by Galaxy Digital and, Galaxy Digital, does not assume responsibility for the accuracy of such information. Affiliates of Galaxy Digital may have owned or may own investments in some of the digital assets and protocols discussed in this document. Except where otherwise indicated, the information in this document is based on matters as they exist as of the date of preparation and not as of any future date, and will not be updated or otherwise revised to reflect information that subsequently becomes available, or circumstances existing or changes occurring after the date hereof. This document provides links to other Websites that we think might be of interest to you. Please note that when you click on one of these links, you may be moving to a provider’s website that is not associated with Galaxy Digital. These linked sites and their providers are not controlled by us, and we are not responsible for the contents or the proper operation of any linked site. The inclusion of any link does not imply our endorsement or our adoption of the statements therein. We encourage you to read the terms of use and privacy statements of these linked sites as their policies may differ from ours. The foregoing does not constitute a “research report” as defined by FINRA Rule 2241 or a “debt research report” as defined by FINRA Rule 2242 and was not prepared by Galaxy Digital Partners LLC. For all inquiries, please email [email protected]. ©Copyright Galaxy Digital Holdings LP 2022. All rights reserved.