Top Stories of the Week - 3/31

Subscribe here and receive Galaxy's Weekly Top Stories, and more, directly to your inbox.

European AML Regulation Targets Crypto

Members of the European Parliament (MEP) of the Economic and Monetary Affairs Committee have voted in favor of an anti-money laundering (AML) bill that will require decentralized autonomous organizations (DAO), decentralized finance (DeFi) protocols, and non-fungible token (NFT) marketplaces to conduct the same due diligence checks on their users as traditional banks and financial institutions. Additionally, the new regulation according to an official press release by the European Parliament will seek “to restrict transactions in cash and crypto assets” by capping payments from self-hosted, unidentified wallets. “They set limits up to €7000 for cash payments and €1000 for crypto-asset transfers, where the customer cannot be identified,” the release states. Luděk Niedermayer, Vice Chair of the Committee on Economic and Monetary Affairs, said about the bill, “Money laundering is a serious crime. It undermines society, the economy, and people’s trust. In our proposals, we focused on data quality, better data access by national authorities and relevant bodies, and cross-border cooperation across the EU. The quality of data is an essential factor in countering money laundering.”

The bill will now enter another round of negotiations between the Parliament, European Council, and European Commission. This is not the first piece of legislation around crypto AML regulation that has been passed by MEP in the past. In 2018, MEPs voted in favor of new AML regulation, which was colloquially known as “5AMLD”, to prevent money laundering and terrorism financing through cryptocurrencies. It has since been implemented as law across the EU. 5AMLD targets cryptocurrencies exchanges and custodian wallet providers, requiring both to apply customer due diligence controls and customer verification requirements. In 2022, MEP passed legislation over self-hosted crypto wallets through revising the text of the Transfer of Funds Regulation (TFR). According to CoinDesk reporter Jack Schickler, the new TFR rules await a formal vote in the European Parliament before being implemented into law. The latest bill passed by MEP on March 28, 2023, explicitly targets the activities of applications and services controlled and operated not by centralized entities or end-users, but rather by smart contracts.

Alongside these efforts to expand AML regulation to seemingly all facets of crypto activity, EU lawmakers are making progress on the Markets in Crypto Assets Regulation (MiCA) bill. MiCA represents a more comprehensive approach to regulating cryptocurrencies that encompasses rules around crypto mining, crypto business licensing, crypto custody, and more. The final version of MiCA, which is over two years in the making, will be the topic of discussion in the European Parliament on April 18. MiCA unlike the policies around crypto AML regulation in specific are widely viewed by the crypto industry as a positive step forward that ensure greater market integrity, encourage broader participation among crypto projects, and drive more innovation to the EU.

Our take

The explicit naming of DAOs, DeFi protocols, and NFT protocols as entities that must conduct the same due diligence on their users as traditional banks is a major action that will impact large swaths of on-chain applications. Despite the term “decentralized” in the naming of these types of applications, most smart contract applications can be controlled by a small group of individuals, usually token holders and/or developers. As discussed in prior newsletters, the ability to change the operations of a smart contract or override normal functions is built in to most smart contracts as a safety net of sorts in case of an unexpected bug or hack. However, so long as these backdoors exist, administrators have the ability to enforce changes to these applications according to rulings and laws, and the legal system can force them to do so, as was depicted in the counter exploit of the Oasis DeFi app back in February. The latest AML bill passed by MEP again illustrates another clear example of how regulators can continue to target dapp developers and token holders to enforce changes to smart contract applications.

Not all smart contract applications have admin keys or upgradeability that make them susceptible to legal action. Uniswap is an example of a decentralized exchange on Ethereum that cannot be changed or influenced in accordance with the will of the Uniswap core development team or UNI token holders. New versions of Uniswap smart contracts can be released, but existing versions of the application cannot be changed and exist on-chain in perpetuity. Since its team’s compliance with court orders back in February, Oasis developers have removed all capabilities for upgrading Oasis smart contracts. Privacy application Tornado Cash continues to operate as normal on Ethereum despite Tornado Cash smart contract addresses having been targeted by OFAC. Apart from these examples, there are still several nuanced designs of DeFi applications where an outright overhaul of all operations is impossible, and only changes impacting certain features of the application can be subject to change through governance (token holder voting) or the influence of the core development team. Therefore, the extent to which the new AML bill passed by MEP can be enforced across all DAOs, DeFi protocol, and NFT protocols is expansive but certainly not all-encompassing. Furthermore, it is precisely regulatory actions like these that could encourage the creation of more decentralized smart contract applications that are truly immutable and non-upgradeable.

Unlike MiCA and the TFR revisions, the AML bill is still a long way away from becoming law. Judging by how fierce pushback and input from the crypto industry influenced the final draft of the TFR revisions in the industry’s favor, there is still time for the final language of this AML bill to be revised such that the existence of non-upgradeable smart contracts on public blockchains and the limited authority of regulators to enforce AML rules on these applications is acknowledged and accepted. That would be a much better outcome than imposing rules to which applications are incapable of complying, which could result in some applications becoming illegal or off-limits to EU citizens - CK

Binance on the Hot Seat After Lawsuit From CFTC

The Commodity Futures Trading Commission (CFTC) sued Binance, the largest crypto exchange in the world, for illegally offering trading products to U.S customers. The 78-page lawsuit shares new allegations that Binance strategically evaded regulation through loopholes, VPNs, false reporting and poor internal processes. Tim Massad, a former CFTC chairman, said that “the CFTC’s allegations appear to include significant information from people who worked at Binance and that “this is a very powerful complaint.” The CFTC opens the lawsuit claiming that a significant portion of Binance’s reported trading volume and revenue derives from customers located in the U.S. Although Binance owns a U.S entity (Binance.US) to comply with U.S regulation, that platform does not provide futures or options trading capabilities, and the CFTC alleges that U.S based customers instead use the international exchange to access these products. Under The Commodity Exchange Act (CEA), all derivatives and futures trading platforms used by U.S investors must be registered with the CFTC.

The CFTC also alleged that there are 300 internal accounts on the exchange tied to Binance and other Binance-controlled trading firms (Merit Peak and Sigma Chain AG) that Binance failed to publicly disclose. However, the CFTC did not mention the type of trading activity the internal accounts conducted, and Binance stated that the trading accounts did not seek profit and were only used to swap tokens, offramp crypto to fiat and provide liquidity for trading pairs. Notably, the lawsuit did not actually allege any fraud at Binance,

Our take

The CFTC’s lawsuit against Binance coupled with the SEC’s lawsuit against Paxos (which issues BUSD, the Binance-branded stablecoin) in February suggests that U.S regulators are focusing on Binance. Last month, Paxos ended its relationship with Binance for BUSD as ordered by the NYDFS, which justified the order by saying there were "several unresolved issues related to Paxos’ oversight of its relationship with Binance in regard to Paxos-issued BUSD.” In ournewsletter, we wrote that the NYDFS and SEC’s approach to Binance suggested that it’s more difficult for regulators to go after Binance directly as a foreign company, so a more addressable option would be to target affiliate and partnered companies like Paxos. However, the CFTC’s lawsuit shows regulators aren’t too deterred to target Binance directly.

The largest crypto exchange in the world receiving regulatory pressure from one of the most aggressive regulatory regimes in the world is an event that shouldn’t be glossed over. However, the market seems to have mostly shrugged off the news. Considering that the CFTC’s allegations almost exclusively involve events from several years ago, many of which have been known or suspected by market participants, it’s fair to say this news is mostly priced-in. Since the CFTC’s lawsuit against Binance on 3/27, Bitcoin and Ethereum increased 3.3% and 4.2% respectively. Notably, Bitcoin also hit a new yearly high of $29,100.

There will be more regulatory headlines about Binance, though. The DOJ and IRS have been investigating Binance since May 2021, we can expect additional developments in regards to Binance evading U.S regulation from these regulatory entities. Additionally, on March 3 during Voyager’s bankruptcy hearing pertaining to Binance’s potential acquisition, the SEC said that Binance U.S. is selling unregistered securities, clearly the SEC is also watching Binance. Also interestingly, the SEC’s argument in the Voyager bankruptcy coupled with the CFTC’s lawsuit shows there remains significant dispute about what is a security. The CFTC’s lawsuit said that BTC, ETH, LTC, BUSD, and USDT are commodities, while the SEC said that BUSD is a security and NYAG argued that ETH is a security. While the dispute among the regulators is real, we spoke to one prominent crypto lawyer who told us that these various pronouncements (by the SEC in their legal claims, by the CFTC in theirs, etc.) are not consequential but mostly relevant to the cases themselves as a way for the regulator to establish jurisdiction. The lawyer told us: “Tokens are basically Schrodinger’s Tokens. While they’re in the box, unobserved, they exist in a superimposed state, existing as everything at once: securities, commodities, money. Once taken out of the box, they’re whatever that regulator regulates.” - GP

Lido Unveils Staked ETH Withdrawals Process and Interface

During Lido’s Node Operator Community Call #5, the Lido team shared more details around the process for stETH to ETH redemptions. Notably, the process involves the use of non-fungible tokens (NFTs) to create transferability for staked ETH withdrawal requests. The following is a step-by-step overview of the Lido staked ETH withdrawals process presented on Tuesday’s call:

Users must navigate to the Lido withdrawals webpage.

On this webpage, they must connect their wallet containing their steth or wsteth balance.

Once a user’s wallet is connected, the webpage will update with additional information about the available balance of stETH ready to be redeemed for ETH and the expected waiting time to process the withdrawal request.

Then, a user will sign a transaction through their connected wallet to initiate the withdrawal request on-chain.

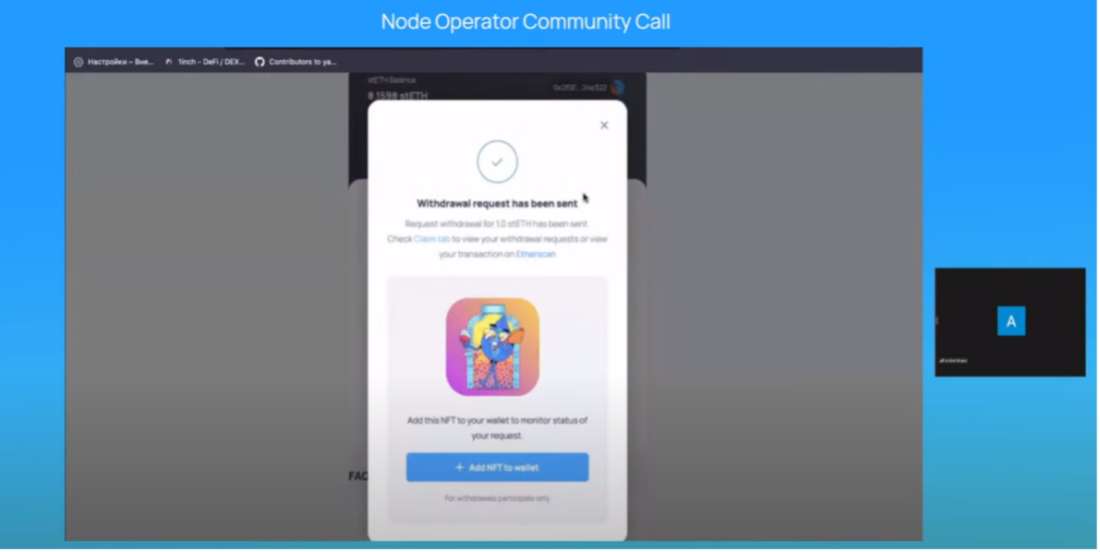

As soon as the transaction has been processed, a user will be able to verify the transaction on blockchain explorers like Etherscan. From the webpage, users will also receive an NFT representing their withdrawal claim, which they can accept and deposit into their wallet.

Caption: Lido staked ETH withdrawals user interface

Source: YouTube, Lido Finance

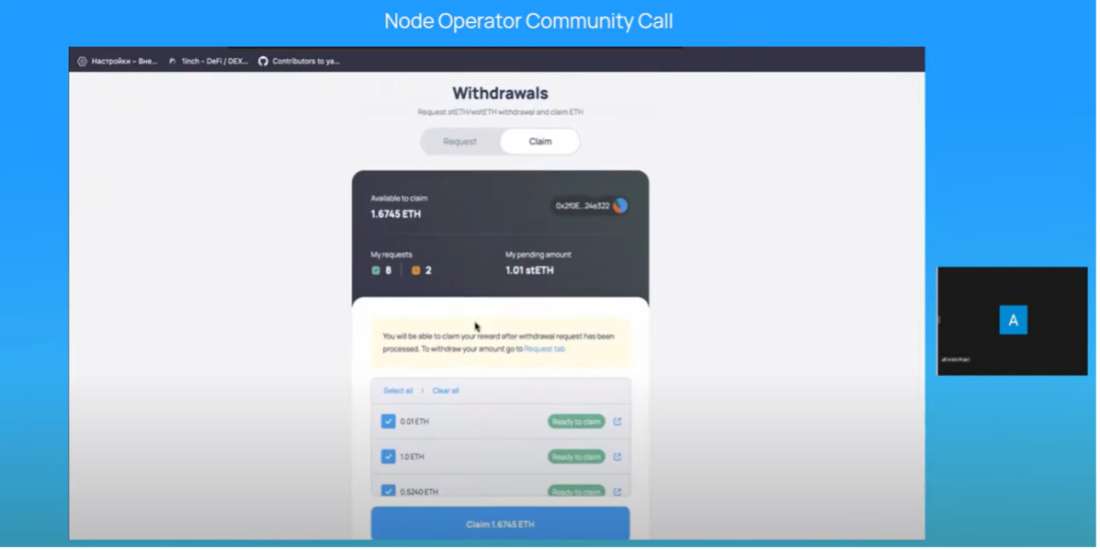

On the backend, Lido smart contracts will burn the specified amount of stETH and withdraw an equal amount of ETH either from Lido’s staking rewards buffer or from initiating validator exits. Once the stETH has been burned and ETH withdrawn, the ETH balance will be made claimable on the Lido withdrawal webpage under the “Claim” tab.

Caption: Lido staked ETH withdrawals user interface

Source: YouTube, Lido Finance

Once a user has claimed their withdrawn ETH, the NFT representing the status of their withdrawals request will be burned. There is no canceling feature for withdrawals requests. However, users can transfer claims to staked ETH withdrawals by transferring the NFT created when they first initiated their withdrawal request to a different wallet.

As stated by the Lido team on Tuesday, the user interface (UI) for staked ETH withdrawals on Lido is in the testing process. The UI depicted above changes slightly during times of extreme volatility such as in the case of a mass slashing event or a sudden outage of Lido validator nodes. During these times, the interface will warn users that the Lido protocol has entered into “bunker” mode and wait times are not guaranteed for stETH to ETH redemption.

As highlighted in a previous Galaxy Research brief, Lido will not be ready to activate withdrawal functionality at the time of Shanghai. Scheduled for activation on April 12 at 6:27PM (ET), Shanghai is the name of the upgrade that will enable staked ETH withdrawals from a protocol-level for all validator node operators. While users staking with Lido will have to wait a few extra months before taking advantage of the network’s withdrawal functionality, at-home stakers and users staking through other services such as Rocketpool and Coinbase will be able to start redeeming their liquid staking tokens for ETH shortly after the upgrade goes live on Ethereum.

Our take

The Lido team has spent a lot of effort on making the user experience for initiating staked ETH withdrawals simple and easy. There is no command line interface that users will have to use. Every step of the withdrawal process can be initiated through the click of a button. The use of an NFT to help users track the status of their withdrawal claims and intuitively transfer claims to another wallet as needed without having to revert transactions or rely on blockchain explorers is another clear example of how usability is being prioritized in the design of Lido’s staked ETH withdrawals process. This comes as no surprise as a large part of Lido’s value proposition over other staking solutions is rooted in Lido’s ability to offer ETH holders a convenient and simple way to stake and unstake their ETH with little to no technical know-how.

It’s important to note however what complexities get abstracted away in the process of simplifying the staked ETH withdrawals process for a non-tech savvy audience. For example, most users relying on Lido’s webpage for withdrawals will not know what interactions are being triggered between Lido smart contracts in the process of claiming their staked ETH. Under normal circumstances, it is not necessary for users to know, especially if the functionality of the Lido webpage is working as expected. However, there are edge cases where understanding how to execute transactions through more direct interactions with Lido smart contracts may be necessary. For example, if the Lido webpage unexpectedly goes down or becomes restricted and censored in certain countries around the world, end-users may be forced to rely on other permissionless tools to stake and unstake their ETH.

To this end, the Lido team is working on documentation around how to use their services through alternative means and without relying on Web2 tools. Given increasing regulatory scrutiny of staking services and crypto more broadly around the world, building tools and levels of access to smart-contract based applications that do not rely on centralized points of failure is becoming increasingly important and needed. That being said, the Lido team’s focus and skill in advancing a more user-friendly design for their services has certainly contributed to greater adoption of not only the Lido protocol in comparison to other liquid staking providers but staking activity more broadly on Ethereum. -CK/GP

Other News

FDIC seeking Signet buyer, returning Signature crypto deposits next week

Circle announces USDC launch for Cosmos via Noble network

Fetch.ai announces fresh funding at a $250 million valuation

U.S. charges FTX's Bankman-Fried with paying $40m to bribe Chinese regulators

Do Kwon to face Montenegro justice first as US and Korea vie for extradition

Safemoon liquidity pair compromised in $8.9 million hack

Lido to cease staking on Polkadot, Kusama in August

Art Blocks debuts NFT marketplace with enforced creator royalties

NFT Collection Y00ts makes anticipated move from Solana to Polygon

Legal Disclosure:

This document, and the information contained herein, has been provided to you by Galaxy Digital Holdings LP and its affiliates (“Galaxy Digital”) solely for informational purposes. This document may not be reproduced or redistributed in whole or in part, in any format, without the express written approval of Galaxy Digital. Neither the information, nor any opinion contained in this document, constitutes an offer to buy or sell, or a solicitation of an offer to buy or sell, any advisory services, securities, futures, options or other financial instruments or to participate in any advisory services or trading strategy. Nothing contained in this document constitutes investment, legal or tax advice or is an endorsementof any of the digital assets or companies mentioned herein. You should make your own investigations and evaluations of the information herein. Any decisions based on information contained in this document are the sole responsibility of the reader. Certain statements in this document reflect Galaxy Digital’s views, estimates, opinions or predictions (which may be based on proprietary models and assumptions, including, in particular, Galaxy Digital’s views on the current and future market for certain digital assets), and there is no guarantee that these views, estimates, opinions or predictions are currently accurate or that they will be ultimately realized. To the extent these assumptions or models are not correct or circumstances change, the actual performance may vary substantially from, and be less than, the estimates included herein. None of Galaxy Digital nor any of its affiliates, shareholders, partners, members, directors, officers, management, employees or representatives makes any representation or warranty, express or implied, as to the accuracy or completeness of any of the information or any other information (whether communicated in written or oral form) transmitted or made available to you. Each of the aforementioned parties expressly disclaims any and all liability relating to or resulting from the use of this information. Certain information contained herein (including financial information) has been obtained from published and non-published sources. Such information has not been independently verified by Galaxy Digital and, Galaxy Digital, does not assume responsibility for the accuracy of such information. Affiliates of Galaxy Digital may have owned or may own investments in some of the digital assets and protocols discussed in this document. Except where otherwise indicated, the information in this document is based on matters as they exist as of the date of preparation and not as of any future date, and will not be updated or otherwise revised to reflect information that subsequently becomes available, or circumstances existing or changes occurring after the date hereof. This document provides links to other Websites that we think might be of interest to you. Please note that when you click on one of these links, you may be moving to a provider’s website that is not associated with Galaxy Digital. These linked sites and their providers are not controlled by us, and we are not responsible for the contents or the proper operation of any linked site. The inclusion of any link does not imply our endorsement or our adoption of the statements therein. We encourage you to read the terms of use and privacy statements of these linked sites as their policies may differ from ours. The foregoing does not constitute a “research report” as defined by FINRA Rule 2241 or a “debt research report” as defined by FINRA Rule 2242 and was not prepared by Galaxy Digital Partners LLC. For all inquiries, please email [email protected]. ©Copyright Galaxy Digital Holdings LP 2023. All rights reserved.