Editor’s Note: Our Ready Layer One series provides deep dives into the fundamentals of important general computation blockchains. Read our foundational report, Ready Layer One: Ethereum & Its Competitors, for a starting point on our thesis surrounding these smart contract chains. While we did not include Cosmos and its ecosystem in our foundational report due to our view that it is not strictly a “Layer 1” blockchain, but rather an “internet of blockchains,” we nonetheless believe that Cosmos and its ecosystem deserve full treatment given its technical merits, design differentiation, and growth. Read our reports on Solana (SOL) and Avalanche (AVAX) as well.

Introduction

Commonly referred to as the “internet of blockchains,” Cosmos is an ecosystem composed of the Cosmos SDK toolkit and IBC, a cross-chain messaging protocol. Blockchains built within the Cosmos ecosystem can each perform thousands of transactions per second, allowing the broader Cosmos network to scale linearly and allocate guaranteed throughput for applications built on sovereign blockchains. Today, the Cosmos ecosystem secures and facilitates the transfers of $60+ billion dollars in value across 50+ blockchains. Despite its technological prowess, however, Cosmos does not accrue significant value from use of its whole ecosystem to its ATOM token, which keeps it truly decentralized, but creates a strain on developer funding.

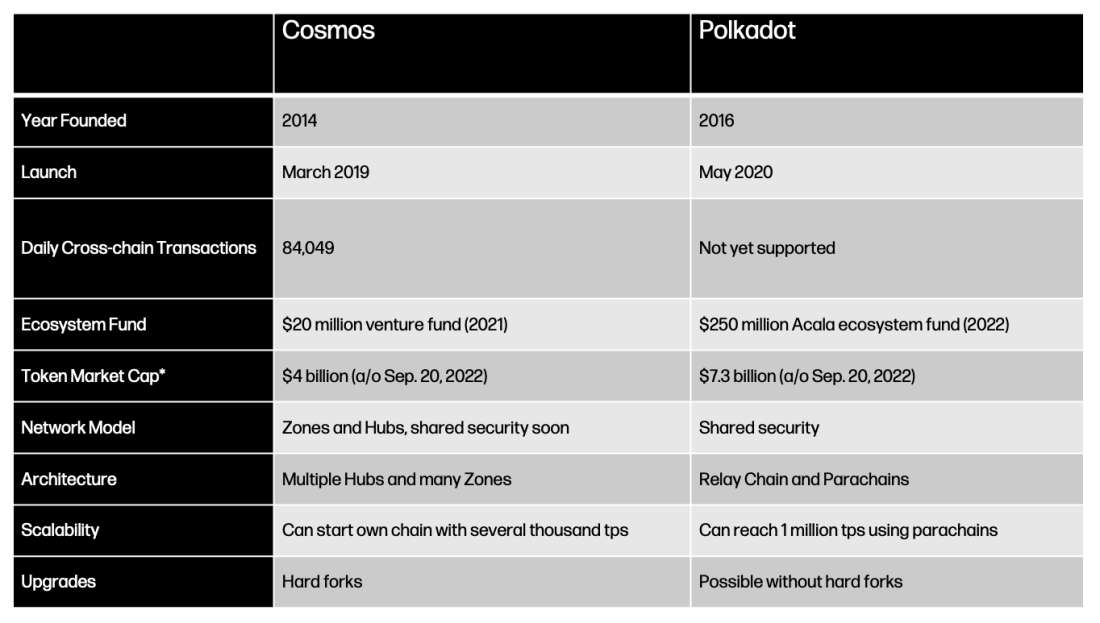

Cosmos dates back to 2014, when Jae Kwon, a developer and entrepreneur with more than 10 years of experience in application development, published the Tendermint whitepaper. Soon after, Jae founded All in Bits Inc., which built the foundations of the Cosmos we know today. Over time, despite the perceived success of the project, there have been changes in leadership and tensions between the different teams, which often led to inconsistent messaging and likely hindered adoption.

The Cosmos ecosystem we see today is distinct from others like Ethereum, BNB Chain, Solana, and Avalanche. These differences boil down to simplicity, flexibility, and features unique to the Cosmos SDK. Cosmos is home to dozens of application-specific and application-agnostic blockchains, such as Cosmos Hub, Osmosis, Axelar, Juno, Evmos, Cronos, Secret Network, Kava, Akash, and Terra 2.0. Each of these blockchains bring unique features like packet routing, LP staking, EVM compatibility with chain-native bridges, Rust smart contracts, and algorithmic stablecoins. The heterogeneity of technical approaches leveraged by projects in the Cosmos ecosystem is what makes it stand out in comparison to other Layer 1 protocols.

In terms of user experience, Cosmos’s primary advantage is that it allows users to onboard from other chains without requiring centralized intermediaries. The plethora of wallets available for users to choose from allows them to take full control of their funds and perform actions like staking right from the wallet interface, reducing front-end risks of interfacing with applications.

With the introduction of Interchain Accounts and the upcoming release of Interchain Security, the ecosystem will become significantly more composable and will offer an even more enriched user experience. The teased revamp of ATOM tokenomics may bring further utility and value accrual to the Cosmos ecosystem, which may incentivize adoption from profit-seeking users.

Background & History

Who is Jae Kwon?

Prior to co-founding Tendermint Inc., a core contributor to the Cosmos Network, Jae Kwon spent many years working on various startups and open-source projects. After graduating from Cornell University in 2005 with a bachelor’s degree in Computer Science, he started off working for Amazon on their web services team. He worked there for 2 years, developing the Alexa Web Search Platform, a tool to create search engines, and the Alexa Web Thumbnail Service, an API for creating website thumbnails. In 2007, Jae joined Yelp as the lead on their mobile development team and successfully launched what would become one of the most well-known platforms for crowd-sourced reviews about businesses.

After leaving Yelp in April of 2009, Jae “got the startup bug” and spent several years as an entrepreneur, founding different startups and looking for the industry which he’d want to stay in long-term. In 2011, Jae co-founded iDoneThis, a productivity app which tracked daily activities via email. iDoneThis was incubated by AngelPad, a seed-stage accelerator program founded in 2010 by former Google employees. After iDoneThis, Jae went on to work on several open-source projects, including a CoffeeScript compiler/interpreter developed in JavaScript, an email service with end-to-end encryption called Scramble.io, and a cryptocurrency exchange. Working on open-source codebases, language compilation, and communication encryption allowed Jae to build up a skill set applicable to the then nascent cryptocurrency market. Jae’s expertise in JavaScript and npm, the JavaScript package manager which significantly simplifies development, inspired him to build a generalizable framework for blockchain development that was easier for developers to onboard into compared to other projects. This is what motivated him to eventually create Tendermint and the Cosmos SDK.

The Early Days of Cosmos

The concept of a Proof-of-Stake blockchain with a Byzantine Fault-Tolerant consensus dates back to 2014, when Jae Kwon published a paper proposing Tendermint, a blockchain which achieves consensus without mining. Following the release of the whitepaper, Jae joined forces with Ethan Buchman, who he met at the Cryptocurrency Research Group and Crypto-economics Conference, and founded Ignite (formerly known as Tendermint Inc. and All in Bits Inc.), which focused on building tooling for distributed networks. In 2015, All in Bits Inc implemented the EVM on top of their proposed Tendermint BFT consensus, calling it Ethermint.

Following the success of Ethermint, in 2016 Jae Kwon and Ethan Buchman published the whitepaper for Cosmos, A Network of Distributed Ledgers. The team went on to win the Shanghai Blockchain Week “Most Innovative Project”, which attracted a lot of attention to their technology. Subsequently, they formed the Interchain Foundation (ICF) to support the development of Cosmos and its ecosystem.

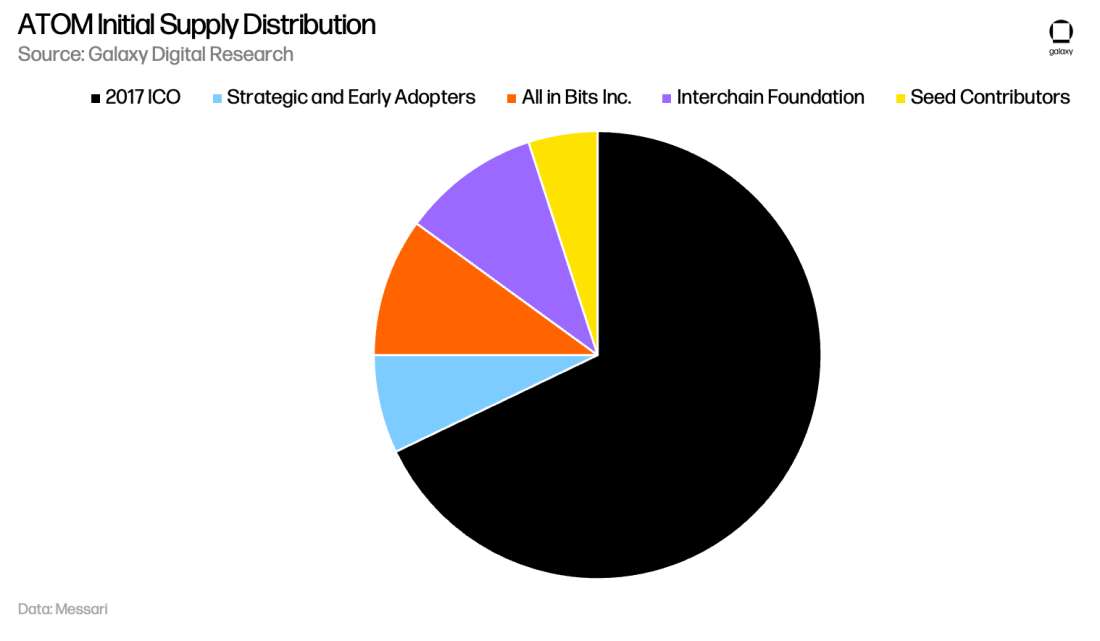

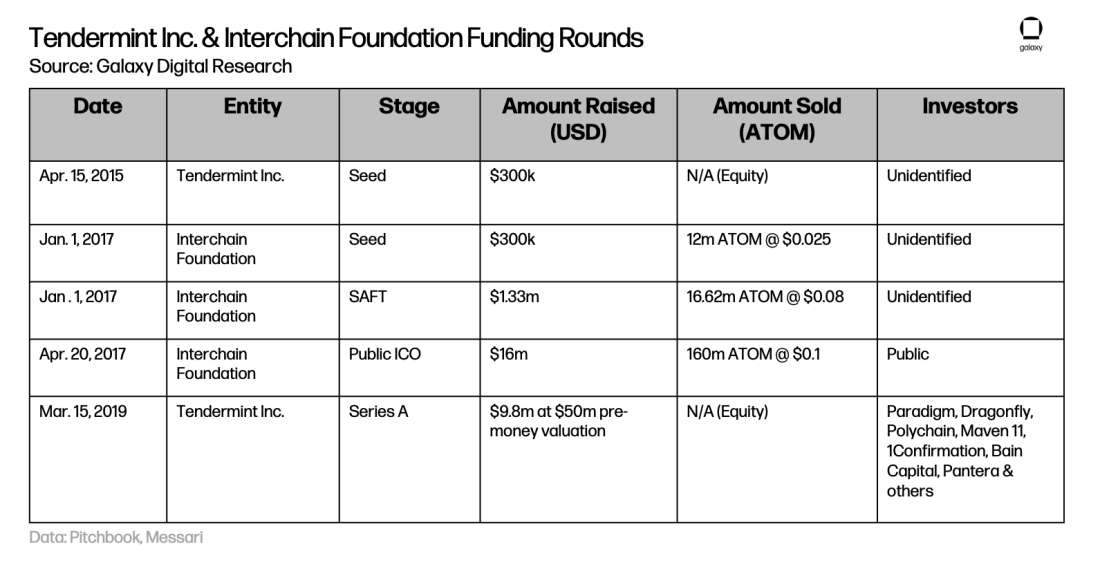

In April 2017, Cosmos conducted an Initial Coin Offering (ICO), during which they sold 67.9% of the initial supply in exchange for $16.8 million in BTC or ETH, raising the full amount within 30 minutes. Strategic and early adopters received 7.1% of the initial supply, seed contributors received 5%, All in Bits Inc. received 10%, and the Interchain Foundation received 10%. At genesis, 236 million ATOM tokens were allocated to just under one thousand accounts. The Cosmos ICO has been cited as one of the most successful blockchain-based fundraising events in history.

Throughout 2018, Tendermint Inc. significantly advanced the development of the Cosmos Network. Specifically, Tendermint Inc. pioneered the concept of Inter-Blockchain Communication (IBC), the cross-chain communication protocol of Cosmos. Over 20 testnets were launched, with each one releasing novel or optimized software and implementing additional features. The Gaia-6001 testnet, for instance, was the first Cosmos testnet to launch in a decentralized and asynchronous fashion, meaning that the community validators were able to independently connect to the network and begin participating in the consensus. Gaia-8001 built upon this success and was the first testnet to reach 1 million blocks after running steadily for over 3 months.

Cosmos Hub, a router chain which connects other blockchains (zones) in the Cosmos Network, was successfully launched on March 13, 2019. The next day, Tendermint Inc. announced a $10 million Series A funding round led by Paradigm with participation from Bain Capital, 1confirmation, and others. Since then, over 200 projects have used Tendermint and the Cosmos SDK to launch their blockchain applications, out of which 72 are connected to the Cosmos Hub through the Inter-Blockchain Communication Protocol (IBC). Notable projects built on top of the technology developed by Ignite include Polygon, BNB Chain, THORChain, and Terra.

Tensions in the Cosmos

Despite the technological and financial success of the project, in early 2020, following a dispute with some of Tendermint employees, Jae Kwon stepped down as CEO of Tendermint Inc. to focus on GNO Land. GNO Land is a Tendermint BFT dPoS network that aims to create a network which can host multithreaded smart contracts by optimizing the consensus process between validators and taking advantage of multi-core processors. The network is currently in its second testnet and has at least two more iterations before going to mainnet.

According to CoinDesk, employees of the company had come to find his behavior untenable. Zaki Manian, director of Tendermint Labs, made his stance public in a Twitter thread, mentioning that Kwon has been neglecting IBC, that he has subjected internal communication channels to abusive rants, and that his reputation was creating problems with hiring and retaining talent. Since 2020, Jae Kwon has claimed several times on Twitter that other core contributors to the Cosmos ecosystem, Zaki Manian, Jack Zampolin, and his co-founder Ethan Buchman, are conspiring to push him out of Cosmos.

In May 2022, Ignite announced the creation of two independent entities – Ignite Inc. and NewTendermint Inc. Ignite Inc. continued to be led by its CEO Peng Zhong and remained on the path of building the Ignite CLI, its flagship product. NewTendermint Inc., on the other hand, saw the return of Jae Kwon as CEO and will focus on the contribution to the core technology of Cosmos, including Tendermint2, Cosmos SDK, and Jae Kwon’s current project, GNO Land.

Soon after, however, on July 1, Ignite CEO Peng Zhong announced his departure from the company. According to Zaki Manian, director of Tendermint Labs, Jae Kwon contributed to Peng Zhong’s resignation as the majority shareholder of All in Bits Inc., Ignite’s parent company. Jae Kwon, however, refuted this claim in a tweet, assuring that Peng Zhong resigned voluntarily. What this demonstrates is that there are significant tensions within the close circle of core developers of Cosmos technology, which likely leads to problems with coordination in development and definitely deters users and developers from engaging with the ecosystem.

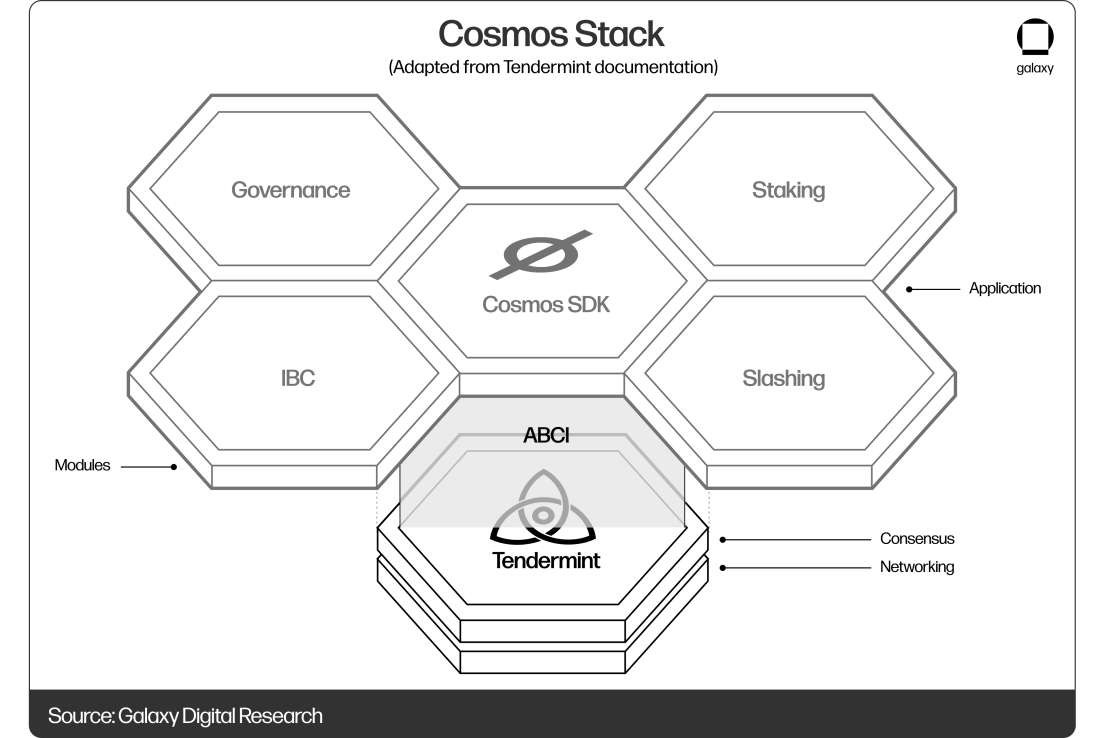

Technical Architecture

Cosmos is an ecosystem of interconnected application-specific blockchains built using standardized, customizable blockchain architecture tooling. The foundation of the Cosmos stack, Tendermint Core, is a Byzantine-Fault Tolerant consensus-level engine for building language-agnostic blockchains. Using the ABCI protocol, Tendermint Core can support state machines written in any programming language. Building on top of Tendermint Core is the Cosmos SDK, an open-source framework for building Proof-of-Stake and Proof-of-Authority blockchains. Blockchains built using the Cosmos SDK are composed of modules, such as auth, gov, staking, slashing, and nft. Developers can spin up blockchains that use the Cosmos stack within minutes using the Ignite CLI, a command-line tool that makes blockchain development significantly faster.

Tendermint Core

Fundamentally, Tendermint Core is software that allows the secure replication of an application on many computers. Tendermint tolerates validator failures up to a threshold of 1/3 machines compromised, which, combined with a Proof-of-Stake or Proof-of-Authority model, forms the basis of the network’s security. The ability of a blockchain’s consensus mechanism to tolerate participants failing or becoming malicious is known as Byzantine Fault Tolerance (BFT).

The key challenge underlying Byzantine Fault Tolerance can be simplified to the Byzantine Generals Problem, where several generals are besieging Byzantium. After surrounding the city, they must decide on a time to attack. If all the generals attack at the same time, they succeed, otherwise they fail. It is possible that some of the generals or the messengers are malicious actors who would seek to undermine the attack. The problem is further complicated by the lack of secure communication channels, as any messages can be intercepted, lost, or even be originally sent by soldiers of Byzantium.

When this problem is mapped onto computer systems, the generals become computers and the messengers become the digital communication protocols. The objective of a Byzantine fault tolerant consensus system is to sustain system service despite failures of specific components, assuming that there is a sufficient number of components operating normally to complete the task. Blockchain is just one of many implementations of BFT, one which emphasizes cryptographic authentication and peer-to-peer networking.

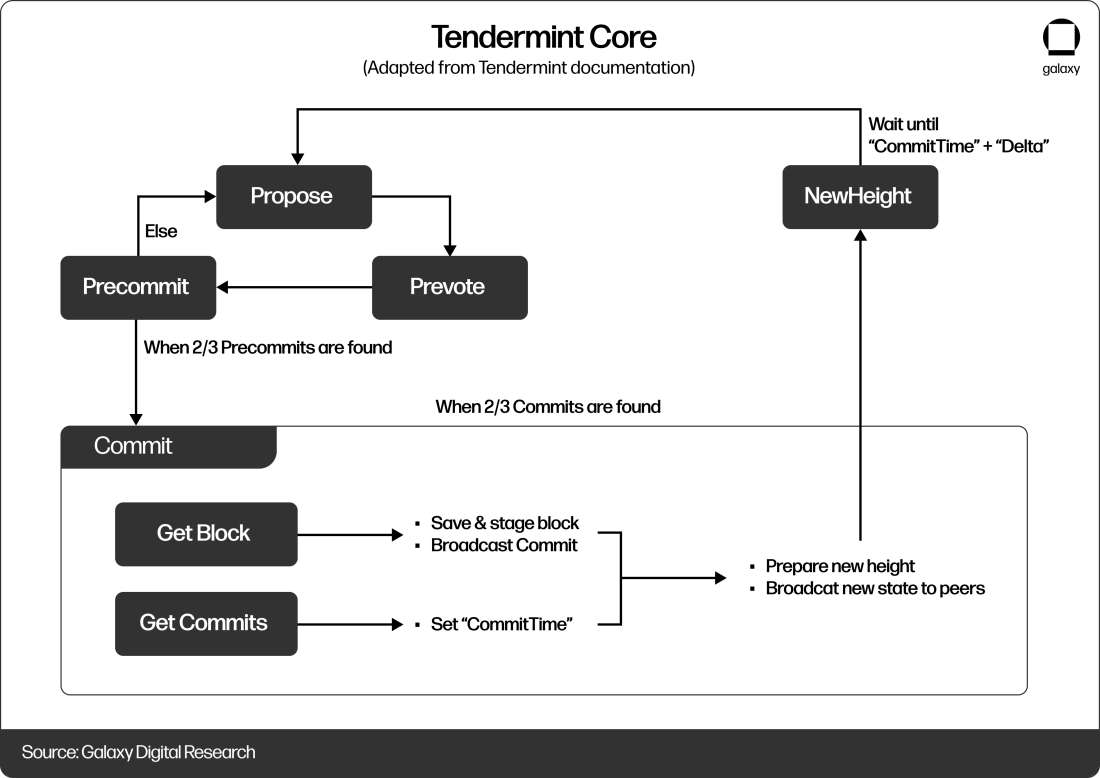

Tendermint Core achieves Byzantine Fault Tolerance using cryptocurrency staking (or permissioned validator sets in Proof-of-Authority) and round-by-round cryptographic consensus in the block validation process. At a high level, validators are network participants who confirm transactions and broadcast cryptographic signatures to cast their “vote” in favor of ledger updates. Validators cannot sign invalid or duplicate transactions as other network participants can generate and post evidence on-chain, resulting in the slashing of the stake of a guilty validator. There are three main types of votes validators cast: prevote, precommit, and commit. A block is considered to be committed by the network after 2/3 of validators have broadcast their commits.

The confirmation of each new block in a Tendermint blockchain is composed of rounds, each of which has several steps: Propose, Prevote, Precommit, Commit, and NewHeight. Each round, a proposer is chosen out of the validator set such that the frequency of a specific one being chosen is proportional to their portion of the total assets staked by validators. In the beginning of the Propose step, the proposer broadcasts a block proposal to its peers through a gossip protocol. During the Prevote step, validators decide whether the proposed block is valid and, if so, broadcast a prevote for the proposed block. If a validator receives more than 2/3 of prevotes for a valid block, it broadcasts a precommit for that block during the Precommit step. It also locks onto that block and releases the prior lock. At the end of the Precommit step, a node only enters the Commit step if it has received more than 2/3 of precommits. Otherwise, it starts a new round and continues to the Propose step, broadcasting the block it’s locked on to. During the Commit step, the node broadcasts a commit and waits to receive 2/3 of commits from other nodes. When that happens, it sets the block’s CommitTime to the current time and enters the NewHeight step. The duration of the NewHeight step is a fixed amount of time and allows for slower validators to submit commits to be included in the blockchain. Finally, after the NewHeight step, the validators transition to the first round of the next block, starting with Propose.

Tendermint Core assumes a partially synchronous network, where there is an upper bound on the time of messages delivered. It is assumed that non-byzantine nodes have a sufficiently accurate clock, which does not deviate substantially from global time. Despite the slightly variable clocks across validators, however, the network can maintain consensus using the system of rounds and steps and the CommitTime in each committed block.

This consensus mechanism is safe up to a threshold of 1/3 of network validators being malicious. If, for example, in the previous round, at least one good validator committed a block, this means that they received at least 2/3 of precommits. If less than 1/3 of validators are malicious, this means that at least 1/3 were good validators which have precommitted the previous block and locked onto it. These 1/3 of honest validators will be unable to commit any other block in the current or the following rounds because of their lock. Furthermore, if less than 1/3 of validators are malicious, the protocol does not deadlock. Even if two different blocks have been locked onto by honest validators, a proof-of-lock from a validator in the later round will unlock the validators and allow the consensus process to resume. Effectively, if malicious validators have less than 1/3 of voting power, the incentive is to continue performing validation correctly, because otherwise malicious behavior is identified and the validators are punished through slashing.

Tendermint Core also accounts for validators attempting to game the system and exclude others’ signatures from the previous block when proposing the next one to gain a larger share of protocol fees. If a malicious validator excludes a block signature the whole validator set gains the excluded validator’s rightfully deserved fees, with the malicious validator receiving his proportional share. This, however, will cause the excluded honest node to exclude the malicious validator’s signatures from their subsequent blocks. If this continues and both nodes exclude each other’s signatures, both lose in the long run, effectively dividing a portion of their fees across the rest of the delegator pool. It may make sense for the malicious validator to exclude some signatures from a block that has an outsized block reward linked to it, which may compensate for the loss of the full block reward when the honest validator excludes them from their block. However, even in that case, they will still lose money in the long run as they will be consistently excluded from block rewards by the honest validator.

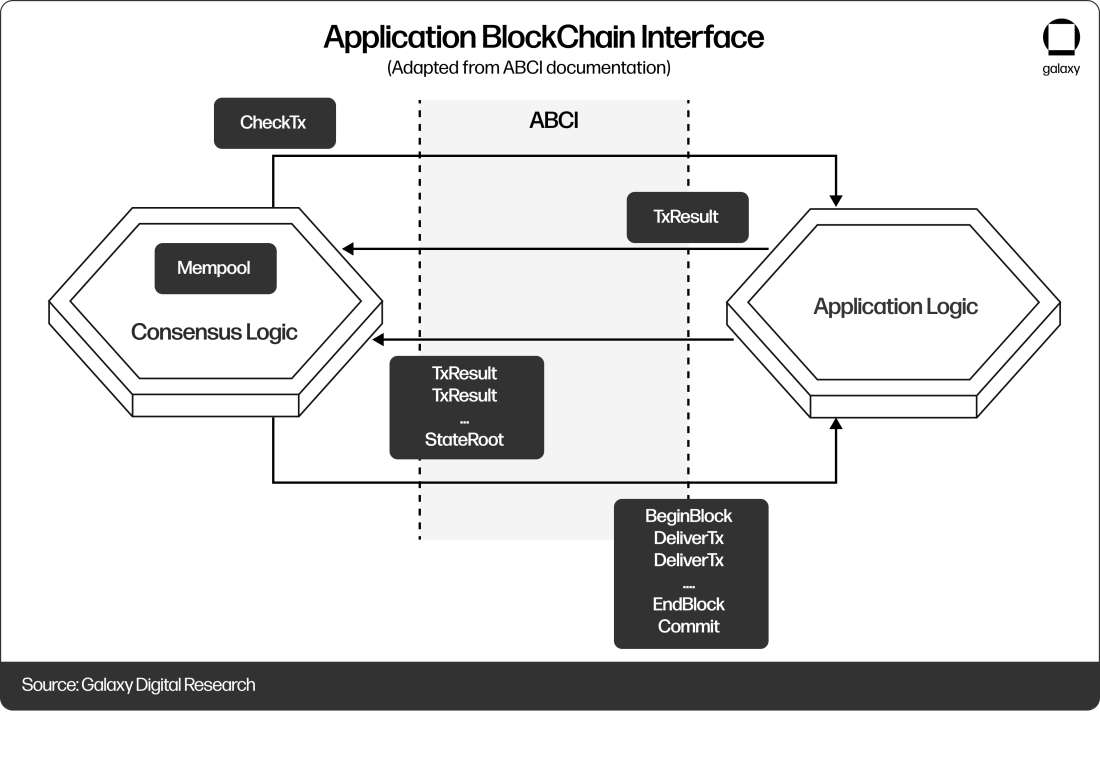

Application Blockchain Interface (ABCI)

An Application BlockChain Interface (ABCI) acts as the data channel connecting Tendermint Core, the secure consensus layer of the blockchain, to the application layer which maintains and utilizes the blockchain’s state. ABCI is effectively an API between the application and the consensus process. The most common message types in the ABCI are CheckTx, DeliverTx, and Commit.

When a transaction is added to the mempool (a register where transactions are stored before they’re included in a block and committed to the blockchain), the consensus engine sends a CheckTx message through the ABCI to the application layer (the Cosmos SDK). This message is used to run both stateless and stateful checks, including that the signatures are valid, that enough fees are provided, that the sending account has sufficient fees to pay for the transaction, and that the incrementing sequence number in the transaction is correct. The CheckTx message returns response code 0 to the consensus engine if the check is successful. The node will only propagate the transaction to its peers if it passes CheckTx.

When the consensus engine receives a proposed block, it needs to process every transaction. For each sequential transaction, the consensus engine sends a DeliverTx message to the application through the ABCI. Before the application layer processes the first transaction of each block, it initializes a volatile state, a copy of the main state that will be incrementally updated with each transaction. Subsequently, each DeliverTx message updates the volatile state of the application, which is committed to the main state when the block is committed by Tendermint Core.

After the full node receives precommits from 2/3 of the validators (determined by voting power), Tendermint Core sends a Commit message to the application layer, which updates the main state off the application to what’s stored in the volatile state, updates the stored headers, and returns the hash of the commitment back to the consensus engine. The returned hash is then used in the next block as a reference in the header.

Tendermint Core creates three ABCI socket connections to the application layer. The first is used for validating transactions after they’re sent to the mempool and before propagating them further. The second ABCI socket is used for Tendermint Core to propose blocks. Finally, the third is used to query the application state. Application designers, ultimately, have to be meticulous about designing the message handlers to ensure the blockchain is operational. Alternatively, they can use the pre-built Cosmos SDK modules, but then they are limited in the language in which the application will be written.

Cosmos SDK

Cosmos SDK is currently the most popular framework for developing application-specific blockchains. It allows developers to compose their blockchain applications off-the-shelf using open-source modules and/or their own custom modules. The SDK significantly reduces the complexity and time requirement of blockchain development. Beyond the simplification of blockchain development, the Cosmos SDK also allows developers to implement the IBC module, which is a cross-blockchain communication protocol.

Cosmos SDK modules are built using the statically typed and compiled programming language, Go. At the core of any blockchain built using the Cosmos SDK is the Daemon, or Full-Node Client. Network validators run this process to initialize the state, communicate with other nodes, and update the state as blocks are added. The core of the state machine, stored in the app.go file, contains the definition of the application and functions which instantiate it. The application created by app.go is an extension of baseapp, a base type which implements the core logic of the application such as ABCI methods and routing.

When a transaction is relayed from Tendermint Core using, for example, DeliverTx, it is routed by baseapp to the appropriate modules for processing. Each module is usually responsible for its own core function of the blockchain application. Developers which build blockchain application using Cosmos SDK spend most of their time building custom modules that are unique to the logic of their application and integrating them with desired existing ones. Modules implement interfaces defined in the Cosmos SDK, AppModuleBasic and AppModule, which are defined in the module.go file.

Here's a non-exhaustive list of the most popular Cosmos SDK modules:

Auth – specifies the base transaction and account types

Authz – allows granting authorizations to others to perform actions on behalf of others

Bank – handles multi-asset transfers

Capability – allows to work with multi-owner capabilities

CosmWasm – enables Rust smart contracts

Crisis – halts the blockchain if specified circumstances happen

Distribution – distributes rewards to validators and delegators

Epoching – allows modules to queue messages at specified block heights

Evidence – facilitates submission and handling of evidence of misbehavior

Feegrant – allows users to grant others allowances of fees

Governance – enables an on-chain governance system

Group – facilitates creation of on-chain multisigs

Mint – provides tooling to adjust the inflation rate

NFT – assists in development of NFT classification and transfers

Params – provides two global parameter storage types

Slashing – provides validator slashing and banning mechanisms

Staking – enables a Cosmos SDK blockchain to support Proof-of-Stake

Upgrade – allows for smooth software version upgrades

One of the most important modules and one that sets Cosmos SDK apart from other blockchain projects is Inter-Blockchain Communication protocol (IBC). Using IBC, developers can connect their application chain to the broader cosmos ecosystem as a zone, benefiting from borderless capital flow on Cosmos Network. In the next section, we discuss the technical underpinnings of IBC.

Inter-Blockchain Communication Protocol (IBC)

IBC is the Cosmos SDK module which defines the standard for cross-chain communication within the Cosmos Network, similar to TCP/IP on the internet. TCP/IP is a hardware-agnostic messaging protocol which connects computers and servers around the world. TCP/IP protocols include Hypertext Transfer Protocol (HTTP), HTTP Secure (HTTPS), File Transfer Protocol (FTP), and Simple Mail Transfer Protocol (SMTP). In the TCP/IP suite, TCP allows applications to open communication channels through the network, and IP defines an address system which allows packets to find their destination.

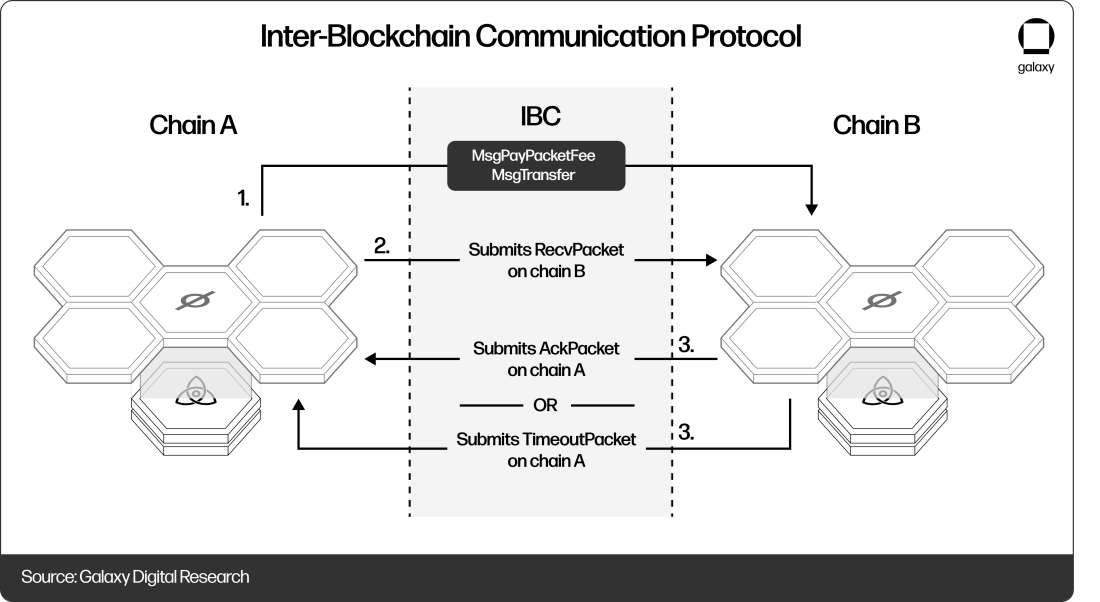

The underlying logic of IBC is similar to TCP/IP. First, to open a connection between two separate chains, a handshake is formed, which consists of a series of transactions submitted to each blockchain. Each transaction contains data and state proofs of the other chain. The handshake allows the chains to authenticate each other’s light clients to prepare for the exchange of packets. Before the chains can communicate, they must also open channels, each through another handshake procedure consisting of four packets exchanged between the chains. A connection between two chains can contain any number of channels, each with a unique data format. After channels are established, the chains can exchange packets of data such as token transfer information or a smart contract call. To ensure validity, the package contains metadata which can be used to verify its origin. Despite being agnostic to the type of data transported, IBC can guarantee that the data came from the source chain and isn’t corrupted. Upon delivery, the transported data is processed by the application layer. Chains can have one or more IBC connections, and each could have different settings, such as timeout requirements or ordering guarantees.

IBC packets are transported between chains by relayers. After an IBC module on the sender chain submits a SendTransfer event, the package is picked up by a relayer and submitted to the receiver chain. After the receiver chain generates an acknowledgement, the relayer delivers that signed message to the sender chain. If the receiver chain doesn’t acknowledge the packet within a specific amount of time, the relayer returns a Timeout package to the sender chain.

On the surface, relaying is an unprofitable enterprise – relayers must pay transaction fees on when posting packets on both the receiver chain in step 2 and the sender chain in step 3. To incentivize relayers to perform their role as a critical part of the Cosmos infrastructure, the Interchain GmbH team has released the ICS-29 relayer fee incentivization IBC module, which will allow chains to compensate relayers for transaction fees. Specifically, the message relaying process is as follows: the IBC sender module specifies each fee (receive packet fee, acknowledgement fee, timeout fee) when submitting the packet in the MsgPayPacketFee parameter via SendTransfer event (step 1), and only pays them when the relayer returns and posts a transaction to the sender chain with either an acknowledgement from the receiver chain or a timeout and proof of posting the packet on the receiver chain. ICS-29 offers developers a high degree of customizability–each fee class can be defined individually. Alternatively, developers may choose to opt out of ICS-29 relayer incentivization altogether, incentivizing their relayers through, for example, a protocol fund. Before ICS-29 is released into production, developers must implement channel upgradability.

In its current implementation, ICS-29 seems to favor the fastest relayer – all others have no reason to run their software as they’ll never deliver the acknowledgement and claim the bounty faster than the one with the lowest latency. Ultimately, this creates centralization risk and the risk of potential IBC downtime if the single relayer experiences technical difficulties. Some argue, however, that relayer incentivization isn’t the optimal design for IBC and that, in the long run, users should be delivering packets themselves.

Any blockchain can implement IBC if they have a system for implementing modules, a key-value store, consensus state introspection, timestamp access, a port system, an exception system, and eventual data availability such that data can be retrieved by relayers. If a blockchain application developer uses the Cosmos SDK, they’ll be able to integrate IBC using the pre-built module. Otherwise, they will have to find an IBC implementation for their blockchain framework or even implement it themselves if one doesn’t already exist.

IBC is fundamentally different from cross-chain bridges like Wormhole and Axelar in that the bridge is secured by the validators of the connected chains rather than an arbitrary validator that is foreign to both chains. The implementation of IBC relies on the validators of the connected chains maintaining light clients to be able to prove the state of the other chain. While this doesn’t scale well with the number of connections, Cosmos uses the Hubs and Zones model to minimize the number of connections that are required to be established for a blockchain to benefit from being connected to the network. By contrast, bridges operate by creating separate validator sets, or even centralized authorities, which check the state on the connected chains and lock/unlock/issue/burn tokens. This way, the cost of an attack is much smaller while the value at risk is, supposedly, the same. The differences between the implementations of bridges lie in the validators that compose the validator set and whether they are permissioned (e.g., Wormhole) or permissionless (e.g., Axelar).

In February 2022, Cosmos developers debuted Interchain Accounts, a feature which significantly improves the interoperability of IBC-connected applications by allowing blockchains to not only exchange data, but also write the state. Specifically, applications will be able to access the features of another chain and carry out actions that are specific to that chain. This is made possible by allowing an IBC-connected chain to create Interchain Accounts channels to other chains and define which messages will be supported. On a technical level, Interchain Account transactions are non-IBC transactions that are packaged into IBC transactions. The receiving chain would process the transaction that’s passed by the IBC package, updating its state. From a user’s perspective, by interacting with an application that makes use of Interchain Accounts, they may use several IBC-connected chains and control wallets on those chains all through one application without even knowing it.

The introduction of this feature may result in an explosion of cross-chain DeFi applications by allowing for actions which are impossible with applications built on a single chain with uniform settings. Concretely, Interchain Accounts allow for the creation of cross-chain applications which leverage the best aspects of various application-specific chains. For example, a play-to-earn game built on its own application-specific chain whose PoS is secured by in-game actions would allow a user to swap or stake funds on a decentralized exchange on another chain whose PoS is secured by LP tokens.

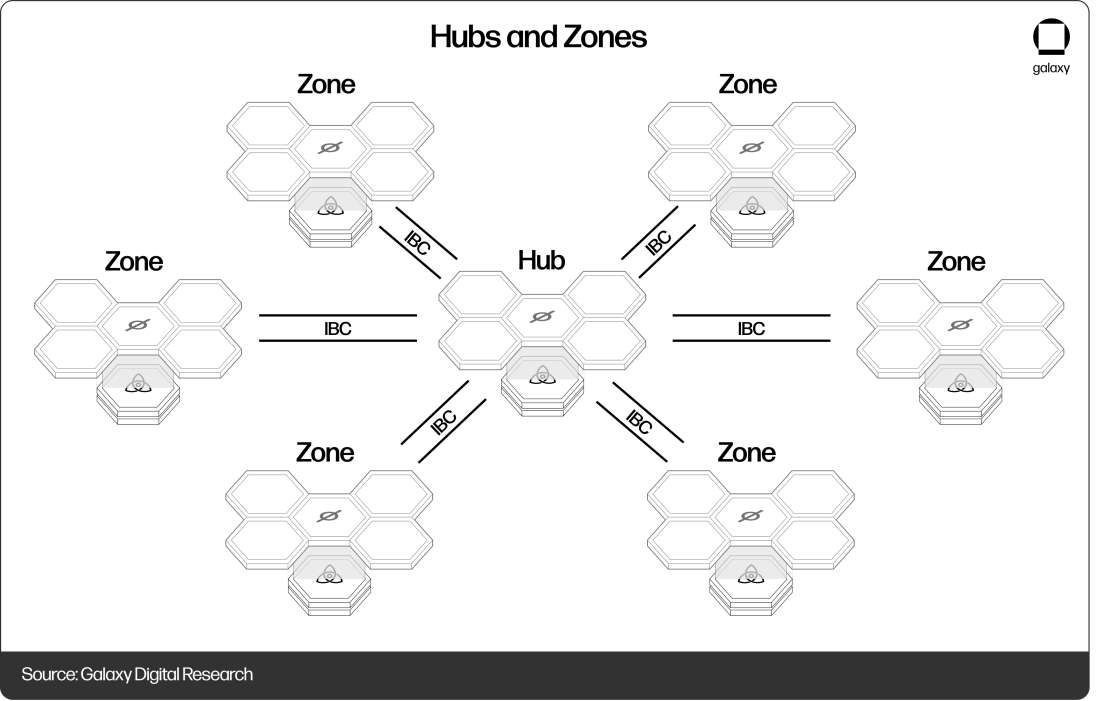

Hubs, Zones and Peg Zones

Cosmos is, effectively, the internet of blockchains: it is a rapidly growing ecosystem of interconnected sovereign blockchains built using developer-friendly tooling. To create the network, blockchains have to be able to communicate with each other. However, connecting each blockchain network to every other is unsustainable as it scales quadratically: for a network with 100 blockchains where each connects to every other there needs to be 4950 connections!

Similar to how TCP/IP routes packages through hub and spoke models where routers act as hubs and individual computers act as spokes, the Cosmos Network proposes two classes of blockchains: Hubs and Zones. Zones are regular, application-specific blockchains built using Cosmos SDK. Hubs are blockchains designed specifically for connecting Zones together. When a Zone creates an IBC connection with the Hub, it can instantly access every zone that is connected to it. This way, a Zone only needs to establish a few connections with the main Hubs of the network. Beyond their work as routers in the Cosmos Network, Hubs also prevent double spending by maintaining a global constant of a token’s total amount across all Zones. Therefore, when a Zone receives a token from the Hub or another Zone, the receiving Zone need only to trust the Hub and the Zone in which the token originated, not all other Zones that it has been bridged to.

So far, we have discussed how Cosmos SDK blockchains can send messages between each other through Hubs and IBC connections. However, Cosmos isn’t limited to this set. Blockchains can be grouped into two classes: deterministic and probabilistic. Deterministic chains finalize the state of each subsequent block such that the blockchain cannot reorganize itself in the future. Probabilistic chains have probabilistic guarantees that the chain will not be reorganized using, for example, the longest chain rule. Hubs in the Cosmos Network can connect to both but working with probabilistic chains is significantly more difficult.

Fundamentally, IBC only works when connected blockchains can all guarantee finality. With probabilistic blockchains, Hubs can’t maintain the global constants of each token’s amounts across the Zones, resulting in a double spend vector of attack. To avoid probabilistic global constants of token amounts, Cosmos uses Peg Zones to achieve interoperability with probabilistic chains. A Peg Zone is an application-specific blockchain which tracks the state of a probabilistic blockchain and establishes finality so that the probabilistic chain can connect with IBC. Effectively, Peg Zones insulate connected chains from exposure to probabilistic blockchains until a significant amount of time has passed and the reorganization risk is low.

Using Hubs, Zones, and Peg Zones, Cosmos developers are able to achieve a standard for blockchain interoperability which is significantly more secure than the current predominant methodology, bridges. According to Chainalysis, over $2 billion has been stolen from cross-chain bridges in 2022 alone. With IBC, however, users only need to trust the consensus of the chain they are bridging to, not the bridge itself. Despite some arguing that using IBC as a universal interoperability standard would be putting all the eggs in one basket, IBC has demonstrated the merits of its approach over the years.

Interchain Security

Interchain Security is a technology specific to the Cosmos Hub, the premier Hub of the Cosmos Network which will be covered in extensive detail later in the report. Expected to go live in 2H 2022, Interchain Security will allow projects to achieve a very high level of security by taking advantage of the full 175 validator set which secures Cosmos Hub. The technology will allow the Hub to share security and provide parallel execution to any number of “consumer chains.” Although permissionless deployment of these consumer chains is on the roadmap, at launch developers would need to submit a governance proposal to the Cosmos Hub to secure their proposed consumer chain.

Unlike for Zones connected to the Hubs through IBC, the binaries that power the consumer chains will be universal across all the consumer chains. Fees on consumer chains will be paid in ATOM and will be divided (25-75) between the Cosmos Hub validator set and the developer DAO behind the consumer chain. The chains will support CosmWasm smart contracts (WebAssembly and Rust) at launch and aim to simplify the developer experience to be similar to deploying a smart contract on Ethereum.

To bring Interchain Security to market, Cosmos Hub plans to partner with liquid staking providers such as Lido to deploy their applications on a DeFi Hub (a consumer chain secured by the Cosmos Hub). The DeFi Hub will be a CosmWasm smart contract blockchain which will support full Interchain Queries. The DeFi Hub has received 150,000 ATOM ($ 1.76 million) from the Cosmos Hub community pool to fund applications which will leverage the Interchain Security and liquid staking.

In the next iteration, Cosmos Hub developers plan to introduce Layered Security, an upgrade of Interchain Security which uses a composition of both the Hub’s token and the connected chain’s token to decide the composition of the validator set. This would allow chains which have already deployed using the Cosmos SDK to connect and benefit from sharing security with the Cosmos Hub without having to completely abandon the use of their own token for Proof-of-Stake validation.

The design of Interchain Security proposed by Cosmos developers closely resembles the underlying mechanics of main competitor, Polkadot. Polkadot provides infrastructure and shared security for application-specific chains by default, limiting them to having to compete against other projects for a sport in the parachain auction. The approach of the Cosmos Hub seems like a more inclusive model of Polkadot’s shared security, although the promise of permissionless deployment in the future begs the question of throughput limitations of the validator set. Additionally, DOT has significantly better long-term tokenomics in terms of value accrual and value retention (if a project wins the parachain slot auction, investors get their DOT back only after the leasing period passes, which is 96 weeks).

Ignite CLI

Originally called Starport, Ignite CLI is the quickest way for developers to get started building with the Cosmos stack. Ignite CLI is a command line interface for spinning up application-specific blockchains using Tendermint and the Cosmos SDK. After creating the blockchain, Ignite allows developers to manage keys, create validators, and send tokens right from their console.

Using Ignite CLI, a developer can:

Create a blockchain using the Cosmos SDK

Set up modules, messages, types, and IBC packets

Scaffold a blockchain node

Initialize a connection to other blockchains using IBC

Generate TypeScript/Vuex clients to interact with the new blockchain app

Experiment with the blockchain’s Vue.js website application

For developers, Ignite saves dozens of development hours by providing the underlying logic of a blockchain out-of-the-box and allowing them to focus on application-specific modules for their project. It can be likened in many ways to web development frameworks like MERN (Mongo, Express, React, Node). Projects built with Ignite CLI include Cronos, Celestia, and KYVE.

Ecosystem

The ecosystem of projects in the Cosmos Network is extremely diverse and unique due to the flexibility offered by the Cosmos SDK. Apart from cross-chain decentralized exchanges and application-agnostic blockchains, the Cosmos Network is home to privacy-focused blockchains, decentralized cloud computing solutions, music fan platforms, decentralized social media, liquid staking applications, and cross-chain bridges. As mentioned earlier in the report, the Cosmos Network resembles a hub and spoke model with Hubs that mostly just route IBC packets and application-specific Zones. While the user experience is unique to each zone, most use the same or similar technologies and client-side applications like browser wallets. Even beyond the IBC channels that connect blockchains in the Cosmos Network, the community considers chains built using the Cosmos SDK as part of the broader Cosmos ecosystem. However, our view is that these non-IBC, Cosmos SDK chains are more accurately depicted as tangential to Cosmos rather than part of the Cosmos ecosystem.

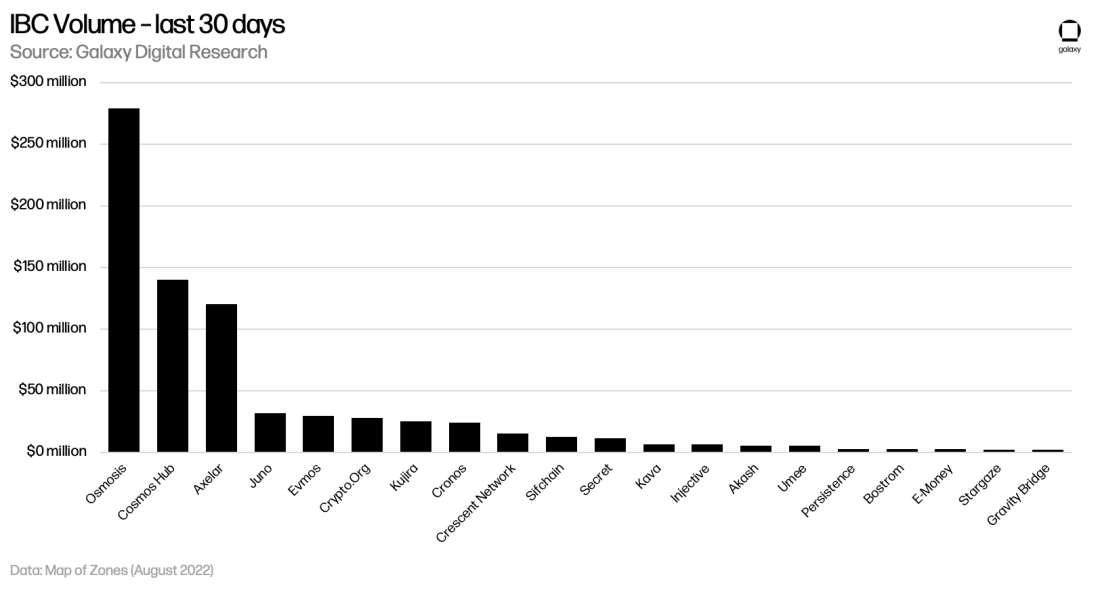

Cosmos Zones

In July 2022, IBC channels processed a total of $345 Million in transaction volume through 2,511,090 transactions. The largest portion, $266 million, was processed by Osmosis, the main decentralized exchange of the cosmos ecosystem. For new projects, Osmosis and the overall DeFi infrastructure of Cosmos is one of the key reasons to deploy on the Cosmos Network. Apart from the simplicity of development and customizability granted by the Cosmos SDK, IBC offers them access to permissionless decentralized exchanges. For projects at an early stage in their development, listing on centralized exchanges is difficult and the lack of listing can be prohibitive for users, so being able to tap into the liquidity offered by decentralized finance is imperative to bootstrapping initial adoption. This led to a lot of projects that aren’t related to DeFi launching on Cosmos so they could benefit from the application-specific chain tooling and the DeFi liquidity for their token.

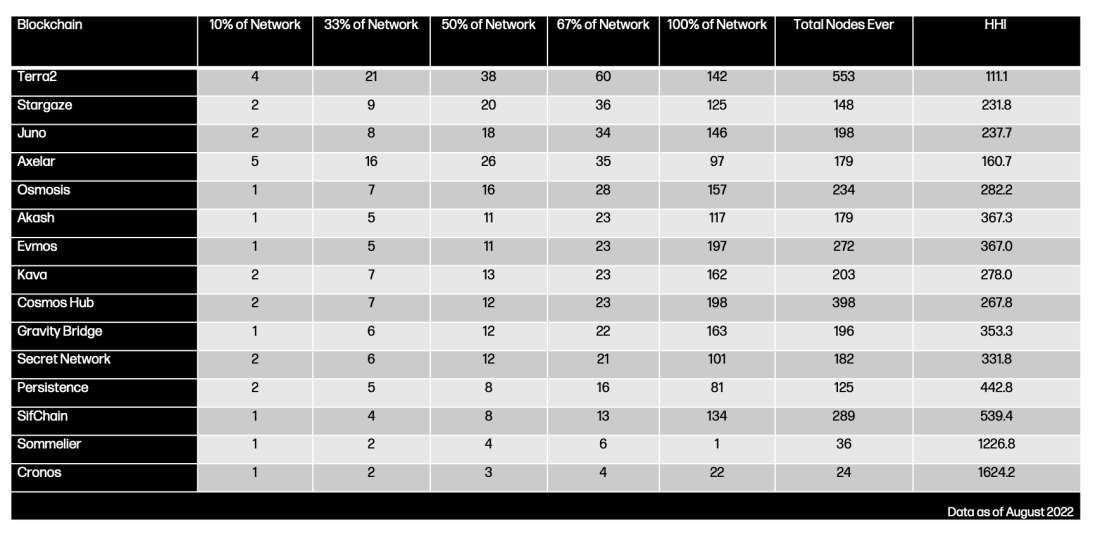

A common criticism of Cosmos is that it is not easy for new projects to build up validator sets which would be considered secure and decentralized enough. When considering the Cosmos Network, most zones have opted for a permissionless Proof-of-Stake model, but a few chose to have smaller permissioned validator sets. From a security standpoint, this decision may make sense depending on the use case and if the chosen validators are trusted participants. Additionally, because the Tendermint Core consensus engine slows down with the number of validators, it is reasonable for a project to desire to keep their validator set relatively small. In the table below, we compiled validator sets for each of the 15 most popular chains in the Cosmos Network. Note that while this represents both active and inactive validators, slightly skewing the data, it still gives a good perspective on the decentralization of each network. For each, we calculated the number of validators needed to control 10%, 33%, 50%, 67%, and 100% of the network. To quantify decentralization, we calculated the Herfindahl-Hirschman Index (HHI), a commonly used measure of market concentration calculated by squaring the market share of each participant and summing them up. The index ranges from nearly 0 (perfect competition) to 10,000 (100% of the market controlled by a single firm).

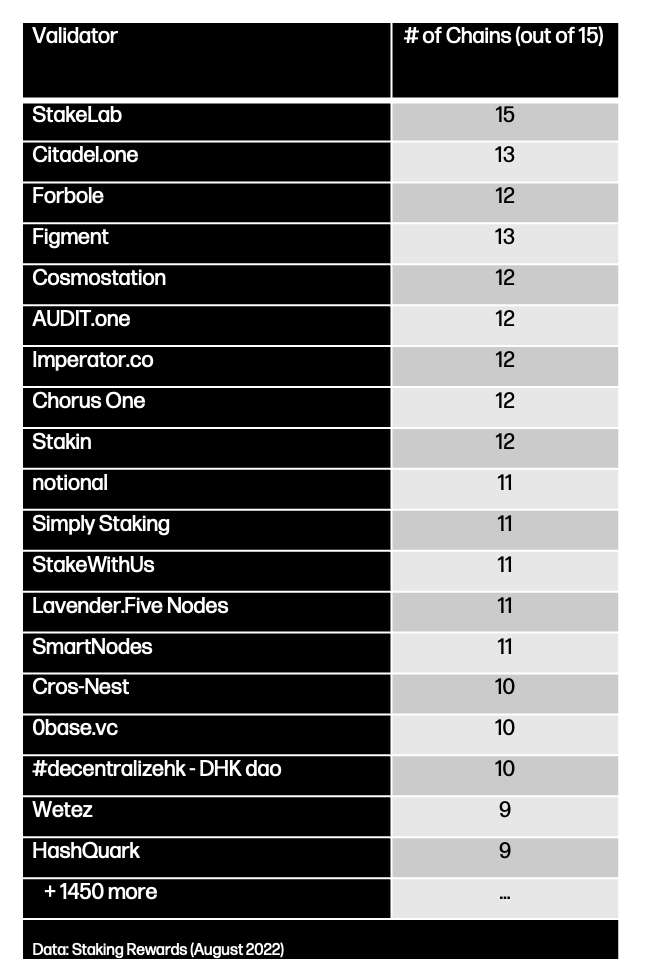

Decentralization metrics for each chain, however, give an incomplete representation of the validator set of the Cosmos Network. As many of these validators are Node-as-a-Service companies, they secure many networks at the same time. When considering the subset of blockchains in the cosmos network outlined above (15 chains), we notice several names that are present on almost all chains and cumulatively secure a high percentage of the Cosmos Network, making them more lucrative targets for attackers. Considering this, the Cosmos Network isn’t really scaling horizontally with nodes that don’t require prohibitive hardware but is instead just linearly increasing the hardware requirements for the main staking providers in the ecosystem with the addition of each new chain.

Despite the network not being as decentralized as it seems to be at first glance, it is significantly more secure and decentralized than most of the blockchains we use today. Ultimately, for developers that want to save hundreds of hours on building the consensus and messaging protocols in their application that requires a standalone blockchain, the Cosmos SDK is one of the best options in the market. This can be seen in the variety of unique apps built using the Cosmos stack and connected to the interchain. Despite the seemingly tiny $20 million ecosystem fund which most likely already ran out, Cosmos is home to some of the most used applications in DeFi and continues to attract experienced talent. In the scope of this report, we’ll go over some of the more unique and established projects, but in doing so we’ll only cover the tip of the iceberg that is the Cosmos ecosystem.

Cosmos Hub

Cosmos Hub is the central Hub blockchain of the Cosmos network. Launched by Tendermint Inc. in March 2019, it is the oldest and the second most connected Zone in the network. Cosmos Hub is connected to 40 other Zones and processes over $140 million in monthly transaction volume over more than 250 thousand individual IBC transfers. At present, the Cosmos Hub is secured by 175 active validators who, in partnership with their delegators, stake ATOM token to participate in Cosmos Hub’s Proof-of-Stake consensus. Cosmos Hub validators can accept any type of token as fee for processing a transaction. To sustain the project’s development in the long term, 2% of transaction fees go towards a reserve pool, increasing the security and value of Cosmos Hub. Cosmos Hub has an active on-chain governance process, which decides the technological upgrades to the blockchain, strategical decisions, and the spending from the reserve pool.

Fundamentally, Cosmos Hub aims to be the router of the Cosmos Network and a neutral force in the general application area. The goal of Cosmos Hub is to support the development of applications and the general growth of the interchain. Originally, Cosmos Hub also featured the Gravity DEX, an AMM decentralized exchange which was incentivized via ATOM token inflation. However, in March 2022. The Cosmos Hub community voted to move the Gravity DEX to a separate chain to allow for faster deployment of features, lower monopolistic pressure, lower ATOM emissions, and to preserve throughput of the Cosmos Hub for IBC transfers.

When it was designed originally, Cosmos Hub was intended to be the centerpiece of the Cosmos ecosystem. It was meant to facilitate most of the transfers within the Cosmos and accrue value from the fees. However, as the networks were maturing, it failed to remain the central point for packet routing and its token has been criticized for having no utility. However, while it didn’t achieve the original mission of being an integral part of the ecosystem and accruing value from all of the applications built on top, recent, upcoming, and teased upgrades aim to significantly increase the Hub’s presence and drive adoption for its token.

Osmosis

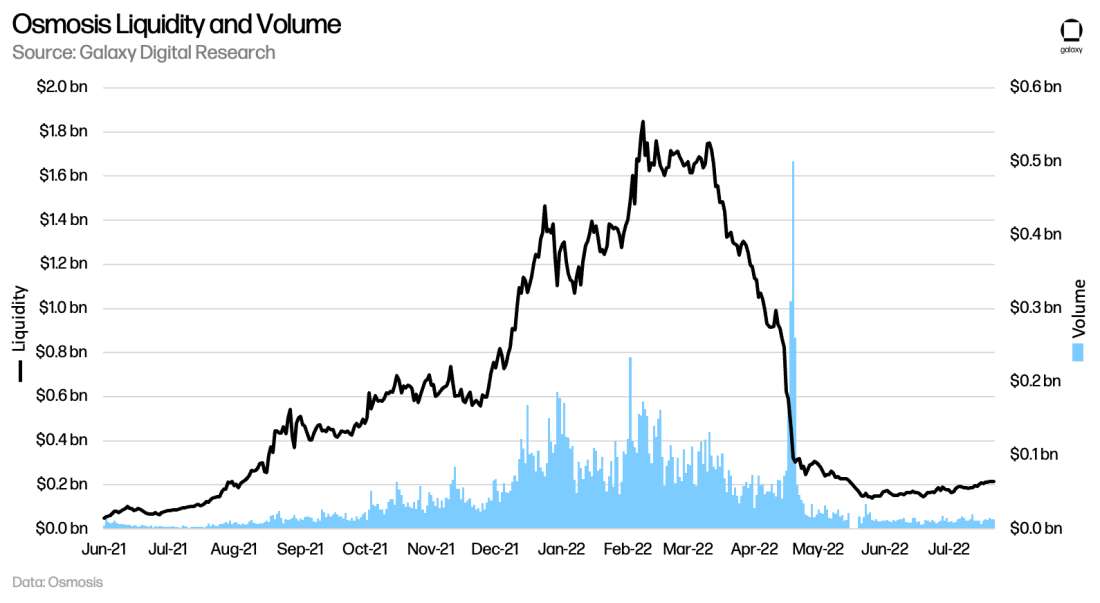

Osmosis is the leading decentralized exchange of the Cosmos interchain. It was founded in 2021 by Sunny Aggarwal, Josh Lee, and Dev Ojha. Built on its own blockchain, Osmosis has features that set it apart from DEXes built on application-agnostic chains like Ethereum. On a functional level, it is an Automated Market Maker with liquidity pools and a smart contract which executes trades via token swaps. Additionally, Osmosis doesn’t require a user to own OSMO to perform a swap – fees are deducted directly out of the swap. Osmosis boasts a Total Value Locked (TVL) of $167 million and $13.4 million of 24-hour trading volume as of the end of July 2022. In a month, Osmosis processes the most value in IBC transfers, $280 million over 940 thousand IBC transfers. In July 2022, Osmosis IBC transfers were mostly outflows: the Zone saw $102 million in inflows and $176 million in outflows. The trend of outflows has been prevalent since April 2022, after TVL peaked at $1.8 billion, and exacerbated by the UST and LUNA collapse in May.

A unique feature offered by Osmosis is superfluid staking, which takes capital composability to the next level. Unlike on application-agnostic blockchains like Ethereum, Cosmos applications must bootstrap their own security. The solution Osmosis pioneered is superfluid staking, the utilization of LP tokens in its Proof-of-Stake consensus. To prevent the attack vector where the malicious actor creates pools of obscure tokens, disrupts the network, and then dumps tokens into the pool, Osmosis limits the LP tokens that can be used for staking as a validator.

In 2022, Osmosis integrated CosmWasm, a WebAssembly virtual machine and smart contract engine, allowing developers to build permissioned apps around the exchange. This integration opens the possibility to DeFi apps like yield aggregators, fiat onramps, transaction schedulers, index protocols, and liquidity management tools. The CosmWasm integration allows millions of Go and Rust developers to use a familiar toolset when working on dApps on Osmosis.

Axelar

Axelar is a solution for cross-chain communication that is built using Tendermint and the Cosmos SDK. Axelar provides a simple integration with cross-chain routing for developers of cross-chain applications. Unlike most other bridges, Axelar offers the opportunity to pass application-agnostic messages between chains and uses a permissionless validator set selected through a Delegated Proof of Stake mechanism. Axelar is the third most active chain by volume of IBC transfers after Osmosis and Cosmos Hub. In July 2022, it processed over $136 million in IBC volume over 71 thousand transfers.

To verify the state of blockchains when processing cross-chain transactions, Axelar validators run light client software for each connected chain. These states are reported and recorded on the Axelar blockchain. Additionally, validators collectively control threshold signature accounts on each chain, allowing them to lock and unlock assets.

Axelar offers two main cross-chain communication protocols: CGP and CTP. The Cross-Chain Gateway Protocol (CGP) allows for state synchronization and asset transfers. State synchronization refers to the ability to post information about the state of one blockchain to another. Asset transfer involves transferring a token from one chain to another. Cross-Chain Transfer Protocol (CTP), on the other hand, allows applications to query another blockchain and control accounts on other chains.

Kava

Kava started out as a lending platform featuring an algorithmic overcollateralized stablecoin similar to MakerDAO’s DAI. Since then, it has expanded to being a two-chain ecosystem connecting the Cosmos SDK and Ethereum. Developers can choose whether they want to develop on an Ethereum co-chain or a Cosmos Co-chain. As part of the Kava Rise developer incentive program, Kava offers a total of $750 million to incentivize on-chain development. Incentives will be distributed to protocols proportionally over 4 years based on on-chain usage. In May, Ethereum giant Sushi announced they will be deploying to Kava, allocating a combined $14 million in incentives to liquidity providers.

Kava is connected via IBC to only 5 other interchain blockchains: Cosmos Hub, Osmosis, Akash, Terra, and Sifchain. It processes a total of $5.7 million in monthly IBC volume with $2.1 million in and $3.6 million going out of the Zone over 11 thousand IBC transfers. According to Defi Llama, Kava boasted $300 million in TVL across 23 dApps at the end of July 2022. The native ones, however, dominate most of the TVL. Kava Mint has a TVL of $158 million, Kava Lend has a TVL of $124 million, and Kava Swap has a TVL of $13 million, amounting to $295 million across just these 3 apps built by the Kava team.

The original lending platform still remains at the core of Kava. Using Kava, users can borrow and lend assets from the Cosmos, Ethereum, and even BNB Chain ecosystems. Additionally, using a smaller subset of assets, users can mint a stablecoin USDX for little to no interest. Kava offers 66.7% Loan-to-Value (LTV) USDX loans on volatile assets and 99% LTV loans on BUSD, the BNB Chain Stablecoin. Prior to May 2022, Kava utilized UST to mint USDX and was badly affected when UST depegged from $1 and collapsed. Despite dropping to $0.65, USDX is now trading close to $1 at $0.95.

In Q3 2022, Kava aims to launch the ETH bridge to allow thousands of ERC-20 assets to be bridged to Kava and vice-versa. Also in Q3, Kava aims to establish the Kava Foundation, a non-profit body which provides strategic input to the Kava community. In Q4 and Q1 2023, Kava aims to launch the BNB Chain and Bitcoin bridges, unlocking the potential for numerous applications on the network.

Juno

Juno is another Layer 1 CosmWasm smart contract platform built using the Cosmos SDK and connected to the interchain via IBC. The project was announced in March 2021, successfully launched in October 2021, and debuted CosmWasm smart contract compatibility in December 2021, kicking off the development of its ecosystem. Currently, one of the main applications built on top of Juno is the Junoswap decentralized exchange, an AMM for Cosmos tokens bridged to Juno.

As of July 2022, Juno processes $33 million in IBC volume per month and, unlike many other networks, is experiencing a net inflow with $18 million in inflows and $15 million in outflows over 159 thousand IBC transfers. Juno is connected to 33 other Zones in the Cosmos interchain, which highlights its long-term vision of becoming a central hub for both DeFi and GameFi activity in the interchain.

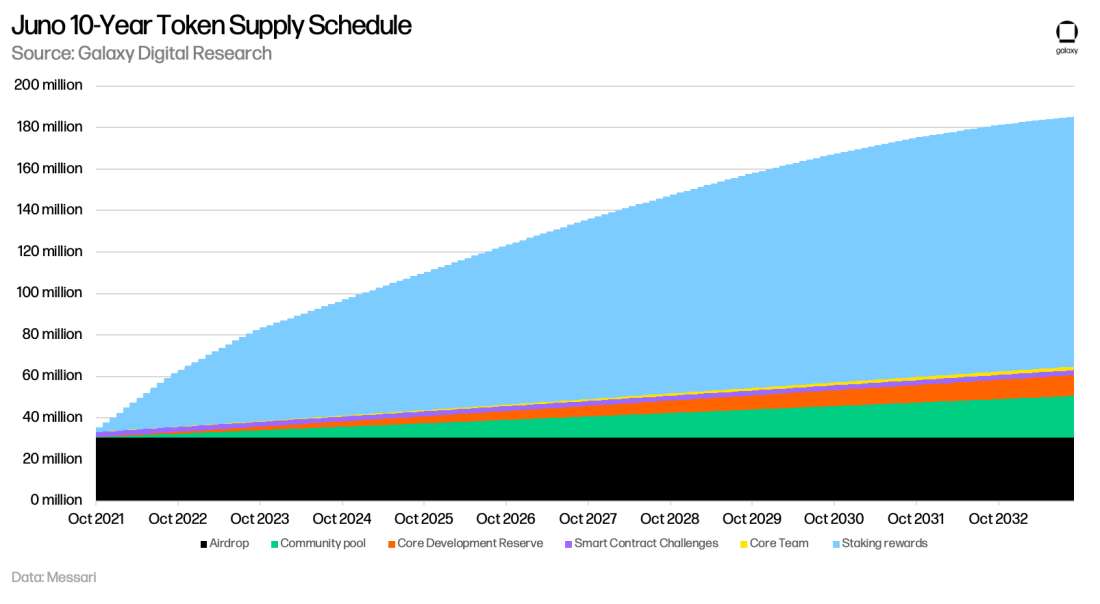

JUNO is the native utility token of the Juno blockchain. It can be used to cover gas fees in the network, deploy smart contracts, participate in the Tendermint Core Proof-of-Stake consensus, and participate in on-chain governance. JUNO is inflationary at a fixed inflation of 40% per year, gradually decreasing each year to 1% in year 12. The current supply of JUNO is 85.6 million, which is expected to increase to 185.5 million over the next 12 years.

Evmos

Evmos is an application-agnostic EVM-compatible Proof-of-Stake blockchain built using the Cosmos SDK and connected to the Cosmos interchain via IBC. Evmos combines the fast finality and high throughput of Tendermint-based blockchains and the established application and developer ecosystem of Ethereum. Evmos is currently the sixth largest chain by IBC transaction volume, sending and receiving almost $30 million of assets over IBC between July and August 2022. Like most other chains, most of the transactions are outflows: $13 million was sent in and $16 million left the Zone.

Originally, Evmos is the evolution of Ethermint, a project built in 2016 to demonstrate the ability to deploy an EVM on Tendermint, using Proof-of-Stake as the consensus mechanism. The project was revived in March 2021, when Tharsis, a core developer team that maintained Ethermint, proposed to advance Ethermint and make an IBC-connected Cosmos-EVM blockchain. After years of development, the project finally went live in spring of 2022.

EVMOS is the native token of the Evmos blockchain. It was airdropped to users in December 2021 based on their prior engagement with the Cosmos and Ethereum networks, such as by interacting with common DeFi applications, cross-chain protocols, and EVM Layer 1s. Because the scope of the airdrop is so large, almost 75% of it hasn’t been claimed by users. Starting August 1, 2022, however, the amount of EVMOS claimable for eligible addresses started to decrease every second. This process will last until all the tokens eligible for the airdrop are returned to the Evmos community pool on September 30.

Evmos has a growing ecosystem, including well-known names like Aave, Frax Finance, Figment, and the UMA oracle. February 2022 was a particularly exciting month for the Evmos ecosystem: Aave, the highest usage money market in DeFi, passed a proposal to deploy Aave V3 on Evmos; Frax Finance announced that they will be deploying the FRAX algorithmic stablecoin on Evmos; and Figment announced their collaboration with Evmos to bring critical blockchain infrastructure.

Additionally, Evmos is working with Celestia to build a fully EVM-compatible settlement layer and data availability solution called Cevmos (short for Celestia/EVMos/CosmOS). Cevmos will function as a Celestia rollup which allows other rollups to settle on it and thus benefit from Celestia’s data availability solution. Cevmos will derive security from Evmos, as the chains will be connected via IBC and the EVMOS token will be used for consensus and gas.

Agoric

Agoric is a Proof-of-Stake application-agnostic blockchain which allows developers to deploy and run JavaScript smart contracts. The project’s main thesis is that native smart contracts written in JavaScript, the most popular programming language in the world, could onboard tens of millions of developers into the cryptocurrency space. Agoric will connect to Ethereum via the Gravity Bridge and to Cosmos through IBC, bridging the two ecosystems.

To simplify the experience of dApp developers, Agoric provides a JavaScript library of reusable components, such as AMM, Vaults & Loans, Covered Call, Non-Fungible Tokens, On-chain Oracles, and UI Widgets. This off-the-shelf componentized product suite draws parallels to similar approaches in frontend web development such as Bootstrap and Tailwind UI. It also provides several smart contract and full dApp templates, such as a Treasury, a simple DEX, a Faucet, a Card Store NFT App, and a Wallet. The goal of the platform is to support developers as much as possible and make the onboarding to crypto seamless.

In January 2022, Agoric conducted a CoinList token sale for their token, BLD, raising $50 million from over 40,000 investors. Depending on the vesting schedules selected by investors on CoinList, some of the tokens have already started unlocking. That being said, the tokens aren’t yet traded on any markets and are on-chain only as IBC has not yet been turned on.

To provide the Agoric community with an asset with minimal price volatility, Agoric is building the Inter Stable Token (IST), an over-collateralized stablecoin similar in mechanics to MakerDAO’s DAI. The amount of IST that a user can mint depends on the value of the collateral and the collateralization ratio as determined by governance for each asset. IST keeps its stability through a several mechanisms, such as a Parity Stability Module which utilizes approved stablecoins in a 1:1 ratio, lending vaults with whitelisted volatile assets, and BLD Boost, a mechanism which allows users to mint IST using staked BLD tokens. Effectively, IST aims to provide additional utility for ATOM and OSMO, allowing users to use their tokens to mint a stablecoin.

Cronos

Cronos (formerly Crypto.com EVM chain) is another application-agnostic EVM-compatible blockchain connected to Cosmos through IBC. Like Evmos, it is building on the Ethermint codebase created in 2016. Cronos is built by the Crypto.com team and uses their token, CRO, for transaction fees. To fund the development of the protocol, Cronos Labs, the organization behind the Cronos chain, was granted $100 million by Crypto.com. Now, Cronos is a top 30 token in market capitalization and the 7th largest chain by TVL, boasting $1.1 billion in locked funds as of mid-August 2022. Since the fall of Terra, CRO is now the largest cryptocurrency by market cap in the Cosmos ecosystem.

Cronos is connected to only five other chains in the Cosmos interchain: Cosmos Hub, Akash, Crypto.org (its predecessor without smart contract compatibility), Juno, and Terra 2.0. Between mid-July and mid-August 2022, it sent and received a total of $23.6 million over 72 thousand transfers using IBC. Most of the transactions were outflows: $15.8 million out and only $7.8 million in. CRO is actively traded on Osmosis but does not have a direct IBC channel with the decentralized exchange.

Unlike most other Cosmos blockchains, Cronos has a permissioned validator set. Currently, there are 27 validators, the top four of which are run by Cronos and control over 80% of the stake. Unlike other chains, the validator set does not use the native token (CRO) as stake and does not receive inflation emissions in rewards, only transaction fees in the network. Cronos aims to reach 60-80 validators by the end of 2022.

Cronos and Crypto.com have had several notable marketing campaigns. Crypto.com has paid for several Super Bowl commercials, purchased the Staples Center in Los Angeles and named it Crypto.com Arena, and sponsored the UFC, formula 1, NBA, and NHL.

Secret Network

Secret Network is an application-agnostic privacy-enabled blockchain built using the Cosmos SDK and connected to Cosmos through IBC. However, Secret augments the functionality of Monero and most other privacy-preserving blockchains by embedding smart contract compatibility for applications written in Rust. To achieve privacy of transactions and data, Secret Network uses key management, encryption protocols, and Trusted Execution Environments (TEEs), which guarantee that nodes are unable to view the computations. Trusted Execution Environments are hardware isolated from the rest of a device. Intel, for example, provides Software Guard Extensions (SGX) which are built into specific CPUs and enable TEEs. Unlike the state and interactions with smart contracts, the underlying ledger of Secret Network is publicly visible, meaning that transactions with the native SCRT token are public, to allow for governance and consensus. SCRT tokens can also be wrapped into a private and fungible equivalent using a Secret Contract.

By enabling smart contracts, Secret Network can offer Secret Tokens, Secret Bridges, Secret Finance, and even Secret NFTs to its users. Secret Tokens are smart contracts that mint tokens that are private and encrypted to preserve confidentiality by default. Viewing keys can be used by users and generated for third parties to view token balances, transaction details, and token metadata. Secret Bridges allow assets from other chains to be bridged onto Secret Network, where they are then encrypted to be only viewable to the owner address or the holders of the viewing key. Secret Finance refers to all of the privacy-preserving dApps built using smart contracts on Secret Network. Unlike dApps on most other chains, dApps on Secret Network are MEV-resistant by being private. Finally, Secret NFTs allow the user to control the metadata of their token but allow verifiable ownership while keeping transaction history private.

Secret Network is connected to 15 other chains in the Cosmos interchain. It is responsible for $11 million in monthly transaction volume over 55 thousand transactions using IBC channels and, in the past 30 days, has seen more value enter the network than leave it: $7 million in, $4 million out. Most of the Secret Network IBC volume is with Osmosis, the premier decentralized exchange of the Cosmos Ecosystem.

Terra 2.0

Terra 2.0 is the reincarnation of the infamous open-source application-agnostic blockchain built using the Cosmos SDK and connected to the Cosmos interchain via IBC. It allows developers to build contracts in Rust. The original Terra was known for its algorithmic stablecoin UST, which was the largest algorithmic stablecoin by market cap and offered some of the highest stablecoin yields in DeFi at 18-20% through Anchor protocol. UST maintained its price stability through mint and burn mechanisms of Luna, the native token of Terra. If price of UST rose above $1, users could burn $1 of LUNA to mint 1 new UST, making a profit. Similarly, if the price of UST fell below $1, users could burn 1 UST to get $1 of LUNA.

In May 2022, Anchor saw major outflows in UST deposits, causing a slight depeg from $1, which caused a panic and resulted in a bank run scenario. Despite Luna Foundation Guard’s efforts to maintain the $1 peg using its BTC reserves, the value of UST and LUNA plummeted. This continued for several days until Terra validators halted the chain. Overall, the meltdown erased over $60 billion worth of value over a few days. Read our report on the collapse of UST for a more detailed breakdown of its unwinding. A little less than two weeks later, on May 25, Terra Classic users passed a proposal which outlined the details of Luna 2.0 and its token distribution. The tokens were airdropped to users of the original chain based on snapshots of holders before and after the depeg.

dYdX V4

Last, as it’s still in development, but definitely not least, dYdX has announced in June that they will be building the next version of their exchange on Cosmos. The team’s goal is to release dYdX V4 by the end of 2022. Today, dYdX isn’t fully decentralized–it functions as a hybrid decentralized exchange built on StarkEx, an application-specific Ethereum rollup that utilizes zero-knowledge STARK proofs. Concretely, while the trades are recorded in a decentralized fashion, the orderbook and matching engine of dYdX are stored and executed centrally, on dYdX Trading Inc. servers.

A major reason why dYdX chose the Cosmos stack to build the next iteration of the exchange was the flexibility of the Cosmos SDK. Specifically, they wanted to maintain that, while the exchange becomes decentralized, traders only pay fees on executed trades. To maintain throughput and not congest the blockchain with orders that don’t pay fees, each validator in dYdX V4 will run an in-memory orderbook that is never committed to the blockchain. The dYdX token will be used to choose validators and secure the network in a Delegated Proof-of-Stake consensus mechanism. Additionally, dYdX will introduce indexers, open-source software to fetch data from the blockchain and store it an efficient format such that it can be served via REST and WebSocket APIs. To allow for deposit and withdrawal from the exchange, dYdX plans to use IBC.

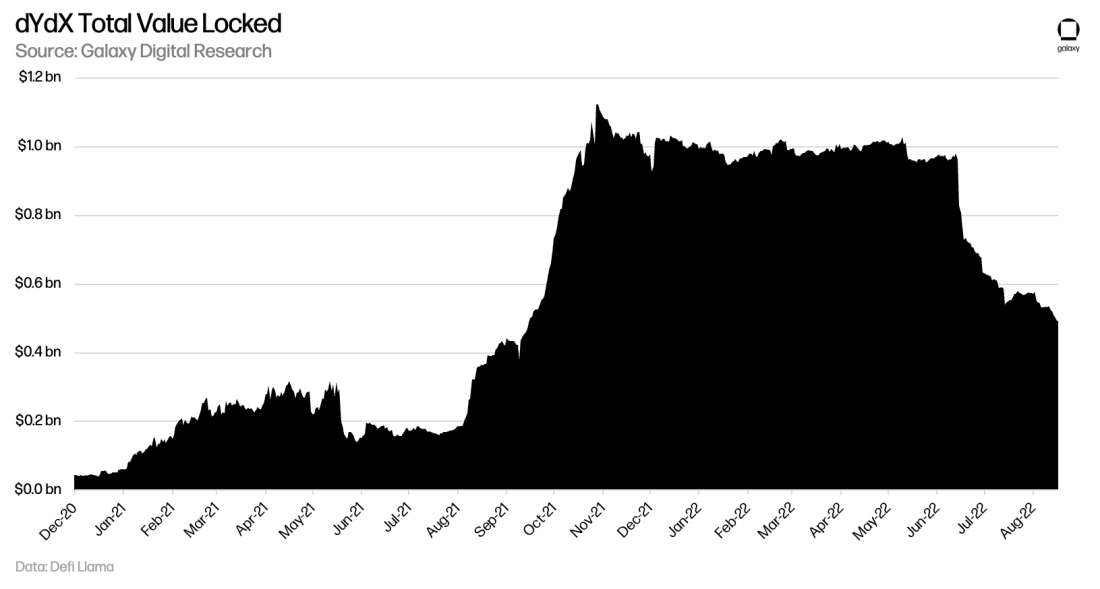

This is a big deal for the Cosmos community and ecosystem because the exchange currently has $492 million in TVL and processes $1.2 billion in daily trading volume on perpetuals, catering to tens of thousands of active users. While its launch shouldn’t significantly impact the market share and volumes of Osmosis and other DEXes, as dYdX is a perpetuals exchange and Osmosis is spot, its addition could potentially bring additional mindshare and user attention to the Cosmos ecosystem.

Not-So-Cosmos

Utilizing the Cosmos codebase does not mean being part of the Cosmos ecosystem. Several chains built using just Tendermint Core or the whole Cosmos SDK have not and do not currently plan to enable IBC connectivity to the Cosmos interchain. It would be misrepresentation to consider them part of the ecosystem as the users in Cosmos don’t benefit from them and can’t access them without using a third-party bridge. An analogy to make here is that Bitcoin, while compatible in theory with Ethereum by virtue of WBTC, is not considered to be a part of Ethereum’s ecosystem. Alternatively, Litecoin, which shares portions of Bitcoin’s codebase, is not considered to be part of the same blockchain ecosystems.

Chains may choose to opt out of IBC for several reasons, including the limitation of the bridging by users or the collection of fees from chain-specific bridges. Whatever the reason, it is still worth discussing the most well-known of these chains and how they’ve implemented the Cosmos technology.

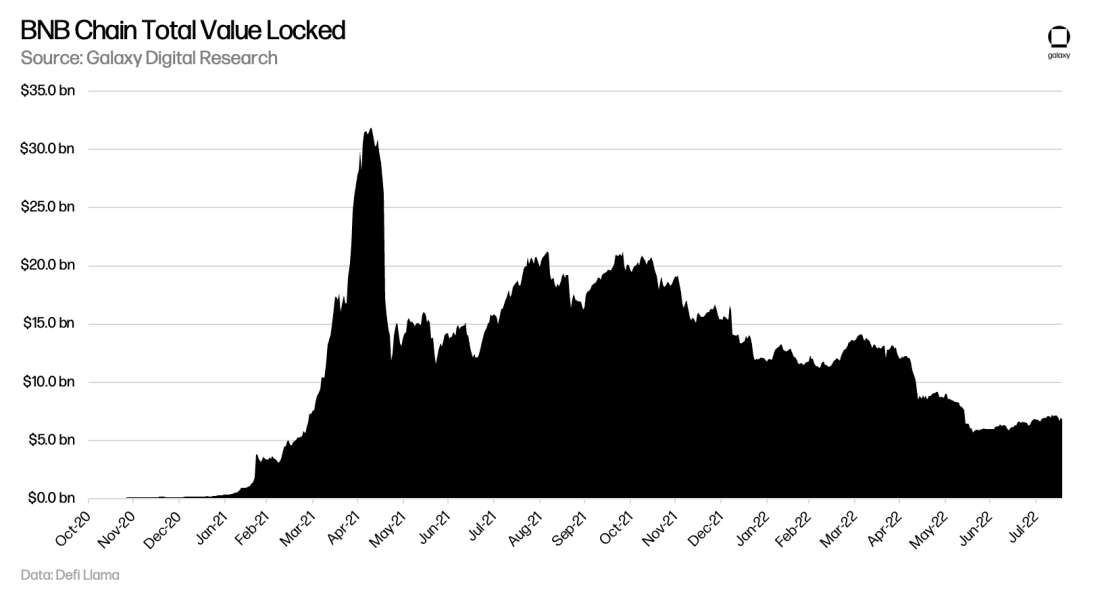

BNB Chain

BNB Chain is a Proof-of-Stake EVM-compatible blockchain built by Binance. BNB Chain is the second blockchain by TVL with a Total Value Locked of almost $6 billion. The central utility token on BNB Chain is BNB, the token Binance originally sold as part of their 2017 ICO. Apart from using BNB for fees on BNB Chain, users can use it to pay fees on Binance with a discount.

BNB Chain uses Tendermint for consensus and leverages the Cosmos SDK to build the application-agnostic blockchain. Despite being built on the Cosmos stack, however, BNB Chain has not implemented the IBC module and is not connected to the Cosmos network. To finalize transactions, BNB Chain uses a mix of Delegated Proof of Stake and Proof of Authority to finalize transactions, allowing only the top 21 validators to participate in consensus. BNB Chain validators are required to have a minimum of 64 GB of RAM and 16 cores of CPU (an increase from 48 GB and 12 cores when Galaxy Digital Research published Ready Layer One in November 2021) and a minimum stake of 10,000 BN (approximately $3,150,000). Binance also recommends validators run specific large instances of AWS or Google Cloud, effectively amplifying further centralization.

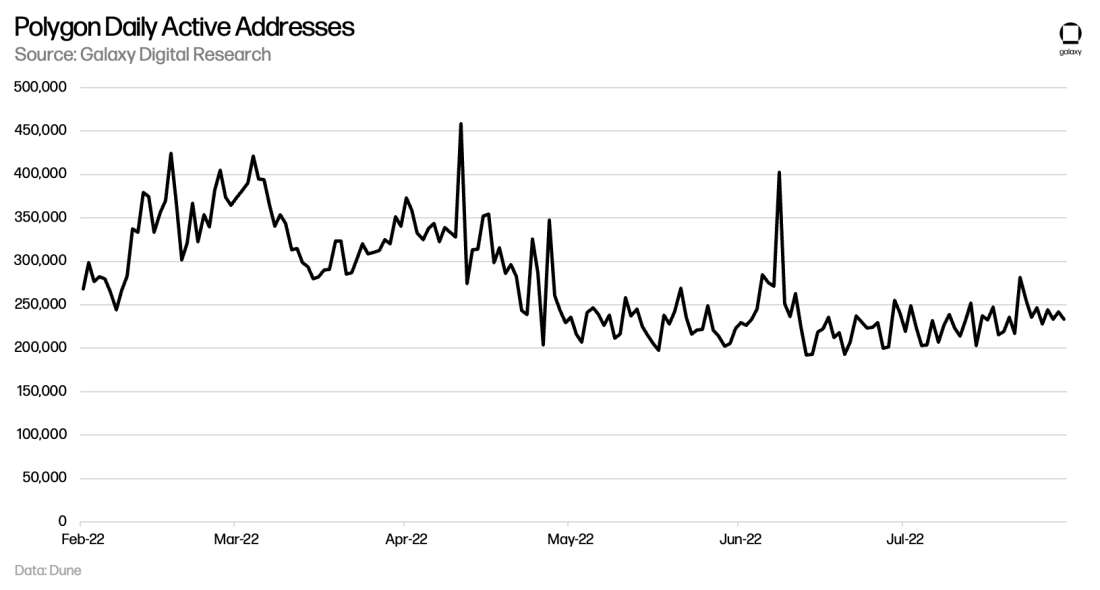

Polygon

In 2017, Sandeep Naiwal, Jaynti Kanani, and Anurag Arjun launched Polygon as Matic Network to address the congestion on Ethereum. They originally pursued Plasma as a solution for scalability but then shifted to building a sidechain. They launched Matic (now Polygon) in May 2020 as a Proof-of-Stake sidechain they called the “commit chain” and a Plasma on-ramp to process transactions coming from Ethereum. Polygon is built using Peppermint, which is Tendermint modified in a way that makes it compatible with Ethereum addresses and verifiable on Ethereum. Since then, Polygon has grown to become one of the best well-known scalability solutions to Ethereum.

As a sidechain, Polygon uses an independent set of validators to track state, which is then periodically committed to Ethereum. Although this approach uses Ethereum for final settlement, it does not protect the sidechain from malicious validators. However, despite not being a true Layer 2, Polygon has seen high adoption from users and developers seeking fast and available solutions. Every day, Polygon processes an average of 3 million transactions for over 1.5 million monthly active users. Like BNB Chain, despite being built using Cosmos technology, Polygon is not connected to Cosmos through IBC, so it shouldn’t be considered as truly part of the ecosystem.

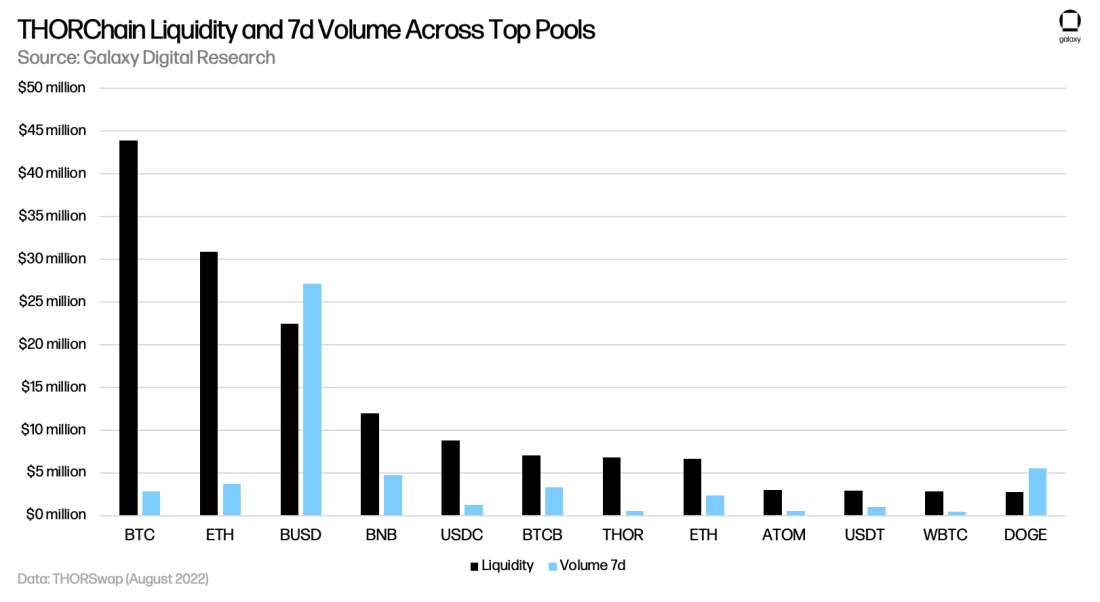

THORChain

THORChain is a decentralized exchange that allows users to swap native cryptocurrencies like Bitcoin, Ethereum, and Dogecoin without bridging them to a single chain or centralized exchange. It is built as an independent Proof-of-Stake blockchain using the Cosmos SDK. Using a system of vaults on various chains controlled by the validator set using MPC signatures, THORChain facilitates peer-to-pool cryptocurrency swaps using an AMM model. To simplify the routing process between tokens and create utility for its token, THORChain only allows users to pool whitelisted tokens against RUNE, their native token. For any token listed on THORChain, the process of swapping it to another involves two swaps, Token 1 to RUNE and RUNE to Token 2, unless the user is swapping to or from RUNE (then it’s only one).

Today, THORChain has a TVL of $370 million and processes over $30 million in daily volume. Cumulatively, it has processed over $6.4 billion in volume over roughly 4 million transactions for more than 50 thousand users.

Out of BNB Chain, Polygon, and THORChain, THORChain uses the most Cosmos technology to achieve their vision. However, despite being a fantastic tool to get started with Cosmos, it is also not planning to integrate with IBC due to the perceived centralization of relayers and difficulty in integrating it with the THORChain design.

Getting Started with Cosmos

A non-custodial wallet is the pre-requisite to interface with any blockchain ecosystem. Non-custodial wallets are fundamental software which allows the user to receive cryptocurrency payments and use their private keys to sign outbound transactions. Some wallets allow users to connect to decentralized applications, such as exchanges, lending platforms, and NFT mints. Effectively, a wallet serves both as a user’s identity and their pen (for signatures) in the digital world. The recent wide adoption of Cosmos technology has resulted in there being many wallet options available, such as Keplr, Citadel One, Cosmostation, Exodus, Guarda, Wallet.io, and others. Out of the list above, Keplr is the market leader with the highest levels of integration by developers. On mobile, users can install Keplr, Cosmostation, or Rainbow. For the sake of simplicity, we’ll focus on the Keplr browser extension wallet as it’s the most widely used in the Cosmos ecosystem with 500,000+ downloads on Chrome Web Store alone.

Keplr was built by Chainapsis, an entity which builds public goods for the Cosmos Ecosystem, such as Keplr, CosmosJS, Blockapsis, ICS-27, and Osmosis. Keplr supports 25 blockchains, including those with drastically different virtual machines, such as Juno, Evmos, and Secret Network. Apart from sending transactions and interacting with decentralized applications, Keplr allows users to choose validators to stake their tokens and to execute transfers over IBC.

After installing the Keplr extension, users are prompted to either sign in with Google (powered by Torus), create a new account, import an existing account, or import a wallet from the Ledger key-signing device. When creating a new account, users are required to save the seed phrase and then re-enter it to ensure security. After the account is created, users are greeted with a wallet interface with a zero balance. Note, however, that in order to explore the Cosmos Hub, users will need to acquire ATOM tokens.

Users can acquire ATOM on almost any centralized exchange, such as Coinbase, Binance, Kraken, and FTX. Alternatively, those who don’t want to go through a centralized exchange can use a decentralized solution, such as THORChain. THORChain added ATOM to the list of tradable tokens in July 2022, making it easier than ever to swap directly from Bitcoin, Ethereum, Doge, BNB, Bitcoin Cash, and many other assets to ATOM. Once they have ATOM on Cosmos Hub, users can head to the Osmosis website, for example, deposit ATOM, and then swap some ATOM into OSMO (for gas on Osmosis). From there, they can swap into any asset via Osmosis and bridge those tokens to any other chain. The Cosmos is your oyster.

Looking Ahead

Cosmos Hub Roadmap

The Cosmos Hub roadmap specifies four upgrades until Q1 2023. Most of these are things the developer community has been discussing for years and are logical next steps for the protocol. Most importantly however, in contrast with previous updates, the focus now is not solely on technology, but also on the growth and adoption of the ecosystem.

Rho (Q3/Q4 2022) – this upgrade will add a groups module to the Cosmos SDK, which would allow developers to build higher-level multisig contracts; add meta transactions to the SDK, which would allow messages to be sent by separate accounts that collect tips for the action; improve the Gov module of the SDK; introduce IBC relayer incentivization; deploy the Interchain Account Message Authorization Module; and, among other upgrades, ship the global fee module.

Lambda (Q3/Q4 2022) – this upgrade will deploy v1 of Interchain Security, which would allow chains to derive security from the Cosmos Hub validator set, and Liquid Staking, which would free up secure on low-risk delegations.

Epsilon (Q4 2022) – this upgrade would make IBC Queries possible and begin accumulating Hub ATOM Liquidity by buying up ATOM LP tokens with proceeds from Interchain Security.

Gamma (Q1 2023) – this upgrade would optimize the storage and performance of Cosmos SDK modules and introduce Interchain Security v2, where consumer chains will be able to use both their own validator set and the provider chain’s validator sets.

Long-Term Vision

Long-term, Cosmos developers plan to build Multi-Hop Routing, a feature that would simplify the channels of the interchain and allow packets to be routed through the hub while preserving the original channel. Some more points on the long-term vision include Privacy, Smart Contracts, and Rollups. The project seems to have features to add until at least the end of 2023.

While Cosmos currently scales horizontally, this doesn’t need to be the case forever. Quadratic scaling, or scaling both vertically and horizontally, would significantly increase both the throughput of the whole interchain and the individual throughput capacities of the chains. Using rollups seems like the logical next step on congested networks, as they derive security from the underlying Layer-1 blockchain but significantly reduce data consumption per transaction. It is likely that Cosmos developers are considering using Celestia for Data Availability on these rollups, especially considering that it is built using Cosmos technology.

Additionally, Cosmos developers promise to revamp ATOM tokenomics in Q3-Q4 2022 to increase its utility throughout the interchain and incentivize additional usage. Little is currently known on this front, but the team has hinted at innovative ATOM monetary policy, dropped the “Sound Money” buzzword, promised better funding of public goods, and talked about potential value accrual through interchain services.

Conclusion

The technology Cosmos offers to developer teams is unrivalled in the broader cryptocurrency space, which is why the applications built on top usually offer unique features which don’t exist anywhere else. Despite the tensions among core team members, the project has a very compelling narrative for steady future adoption. Considering the current state of the ecosystem, it’s easy to tell that Cosmos technology is a prime breeding ground for innovation. And it’s impossible not to look at the Cosmos SDK and ecosystem and not admire its truly open-source origins and nature. Most importantly, it isn’t only new projects that build on Cosmos, but old battle-tested projects consciously deciding that Cosmos would be the best platform to build the next iteration of their apps.

Looking forward, the implementation of the features outlined in the roadmap into the Cosmos ecosystem and technology stack is very likely to improve both user experience and adoption. At the end of the day, most adoption in a blockchain project happens when there are significant monetary incentives being distributed to both developers and users, so if any of the features implement mechanisms to reward both of these key groups of ecosystem participants, the project could see rapid growth.

Considering the success of applications built using the Cosmos SDK and IBC, Cosmos technology can no longer be considered an experiment. There are clear use cases which demonstrate the competitive advantage of Cosmos technology of other blockchain stacks. While we are already seeing developers realizing the technology’s potential, the development of applications and their adoption takes years, so it is likely that we won’t see a major shift in user mindshare towards Cosmos before the second half of 2023.

Key Takeaways

IBC is significantly safer than bridges. By making PoS validator sets of connected chains run light clients that can verify the state of the partner chain, the design of the bridge is perhaps impossible to compromise technologically and extremely expensive to compromise economically (by purchasing sufficient stake to disrupt consensus). Compared to traditional bridges which use external and arbitrarily selected or PoS-selected validator sets, IBC is significantly more secure.

Cosmos technology is exciting but isn’t fully polished yet. Despite being secure, IBC technology relies on centralized relayers which are not compensated for the work they perform. To implement decentralization in packet relaying and to ensure that relayers are compensated, developers will first need to implement upgradability of IBC channels. Similarly, with other aspects of the Cosmos SDK, developers are routinely pushing out updates and new modules.

The Cosmos ecosystem is unique and innovative. The projects built using the Cosmos stack are free to experiment with a lot more features than those built on smart contract enabled Layer 1s. The flexibility has allowed projects to experiment with altered versions of Proof-of-Stake consensus, different virtual machines built on top of Tendermint Core, and protocol-level customizability of applications.