Potential ETHPoW Fork – Impact on DeFi Lending Markets

There has been growing interest in owning/holding native ETH on the Ethereum mainnet in anticipation of an ETH PoW fork. ETH holders are expected to be able to redeem their existing ETH for ETHW on a new, miner-initiated PoW chain. Given the nature of chain splits and intentional forks, these new versions of ETH (ETHW) may not be available immediately or at all to holders of wrapped ETH (wETH), ETH bridged to other networks, ETH held on exchanges, and possibly ETH held in smart contracts. The only way to guarantee that an ETH holder receives an equivalent amount of ETHW at the point of the chain split is to self-custody ETH into the fork.

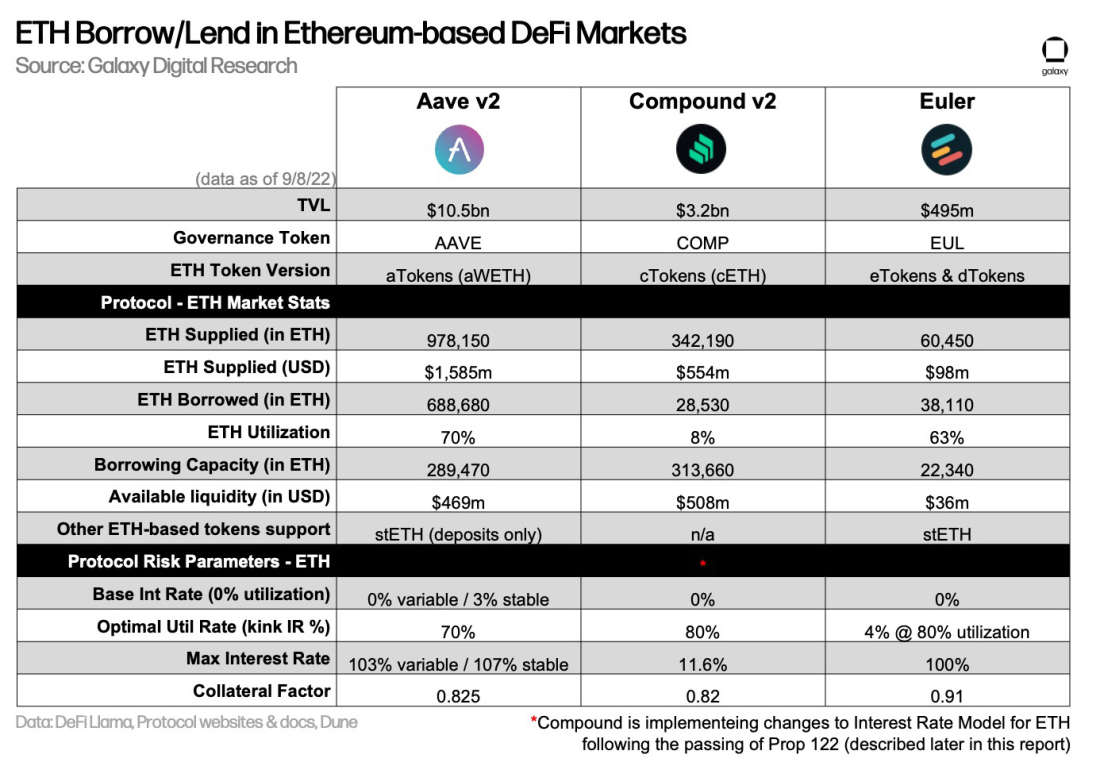

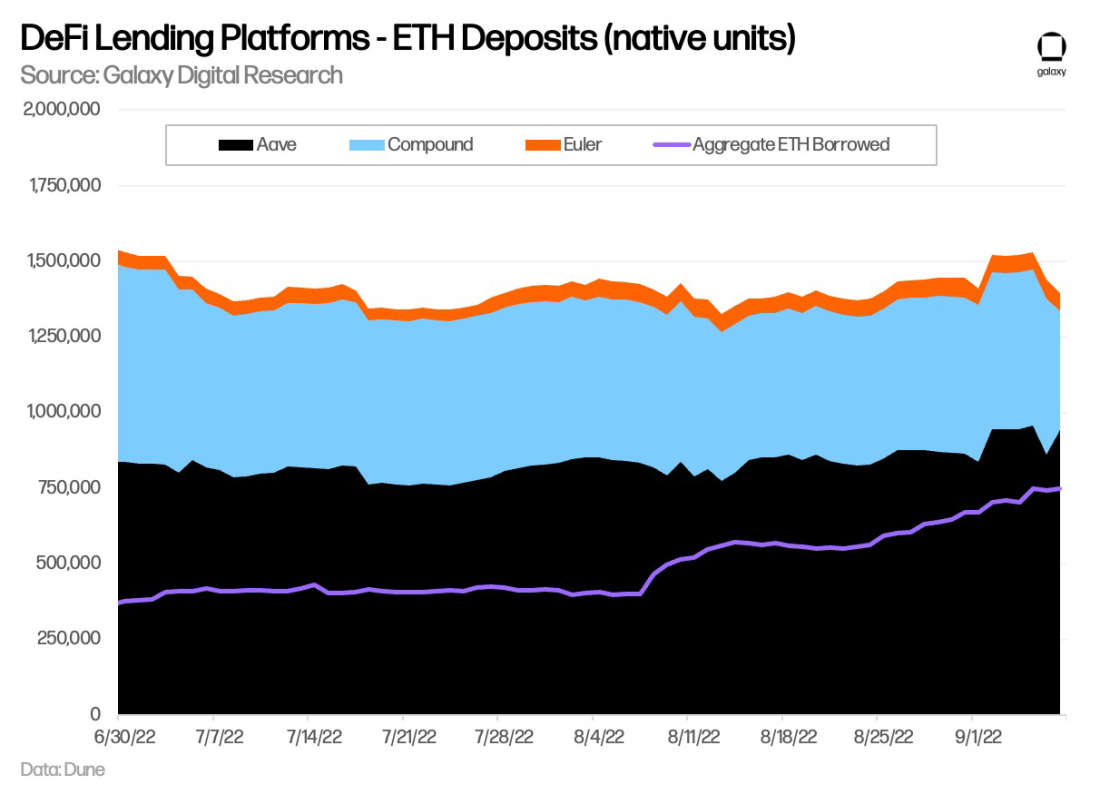

One primary strategy that users have undertaken to maximize their ETHW distribution is to borrow ETH on DeFi lending markets to receive a larger allocation of the new token with plans to then repay after the chain split. In addition, ETH liquidity providers across lending protocols and other DeFi markets have been withdrawing their ETH deposits to reduce the financial exposure of frontrunning by miners or MEV operators that may extract the value of a potential ETHPoW token in the event of a fork. Given these dynamics, DeFi lending protocols that enable borrowing of ETH face increasing liquidity risk from the Merge and PoW fork such as Aave, Compound, and Euler. Each have taken different approaches or are weighing different proposals to mitigate disruption in preparation of increased ETH borrowing interest ahead of the Merge.

Aave

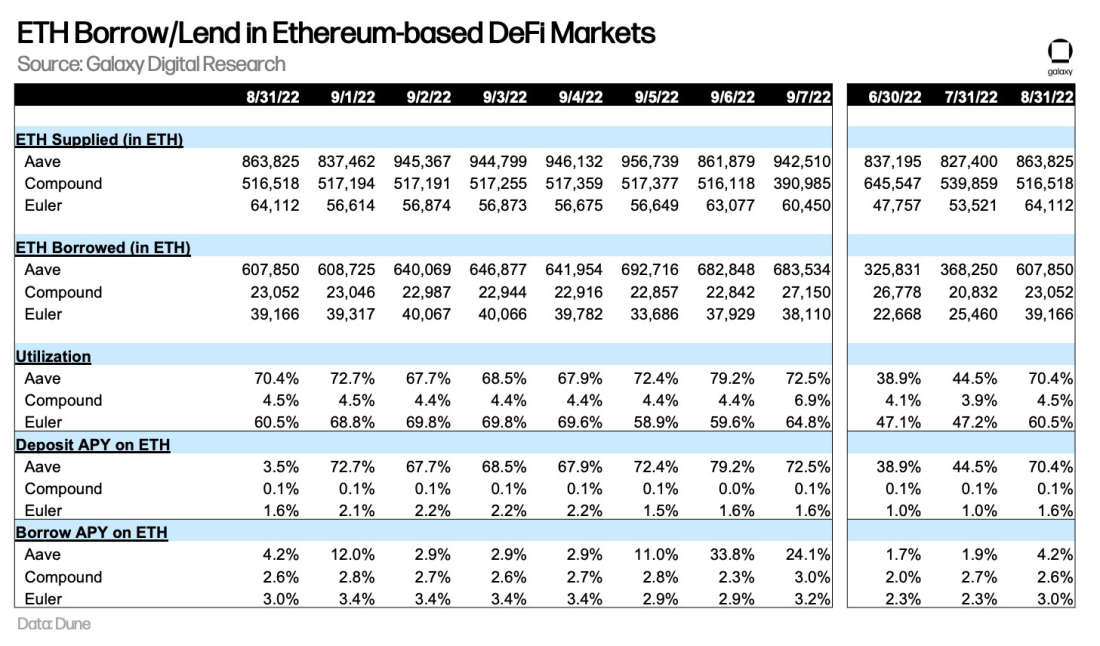

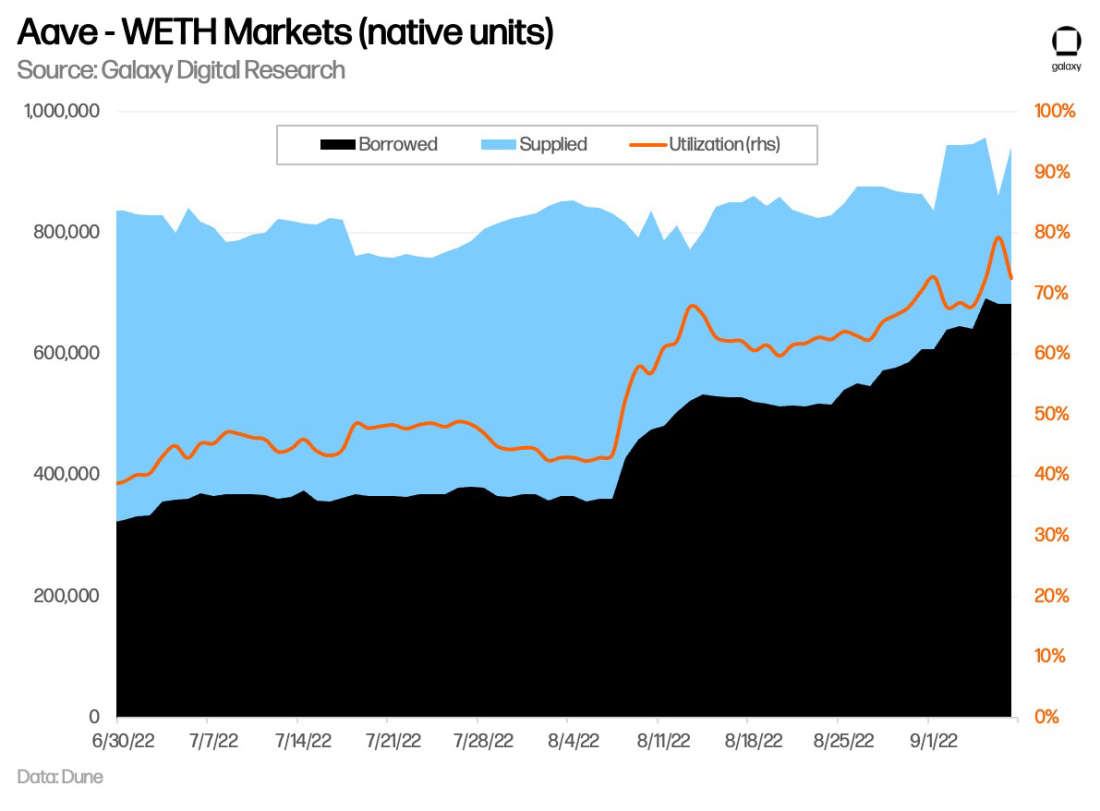

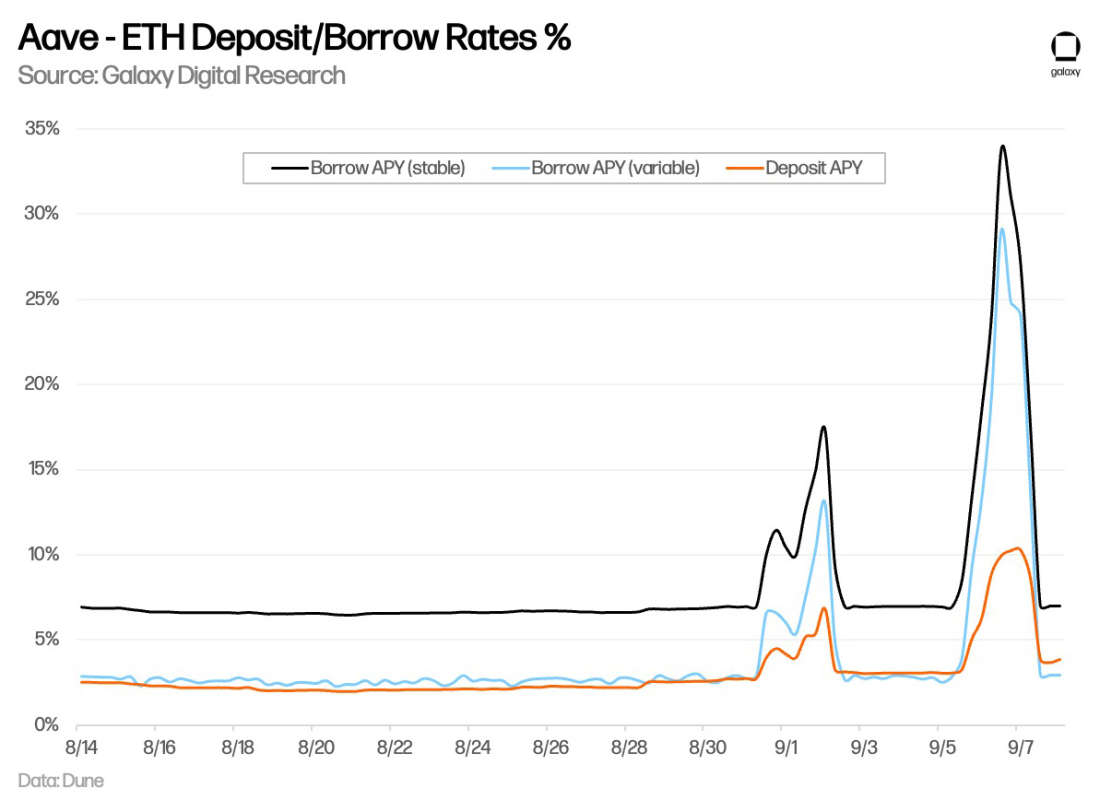

Aave, DeFi's largest lending protocol, saw borrowing rates surge several days over the past week as utilization rates surpassed the optimal level set at 70%. Variable borrow rates on ETH briefly spiked above 50% on Tuesday as deposit rates reached over 16%, driven by a combination of increased borrowing interest and withdrawals of supplied ETH.

Tuesday 9/7 saw a nearly 100k daily drop in supplied ETH as depositors looked to convert their aWETH (Aave interest bearing WETH) back to the native ETH token. This was partially offset the following day by an inflow of new deposits looking to take advantage of the high supply APY from the high utilization of ETH borrowing.

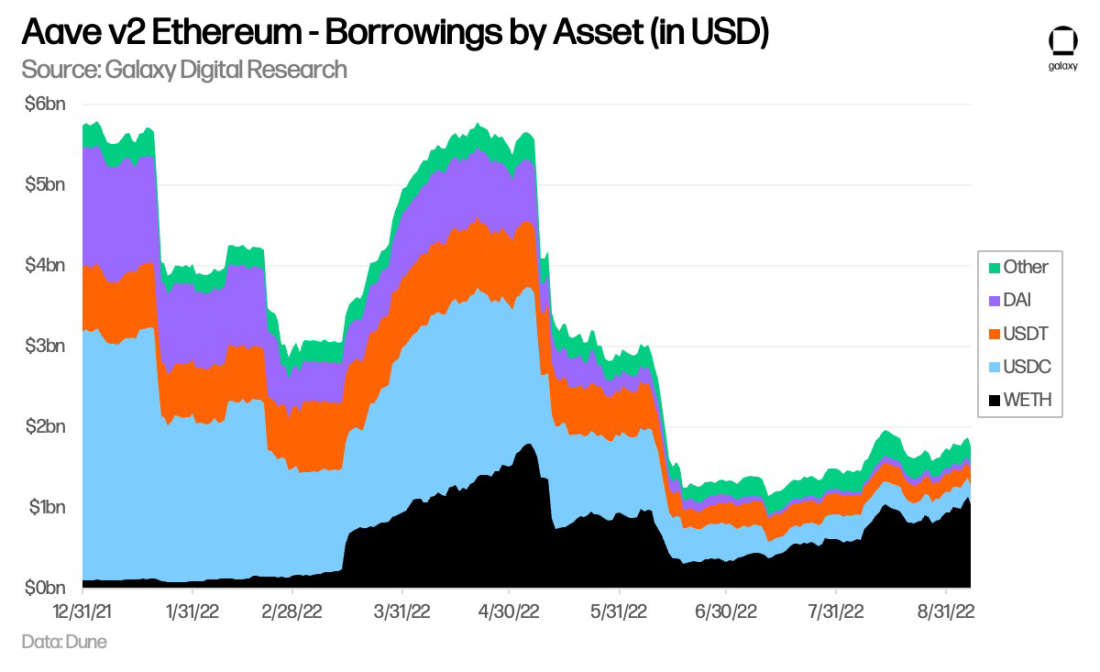

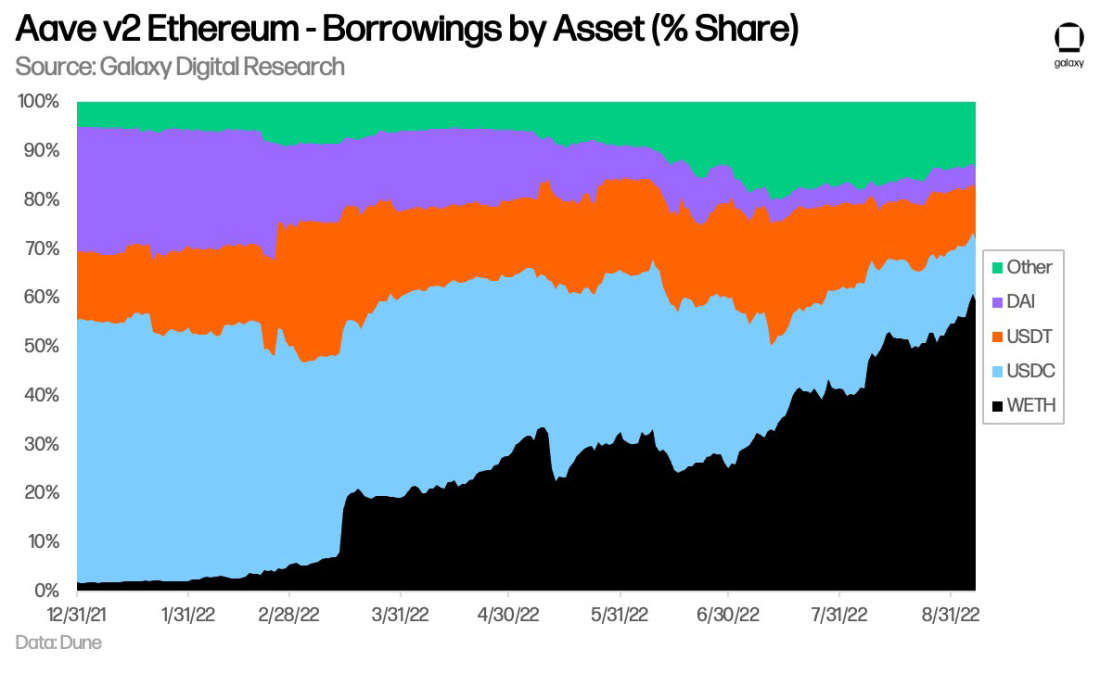

Borrowing interest in ETH over the past few months led ETH to become the most popular borrowed asset on Aave with over 50% share across all assets, overtaking USDC in the process.

On Tuesday evening, ETH borrowing was temporarily paused on Aave as the result of a governance vote (“Temporarily Pause ETH Borrowing”), part of the larger Aave ETHPoW Fork Risk Mitigation Plan. Recognizing Aave's positioning with the speculative strategies around the Merge and potential ETHPoW fork, the proposal aimed to mitigate risks to the ETH markets from high utilization, including: 1) inability to conduct orderly liquidations, resulting in undercollateralized positions and bad debt for the protocol, 2) potential negative APY on stETH/ETH positions should borrow rates surpass 5%, and 3) supply shocks to ETH liquidity on Aave as depositors position themselves for the potential ETHPoW fork.

Compound

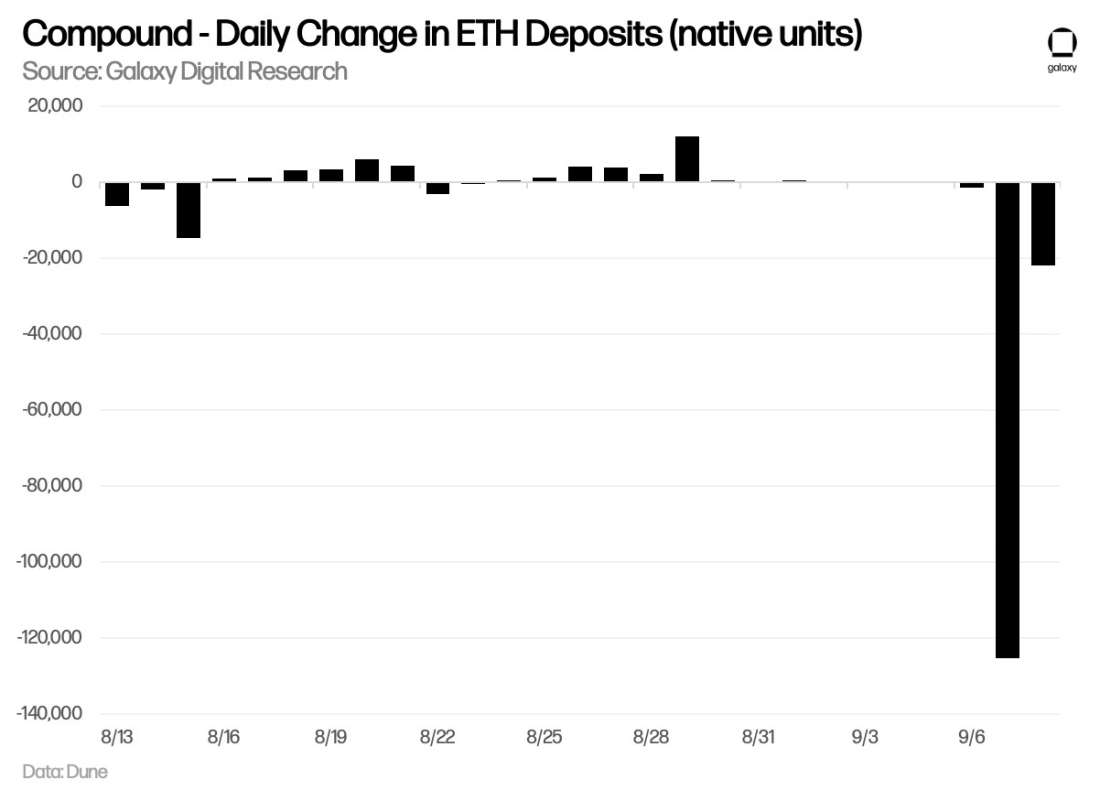

Last week, a bug was discovered as part of an update to Compound price feed which temporarily froze withdrawals and liquidations in cETH (Compound’s cToken representation of ETH given to ETH borrowers). A solution to revert to the previous price feed was not implemented until Tuesday – a week after discovery of the major bug due to the protocol's risk parameters set around upgrades. Deposits remained unaffected and users were cautioned to monitor their risk positions in the meantime.

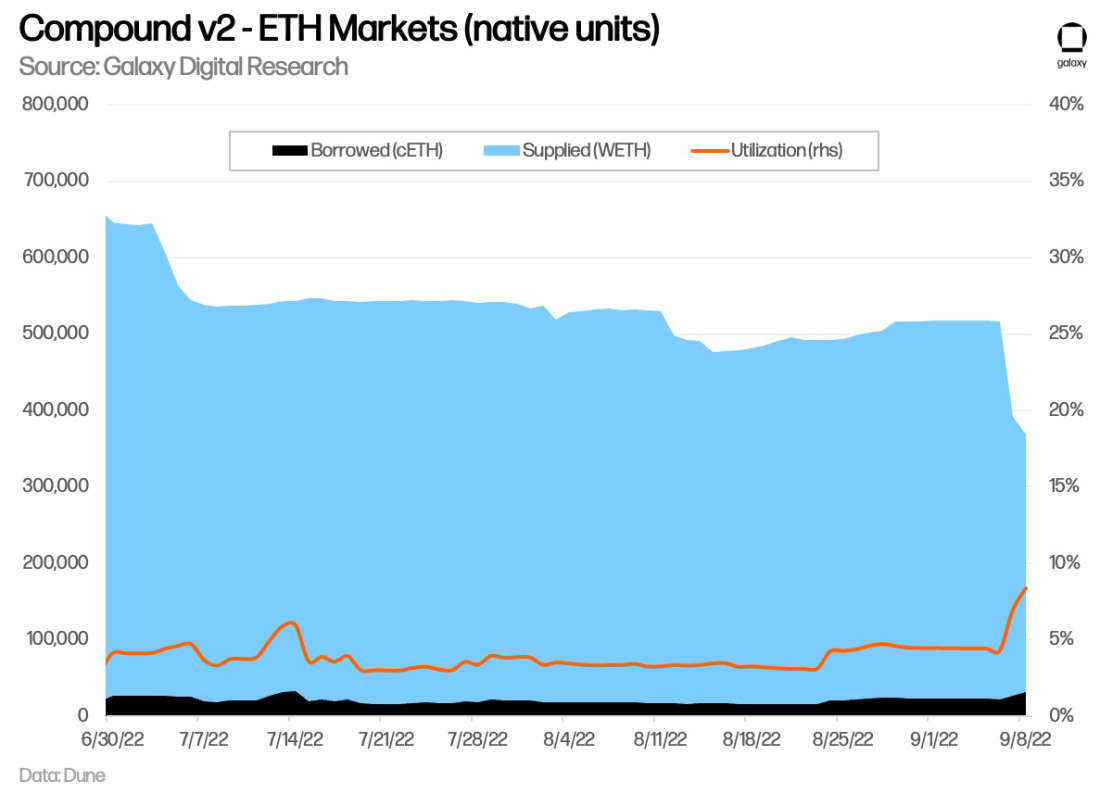

Given the effect of the bug, Compound has not seen increased borrowing activity in ETH to the same extent as Aave over the past week. However, on Wednesday, the first day that lending/borrowing functions were fully re-enabled, Compound experienced new borrows of ~15k ETH (~$22m) while nearly 130k ETH (~$200m) had been redeemed, bringing Compound’s ETH supply down 24% on the day.

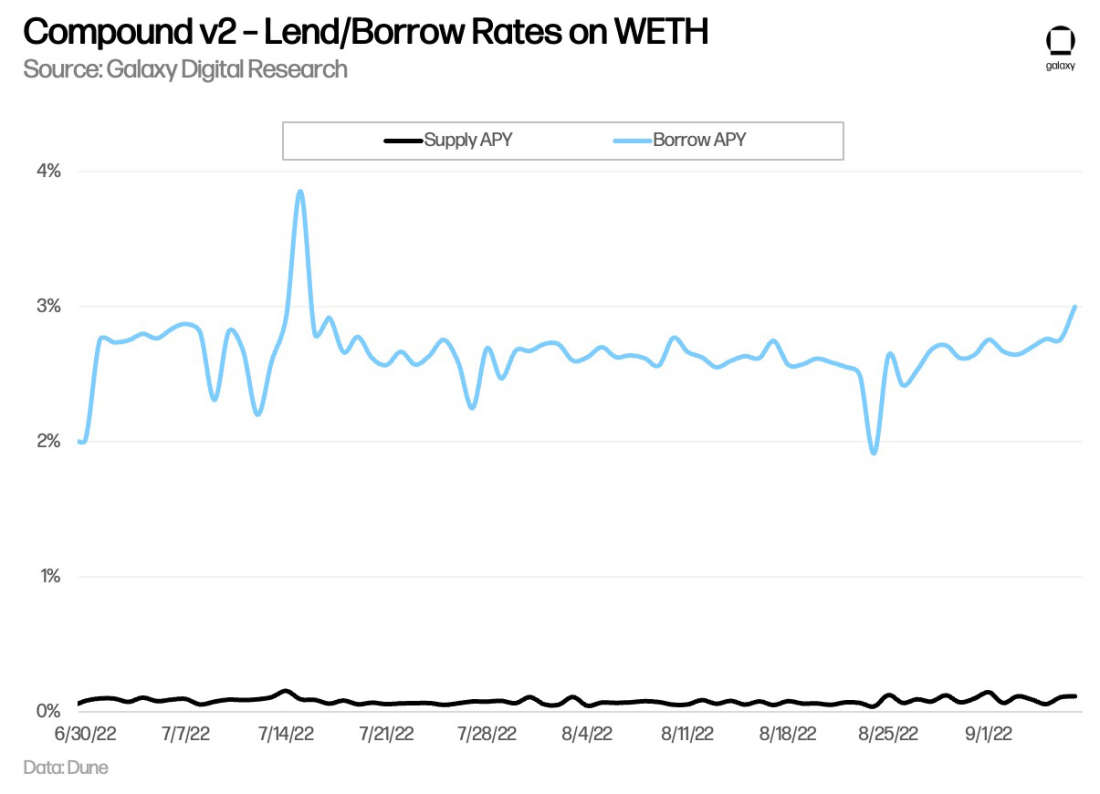

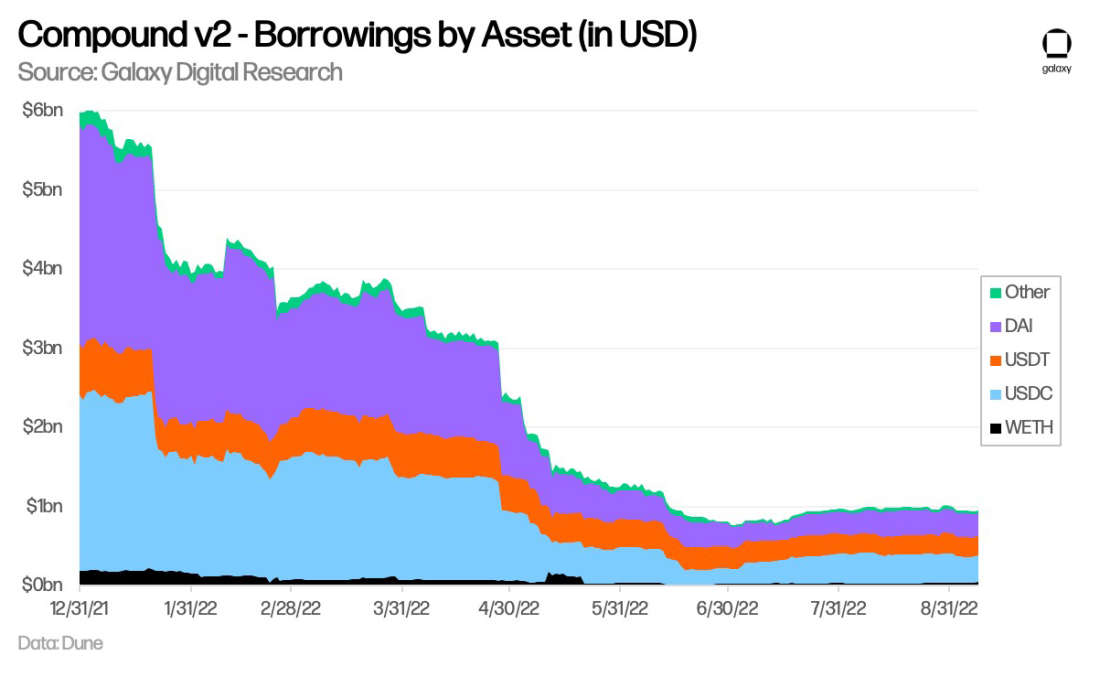

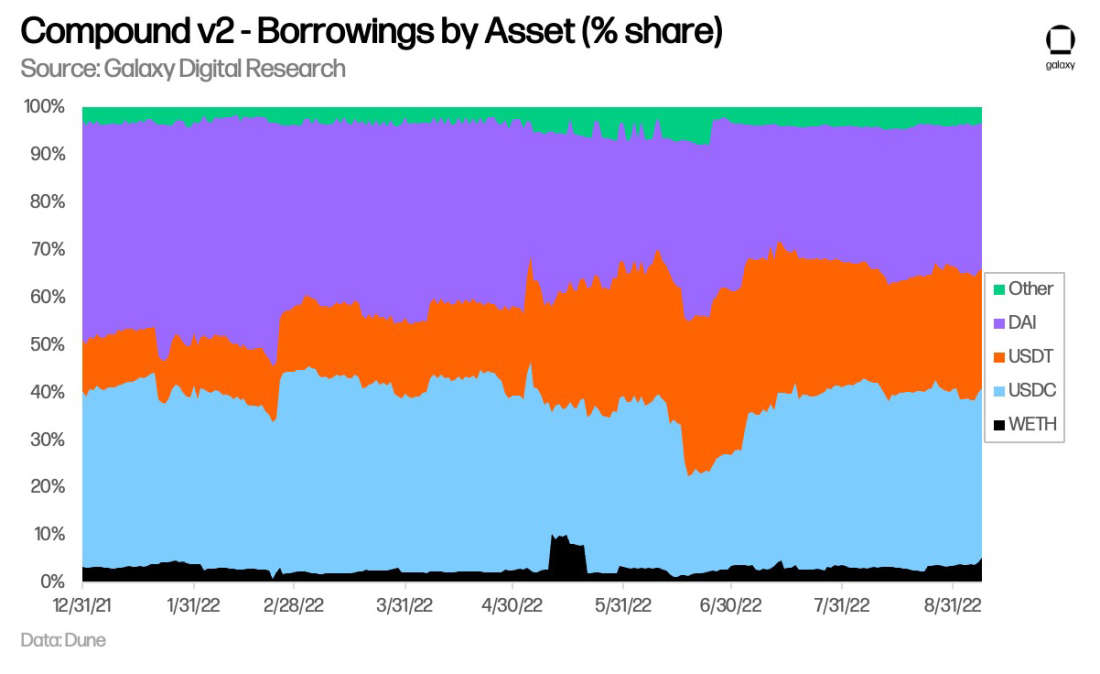

Despite WETH representing one of the largest shares of aggregate deposits of all assets on Compound, it has relatively less interest on the borrowing side as stablecoins are the most popular assets (e.g., USDC, DAI, and USDT). Utilization of ETH has been in the low-to-mid single digits of total ETH supply.

On Wednesday, an official on for Compound’s Proposal 122 (cETH Risk Mitigation) passed, which introduces a new interest model for cETH that would set a 20% rate at an optimal utilization level of 80% and a 1000% rate at 100% utilization to deter high borrowing levels of cETH for the protocol. Prop 122 also imposes a borrowing cap of 100k cETH. With the passing of the on-chain vote, these changes will be executed on Friday given Compound’s time lock of 48 hours.

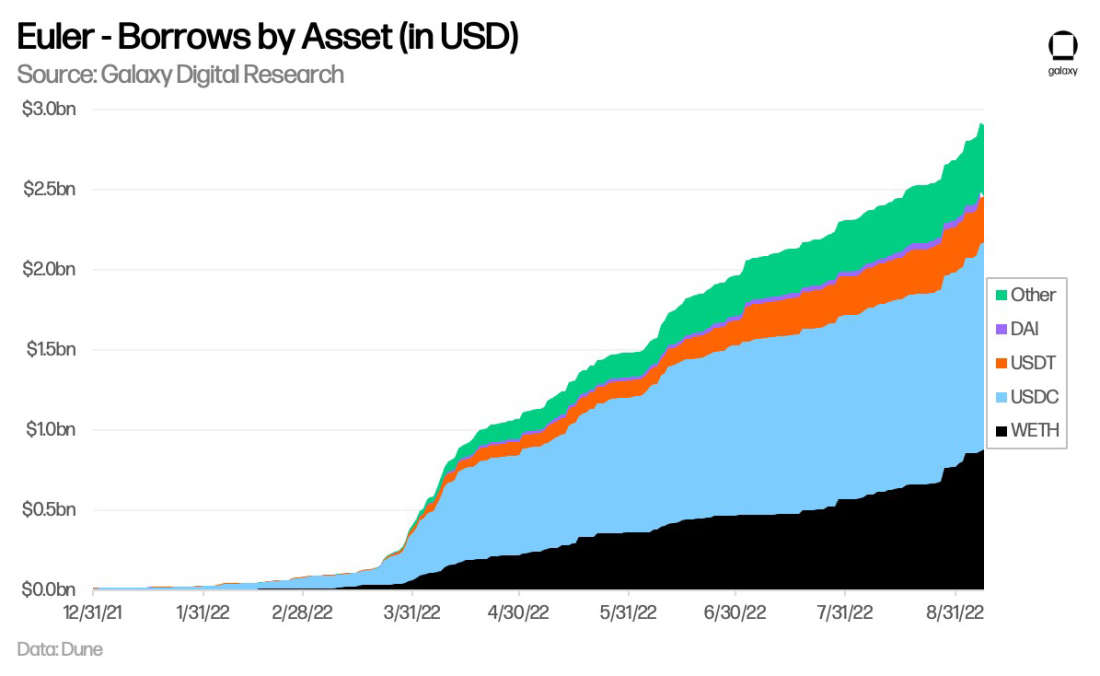

Euler

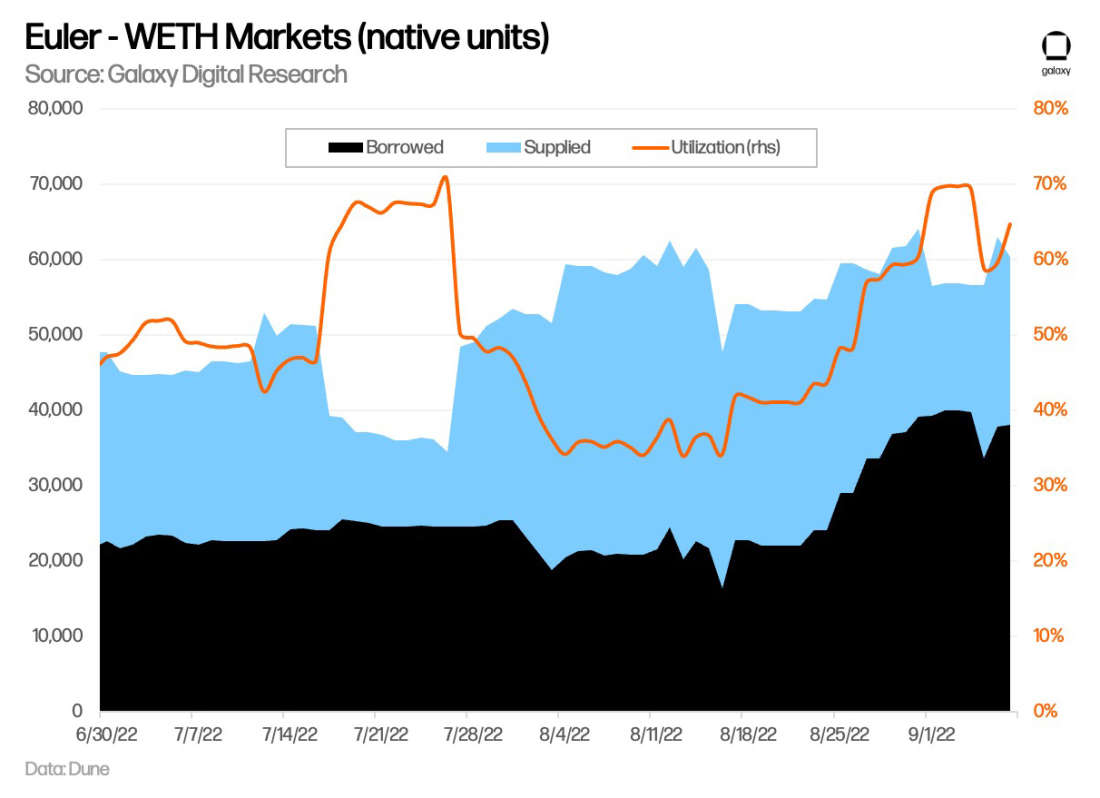

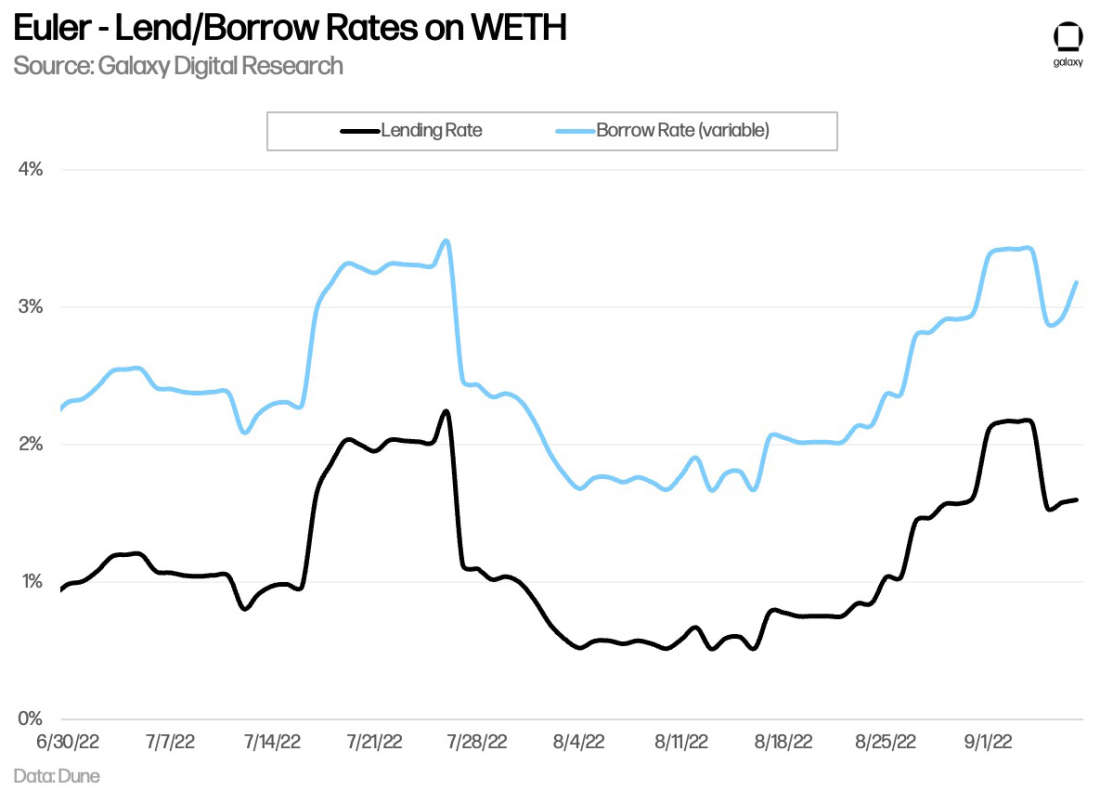

Euler is a relatively smaller lending protocol, with ETH supply of roughly 5-15% the size of Aave and Compound. While its competitors saw withdrawals of ETH deposits this past year, Euler has consistently been growing its supply of ETH deposits including this past week. Part of this may be due to more favorable lending rates on ETH relative to similar borrowing rates of ~3% at Compound as Euler expenses a lower take rate on net interest revenues to attract more deposits.

In contrast to its larger competitors, Michael Bentley—the co-founder of Euler—proposed that Euler leave its interest rate model unchanged for ETH borrowing. He detailed his logic in a thread that addressed the approaches the competing lending platforms are undertaking, noting that freezing new borrowings would not necessarily limit the risk of high utilization given lenders are likely to withdraw funds to avoid risks during the Merge. He reasons that by providing a competitive APY on ETH deposits could solve the supply side of the equation.

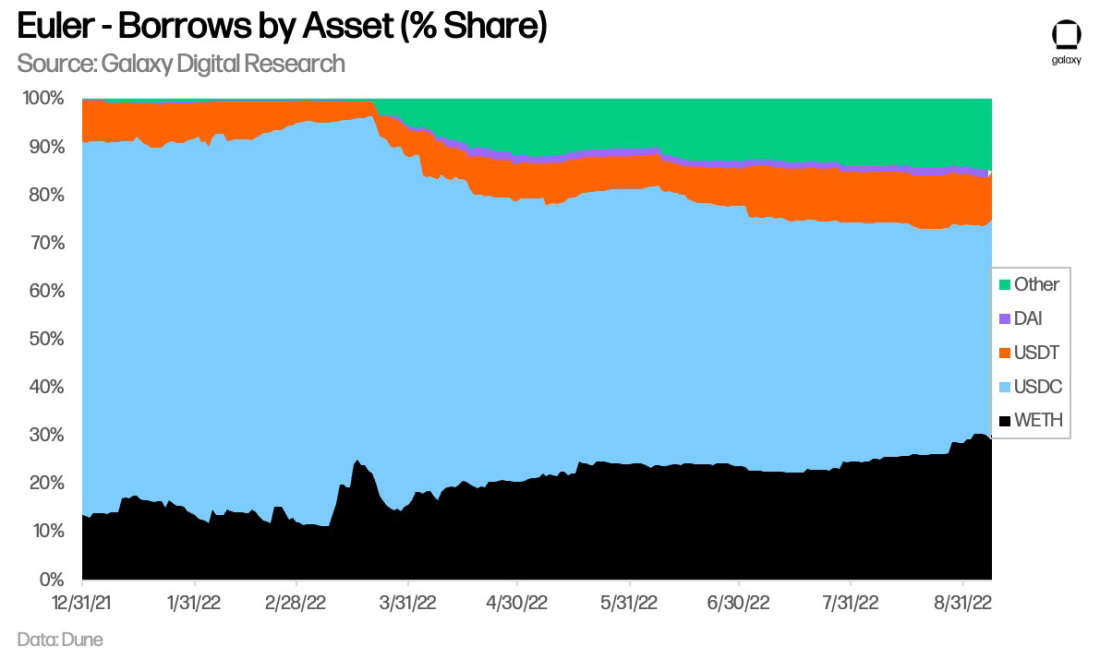

ETH currently sits at ~20% of supply and at ~30% of total borrowings across all assets at Euler, though these figures may be expected to increase in the short term with Euler taking a risk-on approach at a time when Aave and Compound are more cautious heading into the Merge.

Other Market Movements ahead of the Merge

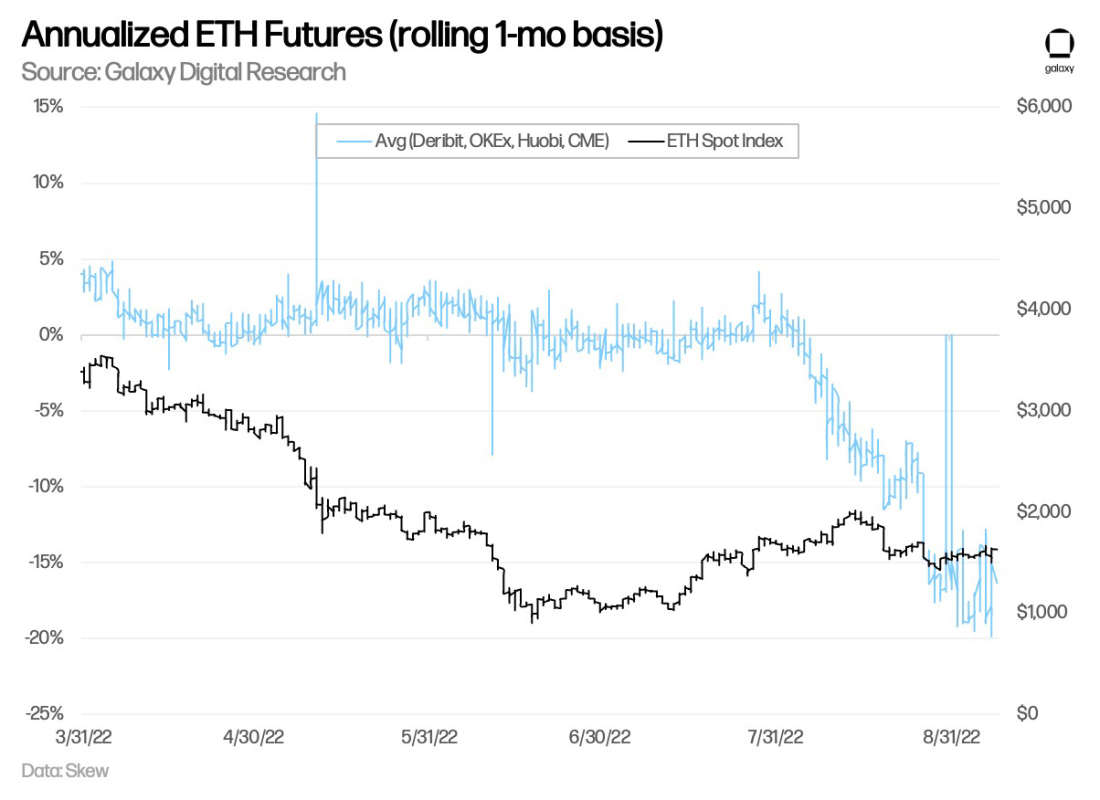

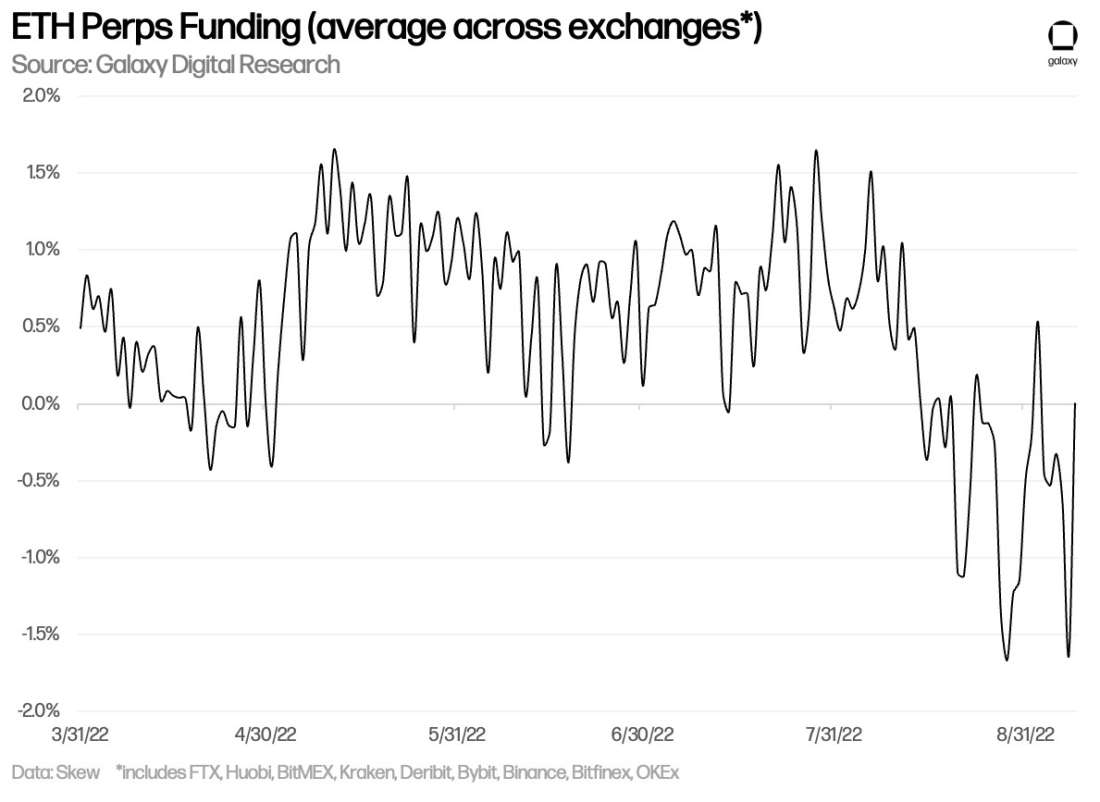

The increased borrowing activity across these lending platforms does not coincide with overwhelmingly bearish sentiment in ETH open interest, futures basis, or funding rates as provided through centralized providers, suggesting that the movements in DeFi lending markets may be largely attributed to positioning for the potential ETHPoW fork.

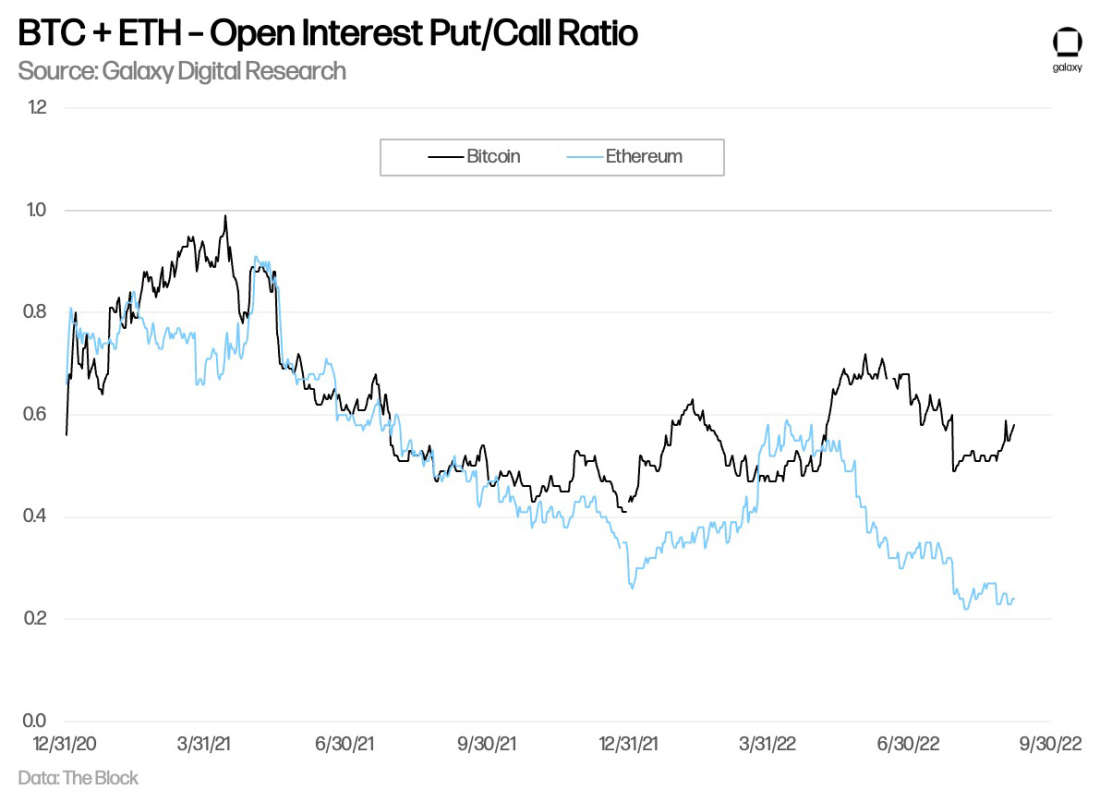

The put-call ratio open interest on Ethereum indicates relatively bullish sentiment. Ethereum’s declining ratio since April to new lows as of late suggests more calls are being bought relative to puts. This is in contrast to Bitcoin, which remains in its usual range.

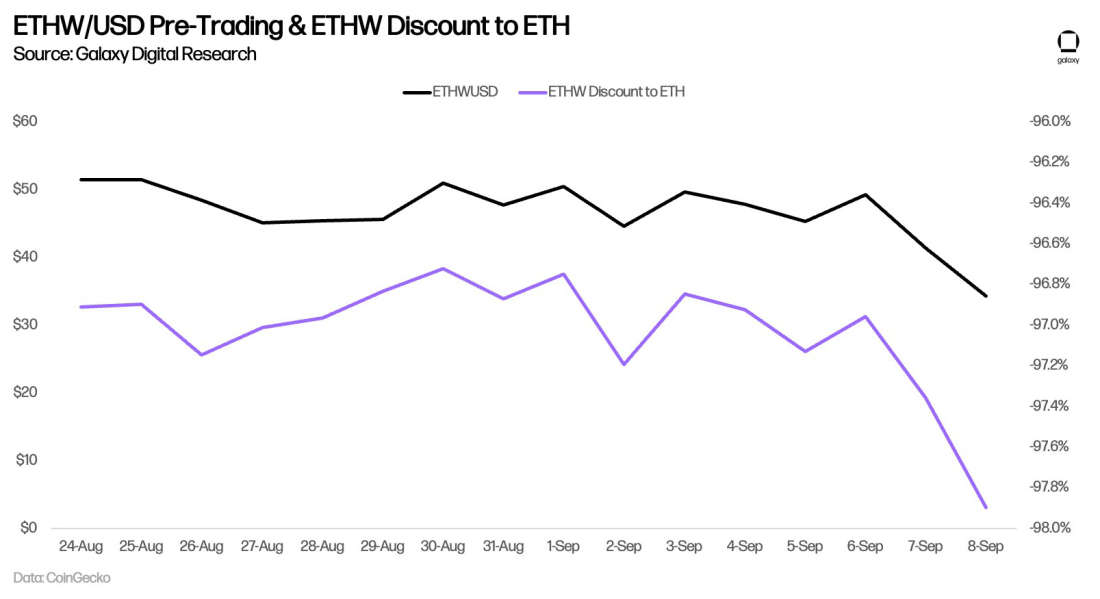

Pre-trading of ETHW (Ethereum PoW Fork IOU on CoinGecko which aggregates trading data from exchanges Poloniex, MEXC, and Gate.io) suggests that the PoW token could begin trading at 2-4% the value of ETH.

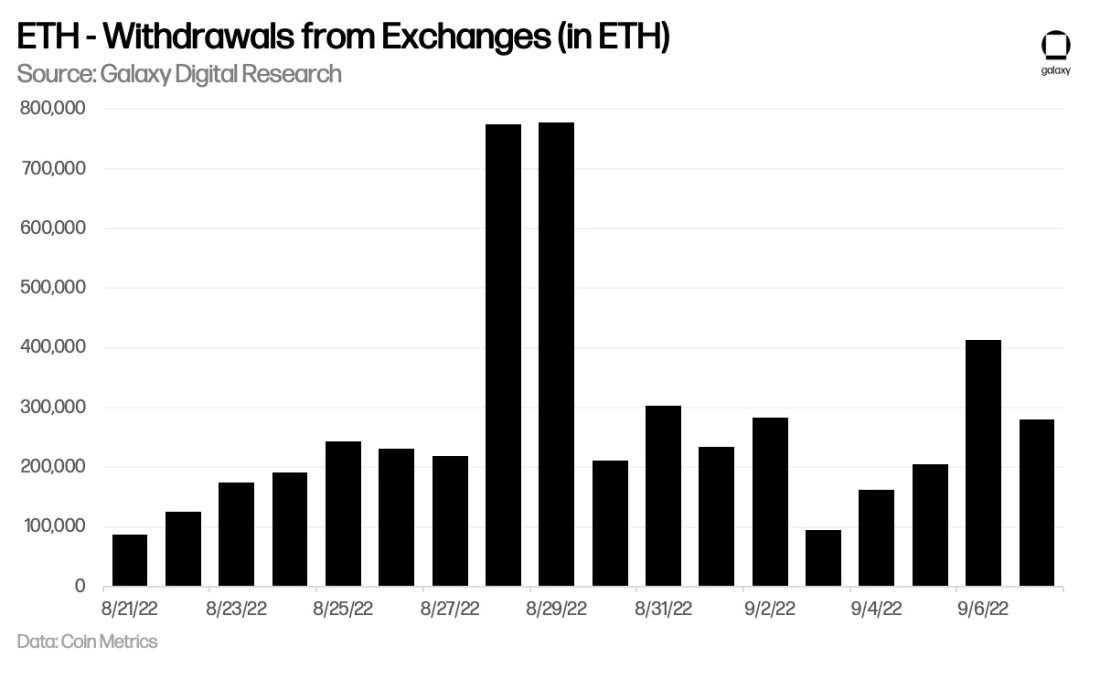

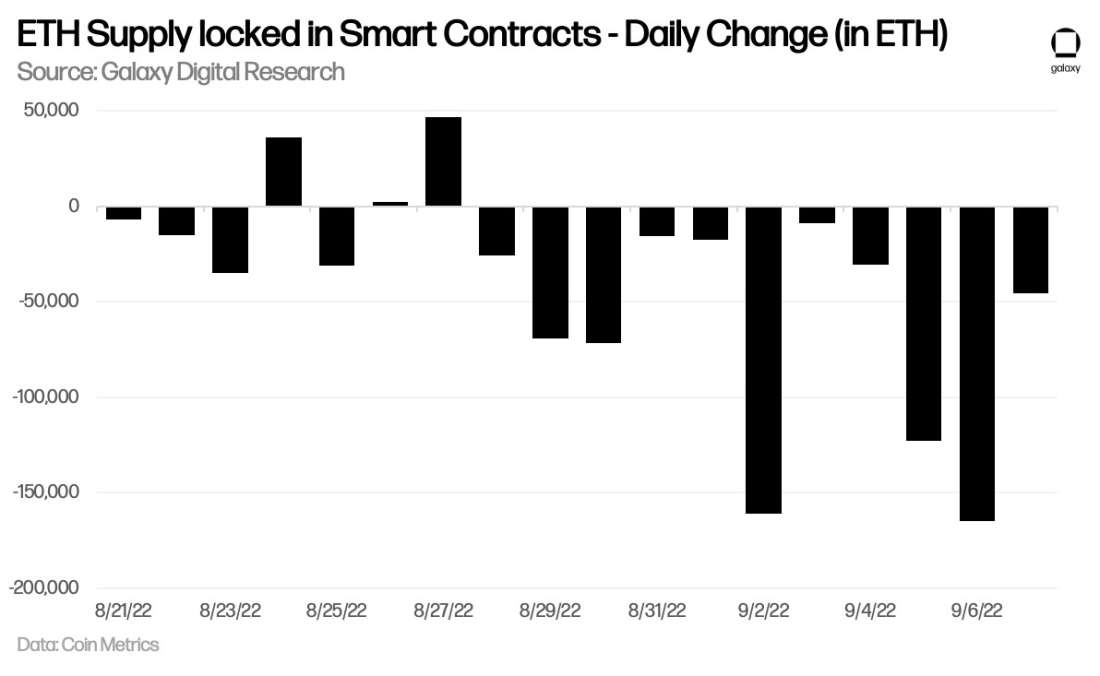

In addition to the increased market activity in lending markets, we are also seeing an increase in ETH withdrawals from exchanges and from smart contracts, and a growing discount in stETH/ETH (Lido’s liquid staking derivative), and increased bridging volumes of ETH from other networks back to the base layer. Again, part of this may be due to potential exclusion from an airdrop for ETH holders that have their assets custodied at an exchange or if they hold a different representation of ETH other than the native token on the Ethereum mainnet.

Conclusion

Overall, next week's scheduled Merge has caused significant disruption to Ethereum and DeFi markets. Market participants are giving more serious consideration to the anticipated ETHPoW fork, resulting in increased demand to hold native ETH on the Ethereum mainnet. This is illustrated in increased ETH borrowing activity and withdrawals of ETH deposits on DeFi lending protocols, where the three largest providers have taken different risk approaches in managing ETH borrowing levels:

Aave—DeFi's largest ETH lending market—has opted to pause further ETH borrowings as it already holds the highest utilization rates and faces greater liquidation risks related to its stETH exposure.

After having ETH borrows and liquidations temporarily frozen for the past week until Tuesday, Compound just passed a proposal to change the interest rate model to deter full utilization of ETH borrowing, which has been standing at an extremely low level in the low-to-mid single digits.

Perhaps recognizing the opportunity to gain market share against its larger competitors, Euler appears to be taking more of a risk-on approach by maintaining its operations as-is. So far, the approach seems to be working out as Euler has experienced an outsized increase in activity levels in ETH markets relative to Aave and Compound.

General consensus of market participants is that in the event of an ETHPoW fork, recipients of the new token will likely sell immediately upon distribution, given that the broader Ethereum ecosystem (minus the miners) has committed to solely support the Beacon Chain and ETH PoS token. This suggests the recent market disruptions in anticipation of the ETHPoW fork may be short-lived, though there remains considerable uncertainty around these major events for Ethereum.

Legal Disclosure:

This document, and the information contained herein, has been provided to you by Galaxy Digital Holdings LP and its affiliates (“Galaxy Digital”) solely for informational purposes. This document may not be reproduced or redistributed in whole or in part, in any format, without the express written approval of Galaxy Digital. Neither the information, nor any opinion contained in this document, constitutes an offer to buy or sell, or a solicitation of an offer to buy or sell, any advisory services, securities, futures, options or other financial instruments or to participate in any advisory services or trading strategy. Nothing contained in this document constitutes investment, legal or tax advice or is an endorsementof any of the digital assets or companies mentioned herein. You should make your own investigations and evaluations of the information herein. Any decisions based on information contained in this document are the sole responsibility of the reader. Certain statements in this document reflect Galaxy Digital’s views, estimates, opinions or predictions (which may be based on proprietary models and assumptions, including, in particular, Galaxy Digital’s views on the current and future market for certain digital assets), and there is no guarantee that these views, estimates, opinions or predictions are currently accurate or that they will be ultimately realized. To the extent these assumptions or models are not correct or circumstances change, the actual performance may vary substantially from, and be less than, the estimates included herein. None of Galaxy Digital nor any of its affiliates, shareholders, partners, members, directors, officers, management, employees or representatives makes any representation or warranty, express or implied, as to the accuracy or completeness of any of the information or any other information (whether communicated in written or oral form) transmitted or made available to you. Each of the aforementioned parties expressly disclaims any and all liability relating to or resulting from the use of this information. Certain information contained herein (including financial information) has been obtained from published and non-published sources. Such information has not been independently verified by Galaxy Digital and, Galaxy Digital, does not assume responsibility for the accuracy of such information. Affiliates of Galaxy Digital may have owned or may own investments in some of the digital assets and protocols discussed in this document. Except where otherwise indicated, the information in this document is based on matters as they exist as of the date of preparation and not as of any future date, and will not be updated or otherwise revised to reflect information that subsequently becomes available, or circumstances existing or changes occurring after the date hereof. This document provides links to other Websites that we think might be of interest to you. Please note that when you click on one of these links, you may be moving to a provider’s website that is not associated with Galaxy Digital. These linked sites and their providers are not controlled by us, and we are not responsible for the contents or the proper operation of any linked site. The inclusion of any link does not imply our endorsement or our adoption of the statements therein. We encourage you to read the terms of use and privacy statements of these linked sites as their policies may differ from ours. The foregoing does not constitute a “research report” as defined by FINRA Rule 2241 or a “debt research report” as defined by FINRA Rule 2242 and was not prepared by Galaxy Digital Partners LLC. For all inquiries, please email [email protected]. ©Copyright Galaxy Digital Holdings LP 2022. All rights reserved.