Digital Assets in an Investor Portfolio

How can we use them?

Digital assets have evolved considerably in the fifteen years since the launch of Bitcoin, enduring multiple market cycles.

Description

In Summary

A quick summary of the topics discussed in this lecture.

Investors should carefully consider volatility and novelty risk for all digital assets categories.

We are still in the early stages of the adoption curve.

We believe the more well-established cryptocurrencies like Bitcoin or Ethereum deserve consideration in investor portfolios today.

Arguments for allocation to cryptocurrencies include: a) The value proposition of blockchain technology, b) The economic backdrop, c) Transparent on-chain data and fundamentals, d) And the positive regulatory progress

Conservative investors should likely avoid digital assets given their volatility, but a small allocation within a growth-seeking portfolio could offer additional diversification and improve risk-adjusted returns.

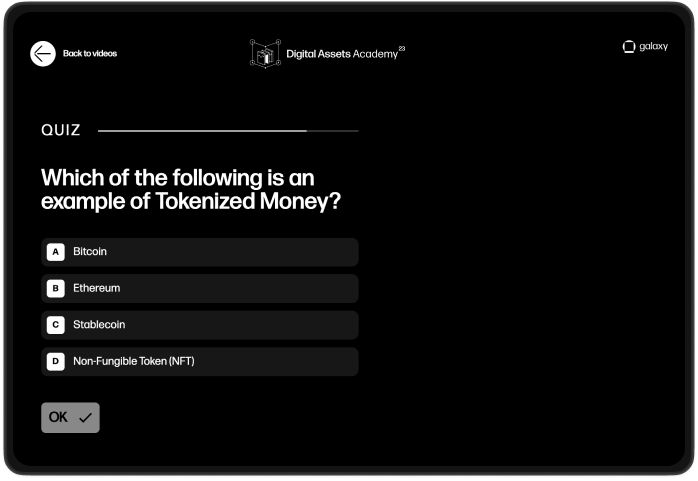

Test your

Learning progress

Previous Lesson

A closer look at Ethereum

Ethereum is a decentralized blockchain that establ...

Next Lesson

Tokenized Money

In a truly digital economy, stablecoins can offer ...