Top Stories of the Week - 11/11

In the newsletter today we talk FTX filing for bankruptcy, Solana reaching crisis mode, and the mid-term elections. Subscribe here and receive Galaxy's weekly top stories, and more, directly to your inbox.

FTX Blows Up, Files for Bankruptcy

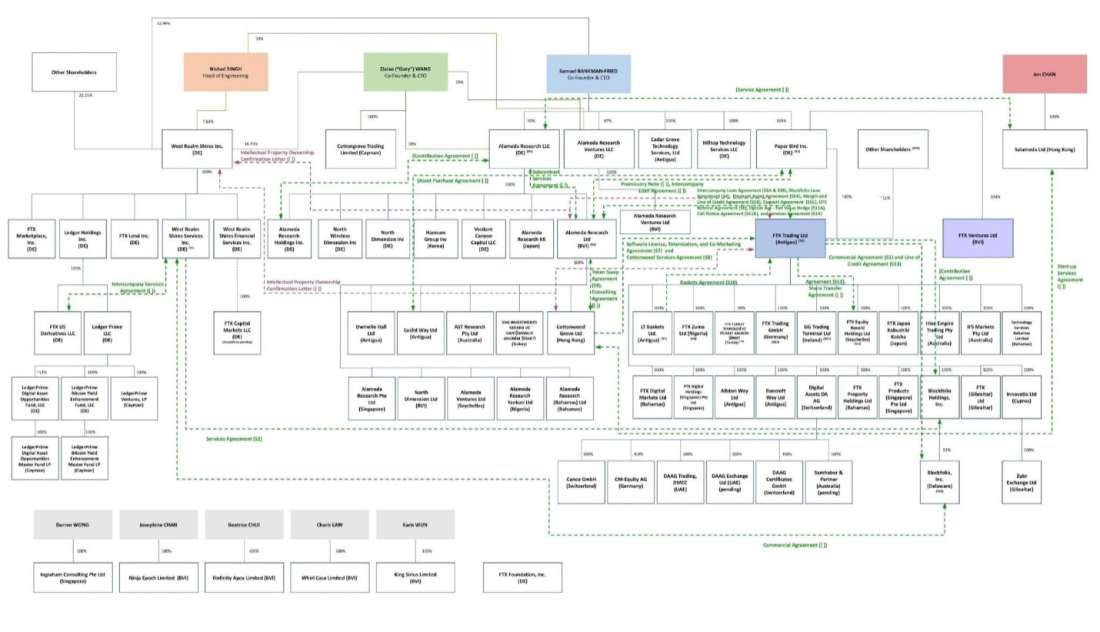

Sam Bankman-Fried resigns as CEO as week-long saga ends with FTX filing for chapter 11 bankruptcy protection in Delaware. Included in the filing are FTX.com, Alameda Research Ltd., and West Realm Shires Services Inc. (d.b.a. FTX US) and 130 other additional affiliated entities. SBF has resigned the CEO role and will stay on to “assist in an orderly transition.”

With bankruptcy now on the menu, it’s likely that FTX depositors who still have funds stuck on the exchange will be considered unsecured creditors and face a lengthy legal process. While several firms have proactively and publicly offered some transparency on exposure to FTX, the totality of industry exposure remains unknown at this time.

The bankruptcy declaration capped a wild week of developments. On Wednesday, November 2nd, CoinDesk reported a leaked copy of the Q2 balance sheet for Alameda Research—the prop trading firm owned by FTX founder Sam Bankman-Fried (“SBF”). The article showed that a significant portion of Alameda's $14.6bn assets were mostly comprised of illiquid assets including FTX's FTT token ($5.82bn), locked SOL ($863m), and equity securities ($2bn). On Friday, 23m FTT tokens (~$583m) were sent from a long-dormant wallet into Binance, leading a 7% decline in the price of FTT - CZ later confirmed that he was responsible for the large FTT transfer and tweeted he would be exiting his $2.1bn equity stake of FTX and selling its FTT tokens due to Alameda's concerning liquidity position.

This led to a twitter spat over the weekend between CZ and SBF, which saw CZ tweeting: "We are not against anyone. But we won’t support people who lobby against other industry players behind their backs" - seemingly a dig at SBF after SBF had previously taunted CZ with in a tweet saying "excited to see him repping the industry in DC going forward! Uh, he is allowed to go to DC, right?" (Note: SBF published a controversial set of regulatory standards for the industry in October and has significant lobbying efforts in DC as the 6th largest individual donor.) By Sunday, on-chain data associated with known FTX-linked addresses showed the exchange's ERC-20 stablecoin balances had fallen by nearly $300m since Friday to just $17m.

On Monday, FTX users had experienced withdrawal issues from the exchange. Knownaddresses belonging to Alameda Research were found to be withdrawing large amounts of deposits on DeFi protocols (including ~2k ETH from Gearbox and 800 wBTC from Compound). CZ later tweeted that afternoon and downplayed the squabble with SBF and said he was surprised that his transparency efforts in exiting his FTT position contributed to a liquidity run on the exchange. Throughout the day, FTT continued to hover around $22 – the level that Alameda CEO Caroline Ellison had previously offered to buy Binance’s position for – until later that evening when FTT finally fell through the $22 support level where it quickly plummeted to a low of under $15.40.

On Tuesday morning, the Block reported FTX appeared to have stopped processing withdrawals, citing on-chain data for FTX International hot wallets #1 and #2 (withdrawals were still being processed for the FTX Blockfolio/FTX US address). Shortly after 11AM, SBF announced that Binance would be acquiring FTX.com pending due diligence. SBF also noted: “Our teams are working on clearing out the withdrawal backlog as is. This will clear out liquidity crunches; all assets will be covered 1:1. This is one of the main reasons we’ve asked Binance to come in,” he said while clarifying that the US-based companies of both exchanges—FTX.US and Binance.US—are not currently impacted. CZ shared the news in his own update, saying a non-binding LOI was signed to fully acquire FTX, adding that "This is a highly dynamic situation, and we are assessing the situation in real time. Binance has the discretion to pull out from the deal at any time."

After the announcement briefly sent markets higher, new media reports detailed SBF’s quest to find alternative funding options including a Semafor article which read, “Before deal with rival, FTX scoured Wall Street, Silicon Valley billionaires for $1 billion lifeline,” noting that “two of the people briefed on Bankman-Fried’s efforts said the firm was seeking more than $1 billion in financing before the Binance deal was sealed, with one adding that by midday Tuesday the hole appeared far deeper – closer to $5 billion to $6 billion.” News of the FTX's liquidity hole led to a steep selloff across crypto.

On Wednesday, the WSJ reported that SEC and DOJ are investigating FTX over its handing of client funds and lending arrangements between the US entity, offshore parent company FTX International, and Alameda Research. Other media outlets reported doubts that Binance would go through with the acquisition after review of FTX's books (CoinDesk) or unless FTX.US is included as part of the deal (Blockworks). Binance later confirmed by 4PM that the deal was off as a result of "corporate due diligence, as well as the latest news reports regarding mishandled customer funds and alleged US agency investigations." A Binance spokesperson said “the issues are beyond our control or ability to help.” Markets continued to sell off as estimates of FTX's liquidity shortfall ranged from up to $8bn (per WSJ) to $9.4bn (per Reuters).

On Thursday morning, SBF issued a public apology and shared that the value of assets/collateral of FTX Int'l currently exceed customer deposits, but acknowledged liquidity was still insufficient to meet all withdrawals (noting over $5bn of FTX withdrawals on Sunday). SBF stated his team was in the process of raising liquidity intending to repay any users first before any capital is then distributed to investors and employees. Later, FTX announced it had reached an agreement with Tron CEO Justin Sun who will provide a special credit facility enabling holders of certain Tron tokens (TRX, BTT, JST, & HT) to swap their assets 1:1 to external wallets with capacity initially set at $13m with more capital injections to be deployed in the future.

The reported size of the hole ($8-10bn), and the likelihood that the asset itself (FTX.com) is irreparably harmed, makes a new deal to rescue FTX exceedingly unlikely. Coinbase CEO Brian Armstrong crystallized increasingly negative sentiment among observers, saying on CNBC Thursday “I don’t know why anyone would invest in this now.” Late Thursday, Bahamian regulators announced that it was freezing “the assets of FTX Digital Markets and related parties.” Regulators also suspended FTX Digital Markets’ license and “applied to the Supreme Court of The Bahamas for the appointment of a provisional liquidator of FTX Digital Markets Ltd. This entity was specifically excluded from the bankruptcy notice issued by the firm this morning (Friday), and it’s unclear what assets it possesses.

Our Take

While the turmoil has roiled markets, Bitcoin and digital assets aren’t going anywhere. Non-custodial, self-sovereign money is a powerful use-case that shines in this scenario. Fully-decentralized DeFi protocols have shined throughout the industry’s credit crunch over the last 6 months. But for digital assets to become a genuine asset class, the market infrastructure at the center of the industry must be reliable and safe. If what is being reported is true, that FTX took customers’ exchange assets and gave them to an affiliated hedge fund who performed proprietary trading strategies (and powerful on-chain analysis from Lucas Nuzzi at Coin Metrics suggests it is), it’s the single worst thing you can do in finance. Misappropriating client funds in this way is unacceptable, immoral, illegal, and it cannot be allowed to happen going forward.

An enormous amount of money is at stake (perhaps lost), but the impact of FTX’s collapse is even further magnified by the exchange’s wide-ranging marketing efforts and Sam Bankman-Fried's prominence. SBF was the most visible and active advocate for the crypto industry in Washington. SBF donated $5.2m to President Biden’s 2020 presidential campaign (behind only Mike Bloomberg’s $56m), testified before the House Financial Services Committee in December of last year, promoted the bipartisan Digital Commodity Consumer Protection Act which was introduced last month by Sens. Stabenow (D-MI) and Boozman (R-AR), and caused controversy when he appeared to advocate for the regulation of crypto protocols themselves. The size of his advocacy and extremeness of his collapse cannot be understated and will have long-lasting ripple effects in Washington for crypto policy.

At this point, it’s obvious that centralized crypto exchanges need regulation, particularly around the safety of customer assets. Some custodians are already committing to—and any regulation on custody should include—a requirement to perform cryptographic proofs of reserves, something that is not possible in traditional assets but which would add significant transparency for digital asset custodians and an area where the digital asset ecosystem can positively differentiate itself with the existing system. There should be only two paths forward for service providers and applications: 1) centralized with rules for transparency and custody, or 2) fully-decentralized and noncustodial. For more commentary on FTX, listen to this week’s episode of Galaxy Brains. -AT

Solana Engulfed in Bahama-Born Storm

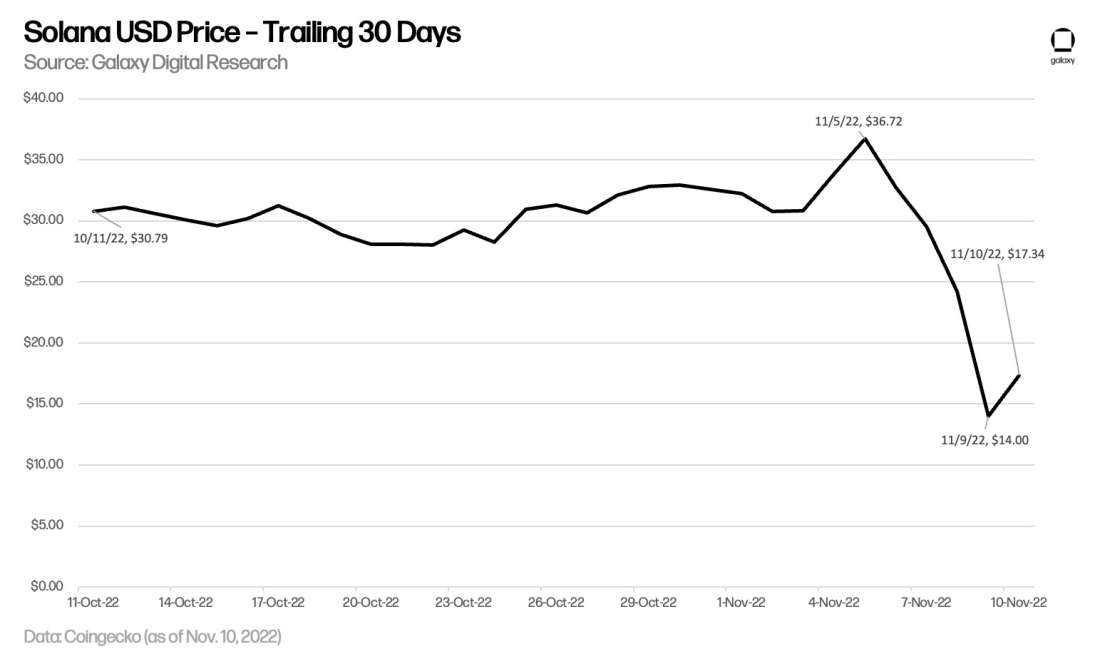

Solana reaches crisis mode. It’s hard to believe just one year ago, Solana threw a 3-day party for itself at its inaugural Breakpoint conference in Lisbon, igniting a euphoric high of $259.56 for its SOL token. Now, Solana finds itself in a vulnerable position, playing defense in the wake of the recent FTX/Alameda debacle. SOL prices have been getting demolished this past week especially compared to other top tokens, and SOL is currently trading in the $18 range (~50% down from just one week ago). This decline puts Solana 93% down from its all-time high, driving a flood of negativity into Solana's ecosystem. The main driver of the sentiment stems from sell pressure generated by Solana’s various ties to SBF’s former empire.

Historically, SBF has been a strong proponent of Solana, regularly tweeting his support for the network and positioning his respective entities to augment Solana's reach. FTX, for instance, is one of 3 exchanges that support a direct fiat onramp within Solana's popular Phantom wallet. In addition, Alameda participated in a 2021 $300mn Solana ICO in exchange for ~10% of SOL token supply. CoinDesk reported that these tokens were Alameda's 2nd-largest holdings (trailing only FTT) with balances of $292 million of unlocked SOL, $863 million of locked SOL, and $41 million held in SOL collateral. There were fears that Alameda would sell off its massive SOL holdings to salvage FTT, which triggered market fear centered on Alameda’s potential dump of SOL.

After Binance’s deal to acquire FTX died, fears about Solana shifted over to "Epoch 370," which encompassed roughly 56mn SOL set to be unstaked by validators and potentially hitting the open market later in the week. Understandably, this massive tranche of unlocked SOL, approximately ~10% of total supply, would have triggered enough sell-pressure to decimate SOL prices even further. However, the Solana Foundation clarified that 28.5mn of this tranche, by pure coincidence, was scheduled for unstaking by the Foundation due to Hetzner’s change in terms for their data centers. However, this 28.5mn SOL has since been restaked, leaving a smaller, but still substantial, remaining balance of ~31mn SOL set to be unstaked for release into the open market.

These turbulent market conditions also caused Solana to shed 50% of its DeFi TVL this past week, a far-cry from its all-time high of $10.17b in TVL from early November 2021. Solend, one of the largest lending protocols on Solana, had to put out a massive fire in liquidating a whale who had amassed close to $7m in bad debt on the protocol. Though Solend has been badly wounded, they appear to have survived this market onslaught. Overall, it has been a very tense week for Solana.

Our take

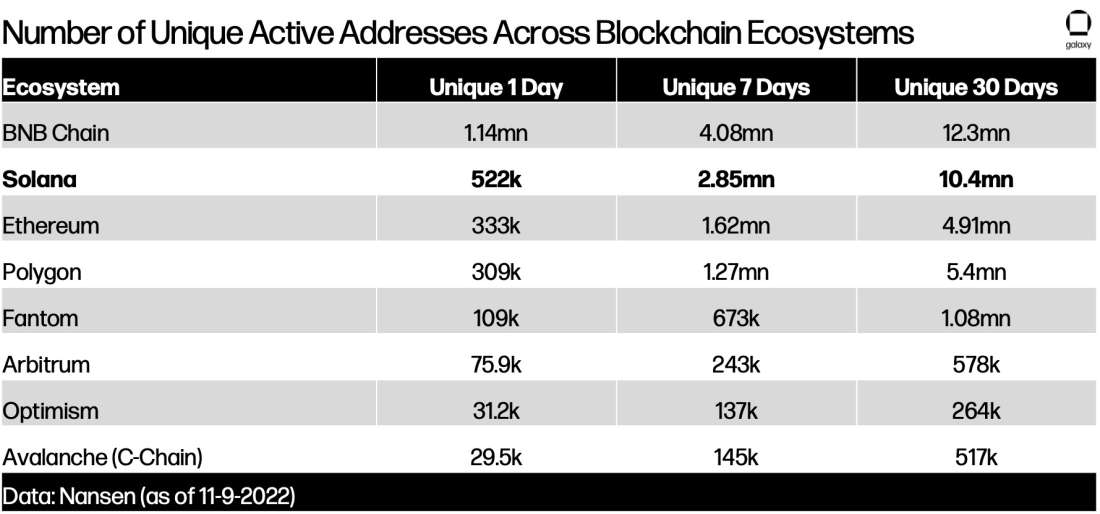

Negativity on Solana is more of a product of its affiliation with SBF rather than any structural problems with the protocol, although the loss of FTX (a major on-and-offramp for the Solana ecosystem is undoubtedly a blow. Solana boasts some of the highest engagement metrics across all Layer 1 blockchains. Solana’s Summer Camp hackathon, for instance, picked up a total of 18k participants and 750 project submissions this past summer. Solana’s Hacker House tour, rivalled only by the likes of Ethereum’s international conference tour, regularly draws in hundreds of participants at each city. These metrics are hard to fake as they require people to physically show-up and code (unlike TVL, which can be gamed through incentive design). Few other protocols can boast such an active developer community. According to data from Artemis, Solana’s 379 weekly active developers rank in the top 4 across all ecosystems, edging out Bitcoin at 377.

On the consumer side, Solana has established a foothold on user adoption that distinguishes it against its rivals. Its 12% share of NFT trading volume (according to DappRadar), while trailing ETH at 73%, is good for 2nd place and 3 times larger than the next biggest ecosystem (Immutable X at 4%). On the other hand, challenger chains like Polygon and Tezos both only command 2% of NFT trading market share, respectively. According to Nansen, Solana also has the 2nd highest daily/weekly/monthly unique active address count (trailing only BNB Chain). This is a function of Solana’s traction across multiple sub-sectors within crypto, such as NFTs, DeFi, Gaming, DAOs, web/mobile wallets, and Decentralized Wireless (DeWi, i.e., Helium, Pollen, Hivemapper, etc.). Solana’s diversified exposure to all facets of crypto enable them to weather these cyclical crypto storms and continuously onboard new developers and users over time.

Solana has a variety of upcoming initiatives that will position their ecosystem at the cutting-edge of crypto over the next few years. At Breakpoint this past weekend, Solana announced a partnership with Google Cloud which will substantially reduce the barriers-to-entry for network participants to run their own nodes in the cloud (which has historically been an onerous endeavor. Jump also demonstrated their validator client, Firedancer, which is capable of processing 1mn transactions per second while simultaneously increasing the decentralization and robustness of Solana’s validator network. Solana’s Saga phone continues to make progress towards its Q1 release as the first crypto-focused phone to include both a native dapp store and a secure element for storing a user’s private keys. Finally, companies like Coral, the creators of Solana’s Anchor development framework, are pushing the boundaries of NFTs with their xNFT standard for launching mini-applications inside of user wallets.

Despite recent price movements, Solana isn’t going anywhere. On the contrary, Solana’s utility and adoption appear stronger than ever, recently shrugging off much-hyped challengers like Aptos with good technology and a massive head-start in traction. It’s worth noting that Solana’s implementation of QUIC and stake-weight QoS might have resolved their spam issue which hasn’t impacted the network since last April. Their implementation of fee markets is also on the horizon for a full release. It is our view that Solana still stands as a clear #3 behind Bitcoin and Ethereum in terms of user adoption, developer traction, and technical roadmap. While other ecosystems like Polygon attract headlines for inking new deals with legacy players, Solana’s robust ecosystem (which already has birthed 2 unicorns in Magic Eden and Phantom) is currently showing no signs of slowing down. -SQ

Mid-Term Elections Result in Deadlock

Midterm elections still in flux, but no ‘red wave’ emerged. As of writing, the live election results show that the Republicans lead the race in the Senate with 49 seats secured compared to the 48 seats secured by the Democrats. There’s a significant chance that the chamber ends up 50-50, which would leave it in Democratic control (with V.P. Kamala Harris as the tie-breaking vote). Republicans currently lead the battle for the House of Representatives after flipping 15 formally Democratic-held seats after securing 209 seats of the 218 total seats, while Democrats have only secured 191 seats after flipping only five formally Republican seats. While several races remain too close to call, or even under recount, it appears Republicans will win a slight majority of the chamber’s 435 seats.

One of the most critical developments to come out of the neck-and-neck race for the Senate happened in the crucial race happening in Georgia which has resulted in a run-off scheduled for next month. This came after no candidate in Georgia’s Senate race adequately secured a majority of votes. The race in Georgia stands at Democratic runner, Raphael Warnock, in the lead with 49.4% votes and Republican runner, Herschel Walker, trailing with 48.5% of votes. Voters in Georgia will return to the polls to cast their votes for either Warnock or Walker on Dec. 6, exactly four weeks after Election Day. The run-off in Georgia’s Senate race will be closely watched especially after the head of the Senate Republican campaign committee pledged to raise whatever money is needed to help aid Herschel in his final push to reach 50% of votes to get Republicans to secure 50 seats in the senate. Additionally, Nevada’s Senate election is in the spotlight after polls closed and with 84% of votes in Republican candidate Adam Laxalt leads the race with 49.4% votes while Democratic incumbent, Catherine Cortez Masto, trails with 47.6% of votes.

Our take

The relatively uneventful outcome of the election in terms of balance of power, although the House will likely flip by a tiny margin, makes it unlikely that the near-term crypto policy outlook changes materially. Republican control of the House will have some impact primarily at the committee level, where Republicans will set agendas. However, with a slim majority, presumptive House Speaker Kevin McCarthy (R-CA) will likely need to exert significant control over the committee process in order to ensure that bills that hit the floor have either a) broad bipartisan support or b) ironclad majority support with little possibility of Republican defection. So, while bipartisan efforts like the stablecoin bill under discussion in the House Financial Services community may become altered slightly in favor of Rep. Patrick McHenry’s (R-NC) views if he takes over the House Financial Services Committee, both the slimness of the Republican majority and the bipartisan interest in crypto policy could ensure that the main thrusts of the effort remain broadly intact.

While at least one crypto advocate, Blake Masters (R-AZ), lost his bid for the Senate, existing crypto advocates in Washington have mostly emerged unscathed. One big loss for the industry, though, is the retirement of Sen. Pat Toomey (R-PA), one of crypto’s most effective advocates and among the smartest legislators on financial policy in the whole Congress.

Ultimately, given the tepid outcome of the election overall, it’s our view that FTX will be a more significant driver of changes in crypto policy than the election itself.

In Other News

Tether publishes attestation report – reserves are 58% US T-Bills, no CP exposure

Paxos enables support for Solana blockchain

Twitter files paperwork to process payments

StarkNet Foundation officially launches

BitMEX announces its exchange token BMEX will begin trading on 11/11

OFAC redesignates Tornado Cash as DPRK Weapons Representatives in sanctions

Aptos and Google Cloud unveil partnership

Grayscale's Bitcoin fund GBTC hits record-low 40% discount

OpenSea pushes to advocate for royalties

Legal Disclosure:

This document, and the information contained herein, has been provided to you by Galaxy Digital Holdings LP and its affiliates (“Galaxy Digital”) solely for informational purposes. This document may not be reproduced or redistributed in whole or in part, in any format, without the express written approval of Galaxy Digital. Neither the information, nor any opinion contained in this document, constitutes an offer to buy or sell, or a solicitation of an offer to buy or sell, any advisory services, securities, futures, options or other financial instruments or to participate in any advisory services or trading strategy. Nothing contained in this document constitutes investment, legal or tax advice or is an endorsementof any of the digital assets or companies mentioned herein. You should make your own investigations and evaluations of the information herein. Any decisions based on information contained in this document are the sole responsibility of the reader. Certain statements in this document reflect Galaxy Digital’s views, estimates, opinions or predictions (which may be based on proprietary models and assumptions, including, in particular, Galaxy Digital’s views on the current and future market for certain digital assets), and there is no guarantee that these views, estimates, opinions or predictions are currently accurate or that they will be ultimately realized. To the extent these assumptions or models are not correct or circumstances change, the actual performance may vary substantially from, and be less than, the estimates included herein. None of Galaxy Digital nor any of its affiliates, shareholders, partners, members, directors, officers, management, employees or representatives makes any representation or warranty, express or implied, as to the accuracy or completeness of any of the information or any other information (whether communicated in written or oral form) transmitted or made available to you. Each of the aforementioned parties expressly disclaims any and all liability relating to or resulting from the use of this information. Certain information contained herein (including financial information) has been obtained from published and non-published sources. Such information has not been independently verified by Galaxy Digital and, Galaxy Digital, does not assume responsibility for the accuracy of such information. Affiliates of Galaxy Digital may have owned or may own investments in some of the digital assets and protocols discussed in this document. Except where otherwise indicated, the information in this document is based on matters as they exist as of the date of preparation and not as of any future date, and will not be updated or otherwise revised to reflect information that subsequently becomes available, or circumstances existing or changes occurring after the date hereof. This document provides links to other Websites that we think might be of interest to you. Please note that when you click on one of these links, you may be moving to a provider’s website that is not associated with Galaxy Digital. These linked sites and their providers are not controlled by us, and we are not responsible for the contents or the proper operation of any linked site. The inclusion of any link does not imply our endorsement or our adoption of the statements therein. We encourage you to read the terms of use and privacy statements of these linked sites as their policies may differ from ours. The foregoing does not constitute a “research report” as defined by FINRA Rule 2241 or a “debt research report” as defined by FINRA Rule 2242 and was not prepared by Galaxy Digital Partners LLC. For all inquiries, please email [email protected]. ©Copyright Galaxy Digital Holdings LP 2022. All rights reserved.