Top Stories of the Week - 2/2

This week in the newsletter, we share updates about FTX's plan to repay creditors, Tether's new attestation and their massive revenues, and the outcome of the much-anticipated Jupiter airdrop on Solana.

Subscribe here and receive Galaxy's Weekly Top Stories, and more, directly to your inbox.

FTX Abandons Plans to Reboot Exchange

During a court hearing on Wednesday, FTX lawyer Andrew Dietderich said that the company has abandoned plans to revive the exchange. “FTX was an irresponsible sham created by a convicted felon,” Dietderich said. “The costs and risks of creating a viable exchange from what Mr. Bankman-Fried left in a dumpster were simply too high.” Dietderich added that the company expects to fully repay customers for lost funds, though this repayment will be in US dollars and calculated based on crypto asset prices from November 2022 when the exchange filed for bankruptcy.

Since FTX filed for bankruptcy, former CEO Sam Bankman-Fried was tried and convicted in federal court for several criminal offenses including fraud and money laundering. He now awaits sentencing, which has been scheduled for March 28, 2024 and could result in a maximum sentence of up to 110 years in prison. Under the leadership of the new CEO of FTX, John J. Ray, who is an attorney that specializes in recovery funds from failed companies, an estimated $7bn in cash and crypto assets has been recovered by the company and will be put toward reimbursing their customers.

The Wall Street Journal reported in January 2024 that FTX faces over 35,000 customer claims totaling $16bn in lost funds. Dietderich noted in the court hearing on Wednesday that the company still needs to evaluate all of these claims and assess their legitimacy. He also said that, because of the appreciation of crypto asset prices since November 2022, many customers “won’t feel like that’s true payment in full from where they started.”

Customers of failed cryptocurrency lending company Celsius have started to receive repayments as of Wednesday, January 31. Chris Ferraro, Plan Administrator and former Chief Restructuring Officer, Interim Chief Executive Officer, and Chief Financial Officer of Celsius (no relation to Chris Ferraro, President and CIO of Galaxy Digital), said in a press release, “Today, over 18 months after Celsius paused withdrawals, we began distributing over $3 billion of cryptocurrency, fiat, and stock in Ionic Digital to Celsius creditors.” Ionic Digital is the name of a new bitcoin mining company that has acquired all of Celsius’ mining assets, which consist of 127,000 bitcoin mining machines across five sites in Texas. Alex Mashinsky, former CEO of Celsius, currently faces charges of fraud and market manipulation and awaits a criminal trial set to begin on September 17, 2024.

Our Take:

Based on the comments shared by Dietderich on Wednesday, it does not appear likely that FTX customers will receive their repayment from the exchange any time soon. Though the company has recovered a sizable amount of assets, enough to assert its ability to fully reimburse all of its customers, the company will still likely need several months to meticulously evaluate each customer claim before processing the payouts.

Once processed, the payouts, which will be handed out in cash and calculated based on asset prices from 14 months ago at the absolute bottom of the crypto bear market, are expected to be paltry in comparison to what customers could have gained in value if they had self-custodied their assets or simply used another crypto exchange that was not misappropriating their money. Also ironic and upsetting, the primary reason that crypto prices tanked so much was FTX’s collapse itself. Though FTX customers have implored the courts to reject the reimbursement terms that would allow FTX to repay their customers in fiat currency rather than in-kind, U.S. Bankruptcy Judge John Dorsey overruled these complaints stating that U.S. bankruptcy laws are clear that company debts can be repaid based on their cash value at the date when the company filed for bankruptcy. (Bitcoin rallied 155% in 2023 and Ether rallied 90%, so receiving coins rather than cash would allow creditors to maintain their investment positions, while receiving cash will effectively lock in significant missed gains).

The company’s assertion that there will be no FTX 2.0 due to a lack of willing investors to seed such a project also shut the door on hopes that certain customers had to recoup some of their losses through the monetization of remaining FTX intellectual property or assets the way Celsius may be able to achieve with its Ionic Digital mining spinout. Overall, unlike the proceedings of Celsius’ bankruptcy which resulted in a reorganization plan that 98% of Celsius’ account holders supported, FTX’s distribution plan is widely opposed by creditors.

What is also equally bewildering are the efforts by some, including two esteemed law professors. to whitewash the fraudulent and obviously criminal behavior of SBF simply because the estate now believes it can repay creditors, partially due to the success of some of SBF’s investments. FTX customers will never be able to get back their crypto assets in-kind or at market value from the exchange like they would have been able to if FTX did not steal customer funds. FTX customers will never be able to regain the time, energy, or money spent to trying to make sense of what happened to the exchange and how to get their money back. So, even if customers can be fully reimbursed in cash for their losses because of the appreciation of crypto asset prices, it’s clear to nearly all parties, FTX’s lawyer included, that the repayments will be paltry compared to what FTX customers were rightfully owed. And just because a criminal thief happened to invest some of the stolen funds successfully does not absolve the thief of the crime itself. - Christine Kim

Jupiter Delivers Historic Airdrop to Solana Users

Users received the largest ever Solana-based airdrop to date on Wednesday from Jupiter, the network’s leading DEX aggregator. One billion tokens, representing 10% of the total supply, were airdropped to users who interacted with Jupiter prior to November 2, 2023. An additional 350 million tokens were earmarked for launch pools, exchange market makers, and emergency purposes.

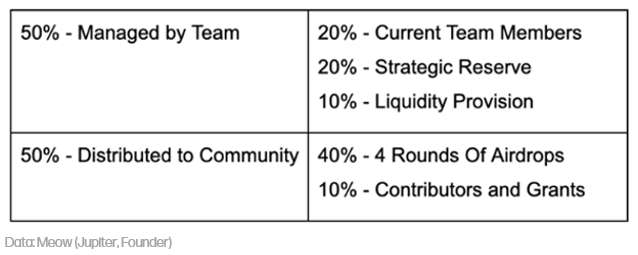

In total, 40% of total supply will be airdropped to users in three additional phases over the coming year (exact timeline TBD). An additional 10% is reserved for community contributors and grants. The Jupiter team will receive the remaining 50% of the supply to be used for team members, strategic reserves, and liquidity provisioning with various lockups and vesting. Jupiter did not raise any funding prior to the launch, including no token presale. They first announced the airdrop at Solana’s annual Breakpoint Conference last November, kicking off a frenzy of onchain activity.

Users who did not receive an airdrop were able to purchase tokens at launch through a new Jupiter launchpad called LFG. LFG uses Meteora, a concentrated liquidity DEX also run by the Jupiter team, to seed a single-sided dynamic liquidity market maker (DLMM). The LFG launchpad earns one percent of launch fees. 75% of those fees are distributed to the JUP DAO and 25% to the Jupiter team.

The airdrop was a significant stress-test for the Solana network due to concerns over the its ability to handle such a large number of transactions. The Jupiter team went so far as to orchestrate a test memecoin launch on LFG last week to work out any remaining kinks. Still, users experienced some issues during the launch, struggling to submit successful claims or buy transactions. The Solana network, however, experienced no downtime and continues to normally process blocks.

Jupiter is one of Solana’s most popular applications, handling 80% of non-bot volume on the network, and is the most-used DeFi trading platform by unique wallets. In recent months the team has launched additional products, including a new perpetual futures protocol, and has plans to further expand in the coming years.

Our Take:

The Jupiter airdrop marks a significant milestone in Solana’s resurgence over the past year and is an excellent gauge of the network’s growth. Teams across the ecosystem worked tirelessly to ensure a smooth launch. Applications upgraded their front ends to include priority fees so that users could increase their chance of transaction inclusion, wallet and infrastructure providers rolled out new functionality to reduce security risks during the claim process, and a whole new launchpad was built to combat bot activity and increase the chances of a fair token launch. Even with a major spike in the use of priority fees, average priority transaction fees topped out at $0.0081 and have subsided since.

Critics of the launch have largely focused on two aspects: (1) that Jupiter earned significant fees (~$50 million) from the launchpad that users were forced to use and (2) that Jupiter plans on removing the liquidity from the launchpad pool a week after launch. If additional pools with substantial liquidity are not spun up in the interim, or the team does not reallocate liquidity from the launch pool to new pools, this could create substantial volatility. Jupiter’s CEO Meow has been proactive in responding, arguing that Jupiter, like any team, has to pay for use of LFG and precautions will be taken ahead of the launchpad close to ensure there is adequate liquidity in additional pools. While there is some merit to these critiques, it’s also important to highlight that these facts were all relayed prior to the launch and published widely.

Solana continues to demonstrate that network upgrades implemented over the past year have led to tangible improvements that reduce downtime and improve user experience. In the near term, upcoming improvements to Solana’s scheduler as part of v1.18 should further reduce “scheduling jitter,” which incentivizes users to overload the network with spam when there is contested state. Please refer to my recent tweet for a more in-depth overview of the scheduler and its impact on transaction ordering/priority fees. Looking ahead, the ecosystem’s focus remains on several additional impending airdrops as well as further details on the release of a new Solana validator client, Firedancer. - Lucas Tcheyan

Unstoppable TogETHER

Tether sets new highs in profitability & excess coverage in 4Q23. According to Tether's attestation report by BDO, the company generated $2.85bn in profit for 4Q23, ~$1bn of which is from US T-bills interest and ~$1.85bn from gold & bitcoin holdings. Tether ended the year with $2.8bn in bitcoin holdings (+70% q/q) and $5.4bn in excess reserves, which is a record-high. For the full year 2023, net profit was $6.2bn, of which ~$4bn came from US Treasuries, reverse repos & money market funds.

Other highlights from the quarter include:

Totaled outstanding Tether tokens reached a new high of $91.6bn (+10% q/q &+39% y/y).

Cash & CE and other short-term reserve assets accounted for 90% of Tether issued tokens (also an ATH)

Total exposure to US Treasuries was $80.3bn (includes indirect exposure from overnight reverse repos secured by UST and money market funds)

Tether achieved its goal of removing the risk of secured loans from its reserves (the company still holds $4.8bn in secured loans but this is now more than offset by excess reserves).

Tether made $640m in strategic investments (e.g., Bitcoin mining, energy, AI infra, P2P tech, etc.), bringing the YTD total invested amount to $1.45bn. Note: these investments are not included in the consolidated reserves report.

Our Take:

Tether's reported financials continue to make a strong case that stablecoin issuance can be one of the most efficient business models in the world. Tether earns 0.1% on all mint/redeem volumes, and currently earns ~4.9% in interest income on cash & short-term holdings while paying out 0% interest to USDT holders. For the full year 2023, the leading stablecoin issuer has generated $4bn in interest income on reserve assets with less than 100 employees – an impressive feat considering fewer than 400 public companies in the world have generated earnings >$4bn over the past year. Although expected rate cuts in 2024 will negatively impact the profitability of Tether and other depository institutions, Tether's bitcoin investment strategy from May 2023 provides diversification benefits and has contributed significantly to Tether's record-setting 4Q23 results.

According to a Bitcoin address suspected to belong to Tether (based on the purchase patterns and balances that closely map to Tether’s quarter-end reported amounts), Tether purchased 8,888.88 BTC during Q4 to increase total holdings to 66.5k BTC, making it the 11 largest Bitcoin holding address in the world. To put this in perspective, this is more than the amount held by Blackrock or Fidelity for their ETFs. The 8,888 BTC purchased during Q4 (~$379m @ $42,640 / BTC) accounts for ~13% of net operating profits for the quarter (in-line with the company’s stated objective in May 2023 of regularly allocating up to 15% of NOP towards purchasing BTC).

Tether also continues to deliver on its stated objectives to improve its reserves - after eliminating exposure to commercial paper holdings in October 2022 and now having mitigated (but not removing) the risk from secured loans, Tether still hopes to start publishing real-time reserve data to further improve transparency as a longer-term goal. The company is quickly evolving from a stablecoin business to a financial / tech / energy powerhouse with its ambitious expansion plans into Bitcoin and other strategic opportunities (incl. investments in sustainable energy, AI infrastructure, and P2P technology). Looking ahead, Tether will serve an important role in accelerating stablecoin adoption and has the potential to transform the way that businesses and people use money in the open crypto economy. - Charles Yu

Charts of the Week

Stablecoin lending utilization on Aave (V2 and V3) and Compound (V2 and V3) on Ethereum Mainnet has sustained between 80% and 90% for much of the last six months. Utilization is calculated as Amount Borrowed / Amount Supplied for lending markets on-chain. A utilization rate of 80% to 90% indicates that 80 to 90 cents for every $1 deposited has been borrowed. Since the turn of 2024, utilization has cooled off as new deposits of stablecoins into lending markets have outpaced that of new borrows. As rates have increased this has incentivized users to bring new stablecoins on-chain and/ or deposit stablecoins into lending markets for the yield. Overall, utilization has increased from 62% on February 2, 2023 to 87% as of February 1, 2024.

Increasing utilization has pushed borrow rates north of 10% from 3% in February 2023. However, borrow rates have cooled down as utilization has come off 90% over the last three weeks. The weighted average borrow rate by amount borrowed for USDC, USDT, DAI, and FRAX fell from 9.6% on January 10, 2024 to 7.2% as of February 1, 2024 using the seven-day moving average.

Other News

Bankrupt Genesis settles SEC lawsuit over Gemini Earn program

Polygon Labs lays off 19% of team after 'rapid growth' during crypto's bull run

Binance launches marketplace for inscription tokens

Ripple’s co-founder was hacked for $112M XRP

Ethereum’s Dencun upgrade goes live on Sepolia testnet

Vitalik Buterin details four ways cryptocurrency and AI can overlap

Legal Disclosure:

This document, and the information contained herein, has been provided to you by Galaxy Digital Holdings LP and its affiliates (“Galaxy Digital”) solely for informational purposes. This document may not be reproduced or redistributed in whole or in part, in any format, without the express written approval of Galaxy Digital. Neither the information, nor any opinion contained in this document, constitutes an offer to buy or sell, or a solicitation of an offer to buy or sell, any advisory services, securities, futures, options or other financial instruments or to participate in any advisory services or trading strategy. Nothing contained in this document constitutes investment, legal or tax advice or is an endorsementof any of the digital assets or companies mentioned herein. You should make your own investigations and evaluations of the information herein. Any decisions based on information contained in this document are the sole responsibility of the reader. Certain statements in this document reflect Galaxy Digital’s views, estimates, opinions or predictions (which may be based on proprietary models and assumptions, including, in particular, Galaxy Digital’s views on the current and future market for certain digital assets), and there is no guarantee that these views, estimates, opinions or predictions are currently accurate or that they will be ultimately realized. To the extent these assumptions or models are not correct or circumstances change, the actual performance may vary substantially from, and be less than, the estimates included herein. None of Galaxy Digital nor any of its affiliates, shareholders, partners, members, directors, officers, management, employees or representatives makes any representation or warranty, express or implied, as to the accuracy or completeness of any of the information or any other information (whether communicated in written or oral form) transmitted or made available to you. Each of the aforementioned parties expressly disclaims any and all liability relating to or resulting from the use of this information. Certain information contained herein (including financial information) has been obtained from published and non-published sources. Such information has not been independently verified by Galaxy Digital and, Galaxy Digital, does not assume responsibility for the accuracy of such information. Affiliates of Galaxy Digital may have owned or may own investments in some of the digital assets and protocols discussed in this document. Except where otherwise indicated, the information in this document is based on matters as they exist as of the date of preparation and not as of any future date, and will not be updated or otherwise revised to reflect information that subsequently becomes available, or circumstances existing or changes occurring after the date hereof. This document provides links to other Websites that we think might be of interest to you. Please note that when you click on one of these links, you may be moving to a provider’s website that is not associated with Galaxy Digital. These linked sites and their providers are not controlled by us, and we are not responsible for the contents or the proper operation of any linked site. The inclusion of any link does not imply our endorsement or our adoption of the statements therein. We encourage you to read the terms of use and privacy statements of these linked sites as their policies may differ from ours. The foregoing does not constitute a “research report” as defined by FINRA Rule 2241 or a “debt research report” as defined by FINRA Rule 2242 and was not prepared by Galaxy Digital Partners LLC. For all inquiries, please email [email protected]. ©Copyright Galaxy Digital Holdings LP 2024. All rights reserved.