This report is the second in our series covering Inscriptions and Ordinals on Bitcoin. Read our original March 2023 report for information on ecosystem, predictions on total addressable market, and the history and developments that led to the creation of this ecosystem.

Key Takeaways

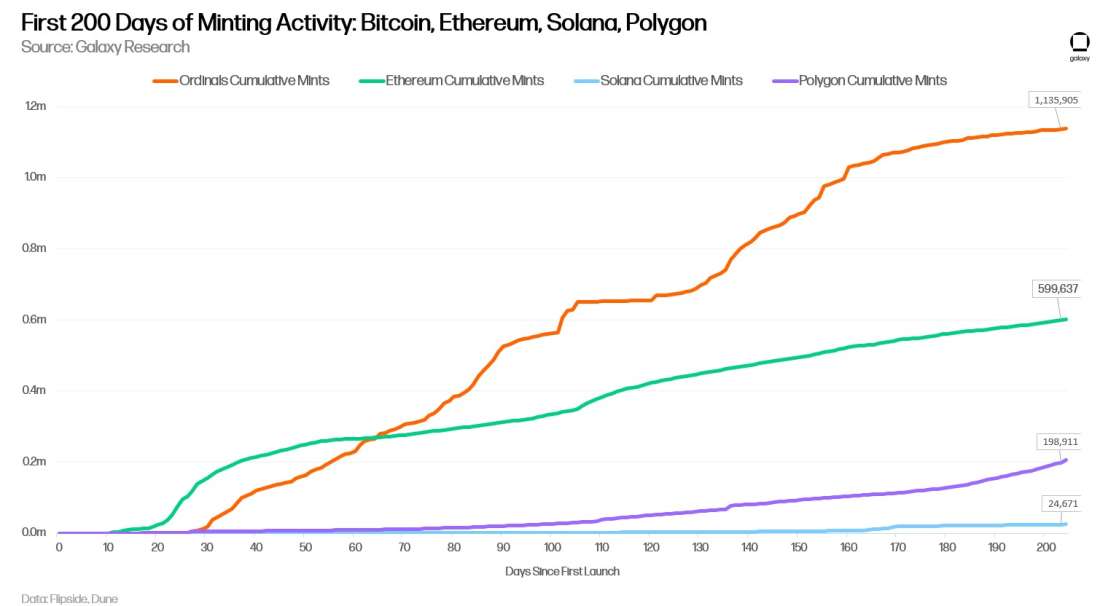

In the first 200 days since the first inscription on Bitcoin, a total of 1.14mn image-based inscriptions have been created. This surpasses the total number of NFTs minted on Ethereum, Solana, and Polygon in the first 200 days since the first NFT was minted on these respective networks.

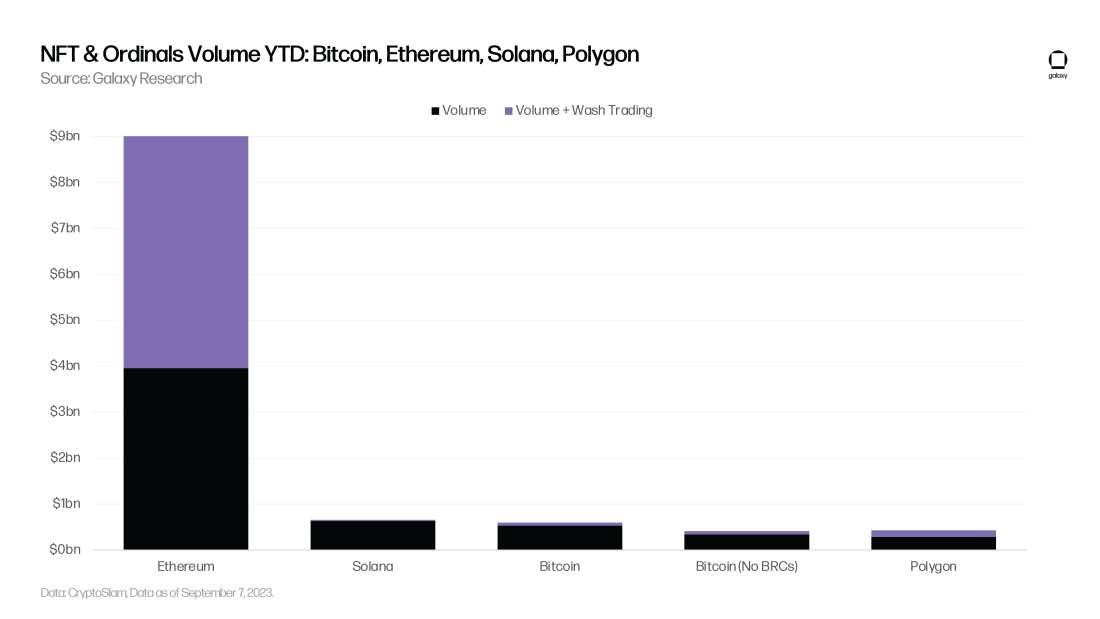

From January 1 to September 1, the total cumulative trading volume for Ordinals on Bitcoin was $596.4mn, making Bitcoin the third most popular network for NFTs by trading volume next to Ethereum and Solana.

Ordinals activity has led to the longest period of uncleared pending transactions for Bitcoin since 2021.

Even when excluding BRC-20's from Bitcoin’s total Ordinal volume, Bitcoin remains as the third most popular chain for digital collectable activity. The cumulative trade volume for the top 50 BRC-20 tokens represented only 30% of all Ordinals volume.

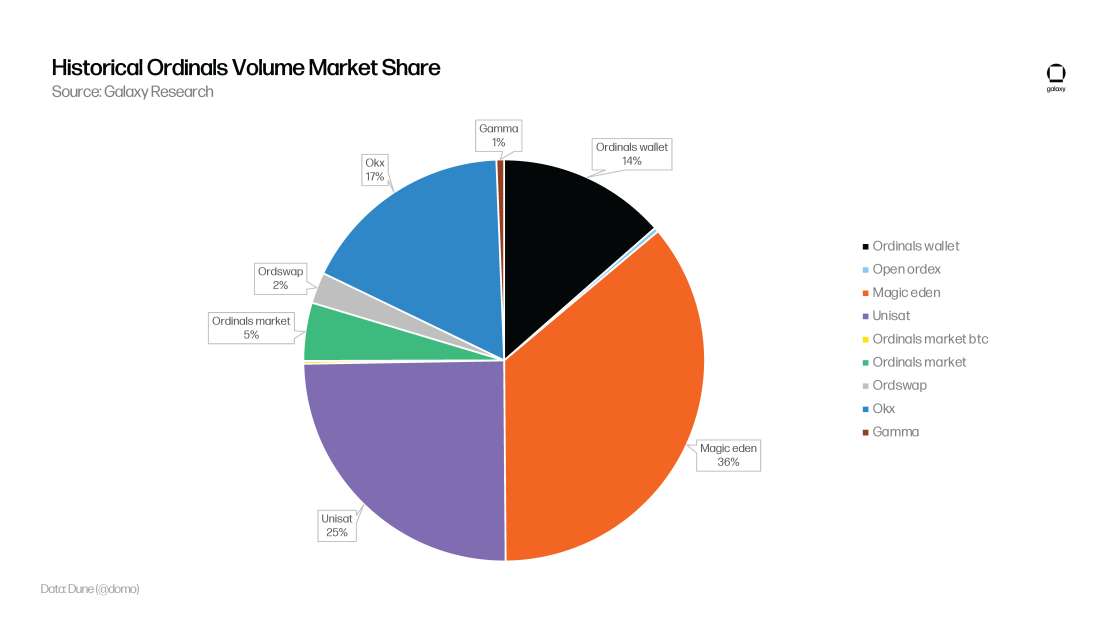

The most dominant marketplaces for Ordinals trading activity by daily volume are Magic Eden, Unisat, and OKX at 20%, 34% and 44% market share respectively.

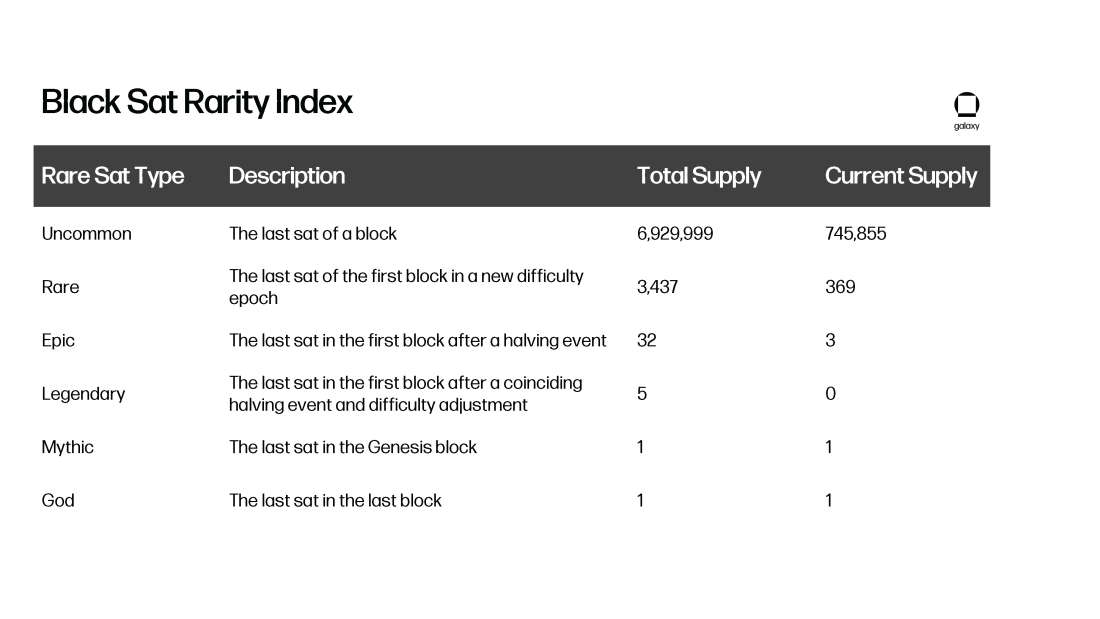

Demand for Ordinals inscribed on rare satoshis continues to grow. There are now robust frameworks for measuring the rarity of satoshis and a handful of rare sat marketplaces that allow users to easily acquire and trade rare sats.

Recursion is a new and innovative technique that enables inscribers to build Ordinals that go beyond the 4MB block size limit and create high resolution artworks at a fraction of the cost minting the inscription would otherwise require.

Introduction

In March 2023, Galaxy Research and Mining published a report highlighting the emergence of Ordinals - a new frontier for digital collectables on Bitcoin. Galaxy Research and Mining projected then that the Ordinals market would reach a $5bn market capitalization by 2025 when the inscription count was a mere 260k. Fast forward to now, the ecosystem has ballooned to over 33mn inscriptions, marking an explosive ~126x growth from March to September 2023. The significant growth of Ordinals is not just a testament to the intrinsic allure of digital collectables on Bitcoin, but a reflection of a rapidly maturing ecosystem. The Ordinals landscape is evolving through improved wallet and marketplace infrastructure, new use cases for inscriptions, and improvements enabling scalability.

This report serves as an update on the Ordinals ecosystem since we last wrote in March 2023. The report provides a comprehensive overview of significant developments in Ordinals infrastructure, and compares Ordinals activity NFT activity on Ethereum, Solana, and Polygon. The report also investigates the impact of Ordinals on Bitcoin fees and highlights how most fee spikes over the past 6 months were not caused by Ordinals-related transactions. This report offers data to suggest that Bitcoin users generally overpay for their transactions, regardless of whether they are Ordinals-related.

The Current State of Ordinals Infrastructure

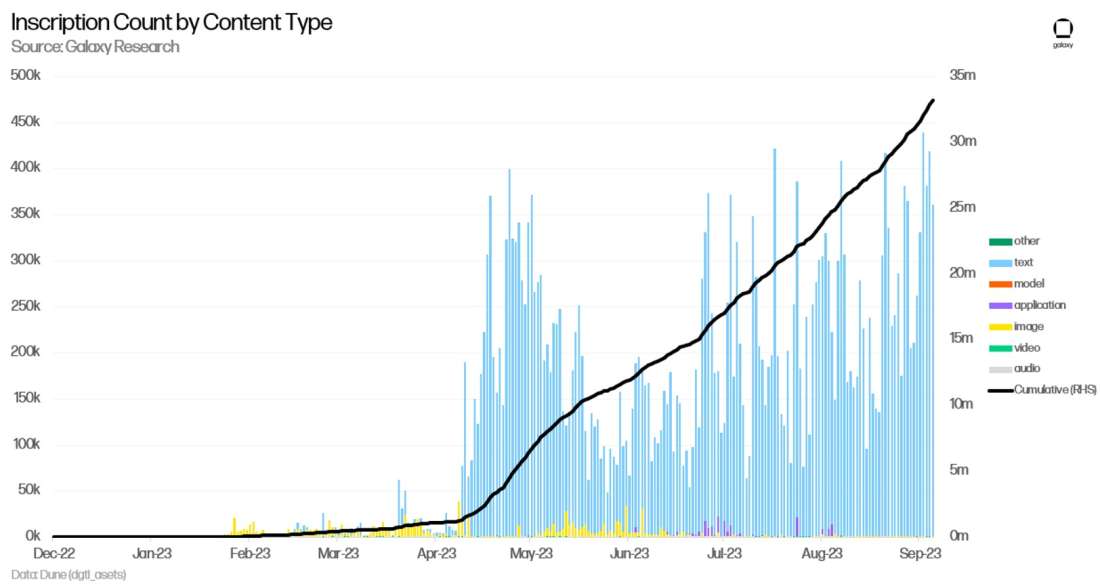

Since the software to inscribe arbitrary data to satoshis, known as the Ord Client, was publicly released in January 2023, there has been an incredible amount of growth and key infrastructure development to support the Ordinals ecosystem. There are now over 33mn total inscriptions, with text files being the most common file type, largely due to the BRC-20 token standard.

The BRC-20 token standard remains an inefficient way to mint and transfer inscriptions as they require users to execute multiple transactions to complete a single action. There are currently several other proposed token standards for Ordinals that are comparatively more efficient and robust protocols for creating tokens on Bitcoin such as ORC-Cash and ORC-69.

Although text-based inscriptions, supported by the BRC-20 token standard, dominates the total inscription count, much of the excitement and key technological developments in the Ordinals space focuses on collectible digital artifacts. Major strides have been made to the tooling to support image-based inscriptions. Three dominant wallet options have emerged to custody their image-based inscriptions: Xverse, Hiro Wallet, and Unisat Wallet. These wallets serve as browser extension wallets that enable users to connect to exchanges, send and receive bitcoin or inscriptions, and view Ordinals collections, offering a comparable user experience to Ethereum’s Metamask. Xverse wallet also offers a mobile app solution as well.

There are several inscriptions-as-a-service offerings such as Ordinalsbot and Unisat. Binance Pool, the mining arm of the world’s largest cryptocurrency exchange Binance, also launched inscriptions-as-a-service on August 31, 2023. From a marketplace perspective, Magic Eden has been the most popular exchange for trading Ordinals. However, Ordinals Wallet, Gamma, and Binance are also emerging as competitive players in the space.

Ordinals infrastructure now supports inscription gating for platforms like Discord (i.e., exclusive access to digital communities through verifying ownership of an inscription). It also utilizes discrete log contracts (DLCs), a native transaction programmability feature on Bitcoin, that allow collectors to use Ordinals as collateral to take out bitcoin-denominated loans.

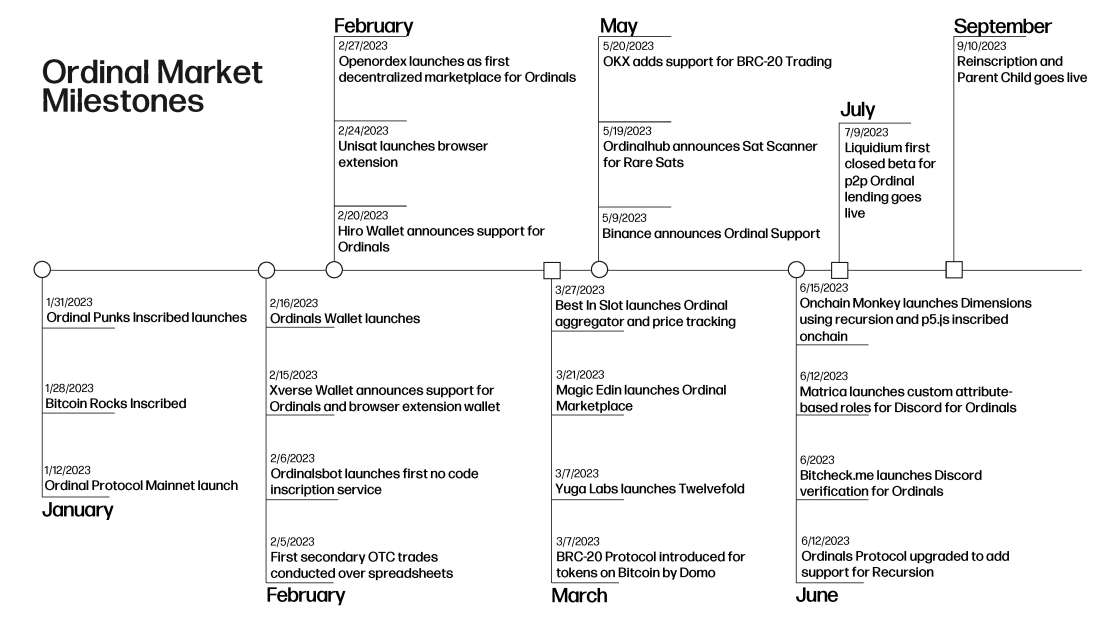

After roughly 8 months of Ordinals development, Bitcoin developers have built tooling for NFTs comparable to the tooling for NFTs on other major Layer-1 blockchains such as Ethereum, Polygon and Solana. There are several companies actively working to build and improve upon Ordinals infrastructure in stealth. The following is a timeline synthesizing the many market milestones in the Ordinals space over the past 9 months:

Though market volumes for both Ordinals and NFTs have been in general decline since the start of 2023, Ordinals infrastructure development continues to move at a rapid pace suggesting that Ordinals are not a fad.

Ordinals Market Activity

Ethereum’s NFT minting activity began in August 2015 with the launch of the Terra Nullius NFT collection. The first NFT mint on Polygon was recorded in May 2020, and the first mint on Solana was recorded in October 2020. NFT minting activity began on Ethereum, Solana, and Polygon before the summer of 2021 when NFTs captured the attention of mainstream media. The first 200 days of minting activity on these networks is minimal compared to the minting activity witnessed after the summer 2021 NFT bull run. For reference, when Solana and Polygon NFT activity first started in 2020, the market cap of the entire NFT ecosystem was only $41m. In two short years, the market cap of NFTs across all three blockchains grew to $32bn by 2022.

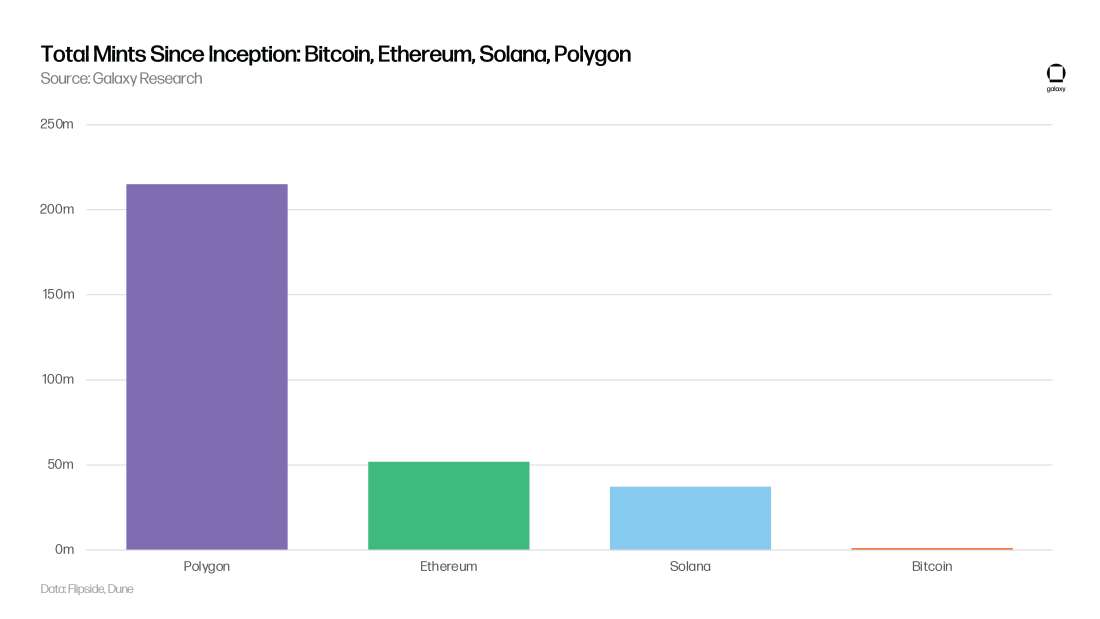

The chart below tracks the number of mints that occurred within the first 200 days of each respective blockchain since inception. The chart disregards BRC-20 mints as inscriptions; the following data is solely based on image-based inscriptions.

The Ordinals ecosystem saw impressive user engagement during its first 200 days of activity. During this time, Bitcoin users minted (i.e., inscribed) 1.14m digital artifacts. The rapid growth of Ordinals is noteworthy when considering that Ordinals launched during a crypto bear market. During H1 2023, NFT volumes and floor prices for blue chip collections rapidly declined. Despite the broader NFT market struggling to pull itself out of a bear market, Ordinals have gained significant traction and the idea of digital artifacts on Bitcoin has flourished.

Although Bitcoin’s minting activity throughout the first 200 days is significant, it remains much lower than the total minting activity for NFTs that have occurred on other general purpose blockchains, illustrating how Ordinals still have a long way to go in terms of adoption relative to the broader NFT ecosystem. One of the obvious reasons for the substantial difference in total mints between chains is the fact that Ethereum, Solana, and Polygon have been supporting NFT activity for many years. Additionally, Ethereum, Solana, and Polygon experienced accelerated adoption with the help of the 2021 bull NFT cycle. If Ordinals continue to gain momentum into the next NFT bull cycle, we could see Bitcoin start to compete with Ethereum, Solana, and Polygon in total mints.

Transaction Activity

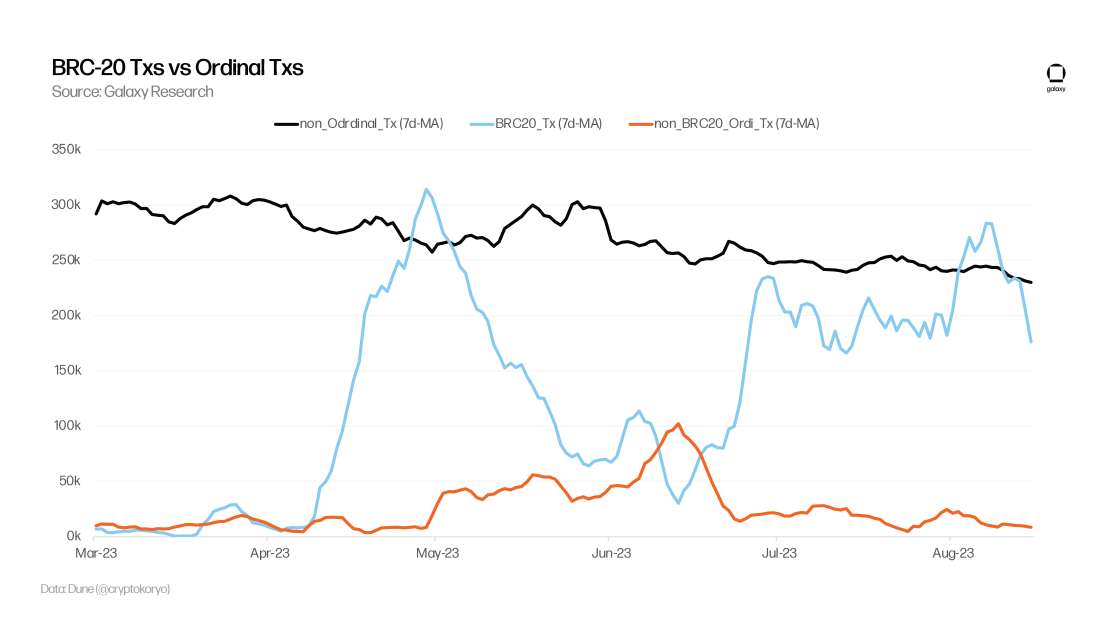

While comparing to other NFT ecosystems necessitates removing non-image transactions from our metrics, including all types of inscription transactions is important for contextualizing the total impact of the emerging technology. Ordinals transactions refer to all types of inscription activity: image, text, application, audio, and other types of digital content. The emergence of inscriptions allows for the building of other meta protocols, such as tokenization schemes, of which BRC-20 has been the most popular so far. BRC-20 transactions are exclusively text-based inscriptions and BRC-20 transactions have significantly outpaced non BRC-20 Ordinals transactions. From observing the volumes for the top 50 BRC-20 tokens, we find that most BRC-20 transactions are low value. From January 1 to August 31, the cumulative volume for the top 50 BRC-20 tokens represented 30% of all Ordinals volume.

To better compare Ordinals trading activity with broader NFT trading activity, we try to exclude BRC-20s from the Ordinals volume calculations detailed in the next section of this report.

Volumes

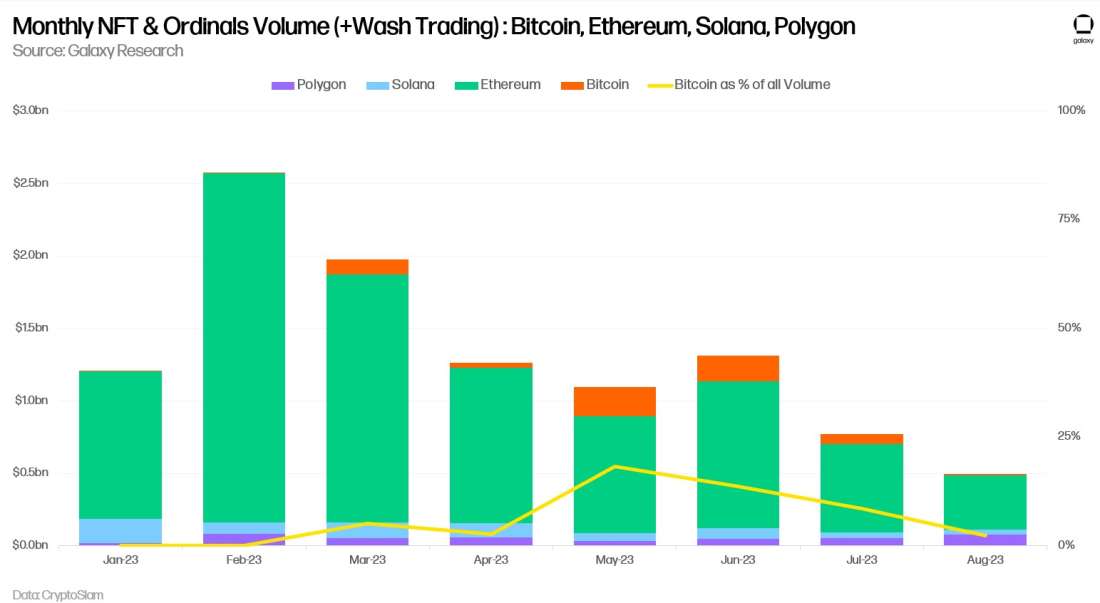

NFT trading volumes have plummeted in 2023. Monthly NFT trading volume declined for six consecutive months from February to August 2023. August 2023 was the worst month this year for NFTs, generating $500mn in volume, down 4x from February 2023. Despite the unfavorable market conditions for NFTs in 2023, Ordinals accomplished meaningful growth. Notably, Ordinals accounted for 18% of all NFT volume in May.

For the first three quarters of 2023, Ethereum dominated NFT volumes, surpassing Solana, Bitcoin, and Polygon combined. Despite Ordinals generating minimal volumes in January 2023, Bitcoin has accumulated the third highest NFT trading volume by network at $596mn. Bitcoin remains as the third most popular chain for digital collectable activity after Ethereum and Solana even when excluding BRC-20s from Bitcoin’s total Ordinals volume.

(Note: To exclude BRC-20 volume from the below calculations, we subtracted the cumulative volume of the top 50 BRC-20 tokens ($187.5mn) from total Ordinals volume ($596.4mn). The top 50 BRC-20 tokens account for the vast majority of total BRC-20 trading volume.)

Daily trading volume for Ordinals witnessed a record high spike on May 11, 2023, when the first wave of BRC-20 tokens was minted through Unisat and Ordinals Wallet. From May 1, 2023, to July 18, 2023, Ordinals daily trading volume generated roughly $207m in total volume and averaged over $2.5m in volume per day.

The following chart illustrates the daily trading volume for Ordinals discounting BRC-20 transactions from February to September 2023. To discount volume data from BRC-20 transactions in the below chart, we eliminated trading volume data from Unisat between May 5, 2023, to May 12, 2023. During this timeframe, Unisat generated over $56mn in volume exclusively from BRC-20 sales. Due to difficulties in accurately sorting between image-based inscription volume and other types of inscription volume from marketplaces, there may be instances of BRC-20 trading volume that existed at various points on other marketplaces beyond Unisat that we could not eliminate.

The following chart also does not feature data from OTC deals for Ordinals and the Twelvefold mint as these transactions do not exist in marketplace volume data tracked by Dune Analytics. Primary sales volume from the Yuga Labs TwelveFold mint generated approximately $16.5m in Ordinals volume in one day. OTC deals for Ordinals accounted for at least 10 BTC (~$270k) in imaged-based Ordinals volume. The following chart represents our best estimation of Ordinals daily volume discounting the BRC-20 mania:

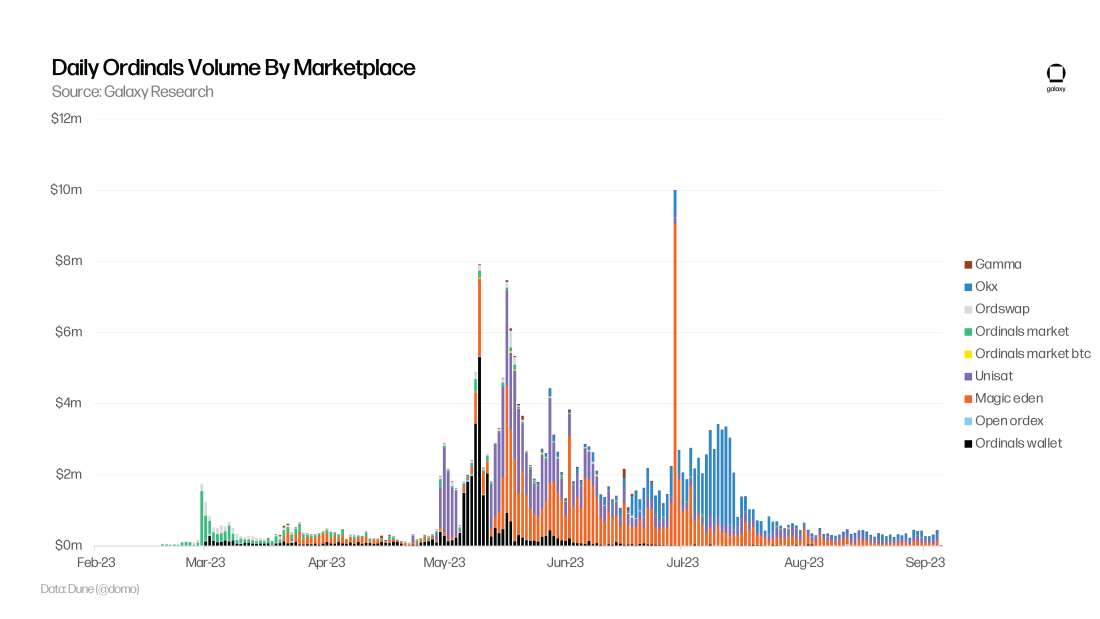

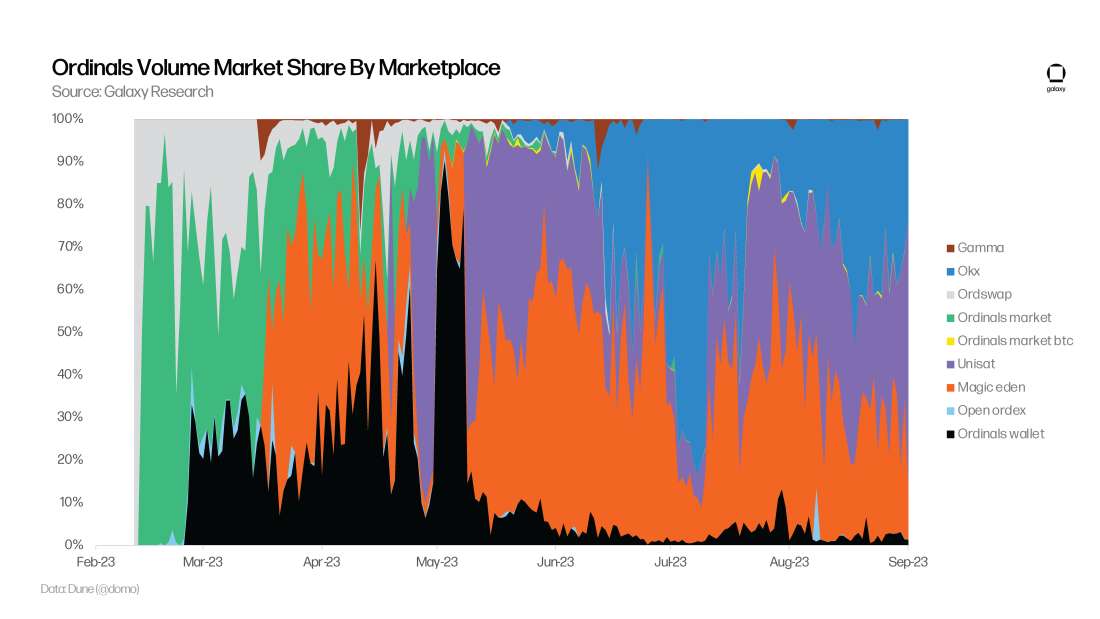

Before Ordinals gained meaningful support from major NFT marketplaces, there were a handful of early marketplaces for trading Ordinals. Ordinals Market, Ordinals Wallet, and Ordswap dominated Ordinals trading volume from February 2023 to April 2023. However, when Magic Eden launched support for Ordinals in March 2023, the marketplace volume dominance shifted away from the early marketplaces. Magic Eden’s entrance into the Ordinals landscape shocked the market as they were the first major NFT marketplace supporting NFTs on other chains to adopt Ordinals.

At the time Magic Eden launched support for Ordinals, Magic Eden was the fifth largest NFT marketplace by volume with over 1.3m users. The most dominant marketplaces by volume for Ordinals are now Magic Eden, Unisat, and OKX at 28%, 28% and 38% respectively.

Despite Magic Eden and OKX getting a late start into the Ordinals ecosystem, they account for 36% and 25% of all Ordinals volume since inception respectively.

In the next section of the report, we analyze the impact of Ordinals trading activity on the Bitcoin mempool and transaction fees.

Ordinals Impact on Bitcoin’s Mempool and Transaction Fees

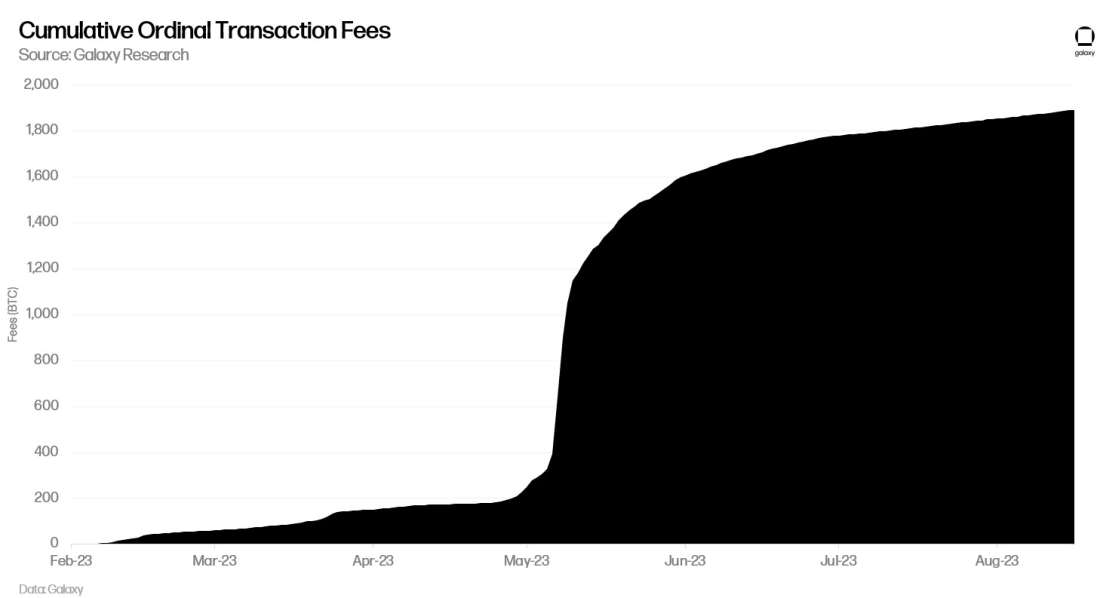

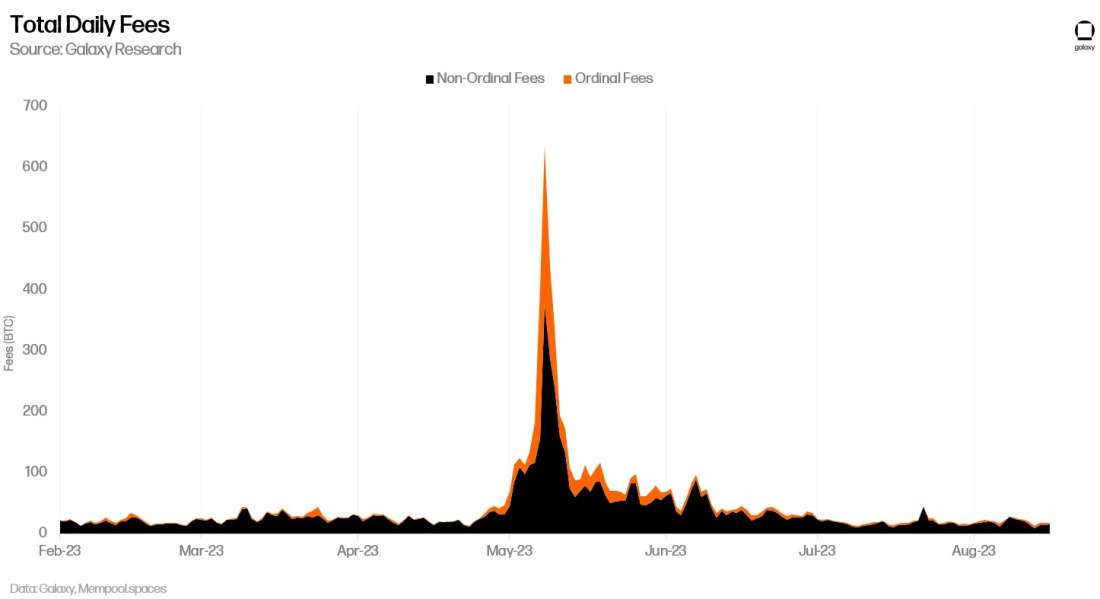

In the first half of 2023, miners accumulated 8,684 BTC in total fees. Notably, transactions related to inscriptions during H1 2023 made up 1,779 BTC or 20% of total miner revenue. This is in comparison to the 2,325 bitcoins in fees for H1 2022 and the 5,375 bitcoins in total fees amassed throughout the entirety of 2022.

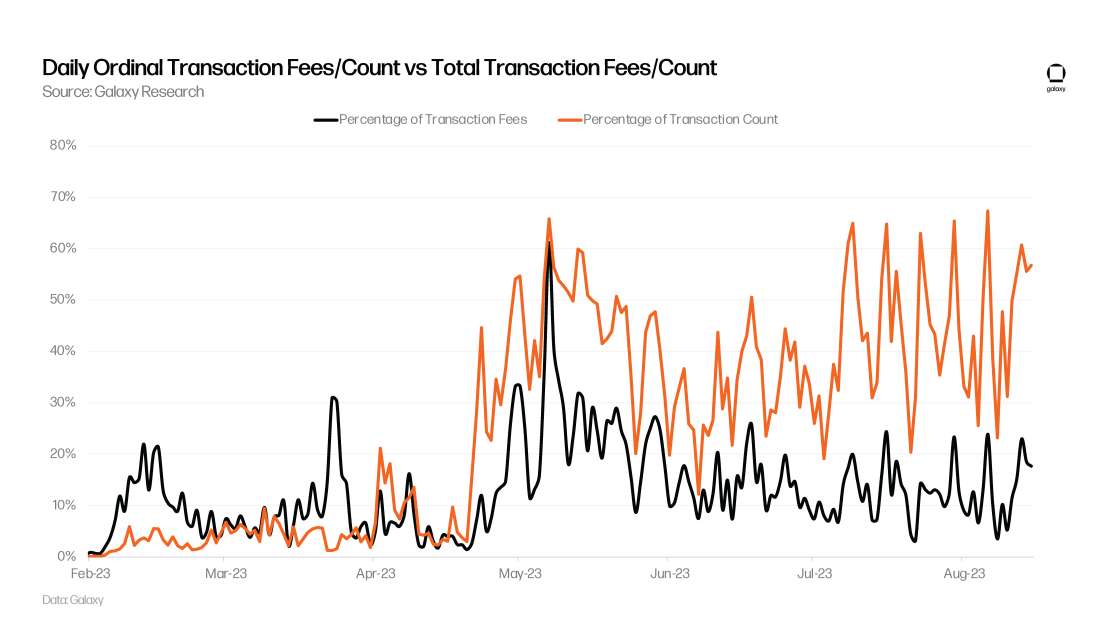

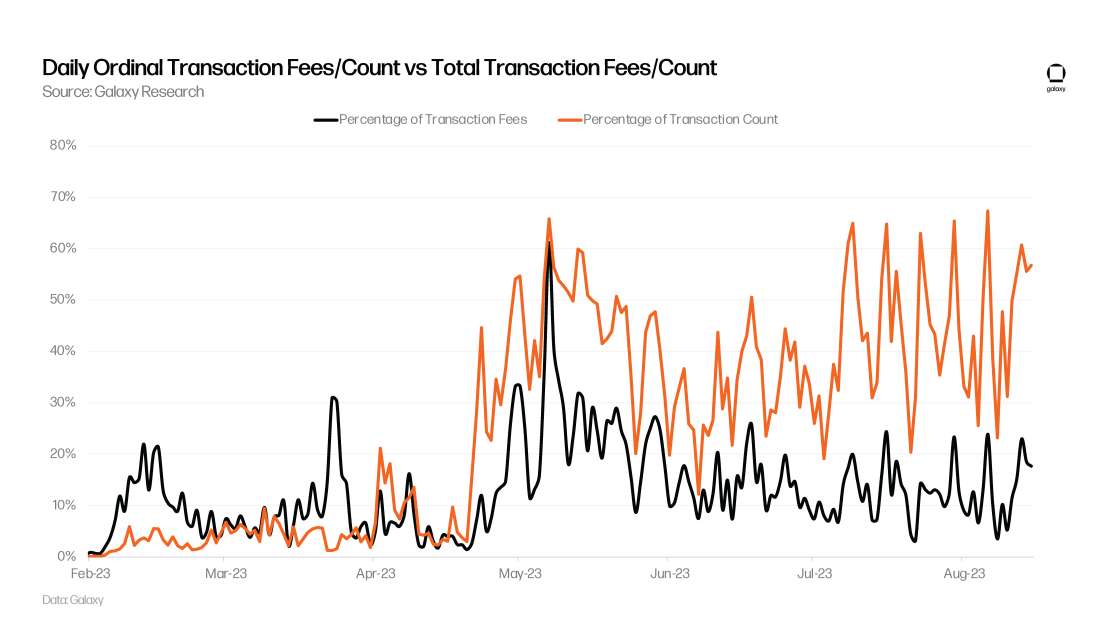

From May to July 2023, the share of transactions related to Ordinals on Bitcoin has been relatively unchanged, moving from 47% of all Bitcoin transactions to 46%. Over the same period, the share of transaction fees on Bitcoin from Ordinals declined from 30% to 12%.

Outside of the transactions that motivated the fee spike in May 2023, most of the transactions with fees greater than the median fee rate in a block were not Ordinals-related transactions. Despite Ordinals making up a significant percentage of the total transaction count, they were not the most lucrative transactions in a block.

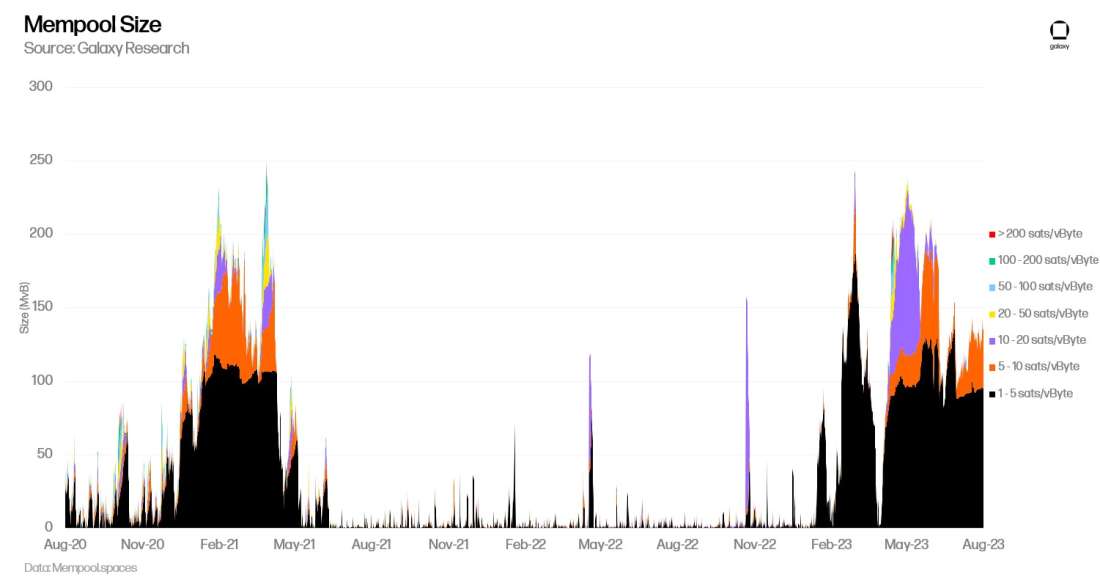

While not the most expensive transactions on Bitcoin, Ordinals have created a backlog of transactions that have clogged the Bitcoin mempool, which is the pool of pending Bitcoin transactions. The mempool has been backlogged since April 22, 2023, or about 4 months. This is the longest active streak for an uncleared mempool since the spike of on-chain activity at the beginning of 2021.

Regardless of whether someone is paying for an Ordinals or making a regular transaction to move Bitcoin from one address to another, users of Bitcoin are often overpaying for blockspace. In the next section of the report, we offer a detailed analysis of the transaction fee spikes that occurred in the first half of 2023.

Factors Motivating Fee Rate Increases on Bitcoin

The two primary factors that lead to fee rate increases on Bitcoin are:

Temporal Disparities in Blockspace Consumption Leading to Voluntary Overpayment. Varying time preferences exhibited by blockspace consumers, meaning differences in urgency and strategic timing decisions, lead to a disparate blockspace consumption pattern, consequently driving the fee rates upward during peak demand periods.

Involuntary Overpayment Through Misestimation of Fee Rates. Users may inadvertently pay a premium on the standard transaction fees due to miscalculations or a lack of understanding of the prevailing fee rate structures.

The behavior of low-time preference users can be rationally explained and visualized on-chain. These users will always bid for the lowest possible fee rate above a widely accepted mempool purge level (the mempool default size is 300 MB so when capacity is reached, it starts to purge or remove transactions starting with the lowest fee rates). Anything above this “purge level” could be considered as a “time preference premium” because it implies a desire to be included in a block faster than X, where X represents the time it would take for the whole mempool to clear and for the “purge level” to go back to zero sat/vByte.

However, high-time preference users are optimizing for different trade-offs such as opportunity cost and analyzing their behavior requires making subjective assumptions. Using this framework, we can begin to quantify and contextualize the magnitude of the “time preference premium” users are willing to pay. In a sense, this “time preference premium” can generally be thought of as how much users are willing to “overpay” to be included in the next block (or blocks). This would be characterized as voluntary overpayment (e.g., BRC-20 users trying to mint a new token before the max supply is reached). Some users may have overpaid for fees due to other non-economic factors such as poor fee estimation from wallets and exchanges. These types of transactions would be characterized as involuntary overpayment.

The following is a case study illustrating an example of voluntary overpayment on Bitcoin.

DeGods Mint Case Study

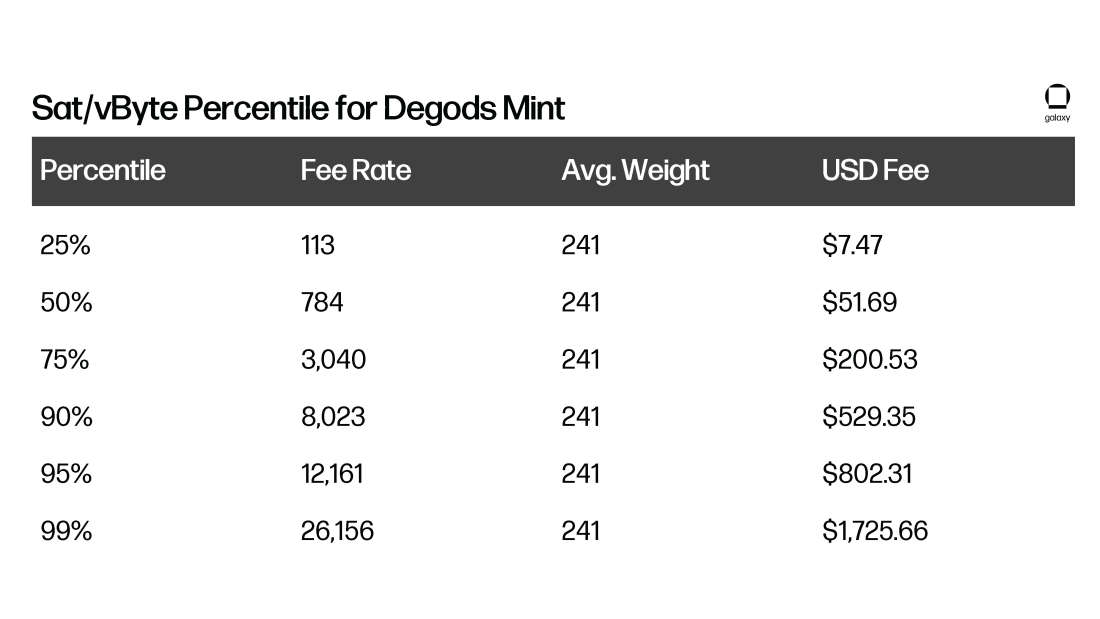

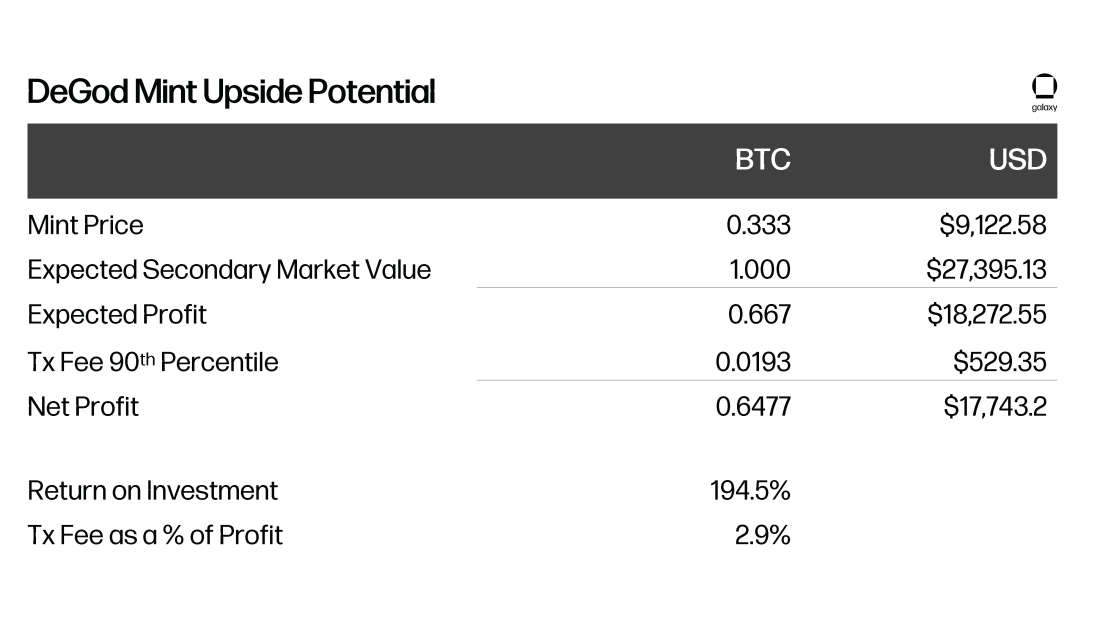

The DeGods mint in March 2023 serves as an illustrative case study to conceptualize why users would voluntarily overpay for transaction fees. As background, DeGods is a collection of 10,000 NFTs initially launched on the Solana blockchain in 2021. In March 2023, the creators of DeGods launched a version of their NFT collection on Bitcoin. Before this point, the DeGods creators sold their collection through Discord raffles. The DeGods mint on Bitcoin was sold on a first come first serve basis on-chain. The inscriptions were sold at a mint price of 0.333 BTC starting from Block 781,279. The users able to get their transaction into the first 500 confirmed transactions for the mint would be the lucky ones to purchase their DeGod inscription for the mint price.

The DeGods inscription minting process created a frenzy among users as many had to make wild speculations about the appropriate fee to attach to their transaction to be successful in the mint. DeGod minters paid between $7 and $1,725 in fees for their transactions, as the following table illustrates:

Other quick facts about the DeGods mint include:

During the mint, the highest fee rate observed in the block was 39,177 sats/vByte for a 10,000,000 sat total transaction fee (0.1 BTC) fee which was 932x higher than the median fee rate in the block.

The median fee rate for Block 781,279 was 6x the median fee rate of the previous block.

The total fees from the block amounted to 3.552 BTC or $96k. The number of confirmed transactions in the block was 2,602 in total.

559 transactions out of the 2,602 were associated with the DeGods mint. The total fee amount for DeGods mint related Bitcoin transactions was 2.969 BTC or $80k (83.6% of total fees).

The median fee rate paid by those trying to mint a DeGod was 784 sat/vByte which is 18.6x higher than the median fee rate for all transactions in the block.

From the perspective of the minter, deciding how much to pay for a transaction in fees is essentially an opportunity cost calculation. If the minter believes that they can profit from the mint by immediately selling the item, they will try to optimize their transaction by determining at what price the item will sell for on secondary markets and attaching a fee that will guarantee both their inclusion in the mint and a positive spread between the mint price and the secondary spread price.

DeGod inscriptions ended up having a secondary market value of 1 BTC after the initial mint. Minters who overpaid for their DeGod by 90% or over in comparison to other minters would still have been able to profit from secondary sales if they sold immediately after their purchase, as the following table illustrates:

The next section of this report will dive deeper into the factors driving fee rate increases on Bitcoin.

Quantifying “Overpayment” for Bitcoin Transactions

Based on these characterizations, we can quantify “overpaying” activity on-chain between users minting and exchanging Ordinals vs users sending and receiving regular Bitcoin transactions. The following is a step-by-step breakdown of the methodology:

For primary inscription transactions (i.e., Ordinals transactions), they are identified by their transaction IDs listed on Ordinals.com. All other transactions in the same period are categorized as regular bitcoin transactions. We do caveat that a portion of these regular bitcoin transactions could have been secondary market transactions not captured on Ordinals.com. However, as shown on NFT data aggregator CryptoSlam, the number of secondary sales declined significantly from their peak on May 8, which suggests even if they were included, they would likely have minimal impact on fee rates.

“Overpayment” is defined as the amount of fees (in sats/vByte) from transactions in a block above the median sats/vByte of the same block. We chose the median sats/vByte level of a block because we believe bidding around this level will offer a reasonable chance to be included in the next block if you are a high time preference user.

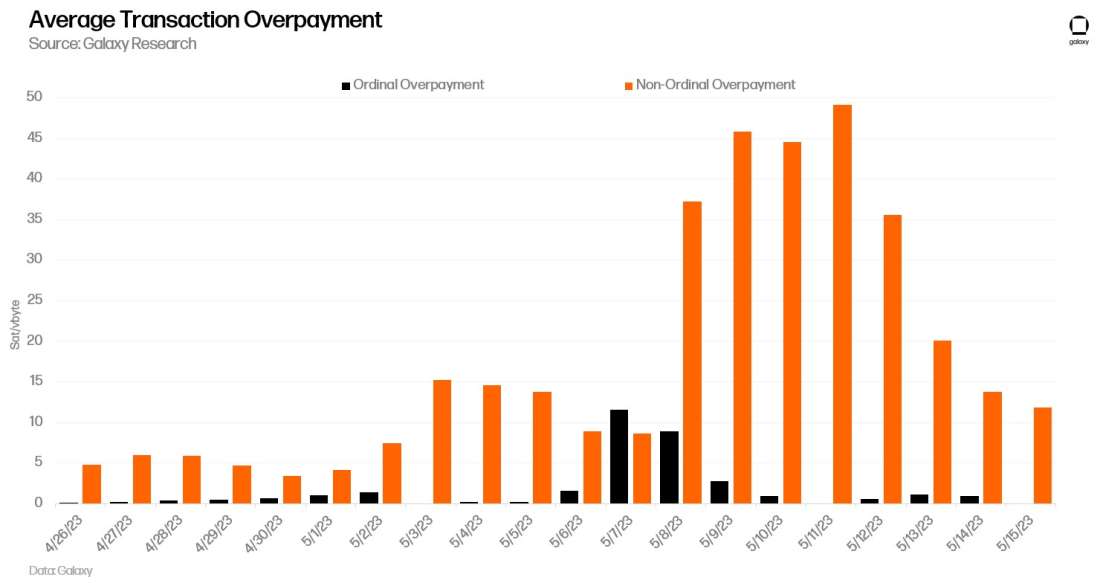

Based on the above methodology, the following chart illustrates the average amount of overpayment between Ordinals and non-Ordinals users on Bitcoin daily during the period of April to May 2023 when the block space market was dominated by higher time preference users attempting to participate in the BRC-20 craze.

Because the mempool is consistently evolving (and block times are volatile by design, with longer block times increasing the fee rates for a given block as users have more time to bid on the next block), a rational high time preference user would not bid with a fee rate below the median fee rate of the mempool at the time they are looking at the mempool. For example, in the chart above, on May 9, 2023, Ordinals/BRC-20 users were paying 2.8 sats/vByte on average above the median fee rate in the block, while non-ordinals users were paying 45.9 sats/vByte on average above the median fee rate in the block, a 16x difference between the two.

Transaction level data indicates that most of the fee pressure from April to May 2023 did not come from Ordinals/BRC-20 users, but from “regular” Bitcoin users. Contrary to popular belief, during the large fee spike period, regular users of the blockchain making what are referred to as “financial transactions” were largely responsible for pricing out Ordinals transactions. Furthermore, the chart below illustrates that Ordinals never represented more than 30% of total transaction fees for miners despite representing more than 70% of mempool volume.

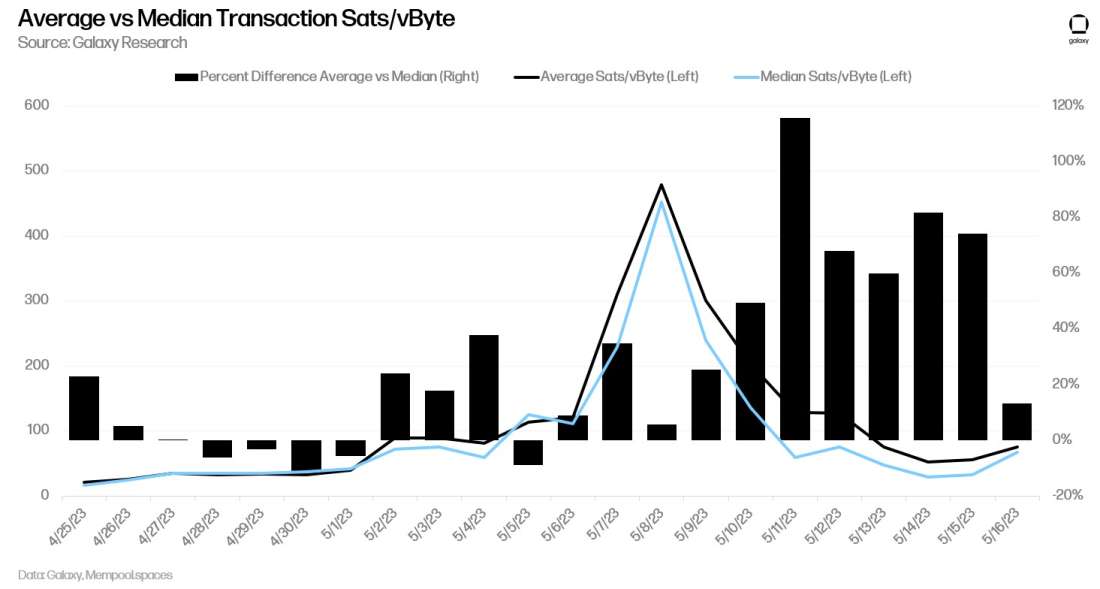

One final insight on overpayment is that there is a high divergence between average sats/vByte and median sats/vByte during periods of high fee volatility. The chart below shows that average sats/vByte and median sats/vByte both peaked on May 8. Prior to May 8, average sats/vByte and median sats/vByte generally moved in lockstep. However, after May 8, the percentage difference between the two widened dramatically, to a peak of 116% (average sats/vByte were 116% larger than median sats/vByte). This divergence was likely due to the overall fee volatility during the run up in transaction fees that made fee estimation from wallets difficult during this period.

From a statistical standpoint, averages can be skewed by outliers, which in this case were for transactions that had outsized fees attached to them. During periods of low volatility, average and median fees are similar, and during periods of high volatility, these two metrics diverge significantly, further highlighting the impact of overpayment on fee dynamics. By measuring the convexity of fee rates on Bitcoin, we know that few transactions are responsible for most fee rate increases seen on-chain.

As demand for block space on Bitcoin increases over time, wallet providers will need to optimize their fee estimation schemes or offer solutions like replace-by-fee (RBF) and fee rate selection to better serve users and prevent them from overpaying for transactions. Overpayment for Bitcoin transactions can be mitigated through more sophisticated fee estimation services from wallets and exchanges. Regular Bitcoin users stand to gain from the optimizations and improvements to fee rate estimation that Ordinals-focused wallets like Xverse, Hiro, and Unisat are pursuing. Especially in the face of increased demand for blockspace and the ensuing fee volatility, fee estimation schemes will become a critical component of next-generation wallet technology to prevent users from overpaying on transaction fees.

Additional Insights and Takeaways About Bitcoin Fee Dynamics

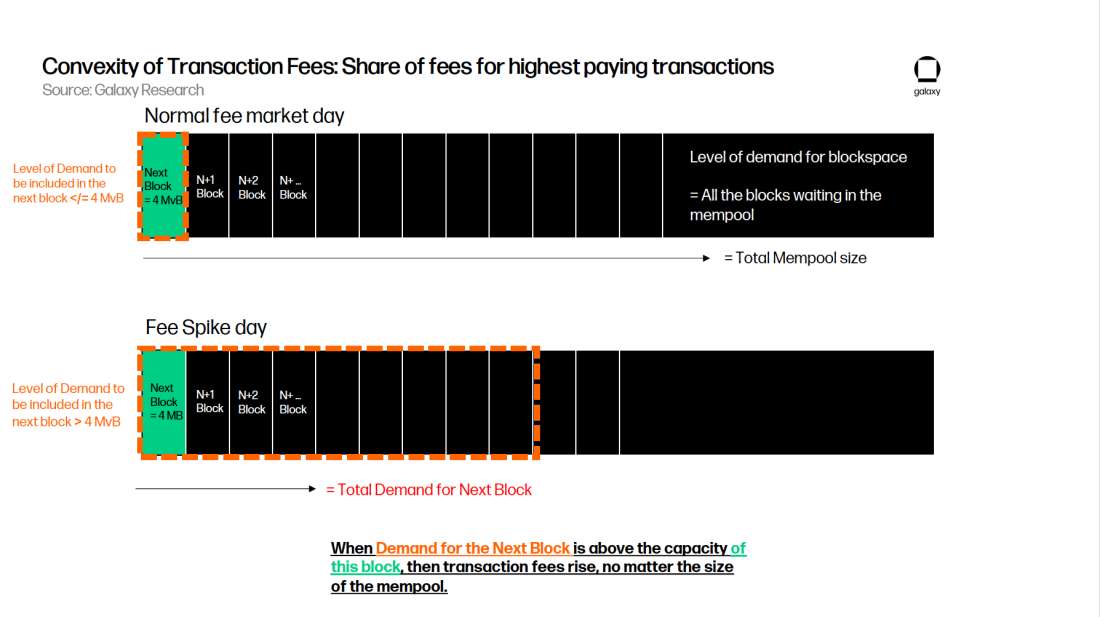

One development that surprised market participants during the BRC-20 craze is how quickly fee rates shot up in the mempool during periods of high demand. This is because it’s not the size of the mempool (i.e., the general demand for bitcoin blockspace from low and high time preference users) that drives transaction fees, but rather it’s the demand for inclusion in the immediate next block from exclusively high time preference users.

In the graphic below, we illustrate this relationship by showcasing that when demand for the next block (in red) is less than or equal to the capacity of the next block, then fees do not generally spike. However, when the demand for the next block exceeds the next block’s capacity, then fees will rise. While this might seem obvious to the casual mempool observer, it underlines an important assumption when discussing the future of transaction fees on the network. Overall demand for blockspace is (almost) irrelevant as long as the network can sustain a level of demand for the next block that does not exceed its natural capacity.

The above framework for understanding block space demand is relevant in the context of Bitcoin security budget discussions. Rather than a discussion centered on the question, “Will transaction fees rise enough to provide adequate revenue for miners?”, the discussion should center on the question, “How can we ensure constant demand for more than 4 MvB of blockspace?”.

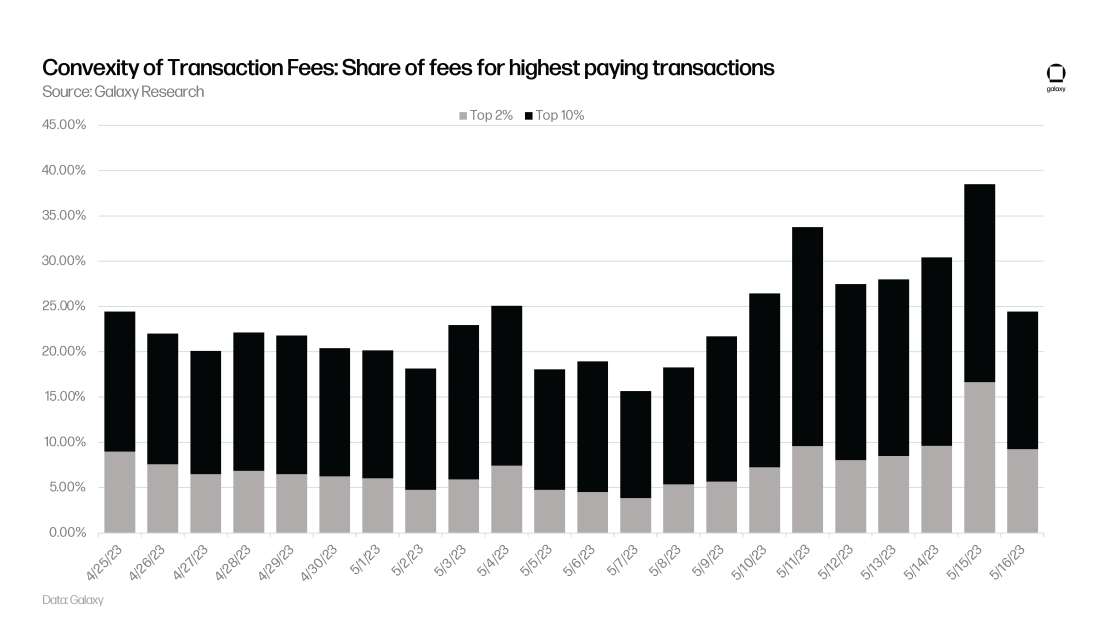

When examining fee spikes during periods of high demand for the next block, we observed that a significant amount of the total fees paid in that block was driven by a small percentage of users paying exceedingly high fee rates, implying strong convexity. However, this relationship becomes less obvious during days when fees are low. To illustrate this two-pronged dynamic for Bitcoin fees, the chart below shows that the top 2% of transactions accounted for over 15% of total fees on May 15. On average, the top 10% of transactions account for 21.05% of total fees in a block. However, the percentage of transactions coming from the top 2% of fee rates declines meaningfully at the high of the fee spike in May and rises back up in the aftermath.

During normal days, when there is no spike in Bitcoin fees, most of the fee pressure is being driven by outlier transactions, which we define as the top 2% of transactions in a block by sats/vByte fee. This was also outlined in the difference between average and median sat/vBytes, most likely due to involuntary overpayment or lack of understanding of mempool dynamics during periods of fee volatility.

During fee spikes, these outliers represent a smaller share of the overall fee pressure, indicating that although users are bidding up fees to be included in the next block, they are not necessarily overpaying in relation to the other users with a high time preference who are also bidding to be included in the same block.

In the next section of this report, we will dive into new developments in Ordinals infrastructure and minting techniques.

New Developments with Ordinals

Transactions on Bitcoin, especially transactions involving Ordinals, have benefited greatly from prior protocol-level upgrades like Segwit that have reduced the transaction weight and therefore overall fee of these transactions. However, Segwit was not originally designed for Ordinals – neither was Taproot for that matter (the upgrade on Bitcoin that enabled the creation of Ordinals). The existence and proliferation of Ordinals on Bitcoin has been made possible for unexpected reasons but, since their creation earlier this year, there is now a concerted effort among the Bitcoin development community to intentionally support this type of activity through building Ordinals-focused tooling. (For a deeper discussion of the factors that led to the creation of Ordinals, as well as the implications of their creation on Bitcoin development, read our original report from March 2023.)

This section of this report will focus on new technologies being developed on Bitcoin to foster the growth and maturation of the Ordinals market.

Recursion

In June 2023, the main Ordinals block explorer received an upgrade enabling recursive inscriptions and added support for Javascript and CSS file types. Recursion allows users to link an inscription to another inscription using the format: /content/

Source: OrdinalsBot

If you were to inscribe each of the above layers in a single image, the file size would be 250 kb before any compression techniques, which would cost ~$1.8m to inscribe assuming a 10 sat/vybte fee for a collection size of 10,000 pieces.

With recursion, an HTML inscription can be created instead. By utilizing the HTML canvas element, inscribers can create graphics with JavaScript, as the following image depicts:

Source: OrdinalsBot

JavaScript logic that has been inscribed can then be referenced using recursion, a strategy that significantly diminishes blockspace usage and reduces the associated costs of generating the final image.

The process operates through a comprehensive script that encompasses a single draw function. This function, which accepts a canvas element alongside an array of inscription links, orchestrates the loading of all image layers.

Consequently, it facilitates the seamless creation of the canvas, ensuring the presentation of only the complete image, as opposed to the gradual loading of individual layers, offering a more streamlined and cost-effective visualization process.

Source: OrdinalsBot

The end result is the complete image that can be resized or saved like a normal image. The final HTML inscription is only 621 bytes compared to 250,000 bytes, but the image can still be viewed at its full size or resolution of 250,000 bytes.

Sticking with the hypothetical collection size of 10,000 pieces, the process of recursion allows for a total size savings of 99.7% (6.21 MB vs. 2.5 GB).

The resulting total cost to inscribe this collection would be ~$12,000 vs $1.8mn if inscribed individually without recursion, assuming a fee rate of 10 sats/vByte.

In summary, recursion can be utilized as a compression technique to allow for more expansive collection sizes and reduce minting cost. With recursion a collection can inscribe the traits that would generate or create a PFP collection as their own individual layers and use recursion to call these individual layers to generate the file image. Three other key benefits to recursion include:

Creators can go beyond the 4 MB Block Size Limit. Utilizing recursion allows for the assembly of a complex digital artifact, mirroring the process of piecing together a puzzle. Initially, individual components — akin to puzzle pieces — are inscribed separately. Following this, a final inscription integrates these disparate elements, synthesizing them into a cohesive and singular image, thus illustrating a unified vision from segmented inscriptions.

Recursion enables composability which unlocks all sorts of use cases. One major benefit from the composability offered through recursion is the ability to do onchain reveal processes for art. Onchain Monkey (OCM) Dimensions was the first collection to do an onchain reveal. Another use case that recursion unlocks is the ability to do open and limited-edition prints. Gamma recently released “Prints” which they are labeling as a fresh take on editions. Prints are made possible by leveraging recursion where the artist inscribes one high resolution original artwork and then Gamma creates a wrapper that is used to create digital editions. The edition number of the print is also able to be viewed on any display by having the print number embedded directly within the digital asset. Other features include the ability to do onchain raffles and leverage code libraries that are inscribed onchain. The Onchain Monkey Team inscribed the p5.js and Three.js library which enabled them to create their Dimensions digital artifact collection. Users are also beginning to inscribe more advanced libraries like react.js and Animate.css libraries.

Recursion makes it significantly more feasible to create games directly on Bitcoin. Developers can inscribe popular game libraries that could be referenced with recursion to create more intricate and complex 3D games natively on-chain.

In a way, inscriptions have the power to transform bitcoin blockspace into a global hard drive and recursion effectively optimizes that storage and data to be significantly cheaper and composable which expands the realm of possibilities and design space. Marketplaces and explorers then serve as the equivalent of web browser clients for exploring and experiencing content on the bitcoin blockchain. As more people inscribe code libraries to Bitcoin, these can be referenced to make it easier for all creators to build more immersive experiences and artwork. Ordinals collector Jokie88 has started a GitHub repository tracking a list of all code libraries that have been inscribed to date. The list currently contains 40 different libraries that can be referenced with recursion.

Reinscription

Reinscription allows users to inscribe multiple pieces of data onto the same satoshi (the smallest unit of a bitcoin). In order to reinscribe a satoshi, a user needs to be in possession of that satoshi, so it is not possible for an artist to reinscribe on a satoshi that contains their artwork after it’s been sold. Reinscription went live in v 0.9.0 of the Ord client released on September 11, 2023. It’s important to clarify that reinscriptions do not impact the immutability of inscriptions. Reinscriptions do not overwrite or delete the data that was previously inscribed on a satoshi, but rather creates an array of the data. All data that is reinscribed onto a satoshi appears in chronological order.

The five key benefits of reinscriptions are:

A single satoshi to contain all recursive elements: Reinscription paired with recursion allows an individual to inscribe all recursive elements on the same satoshi to create a larger more intricate digital artifact.

A version control technique: Reinscription could be used to perform upgrades or version control with code libraries or other on-chain applications.

Reduces risk of fungibility concerns: While inscriptions already posed minimal risk to fungibility of sats, reinscription further diminishes this risk as multiple assets can be stored on a single satoshi.

New metas and storytelling opportunities: With reinscription, an artist could effectively create an entire art gallery or series on a single satoshi. The artist could also leverage reinscription to create dynamic or living artworks. For example, reinscription can be used as a better method for inscribing books where each page could be inscribed onto a single satoshi and then viewed in chronological order through explorers.

Reinscription also offers a mechanism to perform proof of ownership. After buying an inscription a collector could reinscribe a text file with their name before selling it to a new owner to show the history of collectors of the artwork.

Envelopes

On August 28, Ordinals trading platform Ordinalhub released a blog post detailing envelopes and why they could be beneficial for inscriptions and bitcoin experimentation. An envelope helps an indexer analyze the witness data on Bitcoin and determine if an inscription exists in the witness data and what data constitutes that inscription. An envelope does this by using a series of data pushes that each can be no longer than 520 bytes. The first data push is “OP_Push ord” which indicates that what follows in the envelope is an inscription. Indexers look for this string to identify if an inscription exist in the witness data. One of the use cases for envelopes explained in the Ordinal Hub post is the ability to create a dedicated tool for tracking BRC-20-type tokens. Envelopes open the design space for data storage on Bitcoin. Internet archives and decentralized file storage could become a feature of the Bitcoin blockchain, assuming that users are willing to pay the on-chain costs.

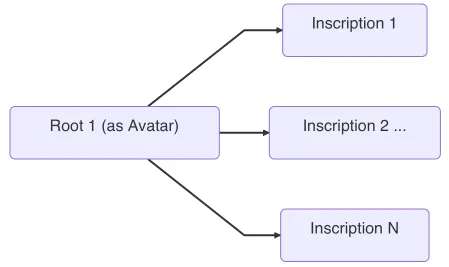

Parent Child Inscriptions

Parent child inscriptions are a way to strengthen provenance guarantees for inscriptions. Provenance refers to the ownership history of an artwork, who created it and when. The establishment of provenance is critical for verifying the authenticity of a work of art. The authenticity of NFTs on Ethereum and other general purpose blockchains is established through accounts and smart contracts. Provenance is established by the wallet address that deployed the issuing smart contract. However, Bitcoin does not use an account-based model making the Ethereum-based method for provenance infeasible.

Instead of associating provenance with a Bitcoin wallet address, which includes privacy tradeoffs and a lack of customization, Casey Roadamor, the creator of Ordinals, conceived the idea of a root inscription that would serve as the equivalent of an avatar or logo for future works. The root inscription is the “parent” and future inscriptions, that is “the children”, can be linked back to the parent. In practice, the way this works is by putting the satoshi of the root inscription as an input to the reveal transaction. When the output created by the commit transaction is spent it reveals the inscription content onchain, this is called the reveal transaction. With this style of provenance, a tree of lineage is created as the following image shows:

Source: Medium, Cypherpork

A pull request for a standard to do parent child inscriptions was merged into the Ordinals client in September 2023 and is currently live.

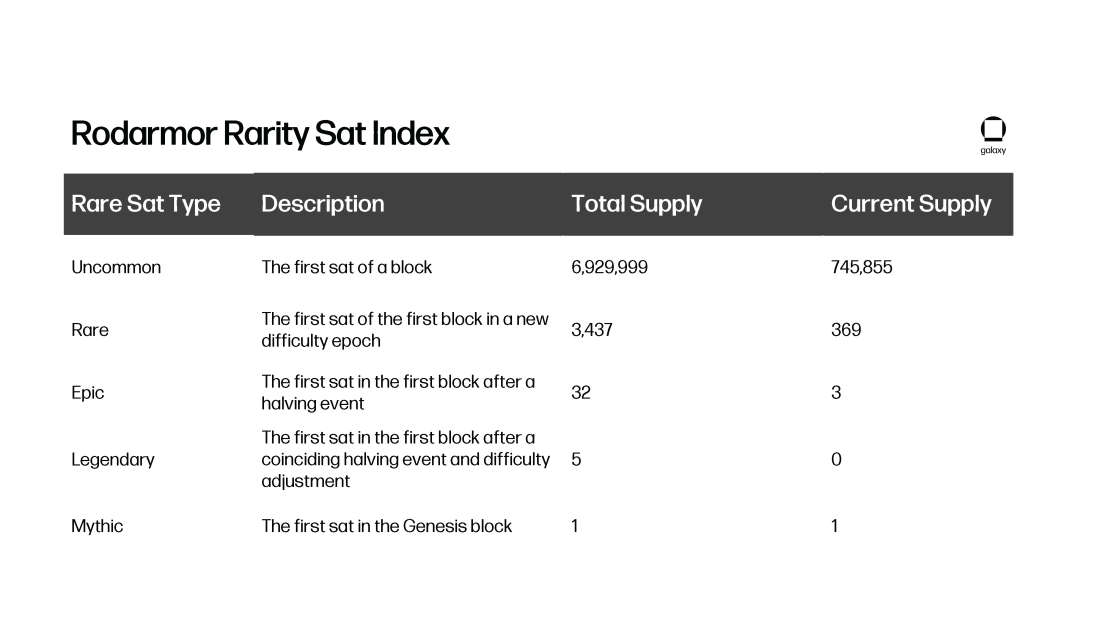

Rare and Unique Sats

Many collections look to inscribe their artwork on sats with some level of rarity or uniqueness. Mining pools have also taken note of the emerging interest in “rare” satoshis. Mining pools Luxor, F2Pool, and Binance Pool, who collectively represent roughly 50% of total hashrate, are separating out rare sats from the block rewards that they earn. Over the last few months, there has also been the emergence of rare sat marketplaces that have made it easier for speculators and artists to acquire and trade these satoshis. Some notable marketplaces include Magisat, Danny Deezy’s Sat Dispenser, and Lumisat. NFT marketplaces and Ordinals explorers such as Magic Eden and Ord.io are also embracing the popularity of the concept of rare satoshis by allowing users to sort and filter inscriptions by sat rarity.

The following are some popular examples of rare sat groupings and methodologies:

Rodamor Rarity Index. The Rodamor rarity index is a methodology for identifying rare satoshis created by Casey Rodamor, creator of the Ordinals client.

Block 9 – Satoshi Sats. Block 9 sats are the oldest sats in circulation and were mined by Satoshi Nakamoto and sent to Hal Finney in the first ever bitcoin transaction. Block 9 sats aren’t necessarily rare from a quantity perspective as there are 50Bn sats from this block and it is unclear how many of these satoshis remain in circulation as many whole bitcoins from these early blocks are considered lost or dormant, that is locked in wallets where the owners no longer have access to their private keys. Block 9 sats have been very popular to inscribe on due to their historical and cultural significance. Some popular collections that have inscribed on Block 9 Sats include Ordinal Maxi Biz (OMB) Green Eyes and Timechain Collectibles Series 2.

Block 78 – Hal Finney Sats. Block 78 is the first bitcoin block mined by someone other than Satoshi Nakamoto. Block 78 was mined by renown cryptography and digital privacy advocate Hal Finney. Like Block 9 sats, Block 78 sats aren’t necessarily rare from a quantity perspective as there are 50Bn sats from this block, and similarly, the circulating supply of these sats remains unclear. These sats have been very popular to inscribe on due to their history and association with Hal Finney. Some popular collections that have inscribed on Block 78 Sats include: Onchain Monkey (OCM) Dimensions and Ordinal Maxi Biz (OMB) Blue Eyes.

Black Sats – the Last sat of a block. Black sats follow the Rodamor rarity index but instead of being on the first satoshi of a block they are the last satoshi minted from a block. The idea of black sats was created by @blackxbtx.

Palindrome Sats. Palindrome sats are sats whose number reads the same backward or forward. There are roughly 9bn palindrome sats representing 0.0000043% of total supply. Some popular collections that have inscribed on palindrome sats include: Geo Ordinals and Palindromes.

Sat Names. Ordinal numbers have several different representations such as integer notation, decimal notation, degree notation, percentile notation and name. The most common representation is integer notation, which is assigned according to the order in which a satoshi was mined. More recently people have begun to experiment and explore the satoshi name representation. Danny Deezy, a bitcoin developer and inscriber has been pushing the boundaries of the sat name meta with launch of his collection Satoshi Cards. Satoshi Cards is a collection of trading card style artwork that is inscribed on satoshis with human readable words or phrases.

Source: Ordinals.com

Conclusion

Bitcoin is one of the top three blockchains next to Ethereum and Solana for NFT mints and trading activity. Ordinals, including BRC-20's, are on pace to accumulate ~$725m in trading volume by the end of 2023. The sustained growth in adoption and value for Ordinals in recent months has been supported by new developments and tooling for Ordinals.

One of the most exciting innovations for Ordinals has been recursive inscriptions, which have created a new framework for NFT creators to expand their digital collections in a cost-effective way. New types of collections and file types on Bitcoin are likely to emerge from recursive inscriptions. In addition to recursion, techniques like envelopes and parent child inscriptions are redefining ways to index and prove the provenance of Ordinals.

The backlog of transactions in the mempool in part due to ongoing Ordinals minting activity will likely exasperate transaction fee volatility which could be positive for miners especially as the Bitcoin halving nears and may encourage the adoption of more sophisticated fee estimation strategies by crypto wallets and exchanges. Miners and mining pools are also embracing Ordinals through the collection and sale of rare sats.

The Ordinals movement is catalyzing a revolutionary period of unprecedented innovation for Bitcoin, spawning a diverse range of new products that harness the blockchain's untapped potential for general purpose computation. Looking ahead, the path for Ordinals is not only promising but delineated by a maturation in infrastructure and an uptrend in adoption. This sustained momentum substantiates the notion that Ordinals is not a transient trend, but a permanent fixture in the on-chain digital collectibles realm.

Legal Disclosure:

This document, and the information contained herein, has been provided to you by Galaxy Digital Holdings LP and its affiliates (“Galaxy Digital”) solely for informational purposes. This document may not be reproduced or redistributed in whole or in part, in any format, without the express written approval of Galaxy Digital. Neither the information, nor any opinion contained in this document, constitutes an offer to buy or sell, or a solicitation of an offer to buy or sell, any advisory services, securities, futures, options or other financial instruments or to participate in any advisory services or trading strategy. Nothing contained in this document constitutes investment, legal or tax advice or is an endorsementof any of the digital assets or companies mentioned herein. You should make your own investigations and evaluations of the information herein. Any decisions based on information contained in this document are the sole responsibility of the reader. Certain statements in this document reflect Galaxy Digital’s views, estimates, opinions or predictions (which may be based on proprietary models and assumptions, including, in particular, Galaxy Digital’s views on the current and future market for certain digital assets), and there is no guarantee that these views, estimates, opinions or predictions are currently accurate or that they will be ultimately realized. To the extent these assumptions or models are not correct or circumstances change, the actual performance may vary substantially from, and be less than, the estimates included herein. None of Galaxy Digital nor any of its affiliates, shareholders, partners, members, directors, officers, management, employees or representatives makes any representation or warranty, express or implied, as to the accuracy or completeness of any of the information or any other information (whether communicated in written or oral form) transmitted or made available to you. Each of the aforementioned parties expressly disclaims any and all liability relating to or resulting from the use of this information. Certain information contained herein (including financial information) has been obtained from published and non-published sources. Such information has not been independently verified by Galaxy Digital and, Galaxy Digital, does not assume responsibility for the accuracy of such information. Affiliates of Galaxy Digital may have owned or may own investments in some of the digital assets and protocols discussed in this document. Except where otherwise indicated, the information in this document is based on matters as they exist as of the date of preparation and not as of any future date, and will not be updated or otherwise revised to reflect information that subsequently becomes available, or circumstances existing or changes occurring after the date hereof. This document provides links to other Websites that we think might be of interest to you. Please note that when you click on one of these links, you may be moving to a provider’s website that is not associated with Galaxy Digital. These linked sites and their providers are not controlled by us, and we are not responsible for the contents or the proper operation of any linked site. The inclusion of any link does not imply our endorsement or our adoption of the statements therein. We encourage you to read the terms of use and privacy statements of these linked sites as their policies may differ from ours. The foregoing does not constitute a “research report” as defined by FINRA Rule 2241 or a “debt research report” as defined by FINRA Rule 2242 and was not prepared by Galaxy Digital Partners LLC. For all inquiries, please email [email protected]. ©Copyright Galaxy Digital Holdings LP 2023. All rights reserved.