Top Stories of the Week - 8/04

This we write about competing rulings on tokens and securities laws in the Southern District of New York, the latest on the Curve vulnerability, and Litecoin’s third halving. Subscribe here and receive Galaxy's Weekly Top Stories, and more, directly to your inbox.

Judge in SEC vs. Terraform Labs Disagrees with Ripple Ruling

The federal judge in the SEC’s case against Terraform Labs on Monday denied Terraform’s motion to dismiss, sending the case forward. In the ruling, the judge specifically rejected the Howey Test analysis by the judge in the Ripple case in mid-July. Federal District Court Judge Jed S. Rakoff wrote: “It may also be mentioned that the Court declines to draw a distinction between these coins based on their manner of sale, such that coins sold directly to institutional investors are considered securities and those sold through secondary market transactions to retail investors are not. In doing so, the Court rejects the approach recently adopted by another judge of this District in a similar case, SEC v. Ripple Labs Inc., 2023 WL 4507900 (S.D.N.Y. July 13, 2023).”

In the Ripple ruling, Judge Torres categorized three types of XRP distributions. First, institutional sales to institutional investors through private placements were ruled to be unregistered securities because those sales were not registered as securities offerings nor were they offered under an exemption (such as Regulation D). Second, programmatic sales were not considered securities offerings because there was no accompanying information provided to purchasers to make them securities. And third, “other distributions,” such as XRP-denominated bonuses paid to Ripple Labs employees, were not considered securities because the employees made no investment of money, thus failing the first prong of Howey. (Read our more detailed overview of the Ripple ruling in the July 14 edition of this newsletter.)

The SEC can now appeal the Ripple ruling and cite the Terraform Labs analysis in its appeal, putting the question before the 2nd Circuit Court of Appeals. Alternatively, Terraform Labs could appeal its ruling and cite the analysis in Ripple. In either case, the appeals court will need to reconcile the two and come to some conclusory decision.

Our take

Because both cases are being heard in the same federal court – Southern District of NY – the contradictory rulings essentially neutralize each other in terms of precedential value within the district. When there is a conflict between rulings within the same district court, it can only be resolved by the appeals court that oversees the district – in this case, the 2nd Circuit Court of Appeals – and only if there is an appeal.

It is likely that the SEC will now appeal the Ripple decision to the 2nd Circuit Court of Appeals and cite the analysis from the Terraform Labs ruling. Whether an appeal is allowed depends on the issuing judge. Torres will need to approve the SEC’s appeal in Ripple, for example, before it can be sent to the 2nd Circuit Court of Appeals. The timing for such a decision is uncertain, but it could take 30-90 days to even find out. Should the SEC win an appeal in Ripple, presumably the entire case against Ripple Labs could go forward, thus almost entirely negating their perceived victory. Market participants mostly perceived the news to be a win for the SEC.

Broadly, the contradictory rulings and analyses highlight the lack of clarity that exists in applying securities laws to tokens and their sales. Rather than embark on a comprehensive rulemaking approach, the SEC is instead rolling the dice in courts around the country. Court cases depend on specific facts and circumstances, but can result in sweeping precedent. Howey itself was a case about interests in Florida orange groves and its outcome has largely guided the application of securities laws in the United States for nearly a century.

-Lucas Tcheyan

Curve your Enthusiasm

Community steps in to prevent large scale CRV liquidation after Curve pools exploited. Curve, the most important stablecoin money market in DeFi, saw several pools exploited on July 30 through a reentrancy bug affecting older version of Vyper that handled native ETH. In total, four Curve pools that handled raw ETH (alETH/ETH, msETH/ETH, pETH/ETH and CRV/ETH) were drained for ~$30-40m. Following the exploit, Curve founder Michael Egorov (“@newmichwill”, “Mitch”), who holds the majority of CRV's circulating supply and has taken loans out against his CRV holdings, began repaying debt on several lending protocols through a series of OTC deals. As of 7/31, Mitch had ~$100m of stablecoin-debt backed by ~427m CRV (~47% of CRV circulating supply) including: 305m CRV on Aave v2 with 63m in USDT debt, 59m CRV on Fraxlend with 16m in FRAX debt, 52m CRV on Abracadabra with 14m in MIM debt, and several smaller positions on other lending platforms.

Given the low level of CRV liquidity in the market relative to Mitch’s collateralized positions, market participants fear that the market would not be able to absorb a large-scale liquidation of CRV, which could leave lending protocols with bad debt and would have broader impacts for Curve and the rest of DeFi. Prominent crypto individuals and DeFi teams have been providing Mitch with liquidity to repay his debt including Justin Sun, DCFGod, DWF Labs, and Yearn Treasury. OTC deal terms are believed to be at a rate of $0.40/CRV with lock-ups of 6-12 months. So far, Mitch has sold 72m CRV through OTC deals for ~$29m used to repay debt.

While the majority of Mitch's CRV collateral is on Aave, he has prioritized repayments on Fraxlend first due to the interest rate model used, which presents a higher financial risk than Aave's model as it has the potential to increase exponentially over time depending on the utilization level. Other lending protocols have been discussing governance actions to manage the risk with Mitch's CRV positions including an Aave proposal to set the LTV = 0 for CRV markets, another Aave proposal to acquire CRV using 2m of treasury USDT, and an Abracadabra proposal to adopt a similar rate mechanism as Fraxlend to incentivize repayment. Since this past weekend, the price of CRV has dropped from $0.73 to a low of ~$0.50 on Monday overnight before recovering back to ~$0.60 as of Thursday afternoon. Curve TVL dropped by as much as 50% to $1.6bn at its low and now stands at $2.3bn.

Our take

It's been a tough week for Mitch, Curve, and many participants in DeFi. Curve has developed a solid reputation through its long operating history which has mostly been free of any significant exploits up until this point. Curve is the primary launch platform for emerging stablecoin products and has been the most popular DEX for stable-swaps until recently overtaken by Uniswap. Curve is one of few projects funding the development of Vyper, which is an alternative to Solidity code, so even though the Vyper bug and Curve are technically distinct, they are still closely related. The hacker(s) likely had to spend a meaningful amount of time digging into the Vyper release history to uncover this vulnerability to drain the Curve pools.

Then, to make things worse, the liquidation risk of CRV from Mitch's risky positions has exacerbated concerns across all of DeFi. While having transparent operations is important for monitoring the risk positions across individuals, assets, and protocols in the market, full transparency can also lead to panic and overreaction by market participants which can accelerate and intensify market volatility. This is not the first time that Mitch’s CRV position was attacked – in November 2022, Avi Eisenberg had detailed a trading strategy based on the amount of market liquidity of CRV using Aave (ultimately, the trade proved unsuccessful as the price of CRV quickly rose unexpectedly after the crvUSD white paper was released). After the attempted trade attempt that would have left Aave with bad debt, risk advisor Gauntlet had recommended freezing or adjusting the risk parameters of CRV markets on Aave v2 due to asset price volatility risk based on market liquidity; then again in June 2023, Gauntlet recommended to freeze CRV markets and to set the LTV to 0 for the same reasons, though the proposal failed to pass.

Now lending protocols are discussing changes to their risk parameters for CRV and re-assessing other markets facing similar risks from concentrated positions. It's an interesting competitive dynamic given many of these protocols rely on Curve gauges to direct yield to their own stablecoins to incentivize growth (e.g., Aave's GHO, Fraxlend's FRAX, Abracadabra's MIM, Inverse Finance's DOLA) However, none of these lending platforms wants to the be the last to be repaid and most risk of accumulating bad debt in the case of a significant liquidation. So far, the risk of liquidation appears to have subsided with these OTC deals, but we are hopeful that Mitch learns from this latest stress incident and will de-risk his own levered position and improve the distribution of CRV to avoid a similar market stress event from occurring once again.

-Charles Yu

Litecoin Undergoes Third Halving Event

On Wednesday, August 2, at block height #2,520,000, the Litecoin network completed its third halving. Halving events are scheduled reductions in block rewards that occur automatically on Litecoin every 840,000 blocks, approximately 4 years. These events are modelled after Bitcoin halving events, which similarly reduce issuance of coins by 50% every roughly 4 years. As the “silver to Bitcoin’s gold,” (an old narrative whose popularity has waned over the years), Litecoin shares many of the same features as Bitcoin, the main difference between the two being block times. Block times on Litecoin are four times faster than on Bitcoin. Like Bitcoin, Litecoin has a deflationary monetary policy designed to create scarcity and increase the purchasing power of its native currency, LTC. Due to these recurring halving events, the total supply of Litecoin (LTC) will never exceed 84mn. When the Litecoin network first launched in 2011, the block reward for mining on Litecoin was 50 LTC. As of Wednesday, the block reward has been reduced from 12.5 LTC to 6.25 LTC.

Our take

Due to the impact on coin supply, halvings are major events for cryptocurrency traders that often spark increased trading activity and speculation. In lead-up to Litecoin’s third halving, blockchain analytics firm Santiment pointed out that users holding between $9.5k and $950k worth of LTC were “aggressively accumulating” in anticipation of the halving being a bullish event. In the months prior to Litecoin’s first halving in 2015, LTCUSD increased by over 800%. Seven weeks before the network’s 2nd halving in 2019, LTCUSD increased by 500%. Most traders view these halvings as “buy the rumor, sell the news” events. Since Litecoin’s halving on Wednesday, LTC price has already declined roughly 3%.

Halvings are also important events impacting the mining economics. Miners are the stakeholders of a proof-of-work blockchain who compete with computation to append new blocks and earn block issuance rewards. Post-halving, Litecoin miners are earning 50% less in rewards. In lieu of increased revenue from transaction fees or a boost in LTC price, several Litecoin miners may find it uneconomical to continue operating mining machines. As miners leave the network, the amount of electricity needed to append new blocks to the chain will dynamically adjust downwards through a mechanism known as the difficulty adjustment, which is modelled after the same design as Bitcoin’s mining difficulty adjustments.

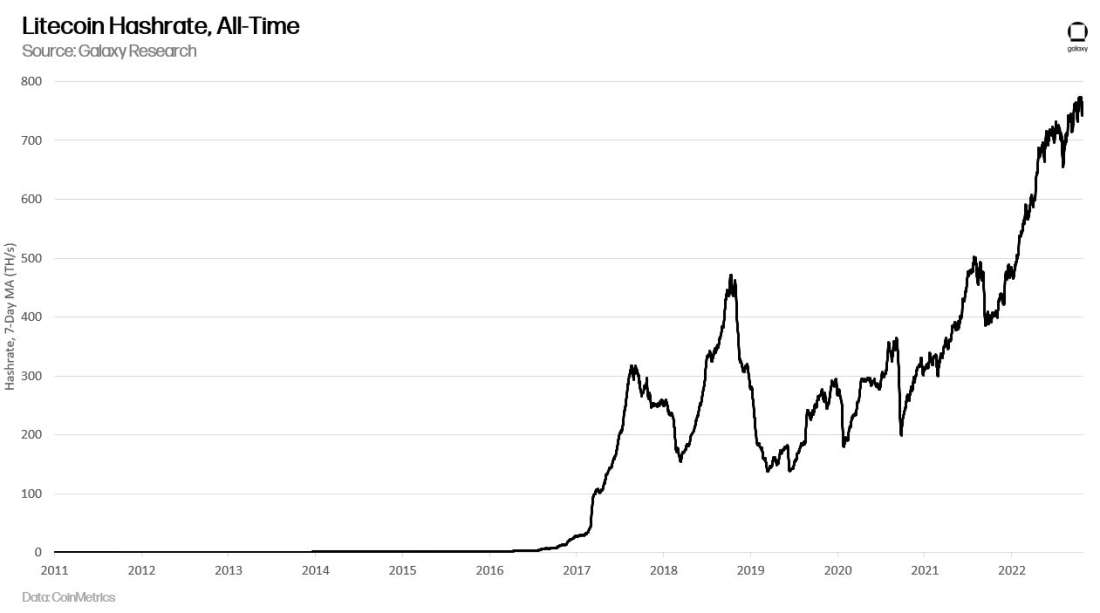

While the difficulty adjustment ensures that some subset of miners are incentivized to continue operating machines, reduced participation from miners would lower network hashrate and negatively impact overall security by causing a decline in the collective amount of electricity being expended to secure Litecoin. Since Litecoin’s launch, hashrate, a measure of the total electricity expended by Litecoin miners, has only increased, much like Bitcoin’s hashrate over the years.

A recurring question in both the Litecoin and Bitcoin communities is whether miner economics will continue to be sustainable over the course of several more halvings still to come. Bitcoin’s next halving is expected to occur in April 2024. Speaking to shared concerns around miner economics on both Bitcoin and Litecoin, the Creator of Litecoin Charlie Lee said on a Twitter livestream, “Satoshi chose four-year block halving so that it gives enough time for the network to grow in time for the fees to eventually take over. … The idea is that there will be enough usage on-chain creating enough fees. The fees will be enough to pay the miners to continue to help secure the network.” To learn more about the fee dynamics of Bitcoin, read this Galaxy Research report.

-Christine Kim

Other News

Coinbase to widen mainnet access to Base on August 9, releases Ethereum bridge

Crypto staking rewards must count as taxable income, IRS says

KPMG touts ESG benefits from Bitcoin, counters misperceptions in new report

Richard Heart, $HEX founder is sued by the SEC for securities fraud

Tether excess reserves increase by $850M to reach $3.3B

Sequoia slashes its crypto fund by 66%

Coinbase looks to add Bitcoin Lightning for Payments

Celo proposal to migrate to Ethereum Layer 2 passes

Legal Disclosure:

This document, and the information contained herein, has been provided to you by Galaxy Digital Holdings LP and its affiliates (“Galaxy Digital”) solely for informational purposes. This document may not be reproduced or redistributed in whole or in part, in any format, without the express written approval of Galaxy Digital. Neither the information, nor any opinion contained in this document, constitutes an offer to buy or sell, or a solicitation of an offer to buy or sell, any advisory services, securities, futures, options or other financial instruments or to participate in any advisory services or trading strategy. Nothing contained in this document constitutes investment, legal or tax advice or is an endorsementof any of the digital assets or companies mentioned herein. You should make your own investigations and evaluations of the information herein. Any decisions based on information contained in this document are the sole responsibility of the reader. Certain statements in this document reflect Galaxy Digital’s views, estimates, opinions or predictions (which may be based on proprietary models and assumptions, including, in particular, Galaxy Digital’s views on the current and future market for certain digital assets), and there is no guarantee that these views, estimates, opinions or predictions are currently accurate or that they will be ultimately realized. To the extent these assumptions or models are not correct or circumstances change, the actual performance may vary substantially from, and be less than, the estimates included herein. None of Galaxy Digital nor any of its affiliates, shareholders, partners, members, directors, officers, management, employees or representatives makes any representation or warranty, express or implied, as to the accuracy or completeness of any of the information or any other information (whether communicated in written or oral form) transmitted or made available to you. Each of the aforementioned parties expressly disclaims any and all liability relating to or resulting from the use of this information. Certain information contained herein (including financial information) has been obtained from published and non-published sources. Such information has not been independently verified by Galaxy Digital and, Galaxy Digital, does not assume responsibility for the accuracy of such information. Affiliates of Galaxy Digital may have owned or may own investments in some of the digital assets and protocols discussed in this document. Except where otherwise indicated, the information in this document is based on matters as they exist as of the date of preparation and not as of any future date, and will not be updated or otherwise revised to reflect information that subsequently becomes available, or circumstances existing or changes occurring after the date hereof. This document provides links to other Websites that we think might be of interest to you. Please note that when you click on one of these links, you may be moving to a provider’s website that is not associated with Galaxy Digital. These linked sites and their providers are not controlled by us, and we are not responsible for the contents or the proper operation of any linked site. The inclusion of any link does not imply our endorsement or our adoption of the statements therein. We encourage you to read the terms of use and privacy statements of these linked sites as their policies may differ from ours. The foregoing does not constitute a “research report” as defined by FINRA Rule 2241 or a “debt research report” as defined by FINRA Rule 2242 and was not prepared by Galaxy Digital Partners LLC. For all inquiries, please email [email protected]. ©Copyright Galaxy Digital Holdings LP 2023. All rights reserved.