Top Stories of the Week - 11/18

In the newsletter today we talk about the continued fallout from FTX, accelerating calls for proof of reserves, and growth in DeFi activity over the last two weeks. Subscribe here and receive Galaxy's weekly top stories, and more, directly to your inbox.

New Details Emerge from FTX Bankruptcy Filing

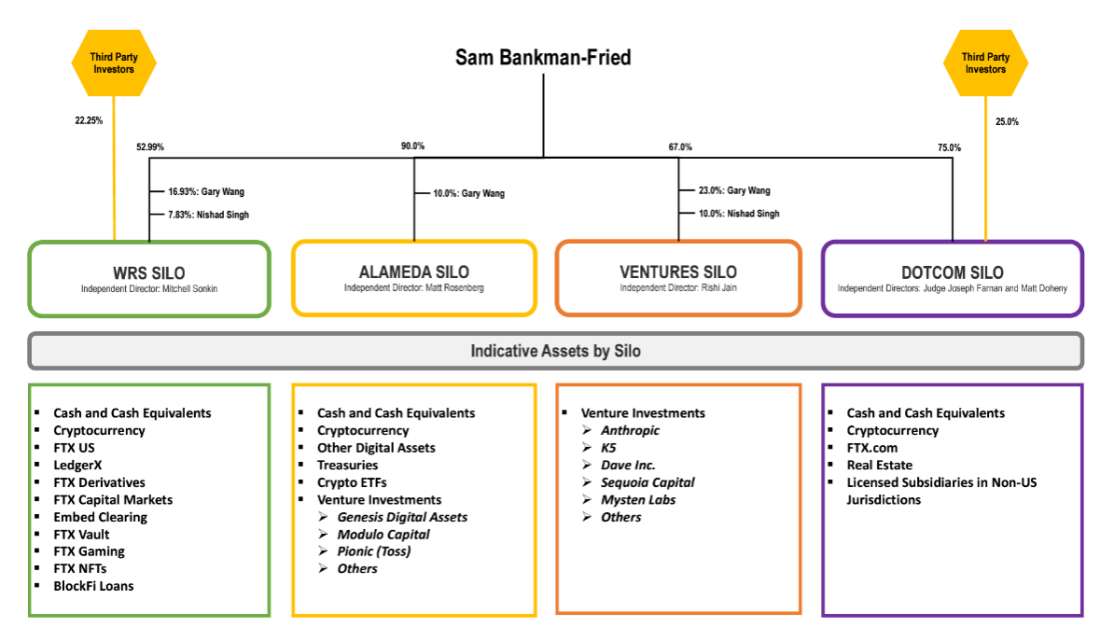

John J. Ray III, FTX’s new CEO, revealed damning details about company operations and management under the leadership of Sam Bankman Fried (SBF) in a bankruptcy court filing on November 17, 2022. Ray, who has a decorated career in leading distressed companies through bankruptcy, (most famously helping manage Enron after its collapse in 2001), said in a court filing, “Never in my career have I seen such a complete failure of corporate controls and such a complete absence of trustworthy financial information as occurred here. … This situation is unprecedented.” Ray then went on to detail how SBF’s massive crypto empire was organized, identifying four individual silos that put together make the “FTX Group.” The following is an illustration of the FTX Group included in Thursday's filing:

Ray explained in the filing that, since his appointment as the new CEO of the now defunct cryptocurrency exchange, he has taken steps to reinstate corporate controls and oversight. Some of the most egregious problems he has identified about FTX’s management include:

The lack of a dedicated group of board members to regularly meet and discuss company direction and performance.

The absence of an accurate list of bank accounts and account signatories, as well as insufficient attention to the creditworthiness of banking partners around the world, leading to a disorganized control of company cash.

The regular use of unacceptable management practices such as the use of an unsecured group email account as the root user to access confidential private keys and critically sensitive data for the FTX Group companies, the use of software to conceal the misuse of customer funds, and the secret exemption of Alameda from certain aspects of FTX.com’s auto-liquidation protocol.

The use of corporate funds to purchase homes and other personal items for employees and advisors without any documentation or centralized disbursement approval process.

The absence of lasting records of decision-making. (SBF often communicated by using applications that were set up to auto-delete after a short period of time, and encouraged employees to do the same.)

Closing out the filing, Ray stressed that SBF is no longer employed by the company and is not authorized to speak on the company’s behalf. A day before the bankruptcy filing was submitted on November 16, 2022, Vox Media published a revealing interview with SBF where the ex-CEO of FTX made explicit comments about the events of the past two weeks. His quotes include statements such as “f*** regulators” and “we say all the right shibboleths and so everyone likes us.”

Our Take

The truth about led to FTX’s collapse is finally being revealed through the company’s bankruptcy proceedings and, based on what we are learning, the situation at FTX may have been even worse than most people had speculated. Crypto assets deposited into the exchange by customers were not recorded at all on a balance sheet. The private keys to FTX wallets and other critically sensitive data were stored in a group email account. There were no control or accounting of the company’s cash balances. Alameda had directly lent its executives, including Sam Bankman-Fried, billions of dollars. These details of corporate mismanagement and lack of oversight by company executives revealed in Thursday’s filing is damning and highlights the opacity of FTX operations. While being trumpeted as the savior of the crypto industry, SBF was misappropriating and mismanaging customer funds to a gross degree.

While the degree of FTX's failure is in many ways unprecedented, this type of situation involving allegations of criminal activity and malfeasance is not singular among large private corporations. John J. Ray III has built a reputation from leading countless companies through scandalous bankruptcy proceedings and settlements. FTX is also certainly not the last cryptocurrency company that will likely be scrutinized and revealed in some way to have betrayed customer trust, which is why it is important to consider what the world’s first cryptocurrency was invented to do. Bitcoin was invented to remove the need for trust in centralized intermediaries when transacting with digital assets. The technology behind Bitcoin, that is public blockchains, does exactly this and has been operational for the past decade with a network uptime of greater than 99.98%. As the details about what happened behind the scenes at FTX come to light, the case for why a technology like Bitcoin presents an improvement to the systems of trust embedded into our world’s financial institutions becomes stronger and clearer. -CK

DeFi Trade Volumes Soar in the Wake of FTX’s Fall

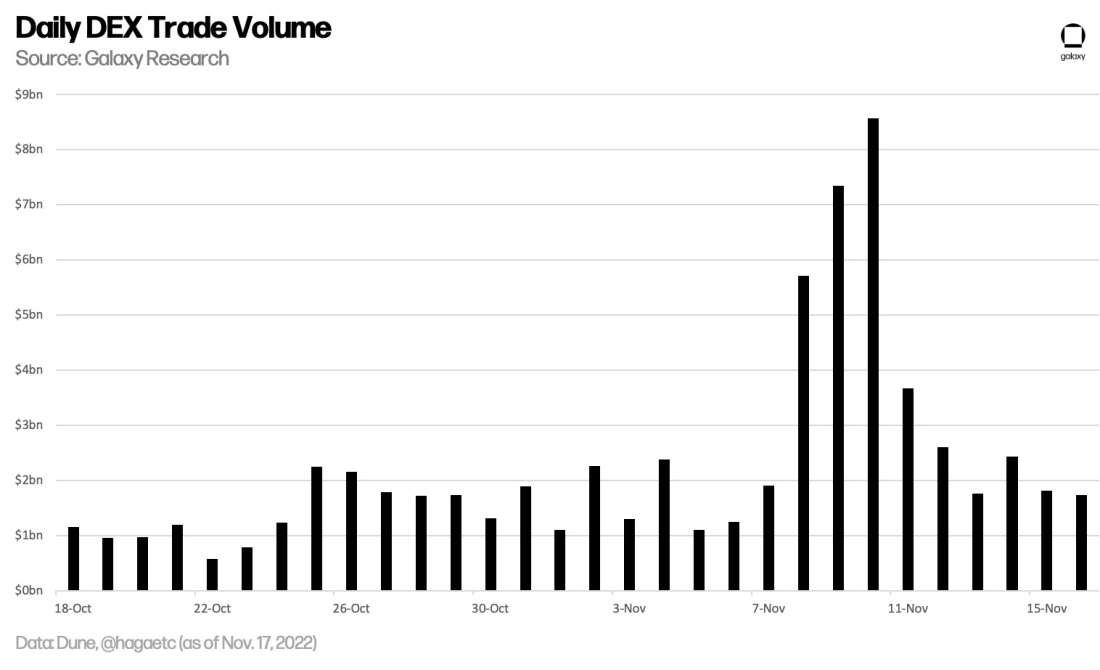

User activity on decentralized finance (DeFi) applications soared as details about FTX’s liquidity crunch and rumors of their insolvency spread. Daily trade volume across decentralized exchanges (DEXs) quadrupled in size over the course of four days from November 7, 2022 to November 11, 2022.

Most notably, Uniswap, which captures about 77% of DEX market share, overtook Coinbase as the second largest cryptocurrency exchange by daily trading volume for ETH pairs. Uniswap also briefly overtook Coinbase in total daily spot volume for a few days between November 19 and November 12, 20222. Increased DeFi activity in turn impacted validator rewards and network issuance on Ethereum. For the first time since the Merge upgrade was activated on September 15, 2022, the total supply of ether (ETH) has started to contract. Total supply has declined by 6,000 ETH since the Merge. Validator rewards also briefly doubled due to increased priority fees from user transactions and maximal extractable value (MEV).

Our Take

Part of the increased volumes through DeFi applications can be chalked up to users wanting access to asset liquidity and de-risk their portfolios by drawing down active loan positions during a widespread liquidity crunch. The transparency of assets moving into and out of these protocols is a key strength of DeFi over CeFi that protects end-users from unexpected revelations about the liquidity or solvency of a platform. Despite unexpected and unprecedented market volatility, users were able to draw down their positions from most DeFi applications without issue since the only authorization users need to pull funds from DeFi applications are the terms and conditions enforced by code, not by a centralized entity. In stark contrast to the opacity of FTX operations, the operations of DeFi applications were transparent and verifiable through on-chain data. In addition, increased flows through DeFi did not change the behavior of applications or break their functionality which suggests that the code dictating how they work is resilient and designed to operate even under market volatility and duress. Finally, despite the surge in on-chain activity and market volatility, decentralized stablecoins on Ethereum including FRAX, MIM, and DAI did not meaningfully de-peg over the last two weeks. For a full breakdown of stablecoin activity in the aftermath of FTX’s collapse, read this newly released Galaxy Research report. -CK

Calls for Proof of Reserves Accelerate

In the wake of FTX’s collapse, crypto exchanges are channeling their focus towards increasing transparency through proof-of-reserves. The concept of proof of reserves (PoR) entails providing a framework for businesses that hold crypto on behalf of customers producing attestations, both cryptographic and auditor-assisted, to prove they possess the digital assets they claim. “Proof of Reserves” is an industry term that refers to the combination of both a cryptographic attestation to the possession of digital assets and a corresponding audit of customer liabilities. From this, customers, investors, and lenders can audit an exchange to prove its solvency on a reoccurring basis.

Given that it appears FTX sent customer assets to affiliate Alameda, a robust proof of reserves framework is necessary to bring trust and transparency back to the centralized exchange sector. The revelations about FTX motivated CZ, CEO of Binance, to announce that his exchange will start releasing proof of reserves soon. In CZ’s announcement he also added “All crypto exchanges should do merkle-tree proof-of-reserves,” which refers to a data structure used to encode blockchain data more efficiently. Following CZ’s announcement, other prominent exchanges including Kraken, BitMEX, Crypto.com and Houbi submitted their proof-of-reserves to prove solvency, although at the time of writing both Crypto.com and Huobi have yet to publish a liabilities report.

Our Take

The FTX crisis undoubtedly erased a substantial amount of trust that the crypto industry built over the years, therefore, implementing frameworks to protect customers is an industry priority. Proof-of-reserves introduces a compelling solution to provide transparency among exchanges, which are among the most important infrastructure companies in the crypto industry. Although PoR is not a standard in the crypto industry today, a handful of exchanges have already implemented PoR to their stack. Binance’s recent announcement regarding their support for PoR is significant considering that they are the largest exchange in the industry. Binance implementing PoR is the first major step that may expedite the adoption of PoR at a wider scale for the industry.

Standardiztion of PoR among all custodial crypto services is critical to establish herd immunity when combating events such as the FTX fallout. If good actors in the space implement effective proofs of reserves, the bad actors who can’t do so will become more apparent. The ability to weed out bad actors in an emerging industry that has lost an immense amount of trust is beneficial to cryptos recovery moving forward.

Proof of Reserves is also a uniquely crypto solution. Cryptographically proving the possession and control of a digital asset like bitcoin is trivial, but it is impossible in the traditional world. Here the cryptocurrency industry possesses a tool that clearly distinguishes it from other asset classes—PoR may even become one of crpyto’s “killer use cases.” Adopting PoR will help restore trust, and unlike other regulatory or self-regulatory proposals, it would actually go a long way to preventing the type of thing that appears to have happened at FTX. -GP

Other News

USDC stablecoin Issuer Circle says businesses can accept Apple Pay

Nike launches .Swoosh Web3 platform, with Polygon NFTs due in 2023

New York Fed and leading banks start regulated liability network pilot

Paxos ordered by US officials to freeze $19M in crypto tied to FTX

FTX hacker now the 35th largest holder of ETH

The House Financial Services Committee plans to hear from FTX

Crypto cold wallets sales surge after FTX crisis

Matter Labs raises $200M for ecosystem projects

Legal Disclosure:

This document, and the information contained herein, has been provided to you by Galaxy Digital Holdings LP and its affiliates (“Galaxy Digital”) solely for informational purposes. This document may not be reproduced or redistributed in whole or in part, in any format, without the express written approval of Galaxy Digital. Neither the information, nor any opinion contained in this document, constitutes an offer to buy or sell, or a solicitation of an offer to buy or sell, any advisory services, securities, futures, options or other financial instruments or to participate in any advisory services or trading strategy. Nothing contained in this document constitutes investment, legal or tax advice or is an endorsementof any of the digital assets or companies mentioned herein. You should make your own investigations and evaluations of the information herein. Any decisions based on information contained in this document are the sole responsibility of the reader. Certain statements in this document reflect Galaxy Digital’s views, estimates, opinions or predictions (which may be based on proprietary models and assumptions, including, in particular, Galaxy Digital’s views on the current and future market for certain digital assets), and there is no guarantee that these views, estimates, opinions or predictions are currently accurate or that they will be ultimately realized. To the extent these assumptions or models are not correct or circumstances change, the actual performance may vary substantially from, and be less than, the estimates included herein. None of Galaxy Digital nor any of its affiliates, shareholders, partners, members, directors, officers, management, employees or representatives makes any representation or warranty, express or implied, as to the accuracy or completeness of any of the information or any other information (whether communicated in written or oral form) transmitted or made available to you. Each of the aforementioned parties expressly disclaims any and all liability relating to or resulting from the use of this information. Certain information contained herein (including financial information) has been obtained from published and non-published sources. Such information has not been independently verified by Galaxy Digital and, Galaxy Digital, does not assume responsibility for the accuracy of such information. Affiliates of Galaxy Digital may have owned or may own investments in some of the digital assets and protocols discussed in this document. Except where otherwise indicated, the information in this document is based on matters as they exist as of the date of preparation and not as of any future date, and will not be updated or otherwise revised to reflect information that subsequently becomes available, or circumstances existing or changes occurring after the date hereof. This document provides links to other Websites that we think might be of interest to you. Please note that when you click on one of these links, you may be moving to a provider’s website that is not associated with Galaxy Digital. These linked sites and their providers are not controlled by us, and we are not responsible for the contents or the proper operation of any linked site. The inclusion of any link does not imply our endorsement or our adoption of the statements therein. We encourage you to read the terms of use and privacy statements of these linked sites as their policies may differ from ours. The foregoing does not constitute a “research report” as defined by FINRA Rule 2241 or a “debt research report” as defined by FINRA Rule 2242 and was not prepared by Galaxy Digital Partners LLC. For all inquiries, please email [email protected]. ©Copyright Galaxy Digital Holdings LP 2022. All rights reserved.