Top Stories of the Week - 12/9

In the newsletter today we talk about fir tree’s suit against grayscale, alameda’s venture portfolio, and another attempt by a DAO to acquire a rare original copy of the U.S. constitution. Subscribe here and receive Galaxy's Weekly Top Stories, and more, directly to your inbox.

Fir Tree Accuses Grayscale of Mismanaging GBTC Trust

In a new compliant filed to the Court of Chancery of the State of Delaware, New York-based hedge fund Fir Tree alleges that Grayscale Investments, a crypto asset management firm, has mismanaged their flagship product, the Grayscale Bitcoin Trust (GBTC). Fir Tree, a $3bn investment firm that became known to in the cryptocurrency ecosystem earlier this year when the Wall Street Journal reported they had taken a short position against Tether (USDT), broadly alleges that the Trust has “flagrantly disregarded its purpose and utterly failed to achieve its stated objectives.” Fir Tree alleges that Grayscale has mismanaged GBTC, engaged in conflicts of interest, and has implied that regulations prevent it from allowing redemptions from the fund despite there being no such regulatory prohibition.

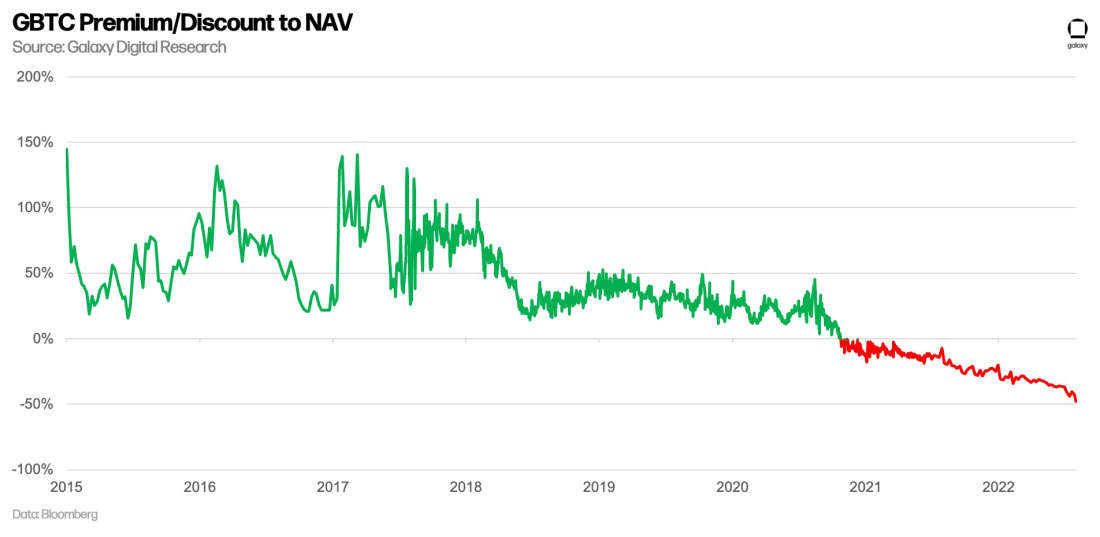

“The age of accountability in digital asset markets is over,” the complaint begins. “The Grayscale Bitcoin Trust has gone wildly off the rails.” Fir Tree then launches into a five-part breakdown of evidence corroborating claims that a deeper investigation into Grayscale’s misconduct and mismanagement of GBTC is necessary. The complaint requests that information about Grayscale and GBTC be made available to Fir Tree, which itself owns shares of GBTC, including the books and records of the Trust, and all other relevant material affecting the Trust. Since the complaint was filed on Tuesday Dec. 6, the GBTC discount has plummeted to all-time lows at -48%.

The key allegations against Grayscale detailed in Fir Tree’s complaint include:

Grayscale’s failed to acknowledge and disclose to shareholders that it has never been required to obtain regulatory approval from the SEC to operate a redemption program for the Trust, but instead “self-imposed this redemption prohibition despite there being no actual regulatory bar to redemptions.”

Grayscale’s pursuit of an “exploitative and wasteful campaign” to convert the Trust into an ETF at the expense of shareholders.

The Trust has “no direct management, no independent board of directors,” and “no independent oversight” to protect the interests of Shareholders.

Substantial conflicts of interest exist between Grayscale and other wholly owned subsidiaries in Digital Currency Group (DCG.)

Grayscale’s “perverse financial incentive” to continue to halt redemptions while Shareholders’ investment suffers (i.e., the GBTC discount to NAV widens) because Grayscale can then “continue to collect its 2% Sponsor’s Fee on Shareholders’ Bitcoin to the tune of hundreds of millions of dollars.”

According to Bloomberg, Fir Tree wants to obtain information from Grayscale about its Trust and related activities to force the cryptocurrency investment firm into lowering management fees and resuming redemptions.

Our Take

This is the latest entry in the multi-year saga of GBTC and its shares’ inability to maintain parity with the Trust’s net asset value. For most of the Trust’s existence until late February 2021, GBTC traded at a premium to NAV, sometimes as high as 140%. The premium was driven by the fact that, at the time, GBTC was one of the only ways to gain bitcoin exposure in a traditional brokerage account, making it an attractive option for retail investors and even RIAs whose clients sought exposure on traditional brokerage platforms. But the premium drove a large arbitrage trade among institutional investors, who rushed to create shares (often with borrowed bitcoin), hold it through the lockup period, and then sell them on the secondary market to capture the premium. A combination of that trade running its course and the emergence of many new ways to gain exposure to bitcoin (including ETFs in Canada and improvements in spot crypto exchange UX) eventually collapsed the premium into a discount, which has only widened over the last 21 months. Indeed, no new shares of GBTC have been created since March 4, 2021.

A key allegation by Fir Tree is that Grayscale has misled the public to believe that it is impossible, under Regulation M, for the Trust to allow redemptions without specific relief from regulators. Fir Tree counters, however, that Reg. M only prohibits such a Trust from offering redemptions within 5 days of a creation (i.e., the creates and redeems cannot be simultaneous), but given that no new shares have been created in more than 1.5 years, simultaneous create/redeem does not appear to be a practical barrier. We aren’t lawyers, so we won’t comment one way or another on the legal analysis here, but we suffice to say we are advised that Fir Tree’s attorneys at Wilkie and Potter Anderson are serious and talented.

Whatever the outcome of the suit (which seeks information and books & records from Grayscale) and GBTC, it puts Grayscale in the tough position of having to either fight the suit (which could further damage its reputation in the market), provide information to Fir Tree (which Fir Tree expects to be damaging to Grayscale), or comply and open redemptions (which would likely result in significant Trust outflows, significantly reducing Grayscale’s 2% Sponsor Fee, perhaps the largest single source of income for DCG. Keep in mind, Grayscale itself sued the SEC in June, asking the U.S. Court of Appeals for the District of Columbia Circuit to review the SEC’s rejection of Grayscale’s bid to convert GBTC into an ETF, arguing that the SEC’s denial was “arbitrary, capricious, and discriminatory” under the Administrative Procedures Act and the Exchange Act. Managing these two suits simultaneously is likely to cause some fireworks, and Fir Tree’s suit is likely to draw even more scrutiny to DCG, which is currently embroiled in an attempt to save Genesis, Grayscale’s sister company, from bankruptcy. -AT/CK

Alameda VC Investments Revealed

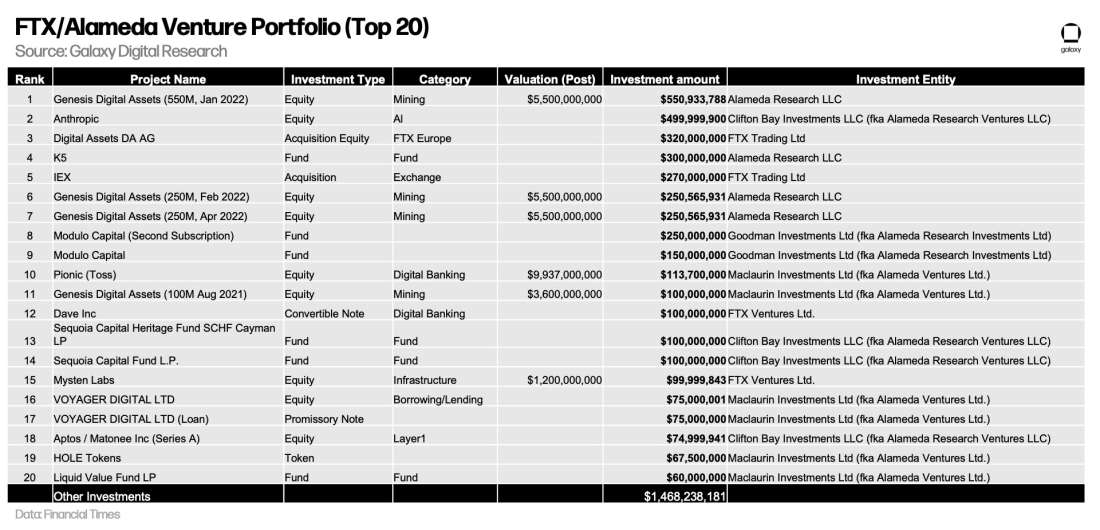

Financial Times reveals Alameda venture portfolio. The released data (also aggregated into a public spreadsheet by @lawmaster) showed over 470 investments with an invested amount of over $5.3bn across 13 different investment entities. The FT reported that the Alameda Research private equity portfolio and some FTX bets included in the spreadsheet was offered as collateral when SBF was searching for FTX rescue funding in early November.

The largest investment was in Genesis Digital Assets (GDA), a bitcoin mining company (not related to Genesis Global Capital, the embattled lending subsidiary of Digital Currency Group). In total, investments in GDA were $1.15bn across several rounds, or 22% of the total portfolio. The portfolio also includes investments in Voyager Digital ($110 in equity investments) and in various funds including Sequoia Capital, SkyBridge, and Multicoin. The majority of investments were in crypto and DeFi projects, but the list also included several non-crypto investments including AI research firm Anthropic, neobank Dave, and drone manufacurer Brinc. In total, equity allocations made up about one-third of the portfolio (not including the 22% in GDA), fund allocations made up 18%, and the remaining ~27% was split between token allocations, acquisitions, and debt.

While the reported list of investments were labeled as the Alameda portfolio (and not FTX), the FT article also notes that some investments (including Genesis and Anthropic) were listed on the draft FTX balance sheet published last month by FT Alphaville (Semafor later reported FTX had seized certain investments from Alameda after a margin call). The document itself, published by FT, also lists FTX entities as the investing party for several of the investments.

Our Take

The revealed list of investments in the Alameda VC portfolio shine some light into how closely related the Alameda hedge fund operation was to FTX's business. Aside from Alameda's investments to companies and funds operated by entities that had invested in FTX (including Sequoia, Multicoin, and Circle), Alameda also invested in SkyBridge (which FTX acquired a 30% stake in) and several fintech companies like Stocktwits and Dave (which had partnership with FTX to offer crypto trading to users). As SBF continues his busy media tour claiming limited involvement over Alameda's financial decisions, the close connections between Alameda's investments and FTX's business suggest his involvement may not be as limited as he claims.

However, while the Solana ecosystem and SOL token have been hit due to the strong ties to FTX and Alameda, there were notably few Solana-based projects that were included in the disclosed Alameda illiquid investment portfolio (top Solana-based investments on the list includes Port Finance, Euclid Labs / Magic Eden, Vybe Network, and Metaplex) – Alameda had more investments in CeFi, platform tokens, and Ethereum-based projects, let alone the 22% portfolio allocation into a bitcoin mining company.

The extent to which FTX customer funds were commingled and misappropriated with Alameda is still unclear based on the reported Alameda investment portfolio. The bankruptcy court will have to determine if customer deposits may have been used to fund investments which can impact on how much of the Alameda venture portfolio will be made available to repay FTX users and creditors. If the entire Alameda venture portfolio is to be liquidated to repay users, if that’s even possible given the illiquidity of these investments, it could provide a cash amount that is materially different than the $5.3bn given changes in the valuations of equity and tokens since Alameda/FTX invested (many companies in the portfolio will likely see lower valuations from subsequent raises in down rounds). Indeed, crypto venture funds are reported to have been materially marking down their portfolios, so it’s hard to know what this portfolio is really worth. -CY

Another DAO Wants to Buy the U.S. Constitution

ConstitutionalDAO2 is raising money to purchase an original copy of the U.S constitution. After the original ConstitutionDAO failed to win a similar auction last year, another DAO run by some of the same people is making a second attempt to buy the Constitution, this time the last privately held original copy. The first attempt failed when Ken Griffin, CEO of Citadel Securities, beat the DAO and won the auction with a bid of $43.2m, slightly above ConstitutionDAO’s known treasury size. Since the DAO’s announcement to begin crowdfunding two days ago, they have raised 36.4ETH ($45,6652) from 139 individuals through public and private contributions.

Public donations are done through Juicebox, a programmable treasury for community owned Ethereum projects, also used in last year’s DAO crowdfunding. The most noteworthy addition to this year’s crowdfunding, though, is that the DAO now supports private contributions through implementing ZK proofs. This is achieved by using Nucleo, a private, auditable shared multi-sig treasury built on the Aztec network. Aztek uses privacy focused ZK-rollups, which not only use validity proofs to compress data, but also to shield transaction data to promote privacy. Contributions with Nucleo preserve privacy by using ZK Proofs to obfuscate where a deposit is routed to on Aztec and uses ZK Attestations to issue NFTs to contributors. The issuance of NFTs for both private and public contributions function as a receipt to return funds incase ConstitutionDAO2 doesn’t win the auction. The DAO will have one week to accumulate as much ETH as they can to place a promising bid for the last private copy of the U.S. Constitution.

Our Take

The ability to privately contribute to the DAO is a critical addition as, during last year’s auction, other bidders essentially knew ConstitutionDAO’s maximum possible bid prior to the auction opening because all contributions were publicly verifiable on the Ethereum blockchain. As a result, billionaire Ken Griffin placed a bid just above the amount ConstitutionDAO raised and won the auction. With the new implementation of ZK proofs to shield contributions, ConstitutionDAO2 is positioned to compete on a level playing field with the other bidders who will be present at the Sotheby’s auction next week. If the DAO is able to raise significant funds privately, ConstitutionalDAO2 will inevitably influence other DAOs to adopt confidential contributions through privacy focused ZK-rollups using Aztec, regardless of whether they actually win the auction.

Despite ConstitutionalDAO2 improving their contribution frameworks though privacy ZK-rollups, this might not be enough to motivate potential contributors facing the brutal crypto market conditions. During last year’s auction in November, the crypto market’s total implied market value stood at $2.9tn vs. $882bn today (~70% decrease). Raising for the DAO at the peak of the crypto bull market no doubt helped it bring in so much money—people were feeling wealthy, and the novelty of the attempt was intriguing to many. Markets are different today, so it’s unlikely ConstitutionDAO2 will be able to raise as much as last year.

There are many questions about how DAOs can operate in the real world, including questions of legal liability, how to turn decentralized digital votes into real-world outcomes, and how to protect the privacy of members and treasuries. But regardless of whether this attempt succeeds in purchasing the Constitution, new solutions to these problems, such as ConstitutionDAO2’s use of privacy technology, will continue to drive new innovations and applications for this natively digital organizational structure. -GP

Other News

Merger Agreement to take Circle public through SPAC was mutually terminated

Nexo announces gradual departure from the US citing lack of regulatory clarity

Tether launches offshore Chinese Yuan (CNH₮) on Tron

Coinbase announces zero-fees when you trade USDT for USDC

Rep. Maxine Waters says a “subpoena is definitely on the table” to force Bankman-Fried to testify before Congress

Ledger introduces new hardware wallet Ledger Stax

Chainlink Staking v0.1 launches on Ethereum

Binance audit report by Mazars says customer BTC holdings are overcollateralized

CME Group to launch three new DeFi reference rates for Aave, Curve, Synthetix

New Head Chef at Sushi proposes directing all fees paid to xSushi to its Treasury wallet

Lens Protocol, a decentralized social graph, to acquire Sonar, a mobile-first Metaverse

Nomad Bridge to relaunch and partially reimburse users impacted by August $190m exploit

Legal Disclosure:

This document, and the information contained herein, has been provided to you by Galaxy Digital Holdings LP and its affiliates (“Galaxy Digital”) solely for informational purposes. This document may not be reproduced or redistributed in whole or in part, in any format, without the express written approval of Galaxy Digital. Neither the information, nor any opinion contained in this document, constitutes an offer to buy or sell, or a solicitation of an offer to buy or sell, any advisory services, securities, futures, options or other financial instruments or to participate in any advisory services or trading strategy. Nothing contained in this document constitutes investment, legal or tax advice or is an endorsementof any of the digital assets or companies mentioned herein. You should make your own investigations and evaluations of the information herein. Any decisions based on information contained in this document are the sole responsibility of the reader. Certain statements in this document reflect Galaxy Digital’s views, estimates, opinions or predictions (which may be based on proprietary models and assumptions, including, in particular, Galaxy Digital’s views on the current and future market for certain digital assets), and there is no guarantee that these views, estimates, opinions or predictions are currently accurate or that they will be ultimately realized. To the extent these assumptions or models are not correct or circumstances change, the actual performance may vary substantially from, and be less than, the estimates included herein. None of Galaxy Digital nor any of its affiliates, shareholders, partners, members, directors, officers, management, employees or representatives makes any representation or warranty, express or implied, as to the accuracy or completeness of any of the information or any other information (whether communicated in written or oral form) transmitted or made available to you. Each of the aforementioned parties expressly disclaims any and all liability relating to or resulting from the use of this information. Certain information contained herein (including financial information) has been obtained from published and non-published sources. Such information has not been independently verified by Galaxy Digital and, Galaxy Digital, does not assume responsibility for the accuracy of such information. Affiliates of Galaxy Digital may have owned or may own investments in some of the digital assets and protocols discussed in this document. Except where otherwise indicated, the information in this document is based on matters as they exist as of the date of preparation and not as of any future date, and will not be updated or otherwise revised to reflect information that subsequently becomes available, or circumstances existing or changes occurring after the date hereof. This document provides links to other Websites that we think might be of interest to you. Please note that when you click on one of these links, you may be moving to a provider’s website that is not associated with Galaxy Digital. These linked sites and their providers are not controlled by us, and we are not responsible for the contents or the proper operation of any linked site. The inclusion of any link does not imply our endorsement or our adoption of the statements therein. We encourage you to read the terms of use and privacy statements of these linked sites as their policies may differ from ours. The foregoing does not constitute a “research report” as defined by FINRA Rule 2241 or a “debt research report” as defined by FINRA Rule 2242 and was not prepared by Galaxy Digital Partners LLC. For all inquiries, please email [email protected]. ©Copyright Galaxy Digital Holdings LP 2022. All rights reserved.