Upcoming Regulatory & Policy Dates You Should Know

As regulators continue to jostle for jurisdiction, lawmakers in Washington are bogged down with fights on several fronts that threaten to derail major crypto-related action. However, deadlines are fast approaching for major decisions and proposals in defining the regulatory framework overseeing market activity and participants. These events over the next few weeks will be critical for setting the tone and rules for crypto markets.

Key Takeaways

Regulators around the world and in the US are focused on crypto markets, with several major forthcoming decisions, rule proposals, and guidances expected in the coming months.

Within the US, regulators have targeted exchanges, lending platforms, and stablecoins, including SEC Chair Gensler making a variety of comments on how certain products could be viewed as securities.

However, for the crypto industry, this wave of regulation has long been anticipated, or even welcomed in some cases, as a more defined regulatory framework could spur a new wave of healthy innovation.

Upcoming Policy & Regulatory

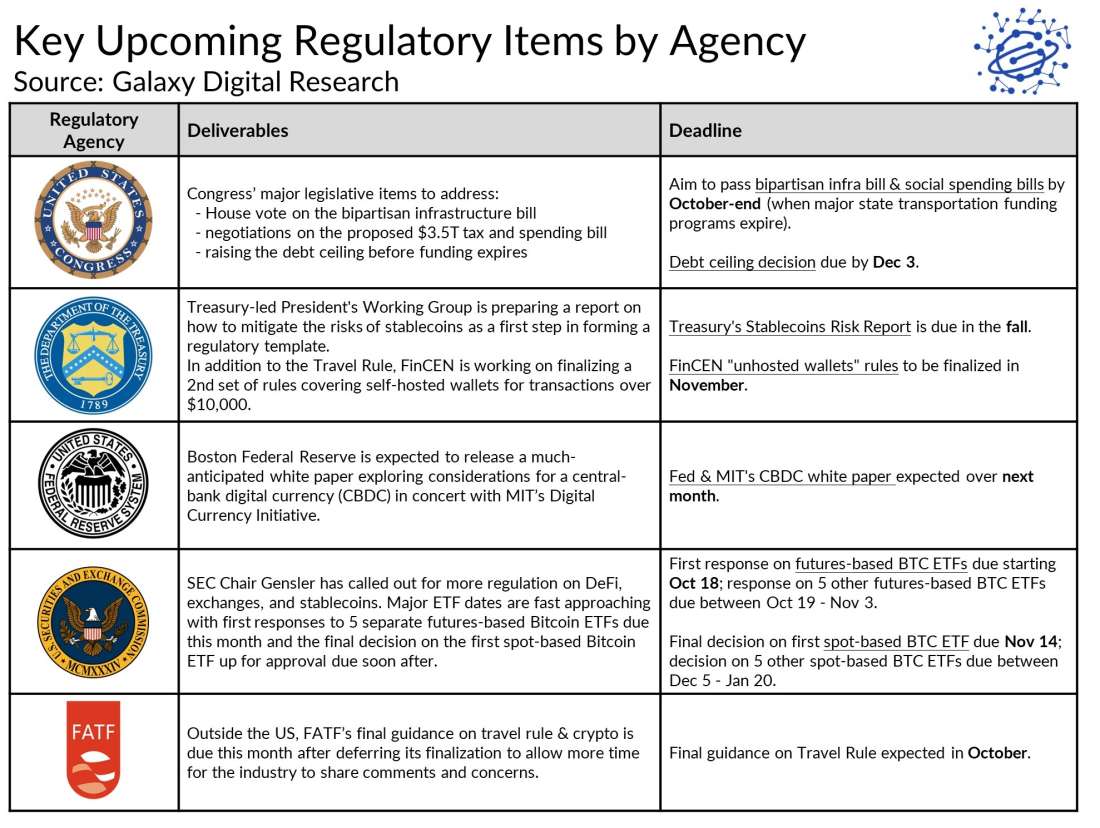

The following items are upcoming over the next 30-90 days:

House vote on the Senate-approved bipartisan infrastructure bill, which contains at least two provisions related to cryptocurrency companies and markets, is expected in the next couple weeks, after delays caused by both partisan and intra-party squabbles.

The Federal Reserve Bank of Boston is expected to release a much-anticipated white paper exploring considerations for a central-bank digital currency (CBDC) in concert with Massachusetts Institute of Technology’s Digital Currency Initiative.

Following Janet Yellen’s comments in July that the government “must move quickly” to establish a regulatory framework for stablecoins, a US Treasury Department-led President’s Working Group is said to be preparing a report with rule recommendations for stablecoin issuers.

The US Justice Department announced the creation Wednesday of the “National Cryptocurrency Enforcement Team,” which will focus on crimes committed by crypto exchanges and services enabling mixing and tumbling (privacy techniques), as well as helping to locate funds lost due to fraud and extortion.

SEC Chairman Gary Gensler has also suggested that the SEC would more closely look to regulate exchanges, lending platforms, and DeFi protocols. Major ETF dates are fast approaching as well, with first responses to 5 separate futures-based Bitcoin ETFs due in October and the SEC’s first final decision on a spot-based ETF due November 14.

FATF’s final guidance on travel rule & crypto is expected in October; FinCEN’s “unhosted wallets” rules are expected to be finalized in November. For more on FATF’s Travel Rule guidance, read our note from July.

Details by US Regulatory Body

Congress

Congress' legislative agenda includes negotiations on three separate, but related tasks related to the President’s economic plan:

Vote to increase the debt ceiling to avoid threat of default, then subsequently funding the government to avoid a shutdown

House's planned vote on the bipartisan infrastructure bill, which includes at least two provisions related to cryptocurrency companies and markets

Negotiations on the proposed $3.5T tax and spending bill on healthcare, education, and climate

Out of these items, the temporary funding bill is the first, and arguably the easiest task to check off. According to Senate Majority Leader Chuck Schumer (D-NY), the debt-limit deal has been reached on Thursday that would raise the statutory debt ceiling by $480bn and extending government funding through December 3rd; the vote is set for Thursday evening.

The Senate-approved bipartisan infrastructure bill, which contains at least two provisions related to cryptocurrency companies and markets, is due for a House vote in the upcoming days. We previously discussed about the contentious “Broker Provision” (tax code section 6045) that was added into the bill’s text at the last minute and passed by the Senate. The provision places reporting requirements to the IRS on a broad set of market participants—some of which are technically unable to comply. This provision remains unclear as the House delayed voting on the proposal late last week.

Another unworkable crypto-related provision that was quietly tucked into the infrastructure bill was §6050I, which places reporting requirements on “business” transactions for amounts greater than $10,000 in cryptocurrencies. As detailed by Coin Center, recipients of digital assets under §6050I would be required to verify the counterparty’s personal information and file a report including the names, Social Security numbers, and the nature of the transaction within 15 days of the transaction. Rather than placing the reporting requirements on the service providers and intermediaries like with the Broker Provision, §6050I places the reporting requirements on individuals and their counterparties that use cryptocurrencies, even where there is no intermediary or third party to facilitate the transaction. The language covering “digital assets” in the infrastructure bill would also extend to recipients of NFTs. Coin Center argues the reporting provision is unconstitutional and would be difficult to obey for crypto transactions:

“Why is that review of BSA constitutionality relevant to our discussion of §6050I? Because §6050I reports are also deputized surveillance but there is no third party. One person to a two person transaction is obligated to collect a load of sensitive information from her counterparty and hand that to government officials without any warrant or reasonable suspicion of wrongdoing. (In the case of two persons exchanging two different cryptocurrencies, they each would have to report on the other.) The law literally asks one American citizen to inform on another if the transactions in which the two are engaged are “business” and if they take place using cash (and, if the infrastructure bill passes as drafted, cryptocurrencies too).”

These two provisions currently included in the text of the infrastructure bill would obviously have meaningful implications for the crypto industry, but they remain relatively low on the list of priorities for Congress. The infra bill is a prerequisite to the Biden Administration’s proposed $4T economic plan focused on healthcare, education, and climate. Both this tax and spending package and the bipartisan infrastructure bill are integral pieces of President Biden’s overall economic agenda.

Many Congress members are unwilling to vote on the infrastructure bill without considering the larger social spending bill. The current state of the larger spending package is facing opposition from members of both parties, which has spilled over to delay efforts to vote on the bipartisan infrastructure bill. Some progressive democrats want to see changes to the larger tax and spending package with greater support from moderate members as a condition to approving the infrastructure bill, some have threatened to block the bill until that happens. According to Senate Majority Leader Chuck Schumer (D-NY), the party now aims to approve the spending plans by end of October when several transportation funding programs are set to expire. Of note, proposed funding for the hefty spending plans could partially come from targeting the nation’s wealthiest on their unrealized capital gains by treating them as income or by taxing them upon death of the asset owner.

Securities & Exchange Commission

Since his appointment, SEC Chairman Gary Gensler has taken a tougher than expected stance on crypto, despite hopes that his background teaching on the subject and his appreciation of all the innovation would suggest a more engaging approach with the industry on thoughtful regulation. Gensler has called for more regulation across a wide spectrum of products and has even requested from Congress for the SEC to have greater authority and resources to regulate the crypto industry, which he likened with “the Wild West.” Specifically, he suggested that the SEC would more closely look to regulate stablecoins, exchanges, and DeFi protocols:

“In my view, the legislative priority should center on crypto trading, lending, and DeFi platforms. Regulators would benefit from additional plenary authority to write rules for and attach guardrails to crypto trading and lending.”

Gensler has been asked a series of pointed questions by US lawmakers requesting that he clarify the agency’s stance on the application of securities laws to digital assets. He believes many existing digital assets will be required to register as securities and reiterated his view on Tuesday when testifying before the House Financial Services Committee:

"While each token’s legal status depends on its own facts and circumstances, the probability is quite remote that, with 50, 100, or 1,000 tokens, any given platform has zero securities. Make no mistake: To the extent that there are securities on these trading platforms, under our laws they have to register with the Commission unless they qualify for an exemption."

Although Gensler has more vocal than expected on his intentions to bring more regulation to the industry, he seemingly intends to leave sufficient room to operate as he claimed in a Tuesday Congressional hearing that the SEC doesn’t plan to follow China’s steps in an outright ban on crypto.

The authority to regulate each of the targeted products mentioned along with their issuers is not totally clear given many tokens have mixed attributes of securities, currencies, and commodities—which would typically fall under the jurisdictions of the SEC, OCC, and CFTC, respectively. Whether an asset qualifies as a security has typically been determined by the Howey Test, a law originating in 1946 that considers whether there is an "investment of money in a common enterprise with a reasonable expectation of profits to be derived from the efforts of others." The difficulty in fitting this test to crypto assets suggests a more modern regulatory framework is needed.

That said, even in the potential “worst case scenario” where every crypto asset falls under the definition of a security, the SEC would face heavy resistance if it tried restricting investing in crypto tokens to just “accredited investors” like startups or other private investments which have unfairly benefitted institutions for decades at the expense of retail investors. In its current form, crypto presents a much more equitable playing field for retail investors. Ideally, the regulatory approach would prioritize consumer protection and inclusion by making startup investing more accessible with the primary goal of educating retail on the investment products and properly disclosing the risks involved. But before the SEC can broadly execute along its mission, they will require a coordinated effort between multiple regulatory bodies and a sign-off from Congress.

Bitcoin ETFs

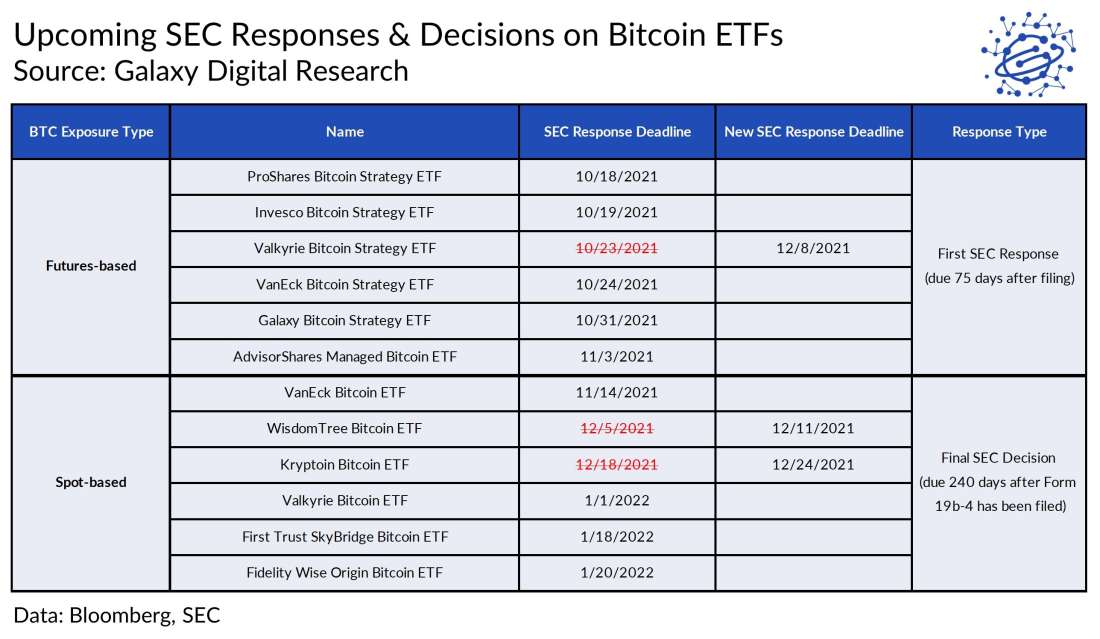

At least one investment product type the SEC has certain oversight over is Bitcoin ETFs, with clear and distinct responsibilities shared with the CBOE, NYSE, and the CME depending on the listing exchange. Futures-based Bitcoin ETFs are filed under the Investment Company Act of 1940 while spot-based Bitcoin ETFs are filed under the Securities Act of 1933.

The SEC has yet to approve a futures- or spot-based Bitcoin ETF as it usually has opted to delay a final ruling as permitted by securities laws (the SEC extended the decision period on four Bitcoin ETFs just last week), but it has looming decision deadlines on several ETF applications—some which can no longer be delayed:

Futures-based Bitcoin ETFs. The first comments from the SEC are due 75 days after initial filings. The first responses on 5 separate futures-based Bitcoin ETFs are due this month, starting on October 18th.

Spot-based Bitcoin ETFs: Before the SEC can provide final approval on spot-based ETFs, the listing exchange (either the CBOE or NYSE) must sign-off to list the ETF on their exchange by filing a Form 19b-4 with the SEC on behalf of the ETF applicant. From that point, the SEC typically provides its decision within 180 days after the Form 19b-4 filing date but can opt to punt the final decision for up to 240 days. After extending its decision period on most spot-based Bitcoin ETFs, the SEC is now due to provide the final decision on the first spot-based Bitcoin ETF in the US by November 14th. Deadlines for five other spot-based Bitcoin ETFs are then more spread out spanning from December 5th to January 20th.

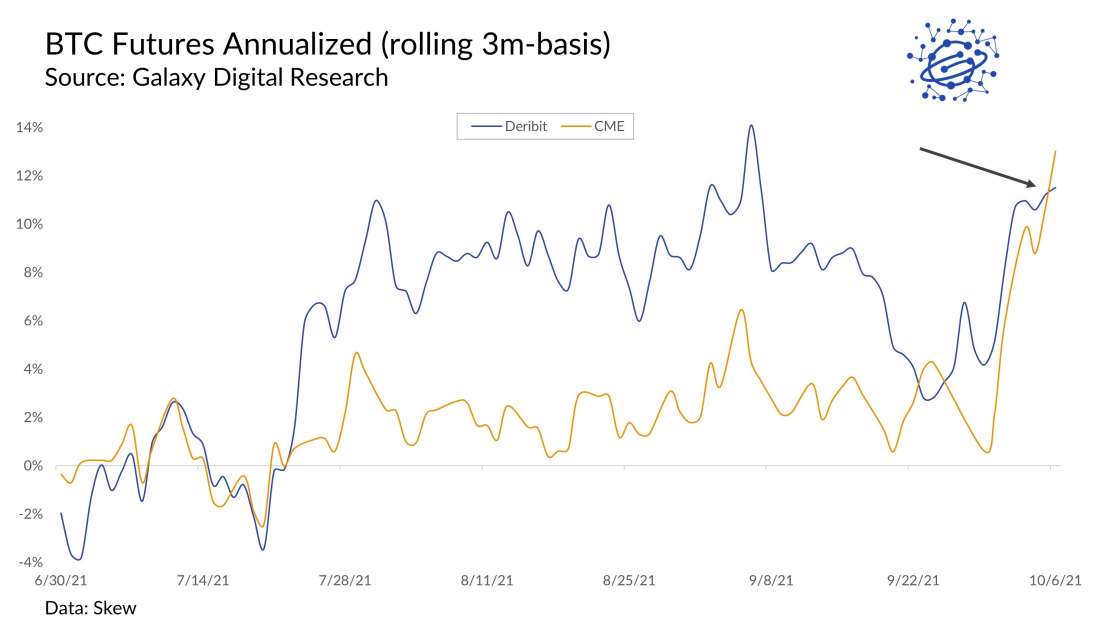

SEC Chairman Gary Gensler on last week reiterated his support for futures-based Bitcoin ETFs (tracking futures on the CME), citing investor protections from investing in futures contracts over investing more directly in the digital asset (physically backed and traded on either the CBOE or NYSE). The BTC annualized basis (spread between BTC futures on the CME and spot price) reached the highest levels in months on Wednesday, implying (i) investor sentiment has turned bullish on bitcoin again, and (ii) CME is outpacing Deribit, which is yet another sign of growing on-shore institutional interest over off-shore crypto-native interest.

Treasury

Stablecoins Risk Report

Led by the Treasury, a President’s Working Group on Financial Markets (PWG) was tasked with exploring risks associated with stablecoins and making recommendations on how to best mitigate those risks. The PWG has met with the OCC and the FDIC during their July meeting, and more recently met with industry executives last month to discuss regulation of stablecoins. Key members of the PWG include:

Janet L. Yellen (Secretary of the Treasury)

Jerome Powell (Fed Chair)

Gary Gensler (SEC Chair)

Rostin Behnam (Acting CFTC Chair)

The Stablecoins Risk Report, expected by end of October, is viewed as a first step in forming a regulatory framework over the crypto industry. The report is expected to include a recommendation for establishing a new limited charter to allow crypto banks to manage stablecoins as deposits, according to a senior official. Treasury officials were reported to have also met with a group of banks and credit unions to see how they could fit into the regulatory framework.

One of the most prioritized topics from the study will be whether reserves have secure software systems in place with sufficient liquidity levels in the event of a bank-run scenario with many individuals cashing in stablecoins at the same time. The PWG is considering tasking the Financial Stability Oversight Council to assess the risk levels of stablecoins and whether they are a potential systemic threat to the financial system. Stablecoins may then see additional restrictions imposed by a different regulatory body if policymakers do not take timely action. Other topics from the study will likely cover requirements around creating new stablecoins, data protection, possible pass-through FDIC insurance, and potential reporting requirements for AML & tax purposes.

The Travel Rule

The travel rule’s AML reporting requirements on digital asset transactions introduced in 2020 from FATF and the Treasury’s FinCEN are expected to be finalized this fall.

FATF’s final guidance on travel rule & crypto is expected in October after deferring its finalization to allow more time for the industry to share comments and concerns.

FinCEN is also working on finalizing another set of rules by November that would amend Bank Secrecy Act implemented regulations to require exchanges and other “virtual asset service providers” (VASPs) to report on transactions into self-hosted wallets for transactions amounting to over $10,000; these extended rules would potentially require recordkeeping of non-custodial wallet transactions for amounts over $3,000.

Recall, the travel rule requires VASPs to provide PII on both the originator (name, account number, and address) and the counterparty (identity and account information) but the latest study on the FATF standards on virtual assets from June had found that “there are still not sufficient holistic and scalable technological solutions available for global travel rule implementation and progress appears to have slowed since the last 12-month review.” Earlier this year, we discussed the requirements and differences between proposed Travel Rule and AML reporting requirements from FinCEN and FATF (read our report here).

Other recent developments within the Treasury Department:

OFAC. The Treasury’s OFAC department provided updated advisory around ransomware payments and sanctions risk, and also designated crypto exchange SUEX on the SDN List for facilitating ransomware transactions.

To further these efforts, Senator Warren and Rep. Ross on Tuesday introduced The Ransom Disclosure Act, a bill requiring disclosures around ransomware payments to help the Department of Homeland Security develop a better understanding of how these attacks are conducted and which types of currencies are used.

OCC. The Office of the Comptroller of the Currency is responsible for approving conditional bank charters and has already granted bank charters to several crypto firms. However, the regulation of stablecoins likely extend beyond just the OCC’s powers requiring the coordination of several department groups. Acting Comptroller Michael Hsu said a couple weeks ago that he finds the crypto/DeFi space “concerning,” while President Biden elected Saule Omarova, who has a reputation of being tough on banks, to serve as the Comptroller of the economy.

The Federal Reserve

Boston Federal Reserve is expected to release a much-anticipated white paper exploring considerations for a central-bank digital currency (CBDC) in concert with MIT’s Digital Currency Initiative. The paper is meant to serve as a starting point to building out the regulatory framework and before opening to public comments. Fed Chairman Jerome Powell says the Fed would ideally work to reach consensus with Congress before any move on creating a digital dollar CBDC. Powell most recently told reporters that we could expect the CBDC white paper some time over the next month.

Powell said there was “no intention to ban” cryptocurrencies but noted some regulation should come over stablecoins. Powell was called “a dangerous man” by Sen. Elizabeth Warren (D-MA), who also called for an insider investigation into other Fed officials. Powell’s four-year term as Fed chairman is set to end in February 2022 but he could potentially be reelected, and according to the White House on Tuesday, President Biden has confidence in Powell.

CFTC

The CFTC regulates derivatives and futures products related to commodity markets. Virtual currencies are largely considered commodities under the Commodity Exchange Act, which has given the CFTC authority to supervise market activity and participants. But it is unclear if the CFTC will maintain its authority over the crypto markets under a revised regulatory framework currently being developed.

On Tuesday last week, CFTC Commissioner Dan Berkovitz announced he would be departing to serve as the SEC’s general counsel, working alongside Gensler once again after previously working with him at the CFTC. Berkovitz is a noted “public-sector critic of DeFi” and is set to start with the SEC General Counsel beginning in November. His departure leaves just two commissioners in the normally 5-member CFTC, but also signals SEC Chair Gensler is enhancing his team with allies who are critical of DeFi.

In the immediate term, the CFTC does not have any key crypto-related regulatory proposals to finalize or deliver. However, the CFTC has seemingly taken a regulatory guidance by enforcement approach as it has filed several charges against crypto firms as of late, including these in past weeks:

Imposing a $1.25m penalty against Kraken for failing to register as a futures commission merchant (FCM) and for illegally offering margined retail transactions

Filing charges against 14 crypto firms – 12 for failing to register as FCMs and 2 for making false and misleading claims about being registered with the CFTC

How the industry is responding

In response to the anticipated regulatory pressure, crypto firms have generally been ramping up compliance hires (e.g. Binance, Coinbase, Robinhood, Fireblocks, a16z) including several former members of the regulatory bodies mentioned above, while many others have been hiring lobbyists to facilitate constructive discussions and consultations with policymakers. Other teams have taken proactive measures to tidy up their offerings and operations, particularly those behind the SEC targeted products—stablecoins, exchanges, and DeFi.

Stablecoin Issuers

Stablecoin issuers have taken proactive measures to tidy up their offerings by providing new disclosures and attestations over the nature of their reserves. The battle between stablecoin issuers became heated this summer:

USDT. Tether CTO provided the asset breakdown for USDT backings in its Consolidated Reserves Report which included attestations from an independent accountant based in the Caymans.

PAX/BUSD. Paxos shared over this summer that its issued stablecoins, PAX and BUSD, are 100% backed by cash & cash equivalents at insured depository institutions.

USDC. Circle shared 61% of USDC was backed by cash & cash equivalents in an attestation report in July. More recently, Circle announced plans last month to move its USDC reserves to 100% cash and short duration US Treasuries.

Last week, Circle’s chief strategy officer Dante Disparte said in a statement, “Circle has already been working toward becoming a full-reserve national commercial bank” and called the Treasury’s intent to regulate stablecoin risks are encouraging. Note: Circle received an investigative subpoena by the SEC in July, which is still ongoing.

Centralized exchanges

Coinbase scrapped its planned launch of the Lend program that promised 4% to USDC lenders after the scuffle with the SEC last month when the SEC threatened to sue the crypto exchange. Meanwhile, Coinbase signed a deal with the Department of Homeland Security to use its blockchain tracing software, Coinbase Analytics, demonstrating the need for federal officials to consult with Coinbase and Coinbase’s willingness to work with them.

Outside the US, FTX has been busy applying for licenses from local regulators and intends to move the company’s headquarters from Hong Kong to the Bahamas. Binance had previously advertised itself as having decentralized headquarters but had shifted from the narrative after poor reception from speaking with regulators.

DeFi

Proactive measures by DeFi platforms in light of upcoming regulation typically fall into three approaches: (i) restricting certain product offerings or avoiding servicing individuals in specific geographies, (ii) going “CeDeFi” by adding a permissioned DeFi product offering with complete KYC and whitelisting processes, and (iii) going completely decentralized. In recent weeks, we have also seen proactive measures taken in DeFi by DEXes and lending platforms:

Uniswap delisted several tokens resembling securities or certain derivatives products, dYdX has restricted the airdrop of its governance token to US residents, and DEX aggregator 1inch started geofencing U.S. IP addresses.

Lending platform Aave has planned to launch a permissioned platform, Aave Arc, and a recent proposal would enlist Fireblocks for push into whitelisted liquidity pools in permissioned DeFi for institutions. Other DeFi lending platforms like Maple Finance have launched specifically for corporate and institutional customers at the start.

In August, Twitter & Square CEO Jack Dorsey shared the Project TBD initiative would focus on the development of a fully permissionless, open platform to create a decentralized exchange for Bitcoin. Sushiswap’s anonymous leader Maki stepped aside from his role last month, although the intentions are not totally clear.

Outlook

Washington certainly has a busy Q4 ahead as it deals with large spending proposals on the Biden agenda, new whistleblower claims against Facebook, and calls for an insider trading investigation at the Fed, plus looming fiscal debt concerns—all while Congressional members have been struggling to reach consensus even within their own parties. US regulatory agencies also have several deadlines approaching for some notable crypto-specific deliverables including several research findings on CBDCs or stablecoins, and decisions on Bitcoin ETFs. These are expected to be the first steps in forming the regulatory framework to oversee the rapidly evolving crypto industry, with more defined responsibilities for each of the regulatory bodies.

Despite the current regulatory overhang, more guidance and clarity from regulators should spur a new wave of healthier, and sustainable innovation. Some institutions like Citadel have avoided investing in cryptocurrencies due to the associated regulatory uncertainties, while other institutions are restricted from direct ownership of crypto assets and are waiting for the first bitcoin ETFs to be approved in the US. More regulatory clarity would be beneficial as it would drive more competition between service providers and would add the stamp of approval needed for hesitant individuals and institutions to gain comfort around investing in cryptocurrencies.

The key to establishing the proper regulatory framework will require regulators to engage in more conversations with community members and stakeholders. These important events over the next few weeks will be critical for setting the tone over the crypto markets.

Legal Disclosure:

This document, and the information contained herein, has been provided to you by Galaxy Digital Holdings LP and its affiliates (“Galaxy Digital”) solely for informational purposes. This document may not be reproduced or redistributed in whole or in part, in any format, without the express written approval of Galaxy Digital. Neither the information, nor any opinion contained in this document, constitutes an offer to buy or sell, or a solicitation of an offer to buy or sell, any advisory services, securities, futures, options or other financial instruments or to participate in any advisory services or trading strategy. Nothing contained in this document constitutes investment, legal or tax advice or is an endorsement of any of the stablecoins mentioned herein. You should make your own investigations and evaluations of the information herein. Any decisions based on information contained in this document are the sole responsibility of the reader. Certain statements in this document reflect Galaxy Digital’s views, estimates, opinions or predictions (which may be based on proprietary models and assumptions, including, in particular, Galaxy Digital’s views on the current and future market for certain digital assets), and there is no guarantee that these views, estimates, opinions or predictions are currently accurate or that they will be ultimately realized. To the extent these assumptions or models are not correct or circumstances change, the actual performance may vary substantially from, and be less than, the estimates included herein. None of Galaxy Digital nor any of its affiliates, shareholders, partners, members, directors, officers, management, employees or representatives makes any representation or warranty, express or implied, as to the accuracy or completeness of any of the information or any other information (whether communicated in written or oral form) transmitted or made available to you. Each of the aforementioned parties expressly disclaims any and all liability relating to or resulting from the use of this information. Certain information contained herein (including financial information) has been obtained from published and non-published sources. Such information has not been independently verified by Galaxy Digital and, Galaxy Digital, does not assume responsibility for the accuracy of such information. Affiliates of Galaxy Digital may have owned or may own investments in some of the digital assets and protocols discussed in this document. Except where otherwise indicated, the information in this document is based on matters as they exist as of the date of preparation and not as of any future date, and will not be updated or otherwise revised to reflect information that subsequently becomes available, or circumstances existing or changes occurring after the date hereof. This document provides links to other Websites that we think might be of interest to you. Please note that when you click on one of these links, you may be moving to a provider’s website that is not associated with Galaxy Digital. These linked sites and their providers are not controlled by us, and we are not responsible for the contents or the proper operation of any linked site. The inclusion of any link does not imply our endorsement or our adoption of the statements therein. We encourage you to read the terms of use and privacy statements of these linked sites as their policies may differ from ours. The foregoing does not constitute a “research report” as defined by FINRA Rule 2241 or a “debt research report” as defined by FINRA Rule 2242 and was not prepared by Galaxy Digital Partners LLC. For all inquiries, please email [email protected]. ©Copyright Galaxy Digital Holdings LP 2022. All rights reserved.