May Milestones: New BTC Highs, ETH Surge, and Evolving Speculation

This post is part of Galaxy Lending’s Monthly Market Commentary, offering insights into trends shaping the crypto credit and lending landscape. Subscribe to receive this commentary and more directly to your inbox.

In this report:

US Regulators Shift Focus to Perp Markets and Structured Crypto Oversight

Corporate Treasuries Embrace Bitcoin and Ethereum for Strategic Reserves

Traditional Finance Moves into Crypto Lending, Trading, & On-Chain Credit

Market Update

The crypto market saw a significant resurgence in May, led by BTC breaking to a new all-time high of $111,970 on May 22. This milestone was driven by a combination of strong institutional flows, favorable macro conditions, and persistent demand for leveraged exposure. One of the most notable drivers was the influx of capital into U.S. spot Bitcoin ETFs, which attracted over $5.2 billion in net inflows during the month—marking a record high for the year and reinforcing BTC’s growing role as a macro asset. Two major industry events—Consensus Toronto and the Bitcoin Conference in Las Vegas—also fueled positive sentiment and increased visibility around digital assets.

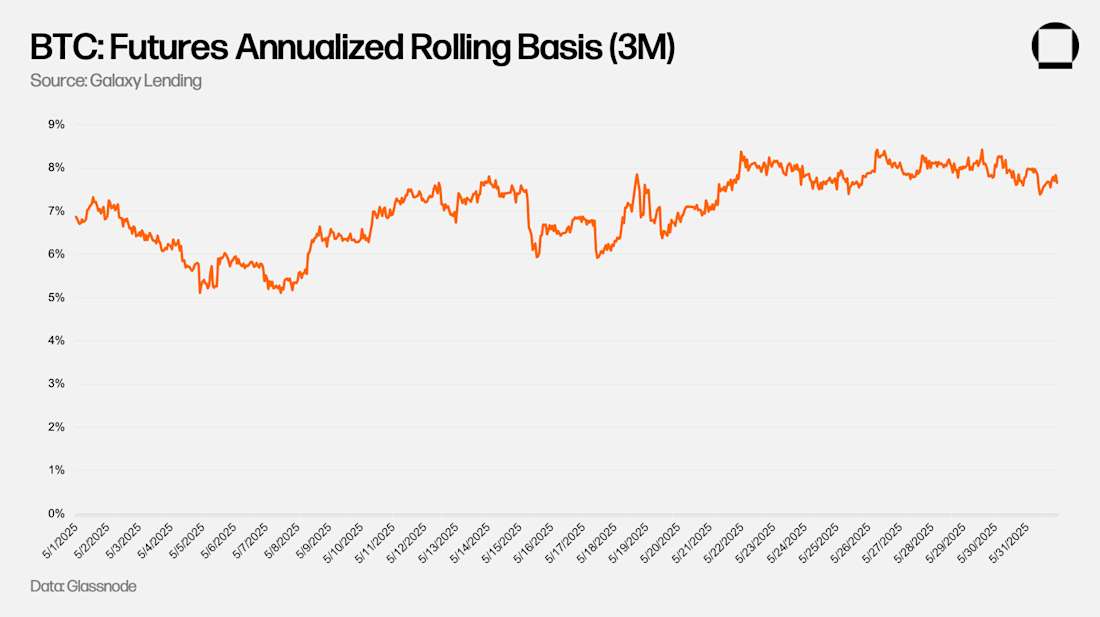

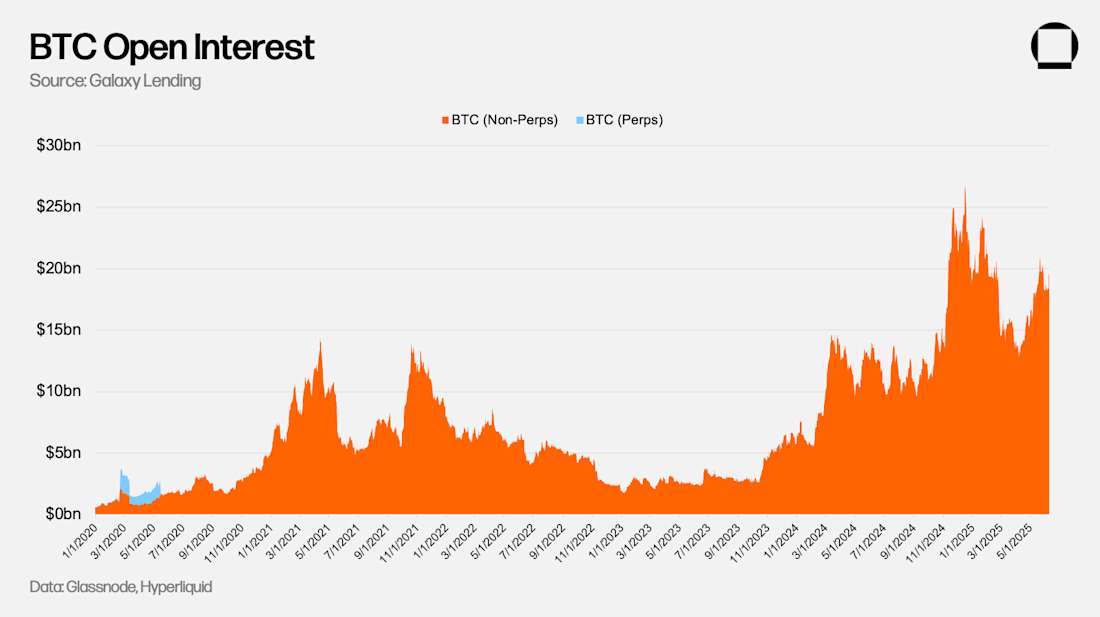

Onchain BTC funding rates remained elevated, with Hyperliquid recording a peak annualized rate of 161.26% on May 21, underscoring intense long positioning ahead of the price breakout. Simultaneously, the 3-month futures annualized rolling basis hovered between 5% and 8.5%. Open interest in BTC futures expanded from $16.3 billion to $18.2 billion, with a monthly peak of $20.3 billion, reflecting increased conviction and leverage across the market.

ETH also posted a strong performance, rising approximately 41% in May—from ~$1,795 to ~$2,530—fueled by growing anticipation around the upcoming Pectra upgrade and a renewed investor focus on Layer 1 narratives.

Key Trends:

001

U.S. Regulators Shift Focus to Perp Markets and Structured Crypto Oversight

In May, U.S. regulators signaled a clear shift in their approach to crypto oversight. The SEC formally dropped its lawsuit against Binance and founder Changpeng Zhao (known as CZ) on May 29, marking a move away from aggressive enforcement. This was followed by SEC Chair Paul Atkins' announcement of plans to introduce tailored rules for crypto token issuance, custody, and trading—aiming for a more innovation-friendly regulatory environment.

Complementing this shift, the Digital Asset Market Clarity Act of 2025, known as the CLARITY Act, was introduced to define the roles of the SEC and CFTC, with the latter expected to gain more authority over derivatives and perpetual futures. These developments suggest perp markets are moving into regulatory crosshairs, potentially bringing new requirements for lending desks and liquidity providers. The focus is now turning from litigation to structural regulation, especially around leveraged trading infrastructure.

002

Corporate Treasuries Embrace Bitcoin and Ethereum for Strategic Reserves

In May, institutional adoption of Bitcoin and Ethereum as treasury assets surged, signaling growing confidence in digital reserves. Strike not only added BTC to its balance sheet but also launched a lending product based on a core thesis of never rehypothecating BTC, which founder Jack Mallers reinforced this stance in a June 4, 2025 X post, highlighting updates to Strike’s User Agreement that removed the notion of “re-hypothecation”. Jack Mallers also leads, Twenty One Capital, which acquired over 4,800 BTC, while GameStop revealed a purchase of 4,710 Bitcoin tokens. Other companies such as Mega Matrix, K33, and Trump Media also unveiled new BTC or ETH treasury strategies.

Concurrently, interest in Wrapped Crypto Treasuries rose as firms sought tokenized yield-generating assets to diversify reserves and enhance collateral frameworks. This trend underscores crypto’s transformation from a speculative instrument into a foundational element of corporate financial infrastructure. That said, crypto’s role in corporate treasuries remains subject to risks, including market volatility, regulatory scrutiny, and operational challenges related to custody, accounting, and liquidity. We highlight the importance of reviewing offering documents—such as convertible note terms—to better evaluate these risks.

003

Traditional Finance Moves into Crypto Lending, Trading, and On-Chain Credit

May saw a major step forward in traditional finance’s integration with crypto infrastructure. Cantor Fitzgerald became the one of the first notable Wall Street firms to execute crypto backed loan with Maple Finance and FalconX to expand into institutional crypto credit. At the same time, Morgan Stanley revealed plans to offer crypto trading to its electronic trading clients, and JPMorgan began providing crypto-backed loans, allowing clients to post crypto ETFs as collateral. These moves reflect a broader shift: traditional institutions are now embedding crypto products into core lending and trading operations.

Related Research:

The State of Crypto Leverage: Galaxy Research provides a comprehensive view of the leverage that has accumulated in the crypto economy. This report covers similar topics as our last report, The State of Crypto Lending, with additional CeFi and DeFi venues included in the tally of crypto-collateralized lending. This report widens the lens on leverage to include bitcoin treasury companies and futures markets.

Notable News:

Maple Finance, FalconX secure Bitcoin-backed loans from Cantor Fitzgerald

Morgan Stanley to Offer Crypto Trading to E*Trade Customers

Subscribe to receive this commentary and more directly to your inbox!

This document, and the information contained herein, has been provided to you by Galaxy Digital Holdings LP and its affiliates (“Galaxy”) solely for informational purposes. Galaxy provides comprehensive financial products and services to institutions, corporates, and qualified individuals (typically Eligible Contract Participants and accredited investors) within the digital asset ecosystem. This document may not be reproduced or redistributed in whole or in part, in any format, without the express written approval of Galaxy. Neither the information, nor any opinion contained in this document, constitutes an offer to buy or sell, or a solicitation of an offer to buy or sell, any advisory services, securities, futures, options or other financial instruments or to participate in any advisory services or trading strategy. Nothing contained in this document constitutes investment, legal or tax advice. You should make your own investigations and evaluations of the information herein. Any decisions based on information contained in this document are the sole responsibility of the reader. Certain statements in this document reflect Galaxy’s views, estimates, opinions or predictions (which may be based on proprietary models and assumptions, including, in particular, Galaxy’s views on the current and future market for certain digital assets), and there is no guarantee that these views, estimates, opinions or predictions are currently accurate or that they will be ultimately realized. To the extent these assumptions or models are not correct or circumstances change, the actual performance may vary substantially from, and be less than, the estimates included herein. None of Galaxy nor any of its affiliates, shareholders, partners, members, directors, officers, management, employees or representatives makes any representation or warranty, express or implied, as to the accuracy or completeness of any of the information or any other information (whether communicated in written or oral form) transmitted or made available to you. Each of the aforementioned parties expressly disclaims any and all liability relating to or resulting from the use of this information. Certain information contained herein (including financial information) has been obtained from published and non-published sources. Such information has not been independently verified by Galaxy and Galaxy does not assume responsibility for the accuracy of such information. Affiliates of Galaxy’s own investments in some of the digital assets and protocols discussed in this document. Except where otherwise indicated, the information in this document is based on matters as they exist as of the date of preparation and not as of any future date, and will not be updated or otherwise revised to reflect information that subsequently becomes available, or circumstances existing or changes occurring after the date hereof. The foregoing does not constitute a “research report” as defined by FINRA Rule 2241 or a “debt research report” as defined by FINRA Rule 2242 and was not prepared by GalaxyDigital Partners LLC. Similarly, the forgoing does not constitute a “research report”, as defined under CFTC Regulation 23.605(a)(9), and may only be considered a solicitation for entering into a derivatives transaction for purposes of CFTC Regulation 23.605. It is not intended to constitute a solicitation for any other purposes under CFTC or NFA rules, and it should not be relied on as a form of recommendation to trade under CFTC regulations. Any statement, express or implied, contained within these materials is subject, in all cases, to the actual terms of an agreement entered into with Galaxy Digital on a principal basis. The Information is being provided solely for informational purposes about Galaxy Digital and may not be used or relied on for any purpose (including, without limitation, as legal, tax or investment advice) without the express written approval of Galaxy Digital. The Information is not an offer to buy or sell, nor is it a solicitation of an offer to buy or sell, any investment banking services, securities, futures, options, commodities or other financial instruments or to participate in any investment banking services or trading strategy. Any decision to make an investment or enter into a transaction should be made after conducting such investigations as the investor deems necessary and consulting the investor’s own investment, legal, accounting and tax advisors in order to make an independent determination of the suitability and consequences of an investment. Additional information about the Company and its products and services can be found at Galaxy Digital’s website at galaxy.com. For all inquiries, please email [email protected]. ©Copyright Galaxy Digital Holdings LP 2025. All rights reserved.