Crypto Beyond 2023

An examination of six emerging trends that influence Galaxy's Venture investment thesis and shape the future of crypto.

Introduction

Crypto shifts are fast and unpredictable. At Galaxy, we believe that foundational, novel technologies such as blockchains, smart contracts, and zero-knowledge proofs remain poised to transform our financial system, creating a ubiquitous internet-native financial layer. Galaxy’s Venture team aims to capitalize and propel those technologies forward by investing and building alongside their teams.

Galaxy’s 350+ employees operate a variety of business lines at the forefront of crypto. These business lines give our Ventures team, and more importantly, the founders we work with, a unique lens into the future of our dynamic industry. These business lines provide context and focus to our thesis-driven approach, drive our conviction in making early-stage investments, and serve as resources for the teams we invest in.

From an investment perspective, we continue to be focused on applications that will drive long-term demand and usage of public blockchains, such as On-Chain Finance and the associated rise of on-chain institutions. We are also excited about developments at the wallet infrastructure layer, which enable developers to create more seamless experiences for their end users. Finally, we always have an eye towards novel computing developments, like zero-knowledge proofs and rollups, that power advancements in scalability. This blog post dives into six formational pillars of our venture team’s investment thesis.

On-Chain Finance

On-Chain Finance is the convergence of financial markets with blockchain rails. Bringing global financial assets on-chain — a superior rail for financial activity — is a paradigm shift that we believe will upend the largest markets in the world.

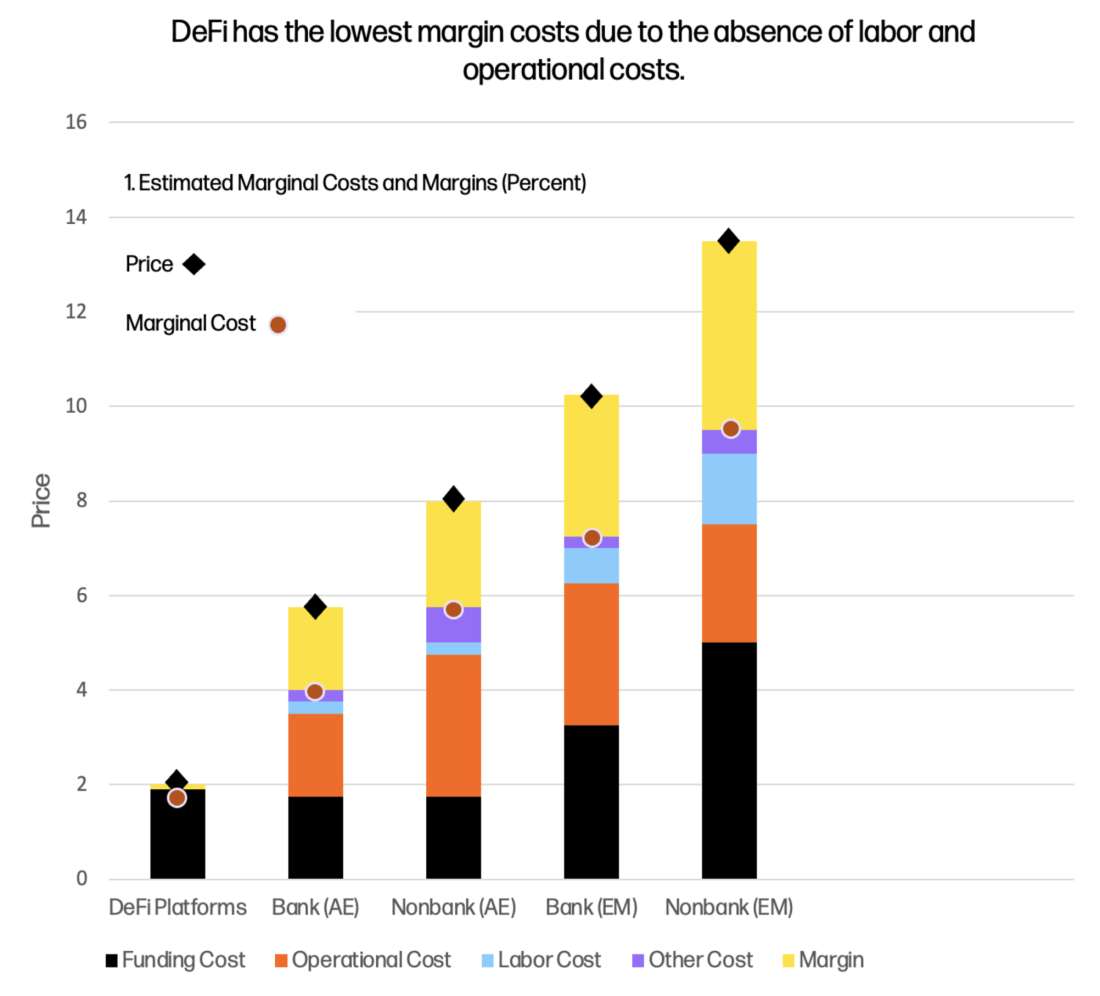

Assets in DeFi represent just under 0.01% of the approximate $510 trillion value of global financial assets. 2022 provided evidence that on-chain financial rails offering transparent and instant settlement can provide greater safety and lower fees under the same stress conditions as off-chain financial rails. In terms of lower fees, the IMF estimates that DeFi applications have the lowest marginal cost of capital by 3x due to slashing operational costs (and margin! Beware).

Furthermore, instant settlement of digital dollars on-chain has opened financial rails between countries, including in emerging markets. Again, this has come at much lower costs and has been brokered by immutable, transparent protocols, instead of uncertain regulatory regimes prone to capture.

However, ETH, stablecoins, and governance tokens do not make a financial system alone. Bringing the remaining 99.9% of global assets on-chain will take time, and requires further research, development, and implementation. There are two key near-term ingredients:

Fundamental Drivers of Asset Onboarding: This includes better cost of capital; lower payment costs for consumers, merchants, and international remitters; improved risk mitigation; shorter settlement times; new financial products; and greater composability. Delivering value-add products will drive asset onboarding.

Clear and Fair Regulatory Framework: Specialized for digital assets and On-Chain Finance, effective regulation can provide strict guidelines for tokenization of off-chain assets by requiring audits and supervision for ‘edge nodes’ that onboard these assets.

Meanwhile, banks and other traditional financial players continue to press forward with blockchains as an experimental but potentially superior financial rail. While these might look like 2018-era revamps, we believe the protagonists of new pilots have a fundamentally better understanding of the value proposition. DTCC launched a private blockchain for settling equities transactions, and JP Morgan alongside the Monetary Authority of Singapore completed an on-chain JPY/SGD trade on Polygon*. Uniswap’s paper covering on-chain foreign exchange is very exciting too, estimating that on-chain foreign exchange can reduce remittance costs by as much as 80%. These trials are on a collision course with public blockchains/rollups, if for no other reason than the traditional players will be challenged to keep up with the talent-driven innovation occurring on public chains.

On-Chain Institutions

As a reaction to 2022, we may see a near-term dip in interest for institutions integrating on-chain, but the long-term trend is undoubtable. Advances in tooling will make it easier and safer for institutions to operate on-chain.

Consistent with our expectation that On-Chain Finance will saturate financial markets over time, tooling will need to improve to expand on-chain participation beyond specialists. On-Chain Finance is brokered by immutable, decentralized rules which provide a reliable playing field and guarantees relative to off-chain deals made by handshake. For instance, in its final hours, Alameda paid off its on-chain debt before attempting to meet its obligations to centralized lenders.

Galaxy is an active on-chain market participant, supplying liquidity, and participating elsewhere when appropriate. While there are clear benefits to participating on-chain, it took Galaxy time to get comfortable with the risks, particularly the compliance risks of on-chain counterparties. Lacking a better solution, we constructed an internal compliance technology stack and have leveraged it to increase our presence on-chain. We expect more tooling in the coming year will lower barriers to entry for institutions, including custody, data products, execution, accounting, and risk management. These products will:

Stitch Together Custody and Execution Layers: Different custodial solutions apply to different financial activities. Fireblocks’* WalletConnect integration is at the center of our on-chain stack. Additional custodial models are desirable that allow for (i) high frequency activity, (ii) bundled transactions, and (iii) further policy-based automation.

Generate Granular and Actionable On-Chain Analytics: On-chain data providers, such as Parsec*, enable institutions to optimize their on-chain financial actions.

Offer Dynamic Risk Management: Monitors real-time liquidity and rate/collateral risk across various protocols and liquidity pools, along with trade simulations.

Operationalize Back-Office Tools On-Chain: Essential tools like accounting and compliance will need to be brought up to parity with existing TradFi back-office tooling.

With the addition of these products, we expect more institutions to become more comfortable shifting their operations on-chain, particularly as the market offers opportunities to do so.

Embedded Crypto Drives Consumer Adoption

More tools will be built that embed crypto into our everyday lives, making interactions easy for people and creating new business model opportunities for companies.

Recently, we’ve seen Web2 companies begin to integrate crypto more deeply, leveraging the cross-domain nature of blockchains—the fact that it’s a substrate—to create new consumer experiences. For instance, Reddit has minted millions of NFT avatars and Stripe has rolled out global crypto payouts enabling 4.4 billion people across 110 countries to receive funds in local currencies or crypto. Starbucks and Alo Yoga partnered with Polygon to use NFTs for rewards, and Shopify launched token-gating features to its 1.7 million merchants. We expect crypto to continue to find its way into apps, products, and physical spaces where consumers already spend their time, generating new business opportunities, monetization avenues, and loyalty primitives for major and emergent brands.

To enable this, an operational layer invisible to daily users must emerge to abstract away complexities of onboarding, creating a seamless user experience. We call this “embedded crypto.” Consumers will transact through crypto rails without knowing it, while interacting with abstraction layers instead of directly with the underlying blockchains. A variety of tools will take hold including:

Hidden Wallet APIs: Most users onboarding through Web2 don’t come with a crypto wallet. The wallets they interact with that facilitate their crypto interaction may or may not be custodial, will abstract away the concept of mnemonics and private keys, and must be secure and trusted.

Invisible Gas (Account Abstraction): It’s common for Web2 users to have no transaction costs for most interactions. Wallets will hide the concept of gas to enable users to transact seamlessly without added friction.

Multi-Party Computation (MPC)-as-a-Service: More sophisticated Web2 companies won’t want to use a third-party wallet API and instead will build around non-custodial solutions that enable more flexibility, for example enabling more refined access controls.

As institutions keep experimenting with on-chain assets and crypto becomes more embedded in everyday life, the development of these tools will be crucial for continuing crypto adoption across the global economy. Some of these tools’ capabilities are enabled by novel computing advances, which we explore below.

Zero-Knowledge (ZK) Focuses on Succinctness

ZK’s focus on succinctness will enable applications that shift the trust model expected in blockchains—why trust anything that is not verifiable?

SNARKs historically were associated with use cases such as private payments, private identity, and mixers. However, today, the focus is on the succinct property of SNARKs, which alter the constraints of a blockchain system.

A blockchain is a resource constrained environment. Succinctness enables developers to provide a small proof that is verified on-chain and maps to a larger operation that would take up more compute and memory. In other words, expensive operations are shifted to an off-chain environment and the results are verified on-chain, increasing the resources available to a blockchain by orders of magnitude.

Blockchains no longer have to enforce re-execution of transactions by validators. Aleo*, a ZK-powered L1, plans to roll out its mainnet in 2023, cutting out transaction re-execution, preserving node resources and letting networks run to their absolute limits. Likewise with ZK-rollups — in contrast with an optimistic rollup — the L1 only needs to verify a proof that L2 transactions were correctly executed. Leveraging ZK for succinctness will yield many novel applications that we're excited about in the near term as they shift the trust model in blockchains. These applications include light client bridges, verifiable data indexing, verifiable data science models, new DeFi compute primitives, and fully on-chain generative art and gaming.

As an example, imagine a DeFi protocol wants to use the Black-Scholes model to price options. This would require complex calculations, which are prohibitively expensive to run on-chain. A protocol can currently solve this with a trusted third-party oracle. In a paradigm that leverages the succinctness properties of ZK proofs, calculations can be shifted off-chain and the results verified on-chain, ensuring pricing is honest and the protocol remains maximally trustless.

Succinctness from verifiable off-chain computation will slowly permeate many aspects of public blockchains. But outstanding questions remain:

ZK Proof Affordability: If on-chain verification of ZK proofs is expensive on an L1, what applications can "afford" the cost of the ZK proof verification overhead? What specific applications will become viable overnight and what applications will require cheaper proofs?

Market Size and Hardware Relationship: How large is the market for ZK compute today?

ZK proofs represent a new model of computing and privacy in crypto. The set of use cases is nascent but will expand dramatically as developer comfort grows with ZK proofs as a tool. Underpinning traction and confidence in the utility of these technological primitives is their security.

Security as a Foundation for Secular Growth

Crypto will build and advance existing security practices by merging proven ones with its emergent and secure computing capabilities. In turn, enhanced security will create a positive feedback loop for institutions and individuals conducting commerce on-chain, serving as a foundation for secular growth.

Providing a secure environment for users, protocols, corporations, and investors who want to access the crypto ecosystem remains critical for broader adoption. The immaturity of blockchain technology makes it a particularly attractive target for bad actors, resulting in more than $3 billion in DeFi exploits in 2022, a ~30% increase from 2021.

To date, malicious actors have had the upper hand against initial security implementations, which have been too static, manual, reactive, and expensive to be effective. While some practices like security audits have proven to be an incontrovertible step in the development process, the demand for audits greatly outstrips the supply of good auditors.

All market participants must do their part in reducing technical and economic risk vectors. Last cycle, we saw a wave of solutions come to market, but they are just starting to define the category. Protocol developers are beginning to employ a “Swiss cheese” approach, including formal verification solutions from companies like Certora* and Veridise*, white glove audits from Trail of Bits, and bug bounty programs to incentivize whitehats to find bugs before they’re exploited. Security also extends beyond smart contract risk to economic attack vectors where agent-based simulation platforms like Chaos Labs* can help protocols withstand market-based attacks (e.g., oracle attacks, price manipulation). Users and investors are also using other solutions to understand transaction risk in real-time to avoid malicious wallets, protocols, and actors.

While we’re hopeful broader adoption of these approaches will shift the security pendulum, we expect to see bad actors evolve, keeping pressure on developers and users. Similar to Web2 cybersecurity, we are likely to see an unceasing arms race toward increasingly sophisticated exploits that market participants will always need to contend with.

Going forward, we believe scalable, software-based products that are proactive and offer automated ways to prevent, remediate, and recover assets will be critical for broader adoption of crypto networks and their assets. Product vectors include:

Prevention: More advanced threat intelligence systems must be built to prevent attacks in the first place. Monitoring capabilities are still very weak today—some attacks aren't discovered for days or even months after they are executed. Protocols and investors need solutions that have foresight and can proactively mitigate losses prior to exploits occurring.

Remediation: More granular incident response and remediation, once an attack does occur, is critical. Attacks take place over periods of time and bad actors are constantly looking to pile into exploits led by other malicious parties. Finding methods to close attack vectors quickly, in an automated fashion, without shutting down the protocol completely is essential to mitigate losses.

Recovery: Attacks will occur and unfortunately funds will be lost. Insurance products will become table stakes and likely embedded at the wallet and custody levels. These service providers will want to offer insurance to protect customers, differentiate in a competitive market, and to open new avenues for monetization. They will likely be willing to share valuable data with insurance providers that will help them price risk more effectively.

Blockspace Clusterization

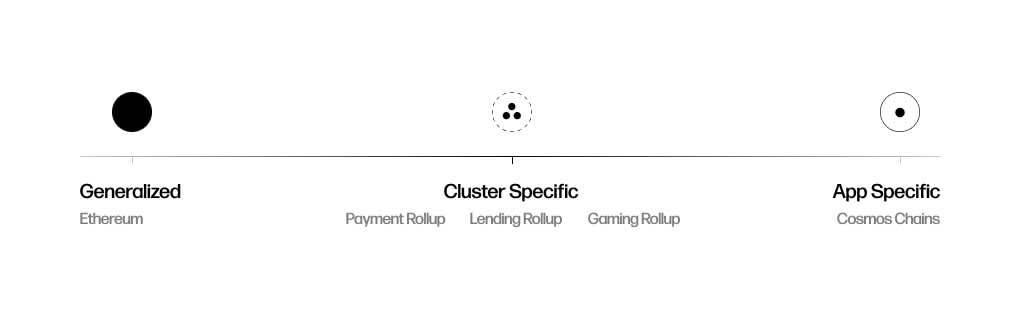

New chains will hone in on specific verticals or applications which complement each other—the future of crypto is cluster-specific.

On the spectrum between general-purpose rollups and application-specific rollups sits cluster-specific rollups. The coming years will fuel blockspace commoditization via L2s and alternative L1s. In a world of hundreds or thousands of rollups, valuable state (the on-chain accumulation of account balances, contract liquidity, and contract variables) is the scarce resource. New applications will cluster around valuable state like gravity.

Launching an L2 blockchain is becoming much easier. It can be as simple as clicking a button through Rollup-as-a-Service providers (i.e. OPStack, Constellation, Sovereign Labs) and the modular blockchain stack (Celestia*, EIP-4844). Some possibilities include:

Payments Rollup: A payments-tailored L2 could provide sufficiently high throughput for cheap payments. Value-add services like loyalty, promotions, and credit, will cluster around payments state.

Lending Rollup: A lending-focused chain or rollup would quickly see interest rate swap protocols emerge in its orbit.

Gaming Rollup: A gaming-tailored L2 with pre-compiles and features that are optimized for a particular game ecosystem, that has a vibrant community of third-party mods.

Private Rollup: B2B lending, private credit pools, and regulatory restrictions will induce demand for more customizable but secure blockspace. Easy to deploy and customize white-labeled rollups will unlock new use cases for institutions and businesses wanting crypto economic guarantees and sovereignty of who and what transactions and data they are interacting with.

We’ll be watching for anchor applications to plant a flag in a specific rollup, and for a universe of symbiotic or supporting cast applications to emerge around the anchors.

Crypto Beyond 2023

Despite the recent downturn, we see crypto innovation propelling forward across the protocol, software infrastructure, and application layers. While crypto is filled with a broad range of exciting narratives, these are the few that we believe will fundamentally unlock the most growth going forward. These innovations are bound to drive more users and new use cases for public blockchains, and we are excited to partner with intrepid founders building in these categories.

* Denotes Galaxy portfolio company

Legal Disclosure:

This document, and the information contained herein, has been provided to you by Galaxy Digital Holdings LP and its affiliates (“Galaxy Digital”) solely for informational purposes. This document may not be reproduced or redistributed in whole or in part, in any format, without the express written approval of Galaxy Digital. Neither the information, nor any opinion contained in this document, constitutes an offer to buy or sell, or a solicitation of an offer to buy or sell, any advisory services, securities, futures, options or other financial instruments or to participate in any advisory services or trading strategy. Nothing contained in this document constitutes investment, legal or tax advice or is an endorsementof any of the digital assets or companies mentioned herein. You should make your own investigations and evaluations of the information herein. Any decisions based on information contained in this document are the sole responsibility of the reader. Certain statements in this document reflect Galaxy Digital’s views, estimates, opinions or predictions (which may be based on proprietary models and assumptions, including, in particular, Galaxy Digital’s views on the current and future market for certain digital assets), and there is no guarantee that these views, estimates, opinions or predictions are currently accurate or that they will be ultimately realized. To the extent these assumptions or models are not correct or circumstances change, the actual performance may vary substantially from, and be less than, the estimates included herein. None of Galaxy Digital nor any of its affiliates, shareholders, partners, members, directors, officers, management, employees or representatives makes any representation or warranty, express or implied, as to the accuracy or completeness of any of the information or any other information (whether communicated in written or oral form) transmitted or made available to you. Each of the aforementioned parties expressly disclaims any and all liability relating to or resulting from the use of this information. Certain information contained herein (including financial information) has been obtained from published and non-published sources. Such information has not been independently verified by Galaxy Digital and, Galaxy Digital, does not assume responsibility for the accuracy of such information. Affiliates of Galaxy Digital may have owned or may own investments in some of the digital assets and protocols discussed in this document. Except where otherwise indicated, the information in this document is based on matters as they exist as of the date of preparation and not as of any future date, and will not be updated or otherwise revised to reflect information that subsequently becomes available, or circumstances existing or changes occurring after the date hereof. This document provides links to other Websites that we think might be of interest to you. Please note that when you click on one of these links, you may be moving to a provider’s website that is not associated with Galaxy Digital. These linked sites and their providers are not controlled by us, and we are not responsible for the contents or the proper operation of any linked site. The inclusion of any link does not imply our endorsement or our adoption of the statements therein. We encourage you to read the terms of use and privacy statements of these linked sites as their policies may differ from ours. The foregoing does not constitute a “research report” as defined by FINRA Rule 2241 or a “debt research report” as defined by FINRA Rule 2242 and was not prepared by Galaxy Digital Partners LLC. For all inquiries, please email [email protected]. ©Copyright Galaxy Digital Holdings LP 2023. All rights reserved.