Stablecoin Markets Show Bullish Sentiment

The stablecoin market is moving, with flows exiting USDC and entering USDT in a reversal of previous trends, an indication of a risk-on market with resumed offshore activity. As prices move upward across most major cryptoassets, stablecoin activity provides supplementary evidence of bullish market sentiment.

Key Takeaways

In a reversal of previous trends, the supply of USDC has been shrinking, while the USDT supply has resumed increasing after a substantial lull. Put together, these indicators are broadly bullish for (non-stable) cryptoassets.

USDT is widely used as an on- and off-ramp for crypto, especially in Asia. USDT growth slowed and briefly turned negative since the crypto ban in China and concurrent slump in the market. The latest supply increase is indicative of renewed offshore interest in crypto.

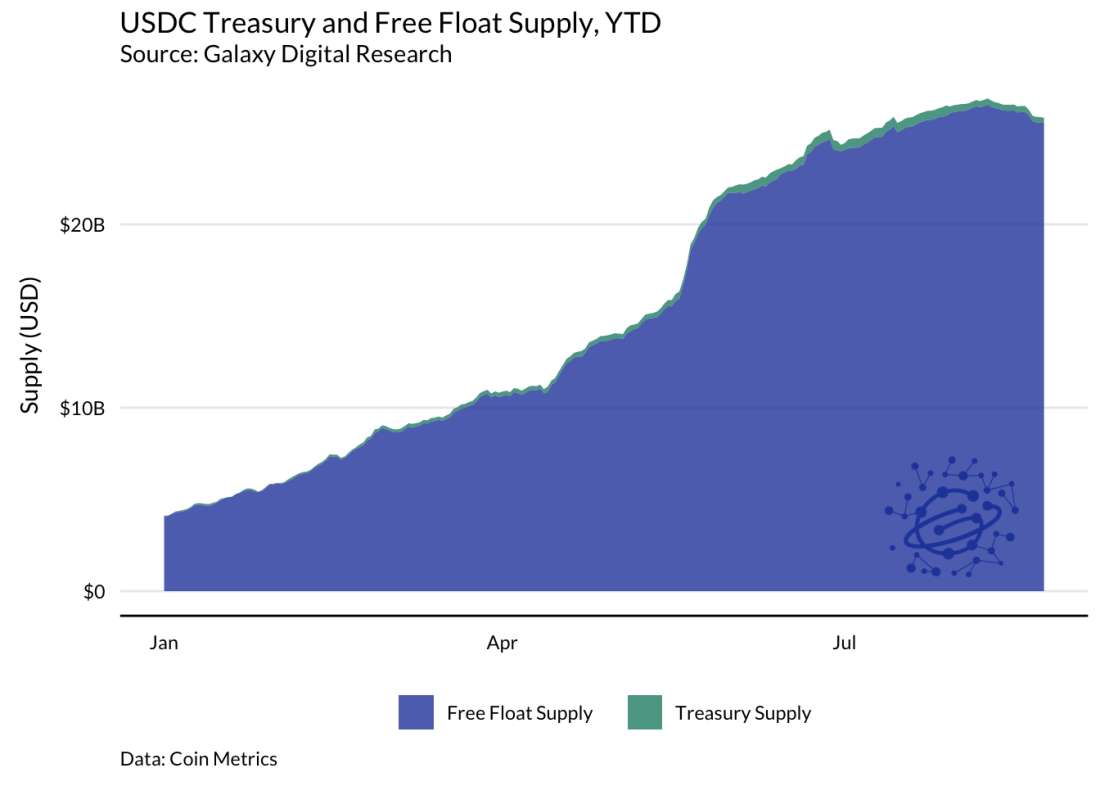

Meanwhile, USDC is typically used as a risk-off asset, especially in DeFi, where stablecoin yield farms are popular during periods of bearish sentiment. Since the beginning of the year, USDC has generally been growing and rapidly gaining market share against the much larger USDT.

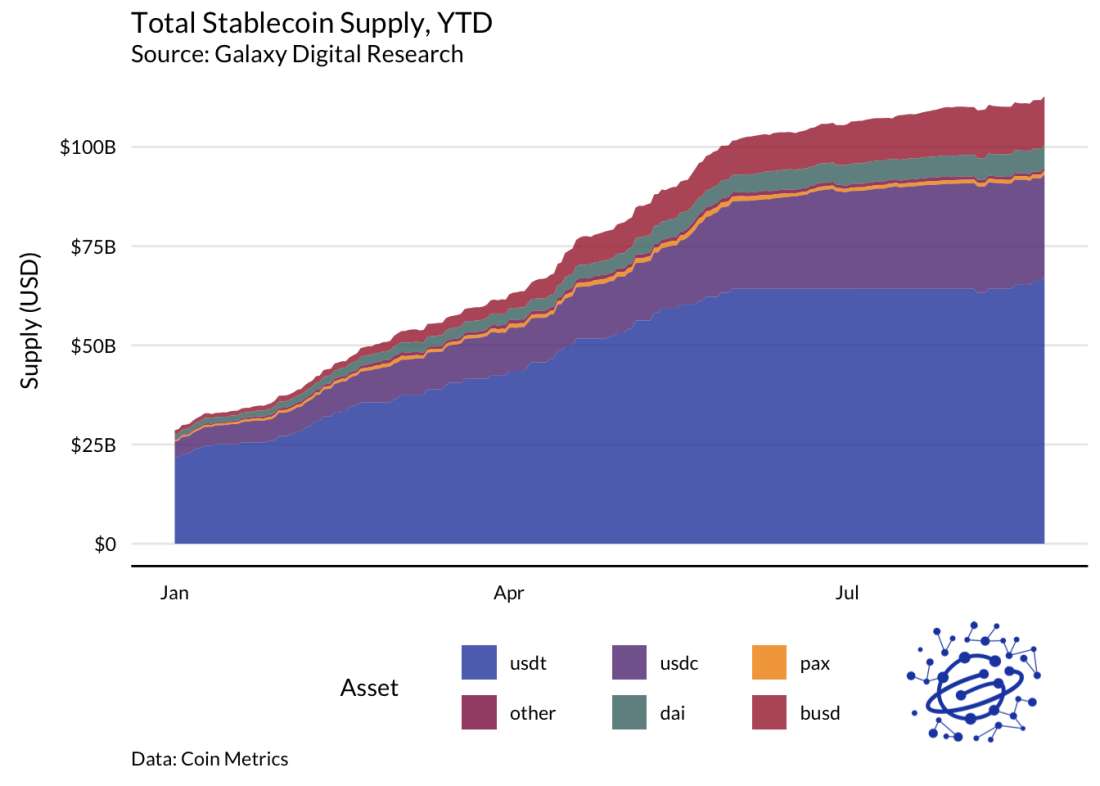

On a net basis, supply across major stablecoins has continued to grow gradually.

Stablecoins On the Move

While stablecoins have been a part of the crypto story for a while, they’ve become a much bigger part of the picture this year. On January 1, roughly $26.8 billion in stablecoins had been issued; despite slow growth since late May, the total stablecoin supply has increased almost fourfold since then, to roughly at $112.8 billion.

In addition to their ballooning supplies, stablecoins have drawn attention recently for several reasons, including the possible entrants of corporates like Facebook, hawkish language from regulators and policymakers, and increased transparency from issuers in the face of criticism of their opacity. Stablecoin market dynamics are also shifting.

The largest stablecoin by total supply is USDT, a multi-chain asset issued by Tether with a total supply of $67.2 billion. Year-to-date, USDT has also seen the most growth in the market by raw dollar value. On a percent basis, other stablecoins have eaten an increasing share of the market, most notably USDC, which today has a total supply of $25.8 billion.

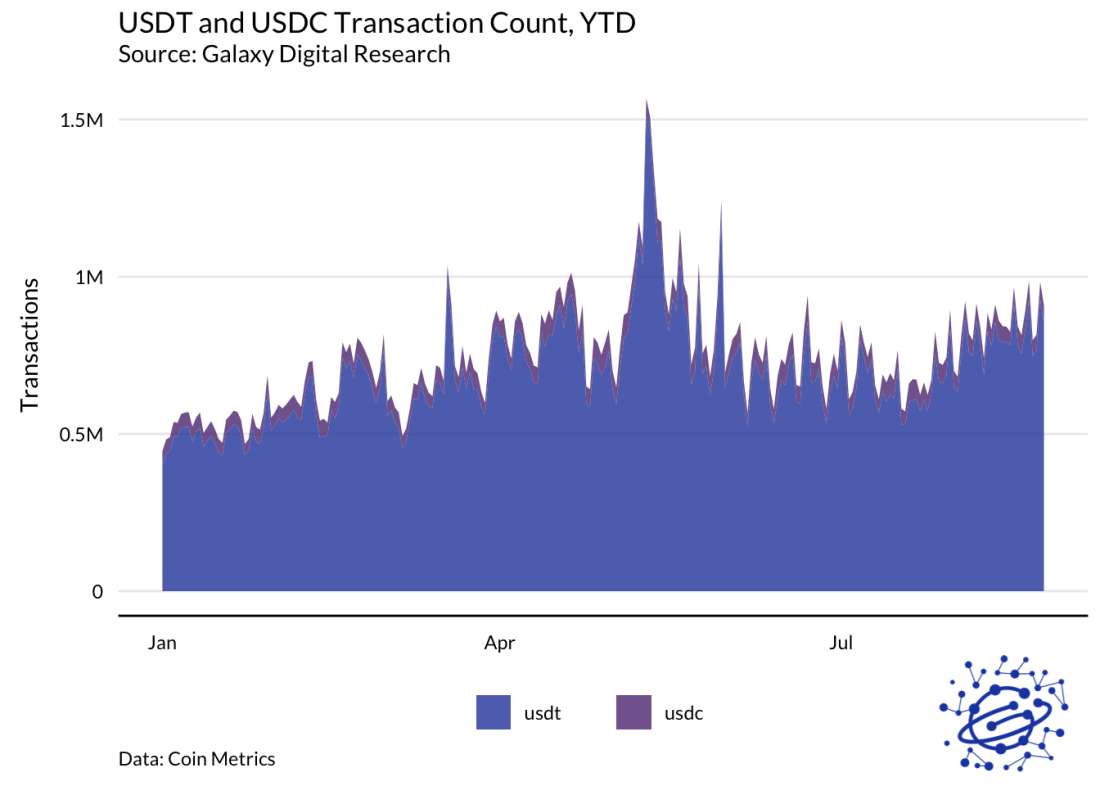

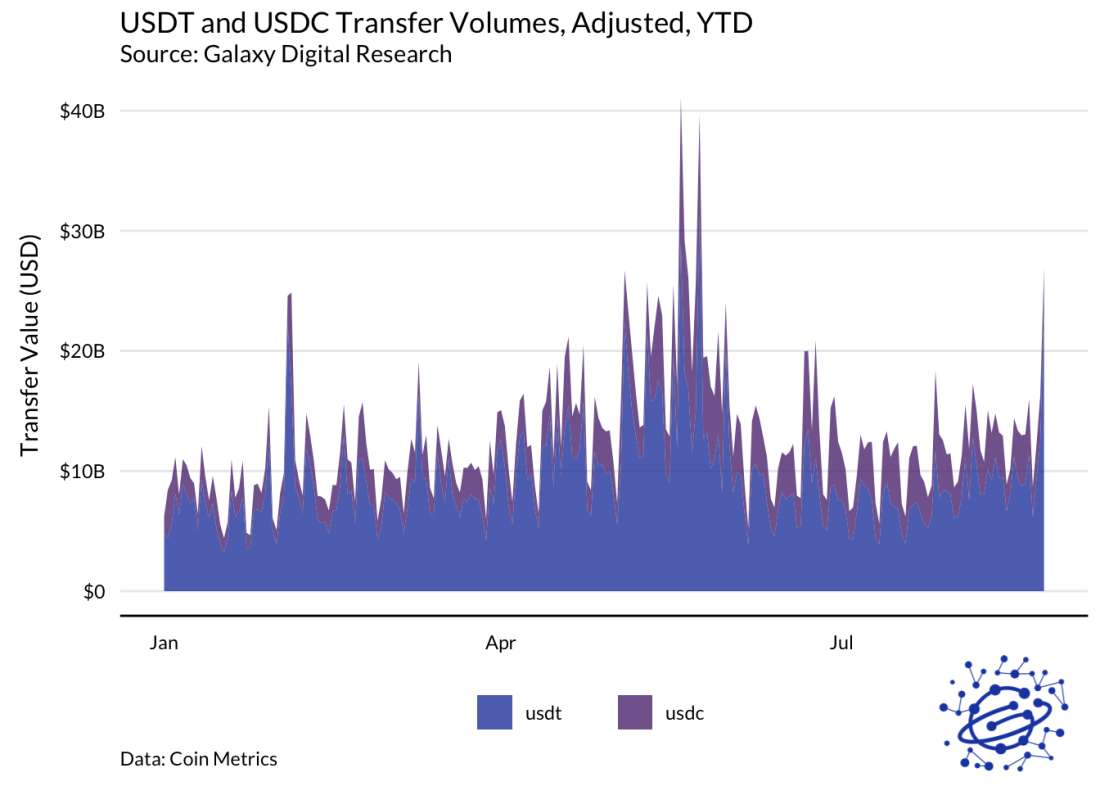

USDT and USDC are the two largest stablecoins by market share, with USDT being the clear market leader. Between the two assets, USDT accounts for the bulk of transactions and transfer volume, in part due to being hosted and widely used on multiple chains as a settlement asset between exchanges. Transaction count and transfer volume for the assets were both suppressed for a period but have recently rebounded.

Stablecoin Reserves

The issuers of both assets have recently made moves to increase the transparency of their operations and use lower-risk assets to back their stablecoins. Tether recently provided a more comprehensive attestation through their accountant, Moore Cayman. In the report, the firm announced that 24% of the value of USDT is now backed by US Treasury Bills, compared to 3% at the time of the previous reserves breakdown, issued on March 31. An executive from the company also stated that there would be a full audit published within months.

Meanwhile, Circle, which maintains USDC’s reserves, announced that the asset will be entirely backed by cash and treasuries in the near future, an about-face following a previous disclosure which showed a more diversified reserve composition. This brings the company’s offering to parity with Paxos’, the issuer of the PAX and BUSD stablecoins, which are backed exclusively by cash equivalents and treasuries.

Tether (USDT)

The first stablecoin, USDT, initially found product-market fit as a way for users to circumvent the banking system at a time when banks were explicitly hostile to crypto companies and traders. Compared to bank transfers, stablecoins also have the benefit of rapid, borderless, mostly inexpensive, 24/7 settlement, which is highly valuable in a fast-paced and global industry like crypto. USDT was originally issued on Omni, a layer on top of Bitcoin, but is mostly used today on Ethereum and Tron today, largely due to those networks’ shorter block times, which allow for faster settlement.

The asset’s use on Tron is particularly notable. Tron has relatively weak settlement assurances and is generally not viewed as a secure platform. But as a centralized asset, USDT is only minimally affected by Tron’s poor settlement assurances, and as such is well-suited to take advantage of the lack of congestion on the platform. Specifically, because USDT tokens represent an IOU for assets held in reserve by the centralized Tether Limited entity, and because Tether can cancel, revoke, or reissue these IOUs at will, there’s no need for the more durable finality offered by Bitcoin or Ethereum. Many of the asset’s core applications are time-sensitive, making them an ideal fit for Tron, which has quick block times and mostly low fees due to less network congestion than Bitcoin or Ethereum. USDT is used as an on-ramp into crypto, a quote currency for spot and derivatives trading, a vector for cross-exchange arbitrage, and an instrument for international dollar-denominated transfers.

USDT is popular offshore, especially in China, where it’s a key part of the workflow for converting fiat to crypto. Due to national regulations prohibiting financial institutions from servicing crypto exchanges, users typically convert their fiat into USDT at an OTC desk before depositing the USDT on an exchange. While this process is somewhat cumbersome, it allows Chinese users to access crypto in a tightly regulated environment and serves as a major source of demand for USDT.

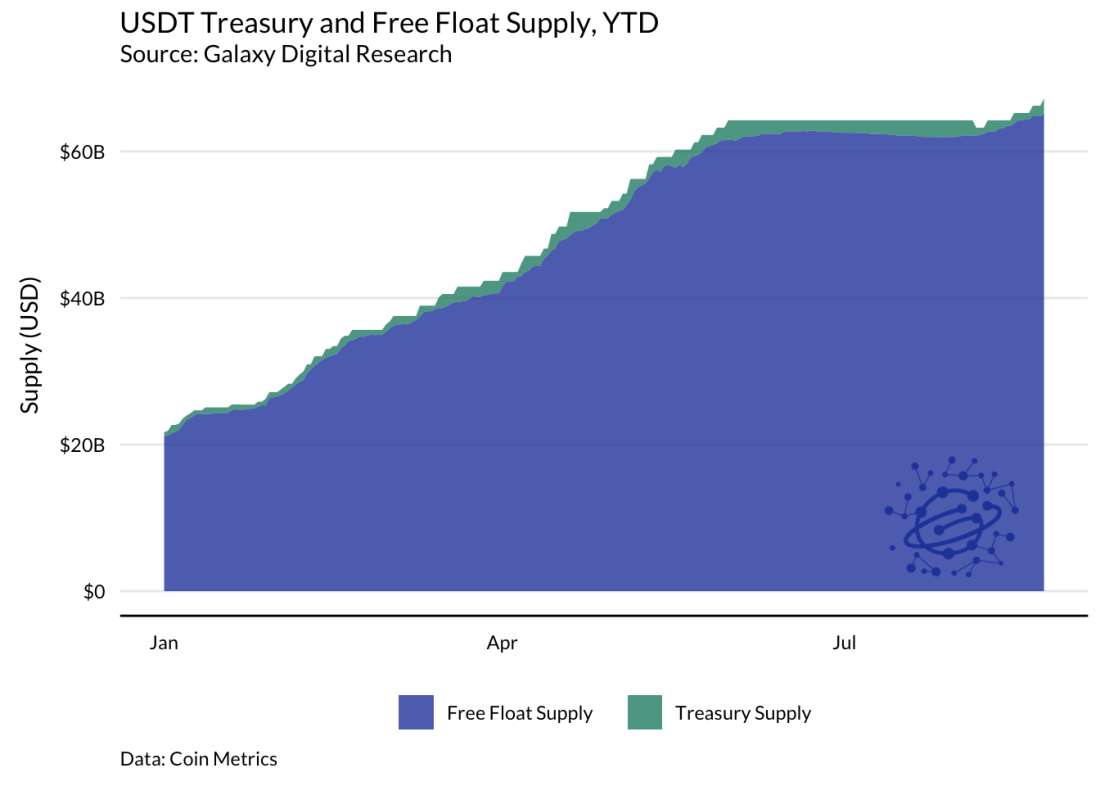

Since the Chinese government announced additional restrictions on crypto trading in May, growth in the USDT supply has largely flatlined, with free-float supply (a measure of supply that excludes inactive coins and those held in the issuer’s treasury) briefly shrinking to a local low of $62 billion on July 26. USDT supply growth has resumed over the last few weeks, indicating returning offshore interest in onramping into the crypto market, with free-float supply currently sitting at $65.2 billion.

USD Coin (USDC)

Meanwhile, USDC has experienced rapid growth throughout most of the year. This trend has recently reversed, though, with total supply shrinking by $1.1 billion, dropping 3.9% from its all-time high of $26.9 billion on August 8.

USDC is most widely used in the United States, serving more as a DeFi reserve currency than a crypto on-ramp like USDT. While USDT is also used in DeFi, USDC is more widely adopted in this market. Strong demand for dollars within the DeFi ecosystem, which lacks connectivity to the traditional banking system, has led to significant interest in borrowing USDC and resulted in favorable APRs for lenders. This, combined with relatively stable banking access for US exchanges, has led to USDC’s adoption in this space. The use of centralized stablecoins like USDC within the ecosystem is controversial, though, because as a centralized asset, it can readily be seized or frozen by its issuer.

USDC is frequently used as a risk-off asset within DeFi, especially as a gateway into stable farms, or incentivized yield programs that use stablecoins as the principal. Stable farms are popular during periods of broader market uncertainty, when they allow users to generate yields while remaining insulated from volatility and without fully exiting the crypto ecosystem.

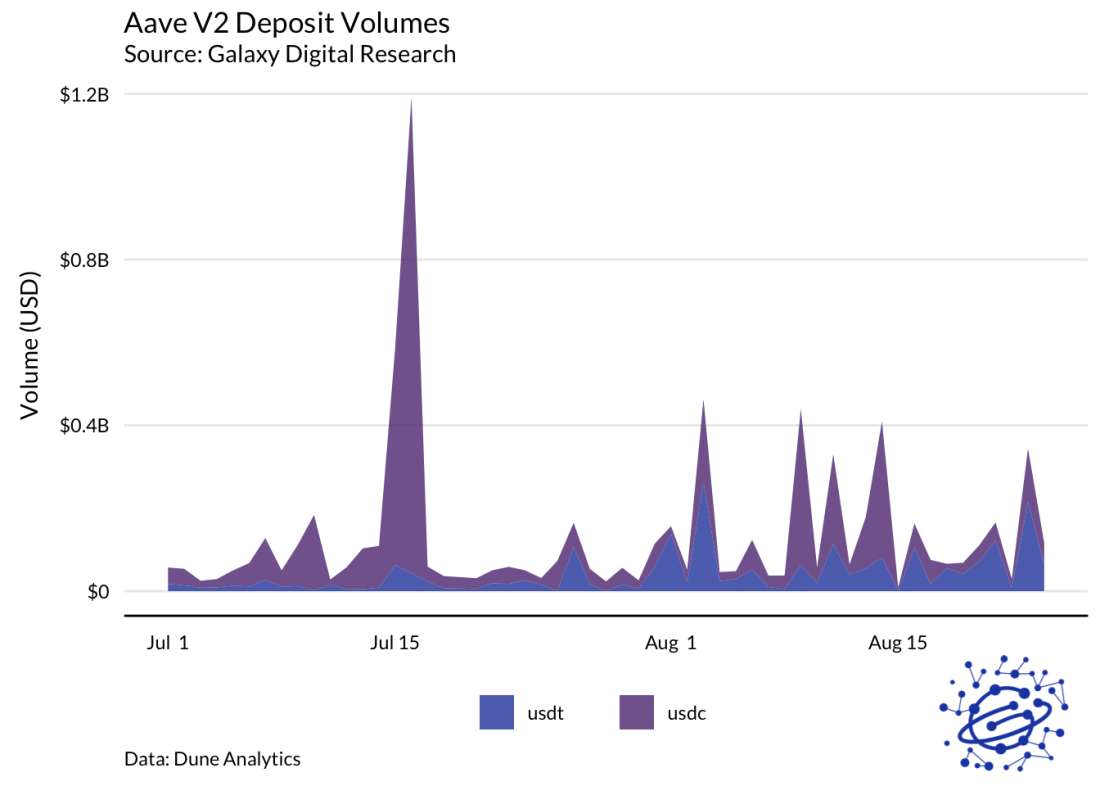

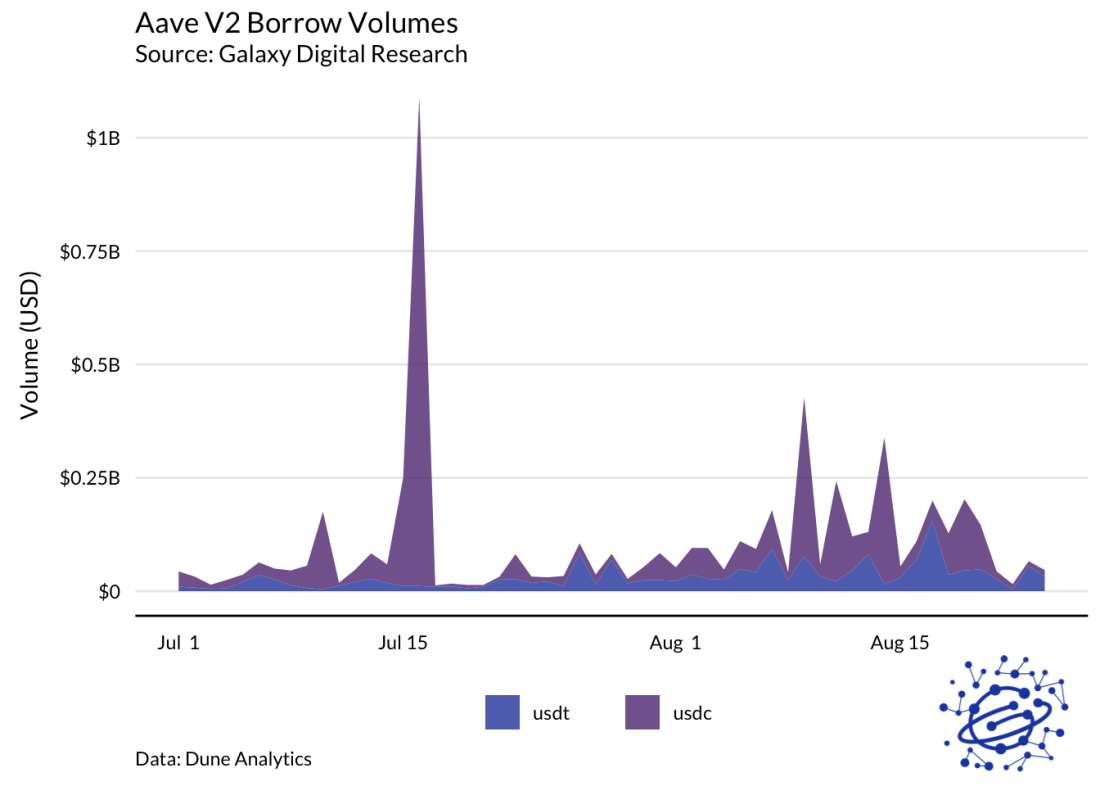

Data from Aave, the leading decentralized lending protocol, shows decreased lending and borrowing activity using USDC since August 8, when the asset reached its peak supply. This provides evidence for a more risk-on market with broadly positive sentiment.

What’s in a Name?

Stablecoins are generally stable: in other words, they’re boring. While they occasionally break from their peg, these dislocations typically don’t last long, and more often than not are accompanied by sharper market movements elsewhere. Most buyers are looking for peace and quiet, at arm’s length from the volatility that the rest of the crypto market affords.

That said, stablecoins have proven immensely successful. Though stablecoins could potentially be a breakthrough technology in consumer payments, their potential there remains largely unrealized today. Instead, the two largest stablecoins have reached product-market fit in two different trading applications. Relative demand for these services and aggregate trends in the sector may reveal preferences that asset prices do not: in this case, sustained bullish sentiment, with growing USDT supply signaling new inflows into the ecosystem and declining USDC supply hinting at a reduction in risk-off DeFi demand. As the market warms up again, it’s good to keep an eye on the supplies.

Legal Disclosure:

This document, and the information contained herein, has been provided to you by Galaxy Digital Holdings LP and its affiliates (“Galaxy Digital”) solely for informational purposes. This document may not be reproduced or redistributed in whole or in part, in any format, without the express written approval of Galaxy Digital. Neither the information, nor any opinion contained in this document, constitutes an offer to buy or sell, or a solicitation of an offer to buy or sell, any advisory services, securities, futures, options or other financial instruments or to participate in any advisory services or trading strategy. Nothing contained in this document constitutes investment, legal or tax advice or is an endorsement of any of the stablecoins mentioned herein. You should make your own investigations and evaluations of the information herein. Any decisions based on information contained in this document are the sole responsibility of the reader. Certain statements in this document reflect Galaxy Digital’s views, estimates, opinions or predictions (which may be based on proprietary models and assumptions, including, in particular, Galaxy Digital’s views on the current and future market for certain digital assets), and there is no guarantee that these views, estimates, opinions or predictions are currently accurate or that they will be ultimately realized. To the extent these assumptions or models are not correct or circumstances change, the actual performance may vary substantially from, and be less than, the estimates included herein. None of Galaxy Digital nor any of its affiliates, shareholders, partners, members, directors, officers, management, employees or representatives makes any representation or warranty, express or implied, as to the accuracy or completeness of any of the information or any other information (whether communicated in written or oral form) transmitted or made available to you. Each of the aforementioned parties expressly disclaims any and all liability relating to or resulting from the use of this information. Certain information contained herein (including financial information) has been obtained from published and non-published sources. Such information has not been independently verified by Galaxy Digital and, Galaxy Digital, does not assume responsibility for the accuracy of such information. Affiliates of Galaxy Digital may have owned or may own investments in some of the digital assets and protocols discussed in this document. Except where otherwise indicated, the information in this document is based on matters as they exist as of the date of preparation and not as of any future date, and will not be updated or otherwise revised to reflect information that subsequently becomes available, or circumstances existing or changes occurring after the date hereof. This document provides links to other Websites that we think might be of interest to you. Please note that when you click on one of these links, you may be moving to a provider’s website that is not associated with Galaxy Digital. These linked sites and their providers are not controlled by us, and we are not responsible for the contents or the proper operation of any linked site. The inclusion of any link does not imply our endorsement or our adoption of the statements therein. We encourage you to read the terms of use and privacy statements of these linked sites as their policies may differ from ours. The foregoing does not constitute a “research report” as defined by FINRA Rule 2241 or a “debt research report” as defined by FINRA Rule 2242 and was not prepared by Galaxy Digital Partners LLC. For all inquiries, please email [email protected]. ©Copyright Galaxy Digital Holdings LP 2022. All rights reserved.