Top Stories of the Week - 1/5

This week in the newsletter, we write about Bitcoin turning 15, Maker’s endgame plan, and a new tax provision that includes digital assets.

Subscribe here and receive Galaxy's Weekly Top Stories, and more, directly to your inbox.

Bitcoin Turns 15 Years Old

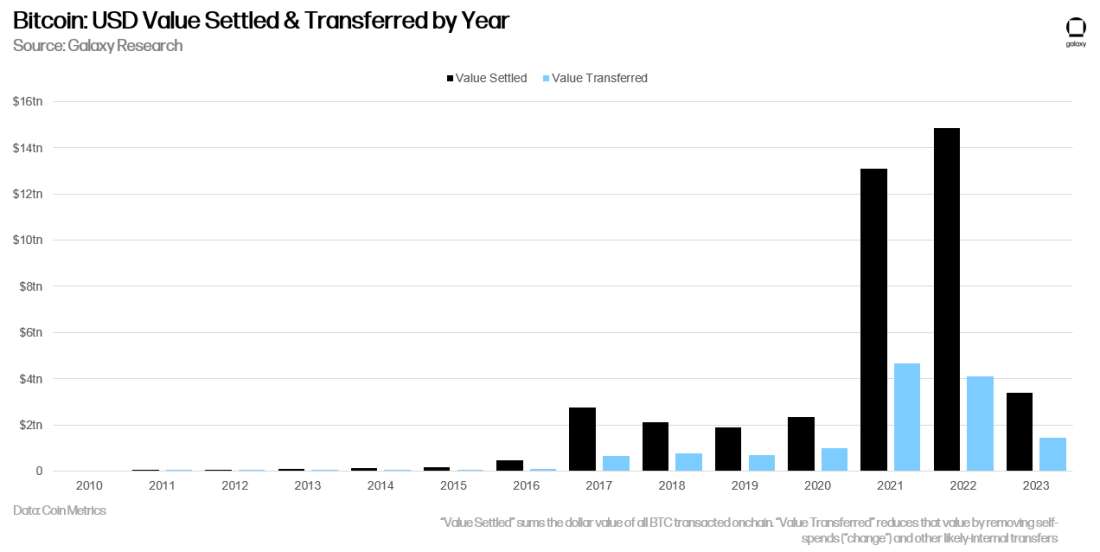

Bitcoin network turned 15 this week. Wednesday marked 15 years since the anonymous developer Satoshi Nakamoto mined the first bitcoin block (“Genesis Block”). Since January 3, 2009, more than 824k blocks have been mined containing more than 946m transactions. The bitcoin network has facilitated the settlement of more than $41.3tn in value, including approximately $13.4tn in peer-to-peer transfers, generating $3.3bn in fees for miners. As of January 3, 2024, there were 52m addresses with nonzero balances and 4.6m weekly active addresses. The Bitcoin miners who work to build the blockchain comprise the world’s largest and most powerful decentralized computer, currently performing more than five hundred sixty five quintillion hashes per second.

Some estimates suggest there are 220m worldwide bitcoin holders among the 425m cryptocurrency users worldwide, although it is impossible to know the true number. Bitcoin has been used worldwide by protestors, political oppositions, nation states, hedge funds, pension funds, and corporations to send, receive, and store value.

As usage has grown, so has the value of Bitcoin’s native currency, BTC. Since it first traded for any value in 2010, BTC has risen 6.2 billion % (!), and 965% over the last 5 years (a 63.4% 5yr CAGR). Despite almost 10 years of competitor launches, BTC still comprises more than 51% of the total cryptocurrency market, a number that is higher if you remove stablecoins or illiquid tokens.

OUR TAKE:

Bitcoin is the oldest and most widely adopt digital currency. It is free and open-source software (FOSS) developed by hundreds and operated by thousands of people around the world. Aside from one 2010 bug (prior to BTC having traded for any nominal value) which required a hard fork upgrade, Bitcoin has never operated consistently without any downtime, making it perhaps the most resilient computer network ever created. It is a technical marvel, introducing the first known solution to the infamous double spend problem in computer science and simultaneously creating the first ever decentralized, non-sovereign monetary instrument since gold.

Despite a decade and a half of growth in adoption and value, Bitcoin’s cultural and economic is set to grow even more in 2024. New technological developments are poised to extend Bitcoin’s capabilities and new market access vehicles will expand its ownership. With global markets continuing to fragment and central banks and governments showing no sign of reigning in long term spending or monetary policy, demand for a store of value not tied to any one nation state is likely to continue to grow.

The expected launch of spot-based Bitcoin ETFs will be a major milestone in Bitcoin’s story. Bitcoin started as an innovative project for computer scientists and cryptography enthusiasts and morphed over time into one of history’s best performing assets and among the only ones in which retail investors had access before institutions. An efficient ETF vehicle will finally make exposure to Bitcoin available to investors of all types.

As an open source, global, decentralized project, Bitcoin and its ecosystem is always evolving. Bitcoin today looks a lot different than Bitcoin of 5 or 10 years ago. While its userbase contains influential forces, these often rise and fall, and no one knows what the future holds. But whatever happens, we believe Bitcoin will continue to grow in adoption, value, and importance worldwide over the next 15 years. -Alex Thorn

Maker’s Endgame Plan Reignites Interest

MakerDAO experienced a resurgence in interest this week as observers prepare for the rollout of the Endgame Plan and the next evolution of Maker. Endgame will overhaul the Maker ecosystem through a five-phase plan focused on enhancing Maker’s “efficiency, resilience, and participation.”

Rune Christensen, Maker’s founder, introduced Endgame in May 2022. Since then, the plan has undergone considerable revisions as it works its way through Maker’s governance process. Endgame was formally ratified by the DAO in October 2022 and in March 2023 Maker approved a new constitution to reach consensus on how best to implement it and the principles underpinning it.

Implementation of the first phase, entitled “Beta Launch,” is expected to commence in early 2024 and focuses on rebranding Maker and updating its tokenomics. The rebranding initiative is meant to unify Maker’s brands, renaming MKR (Maker’s governance token) and DAI (Maker’s stablecoin) to NewGovToken and NewStable (final names to be confirmed on rollout). As part of this process, MKR will also be redenominated with 1 MKR equal to 24000 NewGovToken.

Following the Beta Launch, future phases include the launch of subDAOs to manage Maker governance and DAI collateralization, the creation of AI tooling that simplifies the governance process and enhances oversight, and new governance participation incentive mechanisms. Endgame’s final phase will be the deployment of Maker on its own blockchain (tentatively entitled “NewChain”) that houses all of the protocol’s logic and enhances its security. Late last year Christensen highlighted Solana and Cosmos as two promising codebases to explore for that phase. In total, Endgame is expected to take five years or longer to be fully implemented.

For a full overview of Maker’s prior governance mechanisms and more context on Endgame refer to our Governance in DeFi report.

OUR TAKE:

Maker's evolution over the next few years will push the limits of DAO governance. Endgame’s subDAO model creates a liquidity bootstrapping mechanism that incentivizes the creation of innovative governance systems, many of which will incorporate lessons from the success and failures of previous DAOs.

Execution is a huge risk. Endgame requires considerable engineering and governance coordination across a multi-year timespan in a highly volatile market. MakerDAO's governance has been highly controversial since its inception. Decisions have alienated key contributors, raised questions about DAI's neutrality, or simply been abandoned due to poor management. Following the ratification of Maker’s constitution last year, Maker lost nearly half of its core protocol engineering team for various reasons, including opposition to Endgame.

But this challenging environment has also created a cohort of DAO operators that understand the nuances of executing across the technical, political, economic/financial, and social/cultural aspects of DAO governance that a complex plan like Endgame requires. In the past two years alone, Maker has demonstrated its resilience, moving quickly to deal with OFAC censorship/centralization concerns in the wake of the Tornado Cash court rulings and taking advantage of high interest rates to make the protocol’s business model more sustainable.

If successfully implemented, Endgame’s subDAO model should provide a platform for these individuals to launch their own projects, strengthening Maker when successful while introducing limited additional risk when not. A sign of initial interest, the first subDAO Spark protocol has attracted nearly $2 billion in TVL since its launch thanks to its focus on tokenizing U.S. treasuries.

2022-2023 were the early innings of Endgame. 2024 is when the rubber really hits the road. -Lucas Tcheyan

New Tax Provision Including Digital Assets Takes Effect

A new law amending section 6050I of the IRS Code of 1986, as amended (the “Code”), became effective on January 1. The amendment added in the definition of cash “any digital asset (as defined in section 6045(g)(3)(D) [of the Code]).” As a result, Code section 6050I(a) now requires any person who is engaged in a trade or business and who receives $10,000 or more in digital assets “in the course of” their trade or business to report the transaction on Form 8300 to the IRS (if filing by paper) or to FinCEN (if filing electronically). The amendment was included in the trillion-dollar Infrastructure Investment and Jobs Act, which passed into law in November 2021 (“IIJA”). As a self-executing law, auxiliary regulatory action is not required for it to be enforced. It is arguably enforceable through existing agencies and in effect now that it has been signed into law and the effective date has passed.

There are many question marks around who the amendment applies to and how digital asset users are expected to comply. For instance, what constitutes a “trade or business”? Under Code section 6050I, “trade or business” would have the same meaning as under Code section 162, which permits a deduction for ordinary and necessary expenses paid or incurred in any trade or business. The term “trade or business”, however, is not defined in Code section 162 or other Code sections. Rather, taxpayers must rely on case law and IRS rulings to determine whether they are engaged in a “trade or business”. Factors include whether the activity is intended to make a profit or produce income, whether a taxpayer holds himself/herself to the public as being engaged in the selling of goods and/or services. Based on such guidance, Code section 6050I doesn’t appear to apply to simple individual crypto investors. But when does investing in digital assets rise to the level of a trade or business? Also, Form 8300, Report of Cash Payments Over $10,000 Received in a Trade or Business, was revised in December 2023, but was not revised to enable taxpayers to report digital asset transactions. For instance, Part III of the form doesn’t provide a separate category for “Digital asset”. What box should a taxpayer complete then?

OUR TAKE:

While the amendment doesn’t prohibit the use of digital assets, it does incentivize their use through intermediaries and institutions over peer-to-peer (P2P) activity. Such parties appear to have reporting and disclosure obligations, but without clarity and guidance (e.g., IRS Announcement, Treasury Regulations) such parties will have difficulty complying, and in some cases, such reporting may be unnecessary or potentially unconstitutional. Disincentivizing P2P use of digital assets infringes on the benefits and efficiencies of digital assets that make them unique and innovative; namely their ability to offer individuals outright ownership of their property and their ability to be sent anywhere in the world to any individual at any time.

Secondly, the nature of transactions on distributed ledgers and the applications built on top of them makes the amended filing requirement incredibly difficult, if not impossible, to comply with, particularly given the newly enacted Form 1099-DA filing requirement which certain digital asset intermediaries and brokers will need to begin filing on January 1, 2026. Similar questions that apply for Form 1099-DA reporting apply for Form 8300 reporting. For example, if a dex liquidity provider (LP) receives a $10,000 reward, how do they get the information from the possibly tens of thousands of global users paying fees through the dex and the dex itself? Or, what if a user is staking their assets on a network and receives $10,000 in rewards? Do they have to include information on the validator they’re delegated to? What if they’re running their own validators and get paid out direct block rewards and fees from the possibly hundreds of thousands or more users and the network itself, which is just software maintained by computers all over the world? How are details on all of the aforementioned parties (who have no other obligations to provide the information necessary to comply) supposed to be collected by individuals receiving $10,000 transactions? These examples highlight how the amendment applies to some of the most straight forward and widely adopted use cases of digital assets and distributed ledgers. It becomes apparent that complying with the law is strenuous and physically impossible in some cases.

Lastly, it shows lawmakers view crypto to be identical to physical cash. There are obviously many nuances around how digital assets work and what they are used for that are not present with paper money. Yes, digital assets can be used for the same purposes as paper cash in some cases. However, digital assets apply to more use cases and are sent and received differently than paper money is. The blanket application of the amendment adding digital assets to the filing requirement highlights lawmakers aren’t taking the time to pass rules that bring crypto into the regulatory and legal framework of the United States in a way that compensates for and promotes their innovation and benefits to users.

In short, although Code section 6050I technically applies to digital asset transactions as of January 1, 2024, the IRS and/or Treasury should issue transitional guidance just as it did under Announcement 2023-2 and proposed regulations for broker reporting of digital asset transactions under Code section 6045. -Zack Pokorny

Charts of the Week

Bitcoin facilitated $3.4tn in settled value and $1.4tn in peer-to-peer transfers in 2023, the third largest year for both metrics in Bitcoin’s history.

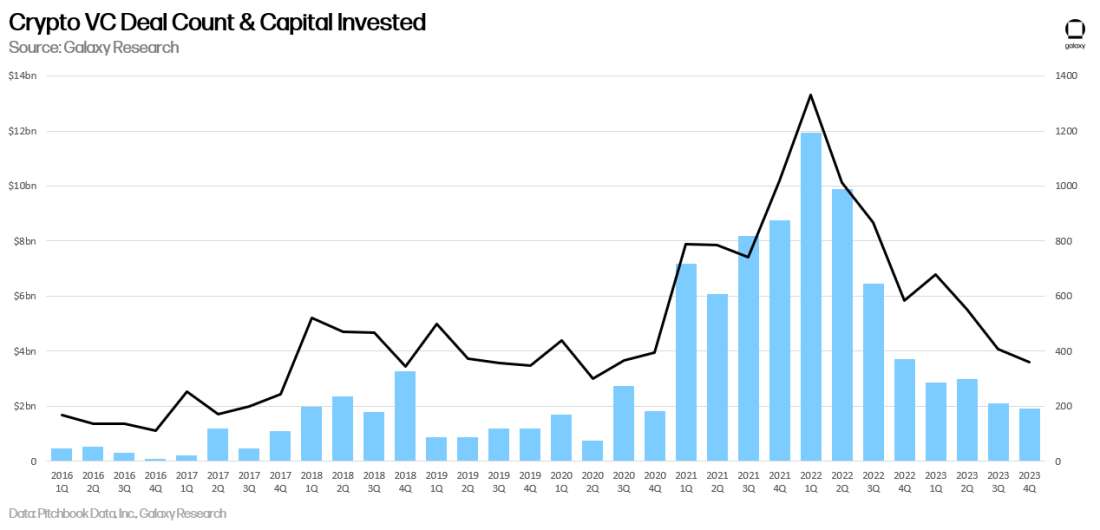

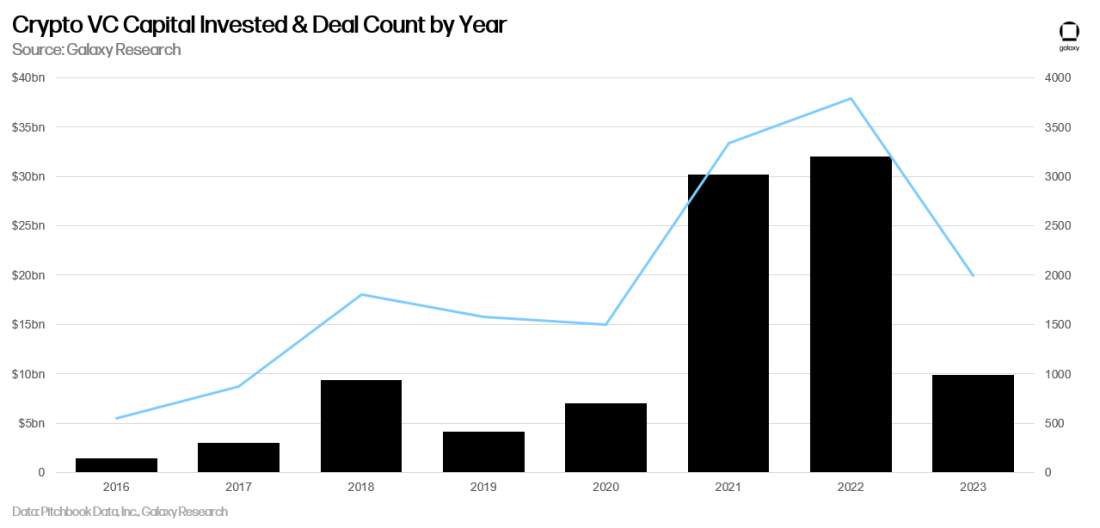

In crypto VC, Q4 2023 saw 359 deals reported, the lowest since 2Q 2020 and $1.928bn invested, the lowest since Q4 2020.

2023 finishes the year with the third highest total investment in crypto history at just under $10bn.

Other News

Jim Cramer capitulates on Bitcoin saying it’s a “technological marvel” that’s “here to stay”

Matrixport research note says SEC will reject ETF applications, Thorn disagrees

Visa announces web3 loyalty rewards program

Coinbase requires UK users to complete risk-acknowledgment form per new regulations

Etherscan acquires leading Solana blockchain explorer Solscan

Legal Disclosure:

This document, and the information contained herein, has been provided to you by Galaxy Digital Holdings LP and its affiliates (“Galaxy Digital”) solely for informational purposes. This document may not be reproduced or redistributed in whole or in part, in any format, without the express written approval of Galaxy Digital. Neither the information, nor any opinion contained in this document, constitutes an offer to buy or sell, or a solicitation of an offer to buy or sell, any advisory services, securities, futures, options or other financial instruments or to participate in any advisory services or trading strategy. Nothing contained in this document constitutes investment, legal or tax advice or is an endorsementof any of the digital assets or companies mentioned herein. You should make your own investigations and evaluations of the information herein. Any decisions based on information contained in this document are the sole responsibility of the reader. Certain statements in this document reflect Galaxy Digital’s views, estimates, opinions or predictions (which may be based on proprietary models and assumptions, including, in particular, Galaxy Digital’s views on the current and future market for certain digital assets), and there is no guarantee that these views, estimates, opinions or predictions are currently accurate or that they will be ultimately realized. To the extent these assumptions or models are not correct or circumstances change, the actual performance may vary substantially from, and be less than, the estimates included herein. None of Galaxy Digital nor any of its affiliates, shareholders, partners, members, directors, officers, management, employees or representatives makes any representation or warranty, express or implied, as to the accuracy or completeness of any of the information or any other information (whether communicated in written or oral form) transmitted or made available to you. Each of the aforementioned parties expressly disclaims any and all liability relating to or resulting from the use of this information. Certain information contained herein (including financial information) has been obtained from published and non-published sources. Such information has not been independently verified by Galaxy Digital and, Galaxy Digital, does not assume responsibility for the accuracy of such information. Affiliates of Galaxy Digital may have owned or may own investments in some of the digital assets and protocols discussed in this document. Except where otherwise indicated, the information in this document is based on matters as they exist as of the date of preparation and not as of any future date, and will not be updated or otherwise revised to reflect information that subsequently becomes available, or circumstances existing or changes occurring after the date hereof. This document provides links to other Websites that we think might be of interest to you. Please note that when you click on one of these links, you may be moving to a provider’s website that is not associated with Galaxy Digital. These linked sites and their providers are not controlled by us, and we are not responsible for the contents or the proper operation of any linked site. The inclusion of any link does not imply our endorsement or our adoption of the statements therein. We encourage you to read the terms of use and privacy statements of these linked sites as their policies may differ from ours. The foregoing does not constitute a “research report” as defined by FINRA Rule 2241 or a “debt research report” as defined by FINRA Rule 2242 and was not prepared by Galaxy Digital Partners LLC. For all inquiries, please email [email protected]. ©Copyright Galaxy Digital Holdings LP 2023. All rights reserved.