This report is part 1 of a 4-part series focused on Optimism and Arbitrum—the two most popular optimistic rollups on Ethereum. The series will cover:

Growth of these networks and their ecosystems – a look back at 2022

Technical evaluation – exploring the tech stacks including Arbitrum Nitro & Optimism’s upcoming Bedrock

Rollups as a business – focused discussion on their economics & fee structures

Outlook – key upcoming events and discussion on optimistic rollups relative to broader ecosystem

Part 1 will discuss the major growth initiatives that led to the popularization of Optimism and Arbitrum, review key applications/projects of each ecosystem, and analyze the user activity and engagement levels across both networks.

Introduction

The events of 2022 shook the confidence of the entire crypto industry – even some longstanding crypto advocates started questioning their beliefs. A persistent grind lower in spot prices coupled with (and sometimes catalyzed by) spectacular blowups and bankruptcies caused many bull market entrants to flee the ecosystem Midst the turmoil of 2022, though, rollups—specifically Optimism and Arbitrum—have not only weathered the great exodus of capital, but they even experienced persistent growth in usage/activity throughout the year.

Some of the major growth catalysts for the two rollups this year were Arbitrum’s Odyssey marketing campaign (“Galxe”), Optimism’s token launch and airdrop & grants programs, as well as Optimism’s own Galxe initiative called Optimism Quests. We will discuss these events in-depth throughout the report.

Background

What are Optimistic Rollups?

Rollups enable hundreds of transactions to be batched together and published together in a single mainnet block, essentially compressing many transactions into one, thereby offering significant scaling benefits. The main value proposition of rollups is to minimize the data footprint on Ethereum while preserving the ability to check for fraud.

Rollup transactions are routed through a data aggregator (known as a “sequencer”) that executes the transactions off-chain and publishes transaction batches on-chain with a compressed form of the data (called “calldata”) so that anyone can reconstruct the off-chain transaction history using the available data to determine the correct state of the rollup.

Rollups typically come in two forms: (i) optimistic rollups, and (ii) zero-knowledge rollups (or “zk-rollups”). The primary difference between the two is their security models, which differ in when the cost of proof generation or validation is paid. Optimistic rollups derive their name because submitted transaction batches are optimistically assumed to be valid by default; the cost of validation (i.e., generating a fraud proof) is only paid if the posted data is disputed. In contrast, zero-knowledge rollups pay the cost of validation upfront by publishing a succinct validity proof for every state transition posted to the base layer.

Dispute resolution: Optimistic rollups reserve a challenge period (typically 7 days) that enables anyone to challenge the rollup block asserted by the sequencer. If no challenge is issued before the dispute window closes (the “optimistic” case), the transactions are finalized on-chain and are no longer disputable. If a challenge is submitted, then the rollup will enter into a dispute resolution process to identify which party is at fault. The party at fault would then be subject to losing a deposit. (For a more detail on the dispute process, see our prior research ‘In Search of Scaling: A Guide to L2’ or wait for our next series report for a more in-depth discussion).

Why Optimistic Rollups?

Rollups are core to Ethereum’s scaling roadmap, which brings more usability/affordability to the network while preserving core security guarantees. Vitalik Buterin has claimed that “rollups are the only trustless scalability solution for Ethereum in the short-medium term, and possibly the long term.”

Compared to zk-rollups, optimistic rollups are more readily equipped for general purpose smart contracts with greater EVM-compatibility. Having EVM-compatibility enables rollups to leverage the existing ecosystem of Ethereum, making it easy for developers to take existing tooling/applications deployed on Ethereum to reused in a rollup environment. While many believe zk-rollups will be the best technology in the future, they have a long way to go before the technology and the economics reach the level of usability offered by optimistic rollups today. For more information on zk-rollups with EVM compatibility, read this report from Galaxy Research.

What are Optimism and Arbitrum?

Optimism (fka the Plasma Group) is developed by OP Labs PBC and was the first generalized rollup protocol to gain popularity after its mainnet launch in January 2021 when Synthetix went live. Optimism has raised $178m across several rounds from venture investors including Paradigm, a16z, ConsenSys, Coinbase, Robot Ventures, Pantera Capital, and others.

Arbitrum, developed by Offchain Labs, had a full public launch with no whitelist restrictions in August 2021. Arbitrum has raised $143m several rounds from venture investors including Pantera Capital, Lightspeed Ventures, Coinbase, Polychain, ParaFi, and others. Arbitrum had jumped to an early lead in DeFi and users, which can be partly attributed to Optimism’s permissioned launch, which limited the projects that could build on the network. Optimism’s whitelist was only removed in December 2021, and it has since been playing catch up in terms of adoption relative to Arbitrum.

At the end of May 2022, competition between the two for users and capital escalated with the launch of Optimism’s governance token, OP. With a thoughtful token design and effective governance framework (discussed in more detail below), the OP token equips Optimism with financial resources to fund grants, giving Optimism at least one advantage when it comes to ecosystem development over Aribtrum, which has not announced any token plans.

In August, Arbitrum successfully completed a major upgrade called Nitro, increasing the capacity of the network by several orders of magnitude, and offering even cheaper fees. Other key differentiators between the two are Optimism’s commitment to RetroPGF (discussed further below), open-source development, and EVM-equivalence. In contrast, Arbitrum has launched Arbitrum Nova, a chain dedicated to gaming/social applications, and acquired Ethereum’s leading consensus client team, Prysmatic Labs.

Arbitrum Odyssey

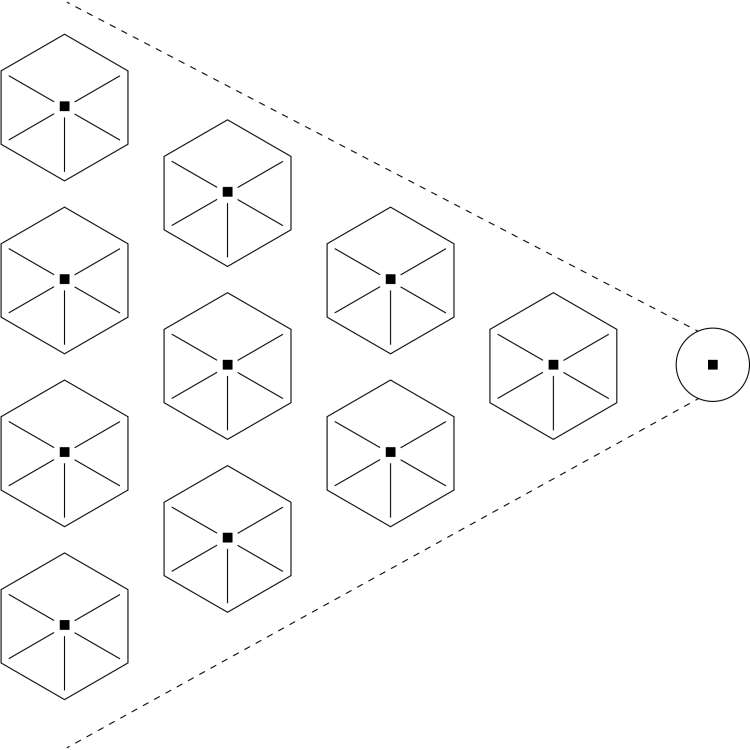

In April 2022, the Offchain Labs team introduced a new marketing campaign called Arbitrum Odyssey—a two month educational program in collaboration with Project Galxe that aimed to onboard new users to the ecosystem and encourage exploration of various projects. By completing tasks like learning about and using a project, users could claim a commemorative NFT representing completion of the quest.

The community voted on narrowing a field of 56 projects to 14 projects to include as part of the Odyssey campaign. Different tasks for using these 14 projects were assigned each week for a two-month period beginning on June 21st. Users that collected 12 of the 15 NFTs would receive a special, exclusive NFT. Though not explicitly stated, many users believed that the number of Galxe NFTs collected from the Odyssey campaign would be a qualifying criterion for a future token airdrop from Arbitrum.

Program details included below:

The announcement of Odyssey was enough to drive user activity significantly higher on Arbitrum as daily active addresses doubled from ~10k to ~20k in the days leading up to the start. Odyssey launched with “Bridge Week,” which drove over 55k ETH worth of inflows into Arbitrum from different networks via Hop, Bungee, Celer, Multichain, and other bridging protocols.

In the 8 days following the start of the program (6/21/22 – 6/29/22), ~250k new addresses were created on Arbitrum, driving a 32% increase in total addresses and crossing the one million mark.

On June 29th, just after the start of the second week of the program (focused on GMX & Yield Protocol), the Odyssey campaign was halted as network capacity was exceeded, leading to high fees, congestion, and other network performance issues. The Arbitrum team noted that Odyssey would resume after the Nitro upgrade is released so all users on Arbitrum would continue to have a friction-free experience.

The migration to Nitro (covered in greater detail in Part 2) was successfully completed on 8/31/22, increasing Arbitrum’s throughput by approximately 7-10x compared to its level since the Odyssey campaign was paused. In December, Offchain Labs confirmed in a Twitter Spaces that Odyssey would be resuming and that they are planning multiple seasons of Galxe quests to include more projects that weren’t in the first season. However, the exact timing of the program restart has yet to be announced.

Optimism's OP Token

OP Token Launch

In April 2022, shortly after the Odyssey announcement but before the start of the campaign, Optimism had formally announced the OP token plans, sharing details of the tokenomics and its governance model. Some distinctive aspects of the token design and launch plans include:

Optimism Collective. Optimism Collective is an experimental governance model consisting of two governing bodies:

Airdrop Round #1 made 215m OP tokens available (26% of total Airdrop allocation) to nearly 250k eligible addresses, averaging 863 OP per address with a median of 681 OP tokens. With OP beginning trading around $1.25 – $1.50 at launch, this was a considerable airdrop for most eligible users (averaging >$1000), especially by retail standards.

Optimism allocated 816m OP tokens (19% of initial supply) to airdrops. After a snapshot of addresses was taken on 3/25/22, OP Airdrop #1 officially launched on May 31st. There were 6 different qualifying criteria for the airdrop, including early adopters, repeat users, DAO voters, Gitcoin Donors, and others. Users that met at least 4 of the qualifying criteria were awarded large overlap bonuses.

Airdrop #1

The initial supply at genesis was 4.3Bn OP tokens. The total supply will inflate at a rate of 2% per year (inflation does not begin until next year). OP allocations are split between an Ecosystem Fund, retroPGF, user airdrops, core contributors, and investors.

OP Tokenomics

The Token House. The Token House is responsible for voting on proposals including Governance Fund grants, protocol upgrades, inflation adjustment, treasury appropriations, and others. Voting power in the Token House is based on the quantity of OP tokens held or delegated.

The Citizens’ House. The Citizens’ House is responsible for retroactive public goods funding (retroPGF), an incentive program that rewards projects and individuals that have made a positive contribution (i.e., public goods) to the Optimism community. These include nonprofit projects and teams that made core infrastructure improvements, rather than proactive grants program like the Governance Fund. Unlike the Token House’s traditional model of coin voting, the Citizens’ House is a one-person one-vote system where voting badges are distributed to elected community members. The Optimism team has committed to giving all profits made from its sequencer to funding public goods.

Iterative governance process. There will be many rounds of governance to experiment with design and process. Each round of grants funding and retroPGF (referred to as “seasons”) will be followed by a reflection period and then a voting cycle to modify the Collective’s structure and to Optimism’s Operating Manual.

OP is a governance token, not a gas token. At launch, OP is simply a governance token. Network fees are paid in ETH. Optimism’s sequencer is operated centrally (at least for the time being) so there are no distributed validators on Optimism and there is no standard protocol inflation rate as seen with typical L1 blockchains. OP’s embedded value comes from token holder’s ability to vote on key economic and social decisions in the future.

Continuous, multi-round airdrops. Instead of just one single airdrop to reward early users, there will be multiple rounds of airdrop to encourage sustained activity on Optimism.

Details around future airdrop rounds (at least 601m OP remain to be allocated) have not yet been formally announced, though many speculate that airdrop round #2 will be tied to governance participation and to the Galxe Optimism Quests campaign (discussed in later section).

Governance Fund & RetroPGF

The Ecosystem Fund (25% allocation ~1.1bn OP) provides proactive funding grants to Optimism projects, serving as the kick-starting mechanism for the network. The Ecosystem Fund is comprised of a Governance Fund (GovFund), Partner Fund, and Seed Fund. The Optimism Foundation intends to phase out the Ecosystem Fund once the OP has been depleted so that future incentives will come entirely from the RetroPGF mechanism.

GovFund Grant distributions to funding ecosystem projects are voted on by the Token House (OP token holders and delegates). Token House governance operates on a seasonal schedule, which include several three-week long voting cycles followed by a one-week Off-Season, a three-week Reflection Period, and a two-week Special Voting Cycle to modify the Optimism Collective’s structure.

Optimism’s OP Summer Program (Season 1) distributed 42m OP tokens to 41 ecosystem projects – many of which then directed to users via liquidity mining and other incentives. The initial projects with incentives from the OP Summer Program included many Optimism-native projects (e.g., Perpetual Protocol, Velodrome, Lyra Finance, and Pika Protocol) and some core Ethereum DeFi projects (e.g., Aave, Stargate Finance, and Uniswap). The GovFund distributions for these projects started at various times beginning mid-July through August (Uniswap OP rewards started October 26).

GovFund distributions and recipients can be tracked through the public GovFund Tracker and OP Incentives Dashboard.

Following the close of Season 1, the iterative governance process resulted in several changes for Season 2 including the establishment of 4 specialized Committees (two DeFi committees, and one for Tooling and for NFTs & Gaming), meant to alleviate the workload of delegates through information filtering and synthesis and making non-binding recommendations to other delegates.

Feedback from Season 2 (ran from Sept – Nov) cited continued issues of voter apathy / delegate overload, as well as other challenges including proposer frustration with feedback and self-delegation, and limited accountability of grant recipients. In Season 3 beginning late January, the GovFund grants process will be managed by a Grants Council comprised of two sub-committees (100% staffed by community members and delegates) that will have full decision-making authority over which grants are made. Each subcommittee is tasked with its own objectives:

Builders Sub-Committee has the objective of maximizing the number of developers building on Optimism.

Growth Experiments Sub-Committee has the objective of maximizing the number of users interacting with applications Optimism.

At the end of Season 3, the Token House will have the chance to evaluate, re-approve, or modify the two sub-committees.

(Governance discussions take place in the official forums; governance voting activity can be tracked through the OP Governance Data dashboard and OptimismFnd’s Dune dashboard.)

RetroPGF

Optimism has committed to distributing 20% of the OP token treasury through RetroPGF. According Optimism CEO Jinglan Wang in a TechCrunch interview: “We made a commitment to the public that we would not take profit from operating centralized parts of the system, so we wanted to remove the financial incentive for ourselves to remain centralized. “While we are making revenue, we’re giving all of that revenue back toward funding public goods on Ethereum… We’re very into building out in the open, every line of code we write is open source as we write it, and similarly we’re transparent about the vulnerabilities and bugs that are found and disclosed in our network. We want to build a good security culture around the Optimism community, where [ethical security hackers] know that if they find vulnerabilities, they will be compensated fairly.”

RetroPGF Round #1 ran from 10/5 – 11/5, distributing $1m of network profits to funding to public goods as directed by a group of pre-selected 24 “badge holders” following the one-person-one-vote system. RetroPGF rewarded individuals and projects that provided better tooling/infrastructure, user education, and research initiatives.

Beginning January 2023, RetroPGF Round #2 will distribute 10m OP from the treasury allocation as directed by a group of 90 badge holders, marking the initial release of the Citizens’ House. RetroPGF2 timeline:

Project nominations: Jan 17 - 31

Final project signup deadline: Feb 7

Voting: Feb 21 - March 7

Optimism Galxe Quests

Copying Arbitrum’s playbook, Optimism Foundation initiated its own Galxe campaign. Optimism Quests ran for four-months from 9/20/22 to 1/17/23 with 18 participating projects.

Optimism Quests was successful in driving a lot of engagement. As many have speculated that airdrop round #2 will be tied to the Galxe Optimism Quests campaign (though unconfirmed), which drove significant user participation and network activity. In total, 3.4m NFTs were minted by ~457k unique addresses, averaging ~7.5x NFTs per address. The most frequent # of NFTs minted per address was 10 (minted by 36% of all participating addresses) though there was a steep drop off beyond that number as several derivatives protocols that were included in the program had restricted access to US residents.

Of the 457k unique participating addresses, 394k (~83%) were new users brought in by Quests. Most of these addresses were from addresses aged <1 day at the time of their first interaction with Galxe vs. when they made their first transaction on Optimism, suggesting Galxe was directly responsible for their onboarding. In addition, of the 930k new addresses that were created on Optimism over the duration of the Quests campaign, 40% had participated in Quests. It’s clear that Galxe has been a successful onboarding campaign for Optimism – it’s a great ROI since there is zero explicit financial cost (could be implicit costs if future airdrop is tied to Galxe NFTs minted but nothing is confirmed yet).

Ecosystem Highlights

(Note on terminology: we may refer to active addresses as “users” when applying certain metrics (e.g., daily active users “DAU” or monthly active users “MAU”), though we recognize that multiple addresses may correspond to one “user”.)

Optimism

Transaction Count

Perpetual Protocol has had the highest app transaction count (excludes token transfers/approvals) across all projects on Optimism, averaging nearly 700k txs / month in 2022. Through May 2022, Perpetual Protocol had accounted for the majority of app txs among the top 10 projects on Optimism. From then, app transactions had started to decrease on Perpetual while ramping up across other projects, especially after September (led by Galxe and related projects), leading to greater diversity of transactions across Optimism’s top projects. It's notable that the each of the top projects included in the chart are all participants in the Optimism Quests.

Users

Through August, Uniswap was the top project by average unique monthly users, although the user count was relatively muted on Optimism compared to the last few months of the year. After the Galxe campaign had started, the top projects by unique monthly users had seen a more balanced distribution, suggesting strong user affinity across these Galxe-related projects. In December, the large Thirdweb data point is associated with a free commemorative Genesis Subscriber NFT that was offered in Optimism’s year in review Mirror post on December 20th (335k users).

Total Value Locked (TVL)

TVL on Optimism was fairly low (<$500m) until Aave launched OP incentives on August 4th with 5.3m OP for distribution. At its peak, Aave TVL had jumped to over $2bn and represented 78% of total TVL on Optimism. However, TVL quickly dropped once the incentives ended 3 months later (also around the same time as FTX collapse). It’s worth noting that TVL of other top recipients of GovFund incentives (e.g., Synthetix and Velodrome) have been relatively more stable compared to Aave after incentive programs had ended.

Quarterly Summary Table

Arbitrum

Transaction Count

For 2022, Uniswap and Sushi have been the two most popular applications ranked by transaction count. Yet at the start of the year through May, TreasureDAO, a gaming ecosystem powered by their MAGIC token, led all projects, averaging ~150k transactions per month. Project Galxe transactions ramped up after the start of the Odyssey campaign in June, including after the pause of the official program as other Galxe programs on programs launched on Arbitrum mostly by individual projects. GMX, a derivatives protocol, has also seen meaningful transaction growth especially after August as the “real yield” DeFi narrative took hold, which emphasized protocols paying out yield to users based on revenue generation. The remainder of the list is either core DeFi protocols or cross-chain projects that are not Arbitrum-native.

Users

The top 10 projects by unique monthly users overlaps with many of the top projects by transaction count. The distribution of users also follows a similar distribution to transactions, led by Galxe, Uniswap, Sushi, and GMX. Project names new to this list include Dopex, an Arbitrum-native options protocol, and Socket, which powers cross-chain bridge aggregator Bungee Exchange and is utilized by other applications including Zapper and Zerion.

Total Value Locked (TVL)

TVL on Arbitrum has been robust and fairly consistent through 2022, dipping below the $1bn mark for a brief stretch from mid-June through July. GMX leads in TVL, accounting for one-third of Arbitrum’s total, and has shown steady growth through the year. Radiant, a lending protocol, had quickly accumulated a significant amount of TVL after launching late July and ended the year ranked #2 on Arbitrum, ahead of Ethereum’s most popular lending protocol, Aave. Vesta, an interest-free collateralized stablecoin provider, is the other Arbitrum-native project ranked in the top 10. The ‘Other’ category outside of the top 10 projects accounted for over 25% of TVL over 2022, a fairly high proportion compared to other chains that are dominated by a few DeFi protocols, reflecting the robustness and diversity of the DeFi ecosystem on Arbitrum (includes Dopex, Convex Finance, Abracadabra, Balancer, dForce).

Quarterly Summary Table

Arbitrum Nova

While Arbitrum One is the primary general network for DeFi and NFT activities, Arbitrum Nova is optimized for gaming and social applications. Nova launched to the public in August and is built using Arbitrum’s AnyTrust technology, which enables lower transaction costs at the expense of security. Rather than posting data on L1 by default, Nova requires a mild trust assumption as data is managed off-chain via an external Data Availability Committee (DAC). The inaugural members of Nova’s DAC include Offchain Labs, Consenys, Google Cloud, P2P, Quicknode, and Reddit. Both Arbitrum One and Arbitrum Nova run on the Nitro stack (more detailed technological discussion will be covered more in-depth in our next series report).

Reddit has migrated its Community Points system to Nova after selecting Arbitrum as the winner of the Reddit Scaling Bake-Off, which also assessed proposals from other blockchains including Solana, StarkWare and Polygon. Reddit Community Points marks the first major deployment on Nova. Other live Nova ecosystem projects include several bridging providers, dexes, gaming, and NFT marketplaces.

Since its public launch on August 9th through year-end, there have been a total of 3.3m txs by 282k cumulative addresses on Nova, averaging 11.8 txs per address.

Comparative Data Analysis

Total Value Locked (TVL)

Arbitrum has had an early lead against Optimism in TVL, which can be partially attributed to its open launch style, which saw several DeFi projects deploy on the network. Optimism took a brief lead in TVL against Arbitrum from August through October as it started OP Summer incentives but saw a steep drop after Aave incentives had ended (also around the same time as FTX collapse). On the other hand, Arbitrum’s TVL has shown more resilience during that time compared to Optimism.

Transactions

Arbitrum and Optimism have been fairly neck and neck for daily transactions over the year, both averaging ~150k per day. There have been occasional instances where transaction count deviated across the two networks, most recently in later December as Optimism transactions accelerated through year end while Arbitrum transactions slowed. This was largely tied to more addresses participating in the Optimism Quests Galxe campaign and the Genesis Subscriber NFT mint from the Year in Review Mirror post (~335k NFTs minted).

Compared to total transactions, Arbitrum holds up a bit better against Optimism when looking at just application actions, which are a subset of total transactions that better reflect application activity (excludes token approvals, wrapping, transfers, self-transactions, and system transactions including gas price oracles). For 2022, application actions as a % of total transactions have averaged 82% on Arbitrum compared to 78% on Optimism, which has experienced a continual decline in this metric over the course of the year.

User Activity: Active Addresses, Engagement, & Retention

(Note on terminology: we may refer to active addresses as “users” when applying certain metrics (e.g., daily active users “DAU” or monthly active users “MAU”), though we recognize that multiple addresses may correspond to one “user”.)

Active Addresses

Throughout the year, Arbitrum has consistently had more active addresses than Optimism, averaging ~2.5x the level of Optimism over 2022. However, this trend reversed in the closing weeks of December when Arbitrum experienced a lull (typical of the holiday period), while Optimism experienced a spike at the same time.

Engagement

Despite having fewer applications than Arbitrum, Optimism has had a more engaged userbase compared to Arbitrum as measured by transactions per active address, daily vs. monthly activity metrics, and user active days.

As noted above, transaction count has been similar on both networks while Arbitrum has had more active addresses than Optimism, which implies active addresses on Optimism transact more frequently than active addresses on Arbitrum. Over 2022, active addresses on Optimism have averaged 11.8 transactions per day, about double the level of active addresses on Arbitrum (~5.6 txs / day), though the gap between the two networks has been closer towards the end of the year. Over a 30-day period, Optimism addresses averaged ~26 transactions per MAU compared to ~14.5 transactions per MAU on Arbitrum.

For the first half of 2022, active users on Arbitrum transacted more often than those on Optimism as measured by the ratio of DAU/MAU (i.e., the proportion of monthly active addresses that transact on the network in a single day window). Said differently, monthly active addresses transacted on more days over a 30-day period on Arbitrum compared to Optimism for the first half of the year. The second half of the year saw users transacting more often on Optimism than Arbitrum, though the gap had closed by year-end.

User Retention by Cohort

Each cohort represents a class of wallets that have been active (i.e., executed a transaction on-chain) for a given week. For example, cohort #1 includes active wallets for the week from 1/3/22 – 1/9/22, cohort #2 includes active wallets for the week from 1/10 – 1/16, and so on. The retention rate measures the % of wallets from each cohort had been active in transacting over subsequent weeks. Taking Optimism’s Cohort #1 below as an example:

1-week retention rate of 36% tells us that 36% of the addresses in cohort #1 had transacted between 1/10 – 1/16

30% of the same cohort had executed a transaction in the fourth subsequent week (1/31 – 2/6)

23% of the same cohort had executed a transaction in the eighth subsequent week (2/28 – 3/6)

[Note: cohort analyses typically segment new users within a defined time-span (no overlap of users across cohorts), but the cohort data here (sourced from Dune) includes both new and old users that have been active in a defined time-span (so one wallet may be included in multiple cohorts).] Also 4-week retention usually implies an account has been active for 4 weeks or after since first using a product (rather than transacting specifically on the 4th week (i.e., 4-week retention vs. 4th week retention).

Optimal signs of engagement would include: (i) higher overall retention rates, (ii) an uptrend of retention rates across cohort groups, suggesting new cohorts are more likely to remain active users, and (iii) minimal difference between longer-term retention rates and short-term retention rates (ideally even a negative difference), suggesting a specific cohort group will see fewer drop offs in users over time.

Optimism’s retention rates after 1 week have averaged 39% across all cohorts in 2022, 33% by the 4th week, and 30% by the 8th week. Retention rates have generally trended upwards for newer cohorts throughout the year. There was fairly low difference in retention rates between the first week and the eighth week for most cohorts – the sharpest differential between the two rates for a cohort was for the cohort #21 (5/23 – 5/29), which saw inflated retention rates from the OP airdrop that launched on May 30th that later dropped off over the next several weeks. Retention rates appear to have trended upwards since the start of Optimism Quests on 9/20 though we are still awaiting data for 4-week and 8-week retention rates for later cohorts. Another key event to monitor is the large cohort relates to the Mirror Genesis Subscriber NFT mint which started 12/20 – the one-week retention for cohorts #51 and 52 have trended downwards from cohort #50.

Arbitrum’s retention rates after 1 week have averaged 40% across all cohorts in 2022 (the same level as Optimism), 31% by the 4th week, and 27% by the 8th week. Early-year and late-year cohorts generally showed higher retention rates than the mid-year cohorts. There was a small spike in retention rates associated with Arbitrum Odyssey campaign (ran from 6/21 – 6/29), which was followed by a drop off before gradually improving through the rest of the year.

8th week retention rates have generally been higher on Optimism than Arbitrum (avg. 30% vs. 27%). 8th week retention rate peaked with cohort #14 on Optimism at 58% due to the OP token launch and hit a yearly low at 16% for cohorts #25 & #26 on Optimism.

Developer Activity

Contracts deployed on Optimism have increased throughout the year especially after May, averaging nearly ~700 contracts deployed by ~260 unique contract deployers per week over the second half of the year. However, these figures appear modest compared to contract activity on Arbitrum, which averaged nearly 2k contracts deployed by ~880 unique contract deployers per week over 2H22.

According to Electric Capital’s Developer Report, as of 12/15, Optimism had 183 total developers (+75 or +73% YoY) of which 67 were full-time developers (+25 or +60% YoY), while Arbitrum had 215 total developers (+59 or +38% YoY) of which 80 were full-time (+32 or +67% YoY).

Potential Concerns: Airdrop Farming & Sybil Addresses

It’s clear that Galxe marketing initiatives were instrumental in onboarding new users to rollups and driving engagement with participating projects. Over 456k addresses participated in Optimism Quests (i.e., they minted at least 1 NFT) and most have been onboarded directly through the program. Galxe has consistently been the most popular project on Optimism since launch as ranked by users and transactions. All the top projects on Optimism ranked by usage have been tied to its Quests. On Arbitrum, 659k addresses (~49% total) have used Galxe (mostly from non-Odyssey-related quests after the program was paused). Ideally, these first-time users of projects would be retained as repeat users.

While the user growth of Optimism and Arbitrum related to Galxe has been impressive, one potential concern is sybil activity, where one individual/entity creates duplicate accounts posing as real users. Specifically for Optimism and Arbitrum, sybil attackers may be looking to take advantage of future airdrops at the expense of positive-sum participants.

During the OP Airdrop #1, the Optimism team had initially identified 265k eligible addresses after applying basic filtering criteria. The Optimism Foundation later announced before the airdrop that an additional 17k sybil addresses were excluded from the airdrop after applying additional filters to remove sybils. The 14m OP recovered from the excluded addresses were redistributed to other eligible addresses. To strengthen the sybil filtering process, a community feedback form was opened, though the Optimism team opted not to publicize the additional filters in the interest of maintaining the integrity of future OP airdrops.

It is likely that many participants in the Galxe campaigns could be sybil addresses or airdrop hunters. We noted earlier that the Arbitrum Odyssey and the Optimism Quests Galxe campaigns were not confirmed to be part of any airdrop qualifying criteria for either network, though many speculate that they will be. Galxe quests are designed to be inclusive for most retail users, so they typically have low financial requirements (<$100), which means they are more easily gamed.

Several concerning data points we find include:

Wallet distribution based on ERC20 balances. Most addresses on both networks have under $100 in value. 73% of addresses on Optimism have less than $100 in ERC20 balances, 21% have between $100 – $1000, and just 6% (~50k wallets) have more than $1k. On Arbitrum, 82% of addresses on Optimism have less than $100 in ERC20 balances, 11% have between $100 – $1000, and 6% (~50k wallets, similar to Optimism) have more than $1k. Of course, many of these wallets could be stale and what matters more is the wallet distribution of active users.

Wallet distribution based on the number of transactions made. On Optimism, 28% of addresses have been one-time transactors, 46% have made between 2 – 25 txs, 21% have made between 25 – 100 txs, and only 5% (~76k addresses) have made over 100 txs. On Arbitrum, 21% of addresses are one-time transactors, 61% have made between 1 and 25 txs; 13% have made between 26 – 100 txs, and only 5% (~95k addresses) have made more than 100 txs.

Specifically, as it relates to Optimism’s Galxe Quests:

Lack of growth in TVL. While TVL certainly is not the best representation of network growth, it is a bit concerning that TVL (measured in ETH) hasn’t shown any growth over the last few weeks of the year, especially as active addresses and transaction count spiked – in fact, the TVL (in ETH) has consistently been dropping from November through December. This suggests that many of the new users are failing to bring in new capital into Optimism’s DeFi ecosystem.

Average DEX trade size. Average DEX trade sizes on Optimism have gotten progressively smaller, reflecting the growth of retail users and also signaling the growth of “quest hunters”. For example, Quest participating DEXes like Uniswap ended the year with an average trade size of $150 and Rubicon was less than $50. Curve (not a Quest participant) has had the highest average trade size among the group, and perhaps surprisingly, Sushi (also not a Quest participant) has ranked at the bottom of the DEX group on Optimism.

Growth Outlook

There has been good competition between the two leading rollups but, for the most part, growth initiatives this past year have been symbiotic for both networks: Arbitrum’s Odyssey program coincided with a usage spike on Optimism, Optimism’s token launch translated into increased user activity on Arbitrum with an expected token launch in the future, and the initiation of Optimism Galxe Quests had renewed interest in Galxe quests on Arbitrum.

Optimism has been able to catch up to Arbitrum’s early lead in DeFi and users through growth initiatives including the OP summer incentives from the inaugural season of grants, other seasons of Ecosystem Fund distributions, and the Optimism Quests Galxe campaign, which onboarded many new users to Optimism since starting in September. Future growth catalysts in 2023 include Season 3 of GovFund, RetroPGF2 with the debut of the Citizens’ House, as well as Airdrop #2, which is expected at some point.

Arbitrum suffered a setback when it paused Odyssey as the chain became congested, but arguable this ultimately worked in its favor. Even without resuming Odyssey, daily user activity has been increasing “organically” (i.e., without a token or financial incentives from Offchain Labs) beyond the level from when Odyssey was in progress. In August, Arbitrum completed its migration to Nitro, increasing network capacity by several magnitudes and offering even cheaper fees, while also launching Arbitrum Nova, its gaming and social platform. By not announcing a token (yet), Arbitrum has the advantage of learning from successes and failures of Optimism as it relates to token design, token-related growth initiatives, governance process, and the completion of the Galxe program and any related follow-up plans. Arbitrum may hold the advantage as the second mover when it comes to growth potential.

That said, Optimism has found success with its experimental governance model that could be difficult to replicate. Optimism has attracted a strong group of supporters with its commitment to retroPGF (which has the buy-in from Vitalik) and open-source development (strengthening its codebase), and its focus on effective governance (with an elite lineup of core delegates and contributors). To help fund its growth initiatives, the Optimism team also closed a more recent funding round in March ($150m Series B co-led by a16z and Paradigm) before crypto valuations cratered following several spectacular blowups in the second half of 2022. Optimism has built an impressive offering of native DeFi projects including a diverse group of options/perps projects (e.g., Perpetual, Synthetix + Kwenta, Pika, Lyra, Polynomial). Looking ahead, it will be important to monitor the retention of new users, particularly the large population brought in by the Galxe quests and any potential “airdrop hunters”.

In our next series report, we will cover the tech powering Optimism and Arbitrum, detailing how they started and how they have changed. Additionally, we will compare the recent Nitro and Bedrock upgrades in detail. Part 3 will revisit some ecosystem developments, expanding on the discussion and diving into the economics of both rollups and analyzing their business models.

Legal Disclosure:

This document, and the information contained herein, has been provided to you by Galaxy Digital Holdings LP and its affiliates (“Galaxy Digital”) solely for informational purposes. This document may not be reproduced or redistributed in whole or in part, in any format, without the express written approval of Galaxy Digital. Neither the information, nor any opinion contained in this document, constitutes an offer to buy or sell, or a solicitation of an offer to buy or sell, any advisory services, securities, futures, options or other financial instruments or to participate in any advisory services or trading strategy. Nothing contained in this document constitutes investment, legal or tax advice or is an endorsementof any of the digital assets or companies mentioned herein. You should make your own investigations and evaluations of the information herein. Any decisions based on information contained in this document are the sole responsibility of the reader. Certain statements in this document reflect Galaxy Digital’s views, estimates, opinions or predictions (which may be based on proprietary models and assumptions, including, in particular, Galaxy Digital’s views on the current and future market for certain digital assets), and there is no guarantee that these views, estimates, opinions or predictions are currently accurate or that they will be ultimately realized. To the extent these assumptions or models are not correct or circumstances change, the actual performance may vary substantially from, and be less than, the estimates included herein. None of Galaxy Digital nor any of its affiliates, shareholders, partners, members, directors, officers, management, employees or representatives makes any representation or warranty, express or implied, as to the accuracy or completeness of any of the information or any other information (whether communicated in written or oral form) transmitted or made available to you. Each of the aforementioned parties expressly disclaims any and all liability relating to or resulting from the use of this information. Certain information contained herein (including financial information) has been obtained from published and non-published sources. Such information has not been independently verified by Galaxy Digital and, Galaxy Digital, does not assume responsibility for the accuracy of such information. Affiliates of Galaxy Digital may have owned or may own investments in some of the digital assets and protocols discussed in this document. Except where otherwise indicated, the information in this document is based on matters as they exist as of the date of preparation and not as of any future date, and will not be updated or otherwise revised to reflect information that subsequently becomes available, or circumstances existing or changes occurring after the date hereof. This document provides links to other Websites that we think might be of interest to you. Please note that when you click on one of these links, you may be moving to a provider’s website that is not associated with Galaxy Digital. These linked sites and their providers are not controlled by us, and we are not responsible for the contents or the proper operation of any linked site. The inclusion of any link does not imply our endorsement or our adoption of the statements therein. We encourage you to read the terms of use and privacy statements of these linked sites as their policies may differ from ours. The foregoing does not constitute a “research report” as defined by FINRA Rule 2241 or a “debt research report” as defined by FINRA Rule 2242 and was not prepared by Galaxy Digital Partners LLC. For all inquiries, please email [email protected]. ©Copyright Galaxy Digital Holdings LP 2022. All rights reserved.