FTX Contagion: Impact on DeFi

Since the beginning of FTX's collapse the week of November 7th, industry contagion has been ongoing and far-reaching. A revelation about FTX’s balance sheet by the Financial Times on November 12, 2022 confirmed that the cryptocurrency exchange had nearly $9bn in liabilities. In addition, through FTX’s bankruptcy proceedings, it was revealed that the exchange owes its top 50 creditors an amount totaling $3.1bn. The names of the top 50 creditors have not been disclosed but the companies that have already self-declared exposure on FTX include lending platforms, hedge funds, other cryptocurrency exchanges, cryptocurrency ecosystem foundations, venture capital funds, trading firms, and even large allocators.

On Monday, November 28, cryptocurrency lender BlockFi filed for bankruptcy citing exposure to the now-defunct cryptocurrency exchange FTX. In addition, news outlet Bloomberg reported on Tuesday that cryptocurrency brokerage Genesis was in the process of heavy restructuring to prevent insolvency and avoid bankruptcy. It is unclear at this time what Genesis’ total exposure to FTX was, though it has publicly declared that roughly $175mn was locked in an FTX trading account. While a chain reaction of losses and disruptions ripples across the ecosystem, one sector of the crypto industry that has seen relatively small impact from recent events has been the decentralized finance (DeFi) sector. In this report, we provide an overview of DeFi activity over the last month and highlight where DeFi has shined.

Alameda’s exposure in DeFi

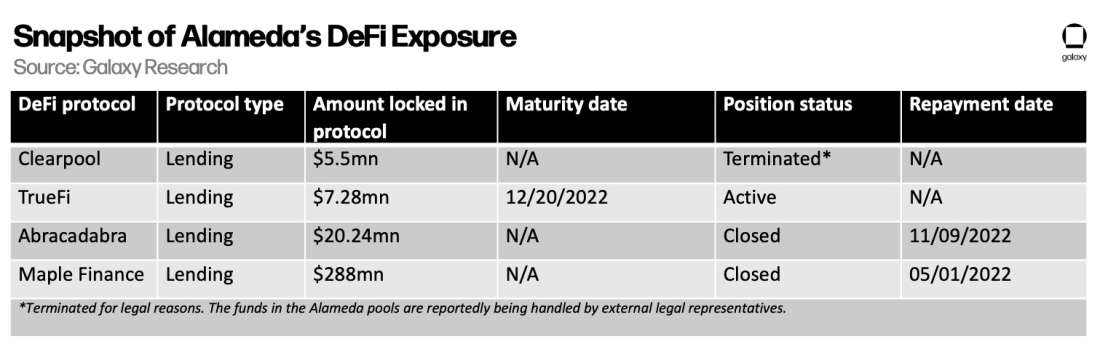

Alameda is the proprietary trading firm of Sam Bankman Fried (SBF), the CEO of FTX. Reuters reported SBF secretly loaned $10bn of FTX customer funds to Alameda. In addition, blockchain data provider Coin Metrics confirmed in their analysis that Alameda had been interacting with nascent blockchain protocols and smart contracts since 2021, sending a total of $9.5bn to bridging protocols alone over the last two years. Before FTX’s fall, Alameda had taken out hundreds of millions of dollars’ worth of loans from DeFi lending protocols such as Clearpool, Abracadabra, TrueFi, and Maple Finance. The following is snapshot of Alameda’s exposure across these four DeFi platforms:

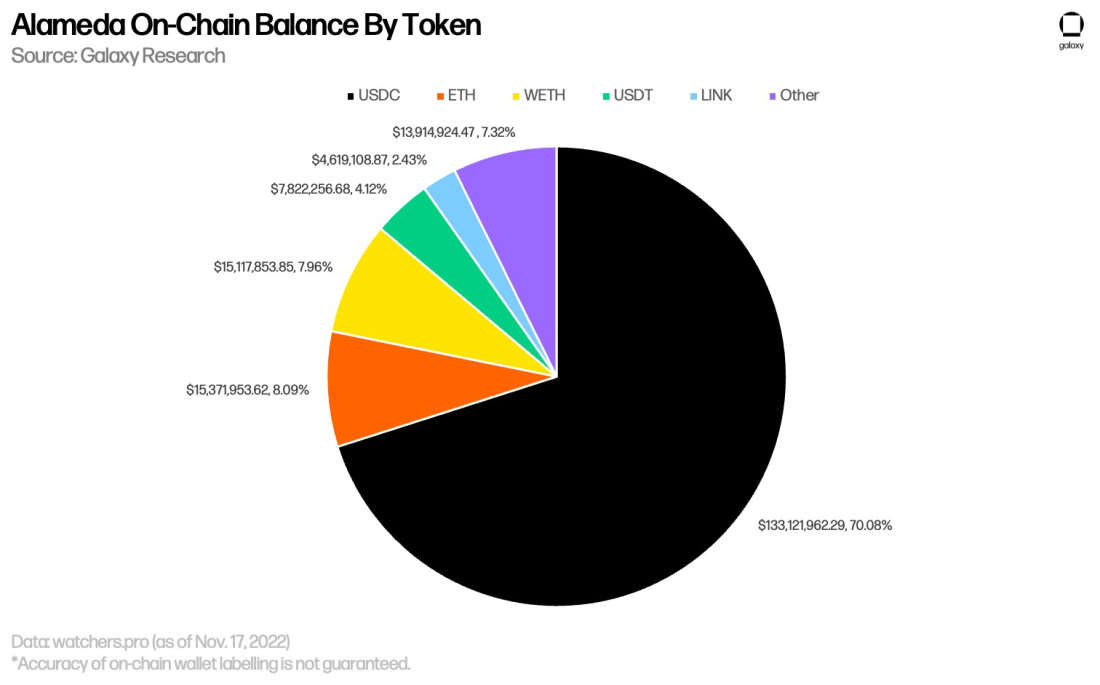

Amid the news of FTX’s liquidity crunch, a slew of on-chain transactions originating from Alameda wallets to other DeFi protocols such as Compound, Gearbox, Aave, and Curve were identified by blockchain service providers such as Nansen, Zapper, Debank and watchers.pro. This activity suggests the trading firm was actively winding down their DeFi positions amid growing rumors of their insolvency, which is more than can be said for Alameda’s centralized counterparties such as Genesis, Apollo Capital, and Celsius, as well as the thousands of customers who deposited money into FTX that was then loaned out to Alameda. According to on-chain data, as of November 23, 2022, Alameda holds a balance of roughly $81.5mn across 643 addresses spread out between 12 different chains. Most of Alameda’s on-chain balance is made up of stablecoins and ETH:

Alameda’s outstanding exposure to DeFi protocols is minimal because there is no wiggle room to renegotiate with or seek extensions from DeFi protocols. A fully decentralized application (dapp) is operated by automated smart contracts, and all actions and interactions with a dapp are governed by code rather than people. For finance-focused dapps, terms and conditions are enforced on-chain indiscriminately across all users. To prevent the collateral locked in DeFi protocols from being sold off on the open market and priced through automated market makers at a severe discount, Alameda prioritized paying back their loans on-chain first. Celsius, faced with a similar situation in July, also paid down its DeFi debts first. The transparency and automation of major DeFi protocols has routinely elevated them to the top of creditor stack.

DeFi trade volumes soar

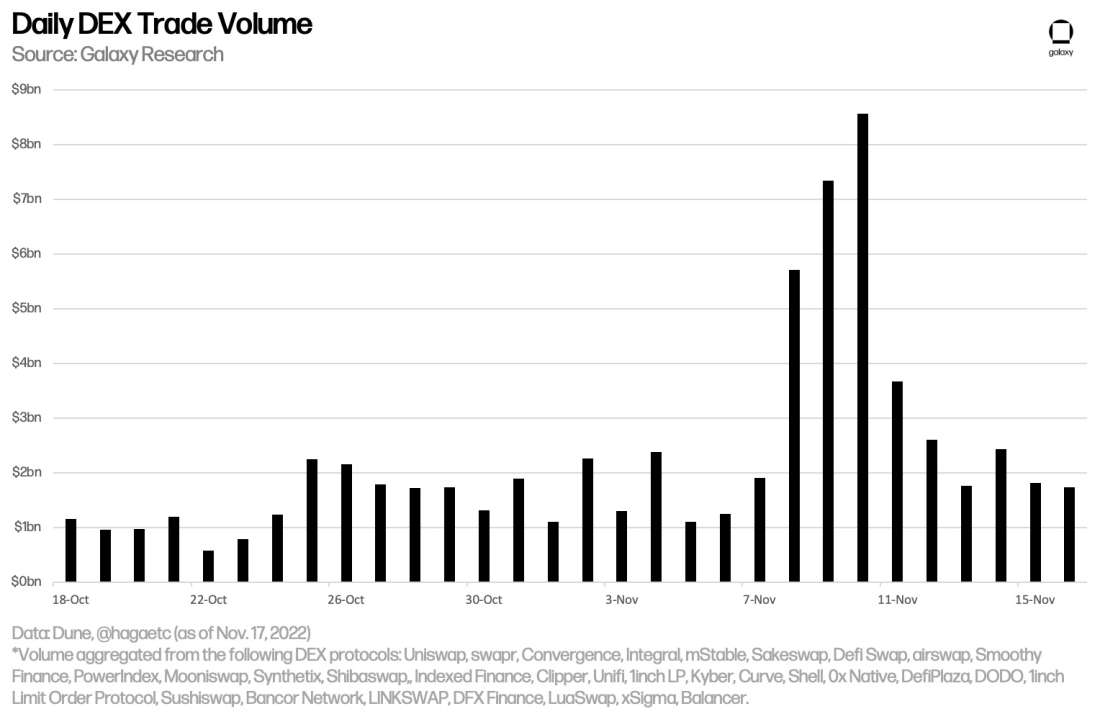

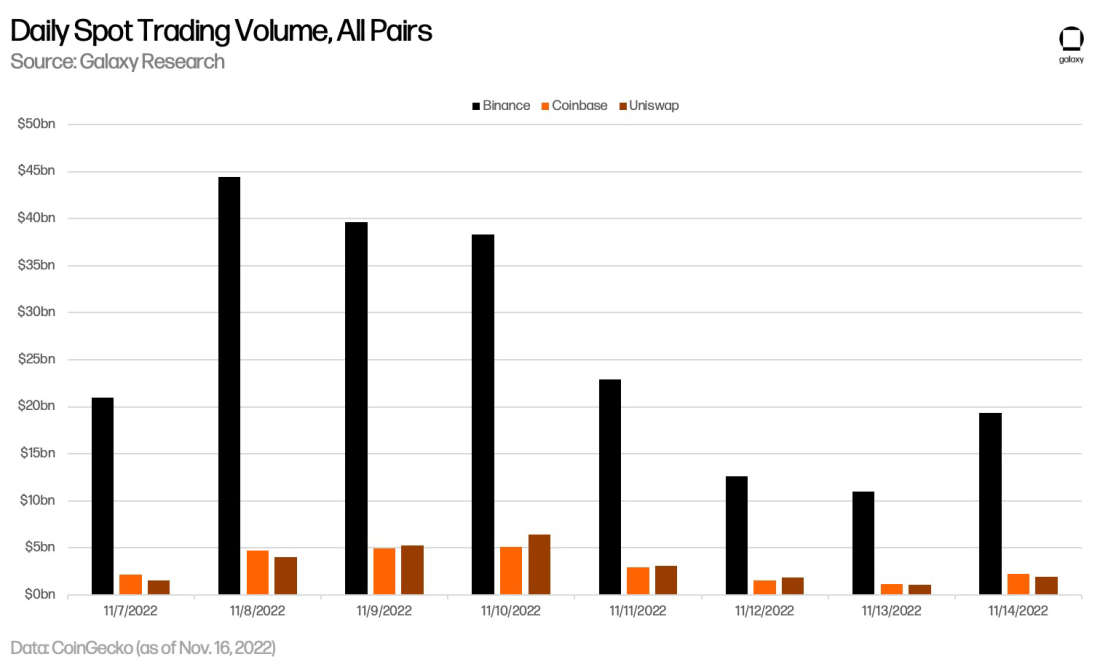

DeFi activity on Ethereum soared as details about FTX’s liquidity crunch and rumors of their insolvency spread. Daily trade volume across decentralized exchanges (DEXs) quadrupled in size over the course of four days from November 7, 2022 to November 11, 2022.

Most notably, Uniswap, which captures about 77% of DEX market share, overtook Coinbase as the second largest cryptocurrency exchange by daily trading volume for ETH pairs. Uniswap also briefly overtook Coinbase in total daily spot volume across all pairs for a few days between November 19 and November 12, 2022.

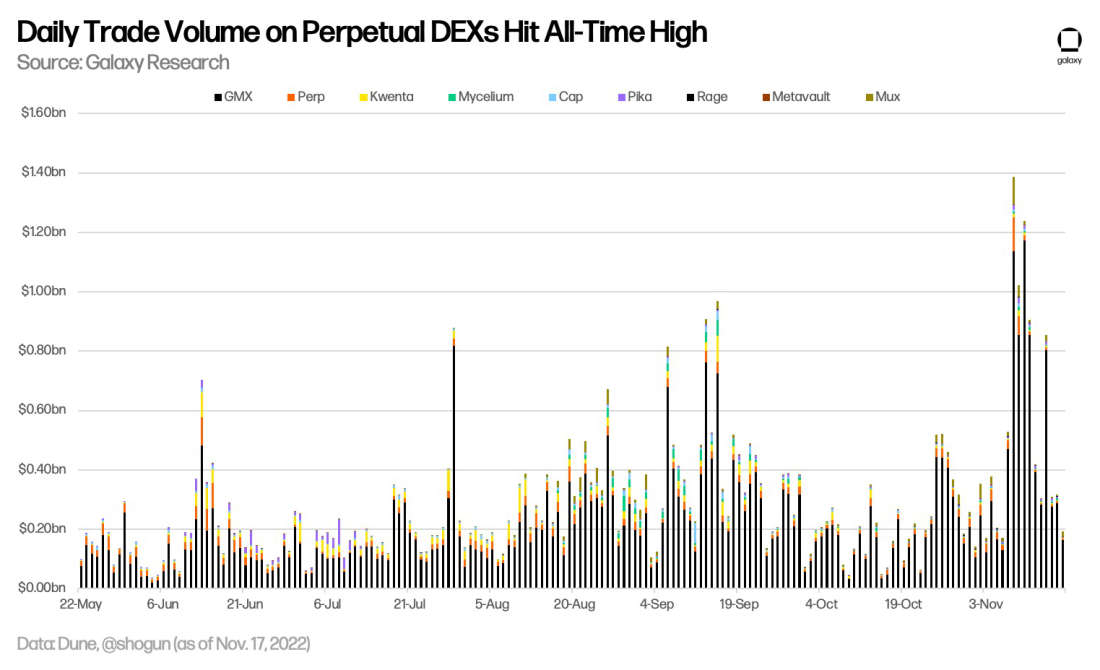

Other decentralized exchanges, such as the ones that offer trading for perpetual futures contracts, a mainstay of FTX’s business, also saw daily trade volumes reach new all-time highs.

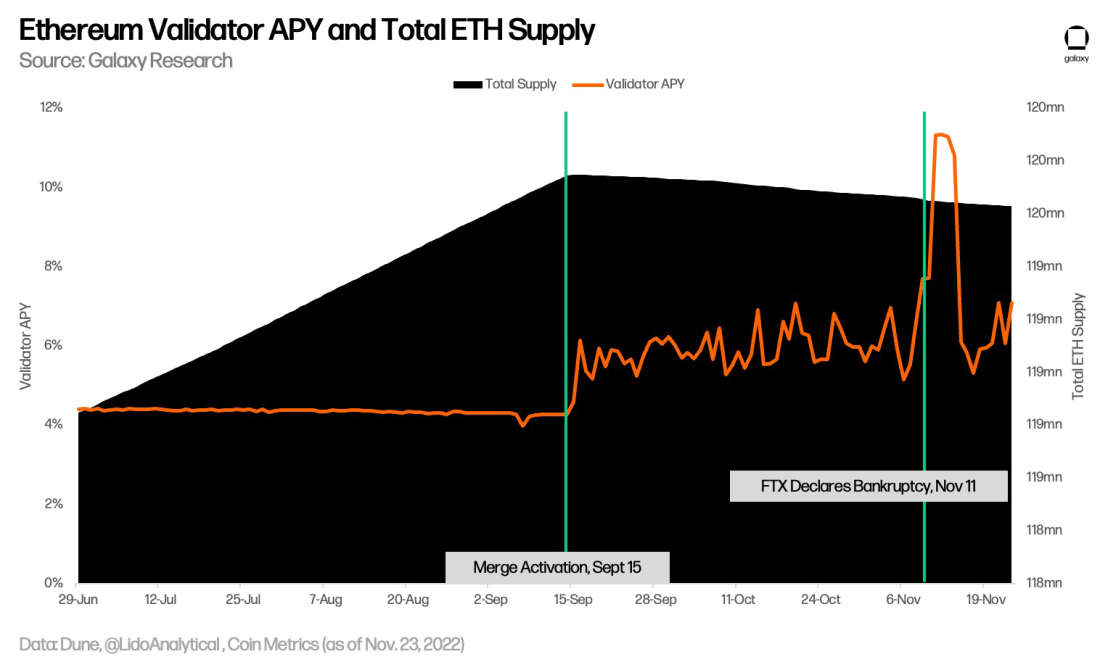

Increased DeFi activity subsequently impacted validator rewards and network issuance on Ethereum. For the first time since the Merge upgrade was activated on September 15, 2022, the total supply of ether (ETH) has started to contract, now down by 6,000 ETH since the Merge. Validator rewards also briefly doubled due to increased priority fees from user transactions and maximal extractable value (MEV).

Finally, despite the surge in on-chain activity and market volatility, decentralized stablecoins on Ethereum including FRAX, MIM, and DAI did not meaningfully de-peg over the last two weeks. For a full breakdown of stablecoin activity in the aftermath of FTX’s collapse, read this Galaxy Research report.

Blockchain analytics company Chainalysis noted in a blog post that increased volumes in DeFi are not primarily flows from users transferring assets away from centralized exchanges to decentralized ones. They are largely fueled by existing DeFi users trading on the volatility of the market and deploying bots to extract value known as MEV from lucrative trades. Part of the increased volumes through DeFi applications can also be chalked up to users wanting access to asset liquidity and wanting to de-risk their portfolios by drawing down active loan positions during a widespread liquidity crunch.

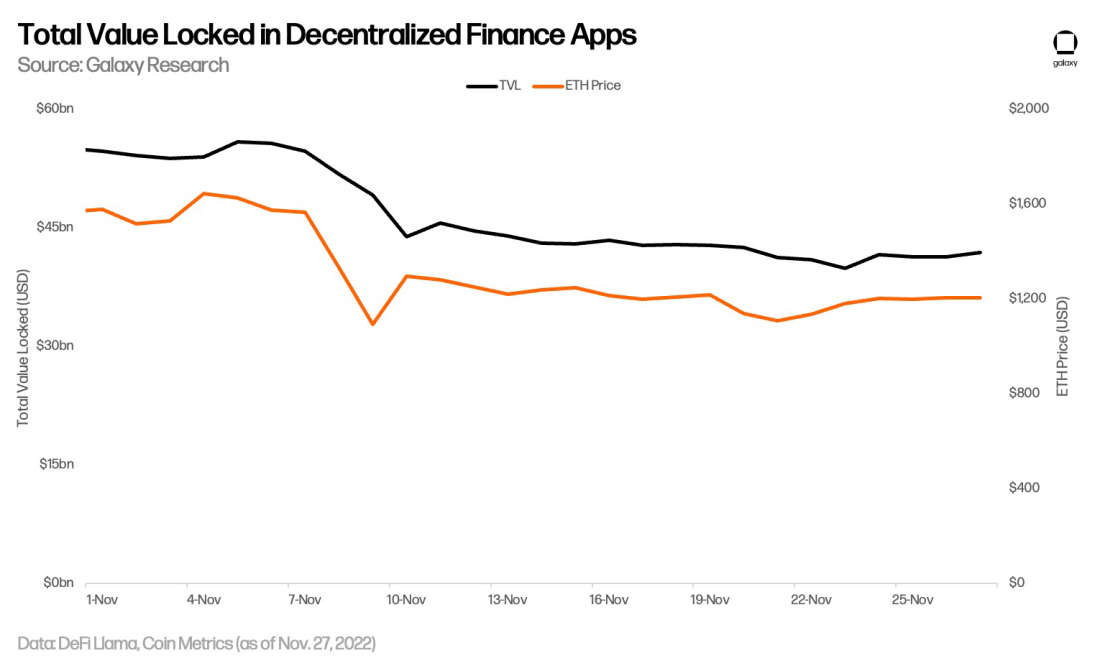

The removal of assets from DeFi apps is illustrated by a decline in total value locked (TVL) from roughly $55bn to $42bn. However, it is important to note that the metric of TVL is heavily influenced by swings in the market value of asset prices. Therefore, it is difficult to clearly delineate what dips in TVL were caused by the number of assets locked in DeFi declining versus the price of these assets depreciating, as illustrated in the chart below:

Though aggregated on-chain metrics like TVL often require additional context and other supporting data to decipher, the transparency of assets moving into and out of individual protocols is a key strength of DeFi over CeFi that protects end-users from unexpected revelations about the liquidity or solvency of a platform. Despite unexpected and unprecedented market volatility, users were able to draw down their positions from most DeFi applications without issue since the only authorization users need to pull funds from DeFi applications are the terms and conditions enforced by code, not by a centralized entity.

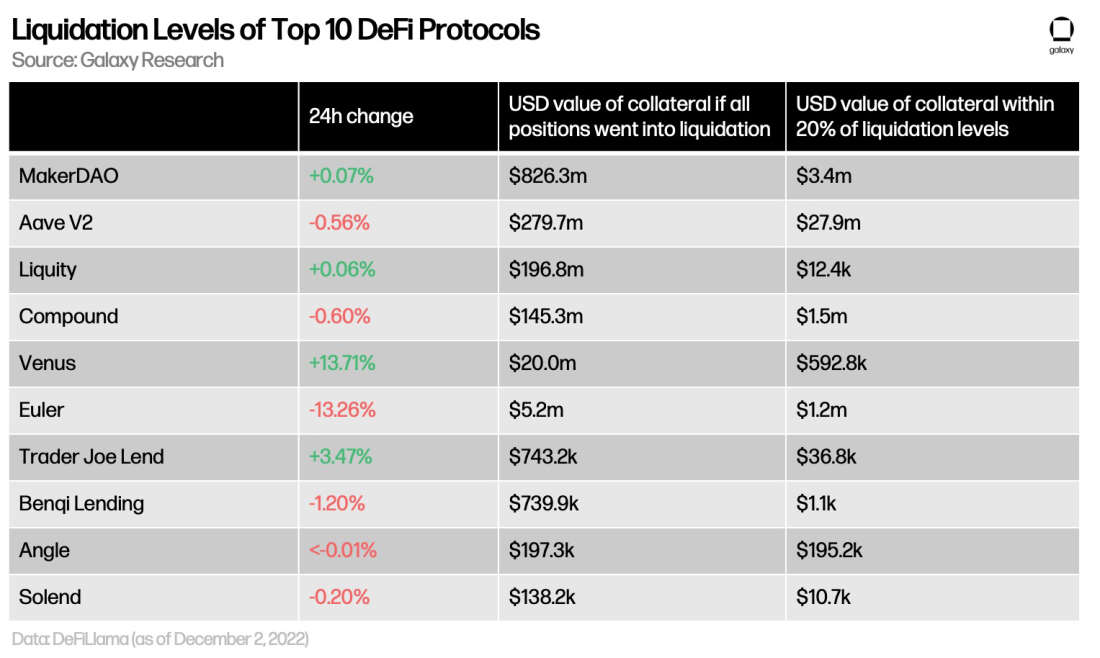

An unexpected DeFi stress test

In stark contrast to the opacity of FTX operations, the operations of DeFi remained transparent, verifiable, and robust despite heightened market volatility. Facing increased flows, DeFi’s application logic was fully functional. The durability of major DeFi applications was tested in an unexpected way on November 22, 2022, when notorious hacker Avraham Eisenberg, one of the people behind a $116mm exploit of the Solana DeFi lender Mango Markets, tried to take advantage of decentralizing lending protocol Aave. For a full breakdown of the attempted exploit, read this Galaxy Research newsletter brief.

It’s important to note how different centralized finance (CeFi) lending and DeFi lending are. CeFi lending operates on an implicit assumption of and privacy. DeFi lending famously marks position, liquidation levels, and counter-party risk on-chain without revealing the specific entity or person borrowing the asset or lending liquidity.

Secondly, it’s key to note how liquidations differ in DeFi. Liquidations in DeFi are (typically) open ended – anyone can participate, sourcing lenders the credited token in return for a small spread or fee on the collateral. On FTX, liquidations were (oddly) internalized and then later sold into the market. FTX also gave Alameda zero-liquidation account, giving the supposed market maker a privileged and unfair edge over other delta neutral trading shops. Although the zero-liquidation account eventually led to the downfall of FTX when user funds were used to backstop Alameda, this sort of opaque and unfair advantage doesn’t exist on-chain.

In DeFi, risks are more clearly parameterized, loans are siloed between pools, liquidations occur on an autonomous open market, and accounts operate without any special privileges. However, for all the benefits of DeFi highlighted in the wake of November’s liquidity crunch, not all DeFi applications are equally transparent or resilient. On Monday, December 1, a liquid staking protocol known as Ankr was hacked, resulting in the loss of 6 quadrillion aBNBc tokens, worth roughly $5mn. Compared to other major DeFi applications like MakerDAO, Compound, and Aave, which all launched between 2017 to 2018, the Ankr protocol is relatively new, having launched in 2021. In addition, the Ankr protocol is significantly smaller, being ranked 43rd among DeFi protocols by TVL.

In general, the longer a DeFi application operates and the more market cycles it undergoes, the more an application’s code and risk parameters become battletested and regarded as likely to stick around in the future. Because the operations of DeFi applications rely exclusively on smart contract code, users face a heightened risk of bugs and technical failures resulting in the loss of funds and little opportunity for recourse due to the immutable nature of transactions executed on a public blockchain. In the next section of this report, we will discuss in more detail the tradeoffs associated with DeFi.

DeFi as a double-edged sword

Because of the decentralized nature of public blockchains like Ethereum and Bitcoin, transactions are generally irreversible. No single network stakeholder should be able to change the transaction history of the blockchain. Therefore, there is an extremely high-level of care and consideration that end-users and centralized service providers must have when moving assets on-chain. In addition, for all the benefits of interfacing directly with smart contract code, there is the risk of bugs and hacks creating loopholes that put user funds at risk. The impartiality and permissionless nature of DeFi applications means that no users, even users that are laundering stolen user funds, can be censored from using these applications. The double-edged nature of DeFi was put on display when less than 24 hours following FTX’s announcement of bankruptcy on November 11, 2022, the exchange was hacked.

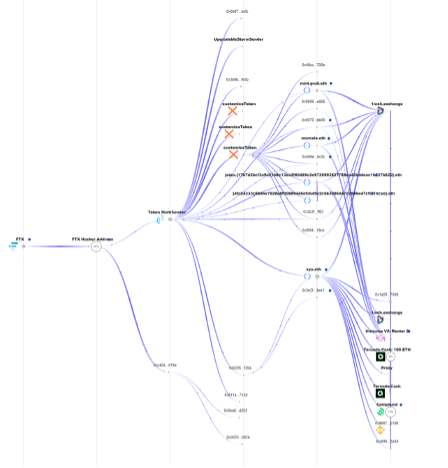

More than $600mn worth of tokens were siphoned from FTX cryptocurrency wallets and swapped through DEXs like Uniswap, 1inch and CowSwap for ETH. The following is an illustration of flows from the FTX hacker’s Ethereum address:

At time of writing, the address of the hacker is now the 35th largest owner of ETH. If this type of illicit activity was identified on a centralized platform, operators would be able to revert transactions and freeze the assets of the hacker. However, because the hack was perpetrated on-chain and transactions were processed through DEXs and other smart contract applications, it is highly unlikely that these transactions can be reversed. On Ethereum, transactions have only successfully been reversed once in the network’s history through an unplanned hard fork. This was during a time when the Ethereum ecosystem was considerably smaller and coordination between network stakeholders was easier.

The permissionless nature of applications on Ethereum, financial and otherwise, is a controversial feature that has come under regulatory scrutiny in recent months. One of the applications used by the FTX hacker is a privacy tool known as Tornado Cash. Tornado Cash smart contracts were sanctioned by the U.S. Treasury earlier this year because North Korean hackers used the tool to launder stolen funds. Since the sanctioning of Tornado Cash, several user-facing applications and infrastructure tools on Ethereum have proactively started to censor user transactions that interact with Tornado Cash, which directly undermines the censorship resistant qualities of Ethereum, and the applications built atop the network.

Transparency in a centralized world

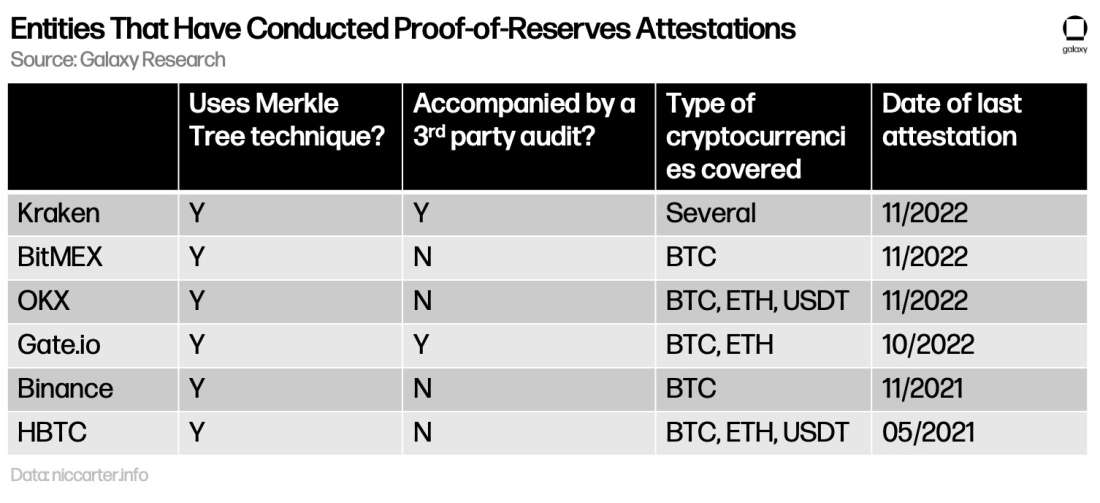

Increased spotlight on the transparency and resiliency of DeFi, despite the sector’s other shortcomings, has motivated centralized cryptocurrency exchanges to adopt new practices to improve customer trust on their platforms. One of these practices, known as proof of reserves (PoR), has become particularly popular after Binance, the largest cryptocurrency exchange in the world, publicly tweeted about the merits of increasing exchange transparency through cryptographic attestations like PoR. As background, PoR is a framework for centralized businesses that custody cryptocurrencies on behalf of customers to attest to their holdings both cryptographically and through a trusted third-party audit. The idea for a cryptographic verification of custodied coins was first discussed by Bitcoin core developers back in 2014. It has since become adopted by several businesses including BitMex, Kraken, OKX, and Gate.io.

Recently, Binance announced they would be implementing a PoR system for verifying their BTC holdings and have partnered with international tax advisory firm Mazars Group to couple their cryptographic proofs with a corresponding audit of customer liabilities. This represents a major step forward to making PoR a standard in the crypto industry, which would help establish a herd immunity to combat events like the FTX fallout and others like it by making it easy for users to hold centralized exchanges to a higher level of transparency and accountability. The following is a list of all the entities that have implemented PoR or some variation of this system:

There are powerful benefits to leveraging the unique characteristics of cryptocurrencies for improving transparency and trust in financial services and applications. On one extreme, DeFi applications replicate the function of traditional financial services using only decentralized smart contracts. These applications, as discussed, have proven in many ways to be more robust and reliable than legacy systems based on trust and centralized intermediaries. There are also CeFi applications that incorporate some element of on-chain transparency to publicly attest to their balance sheet without revealing sensitive information about their counterparties or clients. Innovations like the PoR system, which have been discussed for several years but never widely implemented at scale, are important initiatives that can help meaningfully improve user trust in centralized financial institutions.

Conclusion

The recent growth in volumes and interest in DeFi highlights the sector’s potential to improve access and trust in financial services. However, the immutability of transaction activity executed through DeFi applications can create a poor user experience for individuals and entities unfamiliar with using blockchain technology. In addition, there is a significant amount of regulatory uncertainty especially in the U.S. around DeFi applications and their permissionless use. Even so, DeFi applications shined as transparent and resilient alternatives to centralized finance platforms in the wake of FTX’s collapse. In addition, the power of on-chain activity has fueled greater attention on innovative solutions to improving the transparency of CeFi through cryptographic proof systems like PoR.

Legal Disclosure:

This document, and the information contained herein, has been provided to you by Galaxy Digital Holdings LP and its affiliates (“Galaxy Digital”) solely for informational purposes. This document may not be reproduced or redistributed in whole or in part, in any format, without the express written approval of Galaxy Digital. Neither the information, nor any opinion contained in this document, constitutes an offer to buy or sell, or a solicitation of an offer to buy or sell, any advisory services, securities, futures, options or other financial instruments or to participate in any advisory services or trading strategy. Nothing contained in this document constitutes investment, legal or tax advice or is an endorsementof any of the digital assets or companies mentioned herein. You should make your own investigations and evaluations of the information herein. Any decisions based on information contained in this document are the sole responsibility of the reader. Certain statements in this document reflect Galaxy Digital’s views, estimates, opinions or predictions (which may be based on proprietary models and assumptions, including, in particular, Galaxy Digital’s views on the current and future market for certain digital assets), and there is no guarantee that these views, estimates, opinions or predictions are currently accurate or that they will be ultimately realized. To the extent these assumptions or models are not correct or circumstances change, the actual performance may vary substantially from, and be less than, the estimates included herein. None of Galaxy Digital nor any of its affiliates, shareholders, partners, members, directors, officers, management, employees or representatives makes any representation or warranty, express or implied, as to the accuracy or completeness of any of the information or any other information (whether communicated in written or oral form) transmitted or made available to you. Each of the aforementioned parties expressly disclaims any and all liability relating to or resulting from the use of this information. Certain information contained herein (including financial information) has been obtained from published and non-published sources. Such information has not been independently verified by Galaxy Digital and, Galaxy Digital, does not assume responsibility for the accuracy of such information. Affiliates of Galaxy Digital may have owned or may own investments in some of the digital assets and protocols discussed in this document. Except where otherwise indicated, the information in this document is based on matters as they exist as of the date of preparation and not as of any future date, and will not be updated or otherwise revised to reflect information that subsequently becomes available, or circumstances existing or changes occurring after the date hereof. This document provides links to other Websites that we think might be of interest to you. Please note that when you click on one of these links, you may be moving to a provider’s website that is not associated with Galaxy Digital. These linked sites and their providers are not controlled by us, and we are not responsible for the contents or the proper operation of any linked site. The inclusion of any link does not imply our endorsement or our adoption of the statements therein. We encourage you to read the terms of use and privacy statements of these linked sites as their policies may differ from ours. The foregoing does not constitute a “research report” as defined by FINRA Rule 2241 or a “debt research report” as defined by FINRA Rule 2242 and was not prepared by Galaxy Digital Partners LLC. For all inquiries, please email [email protected]. ©Copyright Galaxy Digital Holdings LP 2022. All rights reserved.