Top Stories of the Week - 1.20

In the newsletter this week, we cover the first-ever congressional subcommittee focused on digital assets, yuga’s blacklisting of NFT marketplaces that don’t enforce royalties, and bitcoin’s mining difficulty reaching a new all-time high. Subscribe here and receive Galaxy's Weekly Top Stories, and more, directly to your inbox.

Rep. McHenry Creates Subcommittee focused on Digital Assets

The Chairman of the House Financial Services Committee (HFSC), Representative Patrick McHenry (NC-10), announced the formation of a new HFSC Subcommittee focused on digital assets. McHenry, who has historically been supportive of digital assets, is developing a congressional subcommittee focused on digital assets. The subcommittee will be led by Rep. French Hill (AR-02) and will have jurisdiction over digital assets, financial technology, and inclusion. Hill expressed his viewpoints following the announcement stating, "[a]t a time of major technological advancement and change in the financial sector, it is our job to work across the aisle and promote responsible innovation while encouraging FinTech innovation to flourish safely and effectively in the United States."

Our take

McHenry's appointment of Hill to the subcommittee focusing on digital assets highlights his commitment to promote regulatory frameworks that push progressive crypto regulation in Washington. Hill is widely considered to be a savvy legislator who acutely understands the US and global financial services sector. Hill has prolific experience working on financial policy, having served as a senate staffer for the Senate Banking Committee, an executive secretary for President George H.W. Bush’s economic policy council, and as a deputy assistant secretary at Treasury, and he also was CEO and chairman of a bank until he entered Congress in 2014. Furthermore, Hill is a trusted ally of House leadership. Thus, his appointment demonstrates that HFSC, under McHenry’s leadership, plans to take digital asset policy seriously in the 118th Congress. With McHenry at HFSC’s helm and Hill tasked as his deputy leading the first digital assets subcommittee, we expect a serious and concerted effort to tackle some of digital asset policy’s big issues over the next two years. -GP/AT

Yuga Labs Blocks Trades on Blur, Sudoswap, and Others

Yuga takes a hard line in enforcing royalties for its latest collection. Yuga's Sewer Pass NFTs launched on Jan. 18 as a free mint for existing BAYC and MAYC holders to claim. The Sewer Pass itself serves a key that unlocks a token-gated game called Dookey Dash (which itself is part of Yuga’s ongoing Jimmy the Monkey story arc). The game will be playable for a limited window from Jan 19 to Feb. 8, and scores accumulated from gameplay sessions will feed into the next chapter of the broader story arc (and may also influence outcomes of an eventual mint).

Sewer Passes are available in tiers ranging from 1-4 (depending on whether the claimee has a Mutant/Ape and/or a paired Kennel), with higher tiers commanding higher floor prices on secondary markets. Thus far, Sewer passes have done $14M in secondary sales volume, and they have earned Yuga Labs at least $700k in secondary sales revenue based on a 5% royalty.

While these volume numbers are a far cry from the mania of Yuga’s Otherside mint (>$500M in primary sales alone), Yuga Labs seems intent on preserving its royalty-driven business model. The Sewer Pass NFTs are the first collection from Yuga Labs to implement a blacklist at the smart contract level, blocking NFT trades on Blur, SudoSwap, LooksRare, and NFTX. Since each of these exchanges either implement an optional royalty model or do not honor royalties at all, Yuga’s intent with the blacklist is to only allow secondary sales of its Sewer Passes to occur on OpenSea (or over the counter, which can’t be feasibly blocked at the smart contract level). This is not the first time a creator has restricted the exchange of its NFTs in order to preserve royalties (Tyler Hobbs’ of Art Blocks’ Fidenza collection blocked trades of QQL Passes on X2Y2 for the same reason).

Floor prices for Sewer Passes currently sit at 1.6ETH according to OpenSea, and 17k passes have been minted so far (out of approximately 30,000 eligible MAYC/BAYC).

Our take

When we originally wrote about NFT Royalties this past fall, one of key questions we left readers with was whether collections would find alternative ways to enforce royalties or forgo royalties completely in favor of a pure ownership model. OpenSea broke their silence on this contentious issue in late November when they announced that they would continue to support royalties on their platform, planting their proverbial stake in the ground. Other NFT exchanges, like X2Y2, have since yo-yoed on their anti-royalty stance. Marketplaces like Blur, LooksRare, and SudoSwap (among others) now constitute the royalty-free camp. The end result is a fractionalized NFT marketplace landscape where royalty-free marketplaces will probably increasingly be blocked by royalty-enforcing smart contracts for future NFT mints.

The implications of these recent moves are clear. Creators that want to enforce royalties on their collections, like Yuga Labs, will continue to rely on OpenSea’s royalty-enforcement standard, even if it means reduced freedom for holders of their NFTs to transact freely across marketplaces. Despite what some thought leaders predicted (and we disagreed with), royalties appear to be here to stay. Two of the biggest (and perhaps THE biggest) juggernauts in NFTs today (OpenSea/Yuga Labs) will continue their fight in support of royalties. We think this trend towards forced royalty enforcement through blacklists will only increase over time. As more creators will feel emboldened by this path blazed by OpenSea and Yuga Labs, we also think OpenSea will shed some market to royalty-free marketplaces who will benefit from being cheaper places to transact (all else equal). -SQ

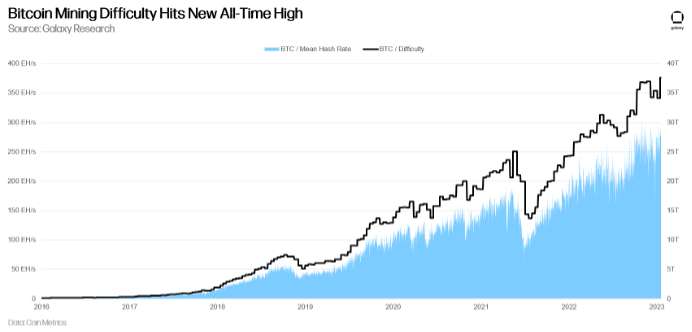

Bitcoin Mining Hashrate is at All-Time Highs

Bitcoin mining difficulty jumps 10%, its biggest adjustment since October 2022. Bitcoin’s hashrate, a proxy for how difficult it is to attack the chain, has also hit a new all-time high. Rises in price can often lead to increased hashrate, with a rise in price driving miners to plug in more machines as mining economics improve.

The rise to an all-time high hashrate also means the cost to attack the network via obtaining 51% of the hash is also at its highest level ever. Despite the ongoing bear market, Bitcoin continues to be secure. But that doesn’t mean miners are necessarily doing too well – per Compass Mining, Core Scientific mined 1,425 BTC (about $30mm at current prices) while also filing for Chapter 11 bankruptcy protection.

Our take

The significant increase in Bitcoin mining difficulty stems from a combination of the brutal Christmas storm that temporarily wiped off significant hashrate in the U.S, delayed hardware shipments, and fluctuating energy prices. However, it is difficult to pinpoint the direct source of the recent high difficulty adjustment as mining difficulty rebounds are lagging indicators. When observing the mining difficulty and hashrate chart from December to today, it is significant to point out that the mining industry only needed less than a month to rebound after the decline around Christmas. During this window of time, our colleagues at Galaxy Mining tell us that public and private miners who already had access to cheap electricity were plugging in their latest shipments of Antminer S19s and S19 XPs, extremely efficient ASICs. This is presumably an indication that mining facilities are comfortable enough with the current energy price fluctuations. In December alone, public miners managed to plug-in over 6 EH of capacity and this pace will likely continue if mining conditions remain at these levels or continue to improve. -GP/WJS

Other News

MetaMask Staking beta now live with Lido and Rocket Pool

EU's final vote on MiCA regulation postponed until April

Polygon successfully completed a network hard fork

3AC founders Zhu and Davies pitch to raise $25 million for new crypto exchange

MakerDAO voting to limit DAI exposure to Gemini

Ethereum Layer 2 protocol Optimism surpasses Arbitrum in transaction volume

ConsenSys confirms 11% staff cut

Coinbase halting operations in Japan

Dogecoin, Bonk and Shiba Inu combine for $25bn in monthly trading volume

Flashbots seeks up to $50 million at a billion-dollar valuation

1inch Network enters the hardware wallet business

DOJ busts Russian crypto exchange Bitzlato

HashKey Capital closes third fund at $500 million

Legal Disclosure:

This document, and the information contained herein, has been provided to you by Galaxy Digital Holdings LP and its affiliates (“Galaxy Digital”) solely for informational purposes. This document may not be reproduced or redistributed in whole or in part, in any format, without the express written approval of Galaxy Digital. Neither the information, nor any opinion contained in this document, constitutes an offer to buy or sell, or a solicitation of an offer to buy or sell, any advisory services, securities, futures, options or other financial instruments or to participate in any advisory services or trading strategy. Nothing contained in this document constitutes investment, legal or tax advice or is an endorsementof any of the digital assets or companies mentioned herein. You should make your own investigations and evaluations of the information herein. Any decisions based on information contained in this document are the sole responsibility of the reader. Certain statements in this document reflect Galaxy Digital’s views, estimates, opinions or predictions (which may be based on proprietary models and assumptions, including, in particular, Galaxy Digital’s views on the current and future market for certain digital assets), and there is no guarantee that these views, estimates, opinions or predictions are currently accurate or that they will be ultimately realized. To the extent these assumptions or models are not correct or circumstances change, the actual performance may vary substantially from, and be less than, the estimates included herein. None of Galaxy Digital nor any of its affiliates, shareholders, partners, members, directors, officers, management, employees or representatives makes any representation or warranty, express or implied, as to the accuracy or completeness of any of the information or any other information (whether communicated in written or oral form) transmitted or made available to you. Each of the aforementioned parties expressly disclaims any and all liability relating to or resulting from the use of this information. Certain information contained herein (including financial information) has been obtained from published and non-published sources. Such information has not been independently verified by Galaxy Digital and, Galaxy Digital, does not assume responsibility for the accuracy of such information. Affiliates of Galaxy Digital may have owned or may own investments in some of the digital assets and protocols discussed in this document. Except where otherwise indicated, the information in this document is based on matters as they exist as of the date of preparation and not as of any future date, and will not be updated or otherwise revised to reflect information that subsequently becomes available, or circumstances existing or changes occurring after the date hereof. This document provides links to other Websites that we think might be of interest to you. Please note that when you click on one of these links, you may be moving to a provider’s website that is not associated with Galaxy Digital. These linked sites and their providers are not controlled by us, and we are not responsible for the contents or the proper operation of any linked site. The inclusion of any link does not imply our endorsement or our adoption of the statements therein. We encourage you to read the terms of use and privacy statements of these linked sites as their policies may differ from ours. The foregoing does not constitute a “research report” as defined by FINRA Rule 2241 or a “debt research report” as defined by FINRA Rule 2242 and was not prepared by Galaxy Digital Partners LLC. For all inquiries, please email [email protected]. ©Copyright Galaxy Digital Holdings LP 2022. All rights reserved.