Solana Leads NFT Market Recovery, Ethereum NFT Market Poised to Follow in 2024

Key Takeaways

NFT trading activity on Solana is recovering 2.5x faster than on Ethereum.

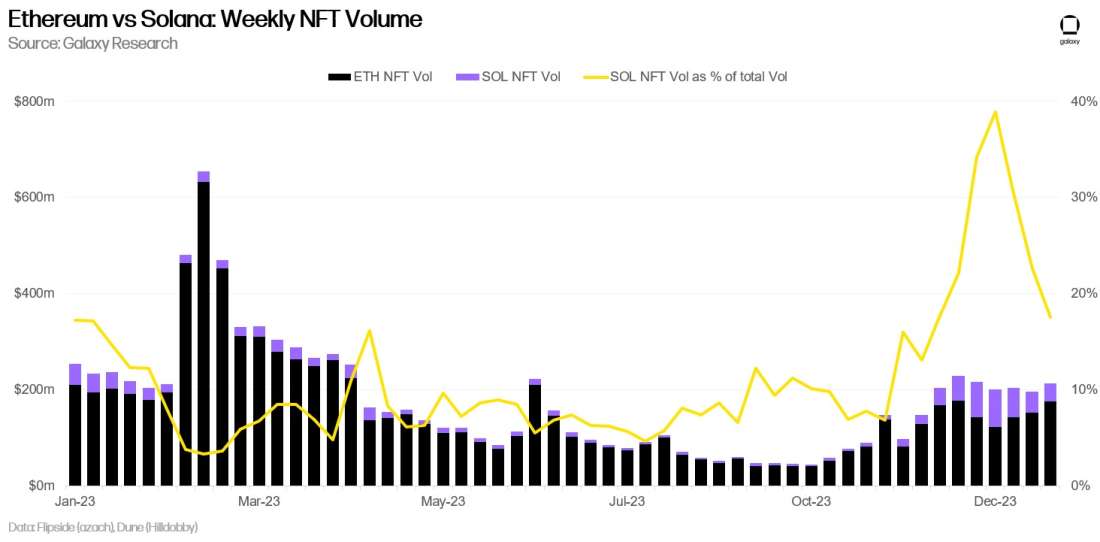

In 2023, Ethereum facilitated over 90% of total weekly NFT trading volume for 67% of the year.

As of January 8, 2024, weekly NFT trading volume on Solana represents 18% of total NFT trading volume (excluding Ordinals).

In 2023, the number of active Ethereum NFT users declined 73%, while Solana’s active NFT user count increased over 80%. NFT users are identified as unique addresses that have minted, purchased, sold, or transferred an NFT in a single day.

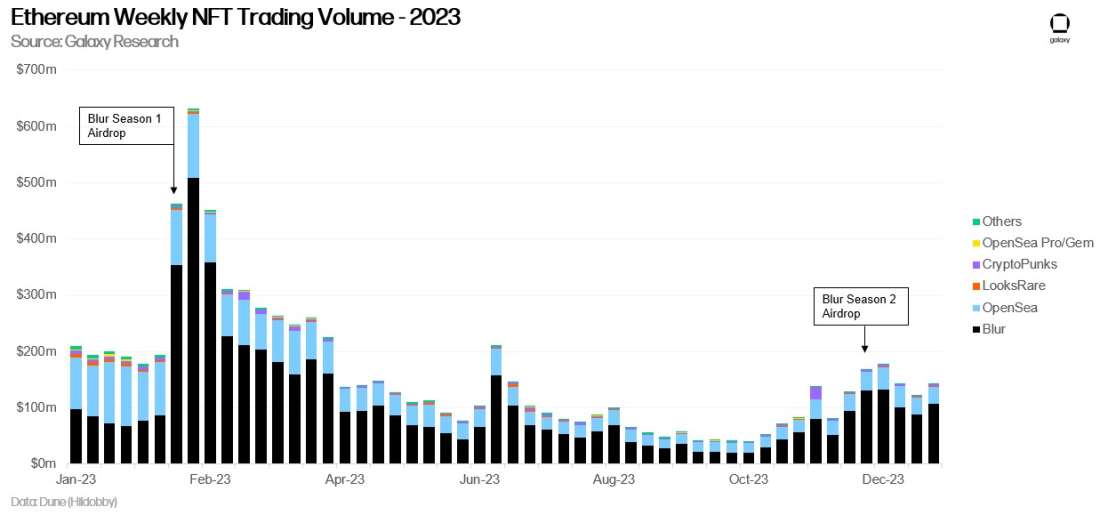

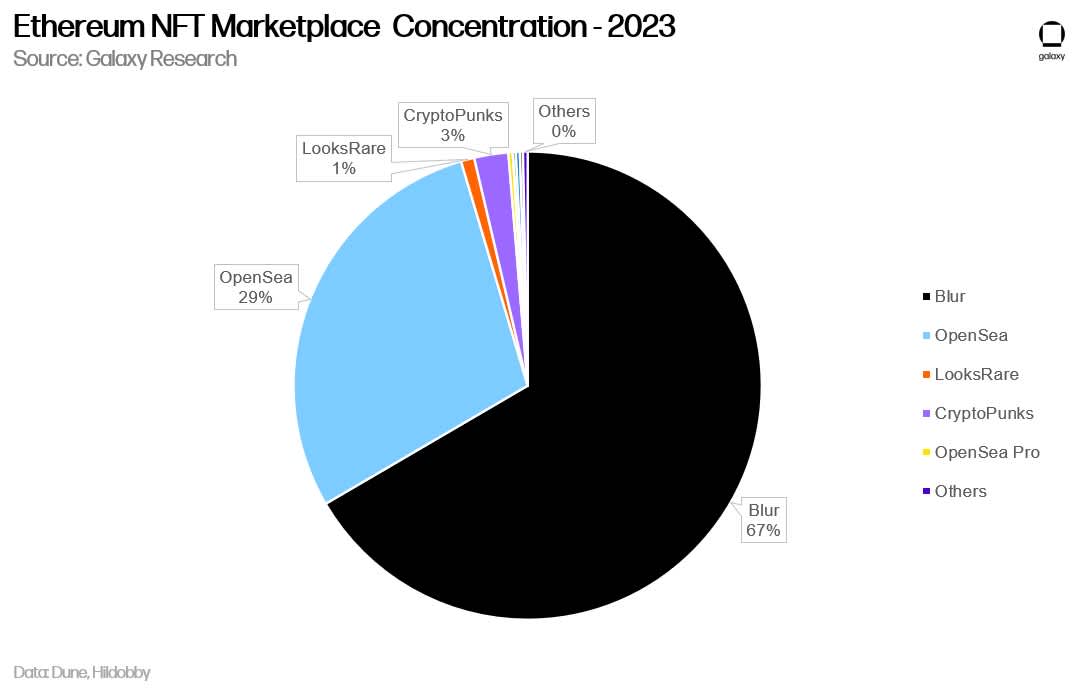

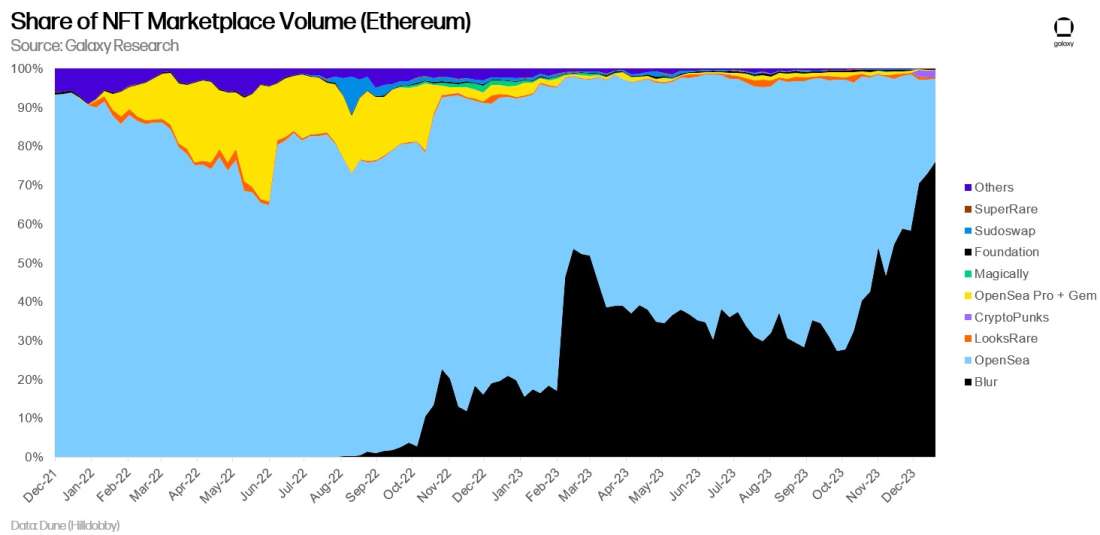

There was a notable shift in NFT marketplace concentration in 2023 with the increasing popularity of Blur, an advanced NFT trading platform. Unlike incumbents such as OpenSea, Blur heavily relied on incentive programs such as token airdrops to attract users.

In 2023, Blur dominated 67% of total NFT trading volume on Ethereum. OpenSea, which previously dominated 80%+ of NFT volume before Blur’s launch, represented only 29% of total Ethereum NFT volume over the same year.

Introduction

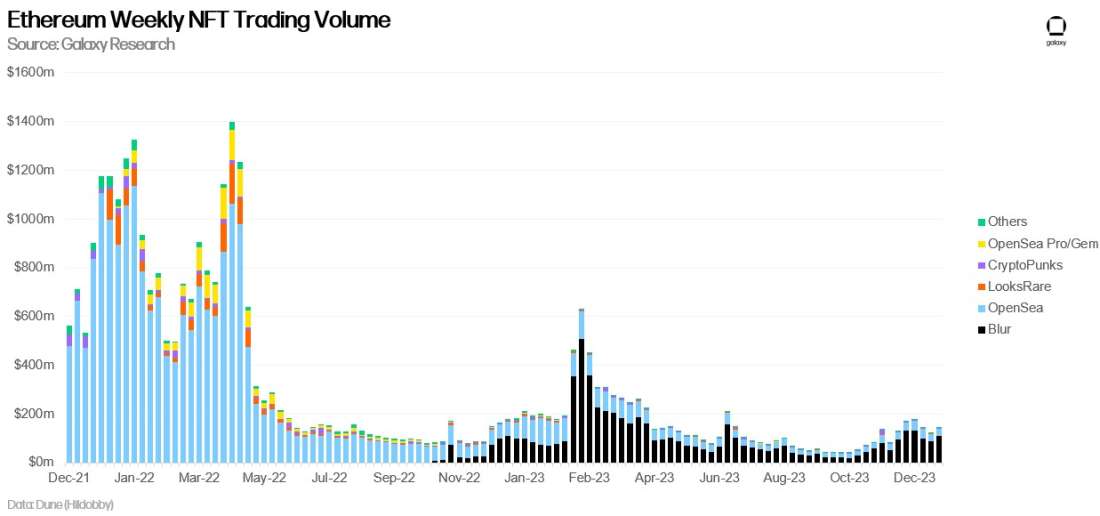

In Q4 2023, NFT markets saw a meaningful recovery. As of January 16, 2024, Ethereum NFT volumes are up over 3x while Solana NFT volumes are up 8x since their respective lows in 2023. As NFT volumes recover from all-time lows, floor prices for the top NFT projects on Ethereum and Solana are also increasing. This research note will highlight the resurgence of the NFTs in both the Solana and Ethereum ecosystems and offer insights for their growth in 2024. This note will also analyze the characteristics of incentive driven NFT marketplaces like Blur and Tensor that have been consolidating significant market share from incumbent NFT marketplaces like OpenSea.

Ethereum NFT Market

Ethereum NFT trading volumes bottomed out in September 2023, hitting a monthly low of $143m. The week from October 9 to October 16, 2023, was particularly challenging, with Ethereum NFT volumes plummeting to a mere $40 million. However, a remarkable turnaround occurred after October 9, 2023, witnessing a staggering 380% surge in weekly Ethereum NFT trading volume by November 27, 2023. This sharp uptick can be primarily attributed to Blur's Season 2 airdrop that occurred on November 20, 2023. Blur incentivizes bidding, listing, and lending NFTs on its platform with $BLUR tokens. It's worth noting that NFT traders actively engage in trading weeks before such airdrops, as evidenced by a similar trend during Blur's Season 1 airdrop on February 14, 2023. Additionally, the aftermath of the airdrop induces a wealth effect, prompting NFT traders to reinvest airdropped funds into NFTs to sustain their point-farming endeavors.

Despite Ethereum’s weekly NFT volume increasing over 300% from 2023 lows, weekly volumes are still down 89% from all-time highs last seen in March 2022. Ethereum’s NFT market still has a long road to recovery ahead. Heading into 2024, the next cycle for Ethereum’s NFT ecosystem will likely be driven by advanced NFT trading platforms like Blur and Blast incentivizing trading activity with airdrops.

OpenSea launched its pro trading platform in April 2023 to compete with Blur; however, OpenSea Pro has accounted for only 9% of Ethereum NFT trading volumes since September 2023. Blur’s dominance in the pro NFT trading narrative persists, primarily due to its first-mover advantage and UX/UI design. For instance, Blur's utilization of an order book system empowers NFT traders to assess the floor price depth for a project better than any other marketplace. This, coupled with Blur's native NFT lending platform, Blend, provides NFT traders with the tools to construct sophisticated trading strategies.

Looking ahead to 2024, Blur's position is fortified by its upcoming Season 3 airdrop scheduled for May 2024. This event is expected to further incentivize NFT traders who have previously used Blur, as 50% of the next airdrop will be distributed to existing $BLUR token holders. The strategic advantages of Blur are not only confined to its first-mover status but extend to the comprehensive ecosystem it has developed.

Blur's proactive approach to tokenomics is evident in its recent governance proposal. This proposal advocates for the community to activate a fee switch, introducing a 1% marketplace fee on purchases with the generated funds proposed to be used to buy back and burn $BLUR tokens, thereby reducing $BLUR supply. While this governance proposal is currently pending, it evidences Blur's continued focus on refining the platforms tokenomics to position itself as a significant player in the evolving landscape of NFT marketplaces.

While the recent surge in NFT volume is attributed to crypto native users re-engaging on NFT marketplaces like Blur, a substantial number of NFT traders remain on the sidelines. Notably, OpenSea's weekly trader count has witnessed an 86% decline from its all-time highs in January 2022, indicating there is a large cohort of retail users that have not yet reentered the market. Despite Blur reigning as the crypto community's favored NFT marketplace, it predominantly caters to a more sophisticated and affluent subset of NFT traders. In this context, monitoring OpenSea's volume share becomes crucial to gauge the resurgence of retail interest in NFTs.

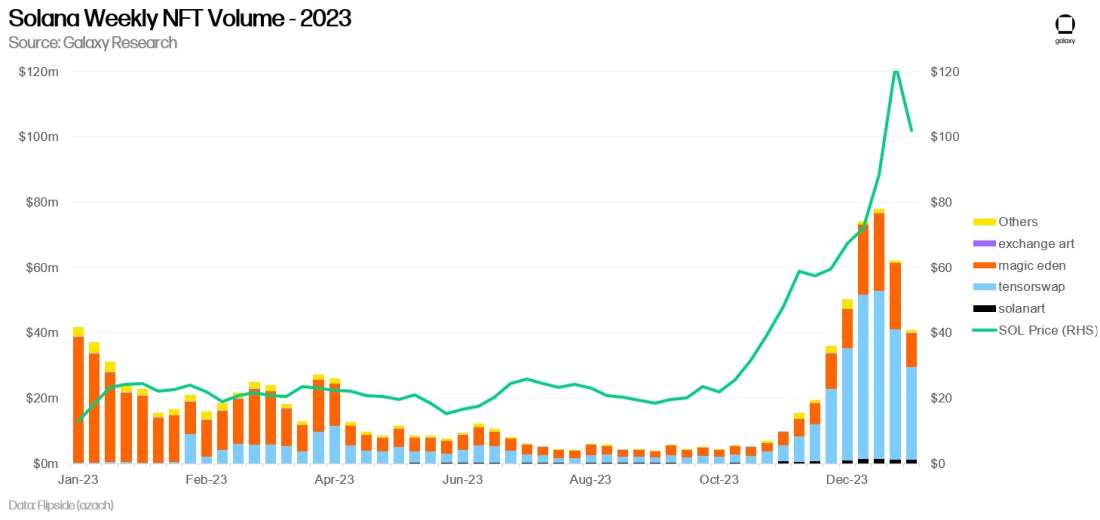

Solana NFT Market

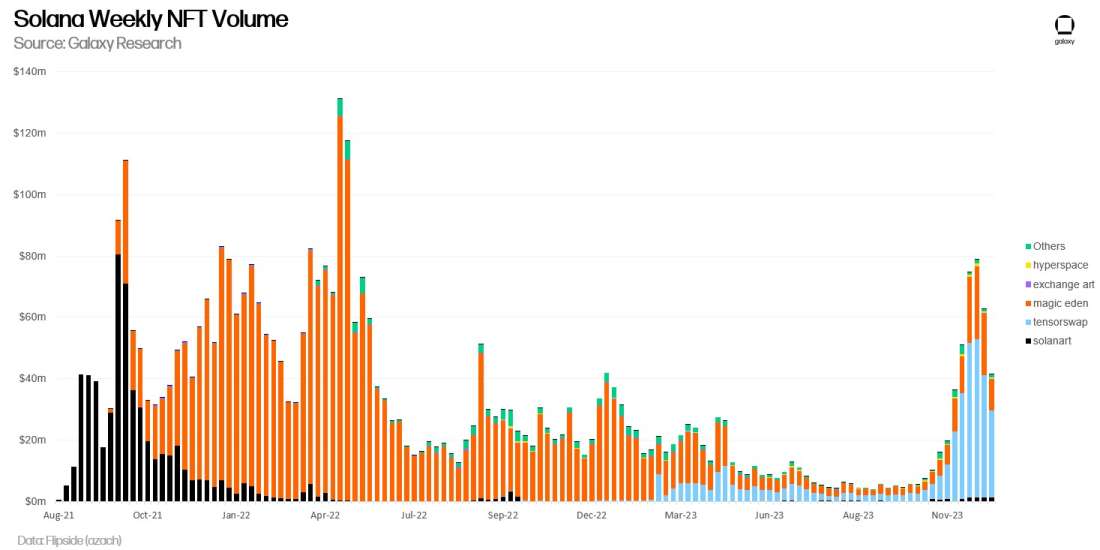

Solana’s NFT trading volume also bottomed out in September 2023, generating $30m in volume for the month. From October 2 to October 9, 2023, Solana NFT volumes recorded their worst week only generating $4.4m in volume. Since October 9, 2023, Solana’s weekly NFT trading volume has increased over 8x. This significant increase in weekly trading volume for Solana NFTs is largely attributed to two main factors:

The announcement of an upcoming airdrop on Solana’s advanced NFT trading platform, Tensor.

Major repricing and additional attention to all Solana NFTs due to a significant increase in SOL tokens.

Tensor is Solana’s version of Blur that launched in 2022, where NFT traders can craft sophisticated trading strategies. Tensor’s season 2 airdrop ended in August 2023, and their next airdrop is expected sometime in January 2024, therefore, Solana NFT collectors are increasing trading activity to farm points. A more critical influence propelling Solana’s NFT ecosystem is the wealth effect Solana holders are experiencing. With SOL rising 615% throughout 2023 along with generous airdrops from other Solana applications being distributed to the community, Solana activity has increased across a range of application types, including NFTs.

Although Solana’s NFT ecosystem is recovering faster than Ethereum’s, weekly Solana NFT trading volume is still down over 60% from all-time highs witnessed in May 2022. Like Ethereum, Solana has a robust NFT ecosystem offering a cost-effective, user friendly experience for trading NFTs. Additionally, Solana’s NFT infrastructure is rapidly maturing, as wallets and other NFT applications onboard features such as displaying NFTs alongside fungible token holdings to better support the growth of the digital collectibles ecosystem. Overall, Solana’s next NFT market cycle, like Ethereum’s, will likely be driven by trading activity on advanced trading platforms such as Tensor.

Marketplace Concentration

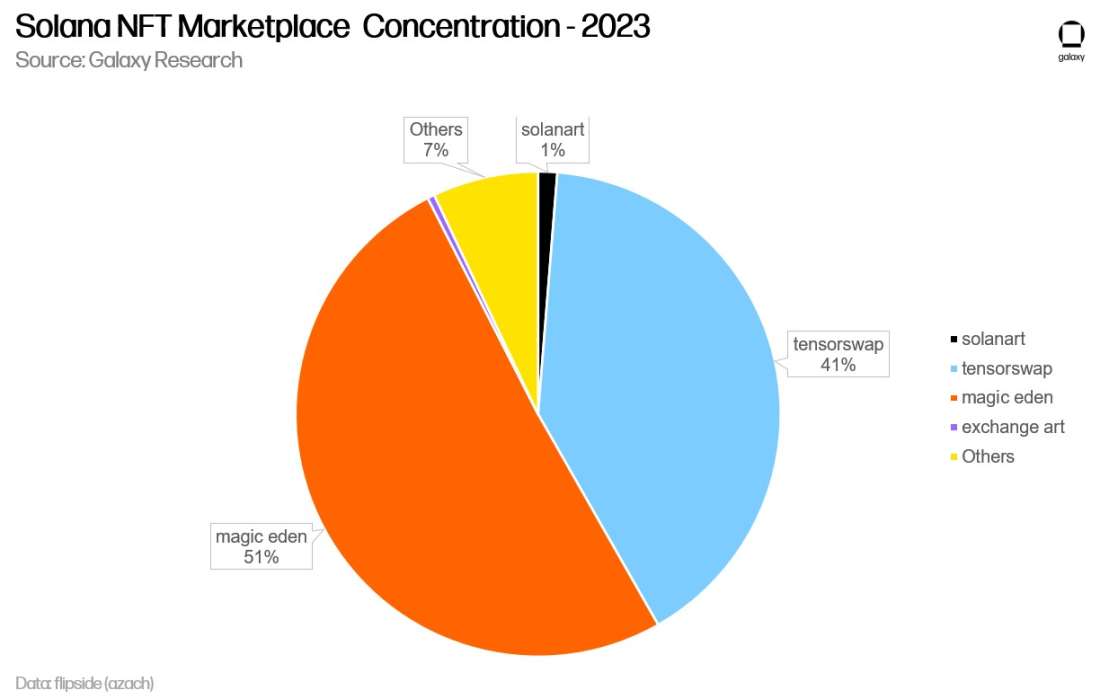

Advanced trading platforms like Blur and Tensor have quickly grown to dominate a significant portion NFT trading volume on their respective chains. NFT marketplace concentration is a mutually beneficial outcome for active NFT traders that rely on ample liquidity to enter and exit extremely volatile assets. Blur and Tensor incentivize users to commit liquidity to their marketplace through awarding airdrops for placing bids, which sellers can view to gauge the market depth for a given NFT. Prior to Blur and Tensor, legacy NFT marketplaces like OpenSea used an offer system with no incentives. The lack of incentives for buyers to submit competitive offers resulted in scattered offers that were significantly lower than the NFTs asking price.

In 2023, Blur captured 67% of total NFT trading volume on Ethereum. OpenSea, which previously dominated 80%+ of NFT volume before Blur’s launch, represented only 29% of total Ethereum NFT volume.

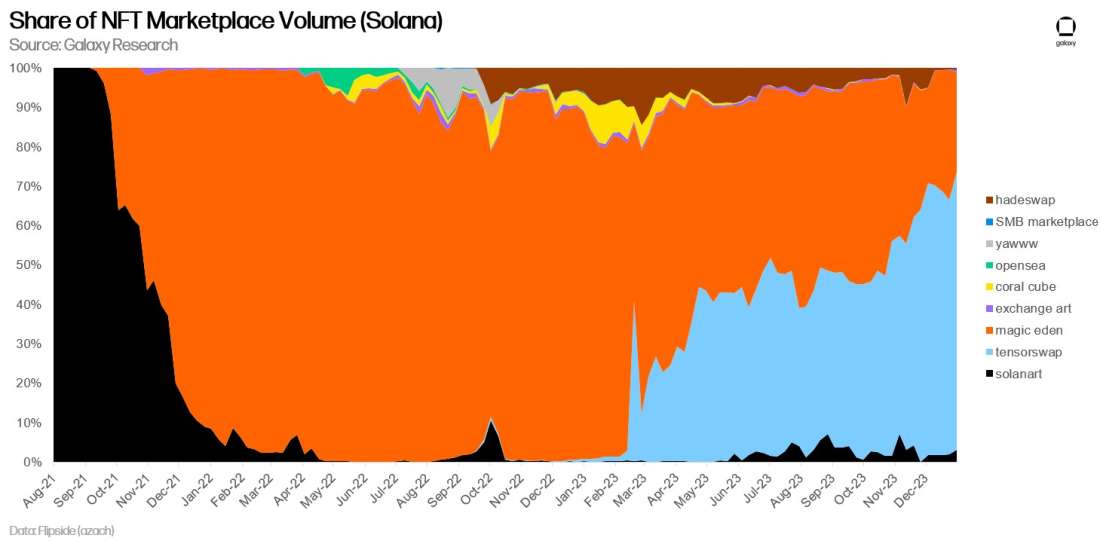

In 2023, Magic Eden dominated the Solana NFT trading landscape, commanding an impressive 51% of the total trading volume. However, securing the second position is Tensor, with a 41% share of Solana's NFT trading volume over the same year.

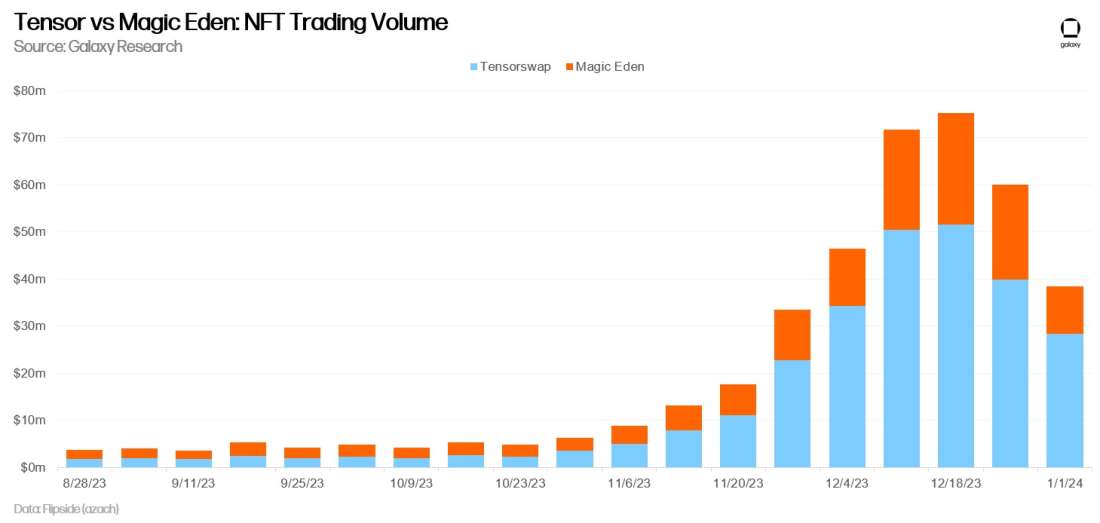

Despite Magic Eden's lead over Tensor in 2023, there have been days this year when trading volumes on Tensor exceeded Magic Eden, especially during the NFT market recovery in October 2023. From October, 1, 2023, to January 1, 2024, Tensor significantly surged ahead, generating 50% more trading volume than Magic Eden.

Tensor is poised to overtake Magic Eden in NFT marketplace market share in 2024, as the advanced trading platform gears up for its season 3 airdrop and other incentive-driven programs to attract liquidity.

Blur and Tensor’s impact on NFT marketplace concentration signals that advanced trading platforms are finding a clear product market fit. Although Blur and Tensor are platforms that were launched in a bear market, these platforms managed to extract market share from notable legacy marketplaces like OpenSea and Magic Eden.

Ethereum vs Solana: Weekly NFT Volume & Active Users

Ethereum dominated the NFT sector throughout 2023, representing over 90% of total weekly NFT trading volume for 60% of the year. This metric excludes volumes for Ordinals and BRC-20s on Bitcoin. Notably, Ordinals and BRC-20s generated $1.8bn in volume in 2023, making Bitcoin the second most popular network for digital collectables during this time frame. This report only focuses on Solana and Ethereum’s NFT market, to learn more about Ordinals read this Galaxy Research report.

Solana NFTs faced stiff competition for market dominance against Ethereum NFTs between May 2023 and September 2023. Throughout this period, the trading volume of Solana NFTs accounted for less than 10% of the overall NFT trading volume, combining both Ethereum and Solana NFT volumes. However, Solana NFTs finally hit their stride in November 2023 and rapidly gained NFT volume market share thereafter. In December 2023, weekly Solana NFT trading volume represented at least 22% to 39% of total NFT trading volume.

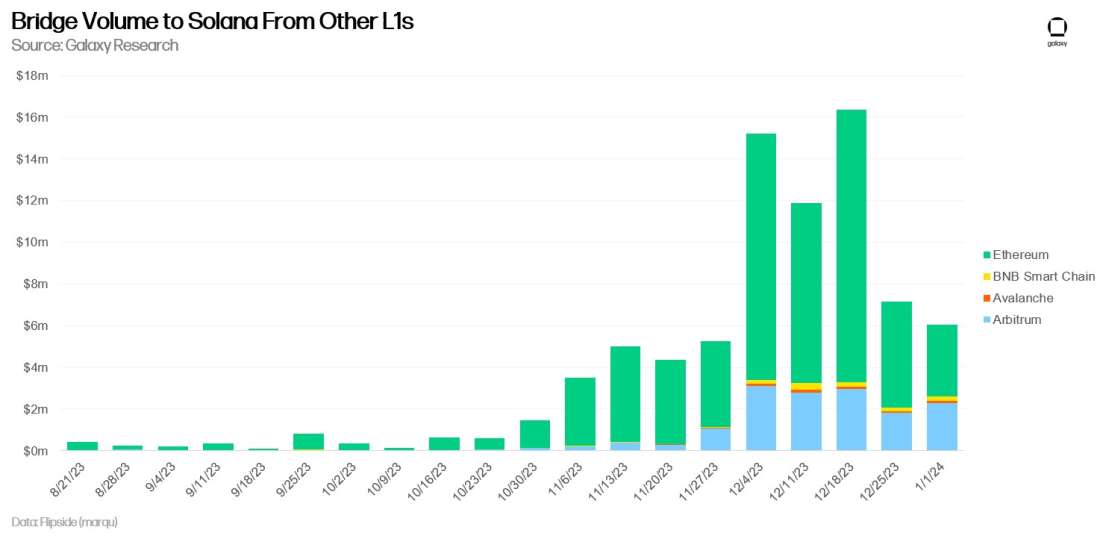

Solana NFT trading volume will continue to compete with Ethereum’s NFT volume in 2024. Since December 1, 2023, over $50.5m has been bridged into Solana from other blockchains including Avalanche, BNB Smart Chain, Arbitrum, and Ethereum. Although new capital flowing into Solana is likely motivated by the airdrops and yields offered by Solana decentralized finance (DeFi) applications that can exit as quickly as it entered the ecosystem if incentives shift, we can expect some portion of the new capital to flow into Solana NFTs. Depending on how rapidly Ethereum NFTs recover, Solana NFT trading volume could reach 30%-50% of total NFT trading volume in 2024 based on the amount of new capital flowing into Solana as of December 2023.

The lack of new users in Ethereum’s NFT market is evident when observing on-chain activity for wallets that have purchased, sold, or minted an NFT on a single day. In 2023, the number of active Ethereum NFT users is down 73% while Solana’s active NFT user count increased over 200% during the same time period. Solana’s active NFT user count spiked on December 19, 2023, propelling it past Ethereum’s active NFT user count. Applying a 30-day moving average to the number of active NFT users on Ethereum and Solana, we can see that Solana now has more daily active NFT users than Ethereum.

As a caveat to the data featured in the chart above, active NFT users are identified as unique addresses that have minted, purchased, sold, or transferred an NFT in a single day. Unique addresses may be owned by a single individual or entity and may be larger in number on Solana due to cheaper costs of transacting on the network than on Ethereum.

Conclusion

The forthcoming NFT cycle is poised to be driven by advanced NFT trading platforms, novel airdrop incentives for NFT holders, and wealth effects stemming from the broader crypto market recovery. Advanced NFT trading platforms have solidified their position in the market and their market dominance will continue to range from 50%-60% as liquidity will consolidate to these types of platforms. Overall, as Solana’s NFT ecosystem experiences their first re-pricing moment, one of the most interesting developments to look out for in 2024 will be the re-pricing of Ethereum NFTs if ETH price also significantly appreciates.

Legal Disclosure:

This document, and the information contained herein, has been provided to you by Galaxy Digital Holdings LP and its affiliates (“Galaxy Digital”) solely for informational purposes. This document may not be reproduced or redistributed in whole or in part, in any format, without the express written approval of Galaxy Digital. Neither the information, nor any opinion contained in this document, constitutes an offer to buy or sell, or a solicitation of an offer to buy or sell, any advisory services, securities, futures, options or other financial instruments or to participate in any advisory services or trading strategy. Nothing contained in this document constitutes investment, legal or tax advice or is an endorsementof any of the digital assets or companies mentioned herein. You should make your own investigations and evaluations of the information herein. Any decisions based on information contained in this document are the sole responsibility of the reader. Certain statements in this document reflect Galaxy Digital’s views, estimates, opinions or predictions (which may be based on proprietary models and assumptions, including, in particular, Galaxy Digital’s views on the current and future market for certain digital assets), and there is no guarantee that these views, estimates, opinions or predictions are currently accurate or that they will be ultimately realized. To the extent these assumptions or models are not correct or circumstances change, the actual performance may vary substantially from, and be less than, the estimates included herein. None of Galaxy Digital nor any of its affiliates, shareholders, partners, members, directors, officers, management, employees or representatives makes any representation or warranty, express or implied, as to the accuracy or completeness of any of the information or any other information (whether communicated in written or oral form) transmitted or made available to you. Each of the aforementioned parties expressly disclaims any and all liability relating to or resulting from the use of this information. Certain information contained herein (including financial information) has been obtained from published and non-published sources. Such information has not been independently verified by Galaxy Digital and, Galaxy Digital, does not assume responsibility for the accuracy of such information. Affiliates of Galaxy Digital may have owned or may own investments in some of the digital assets and protocols discussed in this document. Except where otherwise indicated, the information in this document is based on matters as they exist as of the date of preparation and not as of any future date, and will not be updated or otherwise revised to reflect information that subsequently becomes available, or circumstances existing or changes occurring after the date hereof. This document provides links to other Websites that we think might be of interest to you. Please note that when you click on one of these links, you may be moving to a provider’s website that is not associated with Galaxy Digital. These linked sites and their providers are not controlled by us, and we are not responsible for the contents or the proper operation of any linked site. The inclusion of any link does not imply our endorsement or our adoption of the statements therein. We encourage you to read the terms of use and privacy statements of these linked sites as their policies may differ from ours. The foregoing does not constitute a “research report” as defined by FINRA Rule 2241 or a “debt research report” as defined by FINRA Rule 2242 and was not prepared by Galaxy Digital Partners LLC. For all inquiries, please email [email protected]. ©Copyright Galaxy Digital Holdings LP 2023. All rights reserved.