Taking Stock of the Crypto Correction

Following market-moving comments from Tesla CEO Elon Musk over the last week, BTC, ETH, and the broader cryptocurrency market began a slide that became a significant correction this week, with the ecosystem’s total market capitalization dropping as much as 42% before rebounding modestly by midday Wednesday.

Key Takeaways

Crypto markets saw a severe correction on high volatility that began last week and accelerated into Wednesday of this week. Bitcoin stagnation and ETH overheating primed the market for correction. Negative headlines sparked a downturn, eventually causing record liquidations which exacerbated the event.

Selling was dominated by short term holders, with a significant portion of them selling for a loss. Long term holders were seen accumulating, despite the significant drawdown, with 75% of BTC supply currently still in profit.

Long term bull thesis remains strong. Adoption, usage, ownership, and awareness of crypto are at all-time highs. Demographic changes, a growing distrust of institutions, and a macroeconomic and monetary policy backdrop fraught with uncertainty all continue to buoy the value proposition of decentralized, open networks. Major upgrades to Bitcoin and Ethereum will improve usability and scalability, and provide catalysts for future growth. Crypto market infrastructure continues to mature and connectivity with the traditional financial system keeps improving.

Investors with a long-term view often see downside volatility as a buying opportunity, and indeed our trading desk saw net buying across the asset class throughout the morning on Wednesday, May 19.

Introduction

The crypto markets experienced a severe correction this week, the most significant drawdown since March 12, 2020. At one point Wednesday morning, Bitcoin touched $30k (a 53% decline from its prior all-time high of $65k) and Ether traded at $1918 (a 55% decline from its prior all-time high of $4338). Markets have since rebounded from Wednesday lows, with Bitcoin trading at $39,000 and Ether trading at $2600 at the time of writing.

Bitcoin rallied last year on the back of allocations by institutional investors who viewed its credible monetary policy as a differentiator to the monetary debasement enacted by central banks—Bitcoin as “digital gold.” The properties of Bitcoin supporting this thesis are unchanged. But the trade became crowded, and as bitcoin traded stagnant between $42k and $65k, many shifted their attention to ETH, which saw significant inflows and appreciation, rising 340% between March 1 and May 12. Following ETH’s rally, money cascaded into riskier assets like DeFi tokens, NFTs, and memecoins. Manias erupted and the market became overheated. This is a pattern we’ve seen in crypto markets before: bitcoin leads the way, Ethereum follows, “alt season” erupts after Ethereum’s rise spawning tons of overvalued fringe coins, and a correction ensues. A pullback under these conditions is not unexpected.

While a correction was due, several recent catalysts seemed to spark the decline:

A risk-off mentality in broader markets relating to inflation fears, with equities down for several consecutive days

Tesla CEO Elon Musk’s about-face on Bitcoin transactions and volatile Tweets about the ecosystem

Growing attention to Bitcoin mining’s energy usage (read this report from Galaxy Digital Mining, which makes a good faith effort to quantify and put Bitcoin’s energy use in context)

Fear driven by negative headlines relating to Tether’s reserve composition, China’s supposed “ban” on cryptocurrencies, and an investigation by the US DOJ and IRS into Binance. In our view, the market may have overreacted to these headlines, which mostly didn’t introduce new, genuinely impactful information.

Market Overview

Leading up to the correction, the total market capitalization of the cryptocurrency asset class hit an all-time high of more than $2.5tn on Wednesday, May 12. That evening, Tesla CEO Elon Musk made an about-face on his company’s use of BTC for payments, sparking a selloff that accelerated into the weekend and has continued through this week.

Price Action. Since last Wednesday, the total crypto market capitalization is down 42% to $1.4tn. Bitcoin and Ether were down 30-40% from their May 12 highs intraday Wednesday morning, with other coins dropping significantly more.

Drawdown from All-Time High. Bitcoin closed the day Wednesday down 42.5% from its all-time high, a larger pullback than any during the 2016-2017 bull market. Bitcoin has since bounced more than 33% from its bottom at $30k to the low $40k range.

Volatility. Of course, Bitcoin is a historically volatile asset. Despite the significant correction, Wednesday wasn’t the most volatile day this year for Bitcoin, let alone in its history.

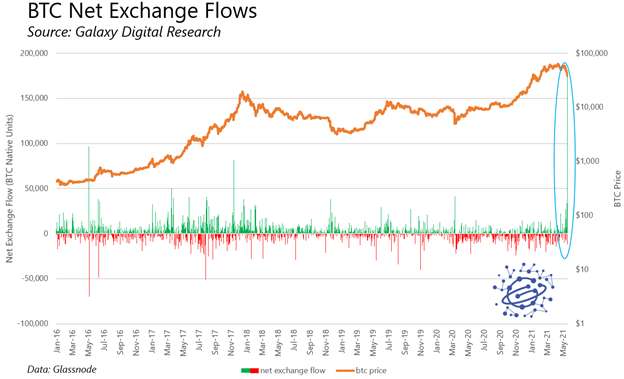

Exchange Flows. Wednesday saw the largest BTC net inflows to exchanges perhaps in bitcoin’s history, according to data from Glassnode.

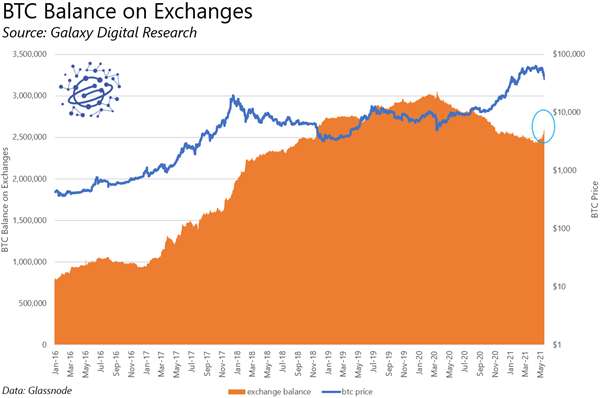

Consequently, BTC balances on exchanges rose significantly, reversing a trend of net declines that has been a hallmark characteristic of the current market cycle.

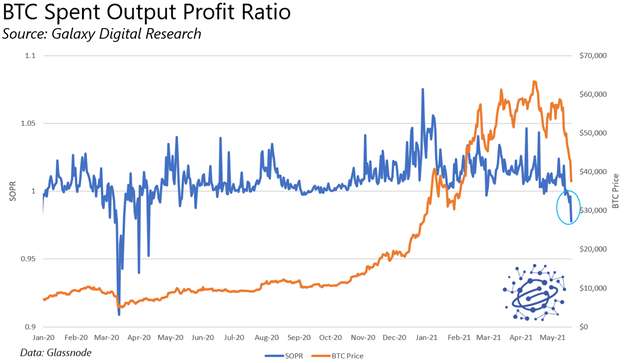

Short term holders sell at a loss. The spent output profit ratio (SOPR), which is calculated by dividing the realized value (in USD) of coins by their value (in USD) when they previously moved, printed significantly below 1, showing selling at aggregate losses. The implication is that Wednesday saw shorter term holders panic-sell at a loss, while long-term holders with a better entry price continued to hold.

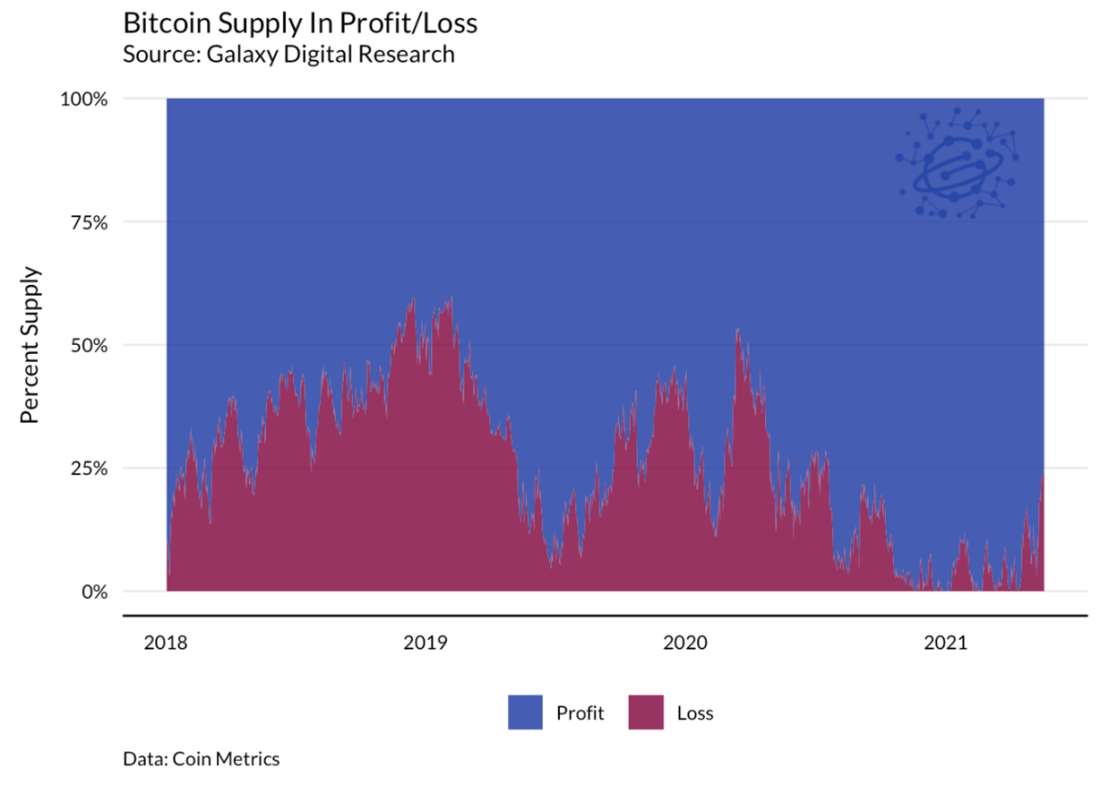

Despite the sudden drop in price, about 75% of the on-chain supply remained in profit, with the price on May 19 remaining higher than the price at which these coins last moved.

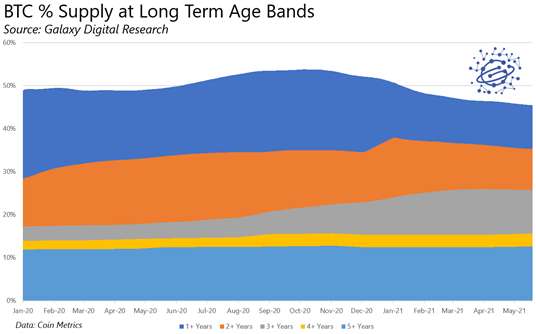

Long term holders accumulating. Galaxy saw net buying on our trading desk throughout the day yesterday, particularly through the volatile morning. On-chain, coins continue to age with no signs that older coins are capitulating. The percentage of coins that haven’t moved in 3+ years continues to increase, showing that even those who accumulated during the prior bear market continue to hold.

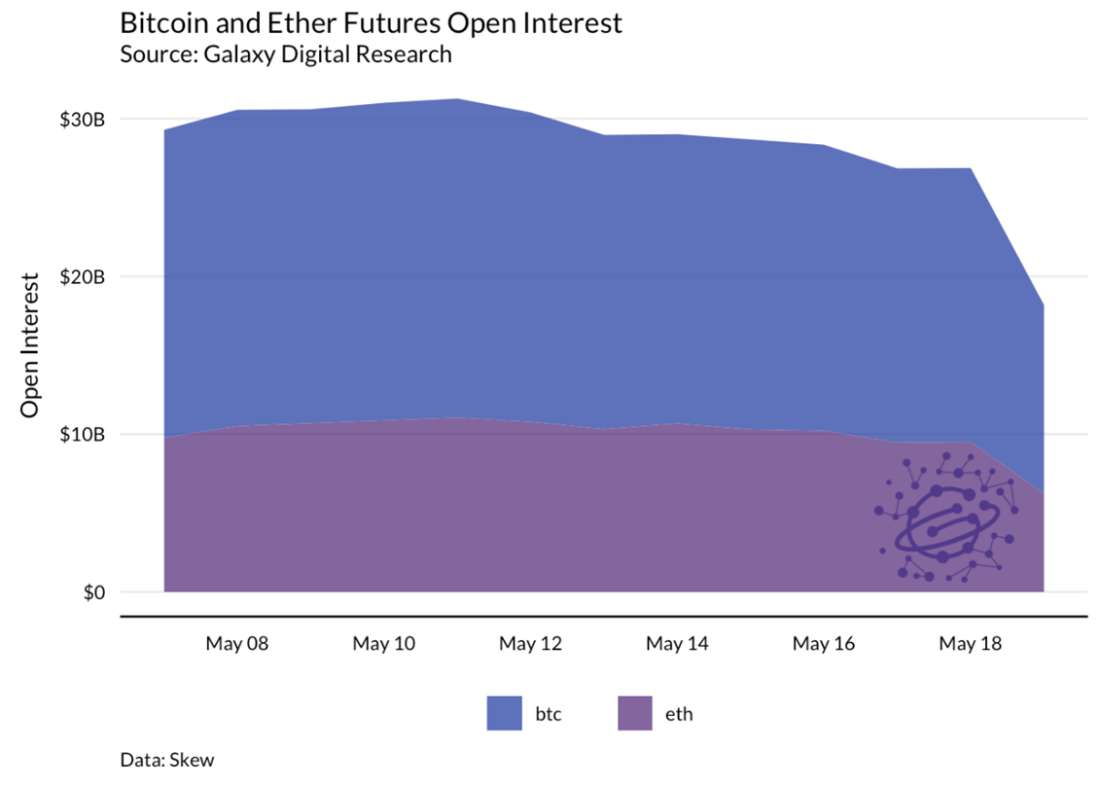

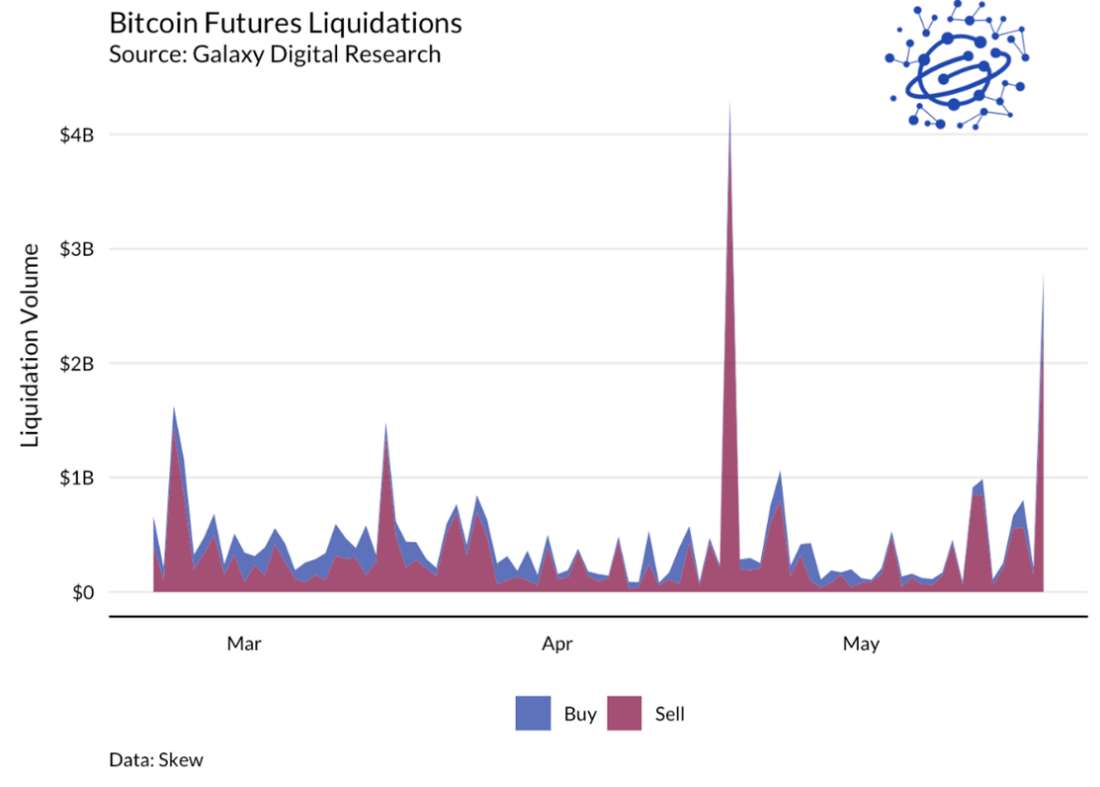

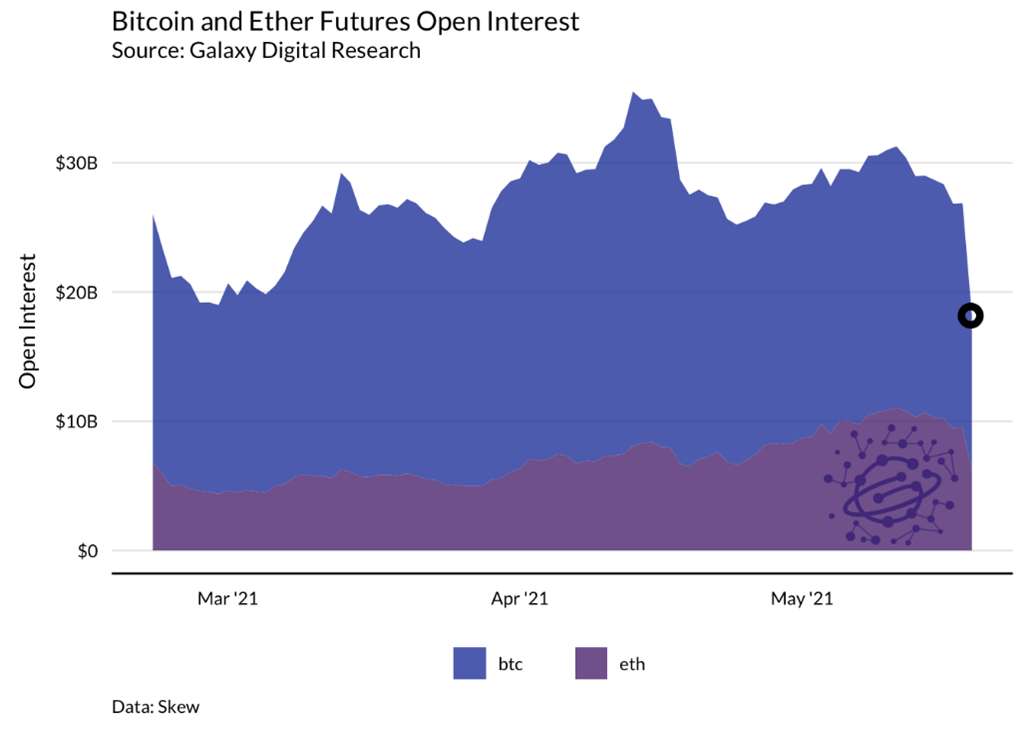

Derivatives. While the drawdown appears to have initially been driven by spot sales rather than leverage unwinding, liquidations picked up as prices declined. A look at change in futures open interest shows a significant decrease in leverage in both ether and bitcoin over the course of the sell-off on May 19.

As the sell-off began on May 12, liquidations were modest with a total of approximately $1.8bn in futures liquidated across exchanges from May 12-13; daily liquidations of ~$0.9bn amounted to less than 25% of the $4.3bn in futures liquidations on April 18, 2021 (the largest BTC futures liquidation to date). The morning of May 19 saw liquidations pick up significantly, with $3bn in liquidations over the day, marking the second largest liquidation event by dollar volume to date next to April 18.

While the futures liquidations in bitcoin were significant, and ultimately responsible for the last leg of the sell-off, change in futures open interest in ether from May 18 to May 19 was larger relative to both the outstanding futures positions and the outstanding market capitalization of the asset than that of bitcoin: bitcoin futures saw a $5.4bn decline in open interest (31% of futures open interest) and ether futures saw a $3.3bn decline in open interest (34% of futures open interest).

In the context of the last year, the liquidity crunch looks even more dramatic. The unprecedented drop took place in the midst of a broader decline in open interest, but was accelerated by the spike in volatility.

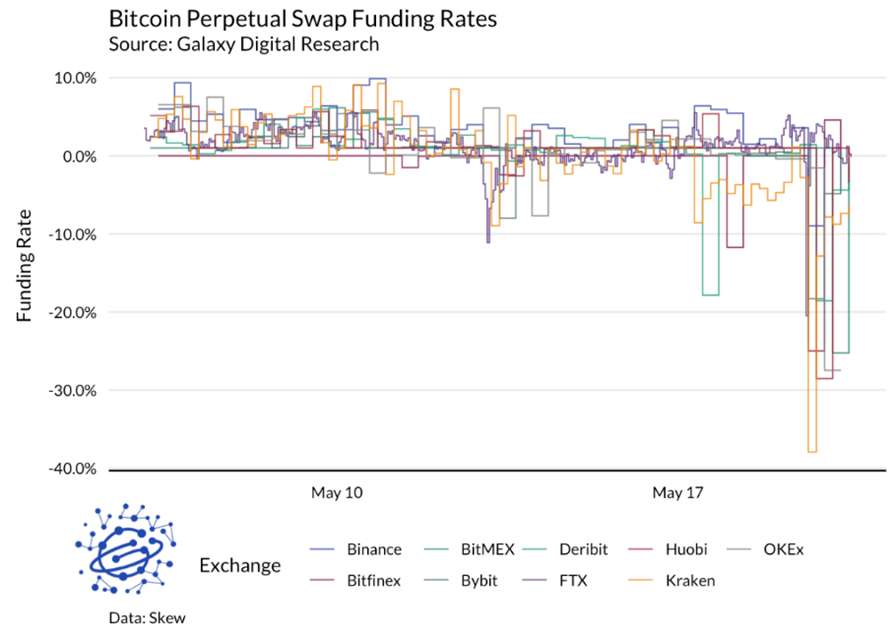

Several forces likely attributed to the underperformance of ether vs. bitcoin on the 19—including an extended period of outperformance in the weeks leading up to the sell-off—and the greater leverage in ether as a percent of market cap, and subsequent greater decline in leverage as a percent of market cap, may also have played a role. Perpetual swaps funding offers an interesting narrative. Bitcoin perp funding rates hovered close to 0.0% heading into the sell-off beginning on May 12. Low funding rates alongside the large outstanding leverage in the market (evidenced by futures open interest and subsequent decline in open interest during the sell-off) suggest that market participants were levered both long and short. This notion resonates with a relatively sanguine market in the 50k range, as well as a continued rise of institutions entering the space and monetizing the spot-futures basis. Notably, perp funding rates plummeted to extremely negative territory on May 19 as the market capitulated, the most negative levels observed outside of March 2020.

Musk's About-Face on Bitcoin

Elon Musk, CEO of Tesla and SpaceX, tweeted at 6:06 pm ET Wednesday that “Tesla has suspended vehicle purchases using Bitcoin” saying “we are concerned about rapidly increasing use of fossil fuels for Bitcoin mining and transactions, especially coal, which has the worst emissions of any fuel.” Musk clarified that “Tesla will not be selling any Bitcoin,” but that they are also “looking at other cryptocurrencies that use <1% of Bitcoin’s energy/transaction.” The announcement roiled crypto markets, sending Bitcoin down 16% from $54,792 to $46,000 within an hour of the Tweet. The rest of the crypto market suffered a similar fate, with ETH dropping 16% from $4234 to $3550. ETHBTC hit an all-time high at 0.08 shortly after Musk’s tweet, then dropped back to the 0.074 before recovering into the 0.076 range early Friday.

The announcement confounded many observers given several contradictions and inaccuracies.

The energy required to power Bitcoin’s Proof-of-Work mining is nothing new, and has been widely reported for years. Hadn’t Tesla done its diligence on Bitcoin before becoming so involved with the asset?

As far as we can tell, Tesla never actually accepted BTC for vehicle payment—they only allowed buyers to pay the $100 down payment in BTC.

Bitcoin’s use of fossil fuels is not “rapidly increasing.” Almost all studies, even those critical of Bitcoin’s energy usage, suggest Bitcoin mining’s energy mix is becoming more renewable over time.

The energy usage of Bitcoin mining does not scale with the number of transactions. This is a common misunderstanding: Tesla halting BTC payments has no effect on Bitcoin’s energy footprint given that the number of transactions per block has practically no impact, positive or negative, on the amount of energy required to mine a block.

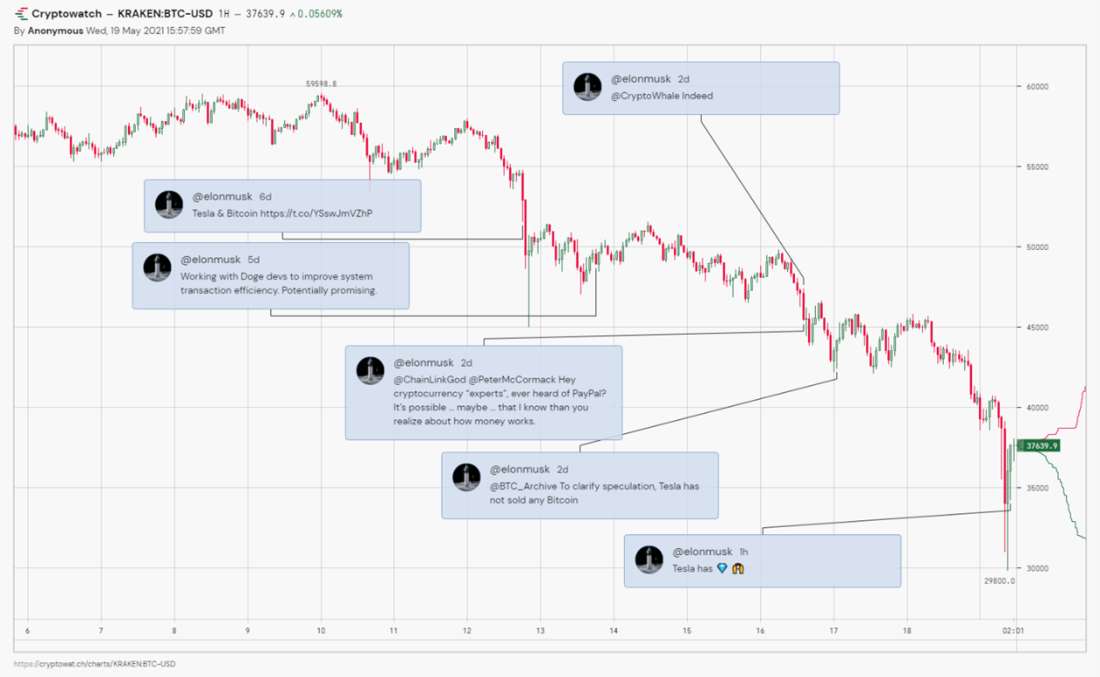

Musk tweeted erratically throughout the weekend, further fueling crypto market volatility with contradictions, personal attacks, and statements revealing his lack of understanding of blockchain technology. He implied that Tesla had already sold its bitcoin, then backtracked, later claiming Tesla had “diamond hands” as markets dropped. He attacked MicroStrategy CEO, Michael Saylor. And he suggested upgrades to Dogecoin that are technically unfeasible, causing cryptocurrency experts to mock his lack of fundamental understanding of blockchain technology.

A timeline of some of Musk’s most notable Tweets from the last week is overlayed on the Bitcoin price below.

Positive Long-Term Trends for Bitcoin, Ethereum, and Stablecoins

Despite the price volatility, network fundamentals look strong across Bitcoin, Ethereum, DeFi, and stablecoins. Dramatically higher cryptocurrency adoption shows maturation in the ecosystem.

Bitcoin. By all counts, the bitcoin ecosystem is increasingly active. The space has matured substantially since the previous bull run of 2017: tooling, technology, and accessibility have all improved dramatically.

Bitcoin is becoming more decentralized. Thanks to the work of advocates and teams like Umbrel, Nodl, Raspiblitz, and Ronin Dojo, running a node is getting easier by the day. Contributing to the Bitcoin network’s security is becoming more and more accessible to the average individual, and more people than ever before are running nodes.

Bitcoin is scaling. The battles that were fought in 2017 to scale the network while maintaining its decentralization are finally bearing fruit. The network is becoming more efficient, and transactions are becoming more compact: most Bitcoin transactions use SegWit, and exchanges and custodians have begun to implement transaction batching in order to save block space. While still nascent, off-chain solutions like Lightning and sidechains are growing in usage. Custodial providers like PayPal and Square process countless transactions and are beginning to resemble Hal Finney’s Bitcoin banks.

Bitcoin’s market infrastructure is improving. Banks, corporates, and fintechs are all beginning to enter the market. Core infrastructure including custody, trade execution, and data has dramatically improved since the previous market cycle.

Bitcoin’s codebase is improving. The network is on the verge of a major upgrade, Taproot, that will help the network scale while also improving privacy and programmability.

Bitcoin network metrics continue to show an increasingly robust and resilient platform. Address count, active address count, and value settled on-chain are all reaching new highs.

Ethereum and DeFi. Ethereum's DeFi ecosystem is growing at an astounding pace. Users, value, exchange volumes, and protocol revenue continue to print all-time highs.

A forthcoming upgrade for Ethereum’s base protocol, EIP-1559, will significantly improve transaction UX while putting deflationary pressure on ETH’s total supply, and is seen as broadly bullish by the Ethereum community. As we wrote in our April 1, 2021 report “EIP-1559: A Major Upgrade for Ethereum,” the upgrade will create a value accrual mechanism for ETH that is directly tied to growing network adoption (via increased transactional usage), while solidifying ETH’s central role in the protocol by specifically requiring it be burnt to transact. Rather than going to miners, revenue generated by the protocol due to growing use will accrue to ETH holders in the form of deflation.

Ethereum’s growing usage has come at a cost, with high gas fees caused by congestion making it expensive to operate on the network. However, we are beginning to see significant usage of 2nd layer solutions like Polygon, with total dollar-value locked rising to $6.75bn, a 1000% increase since April 1. Both zero-knowledge and optimistic rollups are promising and could bring significant additional scaling and functionality benefits in the coming quarters.

Development of Ethereum 2.0 is continuing. If successful, this major upgrade will substantially improve scaling at the base layer while simultaneously moving Ethereum from Proof-of-Work mining to Proof-of-Stake validating. While timing on the upgrade is uncertain—some estimates now suggest a launch sometime in 2022—anticipation of the upgrade should continue to serve as a bullish catalyst for Ethereum investors.

Even without its existing and ongoing scaling and UX improvements, Ethereum’s place as the #1 protocol for financial applications appears solidified. Other networks once considered possible “ETH killers” have instead built bridges to Ethereum and have begun to function somewhat like Ethereum sidechains. It appears that Ethereum, if it doesn’t capture all DeFi activity, will at least serve as the central hub for decentralized financial applications for the foreseeable future.

The Decentralized Finance (DeFi) ecosystem on Ethereum continues to thrive. Across a broad set of metrics, we continue to see significant usage, adoption, and growth.

Stablecoins. The growing use of stablecoins proves public blockchains are phenomenally efficient and reliable technology for transferring fiat currency worldwide. The data shows all-time highs in circulation, ownership, usage, and velocity. Facebook is set to launch its Diem project in partnership with Silvergate Bank, which will further grow the stablecoin ecosystem. We continue to see interest in stablecoins across various applications including traditional finance, card payment settlement, and cross-border remittance.

Conclusion

Corrections are common in crypto, and there’s no circuit breaker or lender of last resort to step in and save the day when markets are volatile. Rates won’t be artificially suppressed, and no additional BTC will be printed to inject liquidity into the system. The long-term value proposition of decentralized, public blockchains remains strong, and the fact that corrections can occur and markets can rebound on their own shows the power of a truly free market in a still-volatile asset class.

We’re still early in the crypto adoption story. The principles of decentralization, self-sovereignty, and trust-minimization continue to inspire. These principles are powered by one of the most revolutionary technological innovations in human history and buoyed by monetary debasement, major demographic shifts, and declining institutional trust. Public blockchains represent one of the most revolutionary innovations in human history, and there’s no putting the cat back in the bag. Disruptive innovation is disruptive—it’s bumpy. And sometimes it feels like a rollercoaster.

Legal Disclosure:

This document, and the information contained herein, has been provided to you by Galaxy Digital Holdings LP and its affiliates (“Galaxy Digital”) solely for informational purposes. This document may not be reproduced or redistributed in whole or in part, in any format, without the express written approval of Galaxy Digital. Neither the information, nor any opinion contained in this document, constitutes an offer to buy or sell, or a solicitation of an offer to buy or sell, any advisory services, securities, futures, options or other financial instruments or to participate in any advisory services or trading strategy. Nothing contained in this document constitutes investment, legal or tax advice or is an endorsementof any of the digital assets or companies mentioned herein. You should make your own investigations and evaluations of the information herein. Any decisions based on information contained in this document are the sole responsibility of the reader. Certain statements in this document reflect Galaxy Digital’s views, estimates, opinions or predictions (which may be based on proprietary models and assumptions, including, in particular, Galaxy Digital’s views on the current and future market for certain digital assets), and there is no guarantee that these views, estimates, opinions or predictions are currently accurate or that they will be ultimately realized. To the extent these assumptions or models are not correct or circumstances change, the actual performance may vary substantially from, and be less than, the estimates included herein. None of Galaxy Digital nor any of its affiliates, shareholders, partners, members, directors, officers, management, employees or representatives makes any representation or warranty, express or implied, as to the accuracy or completeness of any of the information or any other information (whether communicated in written or oral form) transmitted or made available to you. Each of the aforementioned parties expressly disclaims any and all liability relating to or resulting from the use of this information. Certain information contained herein (including financial information) has been obtained from published and non-published sources. Such information has not been independently verified by Galaxy Digital and, Galaxy Digital, does not assume responsibility for the accuracy of such information. Affiliates of Galaxy Digital may have owned or may own investments in some of the digital assets and protocols discussed in this document. Except where otherwise indicated, the information in this document is based on matters as they exist as of the date of preparation and not as of any future date, and will not be updated or otherwise revised to reflect information that subsequently becomes available, or circumstances existing or changes occurring after the date hereof. This document provides links to other Websites that we think might be of interest to you. Please note that when you click on one of these links, you may be moving to a provider’s website that is not associated with Galaxy Digital. These linked sites and their providers are not controlled by us, and we are not responsible for the contents or the proper operation of any linked site. The inclusion of any link does not imply our endorsement or our adoption of the statements therein. We encourage you to read the terms of use and privacy statements of these linked sites as their policies may differ from ours. The foregoing does not constitute a “research report” as defined by FINRA Rule 2241 or a “debt research report” as defined by FINRA Rule 2242 and was not prepared by Galaxy Digital Partners LLC. For all inquiries, please email [email protected]. ©Copyright Galaxy Digital Holdings LP 2022. All rights reserved.