Top Stories of the Week - 10/20

This week in the newsletter, we write about the impacts and learnings from a fake ETF headline on Monday and the state of spot BTC ETF filings, Reddit’s decision to halt its blockchain-based community rewards program, and a letter sent by 100 lawmakers to the White House seeking information on the government’s efforts to prevent the use of cryptocurrency for illicit finance.

Subscribe here and receive Galaxy's Weekly Top Stories, and more, directly to your inbox

Bitcoin ETF Anticipation Heats Up

An erroneous report that BlackRock’s spot Bitcoin ETF had been approved gave a taste of what could come when approval does happen. An inaccurate headline on Monday morning from Cointelegraph (published to X) caused BTC to rise 10% within 15 minutes, sending it above $30k. The move led to significant short covering in both spot and options markets.

While BTC quickly came back down as market participants realized the news was incorrect, BTC has nonetheless held above $28k, meaningfully higher than where it finished last week during the Friday session ($26,482). In response to the price action, BlackRock CEO Larry Fink commented on Fox Business that he believes “crypto will play that type of role as a flight to quality” given increasing macroeconomic and geopolitical uncertainty. (Fink also stated that he is not allowed to say “Bitcoin” while BlackRock has an ETF application pending).

The trend of buying Bitcoin call options has persisted throughout the week. Data by strike on options open interest shows a concentration of long call option positions from $28,250 onwards, with $30,000 being the top strike by open interest.

Applicants for Bitcoin spot ETFs have continued to post new filings. Last week, Ark and Invesco/Galaxy both posted amended S-1 filings. This week, Fidelity and BlackRock both filed amended S-1s. The amendments have mostly included enhanced risk disclosures (bitcoin mining, governance, fees, forks, illicit finance, etc.) and other minor changes. Grayscale also filed an S-3 arguing that their existing 19b-4 filing, along with a Regulation M exemption to allow trust redemptions, is sufficient to list GBTC shares.

OUR TAKE:

Monday’s move gave a taste of the effect a genuine announcement could have on spot BTC prices. The immediate jump showed that active market participants may have been caught off-guard by the potential of an ETF approval. The initial jump saw significant volume on BTC CME contracts, with BTC front-month futures trading about $1.5bn of notional volume in about 15 minutes on Monday. The fact that BTC moved 10% on a headline from Cointelegraph, a crypto-native publication, shows that even the crypto-native and active-traditional capital that remains in the market today had not efficiently priced the likelihood of an approval. The fact that BTC is sustaining now at higher levels than last week suggests some repositioning and re-pricing of the ETF likelihood. While the initial reaction was driven by crypto-natives and active-traditionals, it’s likely we would have drawn more sustained follow-through and made new yearly highs had the news been real. BlackRock CEO Larry Fink’s comments that crypto will be part of a “flight to quality” no doubt got the attention of many traditional investors as well.

Stepping back, Bitcoin markets are extremely constrained, both in terms of ownership and liquidity. Nearly 70% of BTC supply has not transacted on-chain in 1+ years, while 30% has not transacted on-chain in 5+ years, high water markets for both metrics. The portion of supply held by entities with 0.1 BTC - 1 BTC, 1 BTC - 10 BTC, and 10 BTC - 100 BTC are all at all-time highs, while the portions of supply held by larger entities has declined, suggesting that die-hard long-term retail investors have been accumulating while institutions have mostly been deleveraging or on the sidelines. Liquidity is also quite low in historical terms. The balance held on exchanges is at its lowest point since early 2018 (both due to the rise of alternative trading venues and OTC markets and ongoing siphoning into self-custody by bitcoin die-hards) and September saw on-exchange trade volumes (in BTC terms) as the lowest month since December 2016.

Bloomberg analysts Eric Balchunas and James Seyffart continue to put the odds of spot BTC ETF approval before EOY 2023 at 75% and 95% by EOY 2024. Increased accessibility driven by new market access vehicles coupled with constrained supply and low exchange liquidity could put significant upward pressure on BTC spot prices if spot ETFs are approved. -Alex Thorn

Reddit Ends Support for Blockchain-Based Rewards

Web3 friendly social media giant Reddit plans to discontinue its blockchain-based community reward system. Reddit introduced Community Points in 2020 as an additional feature to their platform, not as a replacement for their existing Karma system. Community Points are awarded to users who contribute engaging posts and popular comments within three pilot cryptocurrency-related subreddits (r/Cryptocurrency, r/FortniteBR, r/ethtrader). The rewards are essentially ERC-20 tokens stored in the user's Reddit Vault, the platform's native crypto wallet. The Community Points were initially issued on Ethereum layer 1 but transitioned to Arbitrum Nova, an Ethereum-based optimistic rollup, in 2022.

According to Reddit, the decision to phase out the Community Points initiative stems predominantly from the unclear crypto regulatory landscape in the U.S. While this particular Web3 facet will no longer exist on the platform, Reddit apparently remains committed to other Web3 integrations, including its native crypto wallet and NFT collections.

OUR TAKE:

Reddit is one of the earliest Web2 powerhouses to recognize and adopt Web3-centric features like crypto payments and rewards. In 2013, Reddit stood out as the first major social media platform to accept BTC for tipping and subscription payments. Despite Reddit's evident endorsement of Web3 technologies, their decision to discontinue the Community Points system shouldn't be mistaken as a shift from their Web3 stance. Instead, it likely reflects their conclusion that the traditional Web2 based Karma reward system remains the most effective method for distributing rewards to 430m monthly active users. While the Community Points were established on an Ethereum optimistic rollup, Arbitrum Nova, the associated costs of daily distributions ($0.05 per transaction) for such a vast user base potentially rendered the feature more burdensome than beneficial.

Reddit’s decision to lean on traditional Web2 structures for a significant feature to their platform highlights the realization that not everything needs a blockchain. While public blockchains offer benefits like decentralization and transparency, Web3 integration isn't universally suitable. On-chain social media platforms like Friend.tech prove that blockchain rewards work well with smaller user bases (Friend.tech has 130kunique users). For Reddit, with its massive 430m monthly users, crypto-based reward systems may not be practical given current architecture. Nonetheless, Reddit has been a long-time supporter of crypto and will likely continue to serve as a key retail facing onramp into parts of the Web3 realm. - Gabe Parker

Sens. Warren, Marshall Send Letter Re: Hamas & Crypto

On Tuesday, Senators Warren (D) and Marshall (R) along with over 100 other US lawmakers sent a letter to the Treasury Department and National Security Advisor urging for more action to curtail the use of crypto in terror financing. Of 105 signatories, only 2 are Republicans (Sens. Marshall & Kennedy) and the rest are Democrats. The letter cites a Wall Street Journal article saying Hamas and Palestinian Islamic Jihad (PIJ) raised over $130 million in crypto and use crypto rails to transfer money between each other. Citing the same Wall Street Journal article, the legislators argue that efforts to deal with crypto terror financing to date have been ineffective and that Hamas is “one of the most sophisticated crypto users in the terror-finance domain.”

The letter ends with a series of questions: requesting clarification on what actions the administration intends to take, how much the administration estimates Hamas and PIJ raised through crypto, and asking which challenges the administration faces in preventing this type of activity. It specifically highlights Tether and Binance’s role in facilitating crypto transfers, asking what additional resources the administration needs to execute its mandate.

On the same day, the Treasury Department announced new sanctions targeting Hamas. The sanctions specifically highlight “Hamas Virtual Currency Fundraising,” pointing to a $2000 Bitcoin transfer facilitated by an entity called “Buy Cash.” FinCEN, an agency within U.S. Treasury, also announced a notice of proposed rulemaking (NPRM) that identifies international “convertible virtual currency mixing” (CVC) as a type of transactions are a primary money laundering concern. The NPRM would require certain financial institutions to report when they think they are transacting with funds associated with a mixing service whether inside or outside the United States.

OUR TAKE:

Yes, crypto can and is used for illicit activities. No, that is not its primary use case. It constitutes less than 1% of overall activity. Moreover, it is not a use case or challenge distinct to crypto. Any system that facilitates the transfer of value can be used for this purpose.

Immediately following the letter’s release, several crypto analytics firms published articles to provide a more nuanced and informed perspective on the use of crypto in illicit, and specifically terror, financing. Chainalysis’ report is especially effective, highlighting an example where $82 million of transfers deemed to be used for terrorism financing in reality likely only accounted for $450,000 to an illicit actor. The discrepancy highlights the need for more thorough analysis of how funds are being used and by who.

The fact that firms like Chainalysis even have transparency into the movement of onchain funds is an inherent advantage of permissionless networks like Bitcoin and Ethereum. Previous episodes of Galaxy Brains with Chris Tarbell, who led the FBI investigation into the Silk Road, and Adam Zarazinksi, CEO of onchain analytics firm Inca Digital, both highlighted that, in many instances, crypto actually makes it easier, not harder, to track illegal activities. As Matt Levin wrote in his daily newsletter yesterday, “Bitcoin Is Not Great for Murder.” Transparency is a feature, not a bug, which in some cases can deter its use in terror financing, if not make it easier to identify and track. In April, a Hamas affiliate organization went so far as to stop accepting donations in crypto due to its traceability and the risk that traceability poses to its donors.

As crypto adoption grows, so too will the number of bad actors that try to use it for illicit activities. It is beholden upon industry participants, both the onchain users and off chain service providers like centralized exchanges, to institute precautionary measures that identify and prevent this activity. But the benefits that Bitcoin and other cryptocurrencies bring to the world – predictable monetary policy, self-sovereign financial services, global and permissionless access, faster and cheaper settlement, and more – should not be discarded because they can also be used illicitly. Criminals use email, too. -Lucas Tcheyan

Charts of the Week

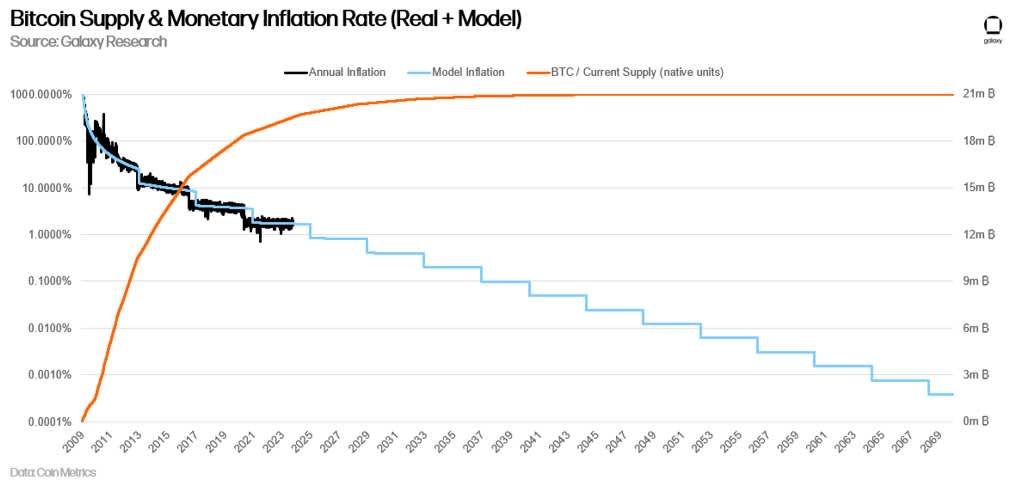

Bitcoin Issuance Rate on Track Heading to 4th Halving

Bitcoin’s fourth halving, the quadrennial event in which the rate of Bitcoin’s supply inflation cuts in half, is expected sometime around April 24, 2024. These events have historically preceded each of the asset’s major bull runs, but they also pose significant challenges for miners, for whom newly-minted issuance comprises the majority of revenue. The chart below shows the modeled supply and inflation rate against the actual inflation rate to-date.

sFRAX and Updated Token Contract

A week after Frax Finance launched Frax v3 and the sFRAX (staked FRAX) token, the protocol deployed a new sFRAX token contract. Since the updated contract was pushed on October 19, 22.5m sFRAX have been minted. Still, 21.3m sFRAX are in circulation under the old token contract.

The updated contract brings 3 key features:

Fixed punctuation of the name string from Staked Frax to Staked FRAX.

Added pricePerShare() function to the contract for easier integrations Curve pools and vault protocols (making Curve swaps cheaper than was achievable with the previous contract).

Minor gas improvements, updated to Solidity 0.8.21, and other optimizations.

89 users held the new sFRAX token 15 hours post launch. At the time of writing, there were 21 new unique addresses that minted the updated sFRAX and not the old one, suggesting ~25% of new sFRAX holders did not mint the original token.

See additional charts created by the team on the Galaxy Research Twitter/X account.

Other News

Lightning Labs launches Taproot Assets Protocol to enable tokens on Bitcoin’s Lightning Network

SEC dismisses case against Ripple executives, but judgment against Ripple Labs remains

New York Attorney General sues Gemini, Grayscale, Digital Currency Group seeking $1bn

California “BitLicense” bill signed into law by Gov. Newsom

FDIC to bolster crypto risk oversight of banks in 2024 following IG report

Hamas crypto funding “likely overstated” says Chainalysis

DC Court of Appeals finalizes ruling against for Grayscale vs. SEC

EU privacy watchdog concerned with privacy implications of digital Euro

Digital dollar may pose “significant risk” says Fed. Governor Bowman

Yuga Labs to focus on building Otherside following restructuring: CEO

Paolo Ardoino sees RGB as 'best opportunity' to issue stablecoins on Bitcoin

Scroll confirms mainnet launch following on-chain indications last week

BNB Chain launches Greenfield mainnet for decentralized data storage

Stellar launches smart contracts to take on Ethereum

dYdX won't profit from v4 as it becomes public benefit corporation

Uniswap to charge 0.15% to swap certain tokens on web interface and wallet

FTX’s former general counsel says he never approved the use of customer funds

FTX plans to return 90% of customer funds, but there’s a catch

Judge Kaplan’s ire hits all the lawyers in the case

DTCC buys Securrency as clearinghouse pushes into blockchain services

Legal Disclosure:

This document, and the information contained herein, has been provided to you by Galaxy Digital Holdings LP and its affiliates (“Galaxy Digital”) solely for informational purposes. This document may not be reproduced or redistributed in whole or in part, in any format, without the express written approval of Galaxy Digital. Neither the information, nor any opinion contained in this document, constitutes an offer to buy or sell, or a solicitation of an offer to buy or sell, any advisory services, securities, futures, options or other financial instruments or to participate in any advisory services or trading strategy. Nothing contained in this document constitutes investment, legal or tax advice or is an endorsementof any of the digital assets or companies mentioned herein. You should make your own investigations and evaluations of the information herein. Any decisions based on information contained in this document are the sole responsibility of the reader. Certain statements in this document reflect Galaxy Digital’s views, estimates, opinions or predictions (which may be based on proprietary models and assumptions, including, in particular, Galaxy Digital’s views on the current and future market for certain digital assets), and there is no guarantee that these views, estimates, opinions or predictions are currently accurate or that they will be ultimately realized. To the extent these assumptions or models are not correct or circumstances change, the actual performance may vary substantially from, and be less than, the estimates included herein. None of Galaxy Digital nor any of its affiliates, shareholders, partners, members, directors, officers, management, employees or representatives makes any representation or warranty, express or implied, as to the accuracy or completeness of any of the information or any other information (whether communicated in written or oral form) transmitted or made available to you. Each of the aforementioned parties expressly disclaims any and all liability relating to or resulting from the use of this information. Certain information contained herein (including financial information) has been obtained from published and non-published sources. Such information has not been independently verified by Galaxy Digital and, Galaxy Digital, does not assume responsibility for the accuracy of such information. Affiliates of Galaxy Digital may have owned or may own investments in some of the digital assets and protocols discussed in this document. Except where otherwise indicated, the information in this document is based on matters as they exist as of the date of preparation and not as of any future date, and will not be updated or otherwise revised to reflect information that subsequently becomes available, or circumstances existing or changes occurring after the date hereof. This document provides links to other Websites that we think might be of interest to you. Please note that when you click on one of these links, you may be moving to a provider’s website that is not associated with Galaxy Digital. These linked sites and their providers are not controlled by us, and we are not responsible for the contents or the proper operation of any linked site. The inclusion of any link does not imply our endorsement or our adoption of the statements therein. We encourage you to read the terms of use and privacy statements of these linked sites as their policies may differ from ours. The foregoing does not constitute a “research report” as defined by FINRA Rule 2241 or a “debt research report” as defined by FINRA Rule 2242 and was not prepared by Galaxy Digital Partners LLC. For all inquiries, please email [email protected]. ©Copyright Galaxy Digital Holdings LP 2023. All rights reserved.