Crypto & Blockchain Venture Capital – Q1 2024

Introduction

Bitcoin and the broader liquid cryptocurrency market rose dramatically in Q1 2024, leading to renewed optimism across the sector. The crypto venture capital market appears to be rebounding, although based on available information at the time of writing in mid-April, the data seems slightly more lackluster than sentiment. Broadly, founders and investors are reporting a more active fundraising environment than prior quarters. After 3 consecutive quarters of declining deal count and capital invested, both rose in Q1. While the uplift in liquid crypto markets can buoy sentiment in the venture world, the respite from high interest rates sought at the beginning of the year does not appear likely to occur. Stubborn inflation data, coupled with a generally strong U.S. economy, has led to a deluge of hawkish language from officials at the Federal Reserve and, accordingly, futures markets have reduced the expectations for rate cuts in 2024 to 1-2 cuts, down from 7 cuts that were expected in January of this year. Higher interest rates will continue to pose a challenge to venture funds seeking to raise capital and, therefore, startups seeking investment from those funds.

Deal count was up more than 50% QoQ, but capital invested was up only 29%. Categories capturing notable amounts venture attention include Bitcoin layer 2s, infrastructure like re-staking and developer tools, and gaming. Deal sizes are flat QoQ but valuations are up almost 100%, suggesting that capital remains tight but founders were able to capitalize on improved market sentiment to raise with less dilution.

Crypto VC Investing

Deal Count & Capital Invested

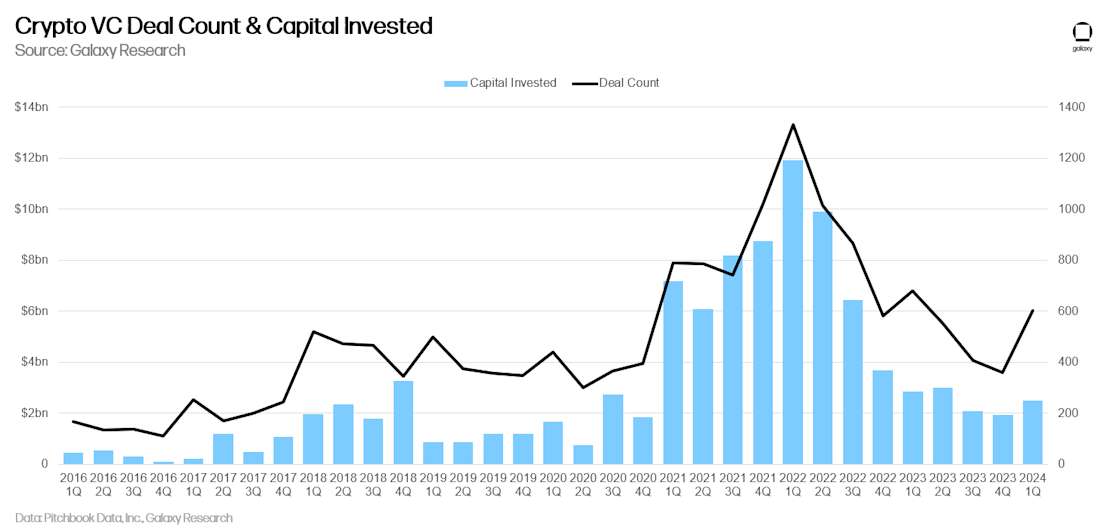

In Q1 2024, venture capitalists invested $2.49bn (+29% QoQ) into crypto and blockchain-focused companies across 603 deals (+68% QoQ).

This was the first rise in both capital invested and deal count in 3 quarters, perhaps signaling that Q4 2023 was the “bottom,” although a continuation of QoQ increases – and a more meaningful increase – would confirm that over the coming quarters.

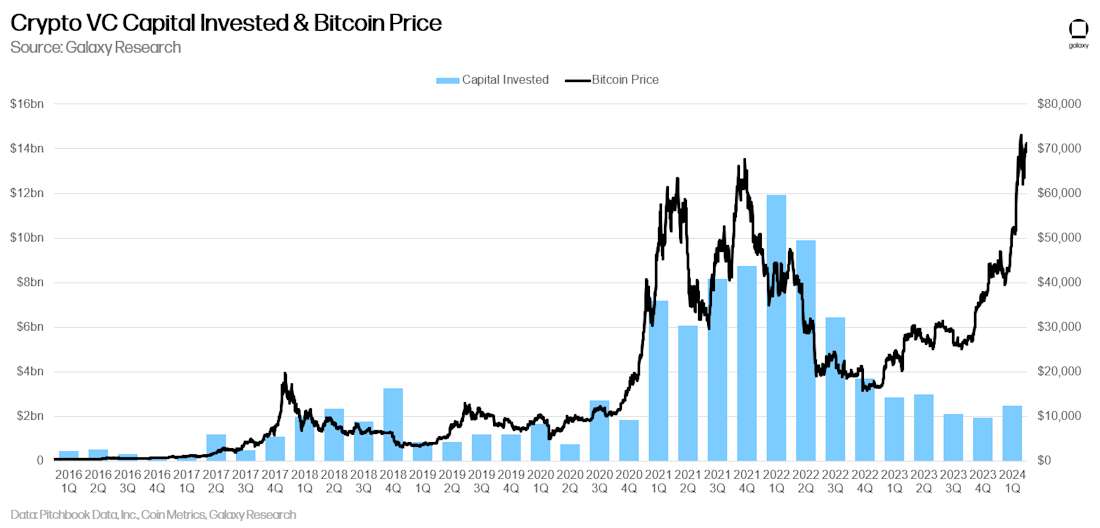

Capital Invested & Bitcoin Price

While venture capital investment in the crypto sector has typically correlated to the Bitcoin price, that correlation has broken down over the past year, with bitcoin rising significantly since January 2023 but VC activity mostly languishing. Q1 2024 saw a significant rise in BTC, and while capital invested also rose, the investment activity is still nowhere near the levels when Bitcoin last traded over $60k. The combination of crypto industry-native catalysts (Bitcoin ETFs, new areas like restaking, modularity, Bitcoin L2s, etc) and macro headwinds (rates) contributed to the notable divergence.

VC Investment by Stage

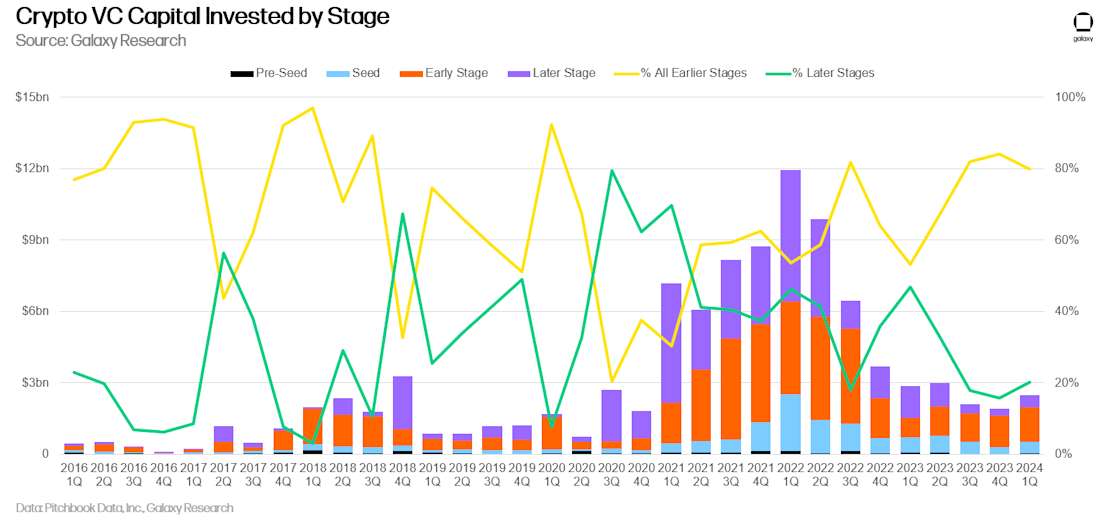

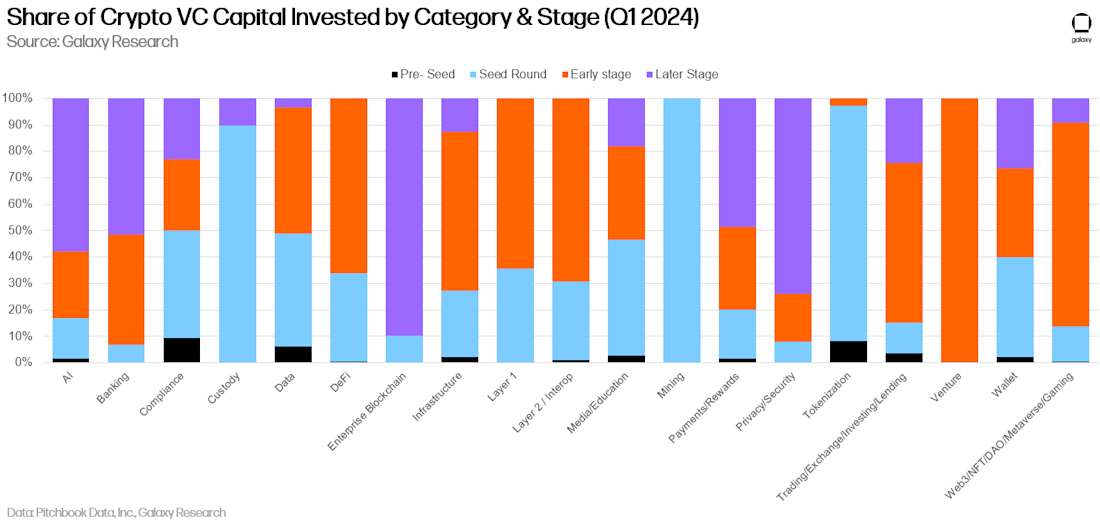

In Q1 2024, about 80% of the capital went to early-stage companies, while 20% went to later stage companies. Because crypto-focused early-stage venture funds have remained active, and many are still sitting on dry powder from their own fundraises in 2021 and 2022, compelling early-stage firms are still able to source funding. But many large generalist venture capital firms have exited the sector, or dramatically reduced their exposure, making it more difficult for later stage startups to raise.

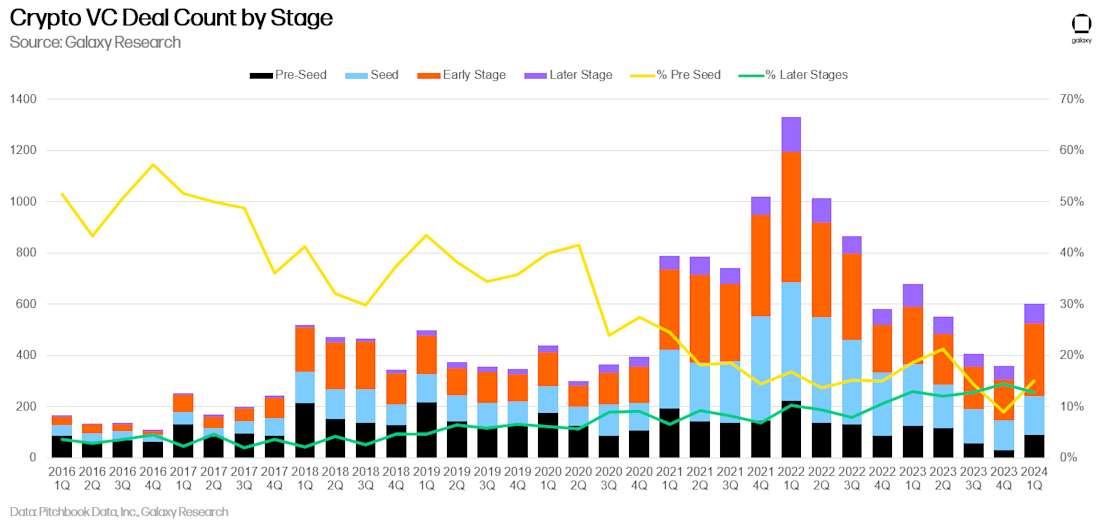

On the deal side, share of pre-seed deals increased modestly in Q1, suggesting some growth in newly founded startups.

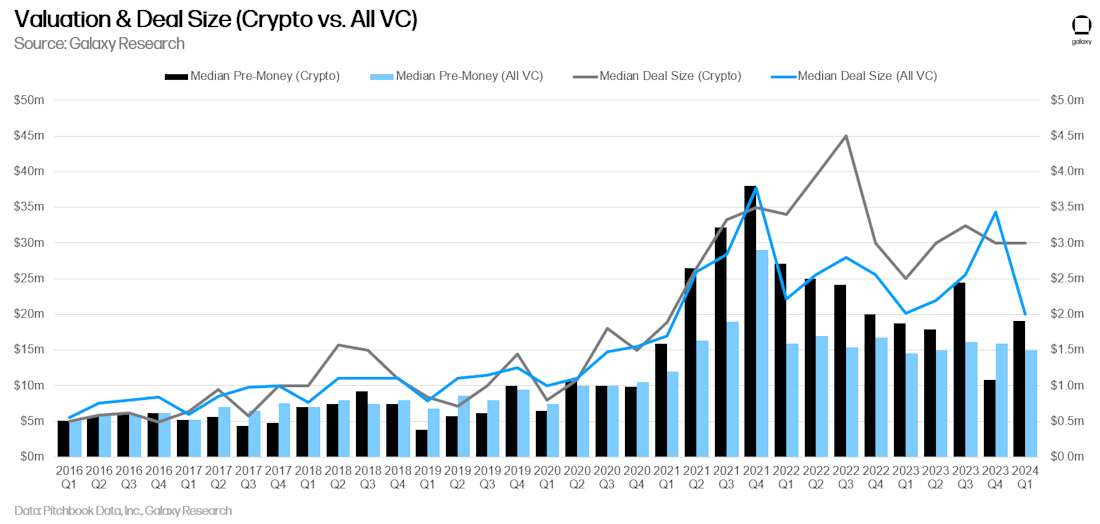

Valuation & Deal Size

VC-backed crypto company valuations declined significantly in 2023, with Q4 reaching the lowest median pre-money valuation since Q4 2020. However, valuations rebounded in Q1 2024 even as median deal size held steady QoQ. The data suggests founders were able to raise the same capital but with less dilution vs. the last quarter of 2023. Meanwhile, the dynamic across the overall venture complex was the opposite – deal sizes dropped 50% QoQ while median pre-money valuations remained mostly flat, suggesting founders were having to sell more equity to raise the same capital. The increase in valuations likely stems from the uplift in sentiment during Q1 – despite the lack of significantly more capital, founders were able to capitalize on improving sentiment to command higher valuations.

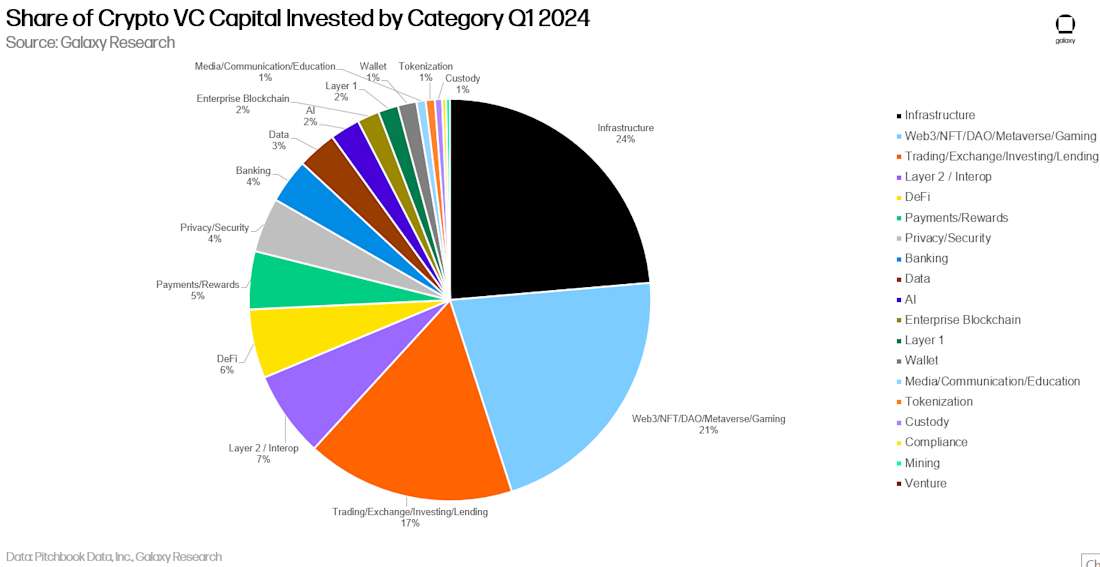

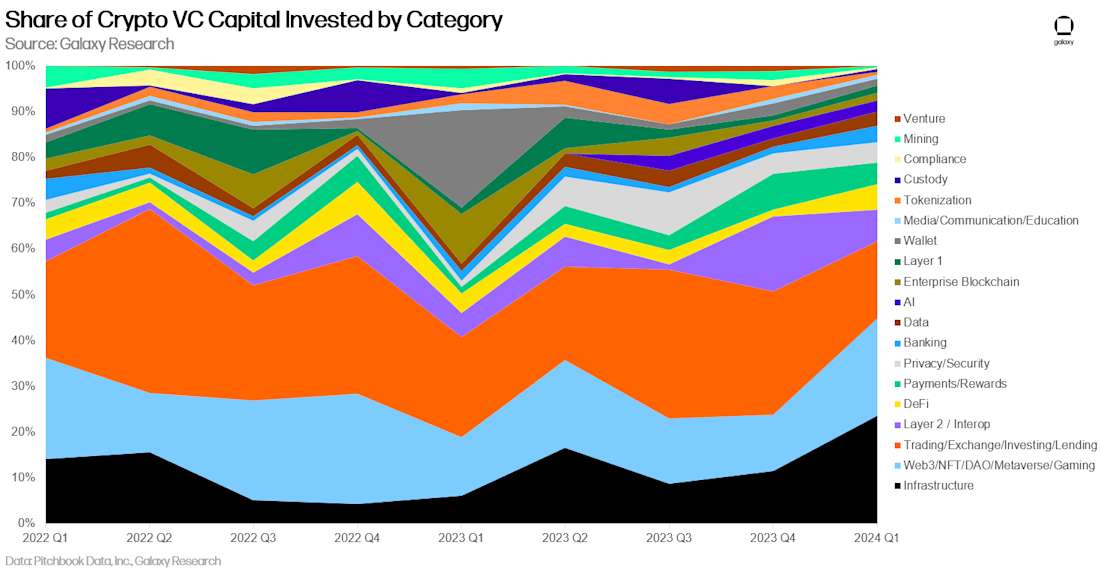

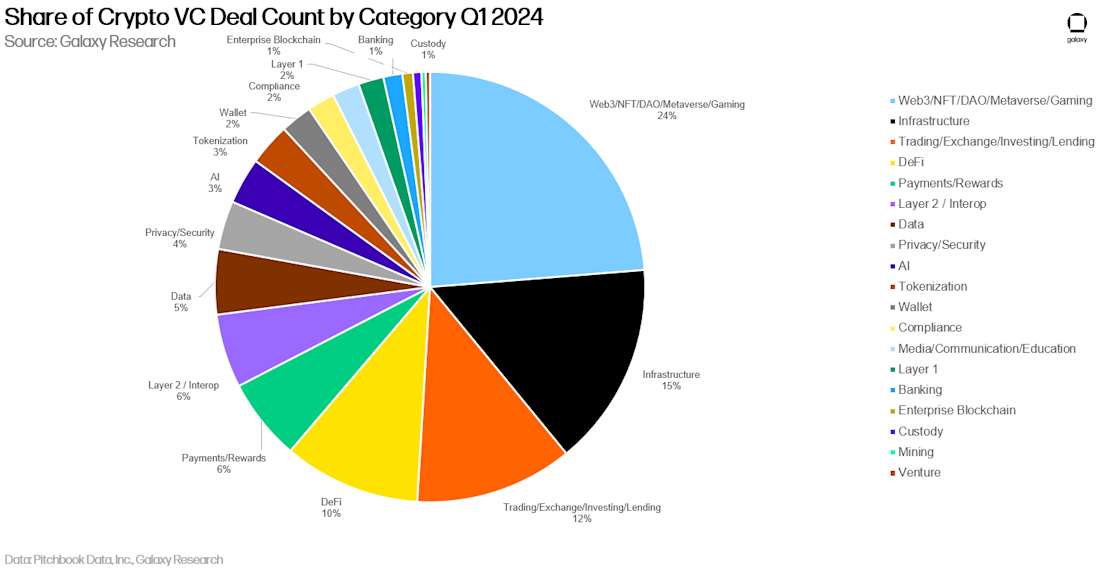

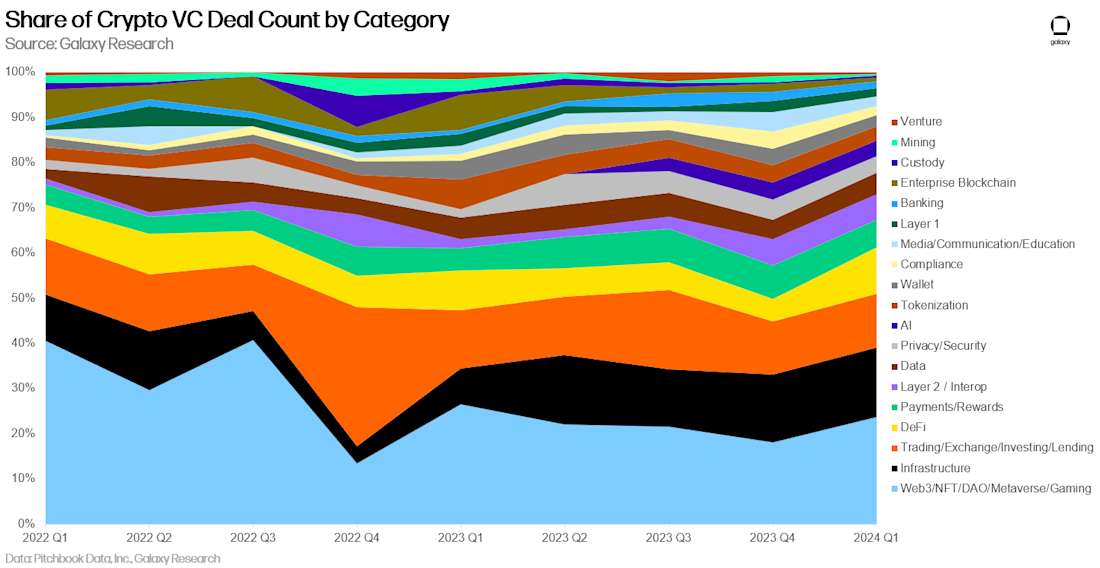

Investment by Category

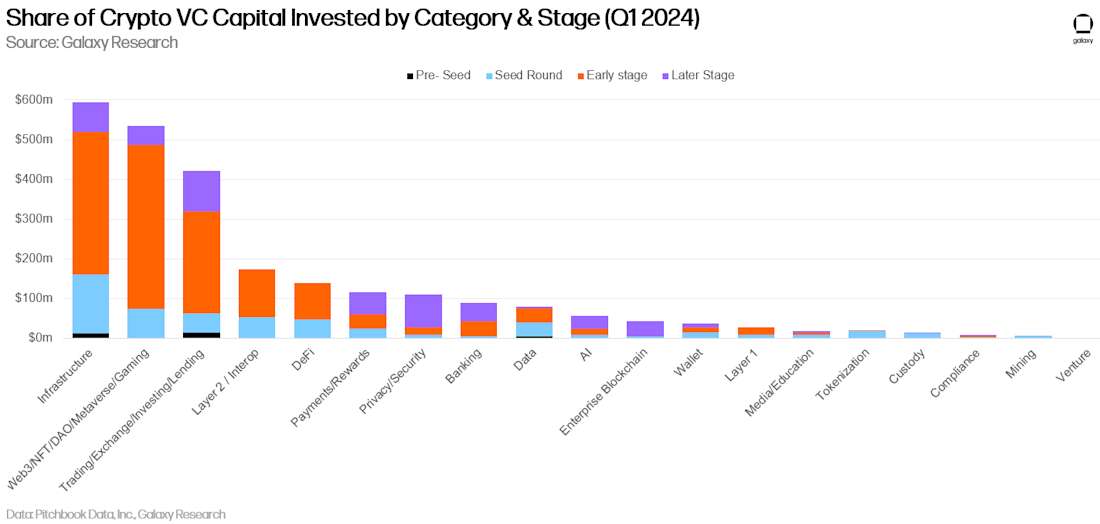

Companies and projects building in the “Infrastructure” category raised the largest share of crypto VC capital in Q1 2024 (24%), led by EigenLayer’s $100m fundraise.

Web3 and Trading companies followed behind with 21% and 17% of capital invested, respectively.

In terms of deal count, Web3 led the way with 24%, largely driven by an uptick in gaming-related deals.

Infrastructure and Trading followed with 15% and 12% of all deals completed in Q1 2024.

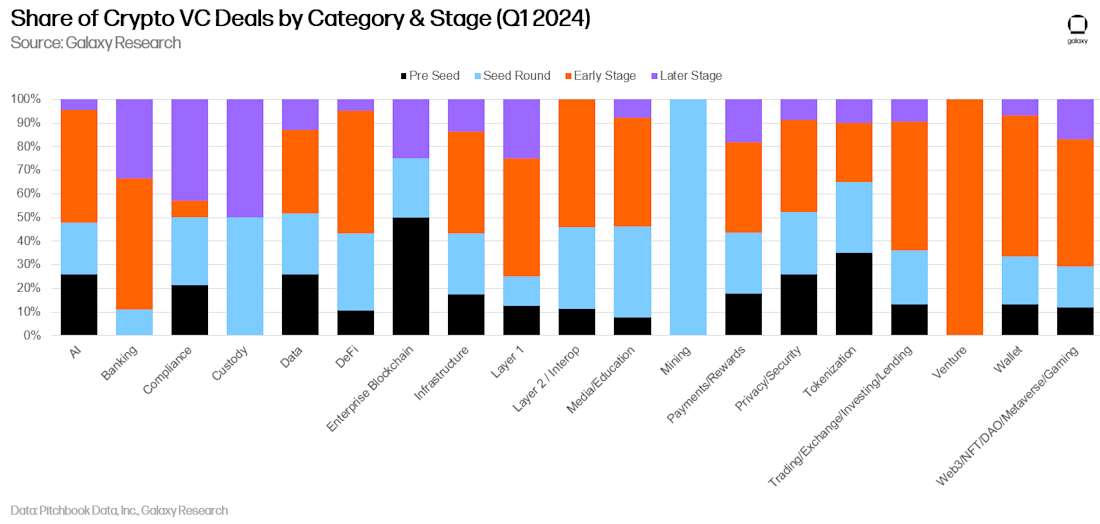

Investment by Stage & Category

Breaking down capital invested and deal count by category and stage gives a clearer picture of what types of companies in each category are raising funds. The vast majority of capital in the Infrastructure, Web3, and Trading categories went to early-stage companies and projects.

Examining by share of capital invested by stage in each category gives an idea of the maturity of each investable category in the eyes of investors.

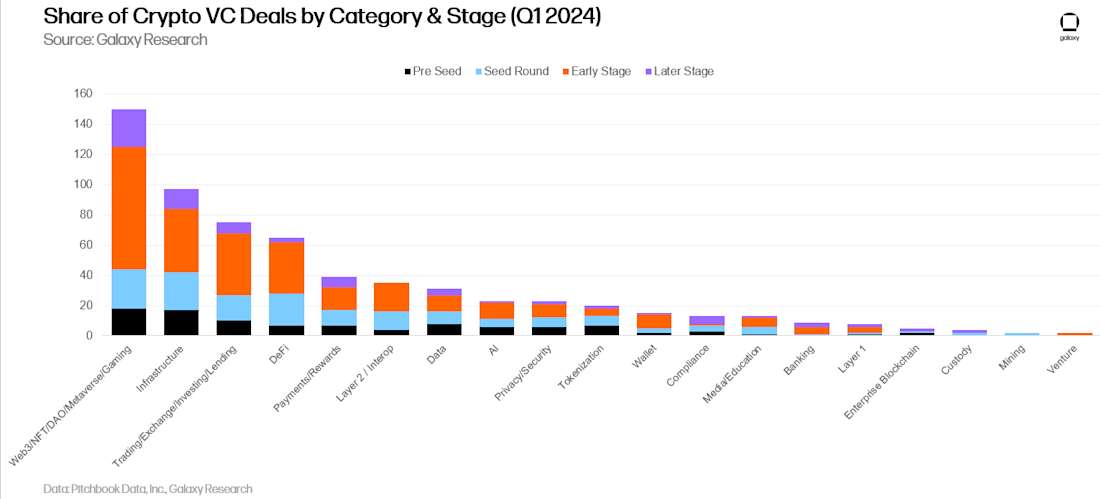

Deal count tells a similar story. Large portions of deals completed in essentially all categories involved early-stage companies and projects.

Examining the share of deals done by stage in each categories offers insight into the various stages of each investable category.

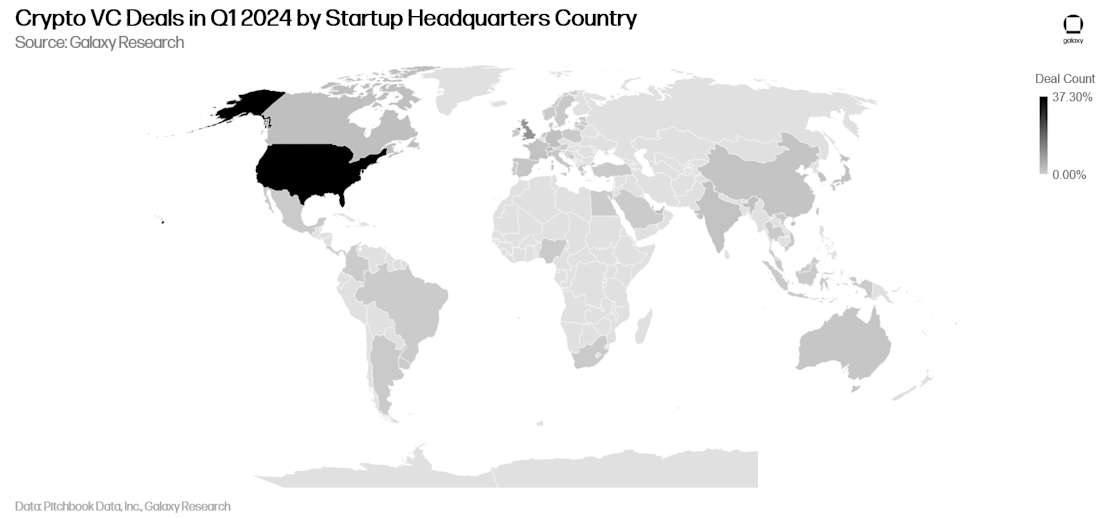

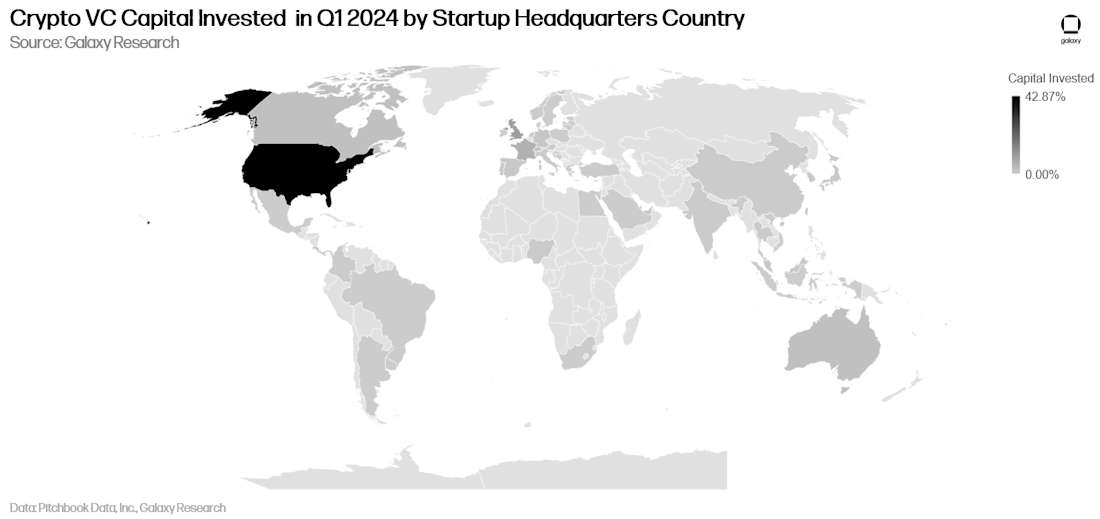

Investment by Geographic Location

Despite a tricky regulatory environment, companies headquartered in the United States continue to complete the most fundraising deals and raise the most capital from venture capitalists. In Q1 2024, more than 37.3% of all deals involved a company headquartered in the United States. Singapore had 10.8%, the United Kingdom had 10.2%, Switzerland had 3.5%, and Hong Kong had 3.2%.

Companies headquartered in the United States pulled in 42.9% of all VC capital invested. Singapore had 11.1%, the United Kingdom had 9.7%, Hong Kong had 7.9%, and France had 5.6%.

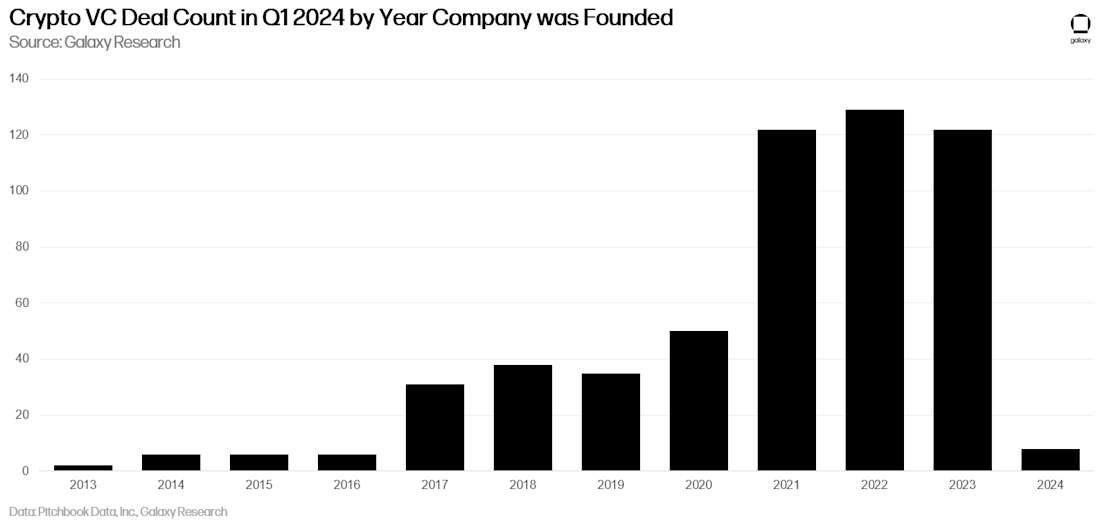

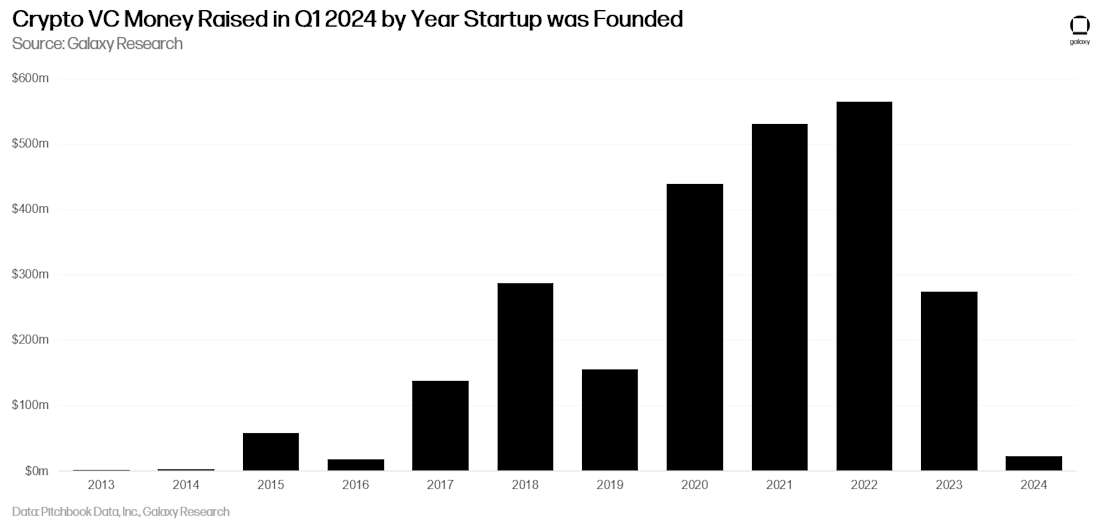

Investment by Cohort

The vast majority of deals completed in Q1 2024 involved startups founded in 2021-2023, which makes sense given that 2024 has only just started.

In terms of capital raised, companies founded from 2020-2022 garnered the most investment.

Crypto VC Fundraising

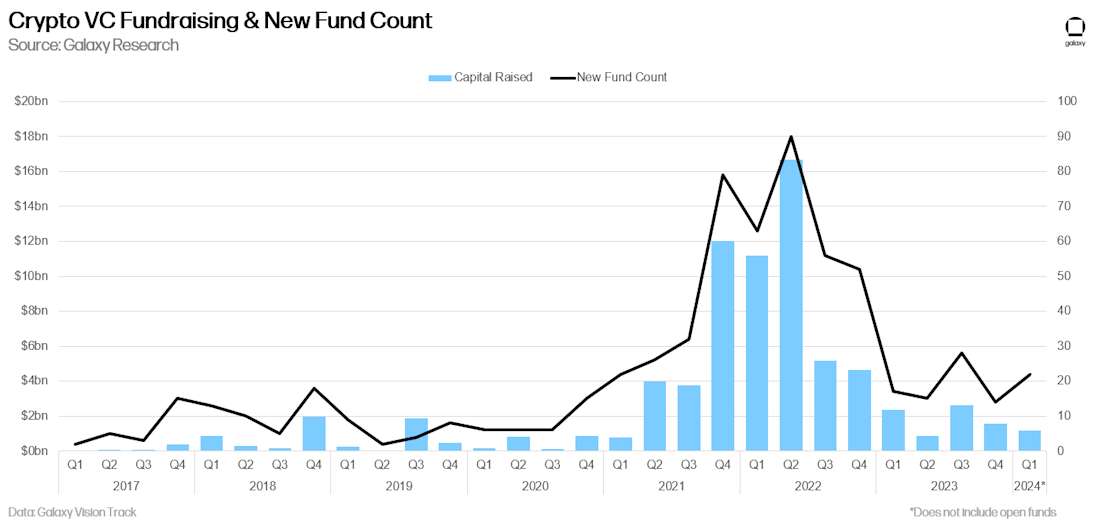

Fundraising for crypto venture funds continues to be challenging. The macro environment and turmoil in the crypto market infrastructure combined to dissuade some allocators from making the same level of commitments to crypto that they did in 2021 and 2022. At the start of 2024, investors widely believed that rates would come down significantly over 2024, but throughout Q1, strong inflation data has tempered expectations for rate cuts this year, which has helped maintain a difficult fundraising environment for venture capitalists. While total capital allocated to crypto VC funds declined QoQ, the number of new funds was higher, with at least 22 new funds announced.

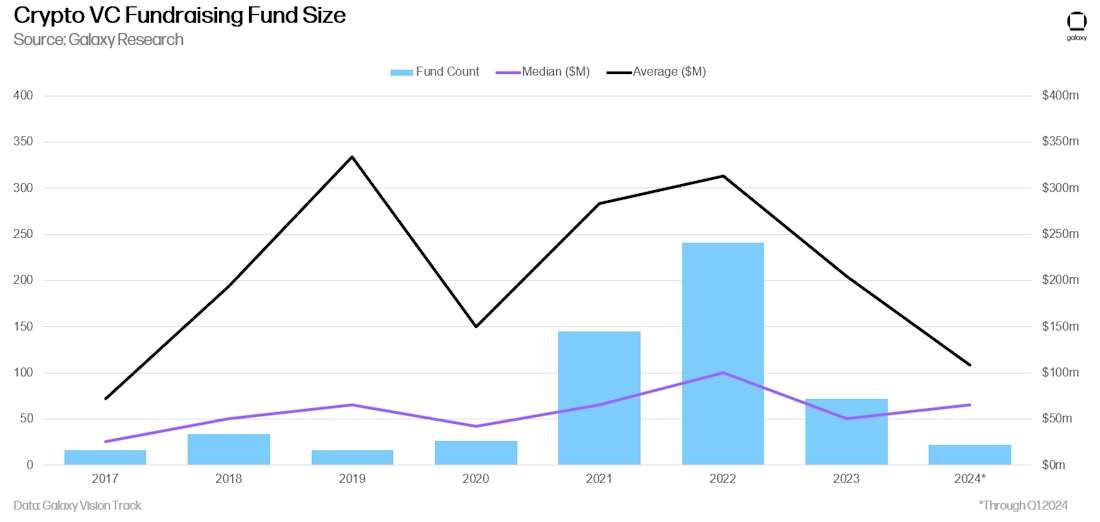

On an annual basis, the average fund size continues to decline in 2024, although median is ticking up slightly.

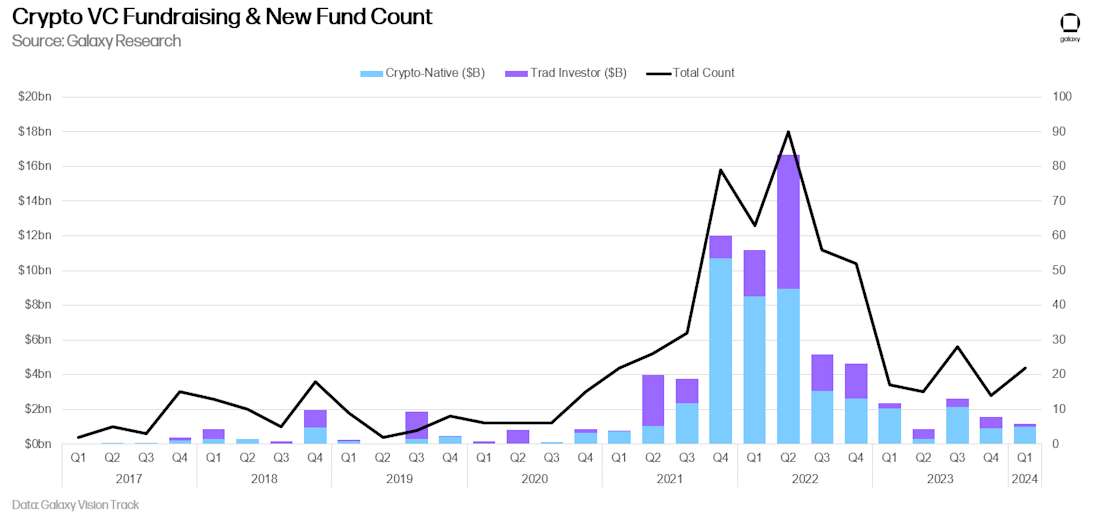

In terms of the source of allocator flows, crypto-focused funds are still struggling to raise from traditional allocators, who made up a tiny portion of new funds allocated in Q1.

Key Takeaways

Sentiment and activity are improving but still well below levels seen during prior bull markets. While digital asset markets recovered significantly from the 2023 lows, venture dollars have notably lagged. Prior bull runs, such as 2017 and 2021, featured a high correlation between VC dollars invested and liquid crypto asset prices, but in 2023 and 2024, venture capital invested has remained well below prior levels while cryptos have rallied. The venture stagnation is due to a number of factors, high rates environment dampening risk appetite, a remaining hangover in crypto appetite after the blowups of 2022, and perhaps also the lack of sufficient later stage companies capable of taking in large venture checks. Thus, by both capital and deal count, earlier stage companies garnered the largest share of venture activity. Indeed, although total capital invested only rose modestly QoQ, deal count was up 50%, with the majority of these deals occurring at Series A or earlier.

Early-stage deals led the way in Q1. The continuing interest in early-stage deals bodes well for the long term health of the broader cryptocurrency ecosystem. While later stage companies have struggled to raise capital, entrepreneurs are finding willing investors for new, innovative ideas. Projects and companies building scaling solutions, games, tools and services at the intersection of AI and crypto.

Bitcoin ETFs could pressure funds and startups. The launch of spot-based Bitcoin ETFs in the United States offer an easy way for investors of all sizes to access BTC exposure. While liquid BTC is obviously not identical to crypto startup investing, it may satisfy the appetite from some subsector of investors and allocators for exposure to the cryptocurrency ecosystem. The ETFs are regulated, available on almost all brokerage platforms, low-fee, and highly liquid. It’s possible that Bitcoin ETFs will also challenge crypto-linked equities that have served as an outlet for exposure to the sector in the past.

Bitcoin Layer 2 projects garnered significant interest from venture investors. One of the most concentrated bets by crypto VCs in Q1 2024 was to invest in Bitcoin Layer 2 projects. The advent of Ordinals on Bitcoin in 2023, the subsequently created BRC-20 token standard, and now the Runes token standard, have helped drive interest in thinking of Bitcoin as a platform network, not just a monetary network. Dozens of teams have emerged attempting to build new types of second layer networks on Bitcoin, many of them relying on and utilizing layered-scaling technologies developed in the Ethereum ecosystem (i.e., optimistic rollups, zk rollups, re-staking primitives, bridging protocols, etc.), and venture investors have poured money into these deals.

Web3 and Trading categories still dominate deal count and capital, but infrastructure plays have also surged. By both capital raised and deals completed, the Web3 and Trading categories still lead the way, but in Q1 2024 “infrastructure” was actually #1 in capital and #2 in deals. This category is admittedly broad (all three of these categories are broad), but the Infrastructure category broadly includes staking, re-staking, platform tools, sequencing services, or other tooling for blockchain developers and users. EigenLayer’s $100m financing round led the way in Infrastructure capital invested.

Fund managers still face a difficult environment, though new, smaller funds have begun seeing some fundraising success. The number of new funds launched grew QoQ to 22 in Q1, though the total capital allocated to crypto-focused venture fund managers continued to decline. Understandably, the average fund size ($108m) is down QoQ while the median fund size ($65m) is up only slightly. As discussed above, crypto-focused venture funds have struggled to raise since 2022 following the blowups of several venture-backed crypto firms and rising US interest rates, which have dampened allocator risk appetite. Should liquid crypto prices and adoption continue to grow, and if some big name venture funds succeed in raising large hauls, we expect the venture market to again loosen and managers to find more success.

The United States continues to dominate the crypto startup ecosystem. While the US is maintaining clear leads in deals and capital, regulatory headwinds in the U.S. could force more companies abroad. Policymakers should be conscious of how their actions or inaction could impact the cryptocurrency and blockchain ecosystem if the U.S. is to remain the center of technological innovation long term.

Legal Disclosure:

This document, and the information contained herein, has been provided to you by Galaxy Digital Holdings LP and its affiliates (“Galaxy Digital”) solely for informational purposes. This document may not be reproduced or redistributed in whole or in part, in any format, without the express written approval of Galaxy Digital. Neither the information, nor any opinion contained in this document, constitutes an offer to buy or sell, or a solicitation of an offer to buy or sell, any advisory services, securities, futures, options or other financial instruments or to participate in any advisory services or trading strategy. Nothing contained in this document constitutes investment, legal or tax advice or is an endorsementof any of the digital assets or companies mentioned herein. You should make your own investigations and evaluations of the information herein. Any decisions based on information contained in this document are the sole responsibility of the reader. Certain statements in this document reflect Galaxy Digital’s views, estimates, opinions or predictions (which may be based on proprietary models and assumptions, including, in particular, Galaxy Digital’s views on the current and future market for certain digital assets), and there is no guarantee that these views, estimates, opinions or predictions are currently accurate or that they will be ultimately realized. To the extent these assumptions or models are not correct or circumstances change, the actual performance may vary substantially from, and be less than, the estimates included herein. None of Galaxy Digital nor any of its affiliates, shareholders, partners, members, directors, officers, management, employees or representatives makes any representation or warranty, express or implied, as to the accuracy or completeness of any of the information or any other information (whether communicated in written or oral form) transmitted or made available to you. Each of the aforementioned parties expressly disclaims any and all liability relating to or resulting from the use of this information. Certain information contained herein (including financial information) has been obtained from published and non-published sources. Such information has not been independently verified by Galaxy Digital and, Galaxy Digital, does not assume responsibility for the accuracy of such information. Affiliates of Galaxy Digital may have owned or may own investments in some of the digital assets and protocols discussed in this document. Except where otherwise indicated, the information in this document is based on matters as they exist as of the date of preparation and not as of any future date, and will not be updated or otherwise revised to reflect information that subsequently becomes available, or circumstances existing or changes occurring after the date hereof. This document provides links to other Websites that we think might be of interest to you. Please note that when you click on one of these links, you may be moving to a provider’s website that is not associated with Galaxy Digital. These linked sites and their providers are not controlled by us, and we are not responsible for the contents or the proper operation of any linked site. The inclusion of any link does not imply our endorsement or our adoption of the statements therein. We encourage you to read the terms of use and privacy statements of these linked sites as their policies may differ from ours. The foregoing does not constitute a “research report” as defined by FINRA Rule 2241 or a “debt research report” as defined by FINRA Rule 2242 and was not prepared by Galaxy Digital Partners LLC. For all inquiries, please email [email protected]. ©Copyright Galaxy Digital Holdings LP 2024. All rights reserved.