Latest in China's Crypto Crackdown

Key Takeaways

China’s continued crackdown on Bitcoin shows that the country doesn’t control Bitcoin. Bitcoin will become more resilient if its network is less centralized in one country, particularly one as restrictive as China.

Average Chinese citizens were already largely shut out of the crypto trading ecosystem, but the new crackdown on OTC desks threatens to close remaining side-doors. This presents an opportunity for other jurisdictions.

Hashrate is plummeting as miners react to closure orders and prepare to migrate. Kazakhstan, Russia, Pakistan, and North America are poised to attract miners.

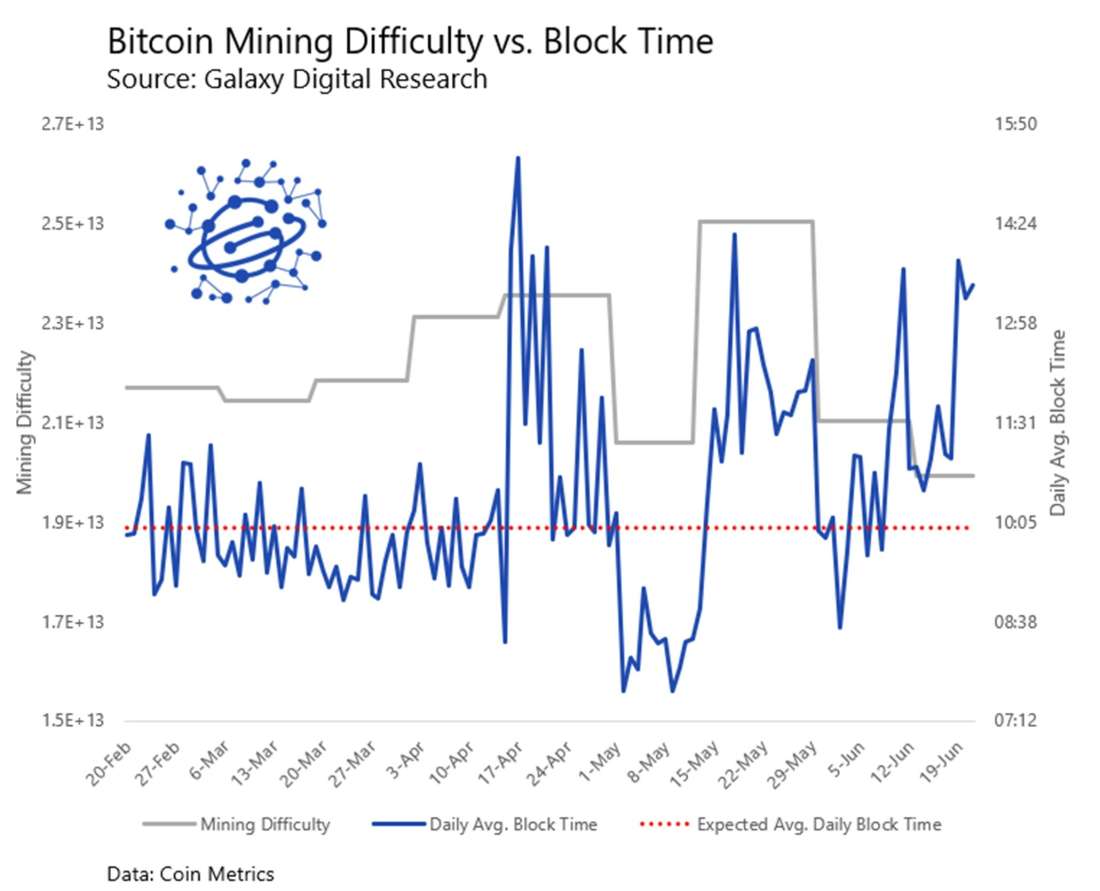

Despite the decline in hashrate, Bitcoin remains secure and operational, albeit with slower than normal confirmation times.

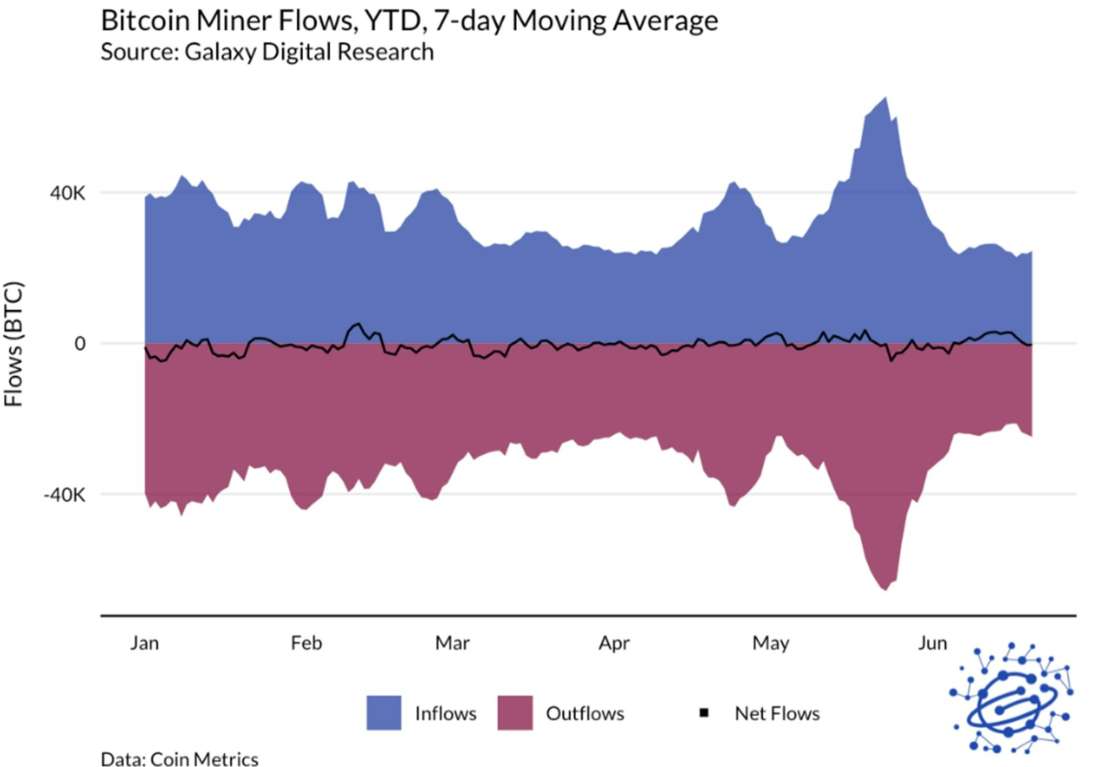

Miners appear to have already priced in regulatory enforcement. After an uptick in miner selling following the initial news at the end of May, on-chain data shows miner selling has returned to normal levels.

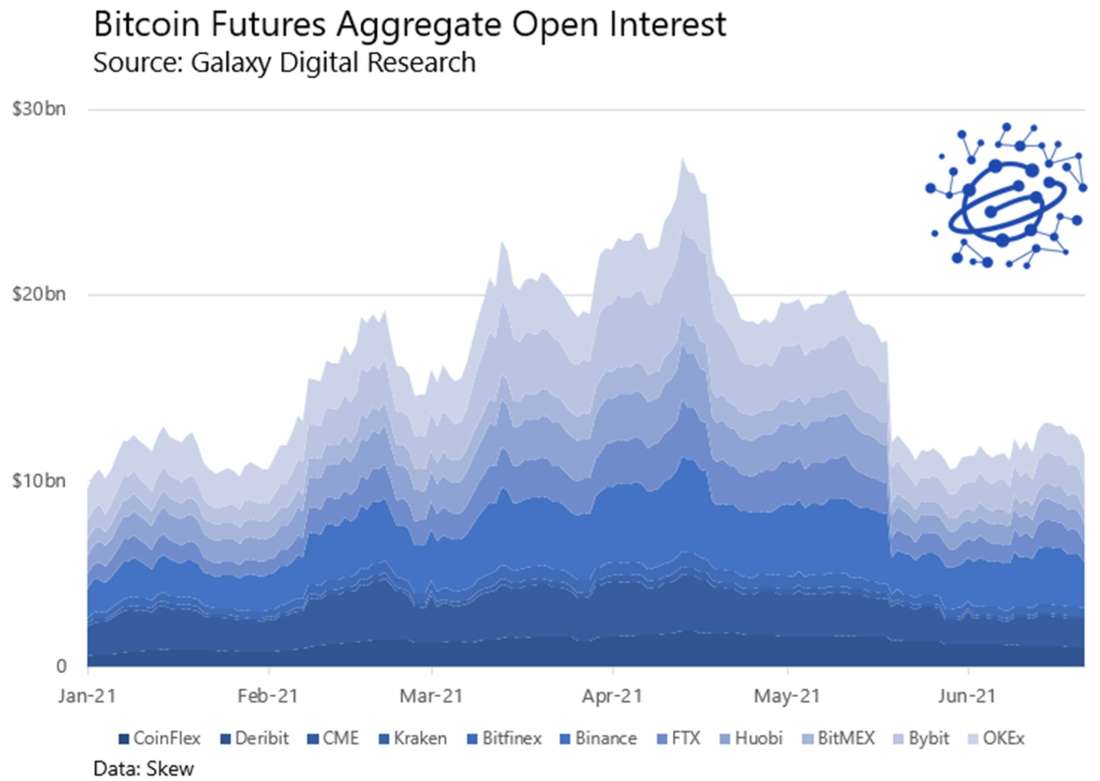

Monday saw the largest liquidation volumes on futures exchanges since May 23, though open interest remains at lower levels not seen since February.

Stablecoin issuance has mostly plateaued, with Tether performing its first burn since March 19.

In our May 25 report Examining the Latest China Bitcoin Ban, we detailed how new language from a major Chinese financial regulatory committee was likely to result in significant “restrictions and greater government scrutiny” over the crypto industry in China. Since then, we have seen an increasing number of restrictions imposed on crypto trading and mining firms in China. While the actions are in line with our expectations, they have proceeded more quickly and severely than we initially anticipated.

Initial fears over the May 21 announcement from China’s Financial Stability and Development Committee of the State Council (“FSDC”) have proven not to be unfounded. Several provincial governments, including coal-heavy Inner Mongolia and Xinjiang, as well as hydro-electric regions like Yunnan and Sichuan, have enacted bans or begun restricting bitcoin mining activity. At the same time, we have seen increased scrutiny of trading activities in China, including the de-platforming of crypto exchanges from major social media platforms and an order from China’s central bank (PBoC) Monday that demands that banks and financial institutions block accounts belonging to over the counter (OTC) desks that facilitate fiat-to-crypto on and offramps.

The Latest Development – PBoC’s June 21 Order

On Monday, June 21, the People’s Bank of China (PBoC), China’s central bank, issued a statement ordering that financial institutions, including major banks and Alipay, identify and restrict onramps to the crypto trading ecosystem.

In the statement, the PBoC ordered institutions to:

“Strictly implement the ‘Notice on Preventing Bitcoin Risks’ and ‘Announcement on Preventing Token Issuance Financing Risks’”

“Earnestly fulfill their customer identification obligations”

No longer “provide account opening, registration, and registration for related activities, products or services such as trading, clearing, and settlement.”

“Institutions must comprehensively investigate and identify virtual currency exchanges and over-the-counter dealers’ capital accounts, and cut off payment channels for transaction funds in a timely manner.”

Institutions “must analyze the capital transaction characteristics of virtual currency trading promotion activities, increase technical input, improve abnormal transaction monitoring models” and improve other internal monitoring and oversight mechanisms to identify and prevent interaction with the cryptocurrency trading ecosystem.

Underscoring the importance of the May 21 meeting of the FSDC, the PBoC cited its obligations as defined by “the spirit of the 51st plenary meeting of the Financial Committee of the State Council,” in issuing the order.

OTC Trading in China

Cracking down on OTC desks shows the seriousness of China’s new efforts to quell cryptocurrency trading. Traditional on- and off-ramps to crypto had been largely closed off to most Chinese citizens in prior bans, with major financial institutions prohibited from providing connectivity to crypto exchanges. As a workaround, savvy Chinese traders began using OTC desks who facilitated the exchange of RMB for Tether (USDT), which could then be deposited on exchanges and used for trading. For years, this workaround proved viable, but the new order from PBoC threatens to shut down the OTC desk route going forward.

Market Reaction

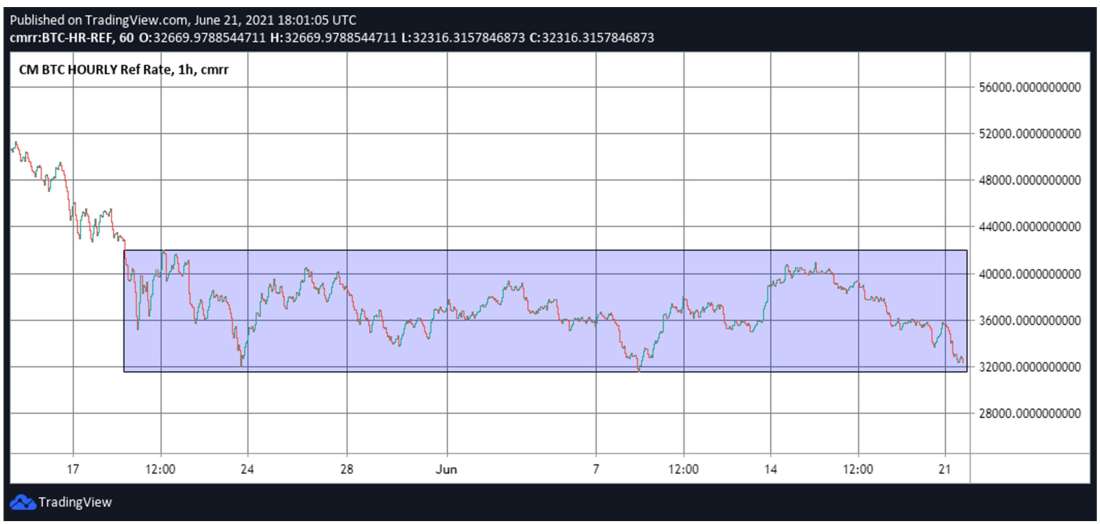

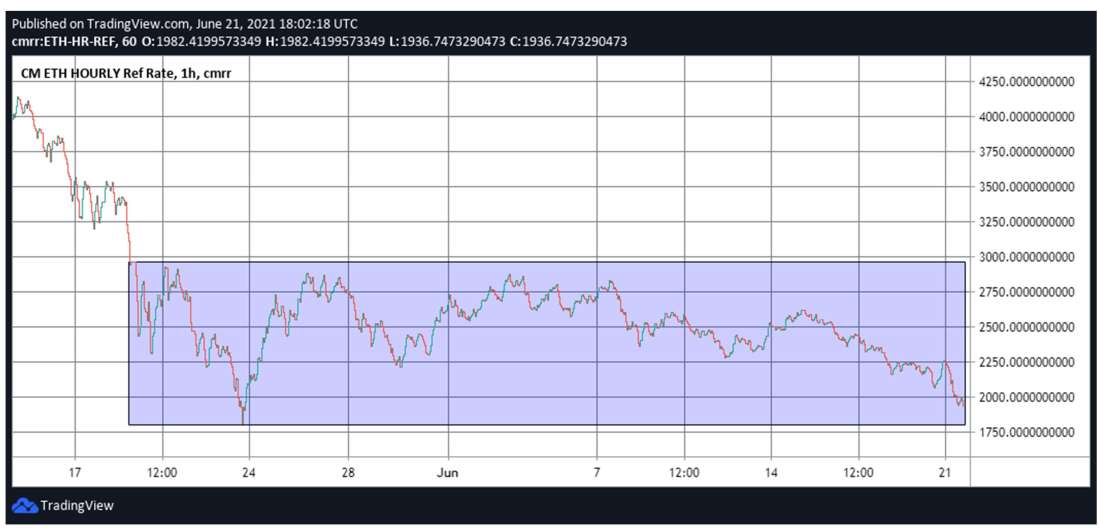

Prices. Markets are down on the day following the news of the PBoC’s crackdown on crypto OTC in China, though still trading within the range that’s held both BTC and ETH over the last several weeks.

Bitcoin (BTC) has ranged between $32k and $41k on the hourly chart since almost mid-May.

Ethereum (ETH) has ranged between $1800 and $3000 over the same time frame.

The news from China depressed markets overnight, with BTC dropping almost 7% between 2-3am EST following the announcement and ETH dropping 8% over the same period.

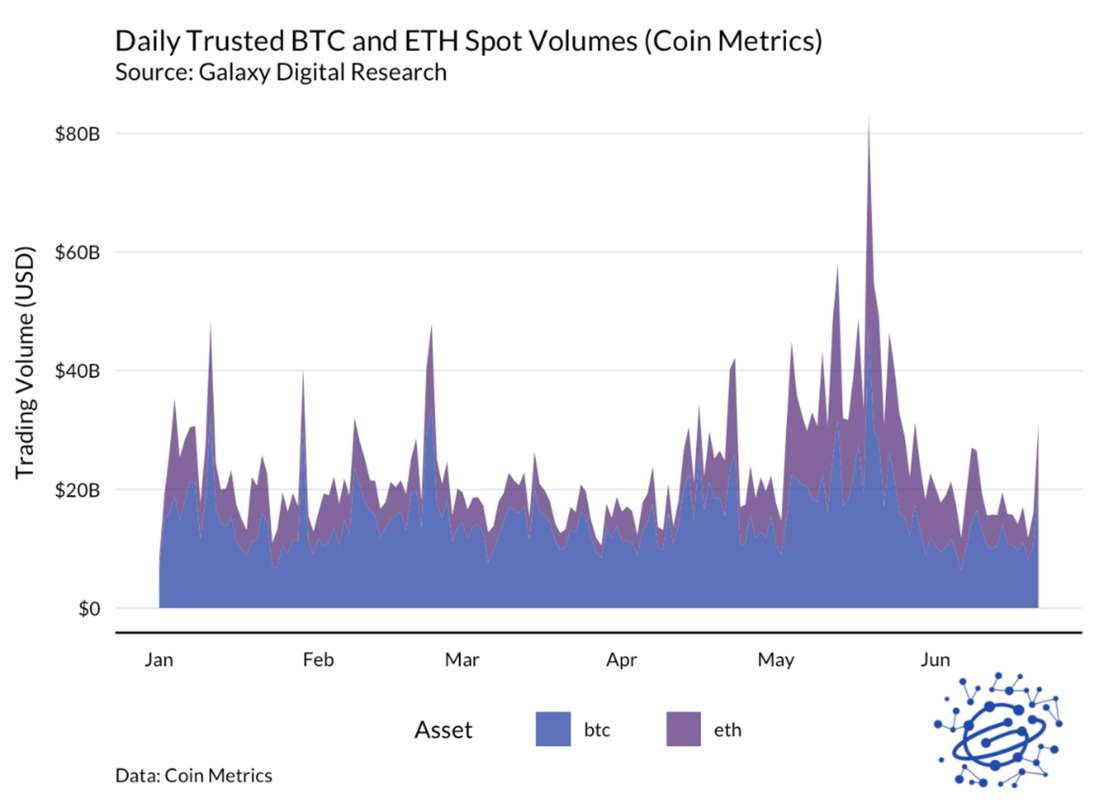

Volumes. Monday saw the largest aggregate daily BTC trading volumes since May 29, and ETH saw the largest aggregate volumes since June 8, according to data from Skew. Despite the uncertainty in China, both Huobi and OKEx continued to transact significant spot crypto, as the 2nd and 3rd most traded venues globally Monday, according to FTX’s Volume Monitor.[1] Binance saw $32bn trade hands in the 24h between 9:30pm ET Sunday and 9:30pm ET Monday. Coin Metrics’ trusted volume index saw a decline in spot volumes for both BTC and ETH through late May and June, followed by a spike on June 20.

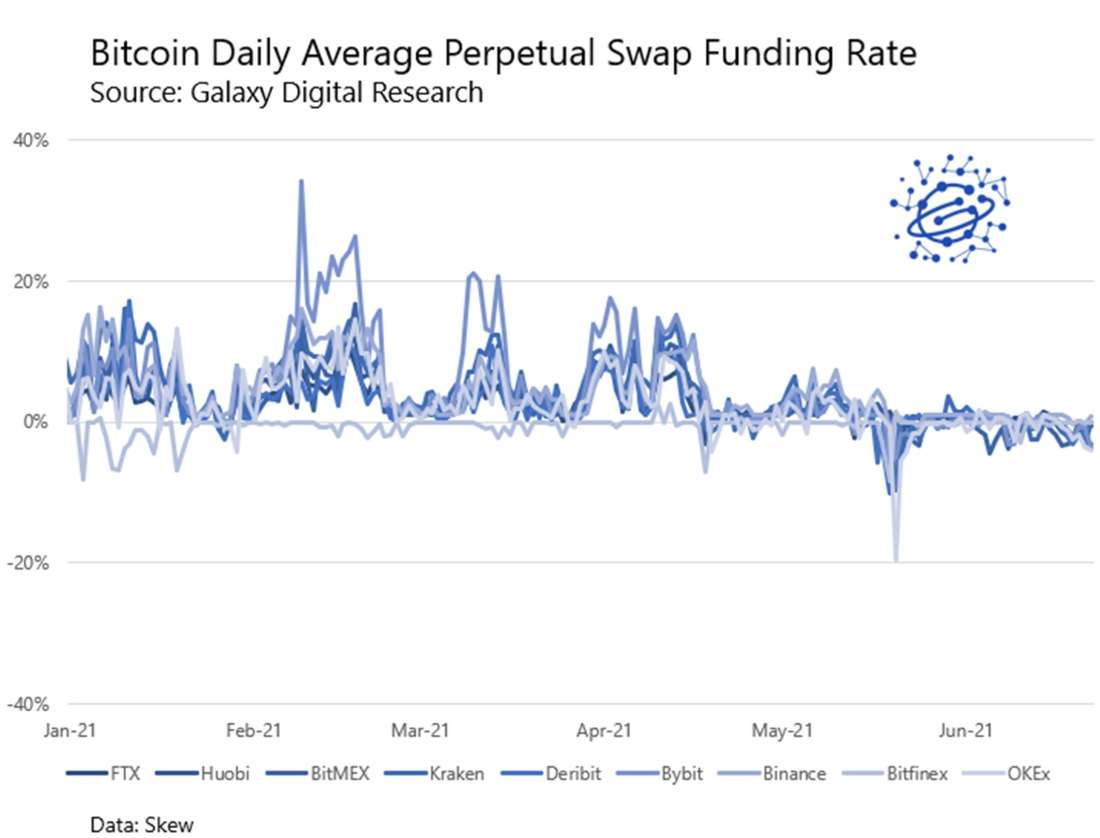

Futures. Since China’s FSDC first announced the beginning of the crack down on May 21, aggregate open interest on futures exchanges has remained at levels not seen since early February.

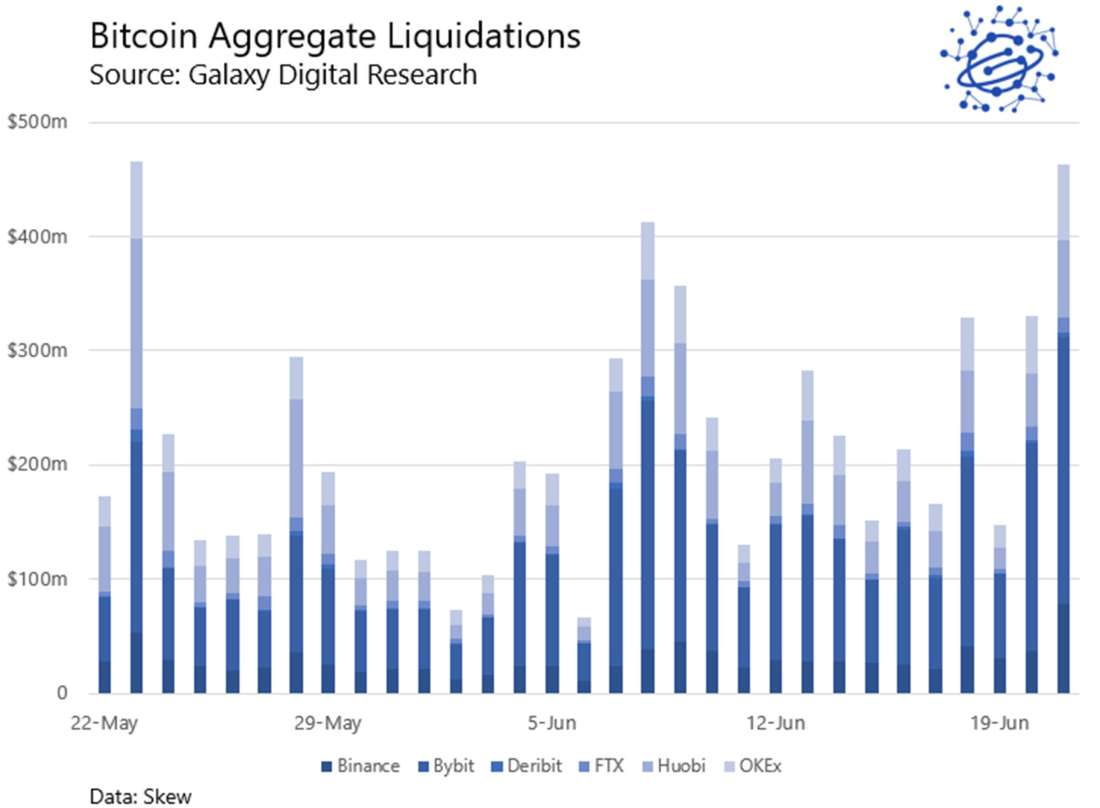

Monday saw the largest volume of Bitcoin liquidations since May 23, according to data from Skew.

Funding rates continue to be mostly negative, albeit only slightly, indicating that there remains interest to be short BTC. Funding has mostly remained flat or negative since April 2021.

Mining Crackdowns Continue

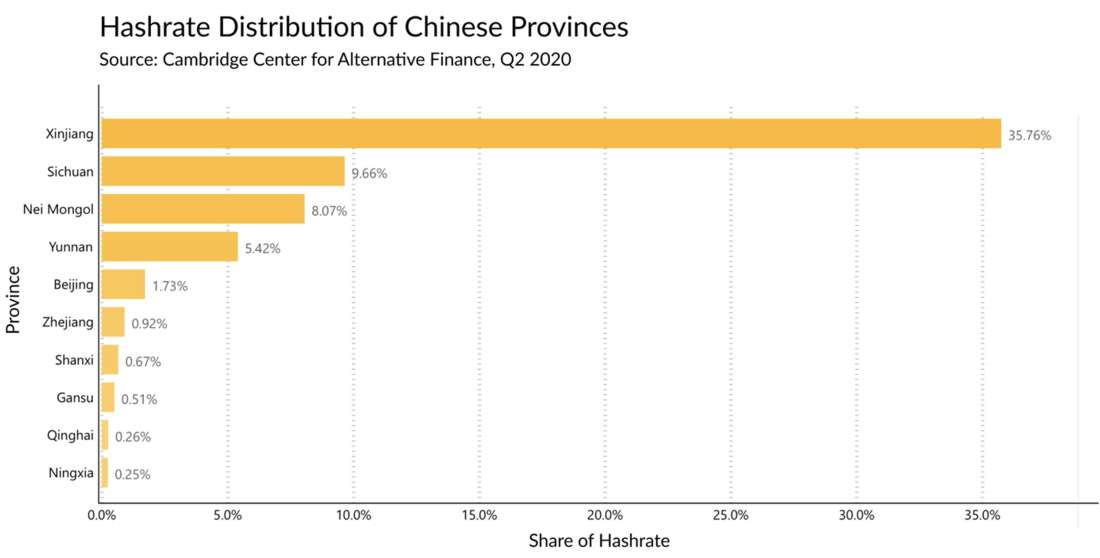

In tandem with announcements on trading restrictions, authorities have accelerated the crackdown on mining faster than many anticipated. In late May, the coal-powered province of Inner Mongolia announced increased restrictions on mining. The coal-powered provinces of Xinjiang and Qinghai and the hydro-powered province of Yunnan followed with announcements or enforcement in early June.

The situation escalated on June 19, when the provincial government of Sichuan ordered state-owned electricity companies to shut off power to 26 known cryptocurrency miners and to conduct inspections of suspected mining farms. Like Yunnan, electricity in Sichuan is almost entirely derived from hydropower, indicating that the crackdown is more closely related to capital markets restrictions than to concerns over emissions.

That said, the distinction between coal- and hydro-powered provinces may be narrowing. China is currently in the process of modernizing its electric grid to allow for efficient long-distance electricity transportation, and energy curtailment has already been substantially reduced. This means that the marginal benefit of keeping miners in the country could shrink over time, since energy gluts in inland provinces, which are currently captured by cryptocurrency miners, could potentially be transferred to coastal population centers with consistently high demand.

Prior to the events of June 19, the Sichuanese government had taken a comparatively lax stance, giving miners until September, near the end of the rainy season, to wind down their operations in the province. The crackdown in Sichuan is particularly significant given the province’s importance to mining: in Q2 2020, the last period for which data is available, Sichuan was the second-largest hub for mining in the country. Miners in the province account for a particularly significant share of the network hashrate in the ongoing May-October rainy season, during which many miners migrate to the Sichuan valley to take advantage of excess hydroelectricity.

With the global chip shortage, machine acquisition has proven to be a bottleneck on hashrate growth over the last few quarters. With the recent crackdowns, we’ll now see a glut of machines entering secondary markets, and an acceleration of the ongoing hashrate exodus from China. Space at hosting facilities will continue to bottleneck growth: there’s simply not enough available hosting capacity outside of China to meet the flood of new machines looking for a home, especially in North America.

The China News On-Chain

The ongoing events in China are leaving an on-chain footprint on Bitcoin and Ethereum. They also appear to be impacting stablecoin issuance.

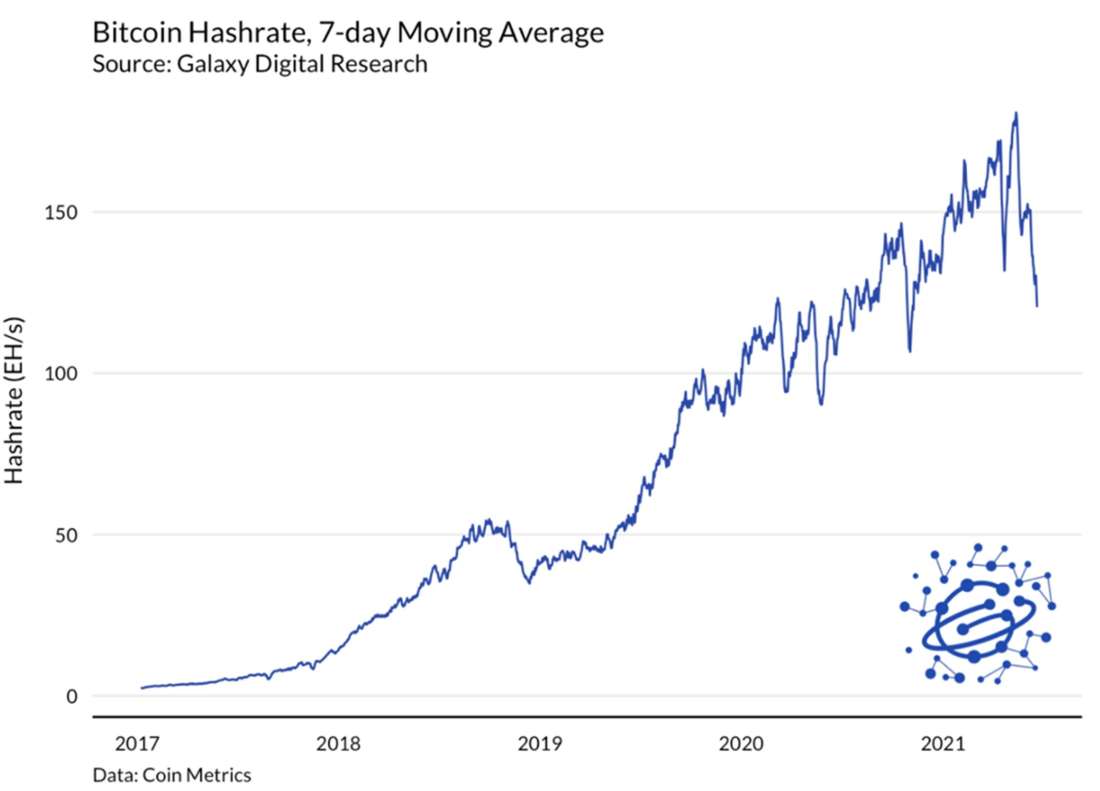

Bitcoin mining update. Since the May 21 announcement from the FSDC, hashrate has been consistently declining as miners react and migrate. As a result, Bitcoin’s network hashrate, which measures the amount of computational power devoted to mining, has declined steeply on a 7-day rolling average from an all-time high of 180 exahashes per second since May 13 to 120 exahashes per second on Sunday, June 20, a level not seen since November 2020.

As miners come off the network, mining difficulty has declined over the last two difficulty adjustments from an all-time high. Despite the continued decline in difficulty, block production continues to be unusually slow, averaging significantly higher than the expected 10-minute interval between blocks, indicating that hashrate continues to come off the network.

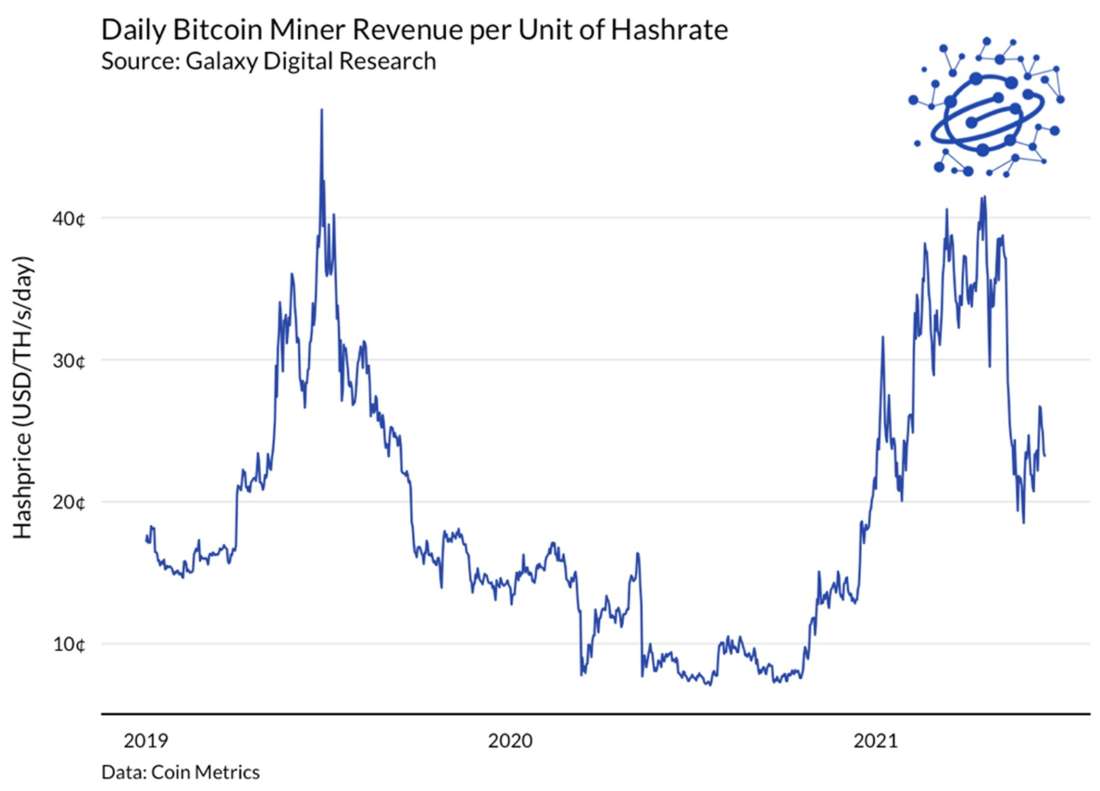

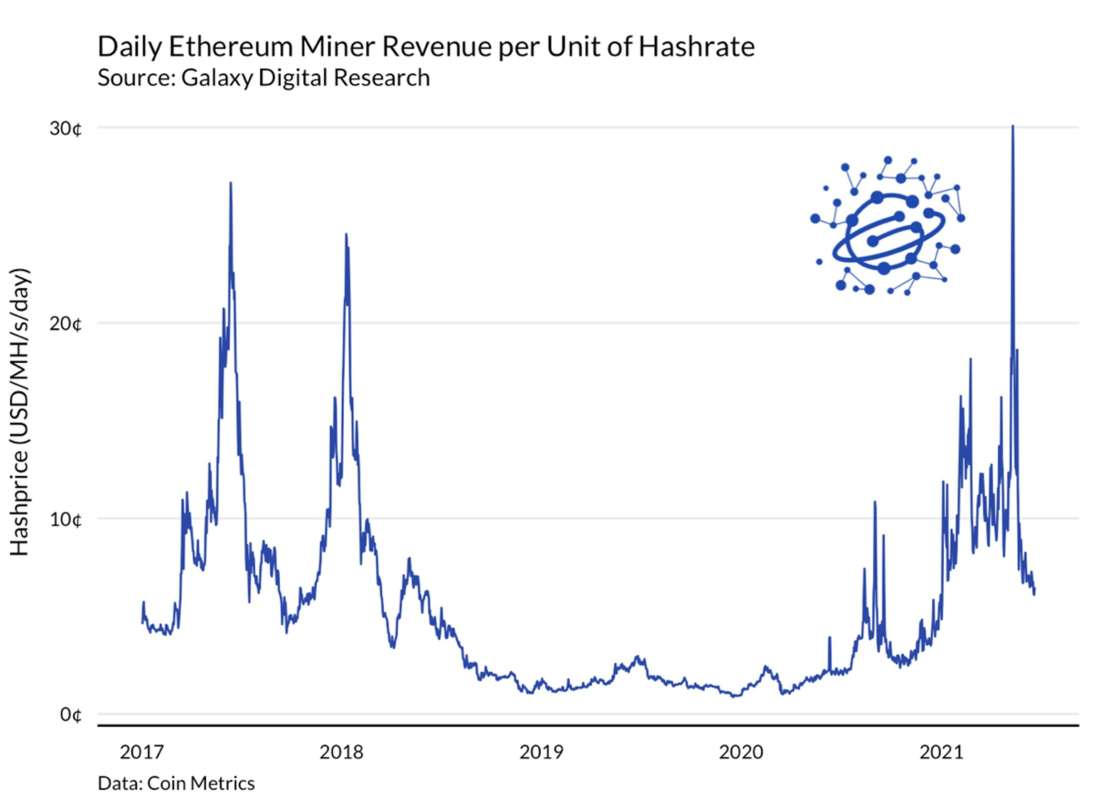

The staggering drop in hashrate stems primarily from political considerations rather than economic ones. While miner profitability has declined substantially with the drop in BTC price, mining continues to be profitable.

Despite the drop in hashrate, Bitcoin remains secure: hashrate is still higher than it was throughout most of 2020, and the economics of mining remain favorable. In the short term, miners in regions outside of China stand to benefit from the drop in hashrate, which will significantly increase their margins and market share. With mining profitability remaining high, we expect most of the machines that were shut off to gradually come back online. There are several hurdles to this process, including a shortage in hosting capacity outside of China that is especially pronounced in North America, but the great international miner migration will be a positive tailwind for Bitcoin’s continuing decentralization.

Bitcoin miners appear to have priced in the regulatory actions back in May, when a spike in miner activity led to net outflows from mining addresses, indicating miner selling. Over the past few weeks, BTC flows from miner address have receded back to normal levels; while there has been a slight uptick in activity over the past few days, most miners appear to have already decided whether to sell or hold, at least for now. Miners are not causing this dip in price.

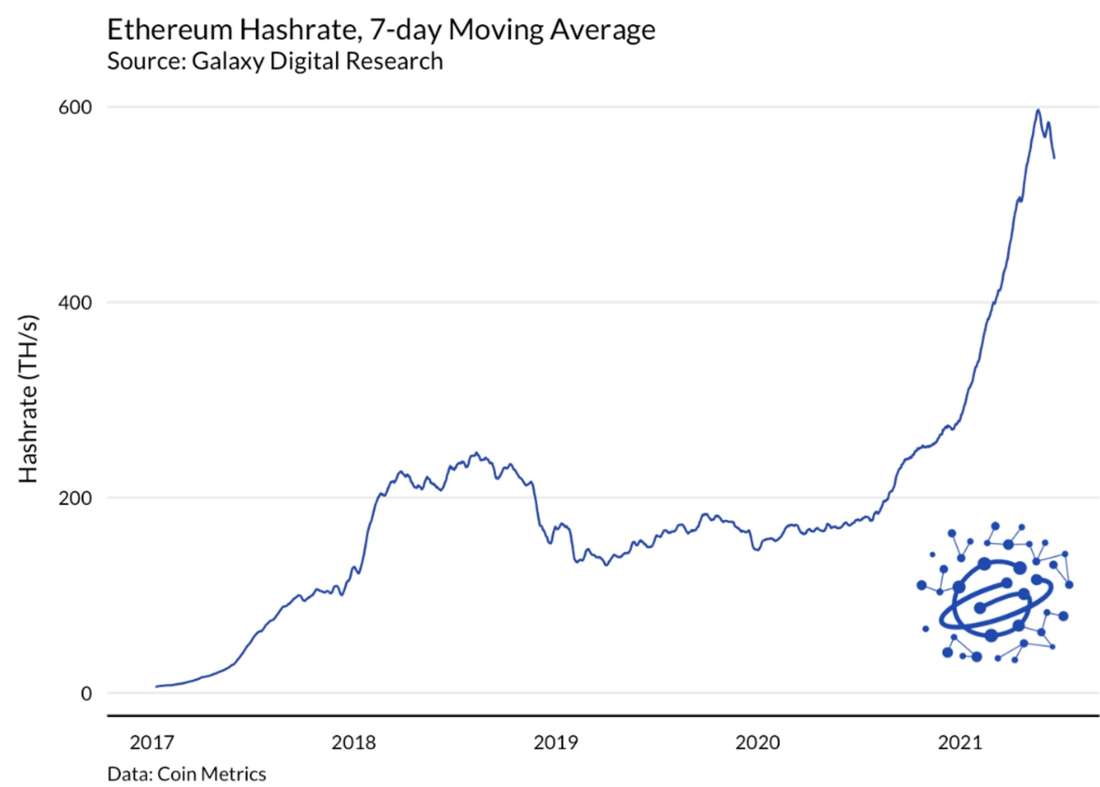

Ethereum mining update. Ethereum’s hashrate has also declined, though not as precipitously as Bitcoin’s. Despite the drop, both networks remain overwhelmingly secure.

Price action, rather than regulatory enforcement, may be the primary explanation for the modest decline in ETH’s hashrate. Ethereum mining is significantly less professionalized than Bitcoin mining—GPU miners are still common, and miners are not as incentivized to seek out low-cost electricity, leading to less concentration in affected regions. With the decline in the price of ETH, miner profitability is down substantially from highs several weeks ago.

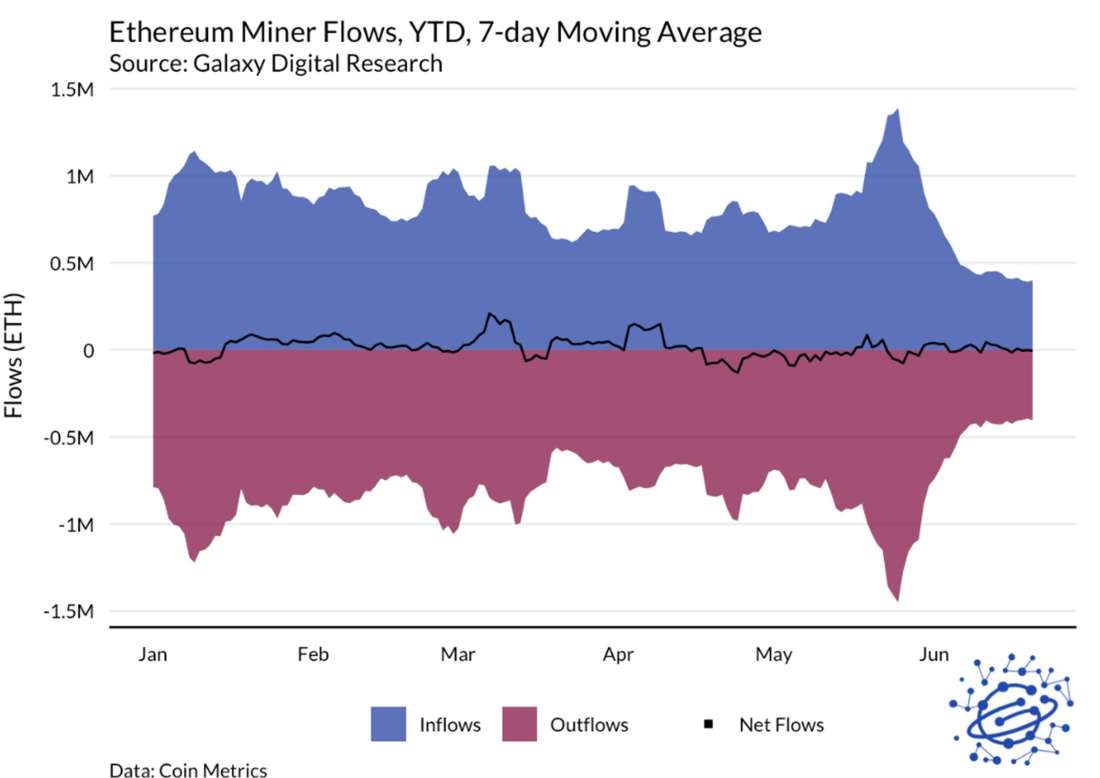

Flows from ETH miner wallets tell a similar story to those BTC. While there was a surge in miner activity corresponding to the initial policy announcement in May, activity has subsided.

Stablecoins Stall Out

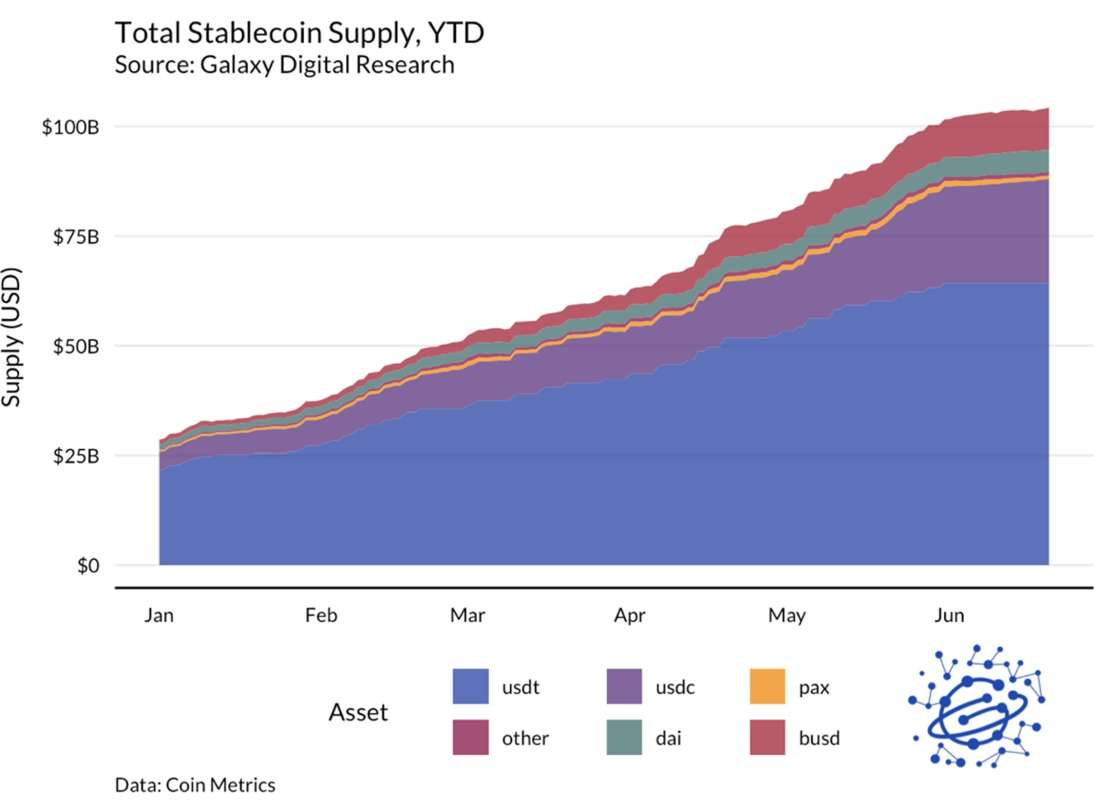

After crossing $100 billion in total supply, stablecoin supply growth has slowed to a crawl. This is predominantly caused by a pause in USDT issuance: while non-Tether assets have continued to grow, no new USDT has been printed since May 31 on any of the major chains used by the platform; in fact, on June 6, about 4.5 million USDT were burned, an event that has not occurred since March 19.

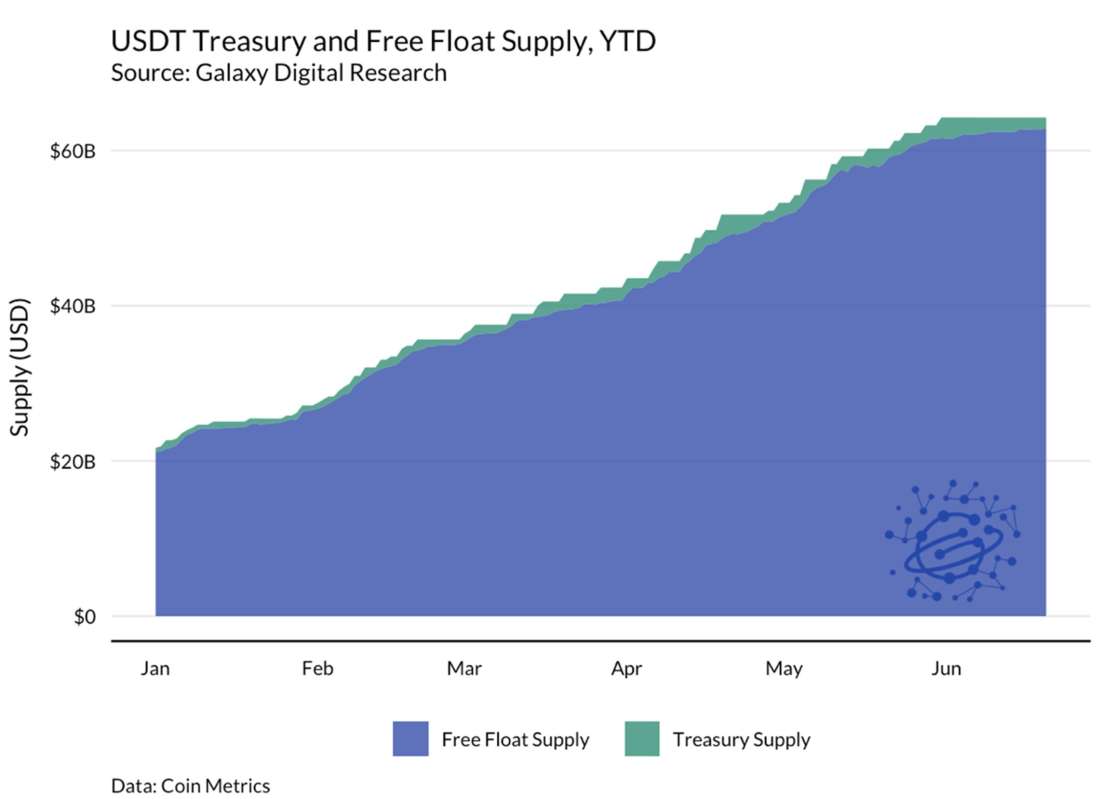

An issuance pause of this length, especially one paired with a burn, is unusual. It is likely tied to the ongoing events in China, where USDT is a popular vehicle for accessing crypto markets—reduced demand for the asset is indicative of a broader slowdown in the Chinese crypto ecosystem. New USDT continues to be released from the Tether treasury, entering circulation: about 753 million USDT have been unlocked since June 6, and about 1.2 billion since May 31.

Where Does Bitcoin Go from Here?

Bitcoin is emerging into a geopolitical force. Nation states are simultaneously adopting and banning it. The network will undoubtedly face more challenges as it grows in importance and usage. The reality is that Bitcoin cannot be banned—it is much too useful, far too demanded, and too widely distributed.

The recent events in China have ultimately been a test of Bitcoin’s robustness, which the network has overwhelmingly passed. Blocks have slowed down, but they are still coming in. Hashrate is down, but the network is still secure. Prices have declined, but Bitcoin is a volatile asset.

We expect that the great global hashrate migration that is now upon us to be looked back upon as one of the most spectacular demonstrations of a network’s resiliency in human history. And it will mark the end of an era: China has long served as the home of Bitcoin mining, in both manufacturing and hashing. We have seen mining manufacturers and exchanges begin to move offshore, and we are now poised to see the industry of securing the network leave the country as well. It will take several months for the dust to settle, but in the end, Bitcoin will have proven itself too strong for even the world’s largest nation to suppress.

Legal Disclosure:

This document, and the information contained herein, has been provided to you by Galaxy Digital Holdings LP and its affiliates (“Galaxy Digital”) solely for informational purposes. This document may not be reproduced or redistributed in whole or in part, in any format, without the express written approval of Galaxy Digital. Neither the information, nor any opinion contained in this document, constitutes an offer to buy or sell, or a solicitation of an offer to buy or sell, any advisory services, securities, futures, options or other financial instruments or to participate in any advisory services or trading strategy. Nothing contained in this document constitutes investment, legal or tax advice or is an endorsement of any of the stablecoins mentioned herein. You should make your own investigations and evaluations of the information herein. Any decisions based on information contained in this document are the sole responsibility of the reader. Certain statements in this document reflect Galaxy Digital’s views, estimates, opinions or predictions (which may be based on proprietary models and assumptions, including, in particular, Galaxy Digital’s views on the current and future market for certain digital assets), and there is no guarantee that these views, estimates, opinions or predictions are currently accurate or that they will be ultimately realized. To the extent these assumptions or models are not correct or circumstances change, the actual performance may vary substantially from, and be less than, the estimates included herein. None of Galaxy Digital nor any of its affiliates, shareholders, partners, members, directors, officers, management, employees or representatives makes any representation or warranty, express or implied, as to the accuracy or completeness of any of the information or any other information (whether communicated in written or oral form) transmitted or made available to you. Each of the aforementioned parties expressly disclaims any and all liability relating to or resulting from the use of this information. Certain information contained herein (including financial information) has been obtained from published and non-published sources. Such information has not been independently verified by Galaxy Digital and, Galaxy Digital, does not assume responsibility for the accuracy of such information. Affiliates of Galaxy Digital may have owned or may own investments in some of the digital assets and protocols discussed in this document. Except where otherwise indicated, the information in this document is based on matters as they exist as of the date of preparation and not as of any future date, and will not be updated or otherwise revised to reflect information that subsequently becomes available, or circumstances existing or changes occurring after the date hereof. This document provides links to other Websites that we think might be of interest to you. Please note that when you click on one of these links, you may be moving to a provider’s website that is not associated with Galaxy Digital. These linked sites and their providers are not controlled by us, and we are not responsible for the contents or the proper operation of any linked site. The inclusion of any link does not imply our endorsement or our adoption of the statements therein. We encourage you to read the terms of use and privacy statements of these linked sites as their policies may differ from ours. The foregoing does not constitute a “research report” as defined by FINRA Rule 2241 or a “debt research report” as defined by FINRA Rule 2242 and was not prepared by Galaxy Digital Partners LLC. For all inquiries, please email [email protected]. ©Copyright Galaxy Digital Holdings LP 2022. All rights reserved.